Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Orange County, New York

The Orange County housing market surged yet again in the fourth quarter of 2016, with clear signs of meaningful price appreciation for the first time in years.

The Orange County housing market surged yet again in the fourth quarter of 2016, with clear signs of meaningful price appreciation for the first time in years.

Sales. Orange single-family sales were up yet again, rising almost 19% from last year’s fourth quarter, and finishing the full 2016 calendar year up almost 25%. This continues a trend we’ve been watching for almost five years, with Orange sales now up nine quarters in a row and 18 out of the last 19. Even more telling, the 3,542 yearly single-family home sales were the most since 2005, and were up 112% from the bottom of the market in 2011.

Prices. These sustained increases in buyer demand are finally having a meaningful impact on pricing, with single-family home prices up a tick on average and almost 4% at the median compared to last year’s fourth quarter. More importantly, prices were up ever-so-slightly for the year, just under 1% on both the average and the median. That may not seem like much, but it was the first time that Orange calendar-year prices rose since 2007.

Inventory. The available inventory continues to tighten in the single-family market, closing in on the six-month market that usually indicates a tight seller’s market. As inventory falls, we would expect even more upward pressure on pricing.

Condominiums. The Orange condo market showed signs of life, with sales up over 10% for the quarter and finishing the year up almost 9%. The condo market has struggled for years in Orange, particularly as the price point between condos and houses narrowed. But that gap might be widening as single-family home prices accelerate, which would likely stop the bleeding in the condo market pricing.

Going forward, we believe that the Orange County housing market is looking forward to its best year since the height of the last seller’s market. The fundamentals are strong: demand is high, prices are still at attractive 2003-04 levels, interest rates are at historic lows, and the economy is generally improving. With inventory declining, we expect to see more meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

