Real Estate Market Report: Third Quarter 2018 – Bergen County, NJ

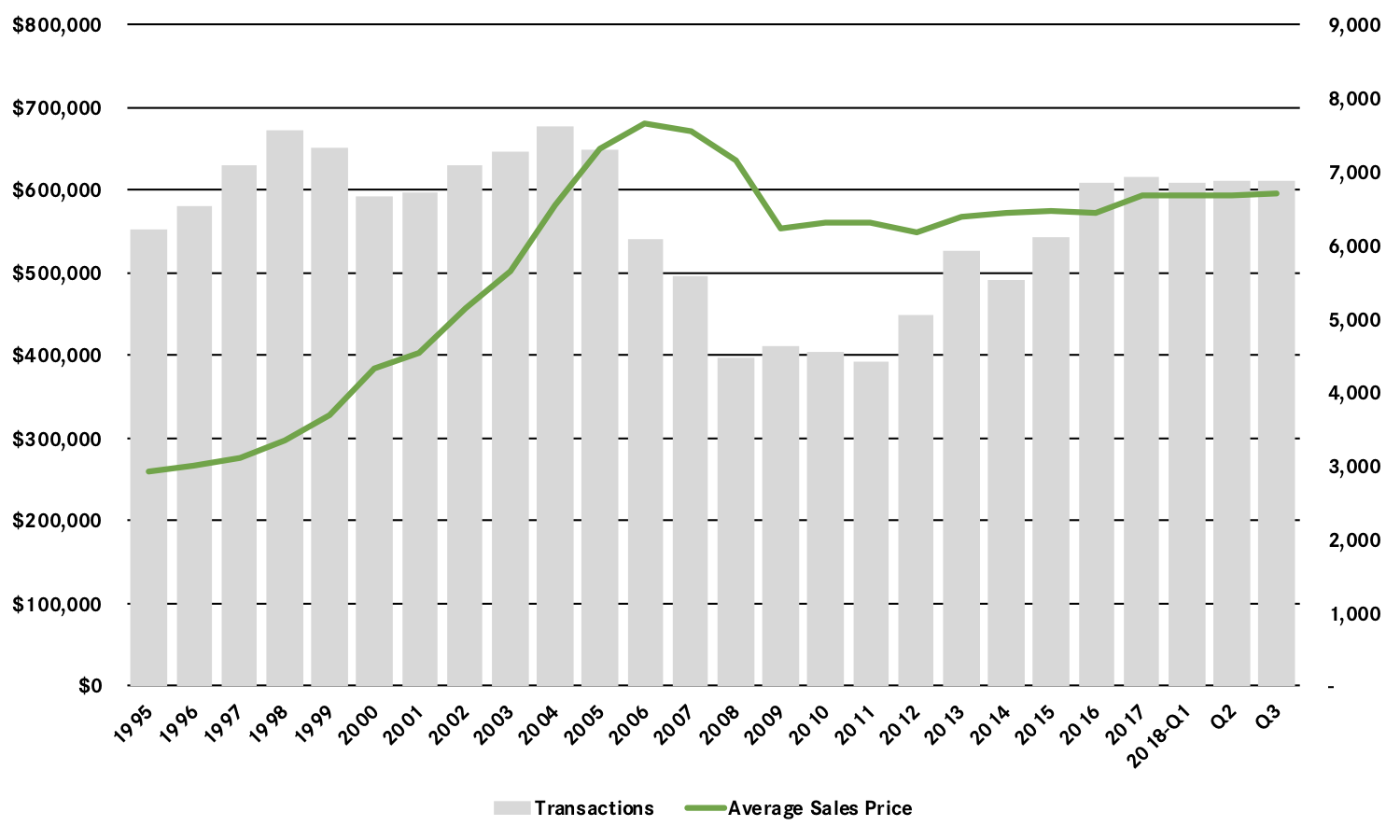

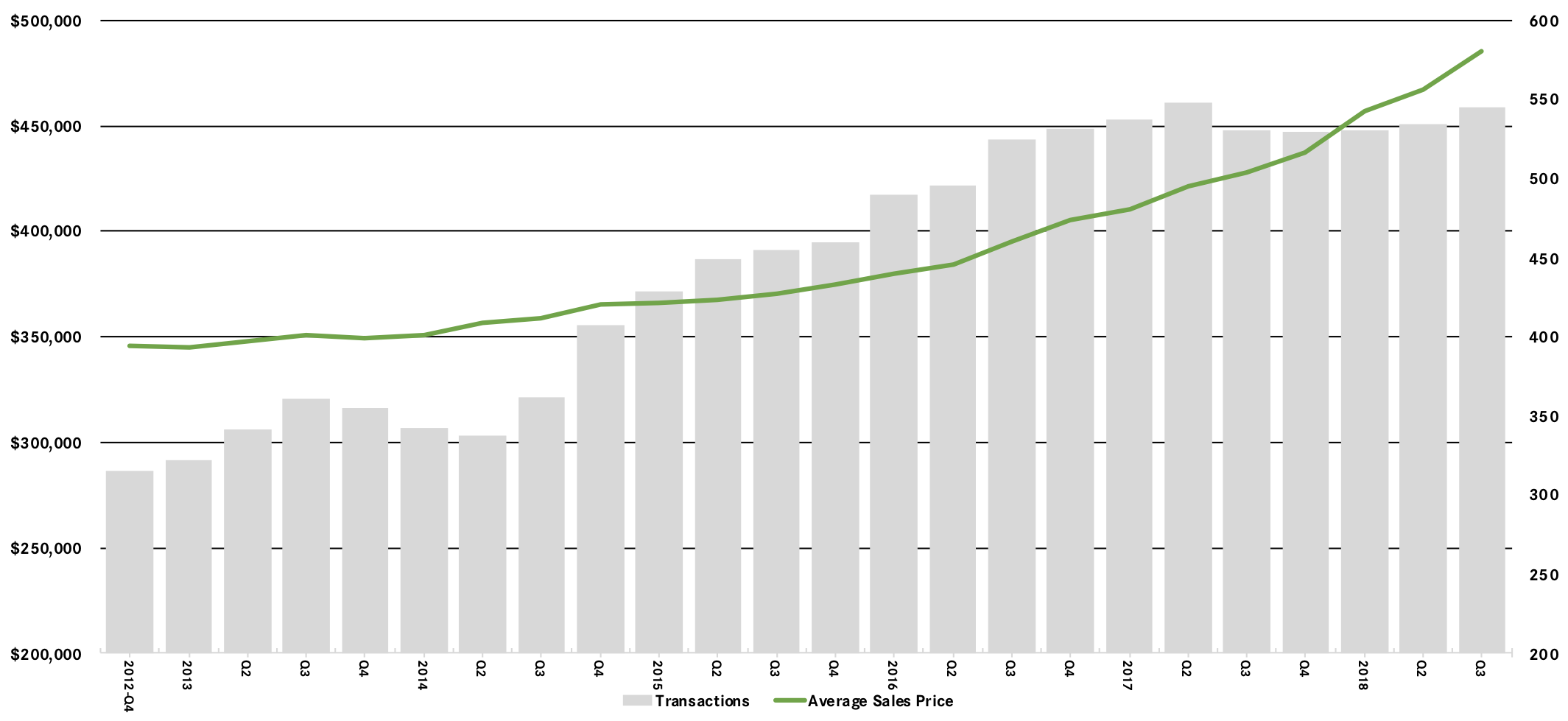

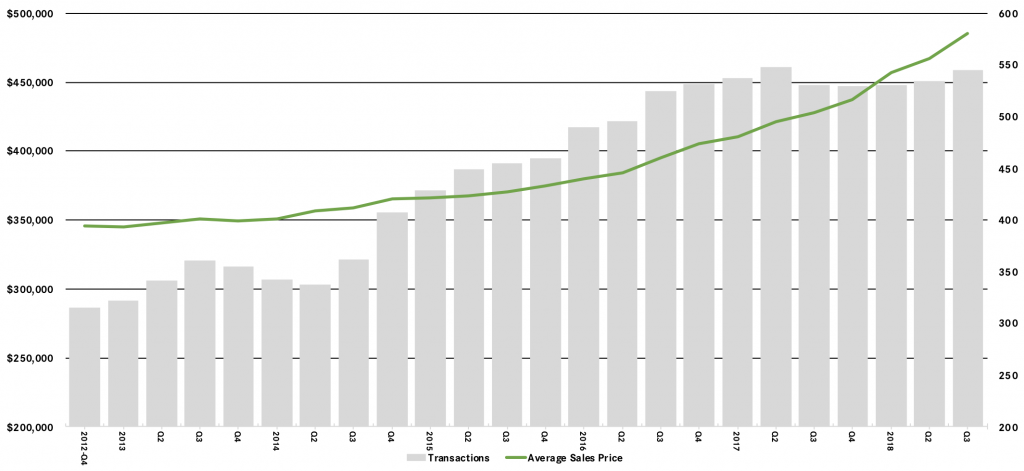

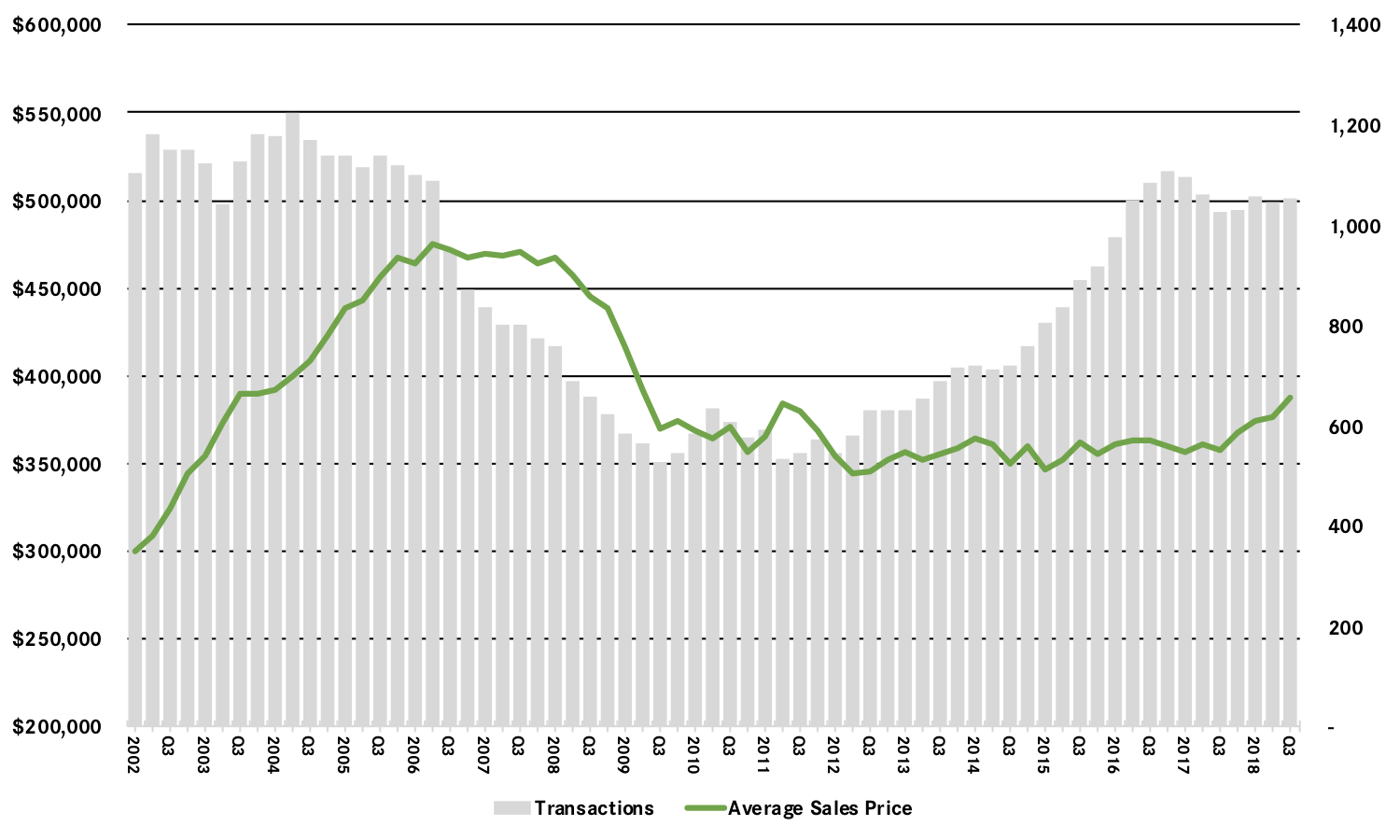

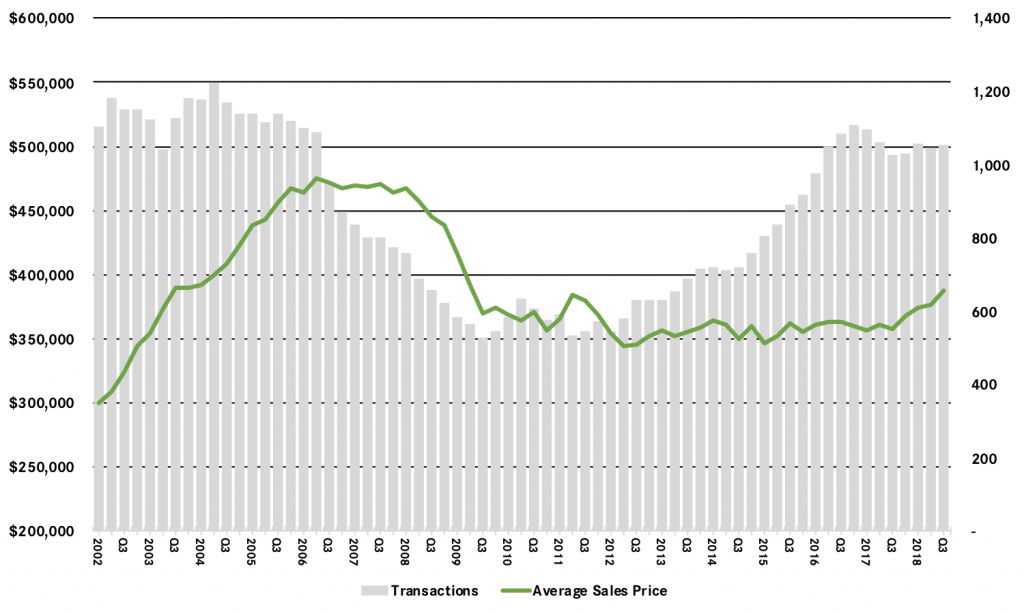

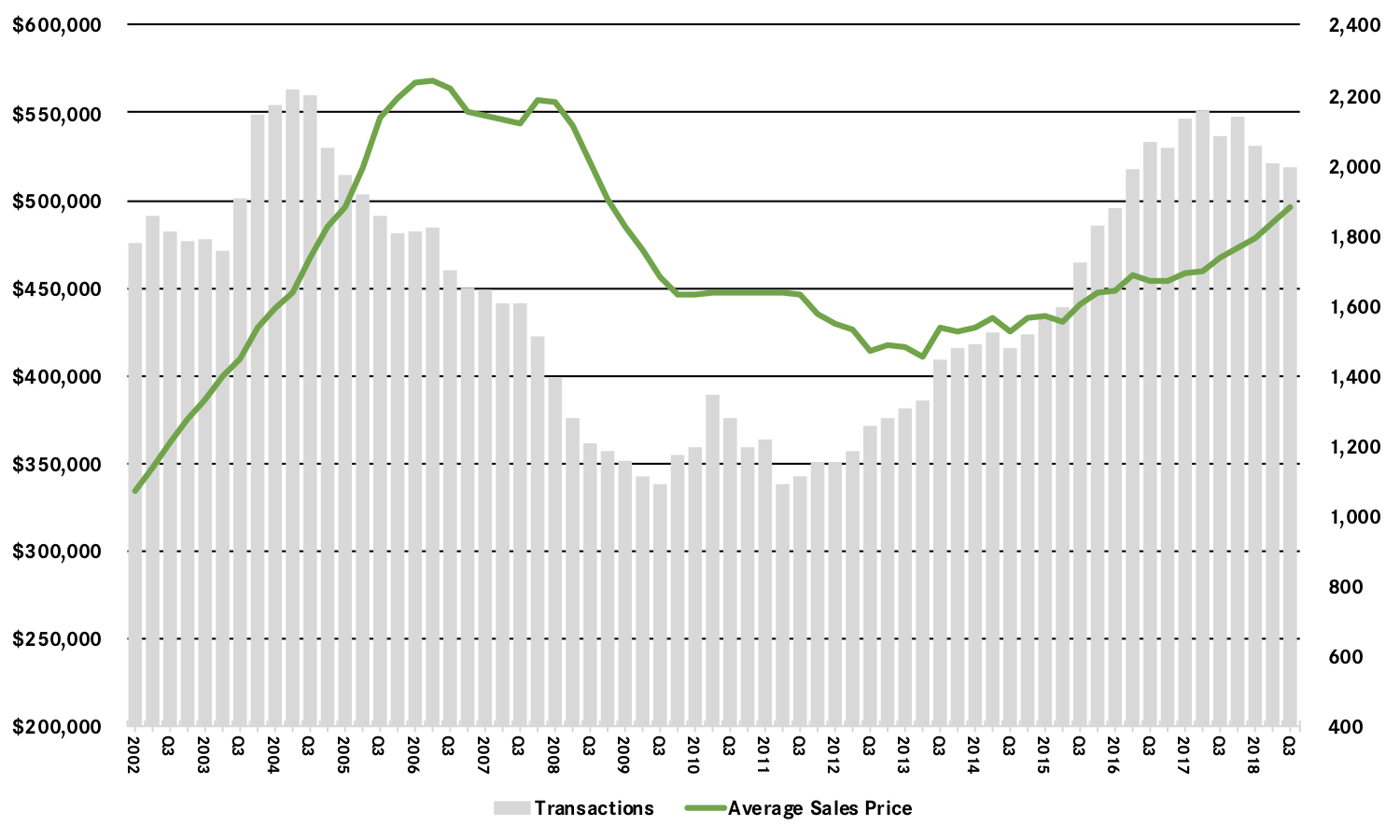

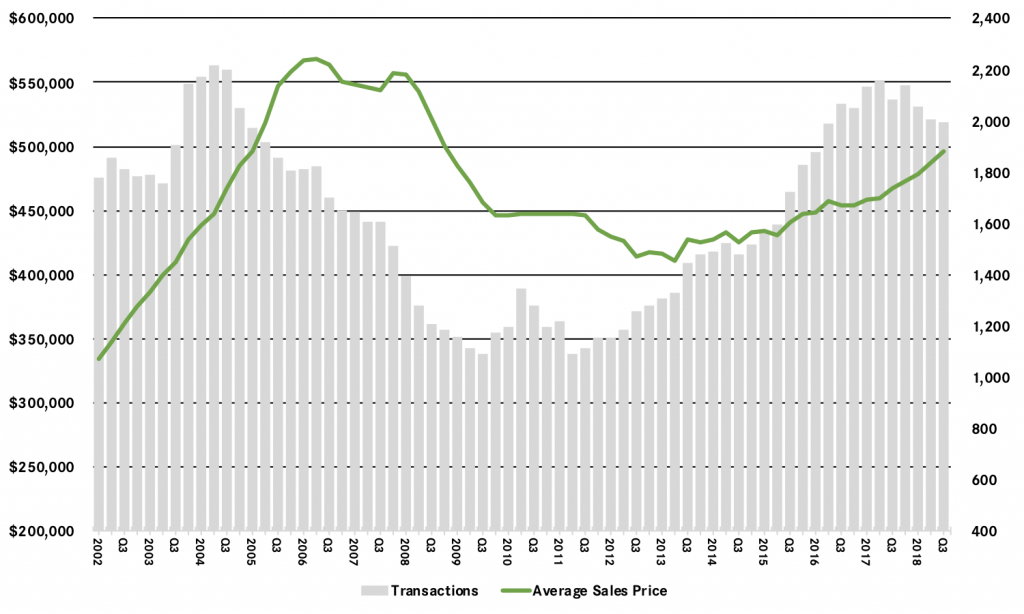

The Bergen County housing market stabilized in the third quarter, with a lack of inventory continuing to stifle growth but pricing showing only mixed results. Sales were up just a tick: Single‑family home sales rose about 1% from last year’s third quarter, and condo sales rose about 2%. For the rolling year, sales in both houses and condos are down slightly, the result of inventory that continues to stick to the four‑to‑five‑month level that’s within seller market territory. But restricted supply coupled with strong demand is having only a mixed impact on pricing: Single‑family home prices were flat for the quarter and are up just a tick for the rolling year, while condos were up sharply for the quarter and now have jumped over 3% on both the average and the median for the year. Going forward, we believe that inventory will continue to stabilize and that prices should continue to go up through the fourth quarter and into 2019.

The Bergen County housing market stabilized in the third quarter, with a lack of inventory continuing to stifle growth but pricing showing only mixed results. Sales were up just a tick: Single‑family home sales rose about 1% from last year’s third quarter, and condo sales rose about 2%. For the rolling year, sales in both houses and condos are down slightly, the result of inventory that continues to stick to the four‑to‑five‑month level that’s within seller market territory. But restricted supply coupled with strong demand is having only a mixed impact on pricing: Single‑family home prices were flat for the quarter and are up just a tick for the rolling year, while condos were up sharply for the quarter and now have jumped over 3% on both the average and the median for the year. Going forward, we believe that inventory will continue to stabilize and that prices should continue to go up through the fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Northern New Jersey

