First Quarter 2017 Real Estate Market Report – Sussex County, New Jersey

Activity in the Sussex County housing market surged yet again in the first quarter of 2017, with sales up sharply even while prices retreated slightly after a strong showing last year.

Activity in the Sussex County housing market surged yet again in the first quarter of 2017, with sales up sharply even while prices retreated slightly after a strong showing last year.

Sales. Sussex sales were up yet again in the first quarter, rising over 32% from last year. And for the year, sales increased over 19%, with almost 2,500 home sales representing the highest 12-month total in over 10 years. Indeed, Sussex sales are now up almost 120% from the bottom of the market in 2011, as a clear seller’s market begins to emerge.

Prices. In our last Report, we noted that the 8% spike in the average sales price in the fourth quarter was probably not sustainable. Well, that played out as we expected in the first quarter, with prices retreating almost 2% on average and an eye-popping 7% at the median. Again, though, don’t read too much into quarterly price changes. Instead, focus on the rolling year, which shows more meaningful, and sustainable, price appreciation levels of over 1% on average and almost 5% at the median.

Inventory. The Sussex inventory of available homes for sale fell dramatically by over 36%, dropping to just 9.2 months. That’s a significant decline, but inventory is still higher than in other Northern New Jersey counties, which are all approaching the six-month inventory line that usually signals the beginning of a seller’s market. But if inventory continues to go down, we would expect that to put some additional upward pressure on pricing.

Negotiability. The negotiability metrics indicated that sellers were gaining some negotiating leverage with buyers. The days-on-market fell dramatically, dropping by 23 days and now down to just over five months of market time. And sellers were retaining a little more of their asking price, with listing retention jumping up to 96.5% for the quarter and over 95% for the year.

Going forward, we expect that Sussex is going to continue to see rising sales coupled with more consistent price appreciation. With an improving economy, homes priced at attractive levels, and near-historically-low interest rates, we expect buyer demand, coupled with declining inventory, to drive a robust Spring market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Essex County, New Jersey

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

Sales. Essex sales activity was up sharply from the first quarter of last year, rising almost 12% and driving the rolling year activity up almost 5%. Buyer demand has been inconsistent throughout the year, certainly not as strong as we are seeing in neighboring Northern New Jersey counties. But Essex closed over 5,000 units over the rolling year, the largest 12-month total since the height of the last seller’s market over 10 years ago, and up over 65% from the bottom of the market in 2011.

Prices. Essex buyer demand is finally showing signs of an impact on pricing. The average price was up almost 4% from the first quarter of last year. Although the median was down just a tick for the quarter, and the rolling year pricing is still down, that increase in the average price was still promising. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the Spring market.

Inventory. Essex inventory fell again, dropping almost 39% from last year’s first quarter and now down to 5.8 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Essex crossed that threshold this quarter augurs well for pricing in 2017.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested that sellers might be gaining just a little bit of negotiating leverage. The days-on-market fell by six days, and the listing retention rate was up sharply. Indeed, for the calendar year, sellers retained over 99% of their last list price. That’s another positive signal of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but meaningful price appreciation through a robust Spring market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Morris County, New Jersey

The Morris County housing market got off to a strong start in 2017, with an increase in sales activity coupled with some promising signs for pricing.

The Morris County housing market got off to a strong start in 2017, with an increase in sales activity coupled with some promising signs for pricing.

Sales. Morris County sales were up solidly, rising almost 9% from the first quarter of last year. This continued a streak in which year-on-year sales have now gone up for 10 straight quarters, over two years of sustained buyer demand. Transactions were also up 10% for the year, and are now up almost 60% from the bottom of the market in 2011. So sales have been strong for several years now, indicating sustained levels of buyer demand.

Prices. These persistent levels of buyer demand are finally having some modest impact on pricing. For the first time in several years, the average price was up, rising a little over 1%. And even though the median was down 1%, and the yearlong price trend is negative, we believe that sustained buyer demand coupled with falling inventory is likely to drive pricing up through the rest of the year.

Inventory. Morris inventory fell again, dropping over 34% from last year’s first quarter and now down to just over six months worth of inventory . We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Morris inventory is now close to that six-month mark indicates that we could be in for some meaningful price appreciation in 2017.