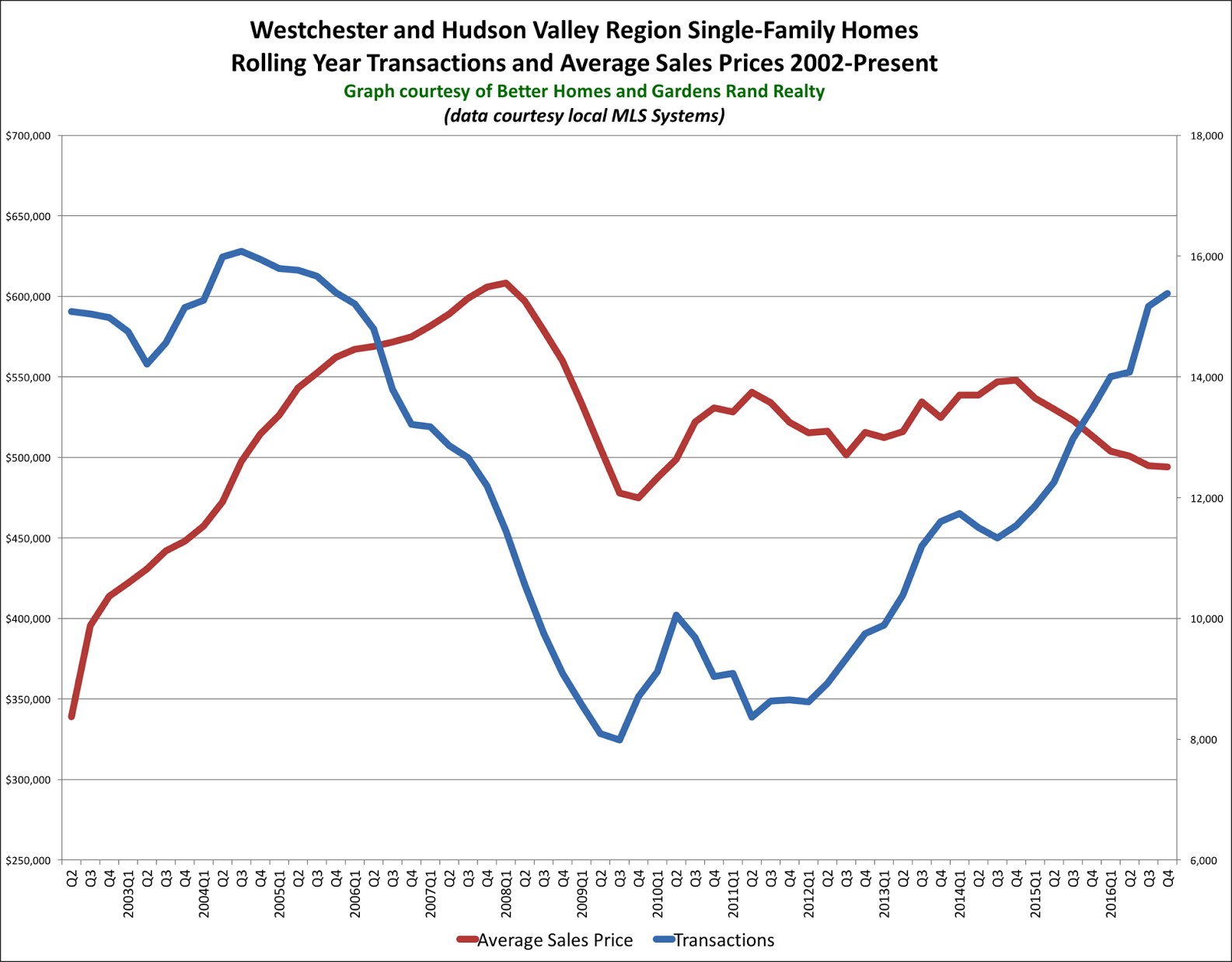

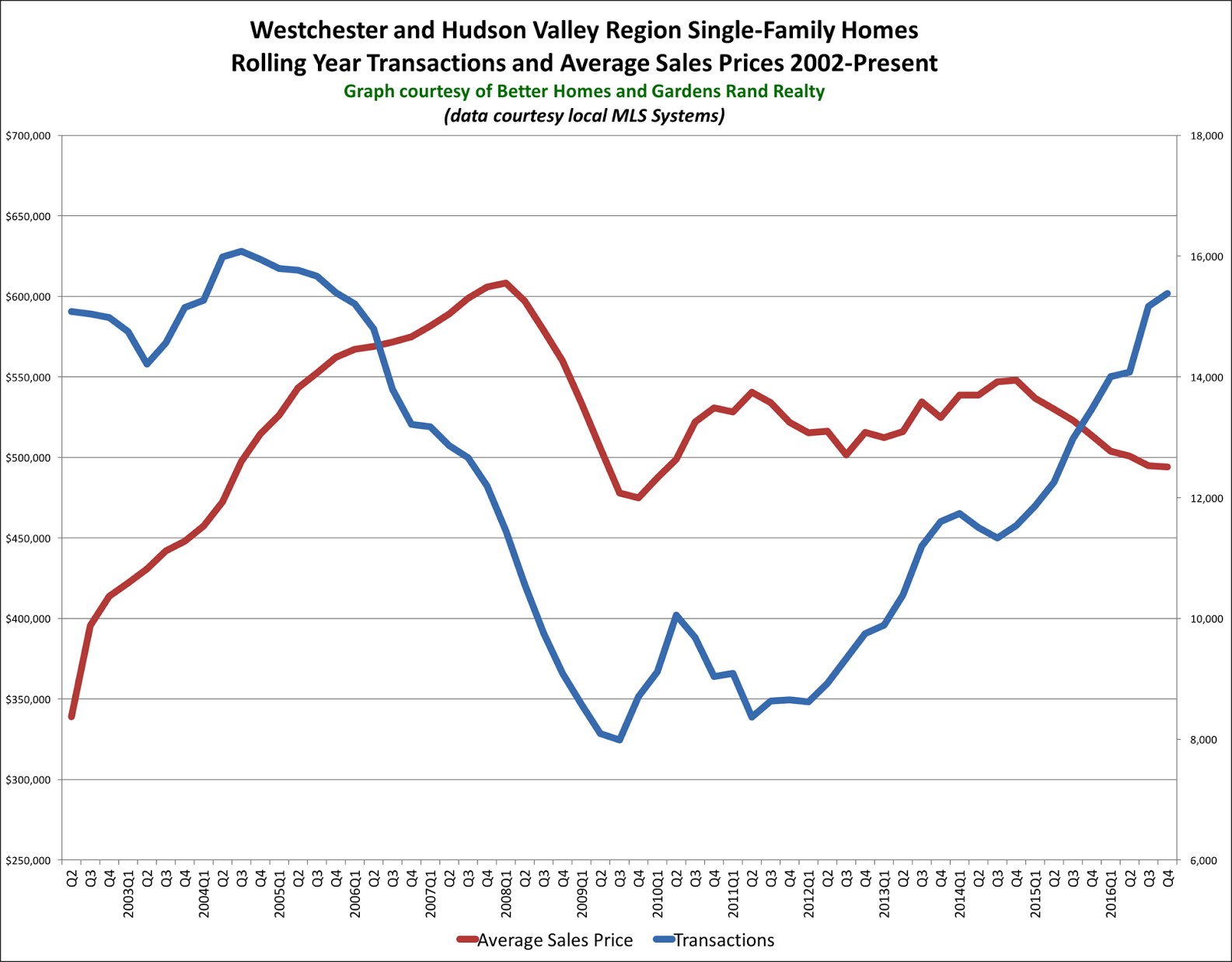

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Real Estate Market Report: Third Quarter 2016 – Orange County, New York

The Orange County housing market surged again in the third quarter of 2016, with sales up dramatically and, more importantly, the first signs of meaningful price appreciation since the 2008-09 financial crisis.

The Orange County housing market surged again in the third quarter of 2016, with sales up dramatically and, more importantly, the first signs of meaningful price appreciation since the 2008-09 financial crisis.

Sales. Orange single‑family sales were up yet again, rising over 18% from last year and now up over 25% for the rolling year. This continues a trend we’ve been watching for over four years, with Orange sales now up eight quarters in a row and 17 out of the last 18. And the 3,400 single‑family sales for the rolling year marked the highest yearly total we’ve seen since the third quarter of 2006 ‑‑ exactly ten years ago, at the top of the last seller’s market.

Prices. These sustained increases in buyer demand are finally having a meaningful impact on pricing, with prices up across the board in the third quarter: up almost 4% on average, 3% at the median, and 4% in the price‑per‑square foot. This is all great news for Orange homeowners, who have been impatiently waiting for pricing to rebound since the 2008-09 financial crisis.

