Congratulations! Renee Zurlo: Realtor of The Year and Richard Herska: “Up and Coming” Award

Congratulations to Renee Zurlo, Orange County Regional Manager, named “Realtor of the Year” by the Hudson Gateway Association of Realtors (HGAR) – and to Richard Herska, Real Estate Salesperson, Nyack office, who received HGAR’s “Up and Coming Award,” selected out of a pool of 15,000 other local realtors. Renee and Rich were honored in front of a crowd of 1,500 members and affiliates who were in attendance for the 102nd Annual Meeting and Member’s Day of The Hudson Gateway Association of Realtors (HGAR). The event took place at the Doubletree Hotel in Tarrytown on Monday, October 29.

Congratulations to Renee Zurlo, Orange County Regional Manager, named “Realtor of the Year” by the Hudson Gateway Association of Realtors (HGAR) – and to Richard Herska, Real Estate Salesperson, Nyack office, who received HGAR’s “Up and Coming Award,” selected out of a pool of 15,000 other local realtors. Renee and Rich were honored in front of a crowd of 1,500 members and affiliates who were in attendance for the 102nd Annual Meeting and Member’s Day of The Hudson Gateway Association of Realtors (HGAR). The event took place at the Doubletree Hotel in Tarrytown on Monday, October 29.

Renee has been a REALTOR® for over 24 years and has been with Better Homes and Gardens Rand Realty for nine years. She has served as president of the Hudson Gateway Multiple Listing Service since 2016 and will continue to serve as president into 2019, when a newly formed MLS—a merger between the Multiple Listing Service of Long Island, Inc. (MLSLI) and Hudson Gateway Multiple Listing Service, is fully operational.

On receiving the honor of the HGAR Realtor of Year award, Renee said: “This award represents my many years of involvement in the real estate industry, building relationships and being able to give back to an industry that has given me so much. Throughout my career I have turned to many people for guidance, and I share this honor with them,” she added.

“Renee has truly earned the title of Realtor of Year with her exceptional talent, experience, skill and results,” said Matt Rand.

Says Marsha Rand, president of Better Homes and Gardens Rand Realty, “Renee has been a huge asset to the Better Homes and Gardens Rand Realty team. She is a real team player and loves to share her knowledge with others. There is no one more deserving of this award.”

Rich has been a REALTOR® with Better Homes and Gardens Rand Realty for three years and is also an active member of the HGAR Board of Directors. He says that combining his two passions – interior design and real estate – has been “a perfect fit” and has helped to propel his career forward at Better Homes and Garden Rand Realty.

Rich has been a REALTOR® with Better Homes and Gardens Rand Realty for three years and is also an active member of the HGAR Board of Directors. He says that combining his two passions – interior design and real estate – has been “a perfect fit” and has helped to propel his career forward at Better Homes and Garden Rand Realty.

“I am both honored and humbled to receive this award,” he said. “This confirms that hard work, dedication and patience yields positive acknowledgment. I look forward to a long future in real estate and with the Rand Realty family.”

“Rich has accomplished so much at Rand Realty in the past few years,” said Marsha Rand. “His eye for design is impeccable, and he gives his all to every client. He is on his way to the top!”

According to Matt Rand, “Richard’s Up and Coming Award is well deserved. He is one of our rising stars and we so appreciate the interior design expertise he brings to our clients.”

“We are extremely proud of both award winners!”

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Better Homes and Gardens Rand Realty Welcomes Sharon Burke to its Pearl River, NY and Closter, NJ Offices

Better Homes and Gardens Rand Realty announced that Sharon Burke, a top producer in Rockland County, NY and Northern NJ, has joined its Pearl River and Closter, NJ offices.

Better Homes and Gardens Rand Realty announced that Sharon Burke, a top producer in Rockland County, NY and Northern NJ, has joined its Pearl River and Closter, NJ offices.

Sharon, who has risen to achieve great successes in the last three years since transitioning from her work as a Senior Analyst of Performance Assurance & Compliance at Verizon Wireless, is known for helping both buyers and sellers reach their goals. In her previous position at Verizon Wireless, she identified and addressed risks in the Customer Care, Retail & Enterprise Channels. She has also held executive positions at NYNEX Mobile as Manager of Customer Acquisition Advertising, and at Jordan, McGrath, Case & Taylor Advertising as a Management Supervisor.

Sharon says that taking the time to get to know each client has been the key to her success. “Knowing that each transaction is different and requires its own understanding and approach, is what makes this job so interesting and exciting. I thrive on understanding first and then determining the best way to move forward,” she said.

Better Homes and Gardens Rand Realty – Hoboken Celebrates a Successful First Year

Congratulations to the Better Homes and Gardens Rand Realty Hoboken team, who just celebrated their First Anniversary.

Congratulations to the Better Homes and Gardens Rand Realty Hoboken team, who just celebrated their First Anniversary.

“The Hoboken office has been a great addition to the Better Homes and Gardens Rand Realty family, with many great achievements and record growth over this past year,” said Hoboken Branch Manager Mary Knapp. “Our office holds true to the core values of Better Homes and Gardens Rand Realty: to provide the best service and create lasting relationships with our customers, our community and our agents.”

“We are committed to growing our team while maintaining our dedication, impeccable ethics and values. We vow to always BE Better,” she added.

She says that what makes her office different is that, “Our office is truly invested in our community. This October we had our Fifth Annual Making Strides Against Breast Cancer fundraiser. I’m proud to announce that we raised over $25,000 for the American Cancer Society. This is one of our favorite events because it brings together the Hoboken community in the fight against breast cancer.”

She says that what makes her office different is that, “Our office is truly invested in our community. This October we had our Fifth Annual Making Strides Against Breast Cancer fundraiser. I’m proud to announce that we raised over $25,000 for the American Cancer Society. This is one of our favorite events because it brings together the Hoboken community in the fight against breast cancer.”