Negotiability. The negotiability indicators showed that sellers are starting to gain leverage with buyers. The days-on-market indicator was down by 15 days, falling over 10%, indicating that homes were selling more quickly. And the listing price retention rate continues to rise, now up to just about 97% for the quarter and the year, signaling that sellers are having more success getting buyers to meet their asking prices.

Going forward, we expect that Morris County’s sales activity will eventually have a more meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that reduced inventory, coupled with rising buyer demand, will drive price appreciation through a robust Spring market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Passaic County, New Jersey

The Passaic County housing market surged in the first quarter of 2017, with sales spiking and prices showing their first signs of meaningful appreciation in years.

The Passaic County housing market surged in the first quarter of 2017, with sales spiking and prices showing their first signs of meaningful appreciation in years.

Sales. Passaic started the year dramatically, with sales spiking almost 30% from the first quarter of last year. We’ve now seen sustained increases in buyer demand for over five years, with quarterly sales up in 21 out of the last 23 quarters. As a result, Passaic closed almost 3,500 homes for the calendar year, the highest total we’ve seen in over 10 years, since the height of the last seller’s market

Prices. More importantly, we’re starting to see these sustained levels of buyer demand have their first impact on pricing. Prices were up across the board, rising almost 2% on average and 6% at the median. Prices are still down for the year, due to the lackluster performance in most of 2016, but they seem to be finally heading in a positive direction. With buyer demand strong, and inventory falling, we would expect prices to be going up.

Inventory. The Passaic inventory of available homes for sale fell again, down almost 38% from last year. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Passaic is now down to just over six months of inventory is important, since it presages the possibility of price appreciation for the rest of 2017.

Negotiability. Sellers gained significant negotiating leverage in the first quarter, with homes selling far more quickly and for closer to the asking price. The days-on-market fell dramatically, dropping almost 15%–almost a full month!–and now down to about five months on the market. And the listing price retention rate jumped almost a full percentage point, and is now up to 97%.

Going forward, we believe that Passaic’s fundamentals are sound, with homes priced at relatively attractive levels, rates near historic lows, and a stable economy. Accordingly, we expect these levels of buyer demand, coupled with declining inventory, to continue to drive price appreciation in a robust Spring market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Bergen County, New Jersey

The Bergen County housing market showed continued signs of emerging into a strong seller’s market, with declining inventory holding sales back even while driving prices up dramatically.

The Bergen County housing market showed continued signs of emerging into a strong seller’s market, with declining inventory holding sales back even while driving prices up dramatically.

Sales. Bergen single-family home sales were up about 1% from last year’s first quarter, the tenth straight quarter of year-on-year sales growth. For the rolling year, sales were up a little more robustly, rising 7%. What’s holding sales back right now is not a lack of demand, but a lack of inventory. If we start seeing more homes hit the market, we’ll see sales go up sharply.

Prices. Bergen prices spiked in the first quarter, rising almost 8% on average and 5% at the median. That’s probably not a sustainable level of price appreciation, but Bergen homeowners can certainly start to depend on the 1-2% increases that we are seeing on average and at the median for the last rolling year.

Inventory. Single-family inventory continued to tighten in the first quarter, with the months of inventory falling over 21% and now down to 4.4 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. With inventory now well below that six-month mark, and falling into the “seller’s market” territory, we will continue to see upward pressure on pricing.

Negotiability. Homes were selling more quickly and for closer to the asking price, which is what we would expect of an emerging seller’s market. The listing retention rate is now about 96%, and the days-on-market is well under three months. As inventory tightens and the market heats up, we would expect to see sellers continue to gain negotiating leverage.

Condos. Activity in the Bergen condo market was up sharply in the first quarter, with sales up almost 11% from last year. Prices were more mixed, with the average down over 4% but the median up almost 2%. With inventory now down below six months, though, we would expect to see more meaningful price appreciation this year.