Negotiability. The number of available homes for sale continues to fall, with inventory dropping almost 38% and now down to about eight months for single‑family homes and six months for condos. According to industry standards, anything below six months of inventory indicates a “tight” market that usually drives price appreciation. The other negotiability factors were mixed, with homes selling for closer to the asking price but days‑on‑market relatively flat.

Condominiums. The Orange condo market was not as active, with sales down almost 8% for the quarter. But prices showed similar signs of rebounding, with the average up almost 2%, the median up 3%, and the price‑per‑square foot spiking 7%. If the single‑family market continues to heat up, we expect that the condo market will follow.

Going forward, we believe that the Orange County housing market is looking at its best year since the height of the last seller’s market. The fundamentals are strong: demand is high, prices are still attractive, interest rates are at historic lows, and the economy is generally improving. We expect a strong finish for the year, and meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Real Estate Market Report: Third Quarter 2016 – Westchester & Hudson Valley Market Overview

The housing market in Westchester and the Hudson Valley in the third quarter of 2016 defied the standard economic laws of supply and demand. Sales were up and inventory was down, but prices were flat across the board. Why? Maybe buyers are just leery of making a move during a tumultuous presidential election year.

The housing market in Westchester and the Hudson Valley in the third quarter of 2016 defied the standard economic laws of supply and demand. Sales were up and inventory was down, but prices were flat across the board. Why? Maybe buyers are just leery of making a move during a tumultuous presidential election year.

