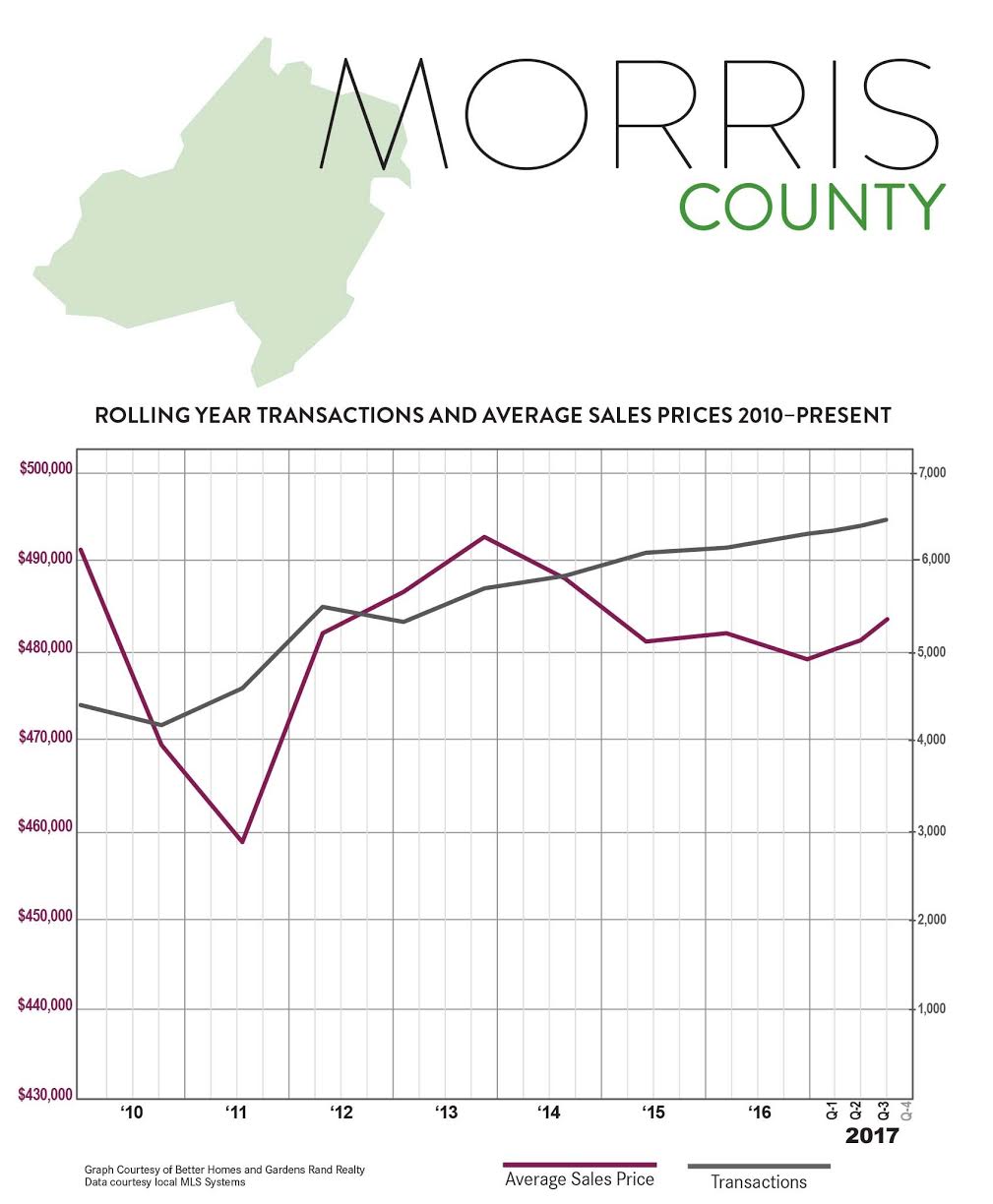

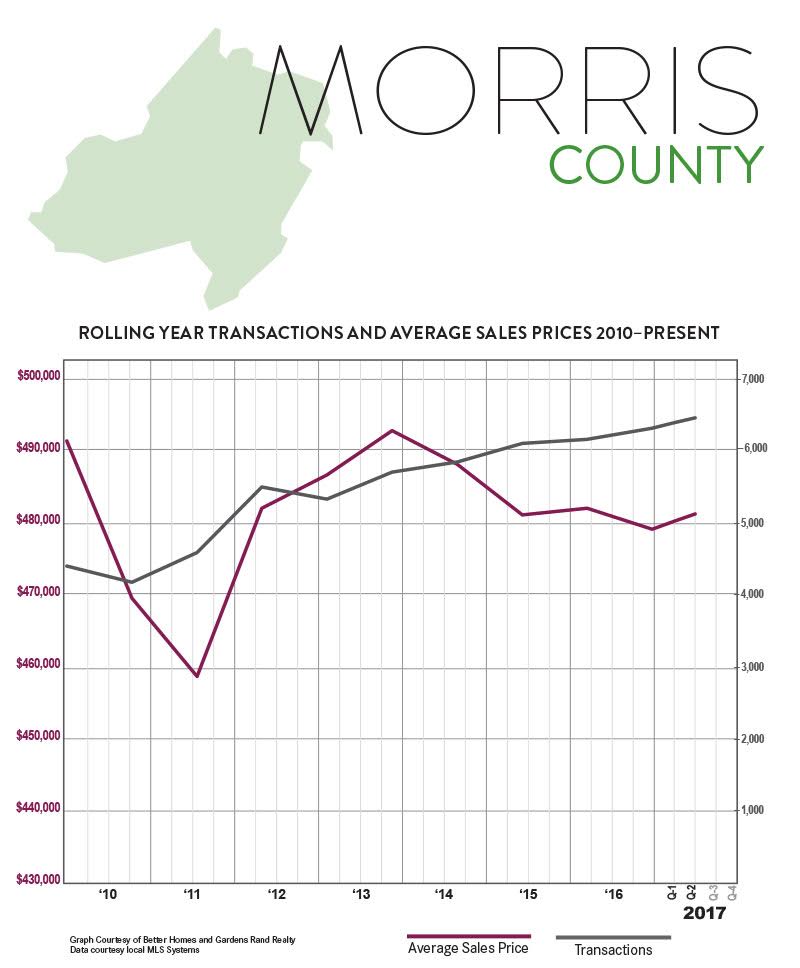

Fourth Quarter 2017 Real Estate Market Report: Morris County Overview

The Morris County housing market finished 2017 with strong signs of meaningful price appreciation, even while low levels of inventory continued to stifle sales growth.

The Morris County housing market finished 2017 with strong signs of meaningful price appreciation, even while low levels of inventory continued to stifle sales growth.