This year, Mary was named one of the Hudson County Women’s History Month honorees for “women who fight against discrimination.” This award acknowledges the courage, efforts and strength of women who work to fight against all forms of discrimination.

Featuring beautiful properties, a thriving economy, an urban feel and close proximity to New York City, Mary and her team are committed to Hoboken and the expansion of the Better Homes and Gardens Rand Realty Hoboken office there.

Featuring beautiful properties, a thriving economy, an urban feel and close proximity to New York City, Mary and her team are committed to Hoboken and the expansion of the Better Homes and Gardens Rand Realty Hoboken office there.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

NYC Agent Turns One Opcity Introduction into Three Closed Transactions!

Being a real estate agent in New York is tough. There’s a lot of competition, and everyone is doing their own thing.

Being a real estate agent in New York is tough. There’s a lot of competition, and everyone is doing their own thing.

However, for Tracey May, that’s all she knows. Originally from Massachusetts, Tracey had always loved NYC, so that’s where she decided to get her real estate license. She moved to the city as soon as she finished school and currently works with Better Homes and Gardens Real Estate Rand Realty.

Tracey has learned a thing or two about the real estate market in NYC over the past 18 years.

It’s a sellers market right now, and Tracey used that to her client’s advantage when she sold her home at a $50k premium over the desired listing price, and then helped her client settle into a new condo in the Bronx.

In October 2018, Tracey claimed what she thought was a buyer-only referral from Opcity. However, during their first conversation, Tracey learned that her client wished to sell her current home first. Two referrals in one!

Tracey didn’t take this opportunity for granted. She met with her new client as quickly as possible to continue building rapport and learn more about what she was looking for. Tracey’s efforts to meet with the client as soon as possible and preparation led the client to choose Tracey over other agents and sign a listing agreement.

She learned that her client had previously listed her home for $439,000 five years ago, but that listing had expired. This time her client’s goal was to sell at $450,000, but Tracey was confident she could get more than that.

“I was already working with a buyer. I brought that buyer into her house before it was even on the market. The buyer I brought in was willing to purchase the home at $450K, however, the buyer backed out. I asked the client to let me list the property on the market. From the beginning, I felt like we would get multiple offers. And that’s what happened. I listed the place for $480K and ended up getting $490K through a bit of a bidding war.”

Fifty thousand dollars over the original listing price! Needless to say, her client was very satisfied. The icing on the cake…

Tracey hosted an open house and ended up finding the buyer who ultimately purchased the house there, so she got the buyer side and the seller side for that transaction as well!

And of course, a realtor’s work is never done.

“I finished selling this home for my client, and after we sold her home we started the hunt for a new condo for her. I originally recommended that she wait until after she sold her home to put an offer in on a new one. There are so many offers going on right now, and being a cash buyer really put us in a nice competitive position. I told her that she wouldn’t need a bank, or an appraisal, you would just take the funds and go right in and purchase in all cash. She beat out some other offers and competition and found a perfect place.”

From one Opcity introduction, Tracey closed three transactions.

“These were quick closes. My phone dinged from Opcity. I clicked “accept” on the lead alert, and got the call from the Opcity rep who introduced me to my client. I met with her right away, and as soon as I met her in person she felt confident enough in me to use me as her listing agent. I listed and got the job done for her with a quick turnaround.”

“The client gave me a 5-star review, so I believe I will work with them again in the future!”

Opcity has impacted my business in a very positive way. I’ve got so many different buyers that I’m working with at all times. I make the calls, connect with my new clients, and take it from there.

I’m hands on. I take every lead that comes through Opcity. They’re all good. I love that buyers are ready and that some of them even come through preapproved from Opcity. Everything is very straight; very cut and dry.

Opcity referrals resulting from online leads come in all different varieties, including price points that may seem low for the client’s desired market. Tracey’s story illustrates how the value of one introduction can far outweigh the price point displayed on the referral alert, and by meeting a client in-person as soon as possible can turn into a lot of business.

In 90% of the closes that happen through Opcity introductions, the agent met with the client face to face within 12 days of the introduction.

Not only does Tracey accept Opcity leads, but she also knocks on doors, sends out mailing, makes phone calls and goes door to door. If she notices a house go up on the market, she’ll give the neighbors a call letting them know and asks if they would like a a free market evaluation done on their home.

People often think, “Oh, my neighbor was able to sell. I wonder what my place is worth.”

Even if they’re not ready to sell now, Tracey makes sure they know that she’s available when they are ready.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Better Homes and Gardens Rand Realty-Morristown Celebrates Successful First Year, Expanding from 5 to 35 Agents!

Congratulations to Morristown Branch Manager Keith Kirkwood and all the talented agents in our new Morristown office on their 1st Birthday! The Morristown office just celebrated its First Anniversary with a big office party for agents, management, owners, affiliates, friends and family. The Morristown office started out as a team of five and now, just one year later, has a team of 35 (with more eagerly waiting to join)!

Congratulations to Morristown Branch Manager Keith Kirkwood and all the talented agents in our new Morristown office on their 1st Birthday! The Morristown office just celebrated its First Anniversary with a big office party for agents, management, owners, affiliates, friends and family. The Morristown office started out as a team of five and now, just one year later, has a team of 35 (with more eagerly waiting to join)!

2018 has been a huge year of growth for the office as it continues to exceed goals. We spoke with Branch Manager Keith Kirkwood to find out more about what makes his office different.

“My previous experience in real estate was very much an agent-centric culture. It was not the most supportive environment to be in. I was fortunate enough to become very successful as an agent, but I could see the struggles that particularly new agents were facing. I knew there had to be a better way.”

“My previous experience in real estate was very much an agent-centric culture. It was not the most supportive environment to be in. I was fortunate enough to become very successful as an agent, but I could see the struggles that particularly new agents were facing. I knew there had to be a better way.”

