Fourth-Quarter 2018: Real Estate Market Report – Orange County, NY

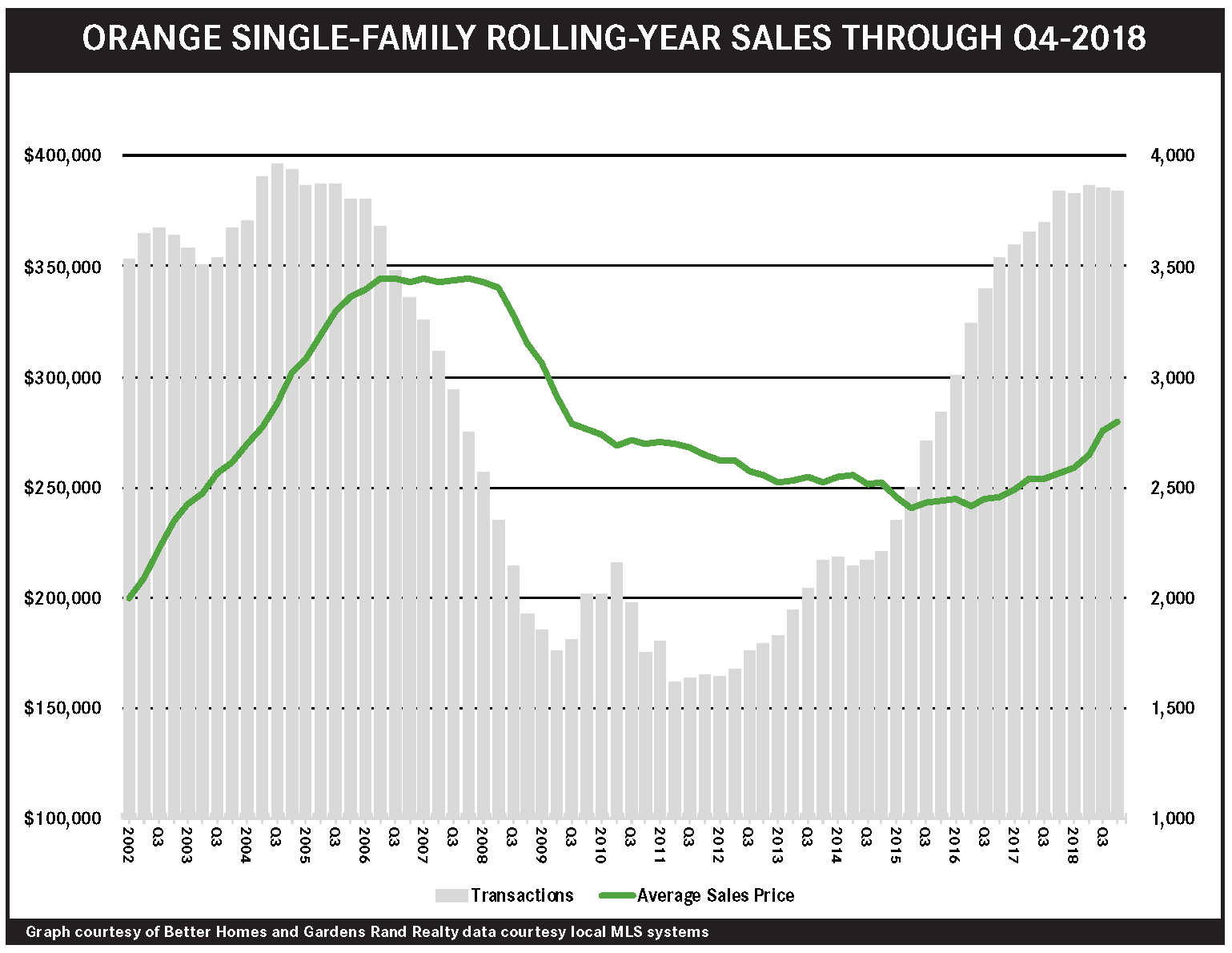

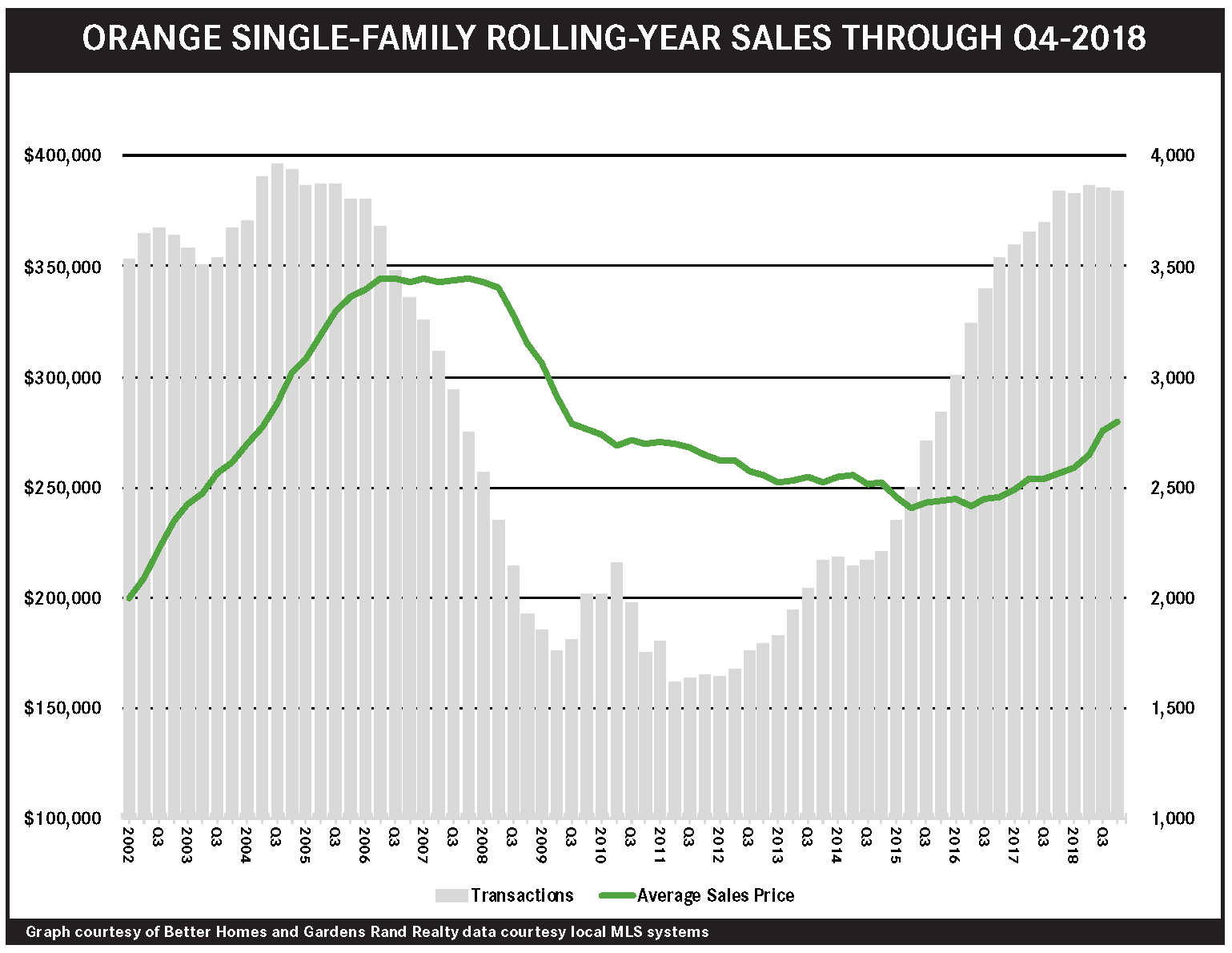

The Orange housing market closed the best year for homeowners since the financial crisis 10 years ago, with the full‑year pricing up sharply for both single‑family homes and condos. Orange is now in a fully realized seller’s market, with low levels of inventory holding back sales, even while driving robust price appreciation. For the full 2018 year, prices were up across the board: single‑family home prices rose 9% on average, 7% at the median, and almost 10% in the price‑per‑square foot, while condo prices rose 12% on average, 8% at the median, and over 12% in the price‑per‑square‑foot. Pricing is now the highest it’s been since the financial crisis of 2008‑09, although it’s still down about 20% from the height of the market in 2006-07. Going forward, we expect that Orange still has some room for growth, and that demand will stay strong through the winter and spring markets.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth-Quarter 2018: Real Estate Market Report – Rockland County, NY