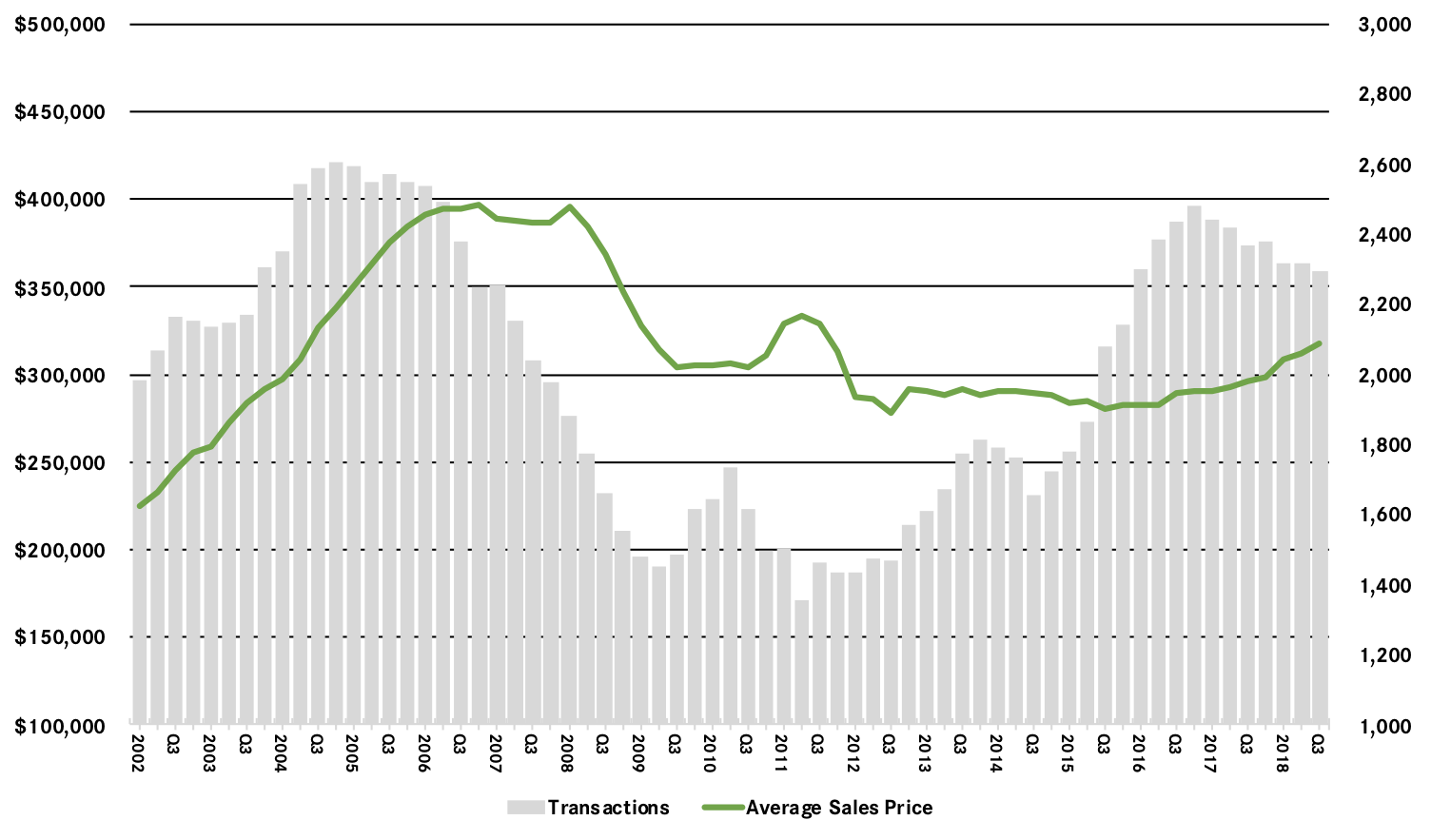

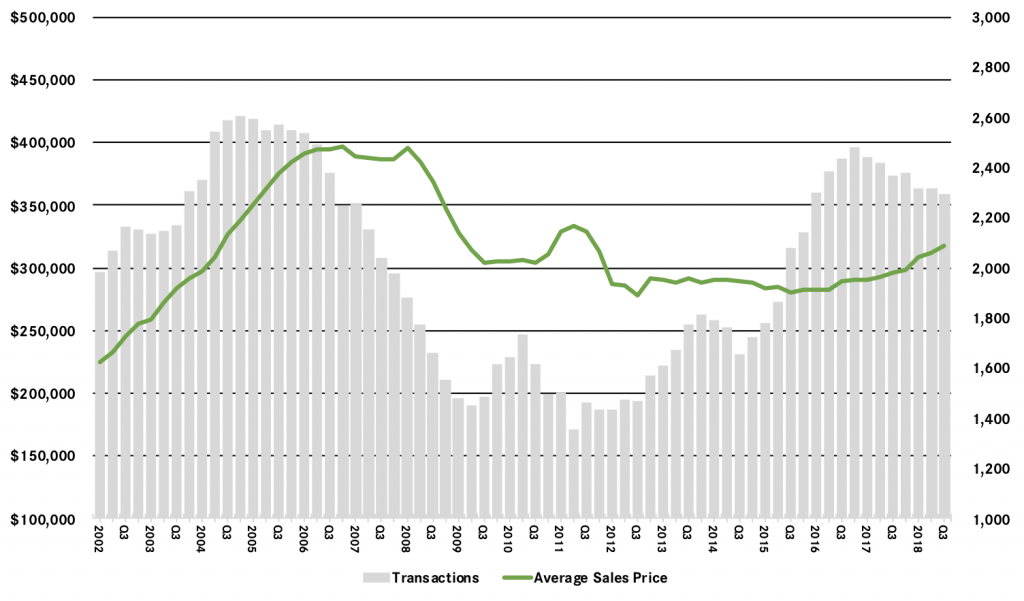

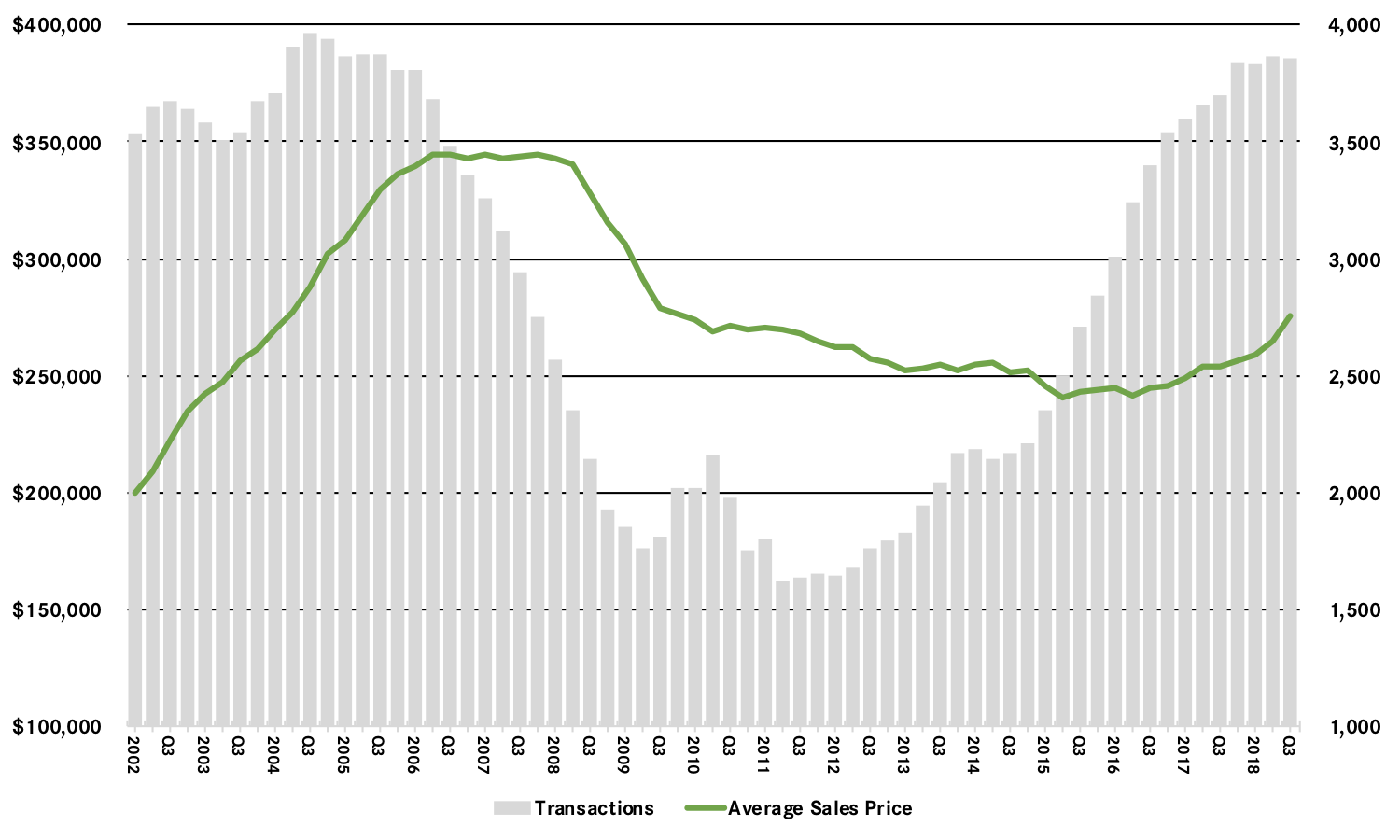

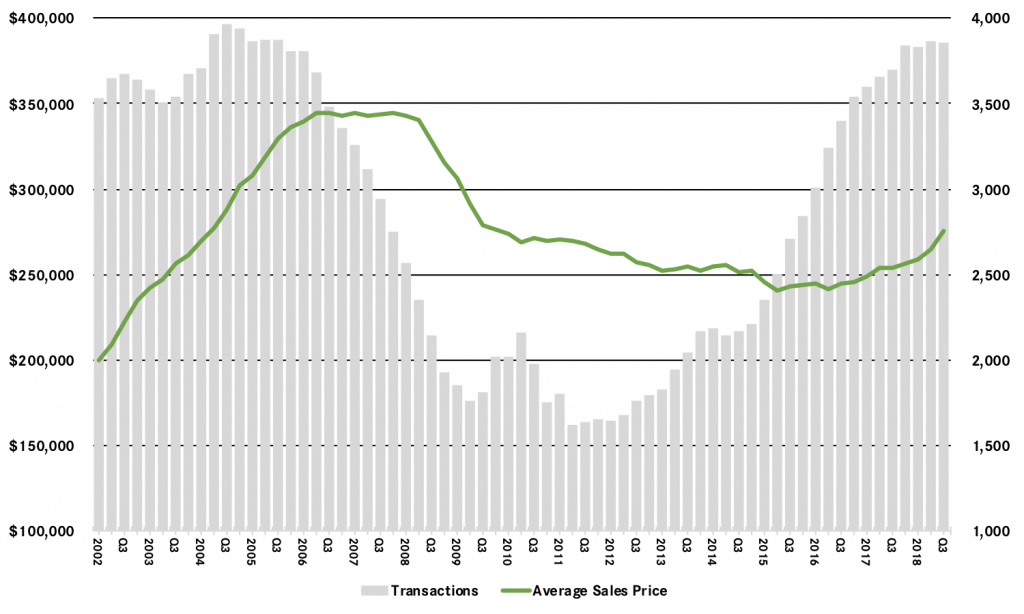

The housing market in the Northern New Jersey suburbs of New York City cruised through the third quarter of 2018, with strong demand driving meaningful price appreciation, even while low levels of inventory suppressed sales growth throughout the region.

The regional market continues to suffer from a lack of supply. The number of homes available has settled at levels that generally signal a seller’s market, with fewer than six months of inventory in most of the Northern New Jersey markets. The lack of inventory has been stifling sales growth, since the market lacks “fuel for the fire” to meet the existing buyer demand, even while driving meaningful price appreciation throughout the region.

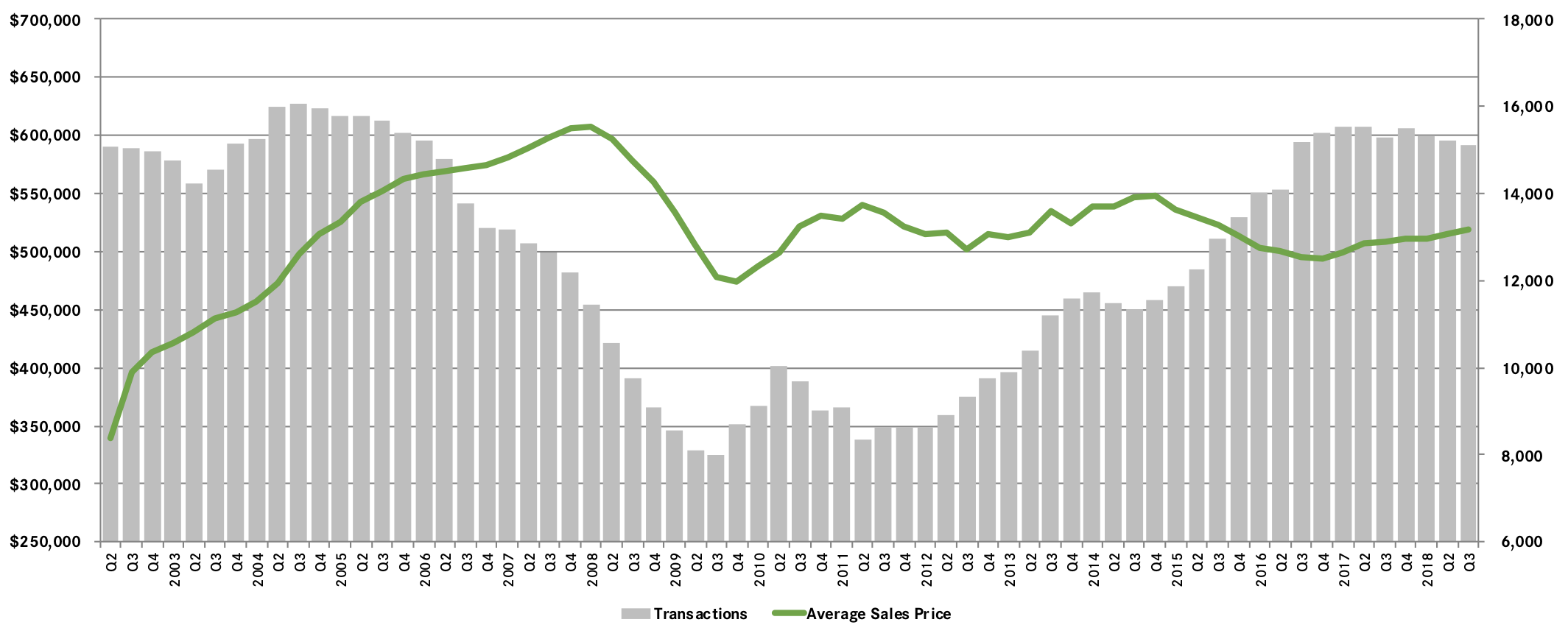

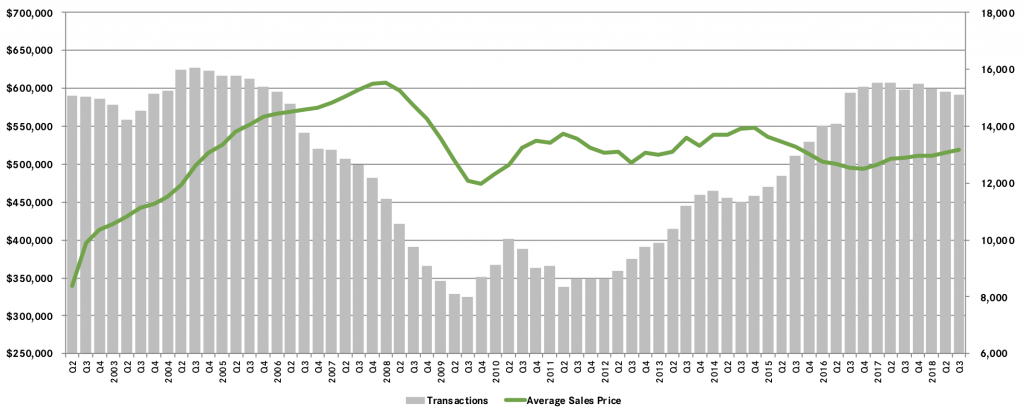

Because of the lack of inventory, sales were mostly flat. For the region, sales were up just 0.7% in the quarter, and they were mixed in the individual counties: Bergen houses up 1%, Bergen condos up 2%, Hudson down almost 8%, Passaic down a tick, Morris up 3%, Essex up 5%, and Sussex up 2%. That said, sales are now at levels we haven’t seen since the seller’s market of the mid‑2000s, and almost double in many places from the bottom of the market following the correction of 2008‑09.

But these low levels of inventory are also driving meaningful price appreciation. Prices rose about 2% regionally, with dramatic spikes in Hudson 8%, Sussex 8%, and Bergen condos 10%. The other markets were relatively flat or even down slightly (in Morris), but the overall trend is generally positive, with most markets up for the rolling year and the rolling-year regional average price rising over 2%.

We are a little surprised we’re not seeing more meaningful price appreciation throughout the region. Given strong buyer demand responding to a growing economy, reasonably low interest rates, and pricing still at attractive levels (mostly at 2004‑05 levels), we keep expecting some dramatic jumps in pricing. Textbook economics tells us that limited supply coupled with high demand should eventually drive meaningful increases in pricing. But other than Hudson, which is feeding off the Manhattan exile market, the rest of the region is not really appreciating at the level we would expect.

