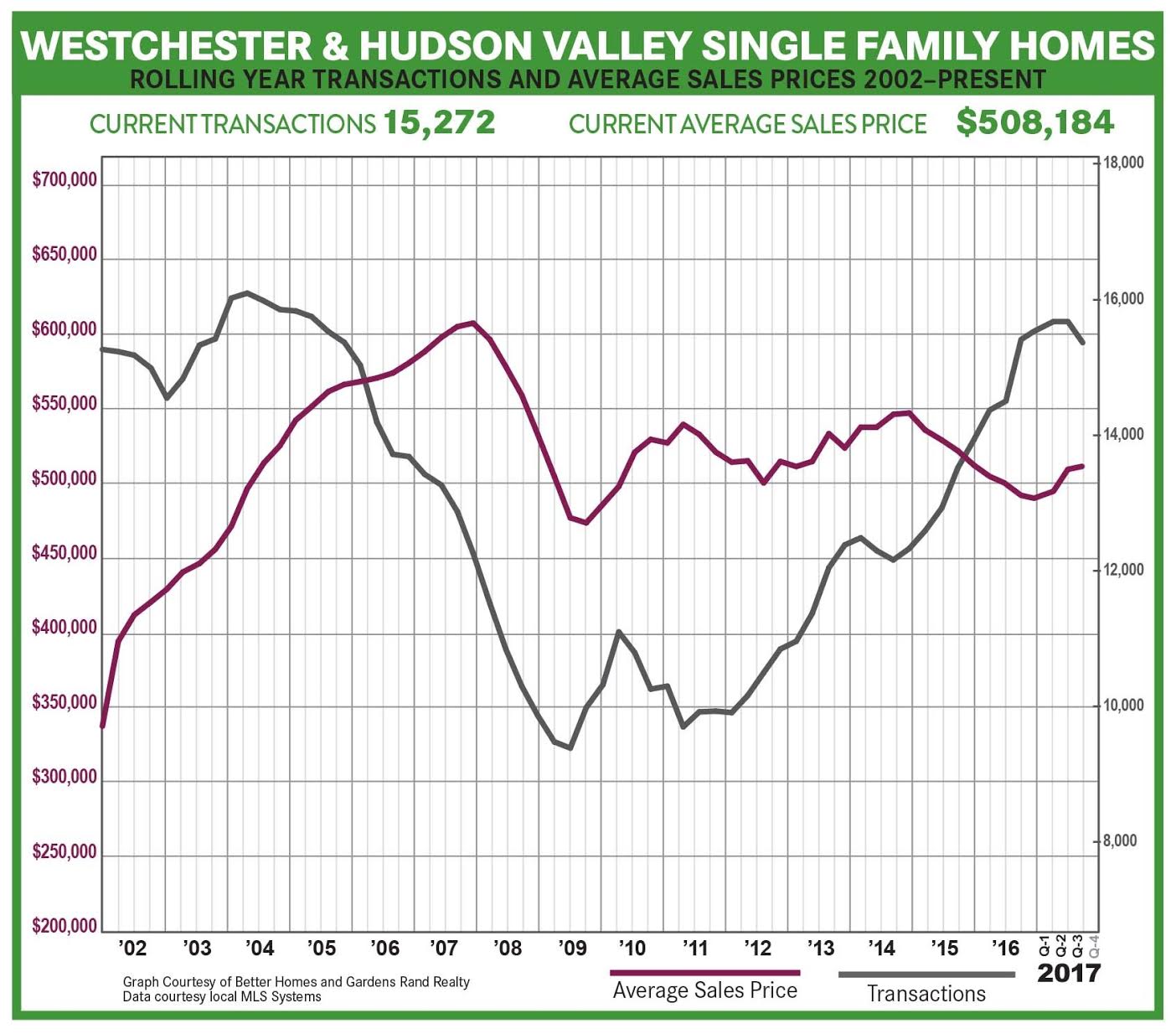

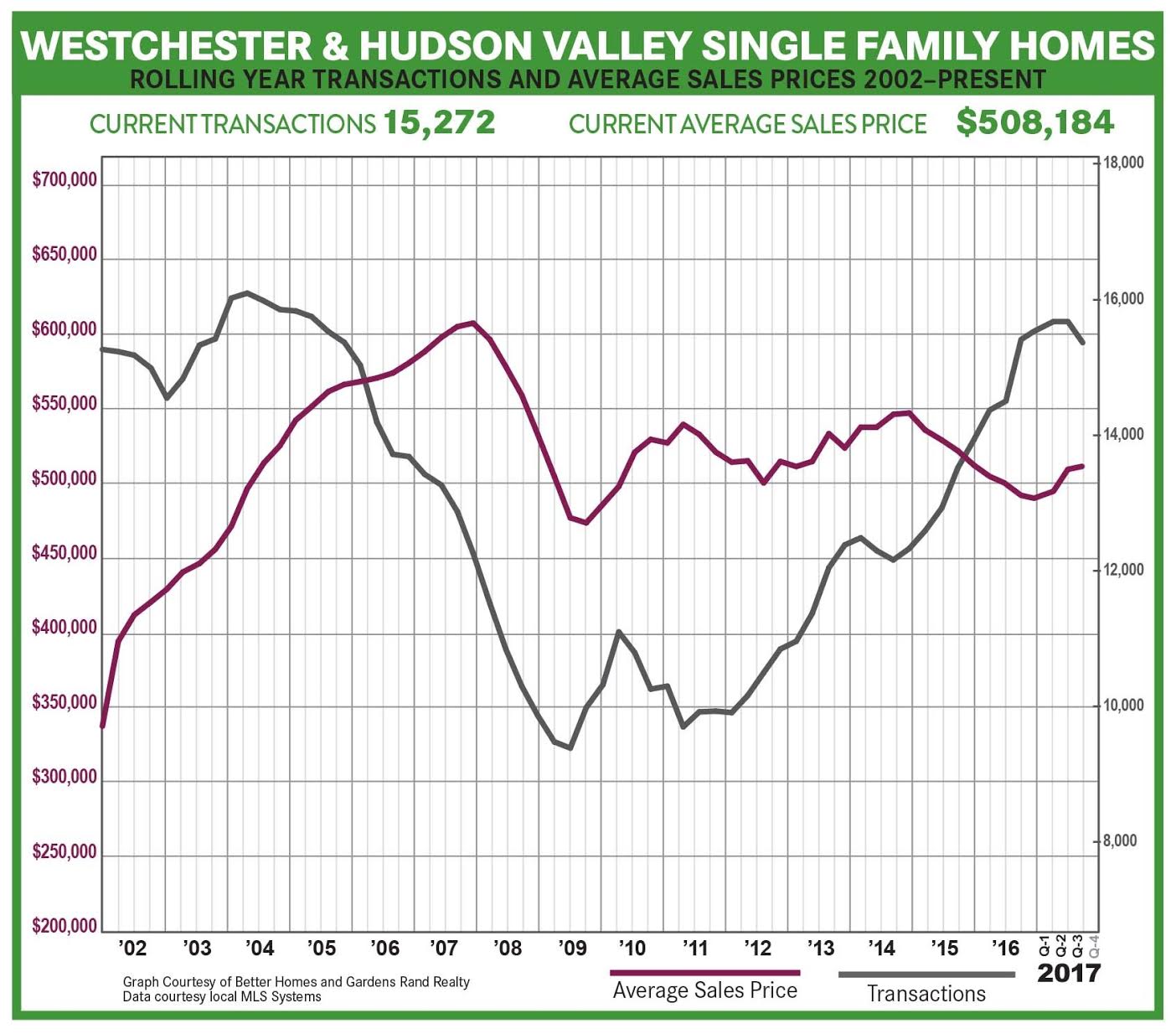

The housing market in Westchester and the Hudson Valley surged again in the third quarter of 2017, with strong buyer demand driving meaningful price appreciation even while declining inventory stifled sales growth. With inventory rates continuing to fall, we expect this trend to continue through the rest of the year.

The housing market in Westchester and the Hudson Valley surged again in the third quarter of 2017, with strong buyer demand driving meaningful price appreciation even while declining inventory stifled sales growth. With inventory rates continuing to fall, we expect this trend to continue through the rest of the year.

Inventory throughout the region continues to fall. Regional inventory was down almost 23%, and is now down to 6.1 months– right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now at‑or‑below six‑months’ worth of inventory, which usually signals a rising seller’s market: Westchester single family homes are now at 5.5, Putnam at 6.4, Rockland at 5.5, and Orange at 6.3.

The lack of inventory is stifling sales growth. Regional sales were down for the second straight quarter, falling over 5% from the third quarter of last year. Even though sales were up just a tick for the rolling year, we’re definitely seeing some pressure on sales growth from the lack of inventory on the market. Essentially, we need more “fuel for the fire.” That said, sales are now at levels we have not seen down since the height of the last seller’s market in 2005

These inventory levels are starting to drive meaningful price appreciation. The regional average sales price was up for the third quarter in a row, rising just about 1%. Most importantly, though, we’re starting to see long‑term meaningful price appreciation, with the average price up almost 3% for the rolling year. And quarterly average prices were up in almost every county in the region, rising 1% in Westchester, over 5% in Rockland, 1% in Orange, and over 3% in Dutchess (prices fell about 3% in Putnam).

Going forward, we expect that prices will continue to appreciate through the rest of the year. Demand is strong, bolstered by near‑historically‑low interest rates, prices that are still near 2003‑04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. We will need fresh new listings to drive more sales growth, but we expect that we will continue to see price appreciation through a strong fall market and into 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link