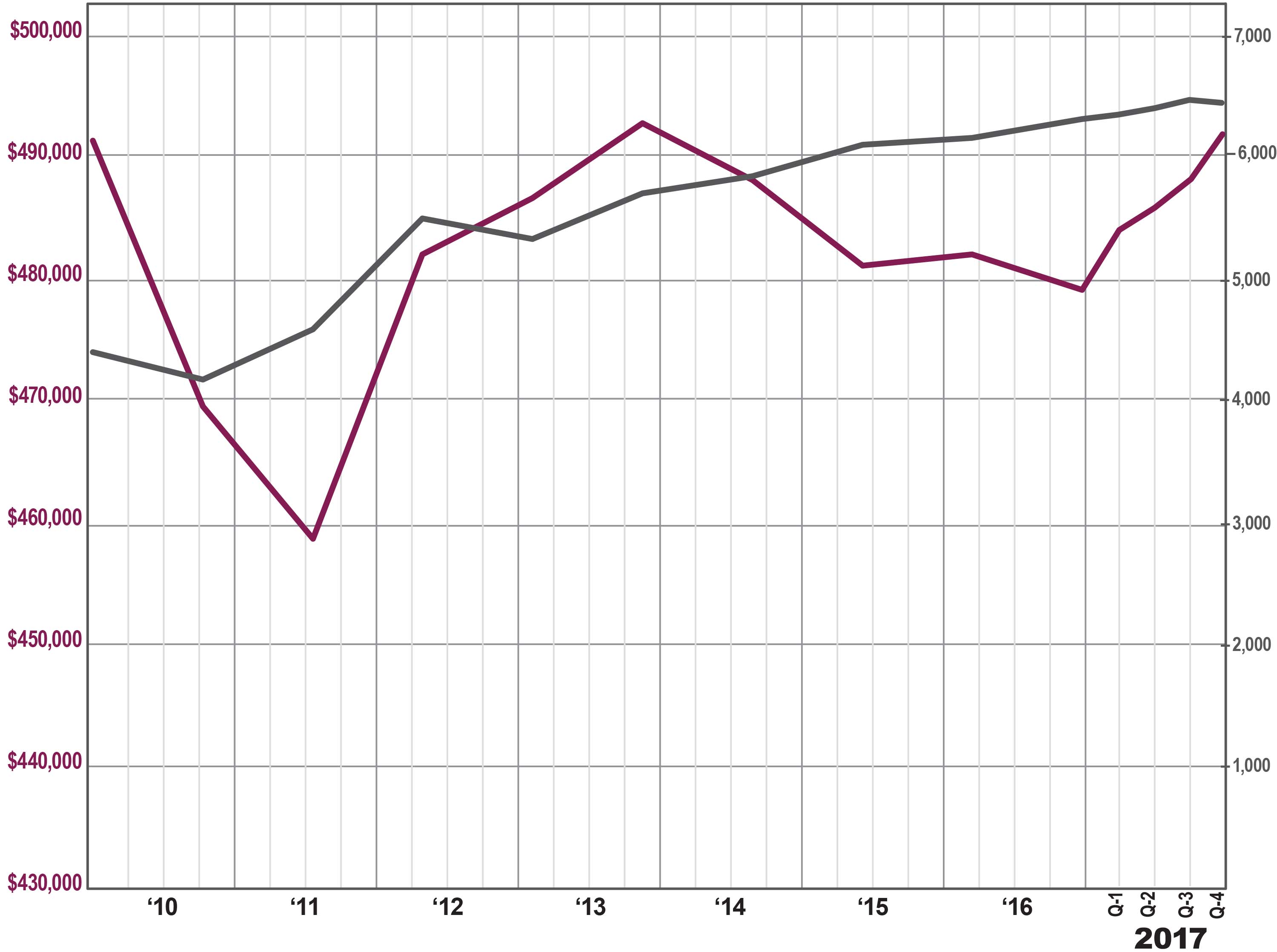

Sales. Reduced inventory continued to hold back Morris sales growth, with transactions down almost 3% for the quarter, breaking a streak of 12 straight quarters of year‑on‑year sales growth. That said, sales were still up almost 2% for the year, and are now up almost 70% from the bottom of the market in 2011. More significantly, sales are falling not because of a lack of buyer demand, but a lack of available homes for eager buyers to purchase.

Prices. These sustained levels of buyer demand are finally having some modest impact on pricing. Prices were up again in the fourth quarter, rising almost 5% on average and 3% at the median. And we are starting to see long‑term price appreciation, with the 2017 full‑year average price up almost 3% and the median up almost 4%. Sustained levels of buyer demand coupled with falling inventory is likely to continue to drive prices up in 2018.

Inventory. Morris inventory fell again, dropping almost 39% from last year’s fourth quarter and now down to 4.5 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So, the fact that Morris inventory is now well below that six‑month mark indicates that we could be in for some meaningful price appreciation throughout 2018.

Negotiability. The negotiability indicators showed that sellers are continuing to gain negotiating leverage with buyers. For the year, the days‑on‑market were down almost 8%, falling by about 10 days, and the listing retention rate was up almost a full point, now up to almost 98% of the last listed price.