He explains: “I wanted to see if we could take the ego out of the process and focus on agent development and client servicing. I also knew that it was important to have an environment where team members felt valued and valuable, and where it was OK to fail – but “fail forward.”. At Better Homes and Gardens Rand Realty, agents feel as though they are part of a team and everyone celebrates each other’s wins, regardless of what they are,” Keith said.

All of our Better Homes and Gardens Rand Realty offices emphasize community spirit and participation – and Morristown is no different! The Morristown office has joined the Morristown Partnership and are regulars at the Sunday Famers Market. This month, the office was involved in the Morristown Fall Festival that packed over 60,000 attendees.

All of our Better Homes and Gardens Rand Realty offices emphasize community spirit and participation – and Morristown is no different! The Morristown office has joined the Morristown Partnership and are regulars at the Sunday Famers Market. This month, the office was involved in the Morristown Fall Festival that packed over 60,000 attendees.

Morristown has been described as a “great place to work, live and play” with its urban lifestyle, bars and restaurants, along with its vibrant arts and theater scene. And, it has a prime location with easy access to NYC transit. Combined with a sense of tranquility, beautiful landscapes and outdoor living, Morristown truly is a unique place to call home.

And, our Morristown branch office indeed matches the culture of our town!

“There is a great energy that permeates the office, which has resulted in a hardworking, positive environment,” says Keith. “I am so proud of the people who have chosen to come along with me on this adventure. They have placed their trust in me and I treasure that so much. My big ‘why’ now is to help them achieve whatever it is they hope to achieve in their business, while holding them to the highest standards of practice in the field.”

“There is a great energy that permeates the office, which has resulted in a hardworking, positive environment,” says Keith. “I am so proud of the people who have chosen to come along with me on this adventure. They have placed their trust in me and I treasure that so much. My big ‘why’ now is to help them achieve whatever it is they hope to achieve in their business, while holding them to the highest standards of practice in the field.”