Sales activity continues to increase throughout the region. Sales were up compared to the third quarter of last year in every county in the Report, ranging from a modest 2% increase in Westchester to a robust 18% rise in Orange. We’ve now seen sustained sales increases for almost five years, with regional year‑on‑year sales going up in 17 out of the last 19 quarters. And we’re reaching transactional totals we haven’t seen since the height of the last seller’s market, with the region hitting 15,000 single‑family home sales for the first time since 2016. We did see some signs, though, that the pace of growth might be slowing: regional sales were up only 8% for the quarter, relatively disappointing in a rolling year where sales rose almost 17%.

Inventory continues to tighten throughout the region. The supply of homes for sale is falling throughout the region, down in almost every county in the Report: dropping 20% in Westchester, 31% in Putnam, 17% in Rockland, and 21% in Orange. And if you look at the months of inventory available given the current rate of sales, we are already approaching the six‑month inventory level that usually signals a tight seller’s market. For single‑family homes, Westchester is already below six months at 5.8, and the other counties are getting close: Putnam at 7.3, Rockland at 6.4, and Orange at 8.1. And for condos, it’s the same story: Westchester at 3.7, Putnam at 4.7, Rockland at 7.1, and Orange right at 6.0.

So with demand up and supply down, why aren’t prices rising? Prices were down modestly throughout the region, and in most of the counties in this Report. We can think of three reasons.

- Disproportionate strength in the lower‑end markets. The fact that sales were up 18% in lower‑priced Orange and only 2% in higher‑priced Westchester might be a sign that demand is stronger at the entry‑level. That would tend to drive overall pricing down a bit.

- Buyers are still spooked by the financial crisis and meltdown of 2008‑09. Maybe buyers aren’t yet willing to give in to seller demands for higher prices – that would blunt the impact of declines in inventory, and might also explain why sales increases have tapered a bit.

- The impact of a particularly tumultuous presidential election year. It’s tough to get data on this, because we have so few presidential election years to use as comparison points. But real estate agents have traditionally complained about the difficulty of selling homes during a presidential election – and we expect that this election is especially fraught for home buyers (on both sides).

Going forward, we are hopeful that the market will close the year well. The fundamentals of our regional market are strong: demand is high, inventory is falling, interest rates are near historic lows, and the overall economy is doing fine. Accordingly, we expect that sales will continue to outpace 2015 levels, and believe it’s only a matter of time before these falling inventory levels start driving meaningful price appreciation throughout the region.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second-Quarter 2016 Real Estate Market Report: Orange County

The Orange County housing market surged again in the second quarter of 2016, with sales spiking over 35% from last year. But pricing was more mixed, as Orange struggles to find its footing after years of bouncing around the bottom set after the 2008‑09 correction.

The Orange County housing market surged again in the second quarter of 2016, with sales spiking over 35% from last year. But pricing was more mixed, as Orange struggles to find its footing after years of bouncing around the bottom set after the 2008‑09 correction.

Sales. Orange single‑family sales were up yet again, rising over 35% from last year and now up almost 30% for the rolling year. This continues a trend we’ve been watching for over four years, with Orange sales now up seven quarters in a row and 16 out of the last 17. Indeed, we are now seeing sales at historically high levels, with the 3,239 single‑family closings marking the highest twelve‑month total since 2007, at the tail end of the last seller’s market.

Prices. Orange homeowners have reason to be hopeful about home prices for the first time in years. The quarterly pricing was mixed, with the average down 5% but the median up 5%, an unusual spread between the average and median. But what was remarkable was that for the rolling year, Orange prices were up across the board: rising 0.1% on average, 2.3% at the median, and 0.8% in the price‑per‑square foot. That may not seem like much, but it marked the first time that Orange prices have gone up in all three metrics in almost ten years.

Negotiability. The negotiability indicators also give homeowners reason to feel like sustainable price appreciation is coming, with fewer actively listed homes selling more quickly and for closer to the asking price. Inventory was down almost 40% from last year, below 9.0 months for the first time in over 12 years. Similarly, the days‑on‑market fell again, dropping almost 8%. And the last listed price retention rate was up again, rising to 96% for the first time since 2007.

Condominiums. The condo market continued to struggle. Sales were up slightly, but we continue to see prices falling. As we’ve noted before, the problem with Orange condos is that they’re priced too close to single‑family homes. If we continue to see meaningful appreciation in single‑family prices, that will arrest the slide in condo prices.