Going forward, we expect Bergen County will enjoy a robust Spring market with both rising sales and prices. With inventory tightening, a relatively strong economy, near-historically-low interest rates, and prices still at attractive 2004 levels, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets got off to a strong start to the year, with regional sales up almost 12% and transactions rising in every market in the region: up 1% in Bergen, 30% in Passaic, 8% in Morris, 12% in Essex, and 32% in Sussex. For the rolling year, sales were up over 9%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 65% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We measure the “months of inventory” in a market by looking at the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything fewer than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up — and we’ve now seen this market cross below that line for the second quarter in a row. Indeed, inventory was down from last year in every individual county in the Report: Bergen single-family homes down 21%, and condos down 34%; Passaic down 38%; Morris down 34%; Essex down 39%; and Sussex down 36%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing. With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re beginning to see some promising signs: the regional average sales price was up almost 1% from last year’s first quarter, and the average price was up in almost every county in the report.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Spring market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Homes in Northern New Jersey Are Cheaper Than They’ve Been in a Generation!

Right now is a really great time to be buying a home in Northern New Jersey

Man, do I hate saying that. As I’ve explained before, I hate the phrase “great time to buy,” for a couple of reasons.

First, people have different needs, and a market that’s great for one person might be terrible for another person.

Second, while markets tend to move together, we do see micro-markets (i.e., towns and villages) that defy larger trends. So while it might be a great time to buy in Village A, it might be not so great in Town B.

Third, and most importantly, though, “it’s a great time to buy!” just seems like a hack thing to say, the kind of thing that TERRIBLE real estate agents have said for generations to get unsuspecting and gullible people to buy an overpriced home. And I think that most people get suspicious when real estate agents talk like that.

So I understand if you’re skeptical. And that’s why I don’t want to just TELL you it’s a great time to buy, I want to SHOW you why it’s a great time to buy.

Specifically, I want to make this specific point: the monthly payment you need to buy an inflation-adjusted average priced home in Northern New Jersey is as low as its been in a generation.

Think about what I’m saying for a second. I’m NOT saying that homes are cheaper than they’ve ever been. That’s not true. Depending on the year, homes have appreciated, and if you go back more than 15 years, they’ve appreciated pretty dramatically. I’m just saying that the MONTHLY PAYMENT you need to make to buy the AVERAGE PRICED HOME is lower right now than it’s been in a generation — if you control for the effects of inflation.