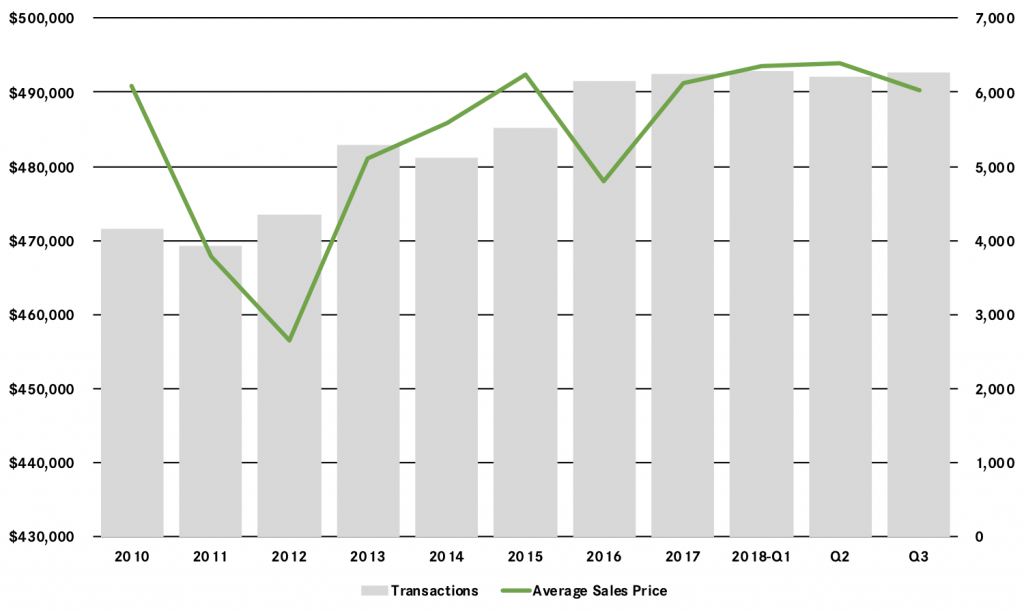

Real Estate Market Report: Third Quarter 2018 – Hudson County, NJ

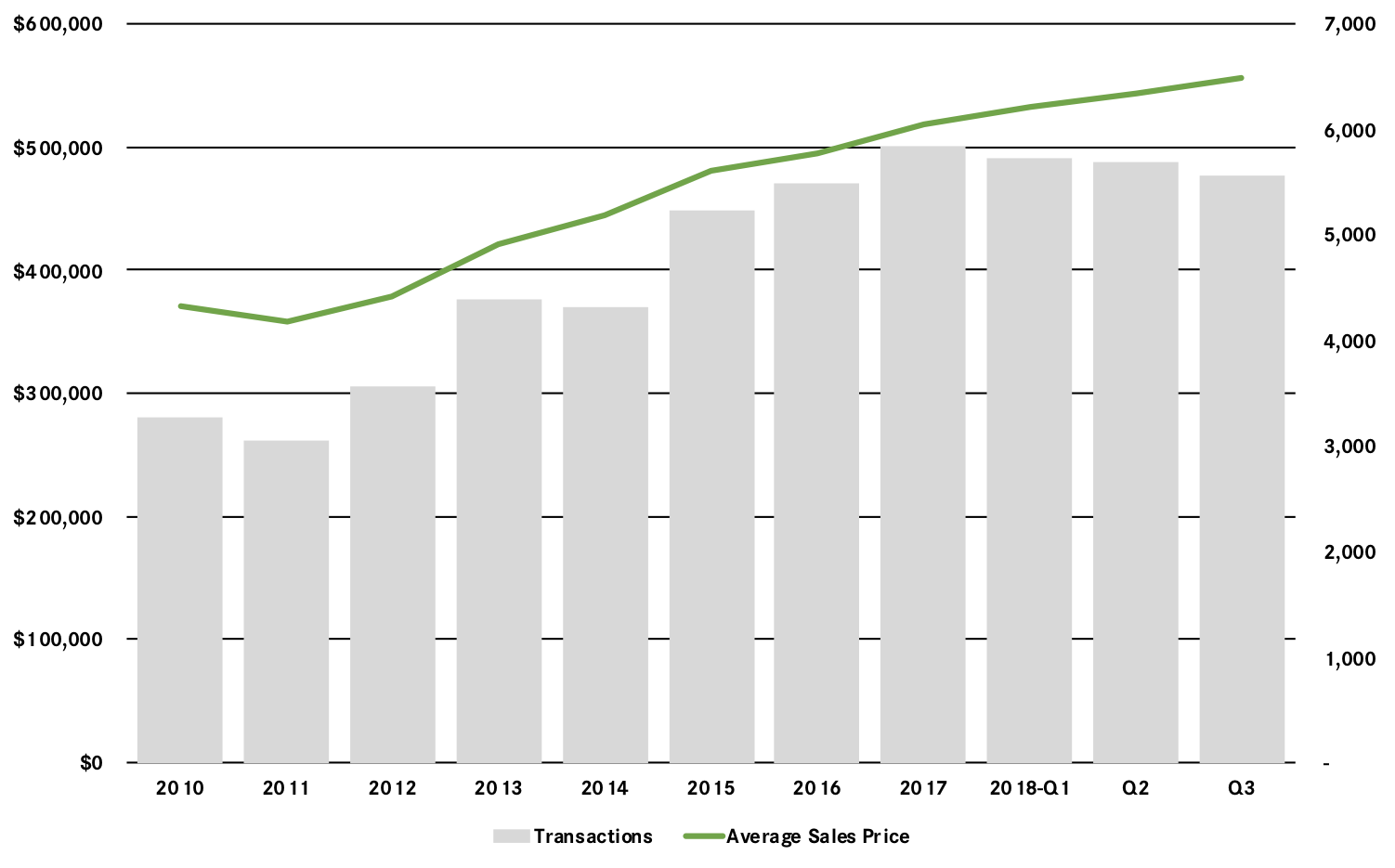

The Hudson County housing market surged yet again in the third quarter, with prices rising overall and particularly for multi‑family and condo properties. Overall sales for the county were down almost 8% from last year’s third quarter, with both multi‑family and condo sales falling sharply due to the lack of inventory available on the market. But that lack of supply, coupled with high levels of demand, is having a dramatic impact on pricing. Average prices were up over 8% from last year’s third quarter for all property types, rising over 3% for single‑family homes, 11% for multi‑family, and almost 9% for condos. And for the year, we’re seeing pretty dramatic price appreciation: single‑family homes up 8%, multi‑families up 17%, and condos up 6%. Going forward, we expect this to continue through a robust fourth quarter, and into 2019, as demand for housing in Hudson remains strong.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

