Second Quarter 2017 Real Estate Market Report – Westchester County, New York

Prices in the Westchester housing market surged forward in the second quarter of 2017, even while a lack of inventory stifled potential sales growth.

Prices in the Westchester housing market surged forward in the second quarter of 2017, even while a lack of inventory stifled potential sales growth.

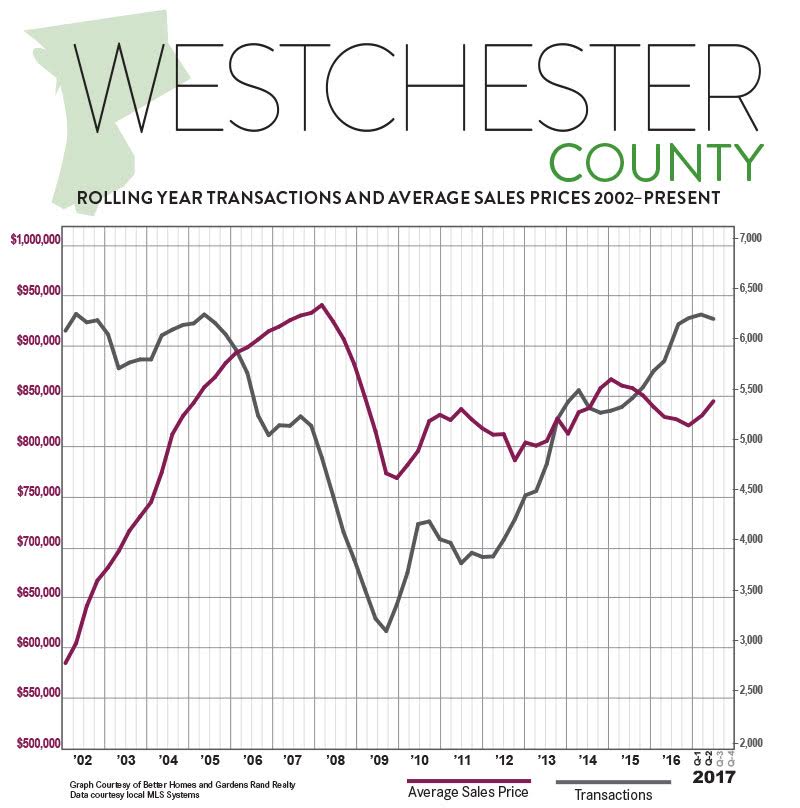

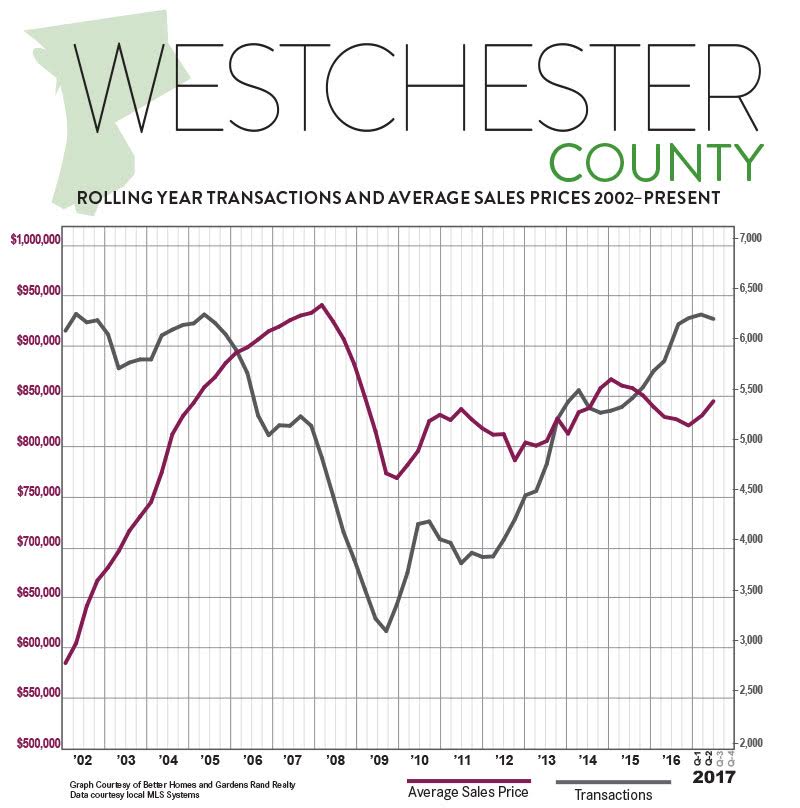

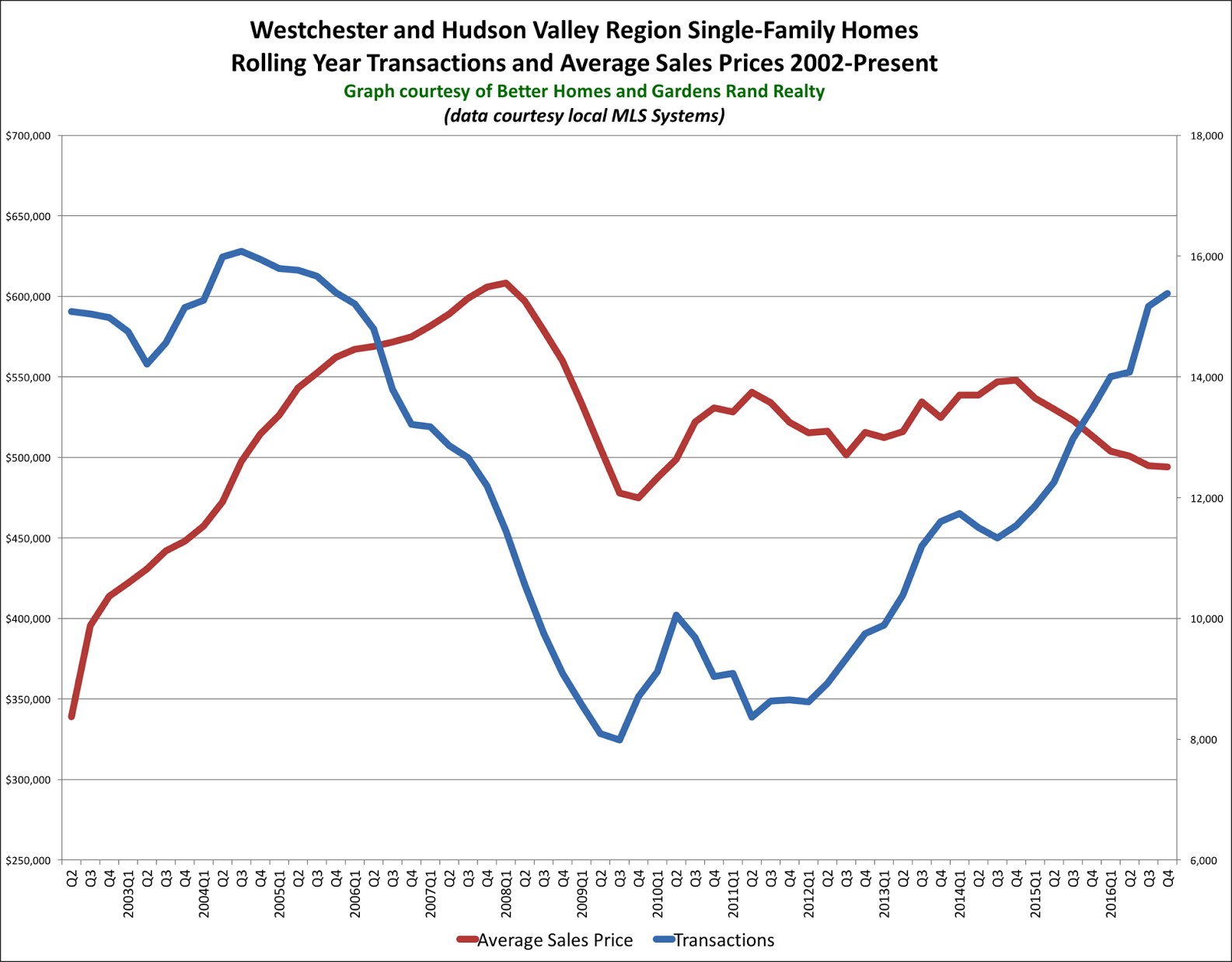

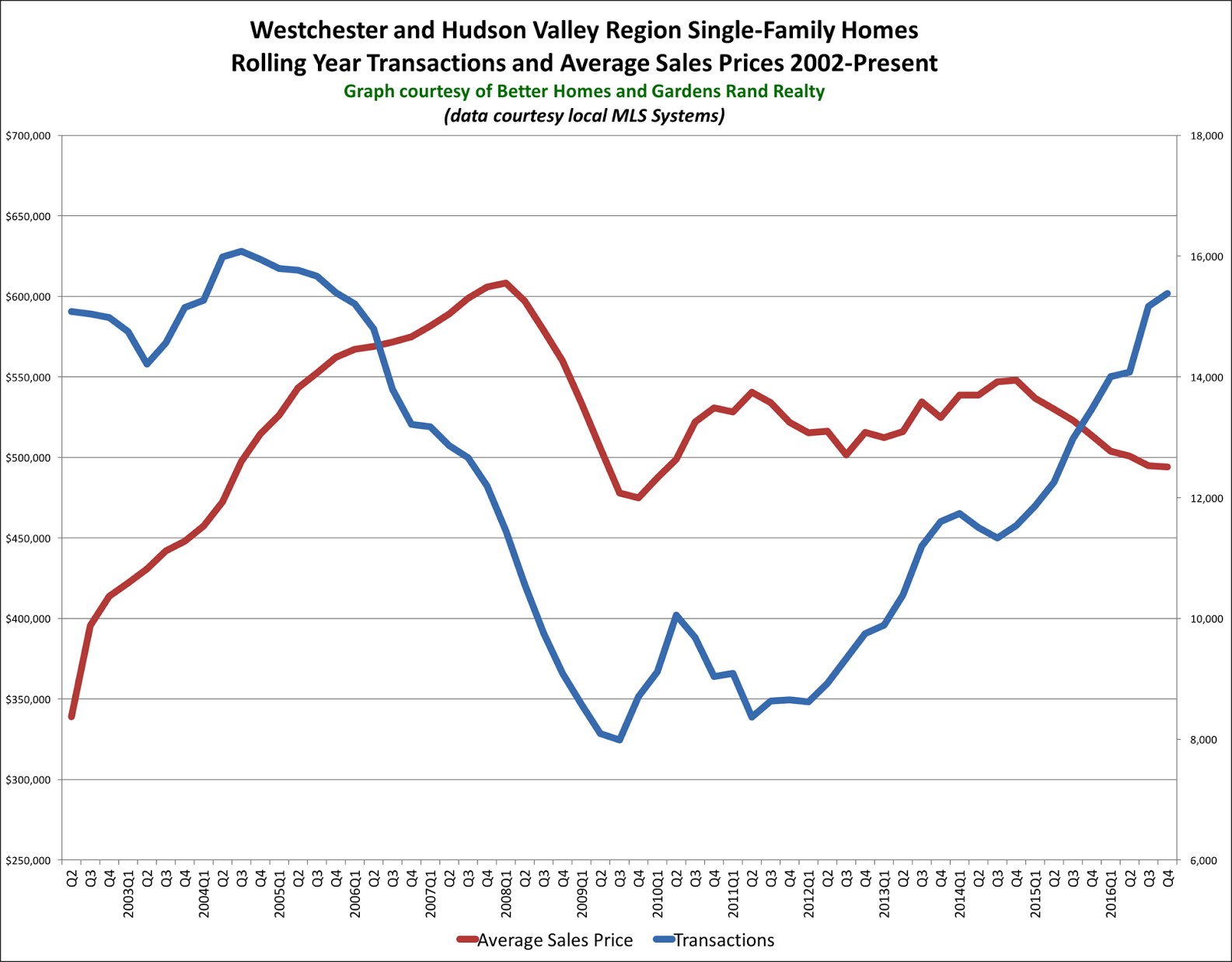

Sales. Home sales were basically flat through the second quarter, falling just about 1% from the second quarter of last year. This marked the first quarter in almost three years where sales fell from the prior year, reflecting the lack of inventory available in the market. Still, though, sales are at levels we have not seen since the last seller’s market in 2005, and up almost 90% from the bottom of the market at the end of 2009.

Prices. Low levels of inventory also had an impact on prices, which were up significantly over last year. Home prices rose across the board: up over 7% on average, almost 4% at the median, and 3% in the price-per-square foot. Over the longer-term, we’re starting to see some meaningful price appreciation, with average prices up almost 3% for the rolling year.

Negotiability. The negotiability indicators continue to signal the emergence of the seller’s market. Inventory declined again, falling almost 12% and now at the lowest level of inventory we have had in Westchester in over 12 years, since the height of the last seller’s market. Similarly, the listing retention rate was up a full percentage point, exactly what we would expect when sellers start to gain negotiating leverage.

Condos and Coops. The condo and coop market was mixed. Sales of coops were up over 12%, but condo sales were down over 6%, the clear result of constricted inventory levels. But that shortage of available condos and coops is having its expected impact on pricing, which was up across the board for both property types.

Going forward, we expect that Westchester is going to continue to see meaningful price appreciation through a strong summer market. With inventory still tightening, pricing at 2004-05 levels, and interest rates still near historic lows, we expect that buyer demand will stay strong for the rest of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley – Market Overview

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

Inventory throughout the region continues to drop. Regional inventory was down almost 18%, and is now down to 7.1 months — right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now down around six months, moving into “seller’s market” territory.