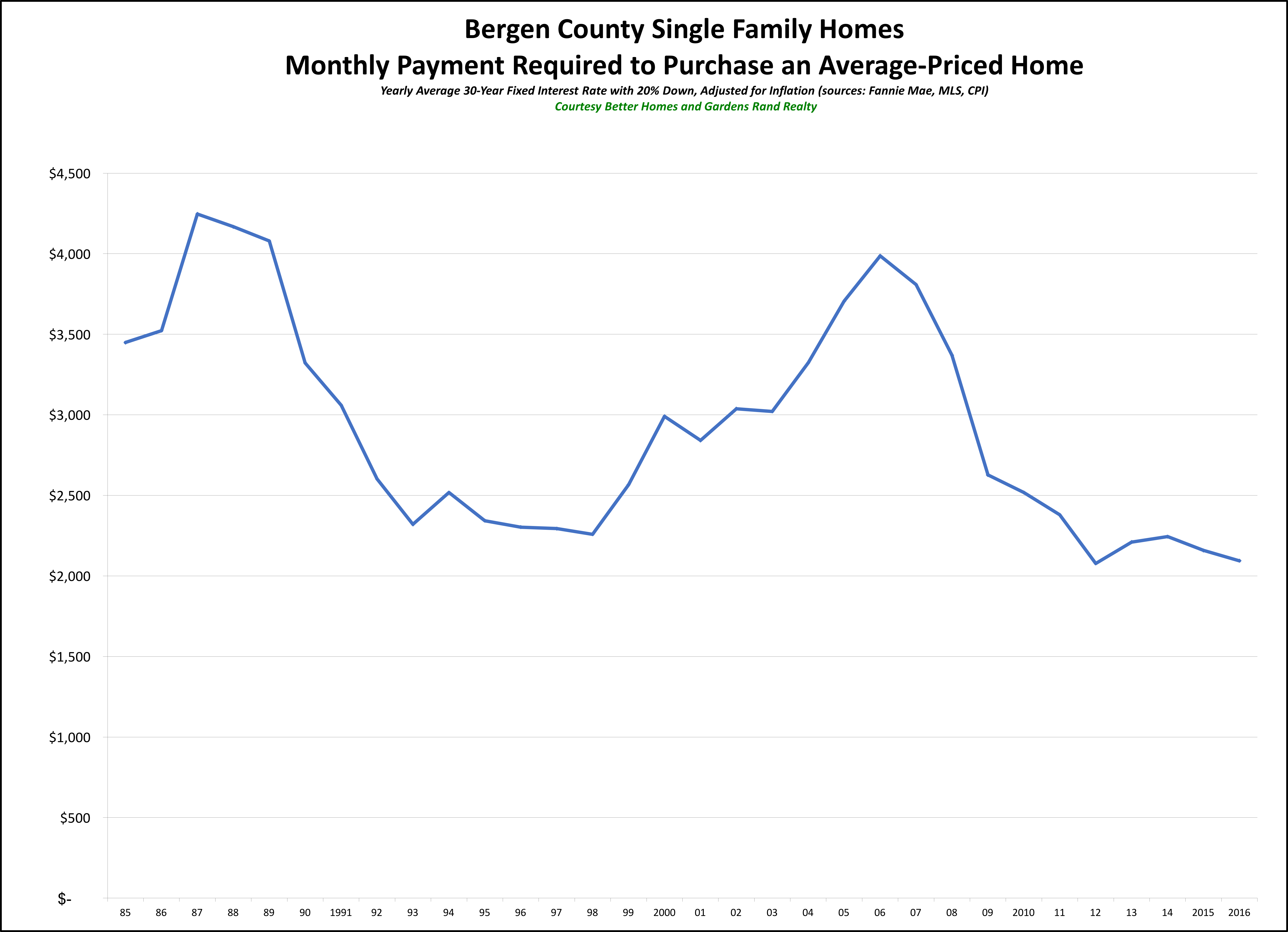

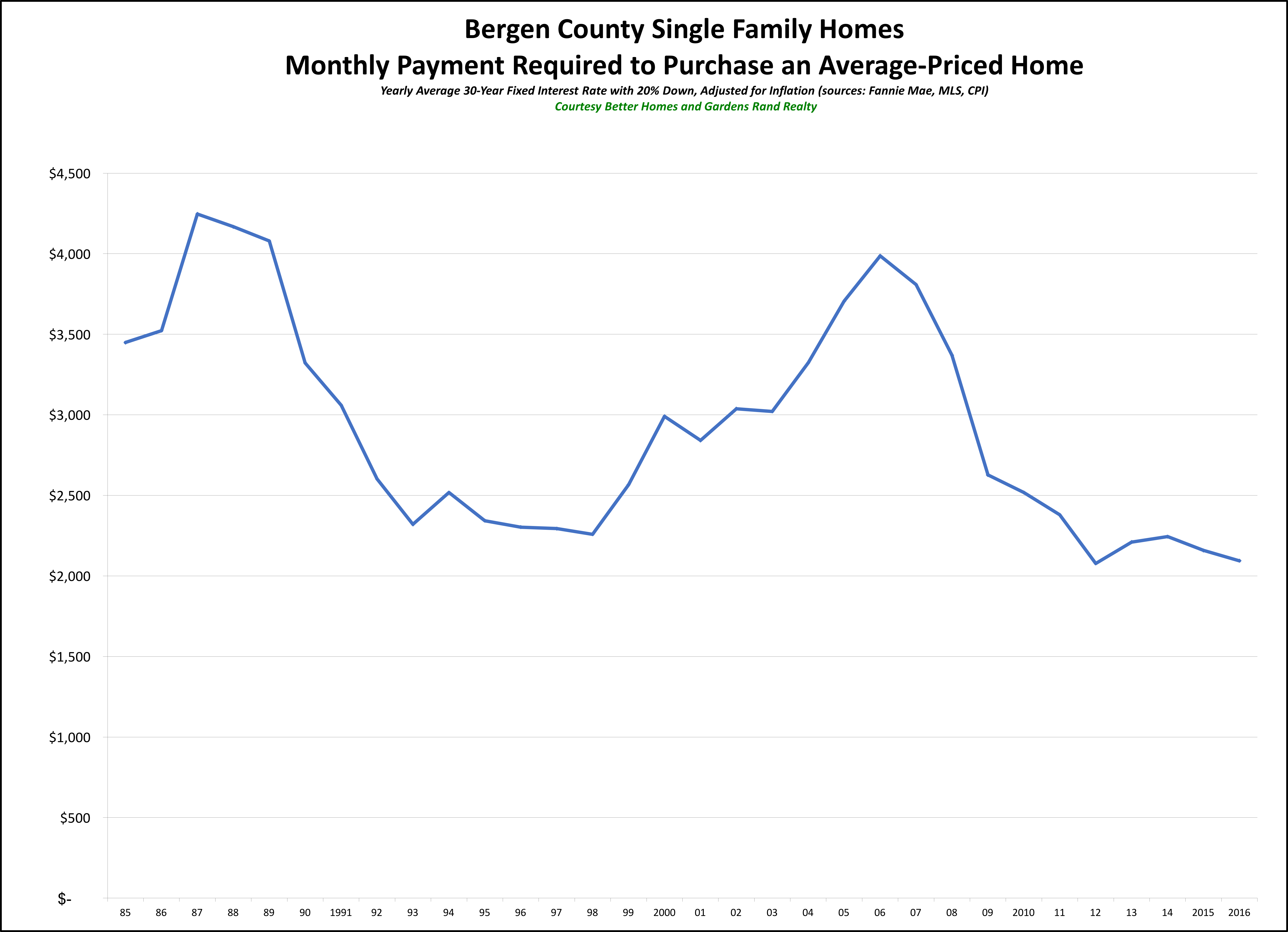

Take a look at these graphs for Bergen and Passaic Counties, and you’ll see what I mean:

On these graphs, as we’ve done before, we’ve plotted the monthly payment that a purchaser in the county would have to make to purchase the average-priced home at various points over the years. After all, affordability is not just a matter of the sales price – it’s a matter of the monthly payment you’re going to have to make, which is partly a function of the prevailing interest rate. And then to measure the change in the monthly payment over time, we factored in the effects of inflation.

So we took the following data points:

•The average price of a single family home up to the end of 2016 – from the local MLS data.

•The average interest rate for a 30-year fixed-rate mortgage for every calendar year up to 2016 – from Freddie Mac.

•The prevailing inflation rate for every calendar year up to 2016– from the US Department of Labor.

You can see the results on the graph. The monthly payment you have to make to purchase the average-priced home in Bergen or Passaic is just about as low as it’s been in years. We saw the slightest uptick from 2012-2014, partially because of a slight increase in pricing and a slow inflating of interest rates. But the payment came down again over the past two years, with rates falling and prices stalling.

Generally, though, we’re talking about a monthly payment that is as low as anytime in the past 30 years – and as low as it was in the mid-1990s, during a crippling buyer’s market. We don’t have data going back in Passaic as far as we do in Bergen, but there’s no reason to think that the markets behaved differently during the 1980s.