Going forward, we expect that Morris County’s sales activity and low levels of inventory will continue to have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that Morris will enjoy a robust seller’s market in 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

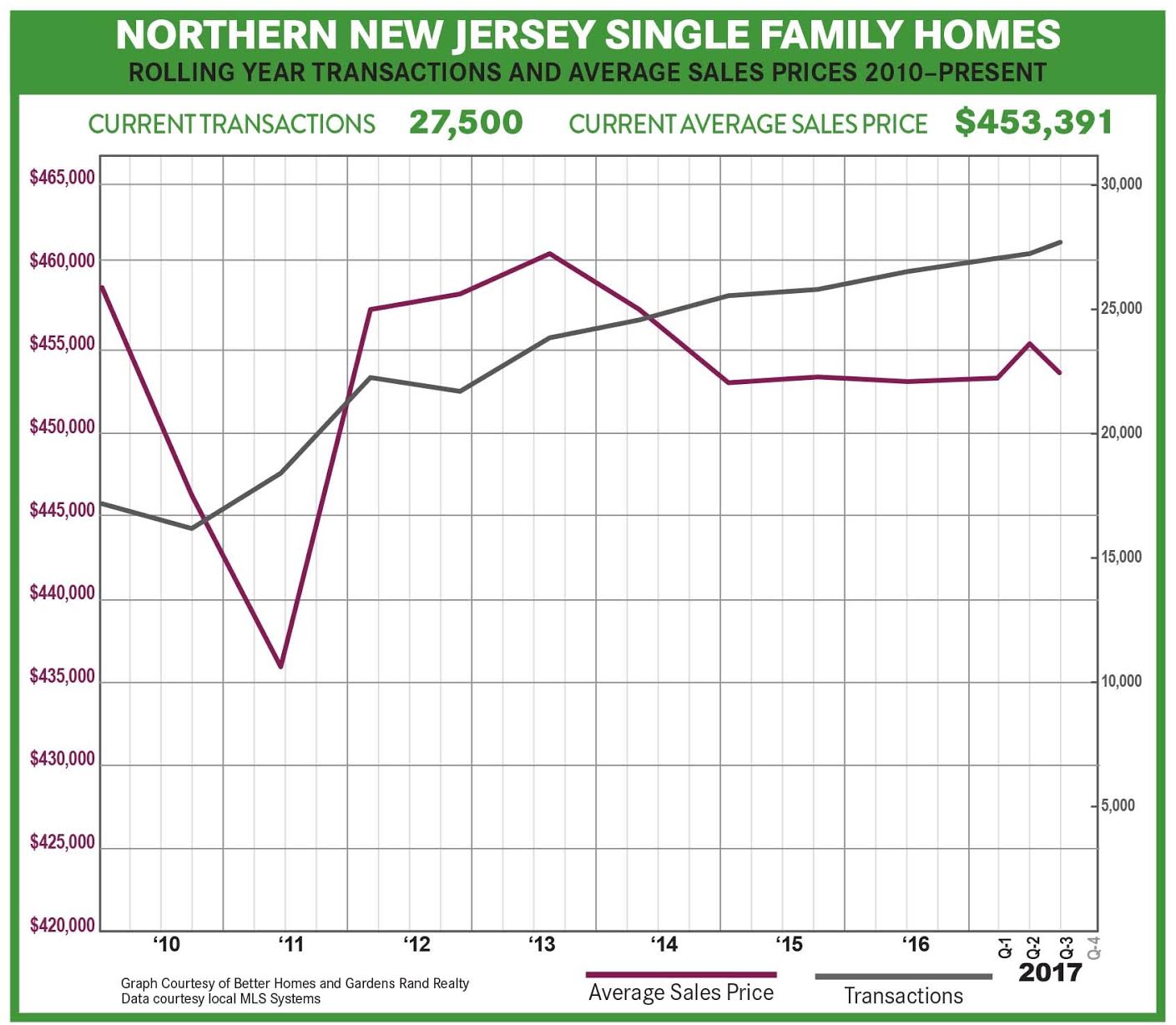

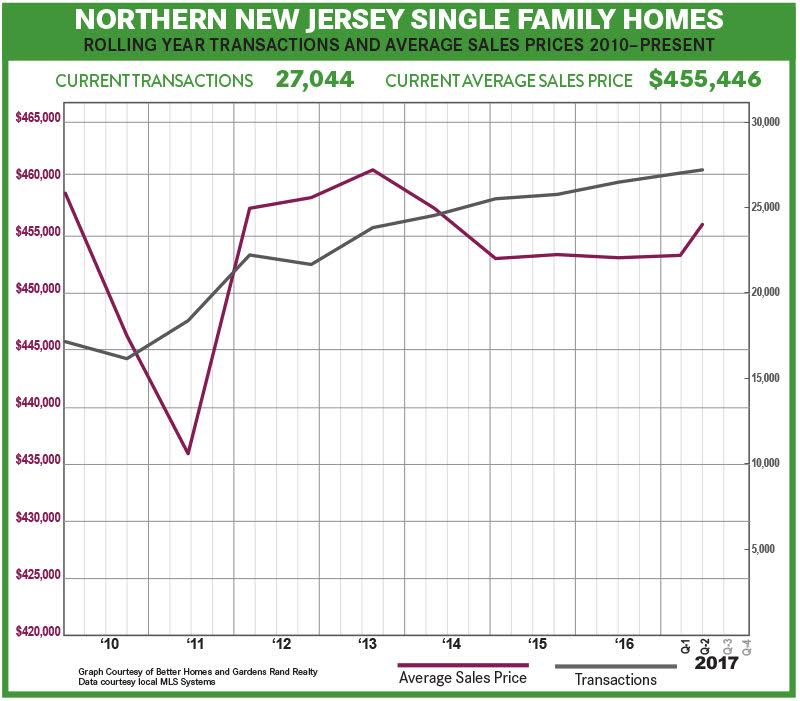

Fourth Quarter 2017 Real Estate Market Report: Northern New Jersey Overview

The Northern New Jersey housing market finished 2017 strong, with prices up even while declining inventory throughout the region stifled sales growth. With demand high, and available homes low, we believe that homeowners will continue to enjoy price increases throughout 2018.

The Northern New Jersey housing market finished 2017 strong, with prices up even while declining inventory throughout the region stifled sales growth. With demand high, and available homes low, we believe that homeowners will continue to enjoy price increases throughout 2018.