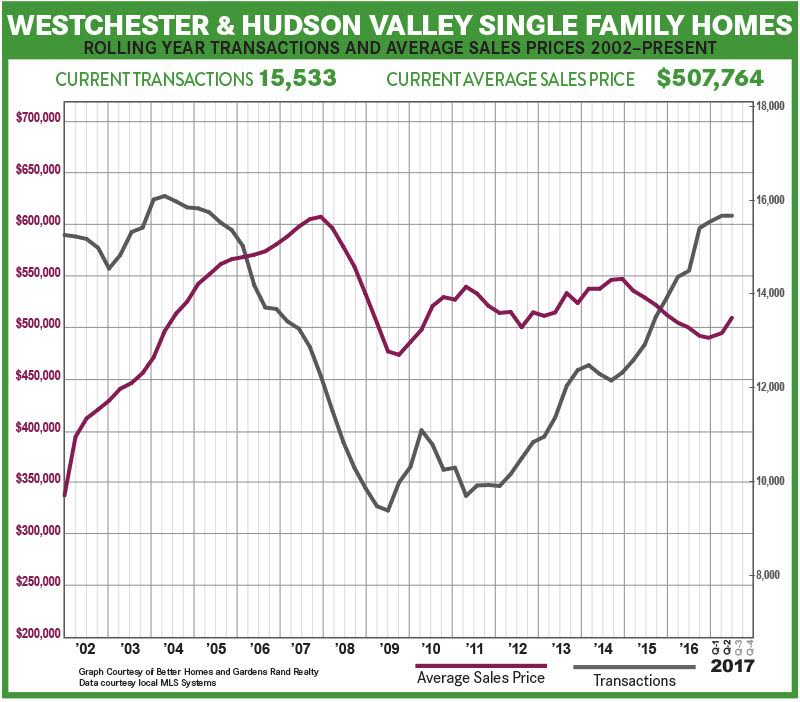

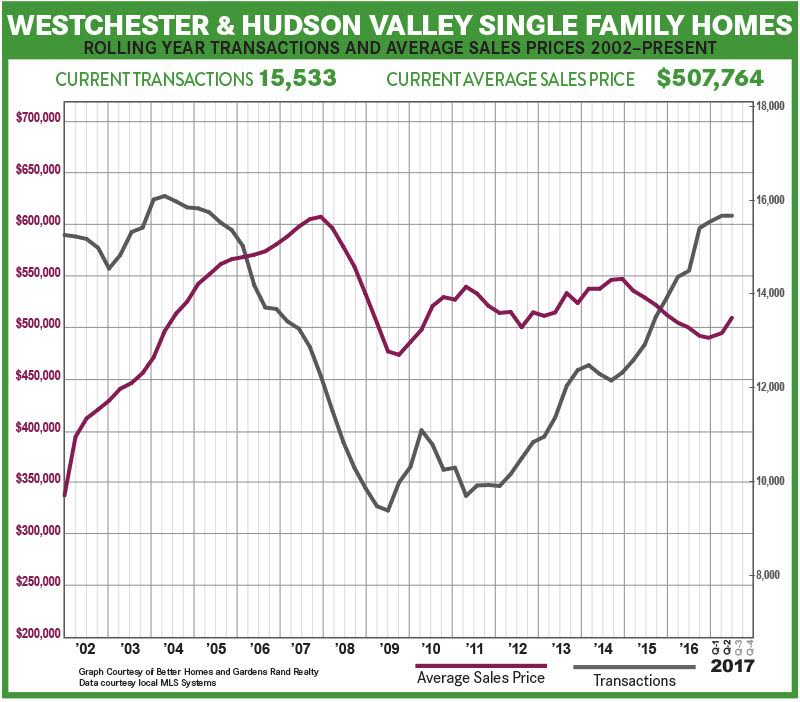

The lack of inventory continues to stifle sales growth. Regional sales were down just a tick compared to the second quarter of last year, just barely breaking a 10-quarter streak of year-on-year sales growth. We noted in our last report that the pace of growth was slowing. Now, it has stalled, at least until we get more “fuel for the fire.” All that said, buyer demand is as strong as we’ve seen in over 10 years, with regional sales up 5% for the year and reaching the highest 12-month sales total since the height of the last seller’s market in 2005.

These inventory levels are starting to drive meaningful price appreciation. The regional average sales price was up over 6% for the quarter, following a similar 7% increase in the first quarter. After several years of slow declines, prices are now up over 1% for the rolling year. That may not seem like much, but it’s a sign of things to come. Indeed, average prices were up in every county in the region, rising over 7% in Westchester, over 6% in Putnam, over 1% in Rockland, 9% in Orange, and almost 5% in Dutchess. We should not be surprised — sales have been going up year after year, and it was only a matter of time before this type of demand drove some meaningful price appreciation.

Going forward, we expect that prices will continue to appreciate through the rest of the year. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2003-04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. We will need fresh new listings to drive more sales growth, but we expect that we will continue to see price appreciation through a robust Summer market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Westchester County, New York

The Westchester housing market started off 2017 with a flourish, with sales up and prices showing meaningful signs of appreciation after a slow 2016.

The Westchester housing market started off 2017 with a flourish, with sales up and prices showing meaningful signs of appreciation after a slow 2016.

Sales. Home sales were strong through the first quarter. Single-family home sales were up over 6%, the tenth straight quarter of year-on-year sales increases. And the 6,266 transactions over the rolling year was the highest 12-month total since the second quarter of 2005, and marks an 87% increase off the bottom of the market at the end of 2009.

Prices. After a lackluster 2016, we finally saw some signs of life in pricing. Home prices were up across the board: almost 7% on average, over 5% at the median, and 3% in the price-per-square foot. Some of this might be the potential return of the high-luxury market, with sales of $3M-plus properties almost double the total from last year’s first quarter. Over the longer-term, prices are basically flat, but we expect that to change as inventory drives a tighter market through the Spring.