Going forward, we believe that Orange is poised for its first sustainable green shoots of price appreciation in almost ten years. With demand strong, prices low, interest rates down, and the economy generally improving, we expect that the market will have its best year in a decade.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second-Quarter 2016 Real Estate Market Report: Westchester & Hudson Valley Market Overview

The Westchester and Hudson Valley regional housing market surged again in the second quarter of 2016, with sharply rising sales finally starting to have an impact on pricing, particularly in the mid- and entry‑priced markets throughout the region.

The Westchester and Hudson Valley regional housing market surged again in the second quarter of 2016, with sharply rising sales finally starting to have an impact on pricing, particularly in the mid- and entry‑priced markets throughout the region.

Sales. Activity continues to surge, with regional sales up over 26% compared to the second quarter of last year, and rising in every county in the Rand Report. We’ve now had sales going up for over four years, with regional transactions rising in 16 out of the last 18 quarters. Most importantly, we’re now seeing sustained sales increases driving sales totals to levels that rival the height of the last seller’s market, with almost 15,000 single‑family homes and 3,000 condos sold over the past 12 months.

Inventory. Available inventory continues to tighten throughout the region. In the real estate industry, we measure inventory levels by looking at the “months of inventory” available at any given time on the market, and consider anything under six months of inventory as an indicator of a “seller’s market.” Well, we are not yet under six months in any of our regional markets, but we’re moving in that direction, with months of single‑family inventory down 24% in Westchester, 38% in Putnam, 32% in Rockland, 39% in Orange, and 25% in Dutchess. Condo inventory was also down, falling 38% in Westchester, 48% in Putnam, 9% in Rockland, 29% in Orange, and 18% in Dutchess. Both Westchester and Putnam condos are now below six months worth of inventory, and other counties are closing in on the threshold.

Prices. These sustained surges in sales activity are not, though, yet having a widespread impact on pricing. You’ll notice on the accompanying graph that regional average prices have been ticking down for the past year or so. This is a little surprising, given that basic economics tells us that increasing demand coupled with falling inventory should drive prices higher. But we caution you not to read too much into the regional price decline, because the relative strength of activity in the lower priced markets (Putnam, Rockland, Orange, Dutchess) compared to Westchester has changed the mix of properties sold over the past year. Indeed, if you look at individual counties, we had price appreciation in Putnam, Rockland, and Dutchess, and mixed results in Orange. It was only in Westchester that we had prices go down, but even there we believe that the drop was largely caused by a relative lack of demand in the very high end of the market, for homes selling above $3 million. In other words, both the regional price decline and the price drop in Westchester are partly caused by the relative strength of lower‑priced markets compared to higher‑priced markets throughout the region.

Going forward, we expect a robust summer market. The fundamentals of our regional market are strong: demand is rising, inventory is falling, interest rates are near historic lows, and the overall economy is doing fine. Accordingly, we expect that sales will continue to outpace 2015 levels, and believe it’s only a matter of time before the sustained increases in buyer demand start driving meaningful price appreciation throughout the region.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2016 Real Estate Market Report: Orange Market Overview

The Orange County housing market finally showed the long awaited signs of meaningful price appreciation in the first quarter of 2016, with prices up significantly for the first time in almost 10 years.

The Orange County housing market finally showed the long awaited signs of meaningful price appreciation in the first quarter of 2016, with prices up significantly for the first time in almost 10 years.

Sales. Orange sales were up yet again, rising 31% from last year and now up over 28% for the rolling year. This was nothing new – we have now seen sustained increases in Orange transactions for almost four years, with sales up six quarters in a row and 15 out of the last 16. Indeed, we are now seeing sales at historically high levels, with Orange closing over 3,000 sales for the rolling year for the first time since 2007 at the tail end of the last seller’s market.

Prices. What’s new is that for the first time in years, we saw some meaningful price appreciation in Orange, with prices up 3% on average, almost 4% at the median, and up just a tick in the price per square foot. This was important because prices had fallen every single calendar year since 2007 – that’s eight straight years of year-on-year price depreciation. As a result, home prices today are down almost 30% from the height of the market. But for the first time, Orange homeowners have reason to be hopeful that the trend is moving in a positive direction.