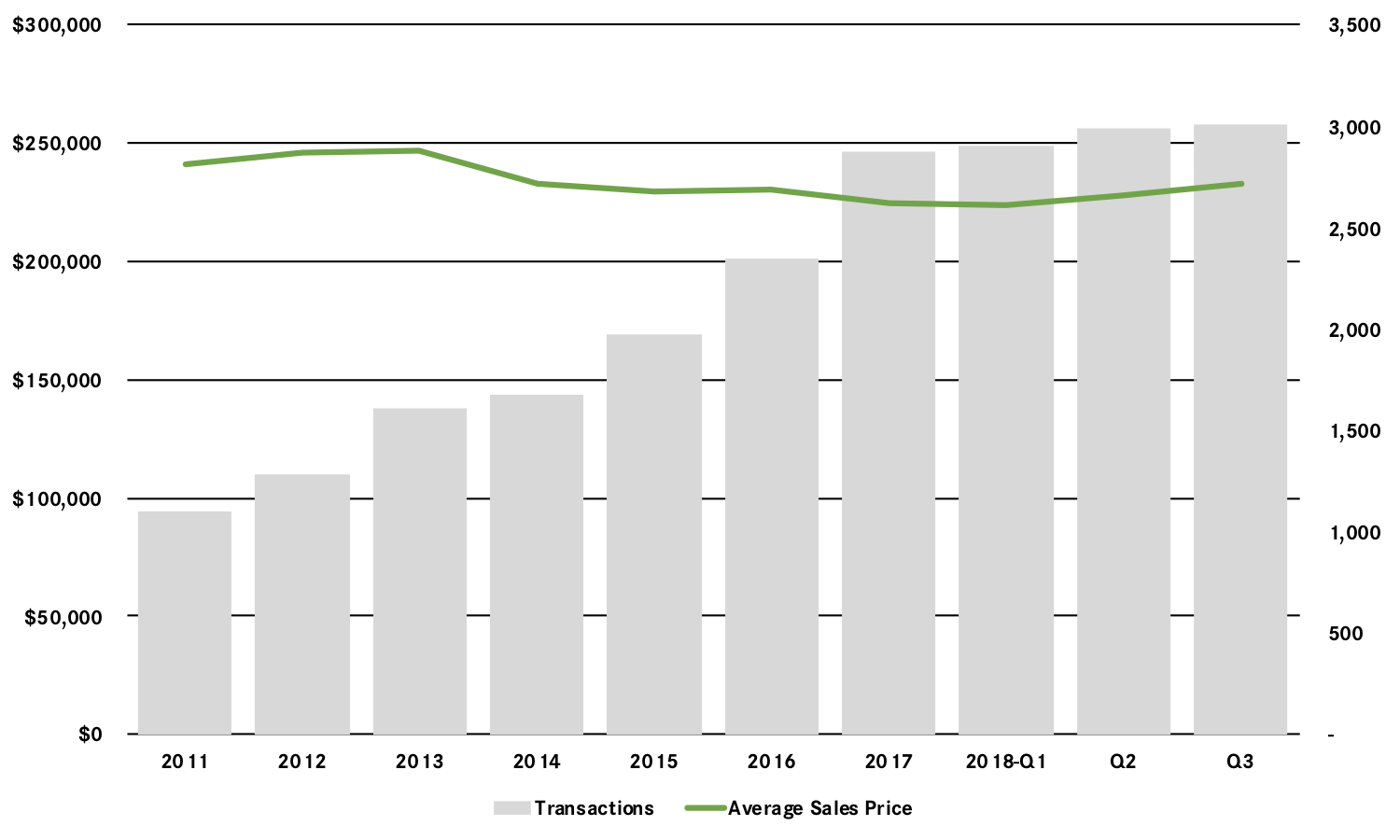

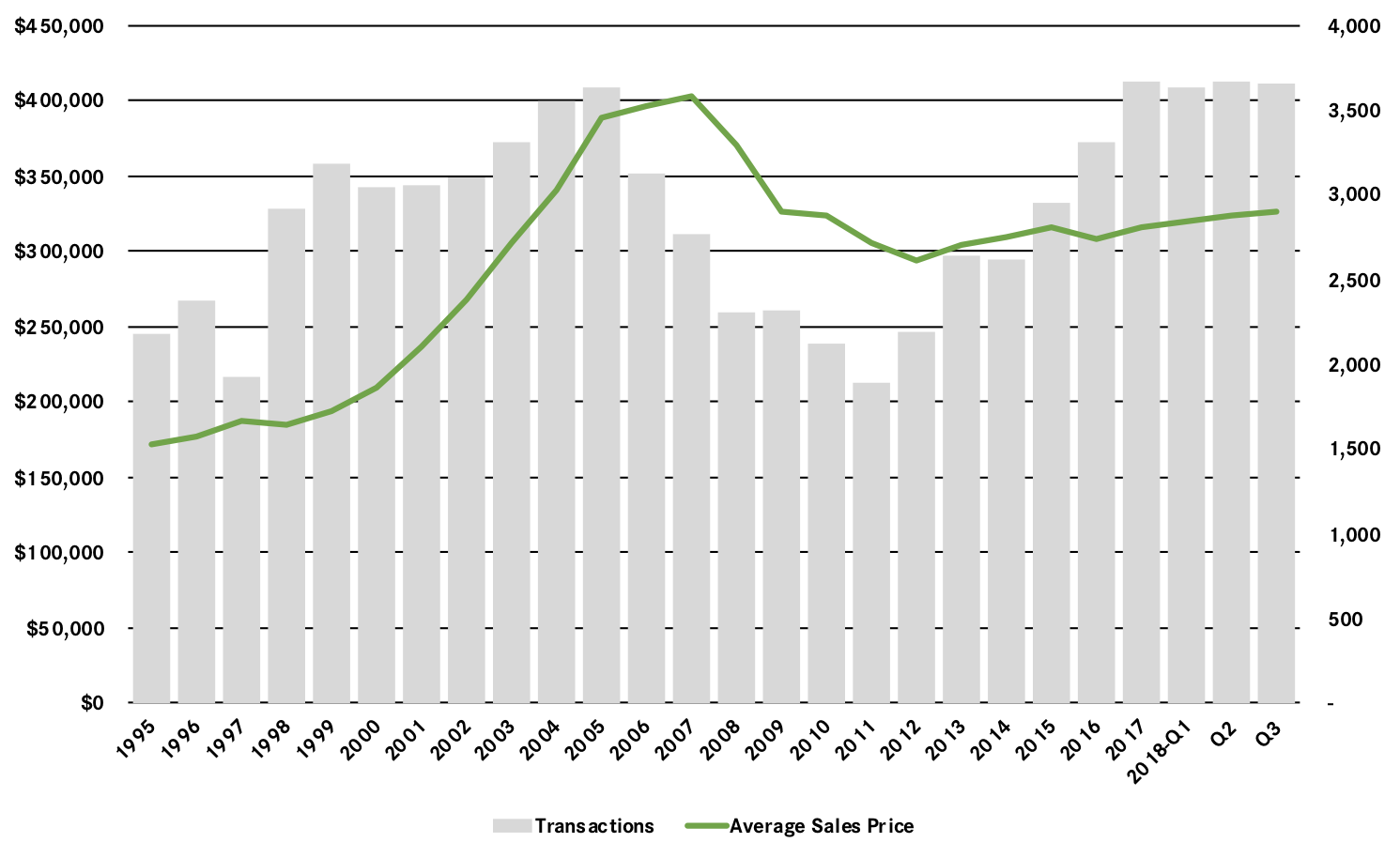

Real Estate Market Report: Third Quarter 2018 – Sussex County, NJ

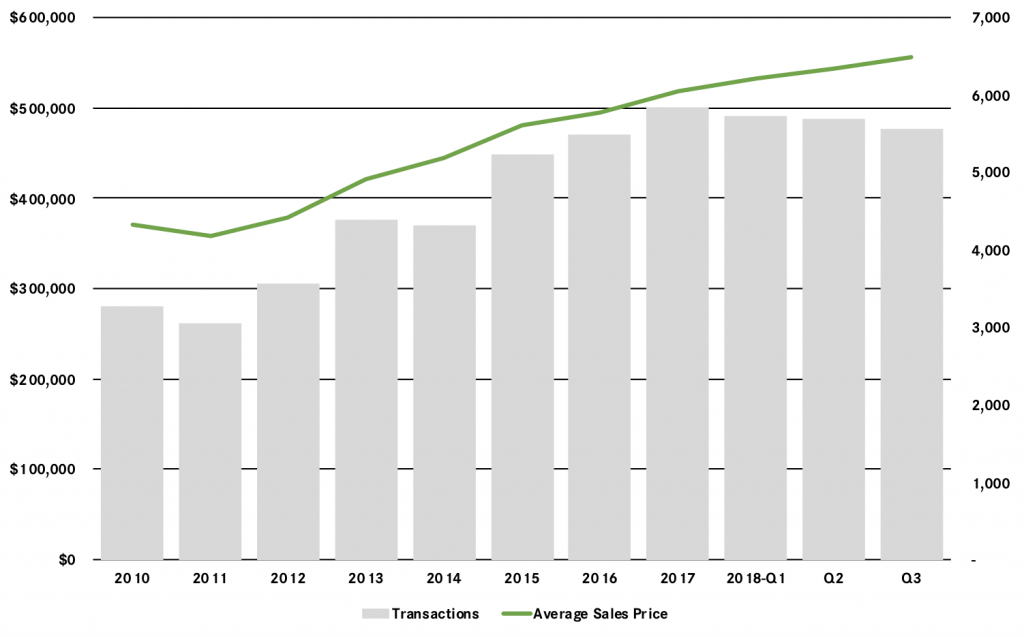

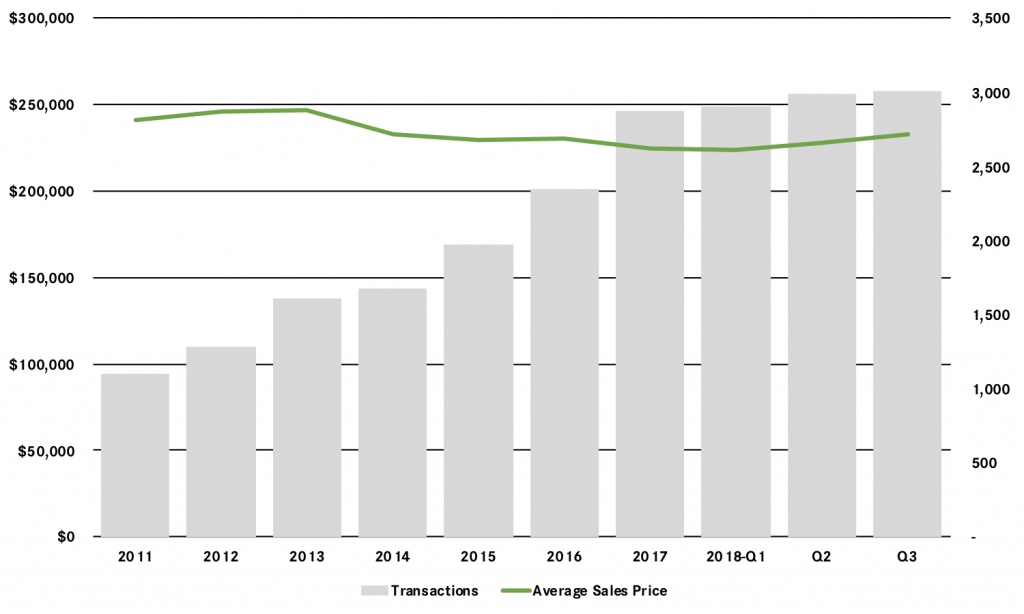

The Sussex market surged yet again in the third quarter, with small increases in sales coupled with a dramatic jump in pricing. Transactions were only up about 2% for the quarter, but that finished a year where sales rose over 9%. That’s a pretty robust showing compared to other markets in the region. This strong buyer demand is having its expected impact on pricing, with the average price spiking over 8% and the median up over 5%. And we’re starting to finally see some long‑term price appreciation, with the average price up 3% for the rolling year and the median up just a tick. More importantly, inventory has finally come down to manageable levels, almost to the six‑month level that usually denotes a seller’s market. Going forward, we expect continued strength in sales coupled with meaningful price appreciation through a strong fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

