WHY YOU MIGHT WANT TO BUY A HOME

(EVEN IN A SELLER'S MARKET)

Sometimes, it’s a “great time to buy.” When prices are falling, inventory is high, and rates are low, you’re probably in a “buyer’s market.” And when it’s a buyer’s market, that’s a great time to buy a home -- indeed, that’s why they call it a “buyer’s market”!

rates are low, you’re probably in a “buyer’s market.” And when it’s a buyer’s market, that’s a great time to buy a home -- indeed, that’s why they call it a “buyer’s market”!

But that’s not what’s happening in the Spring of 2024. Right now, we’re in a “seller’s market” -- prices are at all-time highs, inventory is at an all-time low, and interest rates have been going up for two years.

So if we’re in a seller’s market, does that mean that it’s a “bad time to buy”? Not necessarily. It depends on you, and your personal situation. Everyone is different, and even though the market timing might not be ideal, you might have very good reasons to consider purchasing a home in this market.

In other words -- even if right now isn’t the ideal time to buy a home from a financial perspective, it might be the best time from your personal perspective. Moreover, as we’ll show below, even buying during a seller’s market can be an excellent investment if you stay in your home for a while.

People Buy For Personal Reasons

The first point we want to make is simple: people buy for personal reasons, not financial reasons.

Maybe you have a family that has outgrown your current home, or an “empty-nester” who now needs to downsize. Maybe you want to live closer to work, or maybe you work from home so much now that you can get a bigger or cheaper home further from the city. Or maybe you’ve simply never owned a home of your own, and want to take that step.

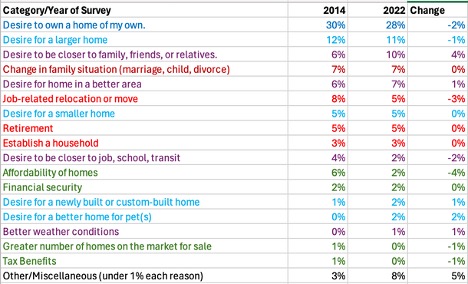

If that’s your situation, then you’re like most people. In the past ten years, The National Association of REALTORS has surveyed home buyers about their “primary reason for purchasing a home” in two very different types of markets:

2014, when the market was slowly recovering from the financial crisis, a fairly robust buyer’s market with prices stabilized after falling precipitously from 2008-2010.

2022, when the market was roaring in the post-COVID bull market, a classic seller’s market with limited inventory and sharply rising prices.

Even in two very different markets, though, the results were strikingly similar, with most people identifying personal rather than financial reasons for buying a home. For example, in both surveys, the top reason was the “Desire to own a home of my own” – 30% of respondents in 2014, and 28% in 2022. Similarly, other top reasons had to do with the desire for different types of homes, homes in a new location, or changes in personal situations.

What about the financial side? Very few people identified a financial motivation in buying a home. In 2022, only 2% for “affordability of homes,” with another 2% for “financial security.” Now, that was in a robust seller’s market, but even in the buyer’s market of 2014, when prices were still down from the financial crisis, only 6% chose “affordability” and 2% “financial security, with another 1% choosing the “greater number of homes on the market” and 1% the “tax benefits”. In other words, even when prices were down and rates were falling, only about 10% of buyers cited specifically financial reasons for purchasing a home.

Here are the results, and the changes between the two surveys. We’ve color coded the results as follows:

Dark blue for “desire to own a home of my own”

Red for changes in personal circumstances

Light blue for desires for a different type of home

Purple for a desire for a new location to live

Green for the financial reasons for buying a home.

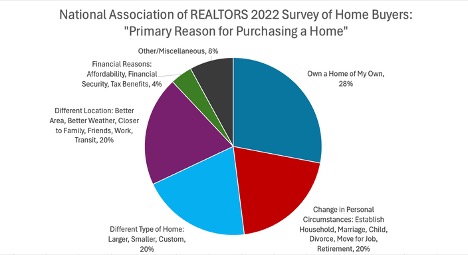

Also, here’s a pie chart combining all the different categories for the more recent 2022 survey so you can see how they stack up:

The point is this: we don’t buy homes the way we buy stocks and bonds, as a purely financial investment. We buy homes to meet our personal needs -- because we want to own our own home, we need a different type of home or a home in a new place, or we have to adapt to a change in our personal lives.

So if you need a new home, don’t get too caught up in the “market timing” about whether it’s the idea time for making an investment in real estate. Do what makes sense for you and your needs.

Can Buying a Home Right Now be a Good Investment?

Of course, that doesn’t mean that buying a home in a seller’s market is necessarily a “bad investment.” Even if the market timing is not ideal, home ownership can still make financial sense for you, especially if you’re planning on staying in your new home for a significant amount of time.

Why? Because home ownership is generally a good long-term investment, even if you don’t time the market perfectly. Here are some of the primary reasons why.