Negotiability. Certainly, the negotiability indicators support the view that Orange is due for continued meaningful price appreciation. The months of inventory in Orange fell again in the first quarter, dropping below 10 months for the first time in over 12 years. Similarly, the days on market fell again and the listing retention rate went up a full point, showing that homes are selling more quickly and for closer to the asking price – all of which tends to drive price appreciation.

Condominiums. The condo market also surged, rising over 43% for the quarter and up almost 45% for the year. So we have a lot of demand. Unfortunately, we’re not yet seeing that demand impact pricing, which was down across the board. As we’ve noted before, the problem with Orange condos is that they’re priced too close to single.family homes. If we continue to see meaningful appreciation in single.family prices, that will arrest the slide in condo prices.

Going forward, we believe that Orange is finally seeing the light at the end of the dark tunnel it entered in 2008. We expect that demand will stay strong through a robust spring market that will continue to drive meaningful price appreciation through 2016 and for several years to come.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2016 Real Estate Market Report: Westchester & Hudson Valley Market Overview

The Westchester and Hudson Valley regional housing market in the first quarter of 2016 picked up where 2015 left off, with another surge in sales activity that is still not yet having a widespread impact on home prices. With inventory declining throughout the region, though, we believe that we will start seeing meaningful price appreciation before the end of the year.

In our last Rand Report, we welcomed readers to the next “seller’s market,” predicting that 2016 would be marked by increasing sales, declining inventory, and rising prices. So far, we’re right on two out of the three predictions: sales continue to go up, inventory continues to go down, but prices have not yet taken off throughout the region.

Sales. Activity continues to surge across the region. Transactions were up in every single county in the Report, and collectively rose over 23% compared to the first quarter of last year and over 18% for the rolling year. This is nothing new – we’ve been watching sales go up quarter after quarter for over four years, with regional transactions rising in 15 out of the last 17 quarters. Indeed, the region closed over 14,000 single-family sales over the past 12 months, which is the highest rolling year total since the middle of 2006 – at the tail end of the last seller’s market.

Inventory. Available inventory continues to tighten throughout the region. In the real estate industry, we measure inventory levels by looking at the “months of inventory” available at any given time on the market, and consider anything under six months of inventory as an indicator of a “seller’s market.” Well, we are not yet under six months in any of our regional markets, but we’re getting close, with Westchester, Putnam, and Rockland all under eight months. More importantly, inventory is tightening across the board, down sharply in most of the counties.

Prices. You’ll notice on the accompanying graph that regional sales prices have been ticking down for the past year, and went down again in the first quarter. How can that be? Why would prices be going down even while sales and inventory are going up? Well, the explanation is that it’s just an optical illusion. Don’t believe your lying eyes – prices are actually rising.

Here’s why: right now, the market is strongest in the lower.priced markets, which is disproportionately increasing the number of lower priced sales and thereby skewing the pricing. We see that most clearly in the countywide numbers, with sales up much more sharply in the lower priced markets. While sales in the highest priced market in Westchester are up only 9%, the other regional markets are spiking: Putnam up 21%, Rockland up 20%, Orange up 28%, and Dutchess up 29%. As a result, Westchester sales accounted for only 36% of the sales in the region in the first quarter of this year, compared to 40% last year and as much as 50% in prior years. So it follows that if higher priced Westchester sales are making up a smaller part of the overall transactional mix, then the average price for the region is going to drop.

Indeed, the average price was up in four out of the five counties in the region: rising 12% in Putnam, 3% in Rockland, 3% in Orange, and up just a tick in Dutchess. Prices were only down in – you guessed it! – Westchester, and we believe it’s for the exact same reason: strength in the lower end of the market. Even within Westchester, the demand was much stronger in the entry-level coop and condo markets, which had higher sales increases, rising prices, and lower levels of inventory. It follows that if the condo and coop markets were so strong, then the lowest end of the single.family market was probably also a lot more active than the middle or high end. So don’t read too much into the regional price drop, or even the decline in Westchester single-family homes.

