Prices in the Bergen County housing market rose again in the third quarter of 2017, even while declining inventory stifled sales growth.

Prices in the Bergen County housing market rose again in the third quarter of 2017, even while declining inventory stifled sales growth.

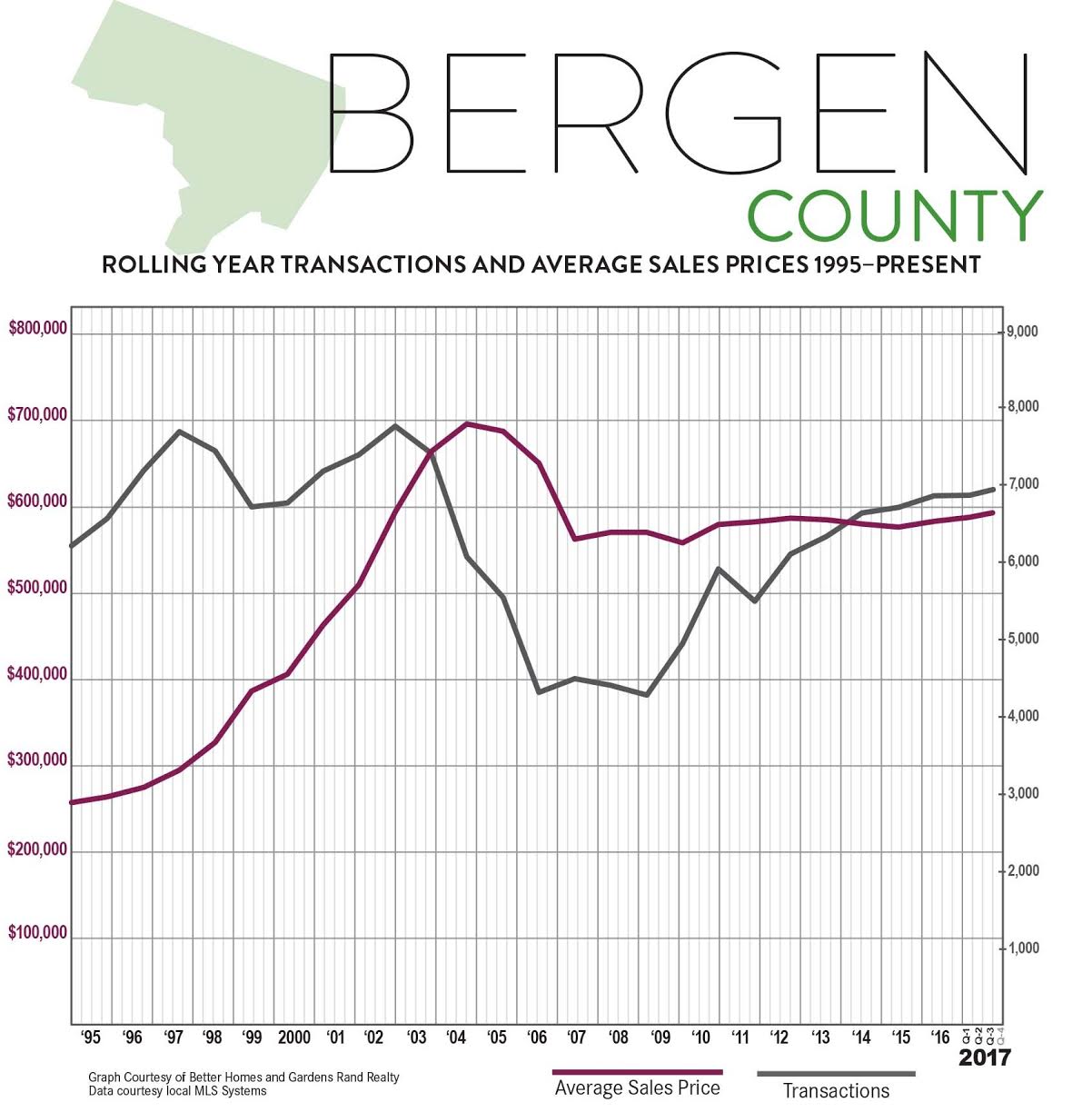

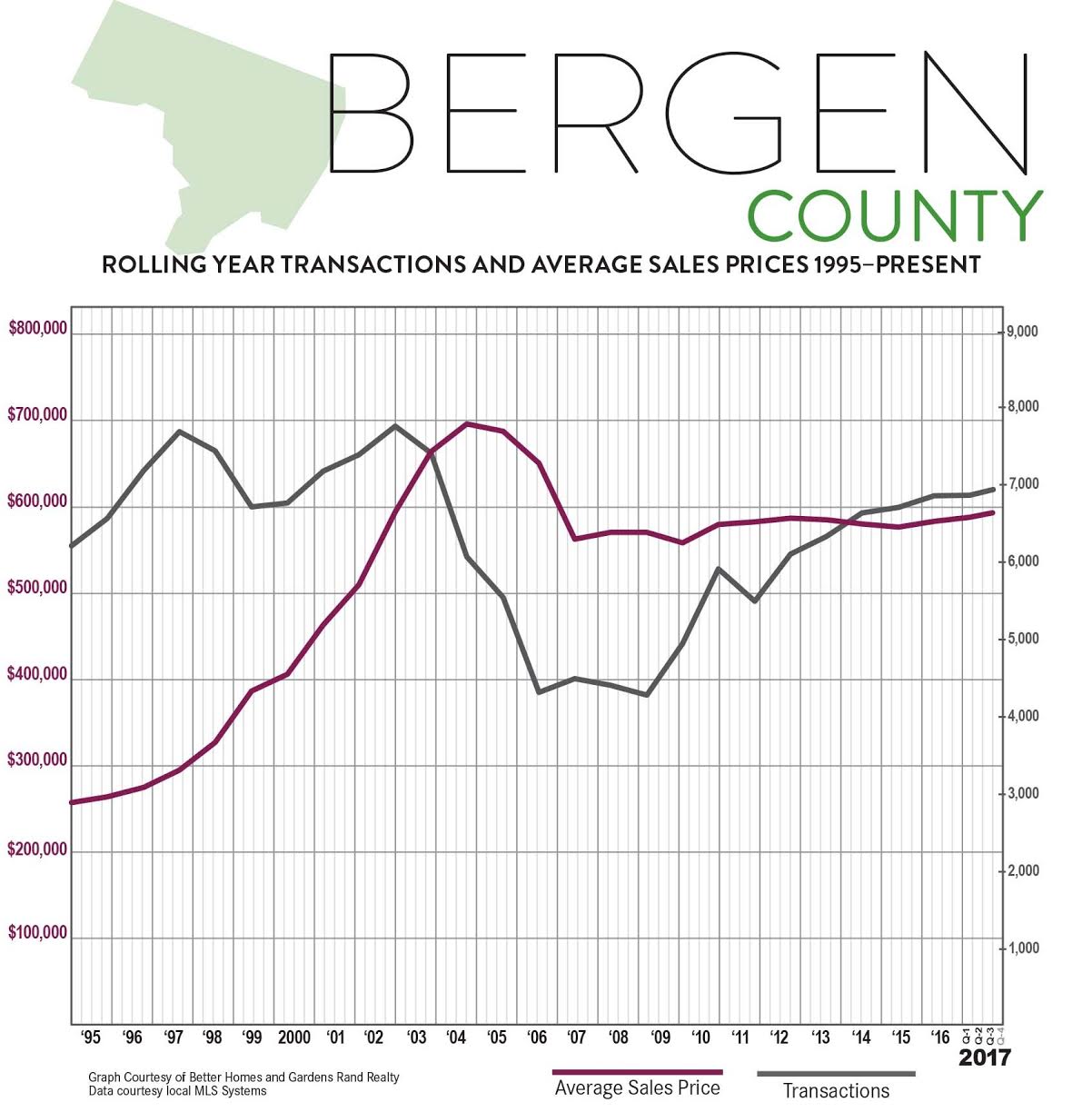

Sales. With inventory continuing to decline, Bergen lacks “fuel for the fire” to satisfy the existing buyer demand. As a result, home sales were relatively flat again, up only about 1% from last year’s third quarter and now up about 4% for the rolling year. This does, though, mark the 12th straight quarter of year‑on‑year sales growth, over three full years of rising sales. What’s holding sales back right now is not a lack of demand, but a lack of inventory. If we start seeing more homes hit the market, we’ll see sales go up sharply.

Prices. These sustained increases in buyer demand are having their expected impact on pricing. Bergen prices rose again in the third quarter, up 3% on average and almost 6% at the median. And for the year, prices are now up significantly: rising almost 5% on average and over 4% at the median.

Negotiability. All the negotiability indicators are also signaling a rising seller’s market. Inventory continued to tighten in the third quarter, with the months of inventory falling almost 17% and now down to well under five months. Similarly, homes are continuing to sell more quickly and for closer to the asking price: the listing retention rate is now over 97%, and the days‑on‑market is down to under two months. As inventory tightens and the market heats up, we would expect to see sellers continue to gain negotiating leverage.

Condos. Activity in the Bergen condo market was up in the third quarter, with sales rising almost 5% from last year. Prices were down, though, with the average falling over 3% and the median down almost 6%. With inventory now down well below six months, though, we would expect to eventually see more meaningful price appreciation.

Going forward, we expect Bergen County will enjoy a strong fall market with both rising sales and prices. With inventory tightening, a relatively strong economy, near‑historically‑low interest rates, and prices still at attractive 2004‑05 levels, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017 and into next year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link