You build equity in your home over time. Assuming you’re going to get a mortgage loan to purchase your home, you’ll start building equity in your home as you pay down the principal in that loan. Conversely, f you’re paying rent, you’re paying down your landlord’s loan, not your own.

You get “leveraged” appreciation. People think that if they buy a home for $500,000 and sell it for $600,000, they’ve gotten the benefit of 20% appreciation – that is, a $100,000 gain on a $500,000 investment. But if they financed that home by putting down $100,000 and borrowing $500,000, they’ve actually doubled their money – they invested $100,000 and pulled out $200,000 when they sold. That’s not 20% appreciation -- it’s 100% appreciation! Obviously, we’re simplifying this a bit, but people often overlook the benefits of “leveraged appreciation” when considering buying a home.

You get all the tax benefits of home ownership. When you own a home, you can realize significant tax benefits over renting. For example, you can deduct the interest on your home loan, deduct some of your property taxes, and save on capital gains taxes when you sell. (We’re not your accountants, but you should talk to a professional if you want to get a better sense of the tax benefits of owning your own home.)

Why Market Timing Isn’t Everything

Let’s use an example to demonstrate the concept that real estate investments can make sense even if the market timing isn’t ideal.

For example, let’s say that you bought a single-family home in Westchester County in early 2008, at the very end of a long and lustrous seller’s market. The average price for a home in Westchester at the time was about $930,000. To buy that home, we’ll say for purposes of using round numbers that you put down about $200,000, which is a little more than the standard 20% down payment. You then financed the remaining $730,000 with a 30-year fixed rate mortgage of 6%, which was the average rate in 2008.

| Home Purchase 2008

|

|

| Purchase Price

|

$930,000 (average 2008 price)

|

| Down Payment

|

$200,000 (22%)

|

| Amount Financed

|

$730,000 (78%)

|

| Mortgage Rate

|

6% (average 2008 rate)

|

| Monthly Payment

|

$4,376

|

Obviously, this was not good market timing, because the financial crisis of 2008-09 drove prices down precipitously over the next few years.

But let’s look at how that investment performed if you held that home until this year. Now, that’s 15 years of owning that home, which is a long time, but it’s actually only a little longer than the national median time of home ownership. So it’s a reasonable baseline. And remember, we’re trying to measure today’s value against the very top of the last seller’s market, when it was especially bad market-timing for buying a home.

What does that badly-timed purchase look like 15 years later?

Well, let’s say that you sold the property at the end of 2023. At that time, the average home price in Westchester was about $1.2M.

| Home Sale 2023 (15 Years)

|

|

| Investment (Down Payment)

|

$200,000

|

| Sales Price

|

$1,200,000 (average 2013 price)

|

| Principal Pay-Down

|

$233,000

|

| Remaining Loan

|

$497,000

|

| Payoff (Sales Price – Remaining Loan)

|

$703,000

|

That’s about $270,000 more than the purchase price, an increase of about 29%. That may not seem like much over a 15-year period, but let’s go back to the three benefits of home ownership and see how they play out.

You Built Equity by Paying Down Principal

When you took out your loan in 2008, you owed about $730,000 after your $200,000 down payment investment. But over those 15 years, part of every month’s mortgage payment slowly paid down the principal of that loan.

You can see from the table below that home loans are front-loaded, meaning that most of your monthly payments at the beginning apply toward interest, and you pay off your principal very slowly. But over time, those payments do add up. After 15 years, you paid down over $230,000 of that principal, leaving you with a little less than $500,000 still on your loan.

So if you were to sell that home for the 2023 average sales price of $1.2M, you’d have about $700,000 that you’d pull out at the closing table. That’s pretty good, considering that you came to the closing table with $200,000 15 years ago.

Your Investment Appreciated Off Your $200,000 Down Payment

The home appreciated by $230,000, which was an increase of 25% off the purchase price. But you didn’t buy the home for cash. You bought it with that down payment of $200,000. So when we’re calculating your appreciation, we have to consider what you actually put in and what you actually pulled out. You put in $200,000 You pulled out over $700,00. That’s about a $500,000 profit from the investment, a 250% return on your $200,000.

Tax Benefits

Finally, you also got tax benefits over the time that you owed the home, particularly the home mortgage interest deduction. The interest you paid on your home mortgage was deductible against your income. You paid over $600,000 of interest during those 15 years, approximately $3,333 per month and about $40,000 per year. Because of the home mortgage interest tax deduction, that $40,000 of interest came off the top of your income. If you would have paid a 40% combined tax rate for state and federal on that $40,000, you would have saved about $16,000 taxes per year. And over 15 years, that would be about $240,000 in taxes, just in the mortgage interest deduction.

Of course, this all depends on your particular financial situation -- including whether you’re earning enough to pay the highest tax rate on your last dollars of income, whether you’re itemizing your deductions versus taking the standard deduction, whether your mortgage interest exceeds the allowed cap, etc. Again, talk to your accountant about this, because it gets complicated. But the general idea is that home ownership does confer tax benefits that should be factored into your investment calculation.