Negotiability. The negotiability indicators continue to signal the coming of a strong seller’s market. Inventory declined again, falling over 23% and now down to five months of inventory for single-family homes. This is the lowest level of inventory we have had in Westchester in over 12 years, since the height of the last seller’s market. Also, the listing retention rate was up, and the days-on-market were down, exactly what we would expect from a strengthening seller’s market.

Condos and Coops. The condo and coop markets were mixed. Sales of coops were up over 10%, but prices fell across the board over the quarter. Meanwhile, condo sales were down almost 8%, but prices spiked over 9% on average and 8% at the median. Inventory in both markets was down to well under six months, indicating that they are likely to see constricted sales but rising prices over the balance of 2017.

Going forward, we expect that Westchester is going to surge again through the traditionally robust Spring market. With inventory tightening, pricing at 2004-05 levels, and interest rates still near historic lows, we expect that buyer demand will stay strong and continue to drive price appreciation through the rest of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley – Market Overview

The regional housing market in Westchester and the Hudson Valley started to show the first signs of meaningful price appreciation in the first quarter of 2017, with prices up in most of the counties. Moreover, with inventory rates dropping, we expect this trend to continue through a robust Spring market and for the rest of 2017.

The regional housing market in Westchester and the Hudson Valley started to show the first signs of meaningful price appreciation in the first quarter of 2017, with prices up in most of the counties. Moreover, with inventory rates dropping, we expect this trend to continue through a robust Spring market and for the rest of 2017.

Inventory throughout the region continues to drop. Regional inventory fell almost 26%, and is now down to 6.3 months–right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now well below six months, moving into “seller’s market” territory. For example, Westchester is now down to 5.0 months for single-family homes, 4.6 months for coops, and 3.2 months for condos. Indeed, outside of Dutchess County, every single market segment in every county in the region is at or below 6.1 months of inventory.

The lack of inventory is continuing to stifle sales growth. Regional sales were up 5% from the first quarter of last year, marking 10 straight quarters of year-on-year sales growth. But that 5% increase was the smallest in that 10-quarter streak, indicating that the pace of growth is slowing due to the lack of inventory. Essentially, the market is capable of even greater sales growth, but only if it gets more “fuel for the fire.” All that said, buyer demand is as strong as we’ve seen in over 10 years, with regional sales up 11% for the year and reaching the highest 12-month sales total since the third quarter of 2005 — the height of the last seller’s market.

High demand and low inventory is starting to drive modest-but-meaningful price appreciation. In our last Report, we said that we were “about to witness ‘Economics 101’ in action,” explaining that rising demand and falling supply were poised to drive prices up. Well, from that perspective, we had a “textbook” result in the first quarter, with the regional average sales price up over 7% from the first quarter of last year.

Moreover, average prices spiked in several counties in the region, rising almost 7% in Westchester, 5% in Rockland, and 7% in Orange. Prices were down in Putnam and Dutchess, but even in those counties, the yearlong trend was relatively promising. Essentially, the market is capable of even greater sales growth, but only if it gets more “fuel for the fire.”

Going forward, expect big things for this market in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2003-04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. Given these conditions, we expect that prices will continue to go up in a robust Spring market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Westchester County, New York

The Westchester housing market in the fourth quarter of 2016 started to show the impact of tightening inventory, with sales flattening out and prices rising as buyers chased fewer available homes for sale.

The Westchester housing market in the fourth quarter of 2016 started to show the impact of tightening inventory, with sales flattening out and prices rising as buyers chased fewer available homes for sale.

Inventory. The story in Westchester as 2016 ended was about the declining inventory. We calculate the “months of inventory” by measuring how long it would take to sell out the existing available homes at the current rate of sales. Anything below six months is considered a “tight” market, and Westchester has now crossed over that line in all property types: down to 3.8 months for single-family homes, 4.5 months for coops, and a sizzling 2.6 months for condos.

Sales. Westchester sales remain strong, with 2016 single-family transactions up over 8% for the year. Indeed, yearly sales hit their highest total since 2004, and are up 85% from their 2009 bottom. But you can see that the rate of growth is slowing if you look at the quarterly numbers, where single-family home sales were up just a tick and condo and coop sales were down sharply. Why? Because the market needs fuel for the fire, and the limited inventory is providing buyers with fewer options to purchase.