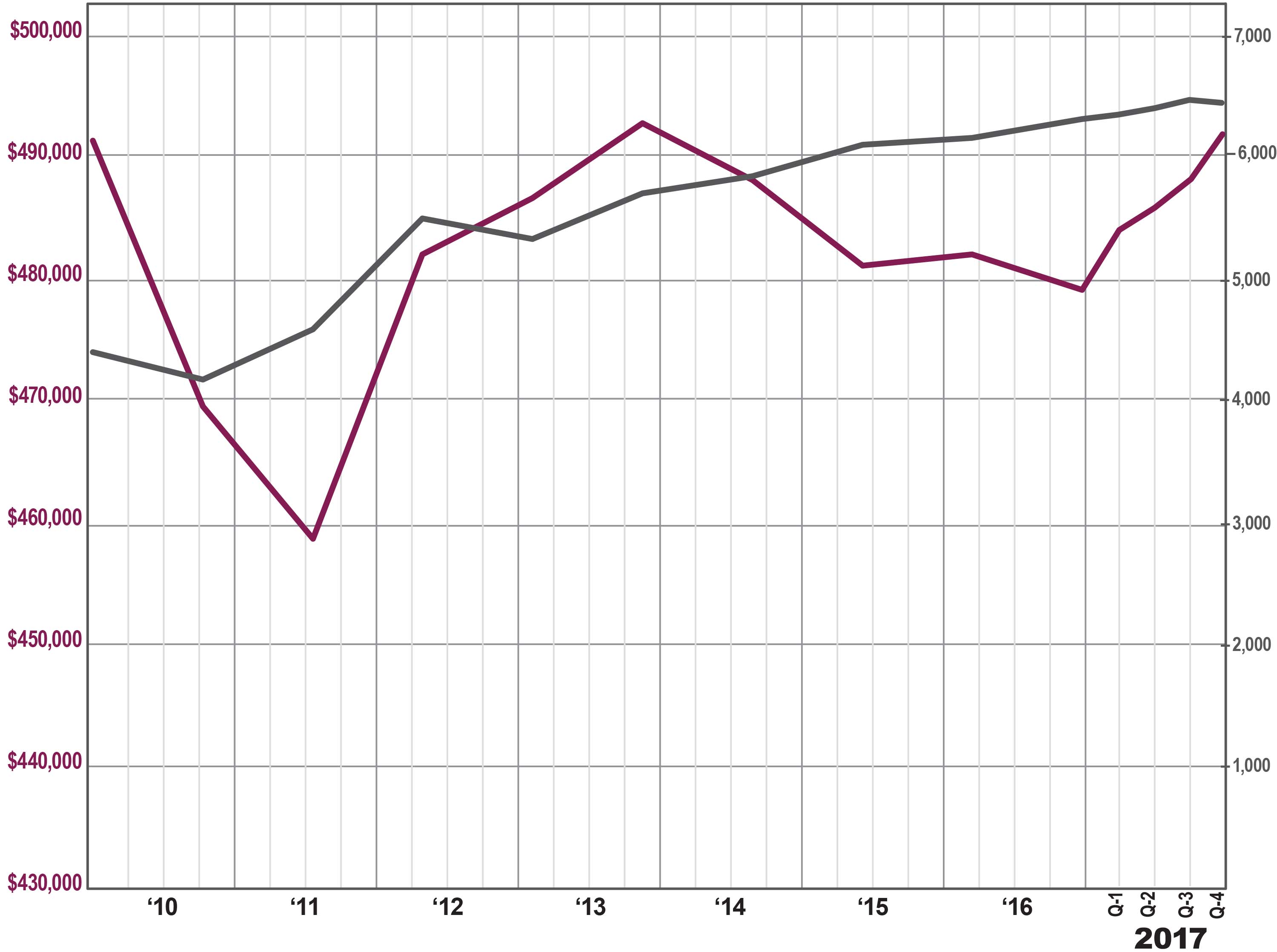

Regional sales were up, but not in every county. Regional sales were up slightly for the quarter, rising almost 2% from the fourth quarter of last year, even while some counties like Bergen and Morris were down slightly. We believe that a lack of inventory is stifling sales growth, simply because we don’t have enough “fuel for the fire” to satiate the existing buyer demand. That said, sales in every county were up for the full calendar year, with the 27,000 regional sales in 2017 representing almost a 6% increase from 2016, and a full 75% increase from the bottom of the market in 2011. Inventory was down significantly again. The number of homes for sale continued to fall in the fourth quarter, dropping in every county in the region. Indeed, most of our Northern New Jersey markets have now fallen below the six‑months‑of‑inventory level that traditionally starts to signal a seller’s market: Bergen at 3.4, Passaic at 4.9, Morris at 4.5, and Essex at 4.1. Only Sussex County, at 7.3 months of inventory, is above that six‑month indicator. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing. With sales up and inventory down, prices are starting to show some meaningful price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: for the 2017 year, the regional average price was up about 1%, and average prices were up in most of the counties in the region: Bergen up 4%, Passaic up 3%, Morris up 3%, Essex up 2%. Again, only Sussex was the outlier, with the average price down about 2%. Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through 2018. Sales have now been increasing for over five years, which has brought inventory below the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust seller’s market in 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