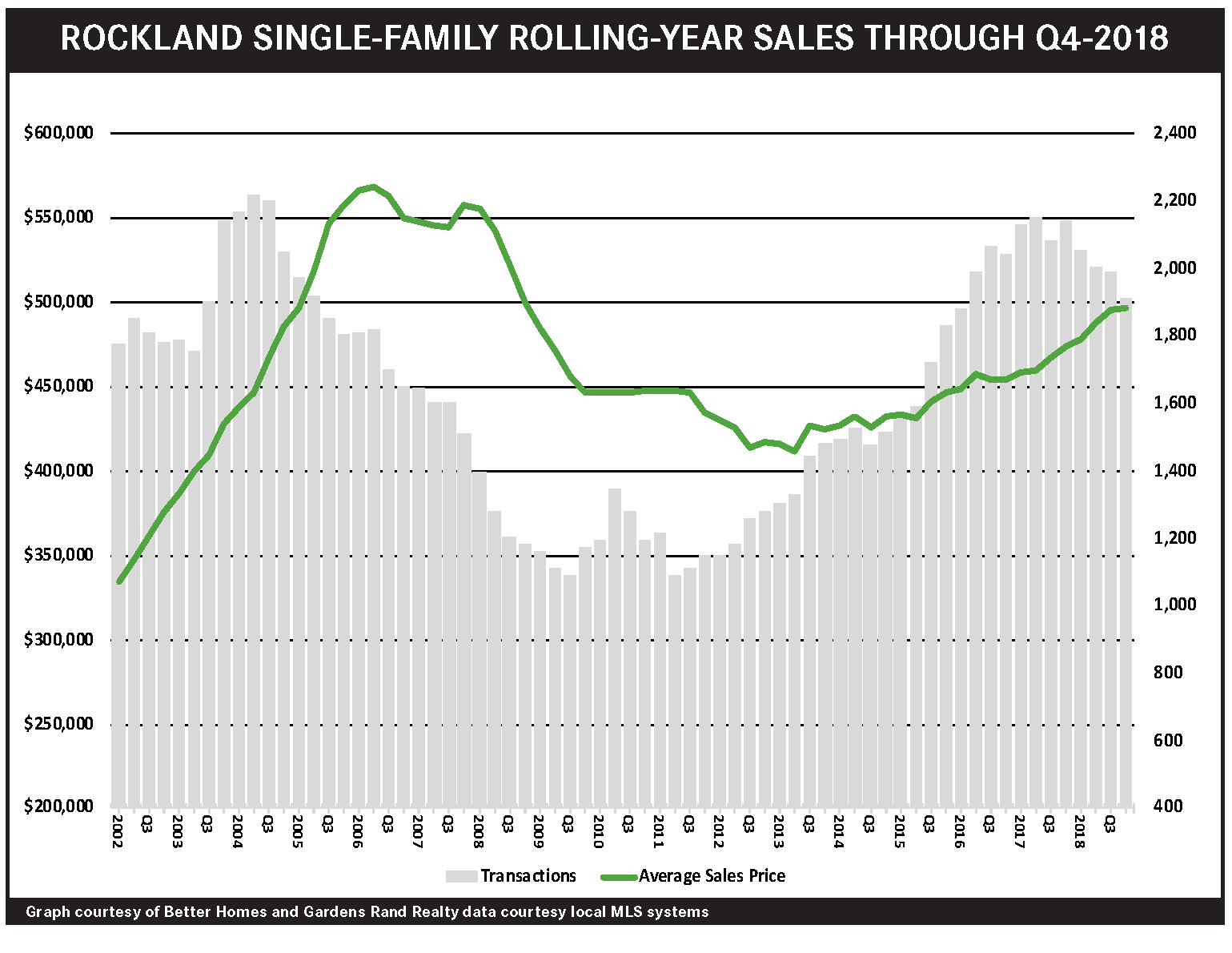

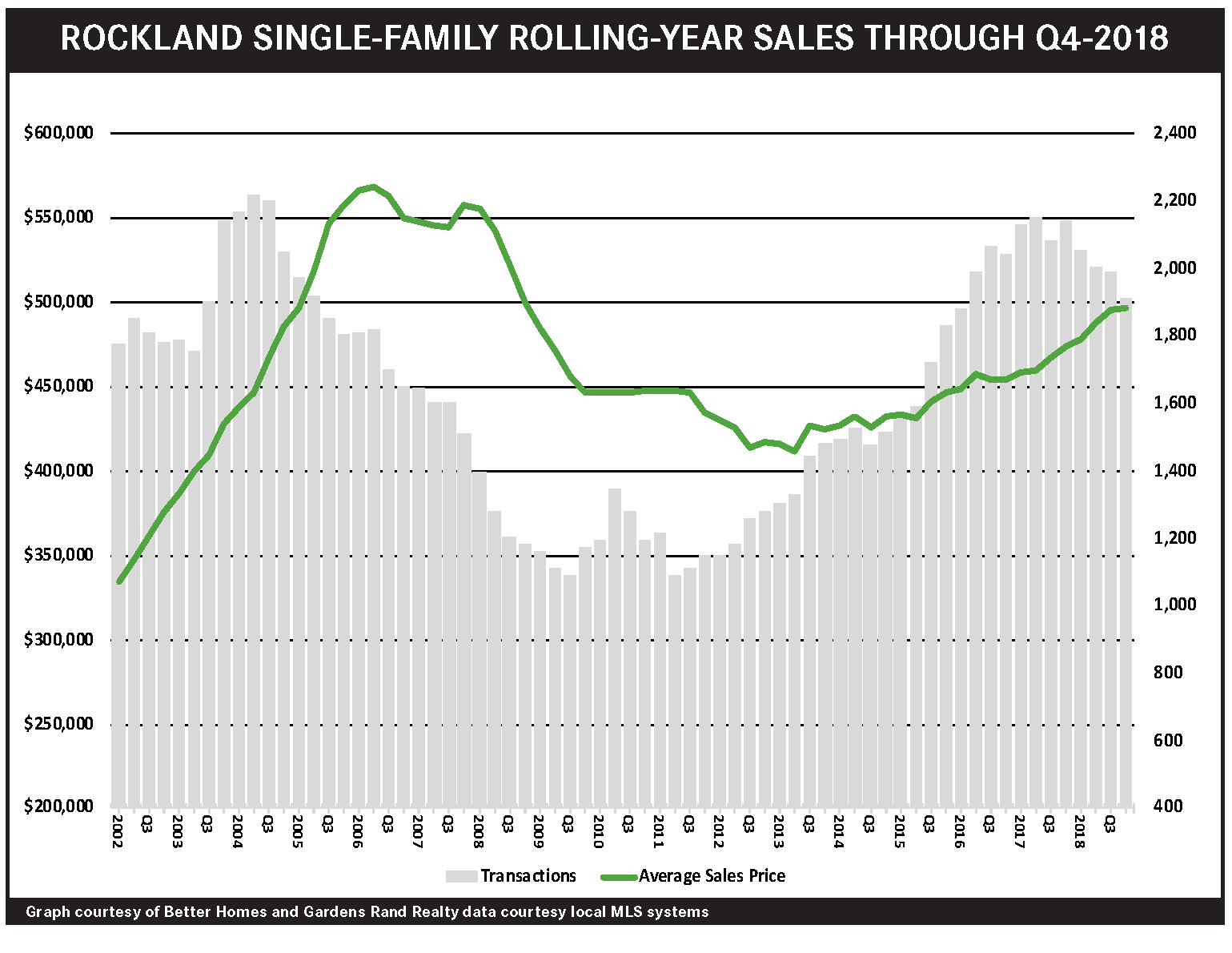

The Rockland seller’s market continues to be constricted by low levels of inventory, which are holding back sales, even while driving prices up. Single‑family home sales were down sharply in the fourth quarter, falling almost 14%, finishing a full year in which they fell almost 11%. But prices were up, rising a tick on average and almost 3% at the median, closing a year in which pricing rose 5% on average and almost 5% at the median. We see the same story with condos, with sales down and prices up for the quarter. So what’s going on? Basically, Rockland needs more fuel for the fire. Demand is strong, but supply is too low to sustain sales increases, even while too many buyers chasing too few homes is driving prices up across the board. But that might be changing, with inventory starting to rise after years of falling, as home owners see prices going up and are tempted into the market. Going forward, we expect that demand will sustain meaningful price appreciation through the winter and spring markets, and that increased inventory might help boost sales as well.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth-Quarter 2018: Real Estate Market Report – Westchester County, NY