So why are monthly payments lower than they’ve been in a generation? A couple of reasons:

1) Prices. Part of it is that we have not seen prices go up in any measurable way in almost 10 years. Home prices peaked in 2006-08, lost about 25-30% of value from 2008-2010, and have bounced around a little since then. But they’re still around 2004 levels — without controlling for inflation.

2) Inflation. Ah, yes, inflation — the value of money goes down a little bit each year as inflation takes a bite. Now, inflation rates have been pretty low over the past 15 years from historical standards, but that little bit each year does add up.

3) Rates. But the biggest reason we’re seeing monthly payments lower than they’ve been in a generation is that rates are still at historic lows. After all, about ten years ago, the average interest rate was about 6%. For the past few years, it’s been below 4%. That’s a huge difference in your monthly payment.

Again, I HATE it when real estate professionals say that “this is a great time to buy,” because at many times in our history that has been bad advice.

But if you measure a “great time to buy” by looking at the monthly payment you’ll have to make to buy a home, then we’re talking about as good a time to buy as any in the past decades. Prices have been flat for almost 10 years, and they’re down significantly if you factor in the effects of inflation. And interest rates are still as low as we’ve ever seen them. Unless we see some major shock to the economy, I think we’re looking at a near-decade of reasonable price appreciation coupled with increasing interest rates – both of which are going to drive that monthly payment up over the next few years.