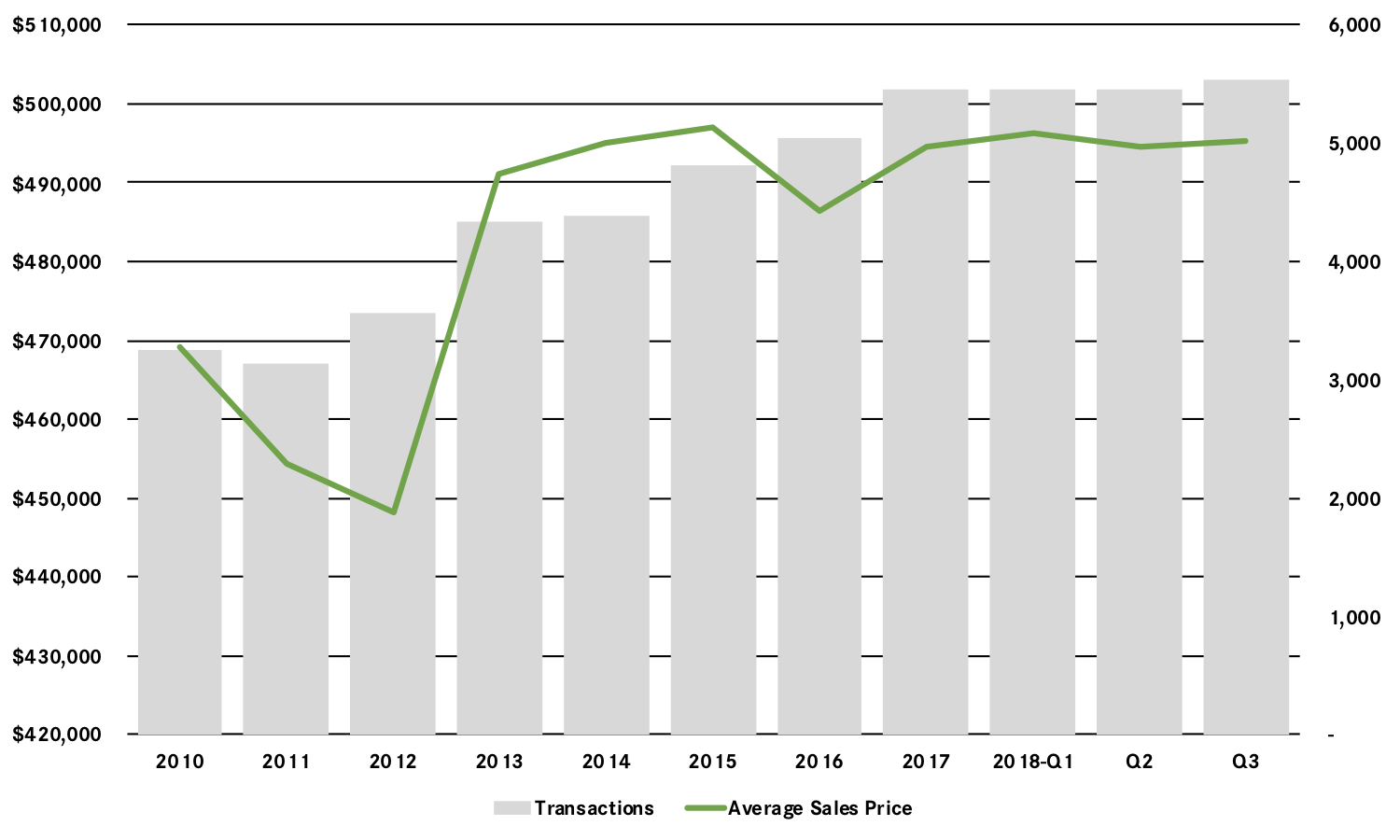

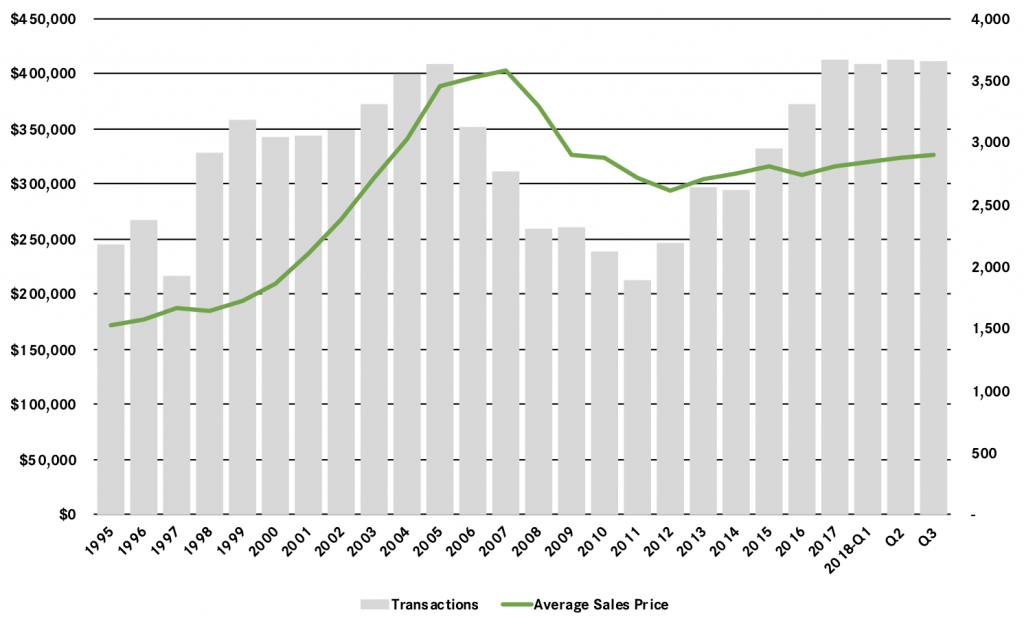

Real Estate Market Report: Third Quarter 2018 – Essex County, NJ

The Essex housing market experienced a strong third quarter, with both sales and prices rising in what is now a pretty robust seller’s market. Sales were up over 5% for the quarter, finishing a year in which they rose about 3%. That’s not a torrid transactional pace, but compared to other counties in the market, which generally saw flat or declining sales due to the lack of inventory, it was a pretty encouraging result. And prices were up for the quarter, rising a tick on average and up almost 3% at the median. More importantly, we’re seeing long‑term price appreciation, with average prices up over 1% and the median rising almost 5% for the rolling year. And we’re seeing seller’s gain leverage in negotiating, with the days‑on‑market falling over 5% for the quarter and now 7% for the year, and the listing retention rate continuing to go up above full price. Going forward, with inventory still falling, we might see some restriction on sales growth, but we believe prices still have room to go up through the fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

