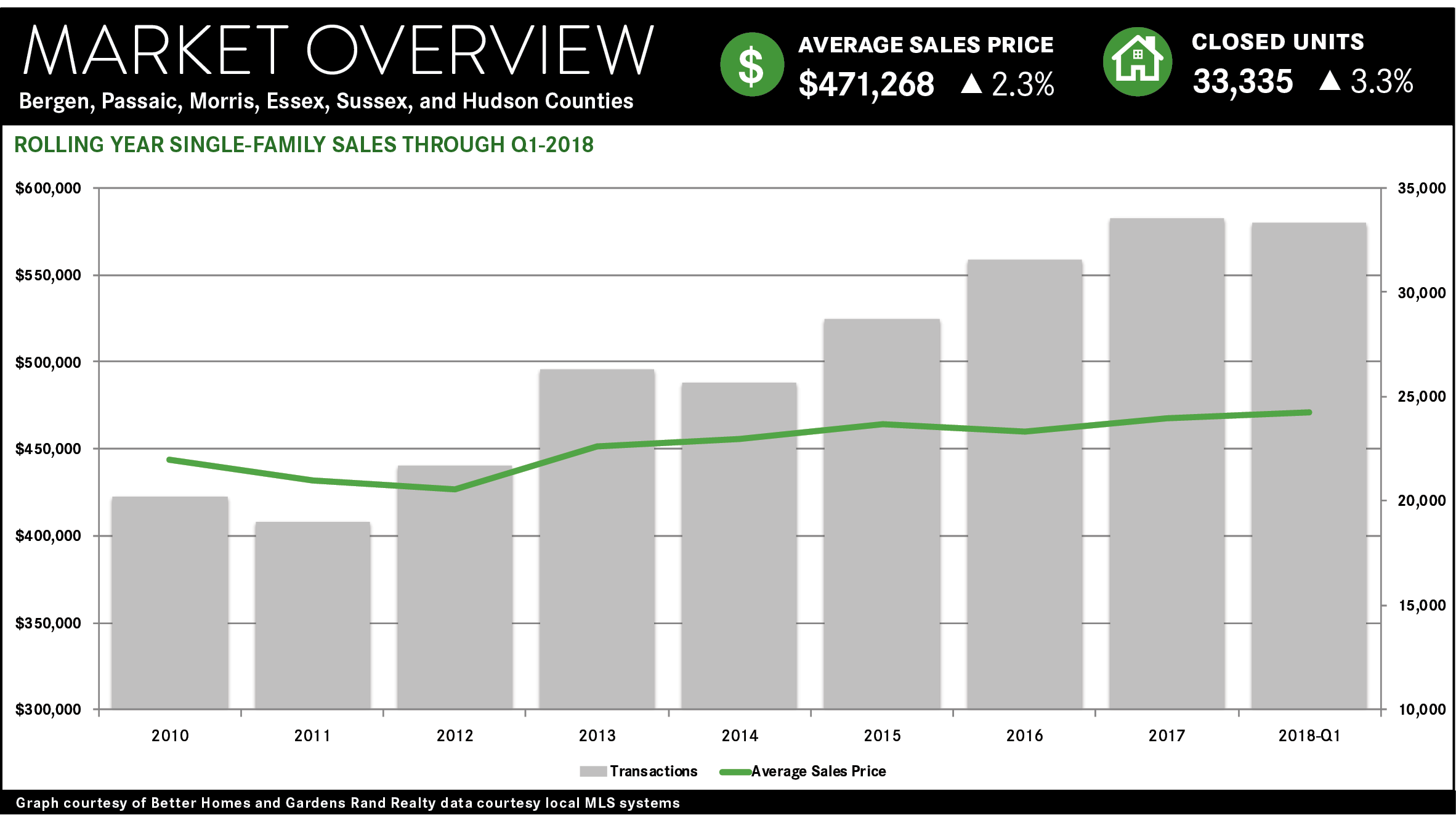

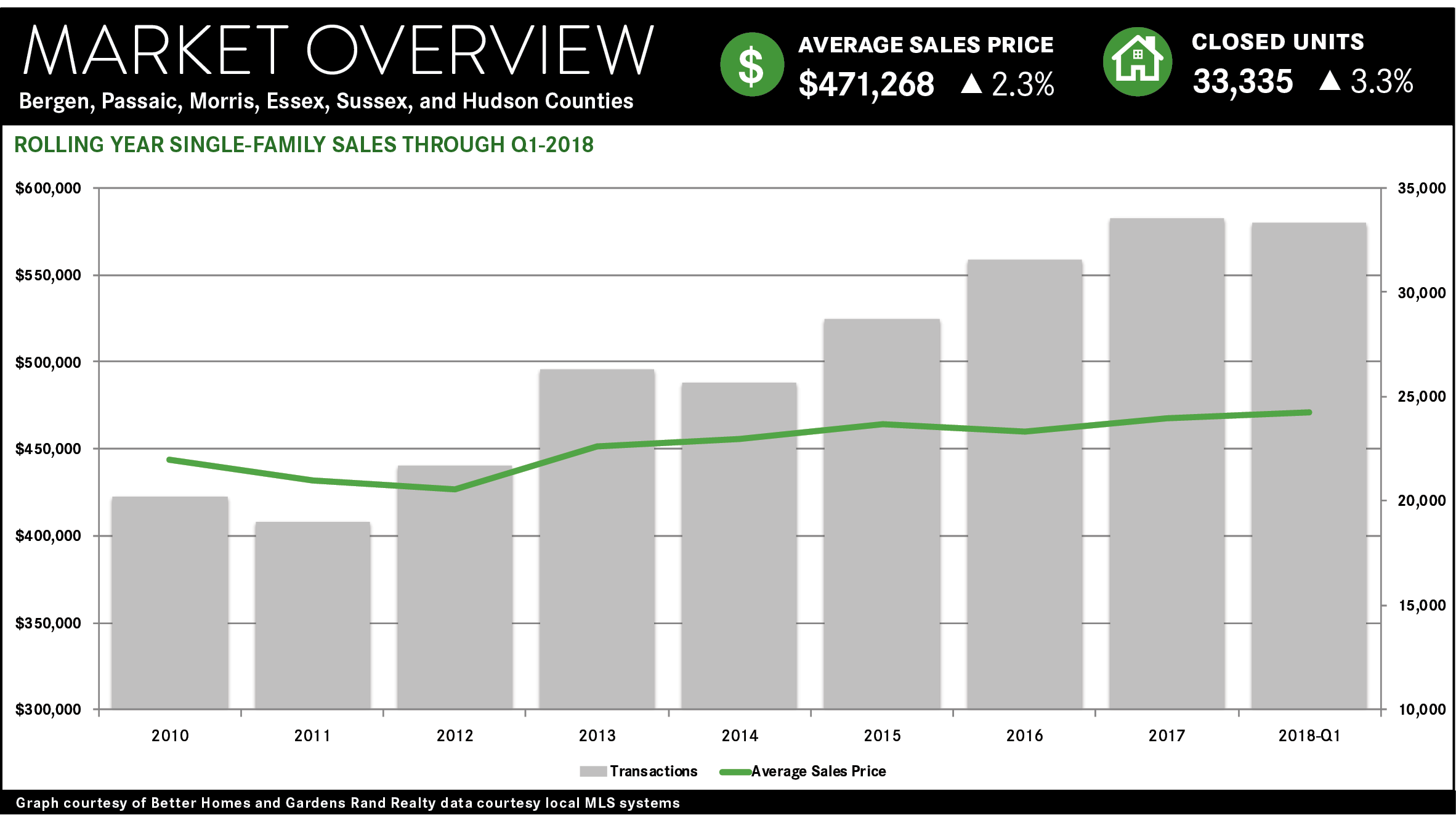

The housing market in the Northern New Jersey suburbs of New York City has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The housing market in the Northern New Jersey suburbs of New York City has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The regional market continues to suffer from a lack of inventory. The number of homes available for sale compared to last year fell sharply in every market in the region. At the current absorption rate, we are now down to well under six months of inventory in every county for single‑family homes (other than Sussex), which usually denotes a seller’s market.

This lack of inventory is holding back sales. While regional transactions were up 3% for the year, they were down over 3% for the first quarter, and quarterly sales fell in most of the counties. We saw this most acutely in Bergen, where quarterly condo sales were down over 13%, and in Hudson County, where sales fell over 7% for single‑family and multi‑family homes, and over 10% for condos. But this isn’t a demand problem ‑‑ demand is strong everywhere in the region. This is more of a supply problem ‑‑ we simply don’t have enough “fuel for the fire.”

But with all this demand chasing fewer homes, prices are up significantly across the region. The regional average sales price was up over 5% in the quarter, rising for every county and property type, particularly in the markets closest to the city: Bergen was up 1% for single‑families and 19% for condos, and Hudson was up 6% for single‑family, 21% for multi‑family, and 11% for condos. This type of double‑digit appreciation is not sustainable, but the long‑term trend for the rolling year is still very positive, up about 3% for the region and rising in every county except Sussex.

Going forward, this is what a seller’s market looks like. Low levels of inventory will continue to hold sales back even while driving prices up. At some point in 2018, this price appreciation will attract more sellers into the market, which will increase supply, bring sales up, and maybe moderate price increases. But that will not happen right away, so we expect a spring market with even lower levels of inventory, which will stifle sales growth but continue to drive robust price appreciation.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link