So I’m not going to tell you what to do. That’s not my job. But if you’ve been thinking about buying a home, I think these graphs speak for themselves.

Joe Rand is the Chief Creative Officer of Better Homes and Gardens Real Estate | Rand Realty, and compiles and writes the Rand Quarterly Market Report.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Homes in Northern New Jersey Are Cheaper Than They've Been in a Generation!

Right now is a really great time to be buying a home in Northern New Jersey

Man, do I hate saying that. As I’ve explained before, I hate the phrase “great time to buy,” for a couple of reasons.

First, people have different needs, and a market that’s great for one person might be terrible for another person.

Second, while markets tend to move together, we do see micro-markets (i.e., towns and villages) that defy larger trends. So while it might be a great time to buy in Village A, it might be not so great in Town B.

Third, and most importantly, though, “it’s a great time to buy!” just seems like a hack thing to say, the kind of thing that TERRIBLE real estate agents have said for generations to get unsuspecting and gullible people to buy an overpriced home. And I think that most people get suspicious when real estate agents talk like that.

So I understand if you’re skeptical. And that’s why I don’t want to just TELL you it’s a great time to buy, I want to SHOW you why it’s a great time to buy.

Specifically, I want to make this specific point: the monthly payment you need to buy an inflation-adjusted average priced home in Northern New Jersey is as low as its been in a generation.

Think about what I’m saying for a second. I’m NOT saying that homes are cheaper than they’ve ever been. That’s not true. Depending on the year, homes have appreciated, and if you go back more than 15 years, they’ve appreciated pretty dramatically. I’m just saying that the MONTHLY PAYMENT you need to make to buy the AVERAGE PRICED HOME is lower right now than it’s been in a generation — if you control for the effects of inflation.

Take a look at these graphs for Bergen and Passaic Counties, and you’ll see what I mean:

On these graphs, as we’ve done before, we’ve plotted the monthly payment that a purchaser in the county would have to make to purchase the average-priced home at various points over the years. After all, affordability is not just a matter of the sales price – it’s a matter of the monthly payment you’re going to have to make, which is partly a function of the prevailing interest rate. And then to measure the change in the monthly payment over time, we factored in the effects of inflation.

So we took the following data points:

- The average price of a single family home up to the end of 2016 – from the local MLS data.

- The average interest rate for a 30-year fixed-rate mortgage for every calendar year up to 2016 – from Freddie Mac.

- The prevailing inflation rate for every calendar year up to 2016– from the US Department of Labor.

You can see the results on the graph. The monthly payment you have to make to purchase the average-priced home in Bergen or Passaic is just about as low as it’s been in years. We saw the slightest uptick from 2012-2014, partially because of a slight increase in pricing and a slow inflating of interest rates. But the payment came down again over the past two years, with rates falling and prices stalling.

Generally, though, we’re talking about a monthly payment that is as low as anytime in the past 30 years – and as low as it was in the mid-1990s, during a crippling buyer’s market. We don’t have data going back in Passaic as far as we do in Bergen, but there’s no reason to think that the markets behaved differently during the 1980s.

So why are monthly payments lower than they’ve been in a generation? A couple of reasons:

- Prices. Part of it is that we have not seen prices go up in any measurable way in almost 10 years. Home prices peaked in 2006-08, lost about 25-30% of value from 2008-2010, and have bounced around a little since then. But they’re still around 2004 levels — without controlling for inflation.

- Inflation. Ah, yes, inflation — the value of money goes down a little bit each year as inflation takes a bite. Now, inflation rates have been pretty low over the past 15 years from historical standards, but that little bit each year does add up.

- Rates. But the biggest reason we’re seeing monthly payments lower than they’ve been in a generation is that rates are still at historic lows. After all, about ten years ago, the average interest rate was about 6%. For the past few years, it’s been below 4%. That’s a huge difference in your monthly payment.

Again, I HATE it when real estate professionals say that “this is a great time to buy,” because at many times in our history that has been bad advice.

