Sometimes, it’s not a great time to sell. If prices are falling, inventory is high, and buyer demand is slackening, the market timing for selling is certainly not ideal.

But that’s not what’s happening in the Spring of 2024. Right now, prices are at an all-time high, inventory is at an all-time low, and buyer demand is still very strong despite rising interest rates. In this kind of market environment, it really is a very good time to consider listing your home for sale.

Here are four reasons why.

1. Your home is worth more than ever!

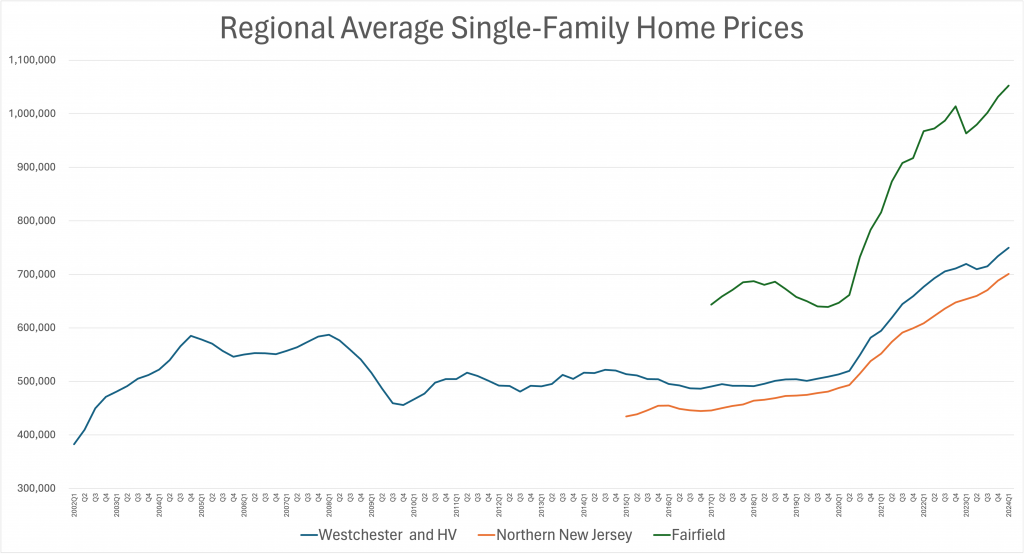

Home prices throughout the region are at an all-time high. It took some time for the market to recover following the Financial Crisis of 2008-09, but starting with the lifting of the “stay-at-home” COVID restrictions in mid-2020, the housing market shot up like a rocket. As a result, average home prices are now up about 50% across the region in just the past five years.

Will they continue to go up? Maybe. But if you look at the graph, you can see that the trend seems to be topping out. And if rates continue to go up, and inventory starts to recover, we will see a lot of downward pressure on housing prices.

Takeaway: it’s better to get out a year too early than a year too late.

2. You have almost no market competition!

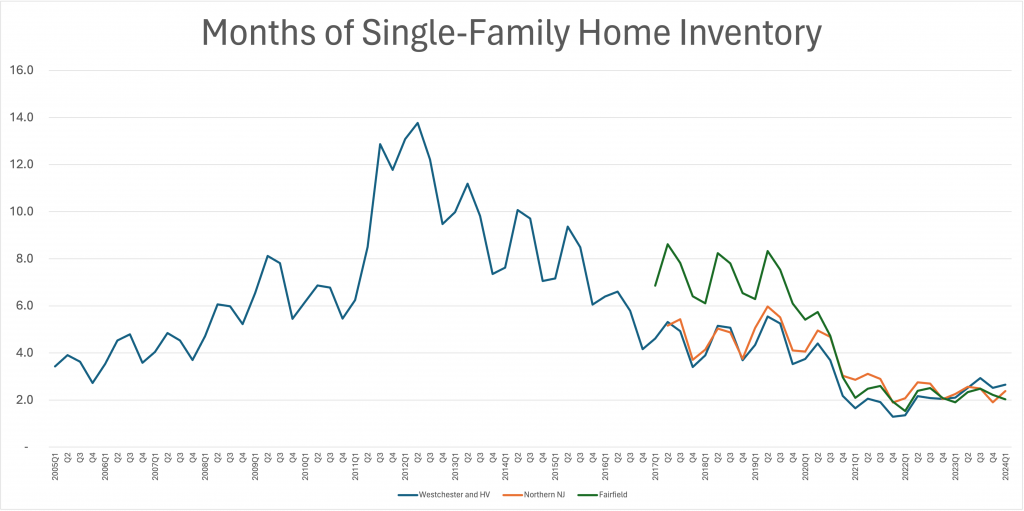

Why are prices going up? Basic supply-and-demand – we have so little inventory on the market that buyer demand is still driving prices up.