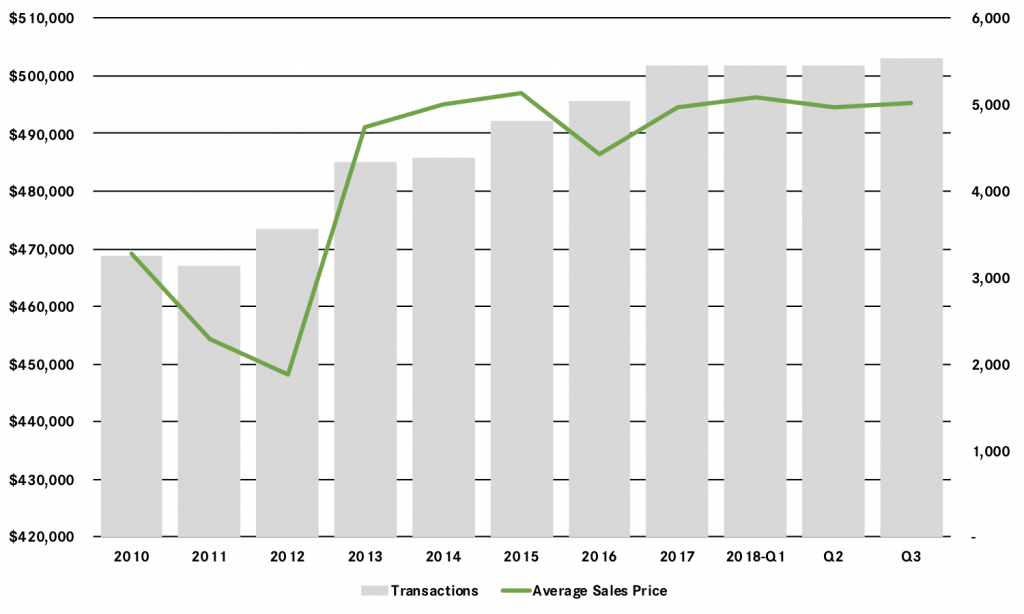

Real Estate Market Report: Third Quarter 2018 – Morris County, NJ

The Morris County housing market contained a series of contradictory indicators in the third quarter, with sales up, prices down, and the negotiability metrics suggesting increased leverage for sellers. Unlike most of the higher‑end markets in the region, Morris actually experienced sales growth, with sales up over 3% for the quarter, and the rolling-year totals relatively flat. But also unlike those other markets, Morris saw some price depreciation, with prices down almost 3% on average and 2% at the median. Meanwhile, the secondary metrics all pointed to increasing seller leverage: Inventory was down a tick, and now below the six‑month level that denotes a seller’s market; days‑on‑market fell again, and the listing retention rate was up just a tick. So what to make of the decline in pricing? Well, that might just be a blip, the result of some disproportionate strength in the middle‑ and lower‑range price points of the market. Indeed, if you look at the rolling year, prices are up nicely. Going forward, we will watch the pricing trend, but we do believe that demand is strong and will eventually drive more meaningful price appreciation through the fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

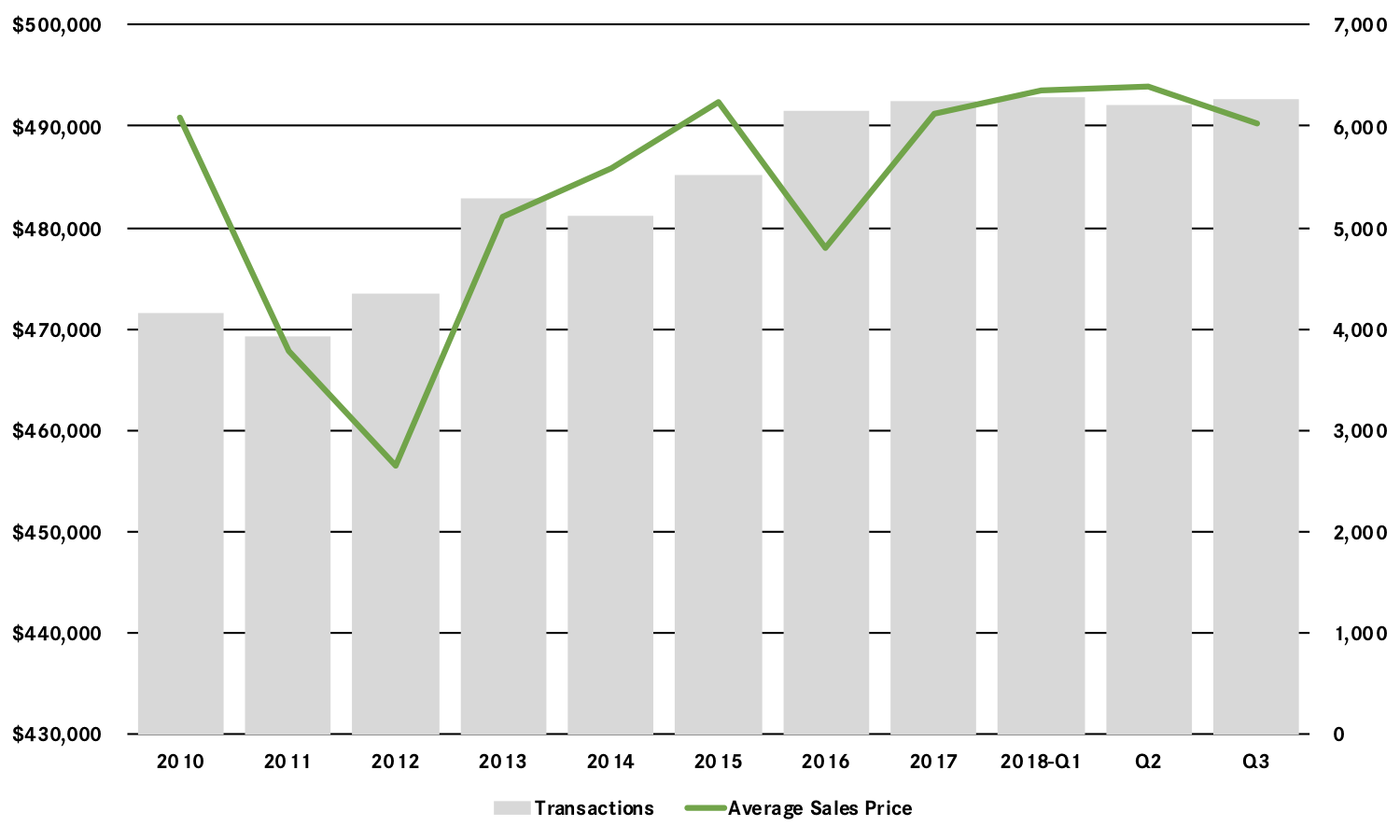

Real Estate Market Report: Third Quarter 2018 – Passaic County, NJ

The Passaic housing market cooled off a little in the third quarter, with both sales and prices relatively flat after a robust second quarter. Indeed, we saw exactly one fewer sale in the third quarter compared to last year, and only 40 more sales for the rolling year. But this sales plateau does not indicate a lack of demand, since prices were up again, rising about 2% on average and at the median for the quarter, and finishing a rolling year up over 4% on average and almost 7% at the median. Meanwhile, inventory is still falling, now down below the six‑month level that usually denotes a seller’s market, which is what is holding sales figures down. Going forward, we expect that sales will only go up when these rising prices tempt more homeowners into the market and that we will continue to see appreciation in pricing through a robust fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link