Going forward, we expect a robust spring market. All the fundamentals point to a burgeoning “seller’s market,” with demand high, inventory falling, interest rates low, and a generally improving economy. Accordingly, we expect that sales will continue to go up, and that the strength in the lower priced markets will gradually extend throughout all price points.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Presidential Homes in the Lower Hudson Valley

For those of you who live in the Lower Hudson Valley, you probably know the area has some rich bits of history ingrained in its land. Whether or not you’re a history buff, you can’t deny how interesting it is to live in a place where notable political figures have made their mark. To coincide with the recent President’s Day and ongoing presidential debates, here are some connections previous Commander in Chiefs have with the Lower Hudson Valley.

For those of you who live in the Lower Hudson Valley, you probably know the area has some rich bits of history ingrained in its land. Whether or not you’re a history buff, you can’t deny how interesting it is to live in a place where notable political figures have made their mark. To coincide with the recent President’s Day and ongoing presidential debates, here are some connections previous Commander in Chiefs have with the Lower Hudson Valley.

Seeing as George Washington was our first president, we’ll begin with him. If you visit 84 Liberty Street in Newburgh, NY in Orange County, you will find the location of Washington’s headquarters, a fieldstone farmhouse that has the distinction of being the first public historic site in the country. Washington resided in this house for 16 months following the end of the American Revolution, and while staying there, he created the Badge of Military Merit, which is the predecessor to the Purple Heart. The house is now a museum that overlooks the magnificent Hudson River and also includes the Tower of Victory, which was constructed in 1890 to overlook the river. The tower is meant to honor the centennial of Washington’s stay at the house. It’s a real privilege to be in close proximity to a piece of history involving one of our Founding Fathers, so if you have time to visit this museum, I highly suggest you do so.

If you find yourself traveling around Hyde Park, NY in Dutchess County, you should go to 4097 Albany Post Road and visit the Springwood estate, which was the birthplace, home, and final resting place of Franklin Delano Roosevelt, our 32nd president. He was once quoted saying, “All that is within me cries out to go back to my home on the Hudson River,” and it’s safe to say anyone can find a sense of tranquility when living in a home as beautiful as this one next to a river as historic and gorgeous as the Hudson. The property also includes a library and museum that will teach you about FDR’s 12-year presidency (this was before the enactment of the 22nd amendment, which limits a president to two terms). In 1943, Roosevelt donated his home to the American people; and following his passing in 1945, it was given to the National Parks Service. There was even a movie released in 2012 called “Hyde Park on Hudson,” which starred Bill Murray as FDR. Roosevelt also had the quaint and cozy Top Cottage, which he built in 1937 as a retreat and eventual retirement home, where he also had guests such as King George VI and Queen Elizabeth. Top Cottage also has the distinctions of being one of the first wheelchair-accessible homes and one of the only homes designed by a living president.

In 1927, our 35th president, John Fitzgerald Kennedy, moved from Brookline, Massachusetts to the Bronx, where his family spent two years before moving into a home in Westchester County at 294 Pondfield Road, Bronxville, NY when he was 12. He and his family lived there from May 1929 to January 1942. It was a 5.5-acre hillside estate called Crownlands, and it was a Georgian-style mansion with a white exterior and red roof, and it had a circular row of columns that added to the home’s stateliness. The house also had a grand white set of stairs that descended the hill on which the house was situated. This was certainly a home where you could imagine the great Jay Gatsby hosting a party. It was demolished in 1953 by a developer who found a use for the land, which back then was the largest piece of property in the village. With Kennedy being one of our most well-known presidents, you can’t deny how neat it is for him to have lived in an area so close to us.

No matter where you live, odds are there is some interesting history behind your surrounding area. Whether it be local history or history that has a bigger connection to national history, it’s always fun to learn the story behind where you live. In celebration of Presidents’ Day 2016 and the current presidential race, take the time to acknowledge the moments in our country’s history that have touched certain places in the Lower Hudson Valley and value the opportunity we have to live in a place that has ties to a few presidencies.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link