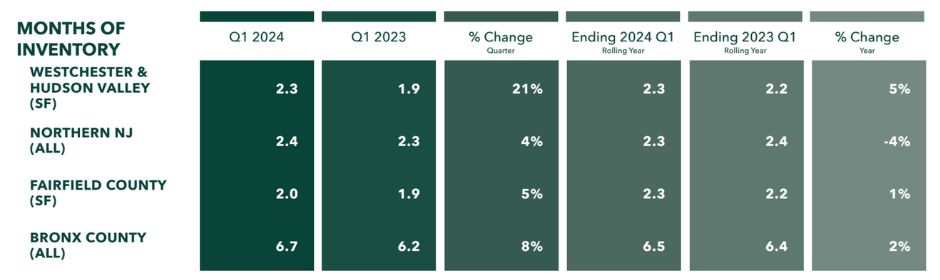

We measure housing inventory by taking the number of homes currently for sale, and then calculating how many months it would take to sell out that existing supply at the current rate of monthly sales. Historically, six months of inventory is considered a “balanced” market between buyers and sellers.

So where are we right now? Currently, most counties in the region have less than three months of inventory, and have been near a historical low for over three years. That drought of supply, coupled with continuing strong demand, has been pushing sales down but prices up. And that’s in the overall regional and county-wide market – if you were to look at just your own neighborhood, in your price point, you might not have any competition. That’s how you end up with bidding wars, which is exactly what you want as a home seller.

Takeaway: when everyone else is zigging (not selling), it’s time to zag (sell).

3. The buyers are out there!

We all know that interest rates have been climbing, more than doubling from the 3% rates buyers were getting just two years ago. But even with rates rising about 7%, buyers are still out there? Why? Because the economy is extremely hot right now – GDP is way up, wages are up, the stock market is up, and unemployment is way down. People have jobs and money to spend. The problem is that we don’t have enough homes to sell to them.