But if you measure a “great time to buy” by looking at the monthly payment you’ll have to make to buy a home, then we’re talking about as good a time to buy as any in the past decades. Prices have been flat for almost 10 years, and they’re down significantly if you factor in the effects of inflation. And interest rates are still as low as we’ve ever seen them. Unless we see some major shock to the economy, I think we’re looking at a near-decade of reasonable price appreciation coupled with increasing interest rates – both of which are going to drive that monthly payment up over the next few years.

So I’m not going to tell you what to do. That’s not my job. But if you’ve been thinking about buying a home, I think these graphs speak for themselves.

Joe Rand is the Chief Creative Officer of Better Homes and Gardens Real Estate | Rand Realty, and compiles and writes the Rand Quarterly Market Report.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Sussex County, New Jersey

The Sussex County housing market surged yet again in the fourth quarter of 2016, with sales up sharply and an eyeopening spike in prices.

The Sussex County housing market surged yet again in the fourth quarter of 2016, with sales up sharply and an eyeopening spike in prices.

Sales. Sussex sales were up again in the fourth quarter, rising over 18% from the fourth quarter of last year. And for the year, sales increased almost 19%, finishing 2016 with the highest yearly transactional total in over 10 years, since the height of the last seller’s market. Indeed, Sussex sales are now up 113% from the bottom of the market in 2011. Essentially, Sussex buyer demand is as strong as we have ever seen it.

Prices. Sussex prices absolutely spiked, rising over 8% on average and almost 10% at the median compared to the fourth quarter of last year. Those kinds of surges are probably unsustainable statistical aberrations, particularly since the calendar year increases were much more modest, with prices up just 0.2% on average and 1.5% at the median. That said, for Sussex homeowners, price appreciation has been a long time coming, so unsustainable good news is still good news.

Inventory. The Sussex inventory of available homes for sale fell by 22%, dropping to just over 11 months. That’s a significant decline, but inventory is still significantly higher than in other Northern New Jersey counties, which are all approaching the six-month inventory line that usually signals the beginning of a seller’s market. But if inventory continues to go down, we would expect that to put some additional upward pressure on pricing.

Negotiability. The negotiability metrics were mixed. Homes took a little longer to sell, with the days-on-market rising by five days. But sellers were retaining a little more of their asking price, with listing retention jumping up to 95.4% for the quarter. As the market heats up, we would expect both these indicators to show that sellers are gaining negotiating leverage with buyers.

Going forward, we expect that Sussex is likely to see some meaningful and sustained price appreciation in 2017. With an improving economy, homes priced at relatively attractive 2004 levels (without adjusting for inflation), and near historically low interest rates, we expect buyer demand coupled with declining inventory to drive a rising market in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Essex County, New Jersey

The Essex County housing market finished the year with a surge in sales, but these sustained increases in buyer demand have not had their expected impact in driving price appreciation.

The Essex County housing market finished the year with a surge in sales, but these sustained increases in buyer demand have not had their expected impact in driving price appreciation.

Sales. Essex sales activity recovered from a disappointing third quarter, with sales rising almost 11% from the fourth quarter of last year and finishing the calendar year up almost 5%. Buyer demand has been inconsistent throughout the year, certainly not as strong as we are seeing in neighboring Northern New Jersey counties. That said, Essex closed over 5,000 units in 2016, the largest calendar year total since the height of the last seller’s market over 10 years ago, and up almost 61% from the bottom of the market in 2011.

Prices. Essex pricing was also a bit disappointing, with the average down over 2% and the median down 3% from the fourth quarter of last year. The results were similar when we looked at the full 2016 calendar year, where prices were down over 2% on average and almost 4% at the median. This is a little surprising, given that an increase in buyer demand is usually associated with some upward pressure on pricing.

Inventory. Essex inventory fell again, falling almost 27% from last year’s fourth quarter and now down to 7.0 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So Essex’s relatively low inventory levels raise the possibility of meaningful price appreciation in 2017.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested the sellers might be gaining just a little bit of negotiating leverage. The days-on-market fell by five days, and the listing retention rate was up sharply. Indeed, for the calendar year, sellers retained over 99% of their last list price. That’s another positive signal of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but measurable price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link