Comparing Investments

All that leaves us with a simple question: did the investment work out? Well, to answer that, we need to look at the alternative. How does that badly-timed real estate investment compare to, say, investing in the stock market?

Well, let’s go back to 2008. Let’s say that instead of investing that $200,000 down payment in a house, you put it in the stock market. According to the Down Jones return calculator at www.dqydj.com, your $200,000 investment in January 2008 would have turned into about $662,000 by December 2023. That’s about a 331% return over those 15 years – making a profit of about $462,000 on the $200,000 investment.

So let’s compare the investments:

| Category | Home to Live In | Dow Jones Stocks |

| Amount Invested

|

$200,000

|

$200,000

|

| Amount Pulled Out

|

$700,000

|

$662,000

|

| Change

|

$514,000

|

$462,000

|

In other words, your return on your poorly-timed real estate investment was better than what you would have gotten by investing in the stock market.

Now, we’ve obviously simplified the numbers to make the comparisons a little clearer, and to keep ourselves from bogging down. So you might think of a couple of objections to this analysis showing that even a poorly-time real estate investment can outperform stock market returns.

Here are a couple of the obvious objections:

Taxes and Insurance

The biggest objection would be that we have not factored in the other costs of home ownership, particularly property taxes, insurance, utilities, etc. That’s fair, especially since you don’t incur those same costs in owning stocks. So if we include those as expenses against the returns on real estate investment, we’d see the returns go down a bit.

Maintenance Costs

Anyone who has owned a home knows that maintenance costs can also add up: a new roof, hot-water heater, lawn cutting, etc. Again, that’s a fair objection, because those costs can add up.

Transaction Costs

Finally, if we want to be fair, we should include the transaction costs of buying and selling a home: transfer taxes, title insurance, commissions, lawyer’s or escrow fees, and so on. Again, those costs will take away from our real estate investment returns.

So that’s all totally fair. And if we wanted to present a more robust 20-page analysis of the comparison between real estate and stock investments, we’d have to go through all that.

On the other hand, though, we also haven’t factored in some of the secondary benefits of home ownership in our comparison, especially those that are far more favorable than stock ownership, including:

Tax Savings

We talked earlier about the benefits of the home mortgage interest deduction, but we didn’t calculate that as part of the investment returns because it’s so dependent on your personal situation. But if you’re indeed saving thousands of dollars from those deductions every year, they do add up to a substantial amount of money that probably offsets much of those home ownership and maintenance costs.

Moreover, we haven’t even talked about the capital gains treatment on the sale of your primary residence. You can exclude between $250,000 (for single people) and $500,000 (for married couples) of the capital gains on the sale of your home. So in our particular example, the $270,000 in capital gains appreciation on the home would almost entirely be capital gains fee. You don’t get that when you sell stocks.

Again, every time we talk about taxes, we’ll remind you to talk to your accountant. But there’s no denying that you get many more tax benefits from real estate ownership than owning stocks.

Investment Fees

Since we stipulated to the objection based on transaction costs in buying and selling real estate, we should also mention that stock market investments aren’t fee. You can invest in many low-cost ways, but most investments involve some sort of percentage fee when you purchase, or a fee for every year that your financial advisers manage your money. The fees vary widely, but we just think it’s fair to point out that stocks have “transaction costs” as well.

The Rental Replacement Cost

Finally, here’s one really big thing. If you invested in the stock market rather than buy a house back in 2008, you still needed a place to live for those 15 years! And that costs money!

Unless you stayed in your parents’ basement, or crashed on couches with your increasingly impatient friends all those years, you probably would had to rent a home for the last 15 years. You can’t live in your stock portfolio. And a single-family rental in Westchester is not cheap. We don’t want to get into the weeds on this, but our experience is that most renters spend about 1/3 of their income on their rent, which happens to be about the same percentage that homeowners spend on their monthly payments for their mortgage, interest, and taxes.

In other words, if you want to factor in the additional expenses of home ownership, maintenance, and transaction sots, you also need to factor in the tax benefits and the value of not having to rent a home. That’s only fair!

Conclusion: All decisions are personal

Listen, we don’t really know whether purchasing your home in this market is the right decision for you personally. Indeed, our first point was that the reason most people buy a home has to do with intensely personal reasons about what they want and need in their lives. Every situation is different!

right decision for you personally. Indeed, our first point was that the reason most people buy a home has to do with intensely personal reasons about what they want and need in their lives. Every situation is different!

But we did want to reassure you that buying a home in a seller’s market isn’t necessarily a poor financial decision. Market timing isn’t everything. As we tried to show you, even if you’d bought in early 2008 with the very worst market timing of the past 50 years, you would still have done very well in your investment over that time, even compared to the stock market.

But, again, every situation is different. That’s why you should meet with your Howard Hanna | Rand Realty agent to see whether buying right now makes sense for you.

So give them a call today, or call 1-800-431-3010 to get connected to someone great!