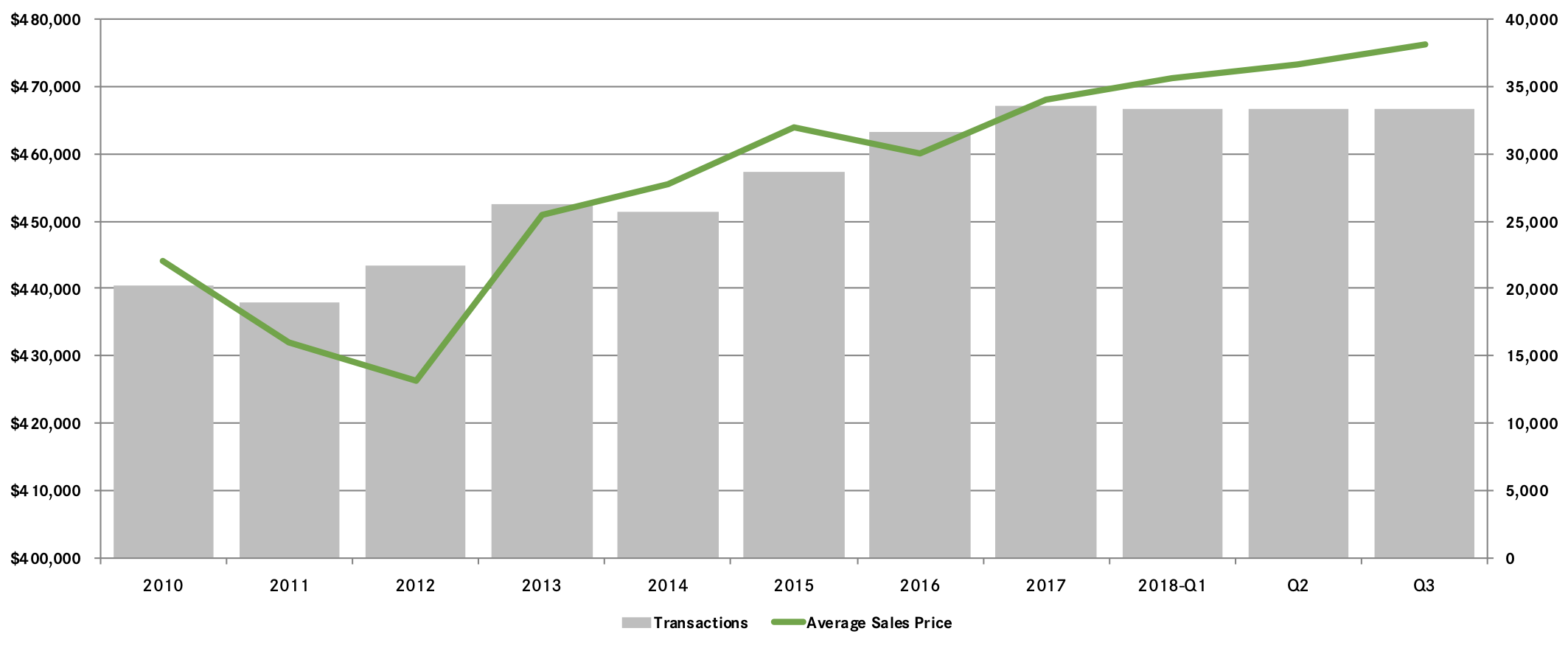

The housing market in the Northern New Jersey suburbs of New York City cruised through the third quarter of 2018, with strong demand driving meaningful price appreciation, even while low levels of inventory suppressed sales growth throughout the region.

The regional market continues to suffer from a lack of supply. The number of homes available has settled at levels that generally signal a seller’s market, with fewer than six months of inventory in most of the Northern New Jersey markets. The lack of inventory has been stifling sales growth, since the market lacks “fuel for the fire” to meet the existing buyer demand, even while driving meaningful price appreciation throughout the region.

Because of the lack of inventory, sales were mostly flat. For the region, sales were up just 0.7% in the quarter, and they were mixed in the individual counties: Bergen houses up 1%, Bergen condos up 2%, Hudson down almost 8%, Passaic down a tick, Morris up 3%, Essex up 5%, and Sussex up 2%. That said, sales are now at levels we haven’t seen since the seller’s market of the mid‑2000s, and almost double in many places from the bottom of the market following the correction of 2008‑09.

But these low levels of inventory are also driving meaningful price appreciation. Prices rose about 2% regionally, with dramatic spikes in Hudson 8%, Sussex 8%, and Bergen condos 10%. The other markets were relatively flat or even down slightly (in Morris), but the overall trend is generally positive, with most markets up for the rolling year and the rolling-year regional average price rising over 2%.

We are a little surprised we’re not seeing more meaningful price appreciation throughout the region. Given strong buyer demand responding to a growing economy, reasonably low interest rates, and pricing still at attractive levels (mostly at 2004‑05 levels), we keep expecting some dramatic jumps in pricing. Textbook economics tells us that limited supply coupled with high demand should eventually drive meaningful increases in pricing. But other than Hudson, which is feeding off the Manhattan exile market, the rest of the region is not really appreciating at the level we would expect.

Going forward, we expect the seller’s market to continue. With good economic conditions, low interest rates, and attractive pricing, we expect that the Northern New Jersey market will finish the year strong and drive meaningful price appreciation through 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link