Going forward, we expect the seller’s market to continue. With good economic conditions, low interest rates, and attractive pricing, we expect that the Northern New Jersey market will finish the year strong and drive meaningful price appreciation through 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – The Bronx

With Better Homes and Gardens Rand Realty’s recent expansion into the Bronx, we are delighted to present the Rand Quarterly Market Report for Bronx County. We have been providing these quarterly market analyses or almost 15 years for the markets we service, which include Westchester and the Hudson Valley, Northern New Jersey, and now the Bronx. We hope you enjoy the Report, and if you have any questions, please reach out to your Rand Realty agent.

With Better Homes and Gardens Rand Realty’s recent expansion into the Bronx, we are delighted to present the Rand Quarterly Market Report for Bronx County. We have been providing these quarterly market analyses or almost 15 years for the markets we service, which include Westchester and the Hudson Valley, Northern New Jersey, and now the Bronx. We hope you enjoy the Report, and if you have any questions, please reach out to your Rand Realty agent.

The Bronx housing market surged again in the third quarter of 2018, with both prices rising sharply in a growing seller’s market, even while low levels of inventory held back sales growth. Going forward, we expect that strong demand will continue to drive meaningful price appreciation through the end of the year and into 2019.

Prices were up across the board. The average price rose almost 12% from the third quarter of last year and was relatively balanced: Single‑family homes were up almost 10% on average and 6% at the median; multi‑families were up 11% on average and almost 10% at the median; coops were up 2% on average, but almost 20% at the median; and condos were up over 12% on average and over 3% at the median. Moreover, we’re seeing sustained price appreciation, with the average price rising almost 11% for all property types and up in every market.

But sales were flat overall, and for most property types. For the borough as a whole, sales fell just a tick during the quarter, even while finishing the rolling year up 6%. Most likely, we’re just seeing the impact of restricted inventory holding back sales, with the market lacking enough “fuel for the fire” to satiate demand. We would expect that these rising prices will eventually tempt more sellers into the market, which could help drive sales up.

Inventory continues to fall. We measure inventory by looking at the number of homes available for sale, and the rate at which homes are selling. A balanced market has about six months of inventory, meaning that at the current rate of home sales, it would take six months to sell all the homes currently available. What we’re seeing, though, is a clear sign of a seller’s market, with the months of inventory well below six months for all property types: 5.2% for single‑family homes, 6.0% for multi‑family, 5.3% for coops, and 4.8% for condos. Inventory might be stabilizing, though, something we’ll be watching in the fourth quarter.

Overall, this is exactly what a robust seller’s market looks like. We have high demand and falling inventory driving sales and prices up throughout the borough. Textbook economics tells us that rising prices will eventually attract more sellers into the market, but in the meantime, we can expect that high demand will continue to drive prices up through a strong fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Editor’s Note: This report includes only those sales reported through the Hudson Valley Gateway Multiple Listing Service.

Real Estate Market Report: Third Quarter 2018 – Dutchess County, NY

Pricing in the Dutchess housing market soared again in the third quarter, with prices rising from high demand and limited inventory. Sales were down, just as in the rest of the region, from a lack of supply, not a lack of demand, which you can see from the pricing trends: Single‑family home prices rose almost 7% on average and 12% at the median for the quarter, finishing the rolling year up 7% on average and almost 10% at the median. And we saw the same results in the condo market, with prices leaping up 13% on average and almost 17% at the median. Those types of numbers are not sustainable, but even for the year, Dutchess condo prices are up meaningfully. Going forward, we expect these trends to continue, with stabilizing sales and rising prices through the end of the year and into 2019.

Pricing in the Dutchess housing market soared again in the third quarter, with prices rising from high demand and limited inventory. Sales were down, just as in the rest of the region, from a lack of supply, not a lack of demand, which you can see from the pricing trends: Single‑family home prices rose almost 7% on average and 12% at the median for the quarter, finishing the rolling year up 7% on average and almost 10% at the median. And we saw the same results in the condo market, with prices leaping up 13% on average and almost 17% at the median. Those types of numbers are not sustainable, but even for the year, Dutchess condo prices are up meaningfully. Going forward, we expect these trends to continue, with stabilizing sales and rising prices through the end of the year and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Putnam County, NY

The Putnam housing market absolutely soared through the third quarter of 2018, with dramatic increases in both sales and particularly in pricing. Putnam was the only county in the region to experience sales growth this quarter, with transactions rising 3% for houses and 5% for condos. The real story was price appreciation, with prices up across the board: Houses were up 11% on average, 5% at the median, and 8% in the price‑per‑square‑foot, and condos were up 13% on average and at the median, and almost 20% in the price‑per‑square-foot. For the year, the pricing gains are also very strong: up 8% on average and 7% at the median for houses, and up 10% on average and 16% at the median for condos. Going forward, we believe that Putnam is going to continue to strengthen, although we would expect that blistering price appreciation to cool a bit.

The Putnam housing market absolutely soared through the third quarter of 2018, with dramatic increases in both sales and particularly in pricing. Putnam was the only county in the region to experience sales growth this quarter, with transactions rising 3% for houses and 5% for condos. The real story was price appreciation, with prices up across the board: Houses were up 11% on average, 5% at the median, and 8% in the price‑per‑square‑foot, and condos were up 13% on average and at the median, and almost 20% in the price‑per‑square-foot. For the year, the pricing gains are also very strong: up 8% on average and 7% at the median for houses, and up 10% on average and 16% at the median for condos. Going forward, we believe that Putnam is going to continue to strengthen, although we would expect that blistering price appreciation to cool a bit.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Orange County, NY

The Orange County housing market soared yet again in the third quarter of 2018, with prices exploding upward. With inventory still very low, and demand high, house prices rose 14% on average, 8% at the median, and 12% in the price‑per‑square‑foot, while condo prices were up 17% on average, 12% at the median, and 14% in the price‑per‑square‑foot. More importantly, after years of frustrating stagnation, we’re finally seeing sustained appreciation trends in Orange County. This was the ninth straight quarter of rising house prices, culminating in a rolling year where prices were up 8% on average, 9% at the median, and 8% in the price‑per‑square‑foot. And we saw the same thing in condos, with the full-year prices up 12% on average, 14% at the median, and 10% in the price‑per‑square‑foot. Going forward, we believe that lack of inventory will continue to hold sales down, but will still drive meaningful price appreciation through the end of 2018 and into next year.

The Orange County housing market soared yet again in the third quarter of 2018, with prices exploding upward. With inventory still very low, and demand high, house prices rose 14% on average, 8% at the median, and 12% in the price‑per‑square‑foot, while condo prices were up 17% on average, 12% at the median, and 14% in the price‑per‑square‑foot. More importantly, after years of frustrating stagnation, we’re finally seeing sustained appreciation trends in Orange County. This was the ninth straight quarter of rising house prices, culminating in a rolling year where prices were up 8% on average, 9% at the median, and 8% in the price‑per‑square‑foot. And we saw the same thing in condos, with the full-year prices up 12% on average, 14% at the median, and 10% in the price‑per‑square‑foot. Going forward, we believe that lack of inventory will continue to hold sales down, but will still drive meaningful price appreciation through the end of 2018 and into next year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Rockland County, NY

The Rockland housing market had another strong quarter, with prices up, even while a lack of inventory held back sales growth. Sales of houses were down almost 3% for the quarter, and are now down almost 5% for the year. But that’s more a reflection of a lack of supply, not a lack of demand, evidenced by continuing appreciation, with prices up 6% on average and 7% at the median for the quarter, and now up 6% on average and 7% for the year. We are starting to see signs, though, that rising prices might be tempting more sellers into the market – months of inventory rose almost 11%, the first increase in over six years. Going forward, we expect that buyer demand is strong enough to absorb this additional inventory and still post meaningful price appreciation through the rest of the year and into 2019.