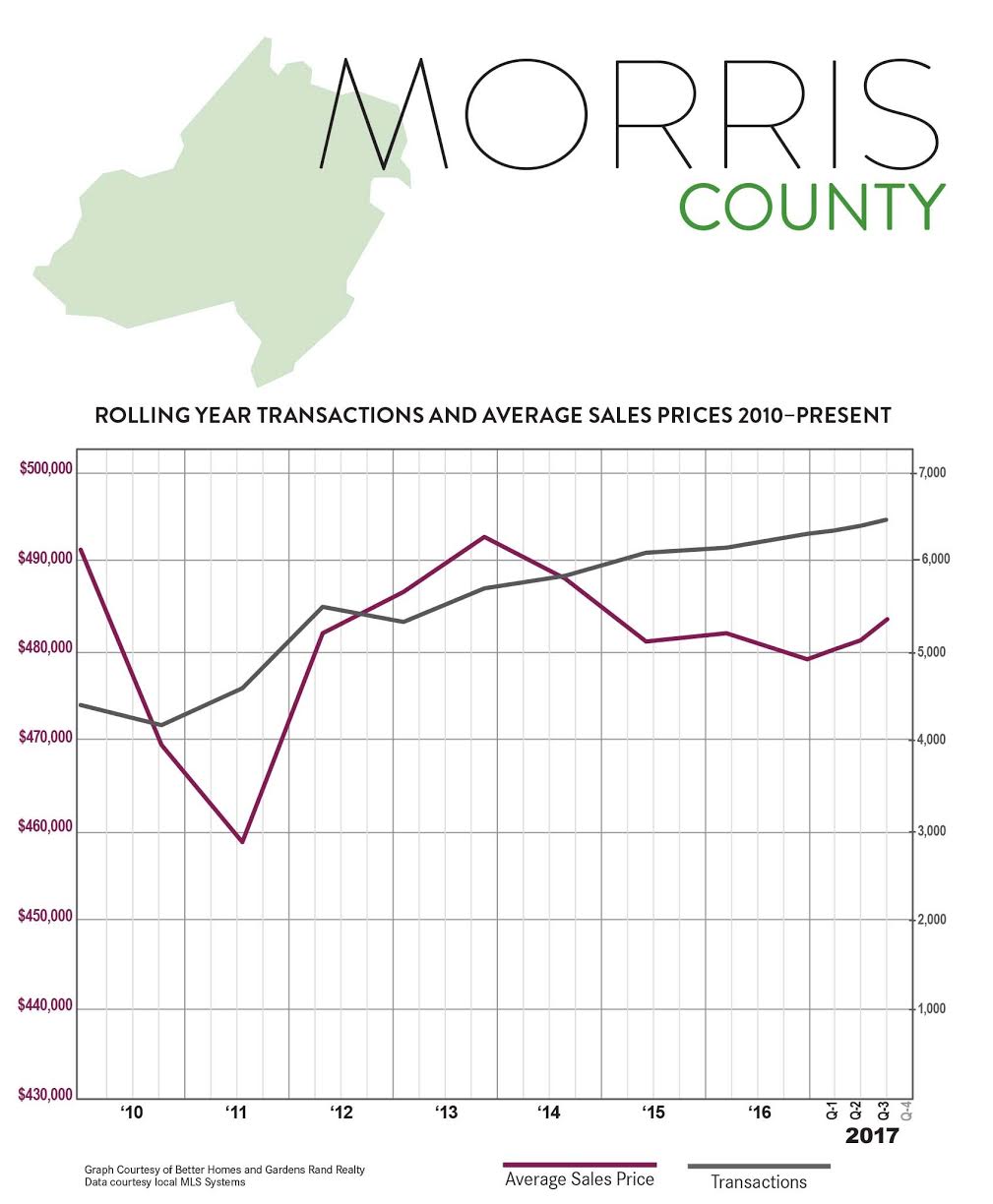

Third-Quarter 2017 Real Estate Market Report: Morris County Market Overview

Prices in the Morris County housing market showed more signs of life in the third quarter of 2017, even while low levels of inventory continued to stifle sales growth.

Prices in the Morris County housing market showed more signs of life in the third quarter of 2017, even while low levels of inventory continued to stifle sales growth.