Prices. The flip side of limited inventory, of course, is rising prices, as buyers chase fewer options and get into multiple-offer situations and bidding wars that drive prices up. And we are finally starting to see the impact of limited inventory on Westchester pricing, with quarterly prices up over 3% for single-family homes, 10% for coops, and 3% for condos. For the year, prices were mostly down or flat, and they remain close to their 2004-05 levels, but we believe they are poised to rise in 2017.

Negotiability. The negotiability indicators also showed the impact of declining inventory, with listing retention up and days-on-market down. Simply put, homes are selling more quickly, and for closer to the asking price. Indeed, for single-family homes, the yearly listing retention rate of 97.5% homes was the highest since 2005, and the yearly days-on-market of 161 was the lowest since 2006.

Going forward, we believe that the fundamentals in the Westchester market are tremendous. With inventory tightening, pricing at 2004-05 levels, interest rates still near historic lows, and a generally improving economy, we expect that buyer demand will stay strong and eventually drive meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Real Estate Market Report: Third Quarter 2016 – Westchester County

The Westchester housing market softened in the third quarter of 2016, with sales flat and prices continuing to weaken even in the face of falling inventory.

The Westchester housing market softened in the third quarter of 2016, with sales flat and prices continuing to weaken even in the face of falling inventory.

SALES. Sales activity was up, but not at the pace that we’ve seen over the past few years. Single‑family home sales rose, but only by about 2%. Similarly, coop sales were actually down by almost 3%, and condo sales fell just a tick. Transactions are still up for the rolling year, rising 11% in single‑family homes, 6% in coops, and almost 12% in condos. But we might be seeing a cooling of the sizzling buyer demand that’s been driving sales up in this market for the past five years.

PRICES. We continued to see some weakness in Westchester pricing, with single‑family home prices down 3% on average, 1% at the median, and almost 2% in the price‑per‑square foot. Pricing in the condo and coop markets was a little more mixed, but the overall takeaway is that sustained levels of buyer demand over the past five years have done little to drive price appreciation.

INVENTORY. Inventory levels continue to drop, now under six months of inventory for all property types. That might explain the relative slack in market activity, if buyers are still adjusting to the limited inventory available. But if inventory continues to fall, and demand maintains its current levels, we might see the price appreciation we’ve been waiting for.

NEGOTIABILITY. The negotiability indicators were relatively hopeful. Sellers seem to be gaining a little bit of negotiating leverage, with single‑family home sellers now retaining over 98% of their last list price. And homes are now selling in under six months, which is relatively quick by historical standards.

Going forward, we continue to believe that the fundamentals in the Westchester market are strong. With inventory tightening, pricing at 2004‑05 levels, interest rates near historic lows, and a generally improving economy, we expect that buyer demand will stay strong and eventually drive meaningful price appreciation.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Real Estate Market Report: Third Quarter 2016 – Westchester & Hudson Valley Market Overview

The housing market in Westchester and the Hudson Valley in the third quarter of 2016 defied the standard economic laws of supply and demand. Sales were up and inventory was down, but prices were flat across the board. Why? Maybe buyers are just leery of making a move during a tumultuous presidential election year.

The housing market in Westchester and the Hudson Valley in the third quarter of 2016 defied the standard economic laws of supply and demand. Sales were up and inventory was down, but prices were flat across the board. Why? Maybe buyers are just leery of making a move during a tumultuous presidential election year.

Sales activity continues to increase throughout the region. Sales were up compared to the third quarter of last year in every county in the Report, ranging from a modest 2% increase in Westchester to a robust 18% rise in Orange. We’ve now seen sustained sales increases for almost five years, with regional year‑on‑year sales going up in 17 out of the last 19 quarters. And we’re reaching transactional totals we haven’t seen since the height of the last seller’s market, with the region hitting 15,000 single‑family home sales for the first time since 2016. We did see some signs, though, that the pace of growth might be slowing: regional sales were up only 8% for the quarter, relatively disappointing in a rolling year where sales rose almost 17%.