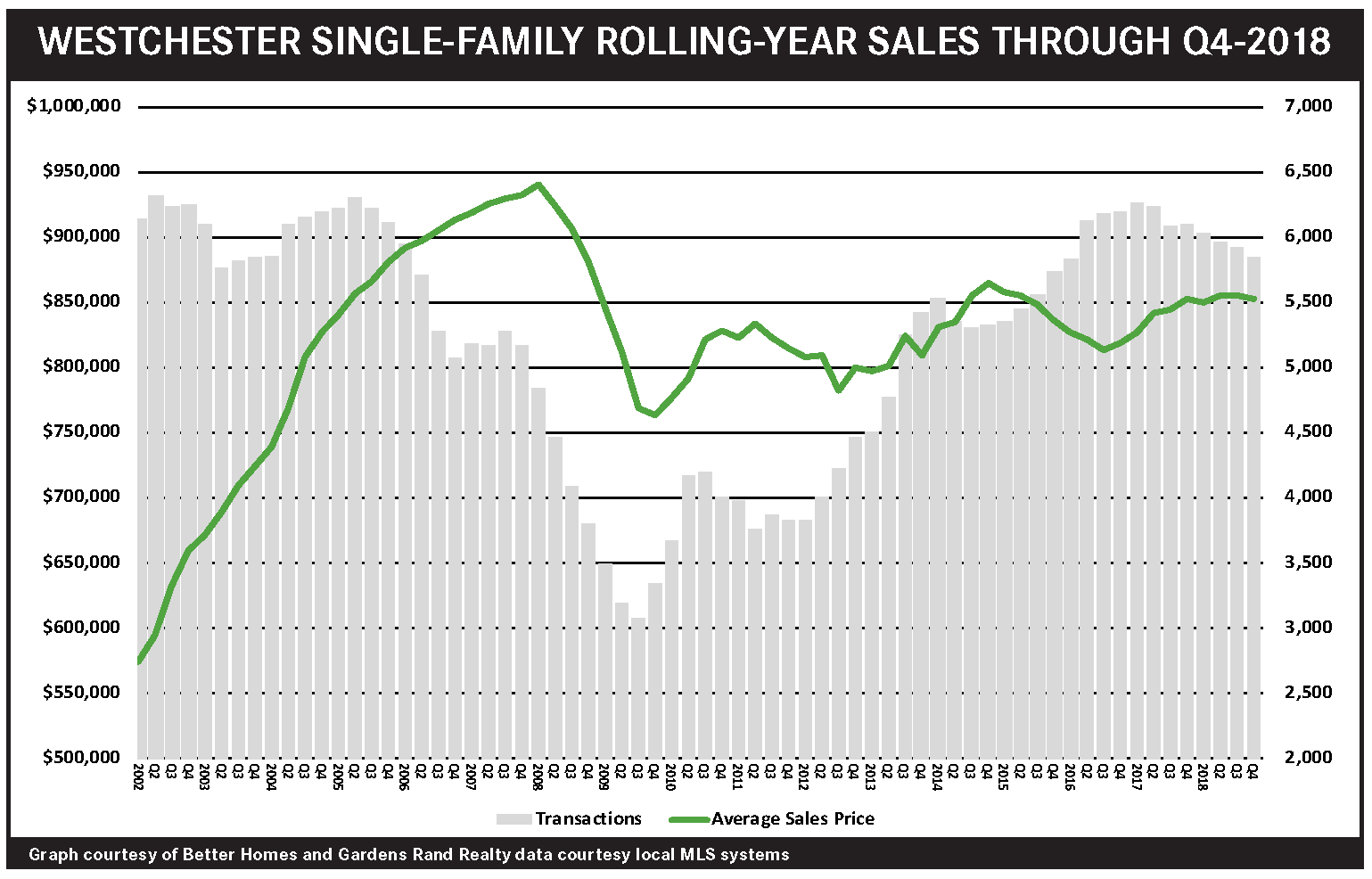

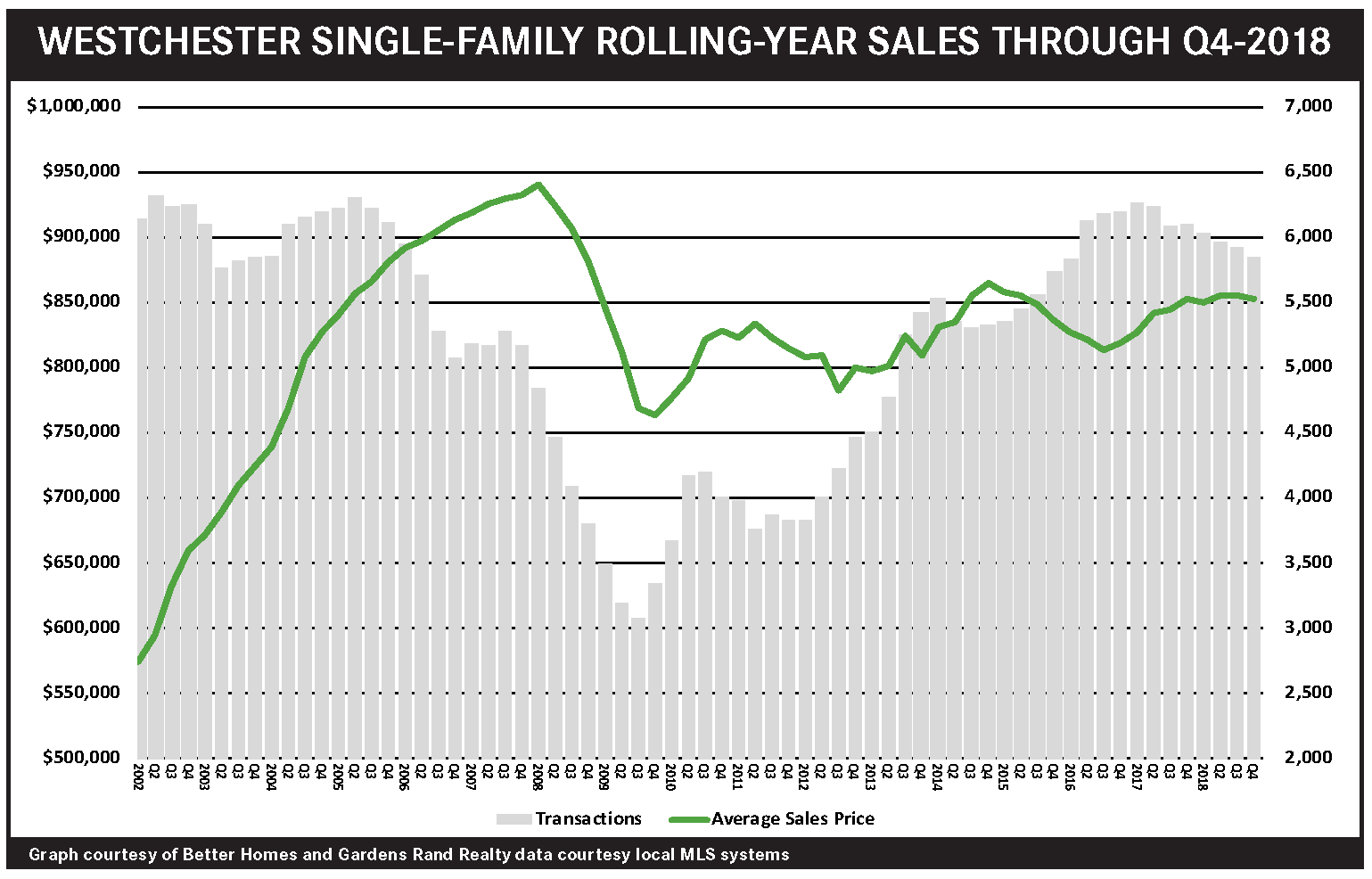

The Westchester housing slowed slightly in the fourth quarter of 2018, particularly in the higher‑priced segments of the market, perhaps as a result of the Tax Reform cap on state and local tax deductions. For the quarter, sales of single‑family homes fell almost 6%, and pricing was mixed: down about 2% on average, up a tick at the median, and down almost 3% in the price‑per‑square‑foot. In contrast, sales in the lower‑priced entry‑level coop and condo markets were more robust, with transactions up over 11% for coops and almost 2% for condos, and average prices up 5% for coops and 1% for condos. The divergence between the higher‑priced single‑family market and the coop/condo market might come from the tax changes, which would particularly hit higher‑income home‑buyers in the higher‑priced markets. Still, though, demand is relatively strong, and with inventory starting to creep up, we might see a more robust start to 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth Quarter 2018: Real Estate Market Report – Lower Hudson Valley, NY

