The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

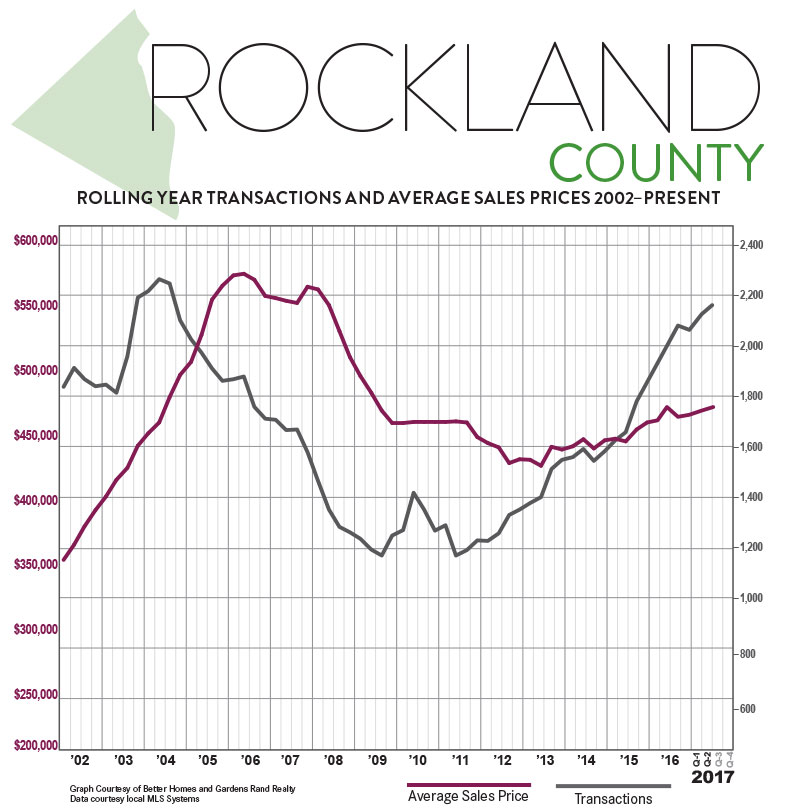

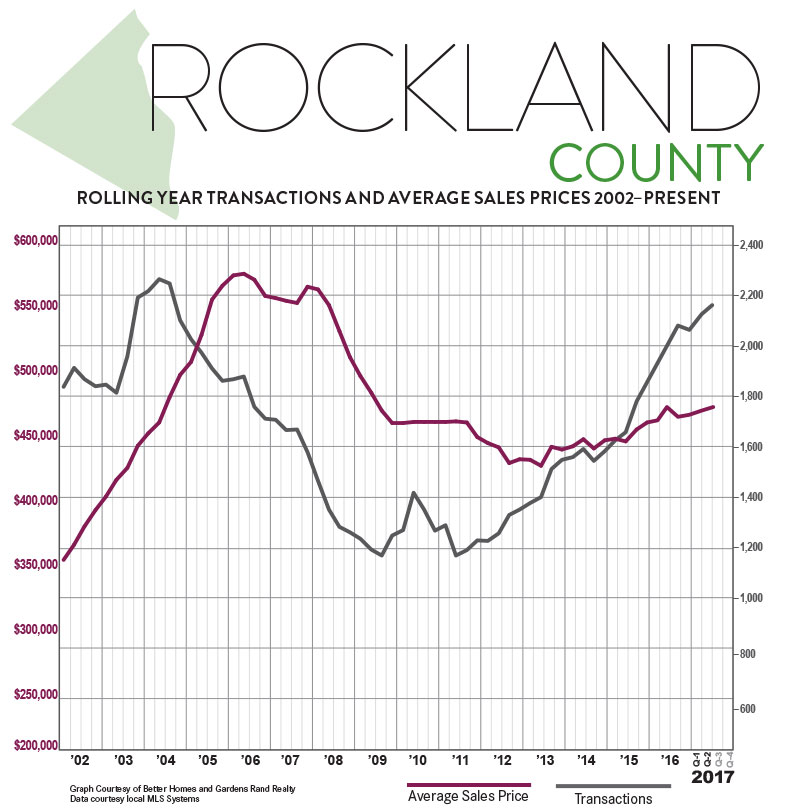

Sales. After spiking almost 24% in the first quarter, sales cooled down in the second, rising a little over 4% from last year. But this did continue a trend we’ve been watching for almost three years, the tenth time out of the last 11 quarters that year-on-year sales have gone up. Indeed, the 2,154 sales over the past rolling year marked the highest 12-month total since the third quarter of 2004.

Prices. These sustained increases in buyer demand are starting to have a tangible impact on pricing. Home prices were up for the quarter across the board, rising over 1% on average, almost 3% at the median, and over 1% in the price-per-square foot. And we are seeing meaningful and sustainable price appreciation over the longer term, with the rolling year median price and price-per-square-foot up over 2%. Similarly, Rockland’s average is now up over 11% from the bottom of the market in 2012.

Negotiability. Inventory continued to fall in the second quarter, depriving Rockland of the “fuel for the fire” that would drive more sales growth. The months of inventory fell almost 19%, and is now consistently at that six-month level market that denotes a seller’s market. Similarly, the listing retention rate rose and the days-on-market fell sharply, indicating that sellers are gaining negotiating leverage with buyers.

Condos. The Rockland condo market absolutely surged in the second quarter, with sales up almost 36% and prices up almost 7% on average 4% at the median. For the year, sales are up over 32%, and prices are showing the first signs of life in years. With inventory falling almost 40%, and now down to well below six months, we expect that prices will continue to rise.

Going forward, we expect that Rockland will have a strong summer market, with prices up and sales rising as much as they can with these levels of inventory. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link