The Rockland housing market had another strong quarter, with prices up, even while a lack of inventory held back sales growth. Sales of houses were down almost 3% for the quarter, and are now down almost 5% for the year. But that’s more a reflection of a lack of supply, not a lack of demand, evidenced by continuing appreciation, with prices up 6% on average and 7% at the median for the quarter, and now up 6% on average and 7% for the year. We are starting to see signs, though, that rising prices might be tempting more sellers into the market – months of inventory rose almost 11%, the first increase in over six years. Going forward, we expect that buyer demand is strong enough to absorb this additional inventory and still post meaningful price appreciation through the rest of the year and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Westchester County, NY

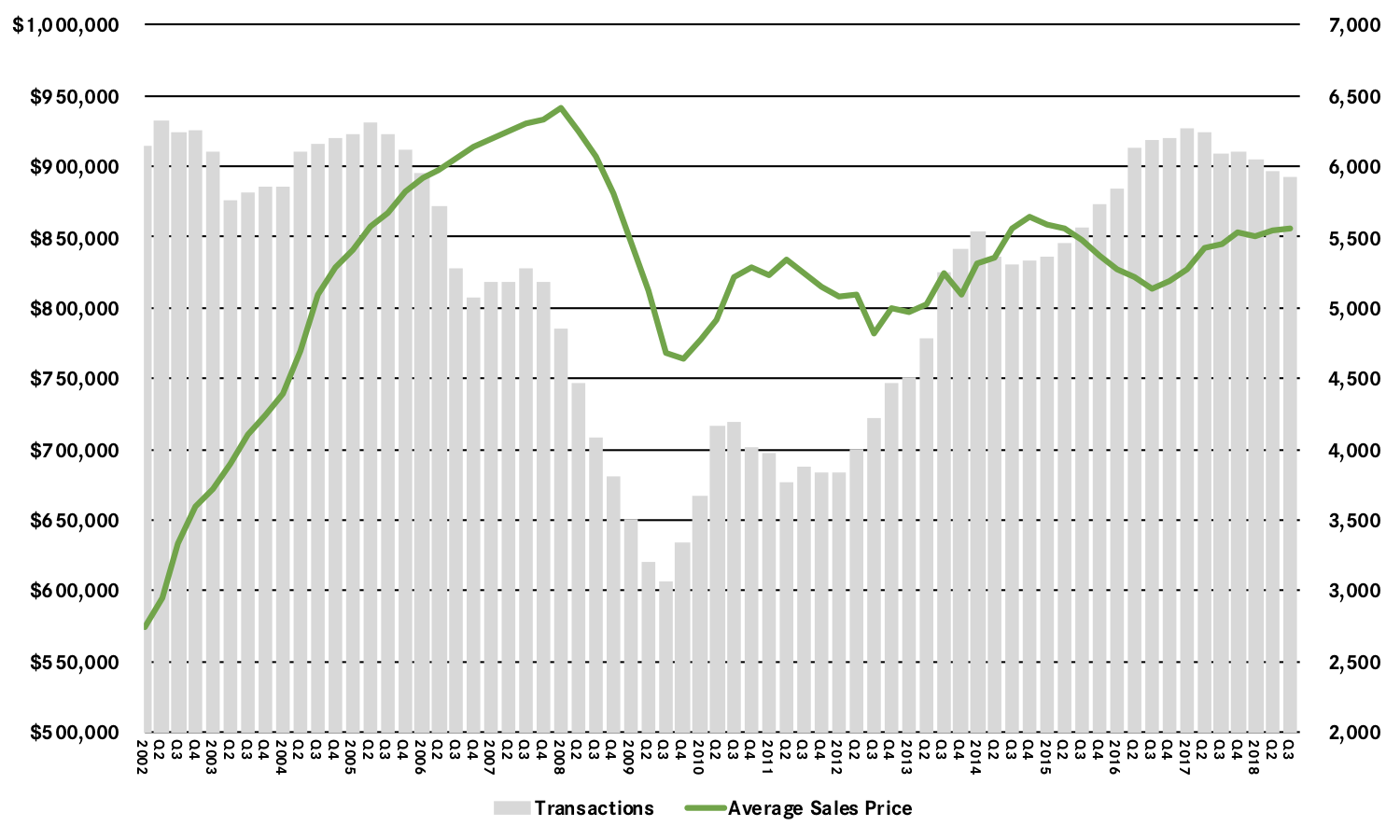

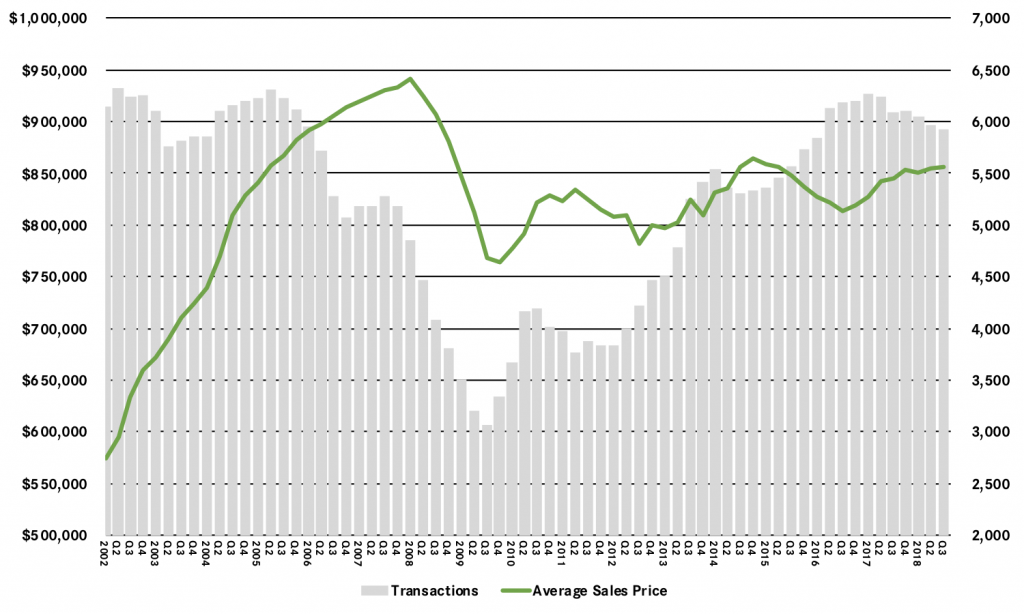

The Westchester housing market held steady in the third quarter of 2018, with a small decline in sales coupled with flat pricing. We believe that the decline in sales comes largely from a shortage of viable inventory, rather than a lack of demand, but it may be that the 2018 tax reform changes have hampered demand in the highest end of the market, increasing the percentage of lower‑priced homes in the mix of properties sold and thereby suppressing price appreciation. That would explain why, for example, average prices are increasing dramatically in the lower‑priced condo (up over 5%) and coop (up almost 4%) markets, as well as the more affordable neighboring counties. That said, tax reform is having only a modest impact on this market, with prices still up slightly for the rolling year. Going forward, we believe that demand is strong enough to overcome the tax concerns and that Westchester will experience a strong end to the year and a robust 2019.

The Westchester housing market held steady in the third quarter of 2018, with a small decline in sales coupled with flat pricing. We believe that the decline in sales comes largely from a shortage of viable inventory, rather than a lack of demand, but it may be that the 2018 tax reform changes have hampered demand in the highest end of the market, increasing the percentage of lower‑priced homes in the mix of properties sold and thereby suppressing price appreciation. That would explain why, for example, average prices are increasing dramatically in the lower‑priced condo (up over 5%) and coop (up almost 4%) markets, as well as the more affordable neighboring counties. That said, tax reform is having only a modest impact on this market, with prices still up slightly for the rolling year. Going forward, we believe that demand is strong enough to overcome the tax concerns and that Westchester will experience a strong end to the year and a robust 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: Third Quarter 2018 – Westchester and Hudson Valley

Despite concerns that the 2018 tax reform law would undermine housing values, Westchester and the Hudson Valley held steady in the third quarter, with prices rising throughout the region and up dramatically in some counties.