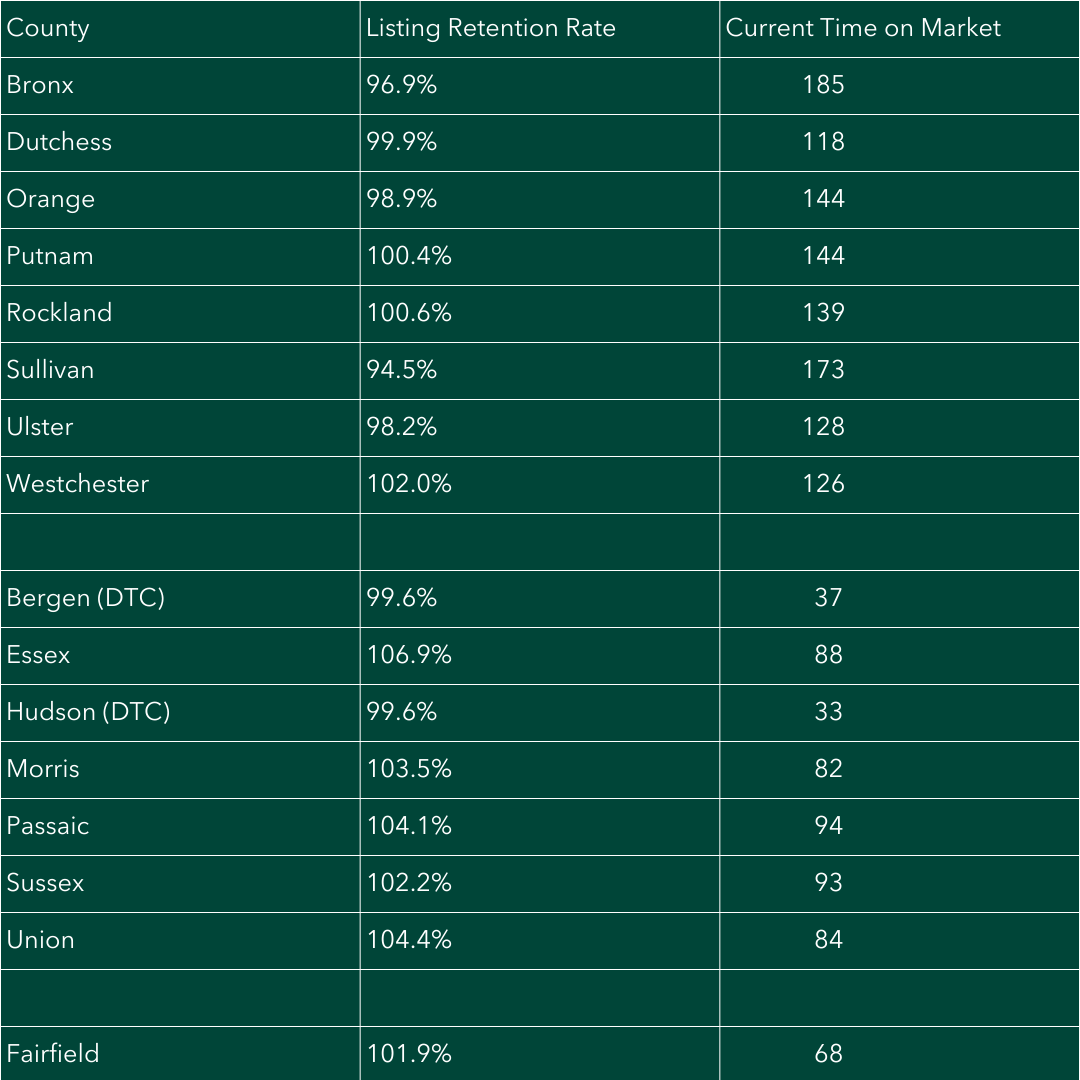

This is what a seller’s market looks like. And it’s not just that prices are going up. You can also see the signs of a seller’s market by looking at how quickly homes are selling for (the “Days-on-Market”) and how much sellers are discounting their asking price to get them sold (the “Listing Discount”). By those metrics, homes are selling very quickly, and sellers are getting close to (or above) their asking prices.

Takeaway: When it’s a “seller’s market,” you should . . . sell!

4. You may not need to be so rate-sensitive.

Many homeowners want to sell their home, but they hate to give up their rate. They bought or refinanced their homes during the era of historically-low interest rates, and they’re loathe to give it up, especially if it means buying their next home with a 7% interest rate. We call these the “Golden Handcuffs” – interest rates that are locking homeowners into their current home even if they’d like to make a move.

Maybe that’s your situation. Maybe you have personal reasons why your current home no longer meets your needs: your family is getting bigger, or smaller, or you’ve got a new job, or you just want a change, or you want to be closer to or further from work/family/whatever.

So should you let those Golden Handcuffs keep you from moving? It depends on your situation, but many homeowners are too rate-sensitive in deciding whether to put their home on the market. For example, many homeowners have so much equity in their current home that they don’t even need a loan to buy their next home, so they won’t need to trade in their amazing rate for a higher one. And other homeowners owe so little on their home, and would need such a small loan, that the difference between a high rate and a low rate is pretty marginal. And that’s not even considering the estimated 30% of homeowners who own their homes outright!

Are you in any of those situation? If you’ve been in your current home for a while, you’ve probably paid down a lot of your principal of your home loan, and your home has probably appreciated significantly since you bought it. If that’s the case, it might make sense for you to make the move that you’ve been putting off for so long.

With our free online home valuation tool, you can see how much your home has appreciated since you purchased it. Now, of course, this is an “estimate”, and doesn’t take into consideration the details of your home. It’s no substitute for a “comparative market analysis” from a trained Howard Hanna real estate professional. But it will give you an idea of just how much equity you have in your home, and you might realize that you don’t need to be so rate sensitive.

Takeaway: Don’t let your “Golden Handcuffs” lock you into a home you don’t want anymore.

Conclusion: All decisions are personal

Listen, we don’t really know whether putting your home on the market is the right decision for you personally. Every situation is different. That’s why you should meet with your Howard Hanna | Rand Realty agent to see whether selling right now makes sense for you.

So give them a call today, or call 1-800-431-3010 to get connected to someone great.