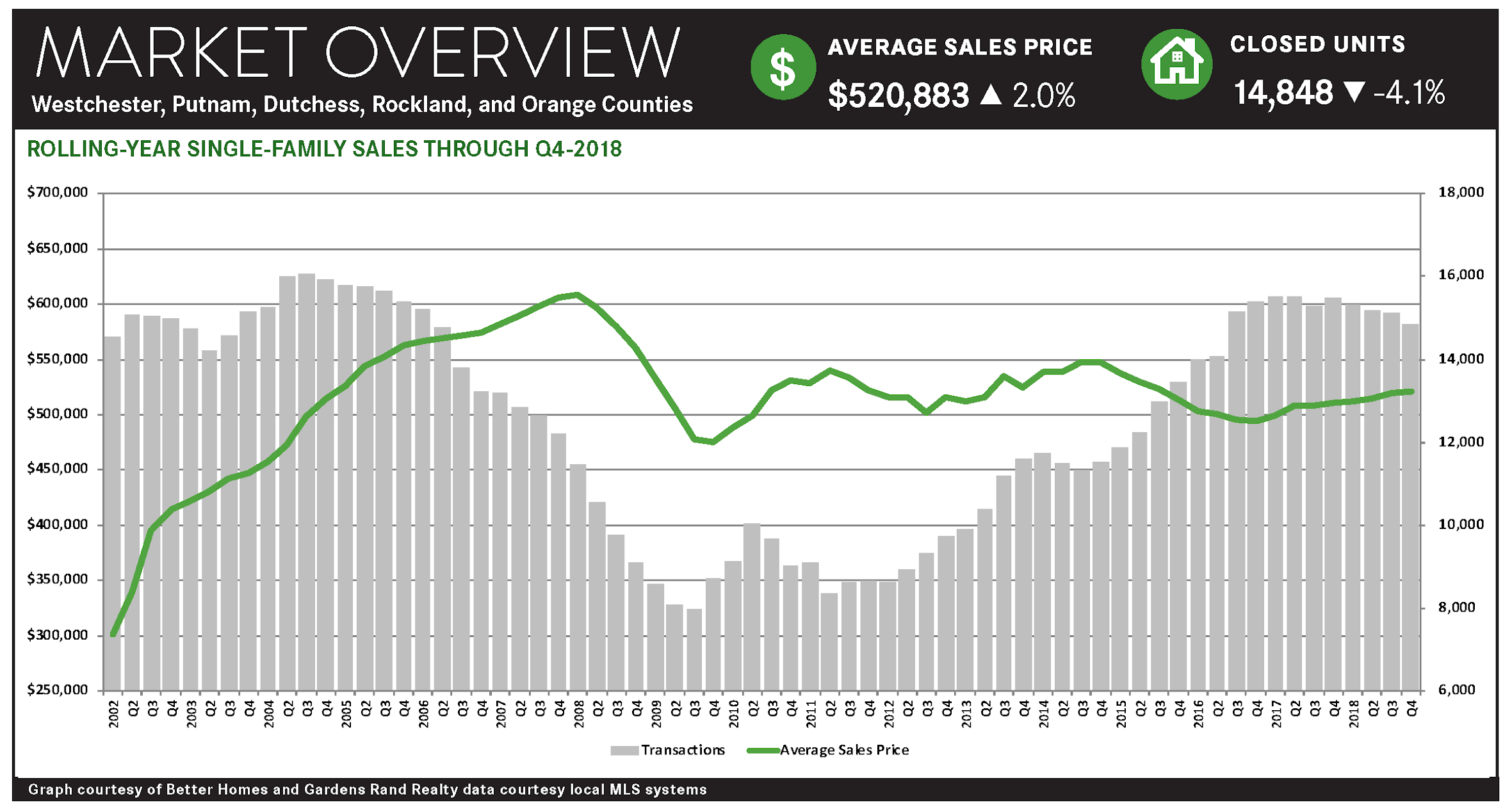

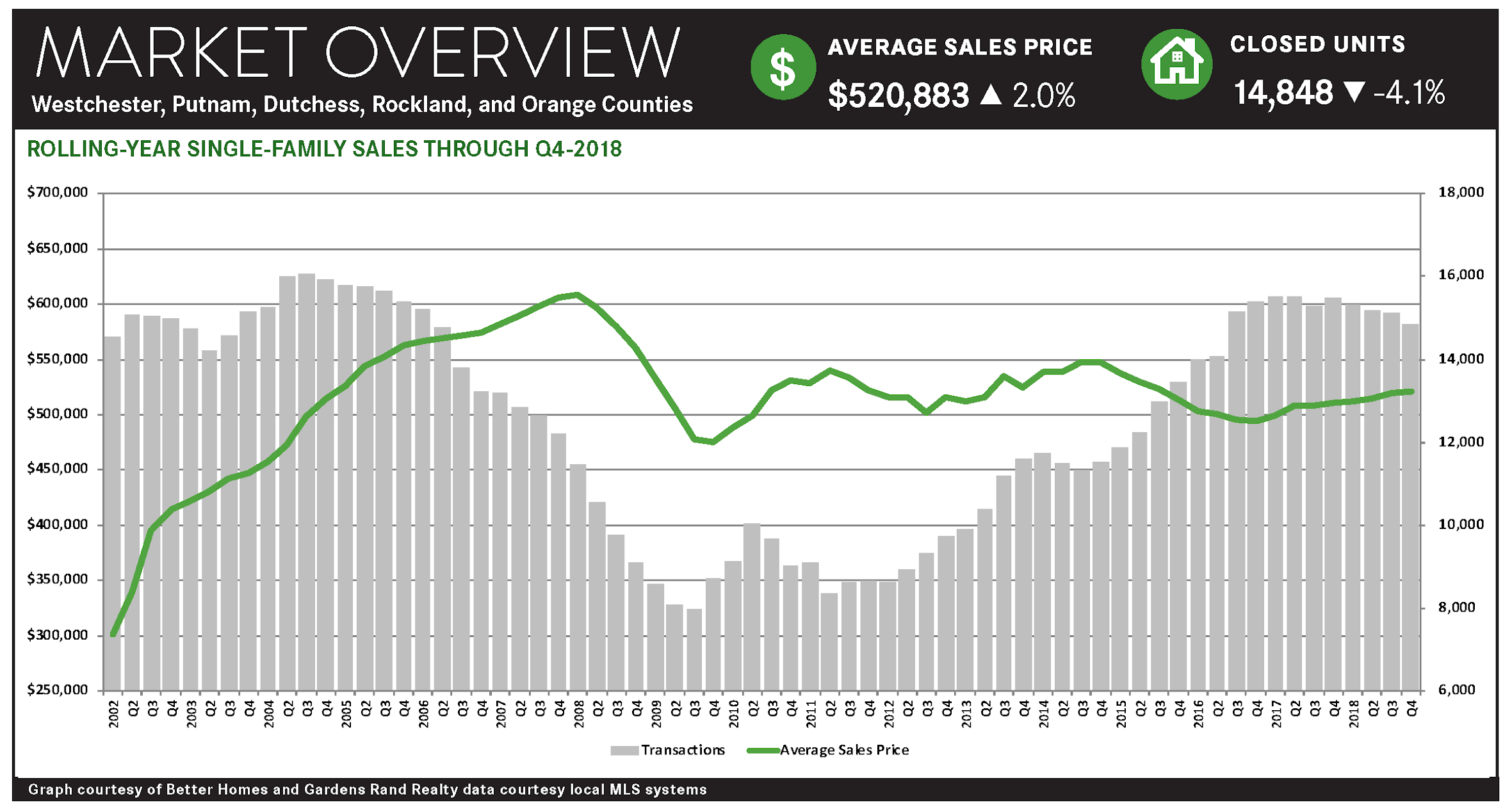

Sales in Westchester and the Hudson Valley housing markets were down throughout the region, even while high buyer demand, coupled with low levels of inventory, drove meaningful price appreciation in most of the regional markets.

Sales were down throughout the region. Regional transactions fell across the board in the fourth quarter, dropping almost 7% for single‑family homes and 5% for condos. We saw the same story for the full 2018 year, with sales down over 4% for single‑family homes and about 1% for condos. To put these numbers in perspective, though, we closed almost 15,000 single‑family homes and almost 3,000 condos in 2018, up from about 9,000 single‑family homes and 2,000 condos back at the bottom of the market 10 years ago. So we’ve had a pretty good run‑up of sales in the past 10 years and were due to plateau at some point.

Prices were up in most of the markets of the region, particularly in the lower‑priced market segments.

Essentially, we had a “tale of two markets” developing in the region, with pricing flat only for the highest‑priced property type in the region – Westchester single‑family homes – even while average prices were up for every other county in the region for the year: up 6% in Putnam, 5% in Rockland, 9% in Orange, and 10% in Dutchess. And full‑year pricing in the entry‑level condo and coop markets was up in every market: rising 6% for Westchester coops, with condos up 0.1% in Westchester, 15% in Putnam, 1% in Rockland, 12% in Orange, and 7% in Dutchess.

So what was holding back pricing for Westchester single‑family homes? We might be seeing the effects of the 2018 Tax Reform, which capped deductions for state and local taxes, and could be having a disproportionate impact on high‑end buyers in high‑property‑tax Westchester. Unlike buyers in the entry‑level condo and coop market, or in the lower‑priced counties, Westchester luxury buyers are more likely to itemize their taxes, so they might be feeling the bite of the cap more acutely. This could be reducing demand at the higher‑ends of the market, suppressing the price appreciation we are seeing in the rest of the region.

Going forward, we believe that the market is still poised for growth. Sales are falling mostly due to a lack of supply, not a lack of demand. Essentially, the market needs more “fuel for the fire” – more viable inventory for the buyers who are looking. And that might be happening: regional single‑family home inventory was up almost 10% from last year, rising for the second quarter in a row after 25 straight quarters of year‑on‑year declines. This makes some economic sense, of course, since we would expect that sustained price appreciation over a period of time should tempt more homeowners into the market. The question is whether buyer demand is strong enough to continue driving price appreciation, even while absorbing this increased inventory. Ultimately, we believe that the region is still growing as a seller’s market, which should allow for both increases in sales and prices in what will be a robust spring market.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link