Inventory continues to tighten throughout the region. The supply of homes for sale is falling throughout the region, down in almost every county in the Report: dropping 20% in Westchester, 31% in Putnam, 17% in Rockland, and 21% in Orange. And if you look at the months of inventory available given the current rate of sales, we are already approaching the six‑month inventory level that usually signals a tight seller’s market. For single‑family homes, Westchester is already below six months at 5.8, and the other counties are getting close: Putnam at 7.3, Rockland at 6.4, and Orange at 8.1. And for condos, it’s the same story: Westchester at 3.7, Putnam at 4.7, Rockland at 7.1, and Orange right at 6.0.

So with demand up and supply down, why aren’t prices rising? Prices were down modestly throughout the region, and in most of the counties in this Report. We can think of three reasons.

- Disproportionate strength in the lower‑end markets. The fact that sales were up 18% in lower‑priced Orange and only 2% in higher‑priced Westchester might be a sign that demand is stronger at the entry‑level. That would tend to drive overall pricing down a bit.

- Buyers are still spooked by the financial crisis and meltdown of 2008‑09. Maybe buyers aren’t yet willing to give in to seller demands for higher prices – that would blunt the impact of declines in inventory, and might also explain why sales increases have tapered a bit.

- The impact of a particularly tumultuous presidential election year. It’s tough to get data on this, because we have so few presidential election years to use as comparison points. But real estate agents have traditionally complained about the difficulty of selling homes during a presidential election – and we expect that this election is especially fraught for home buyers (on both sides).

Going forward, we are hopeful that the market will close the year well. The fundamentals of our regional market are strong: demand is high, inventory is falling, interest rates are near historic lows, and the overall economy is doing fine. Accordingly, we expect that sales will continue to outpace 2015 levels, and believe it’s only a matter of time before these falling inventory levels start driving meaningful price appreciation throughout the region.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second-Quarter 2016 Real Estate Market Report: Westchester County

The Westchester housing market surged in the second quarter of 2016, with sales activity up sharply but prices down slightly because of continued weakness in the ultra high‑end.

The Westchester housing market surged in the second quarter of 2016, with sales activity up sharply but prices down slightly because of continued weakness in the ultra high‑end.

Sales. Market activity exploded, with single‑family sales up over 22% from last year and now up over 12% for the rolling year. Year‑on‑year sales have now risen in 17 out of the last 19 quarters, with rolling year closings crossing over the 6,000‑transaction level for the first time in over 10 years. We saw the same thing in the condo and coop markets, with coop sales up over 10% and condos up over 20% from last year.

Prices. Even with this continued strength in buyer demand, though, prices were still down from last year, falling almost 3% on average and 2% in the median and price‑per‑square foot. Part of this is simply a change in the mix of properties sold, with sales softer in the higher‑end markets: $3M+ sales are down about 44%, even while sales for homes priced at $500,000‑and‑below are up over 25%. Indeed, we see the same dynamic in condos and coops, with pricing in the lowest‑priced coop market up almost 7% at the median even while the mid‑priced condo market is depreciating slightly.

Inventory. We are still seeing declines in inventory levels, which are now hovering near the six‑month level that signifies a seller’s market. Single‑family listings were down 24% to 6.7 months, and inventory is even tighter in the entry‑level markets, down to 6.0 months for coops and 4.0 months for condos.

Negotiability. The negotiability indicators demonstrate that sellers are gaining leverage with buyers. The days‑on‑market were down for all property types, at about the five‑month level for single‑family homes and condos, and the listing retention rate rose across the board. With homes selling more quickly and for closer to the asking price, we would expect to see more upward pressure on pricing.

Going forward, we continue to believe that the fundamentals in the Westchester market point to appreciating prices by year‑end. With inventory tightening, pricing at 2004‑05 levels, interest rates near historic lows, and a generally improving economy, we expect that the strength in the lower‑end of the market will eventually expand throughout all price ranges.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link