The Essex County housing market surged again in the second quarter of 2017, with increases in both sales and prices coupled with another drop in available inventory.

The Essex County housing market surged again in the second quarter of 2017, with increases in both sales and prices coupled with another drop in available inventory.

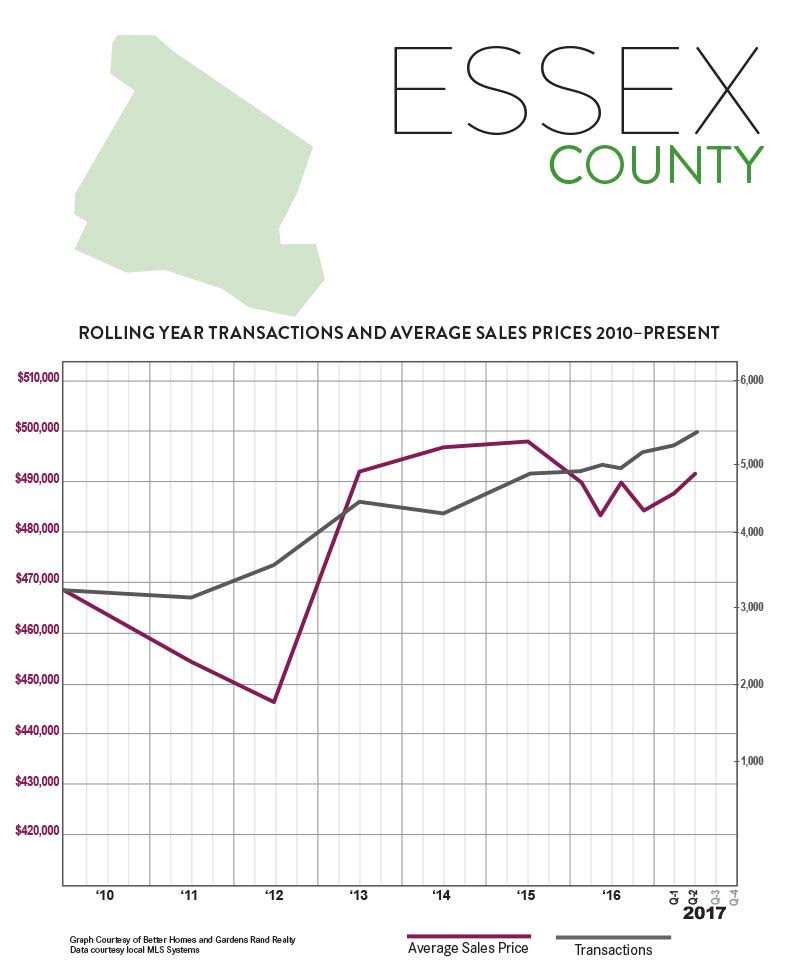

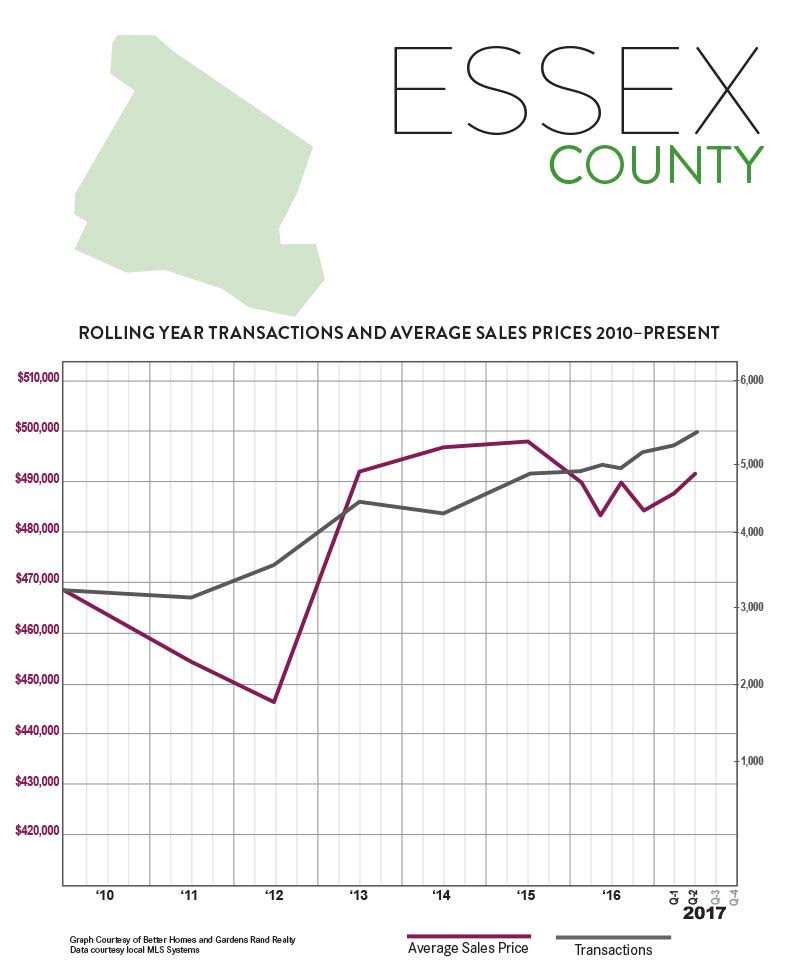

Sales. Essex sales activity was up again, rising over 13% from the second quarter of last year. For the rolling year, sales are now up over 7%. Indeed, Essex closed over 5,300 units over the rolling year, the largest 12-month total since the height of the last seller’s market over 10 years ago, and up almost 70% from the bottom of the market in 2011.

Prices. Essex buyer demand is finally showing signs of an impact on pricing. Compared to the second quarter of last year, the average price was up over 2% and the median was up almost 4%. More importantly, we’re starting to see meaningful long-term price appreciation, with the average up almost 2% for the rolling year. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the Summer.

Inventory. Essex inventory fell again, dropping over 24% from last year’s second quarter and now down to just about six months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested that sellers might be gaining significant negotiating leverage. Most notably, the listing retention rate crossed the 100% threshold for the first time in memory, rising over two percentage points to 101.8%. That’s remarkable. Similarly, the days-on-market fell by two weeks, and is now down to under four months of market time. Those are both positive signals of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will continue to have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but meaningful price appreciation through a robust Summer market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link