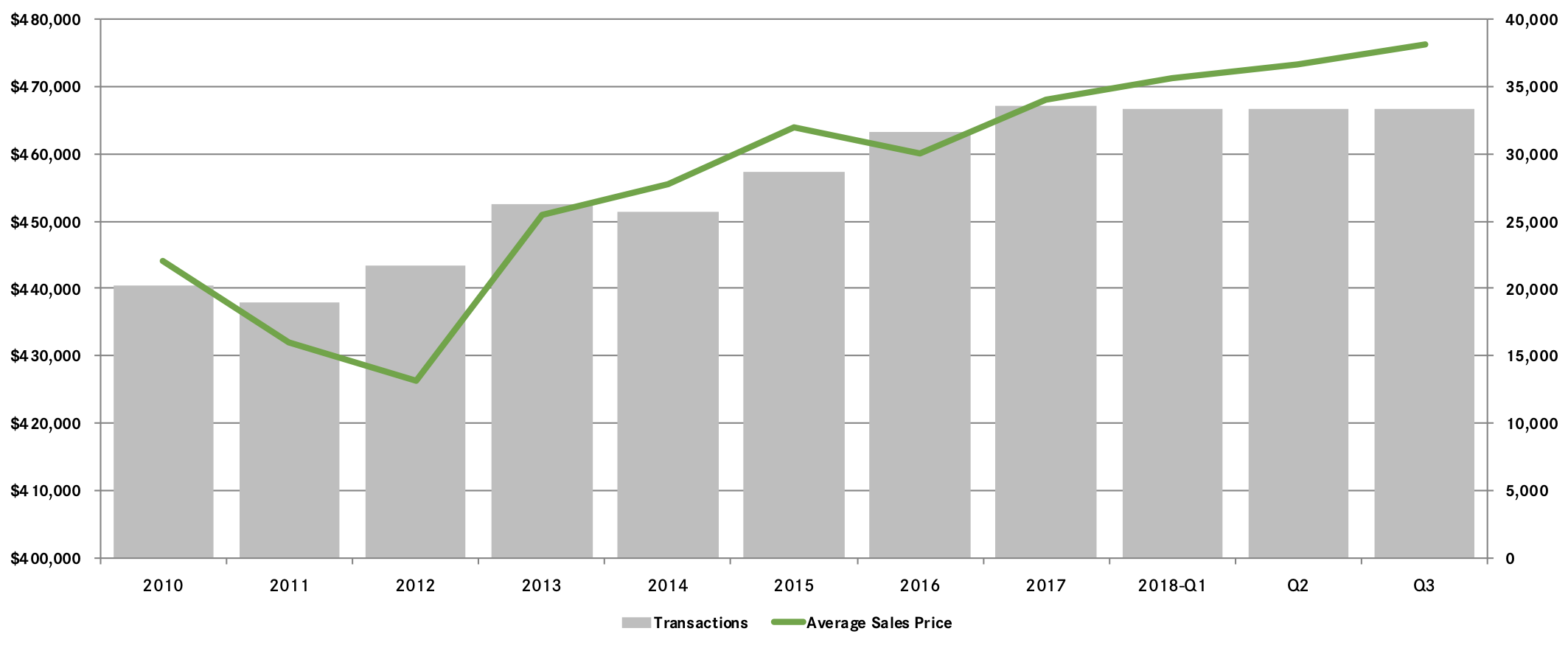

Some analysts have expressed concerns about the effects of the 2018 Tax Reform law on our regional housing market. The tax law capped the deductibility of state and local taxes and reduced the mortgage interest deduction, which particularly impacts high‑tax areas, like Westchester and the Hudson Valley. Indeed, those analysts might see evidence for this theory in the third-quarter results, with regional single‑family home sales falling almost 2% from last year, and down in almost every individual county.

For the most part, though, sales are down because of a lack of supply, not a lack of demand. Regional inventory levels have gone down 25 straight quarters, falling from a high of around 16 months to the current six months. Quarter after quarter, inventory went down until we reached a point where we have a shortage of desirable homes for sale. That’s what’s holding back sales – a lack of “fuel for the fire.”

How do we know that falling sales aren’t the result of slackening demand from the impact of tax reform? A couple of reasons:

First, this trend of declining sales predates tax reform. We’ve been tracking falling sales for almost two years, with regional sales down, in five out of the last six quarters, well before the passage of tax reform in late 2017.

Second, sales are down in all markets, not just high‑priced markets. Tax reform would not explain why sales are down even in the lower‑priced markets, where most buyers do not itemize taxes in a way that they’d be affected by changes in deductibility. And yet, quarterly sales were down more in Rockland and Dutchess than they were in Westchester.

Third, prices are up in almost every market segment. Regional average sales prices were up almost 3% for houses and 5% for condos in the third quarter and were up (in some cases dramatically) in every individual county for almost every property type. If tax reform had sapped demand in the market, we’d be seeing flat or declining pricing, not robust appreciation.

All that said, tax reform might be having a small impact on the very high end of the market, where the loss of deductibility for mortgage interest and local taxes hits the hardest. Price appreciation was more pronounced in the lower‑priced markets, with single‑family average prices rising 11% in Putnam, 6% in Rockland, 14% in Orange, and 7% in Dutchess. Meanwhile, Westchester’s single‑family home pricing was up just a tick on average, and only fell 1% at the median. We’re talking about a marginal, not a major, impact. Prices aren’t rising at the rate they are in the lower‑priced markets, they’re basically flat, not falling.

Moreover, inventory is starting to respond to these rising prices. For the first time since 2012, inventory levels went up this quarter, which illustrates fundamental economic market theory: If demand is strong, and supply stays steady (or goes down), prices will go up. And when prices go up, new inventory will come onto the market. That’s what we’re seeing now: After years of decline, single‑family inventory was up in almost every county in the region, stabilizing near that six‑month level that usually signals a balancing market.

Going forward, we believe that the appetite in the market can handle both the impact of tax reform and this increased inventory while still driving continued price appreciation. With strong economic conditions, relatively low‑interest rates (and the specter of rate increases on the horizon), and pricing still at attractive 2004‑05 levels, we expect a robust market through the end of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Tri-County Realty Teams with Rand Realty

NANUET, NY – Better Homes and Gardens Rand Realty continues to grow throughout Northern New Jersey, following their Wayne, New Jersey, office’s acquisition of Tri-County Realty, which was located in the township and owned by Joseph Palermo, a broker/salesperson.

NANUET, NY – Better Homes and Gardens Rand Realty continues to grow throughout Northern New Jersey, following their Wayne, New Jersey, office’s acquisition of Tri-County Realty, which was located in the township and owned by Joseph Palermo, a broker/salesperson.

“I’ve had the privilege of leading my brokerage for 20 years, and I’m grateful that my dedicated team now has the chance to work with Better Homes and Gardens Rand Realty,” said Palermo. “My agents have a strong commitment to service, which will make them a perfect match for their new colleagues.”

Palermo has been licensed since 1980 and has held several distinguished positions within past agencies. He has been a top manager for Schlott Realtors, an area manager for Coldwell Banker, and a regional vice president and Wayne office manager for Better Homes and Gardens Murphy & Co. He has consistently achieved status as a million-dollar producer, is a member of the New Jersey REALTORS® Distinguished Sales Club, and is a recipient of their Circle of Excellence Award.

“We’re thrilled to have the opportunity to work with Joseph and his team of agents,” said Justin Wrobel, New Jersey regional manager for Rand Realty. “The deep roots that they have in our markets are going to open new opportunities for our offices in these regions.”

About Better Homes and Gardens Rand Realty

Better Homes and Gardens Rand Realty, founded in 1984, is the No. 1 real estate brokerage firm in the Greater Hudson Valley, with over 28 offices serving Westchester, Rockland, Orange, Putnam, and Dutchess Counties the Bronx in New York, as well as Bergen, Passaic, Morris, Essex, Sussex, and Hudson Counties in New Jersey.

Better Homes and Gardens Rand Realty has over 1,000 residential real estate sales associates, as well as a commercial real estate company (Rand Commercial) and the Hudson United Group, which provides residential mortgage lending, title services, and commercial and residential insurance.

These companies can be found online at www.RandRealty.com, www.RandCommercial.com, and www.HudsonUnited.com. Better Homes and Gardens Rand Realty can also be found and interacted with on Facebook, Twitter, Pinterest, and Instagram.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link