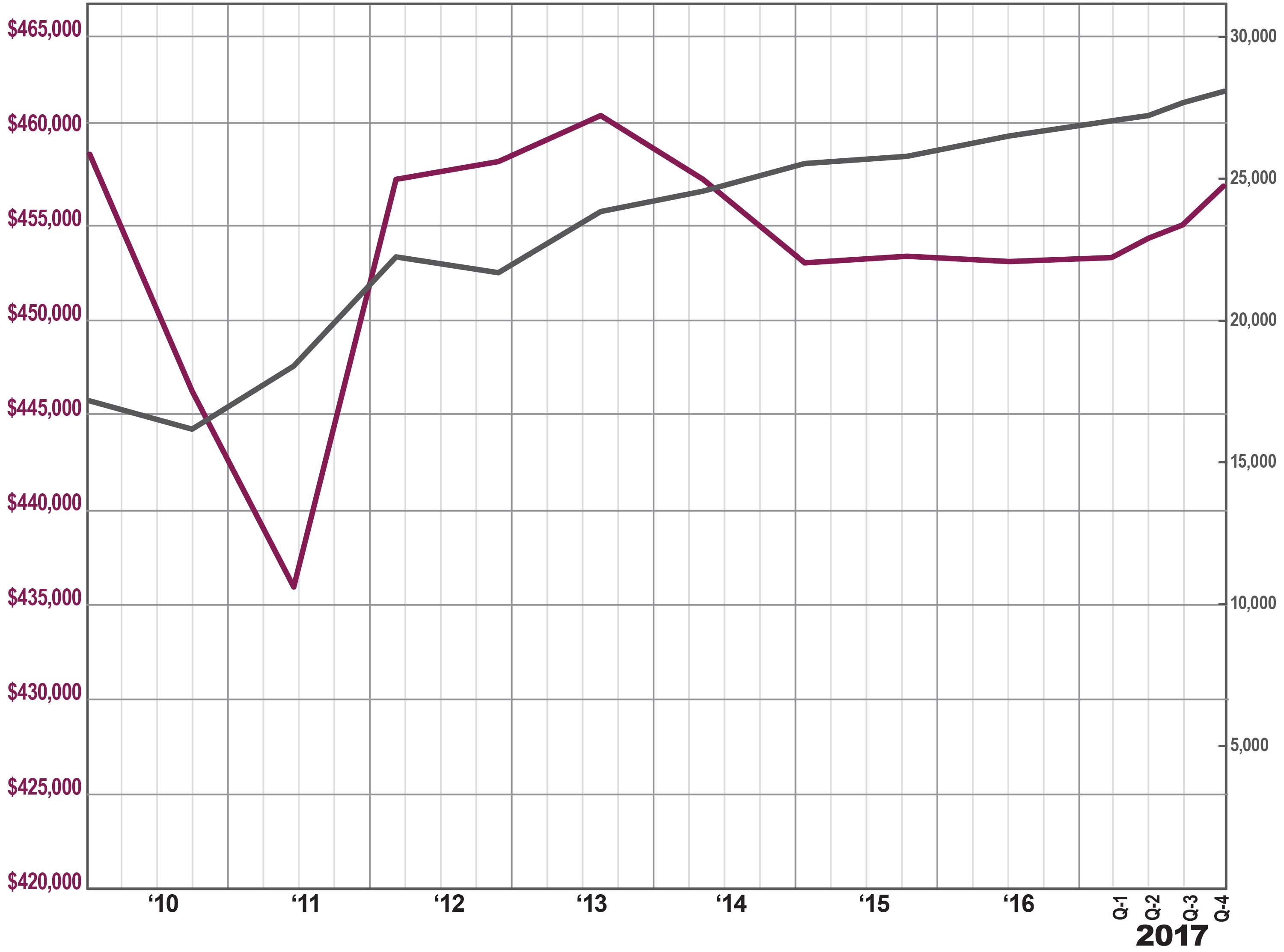

Sales. Morris County sales were up just a tick, continuing a streak in which year‑on‑year sales have now gone up for 12 straight quarters, three full years of sustained buyer demand. For the year, sales were up over 5%, and are now up over 65% from the bottom of the market in 2011.

Prices. These sustained levels of buyer demand are finally having some modest impact on pricing. Continuing a trend that started this year, prices were up again, this time by about 2% on average and 3% at the median. And we are starting to see long‑term price appreciation, with the rolling year average price up 1% and the median rising over 2%. Sustained levels of buyer demand coupled with falling inventory is likely to drive pricing up through the rest of the year.

Inventory. Morris inventory fell again, dropping almost 30% from last year’s third quarter and now down to just under six months’ worth of inventory. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Morris inventory is now at that six‑month mark indicates that we could be in for some meaningful price appreciation throughout 2018.

Negotiability. The negotiability indicators showed that sellers are continuing to gain negotiating leverage with buyers. The days‑on‑market indicator was down by another 9 days, falling almost 8%, indicating that homes were selling more quickly. And the listing price retention rate continues to rise, now up to just over 98% for the quarter, signaling that sellers are having more success getting buyers to meet their asking prices.

Going forward, we expect that Morris County’s sales activity and low levels of inventory will continue to have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that Morris will have a strong fall market leading to a robust 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

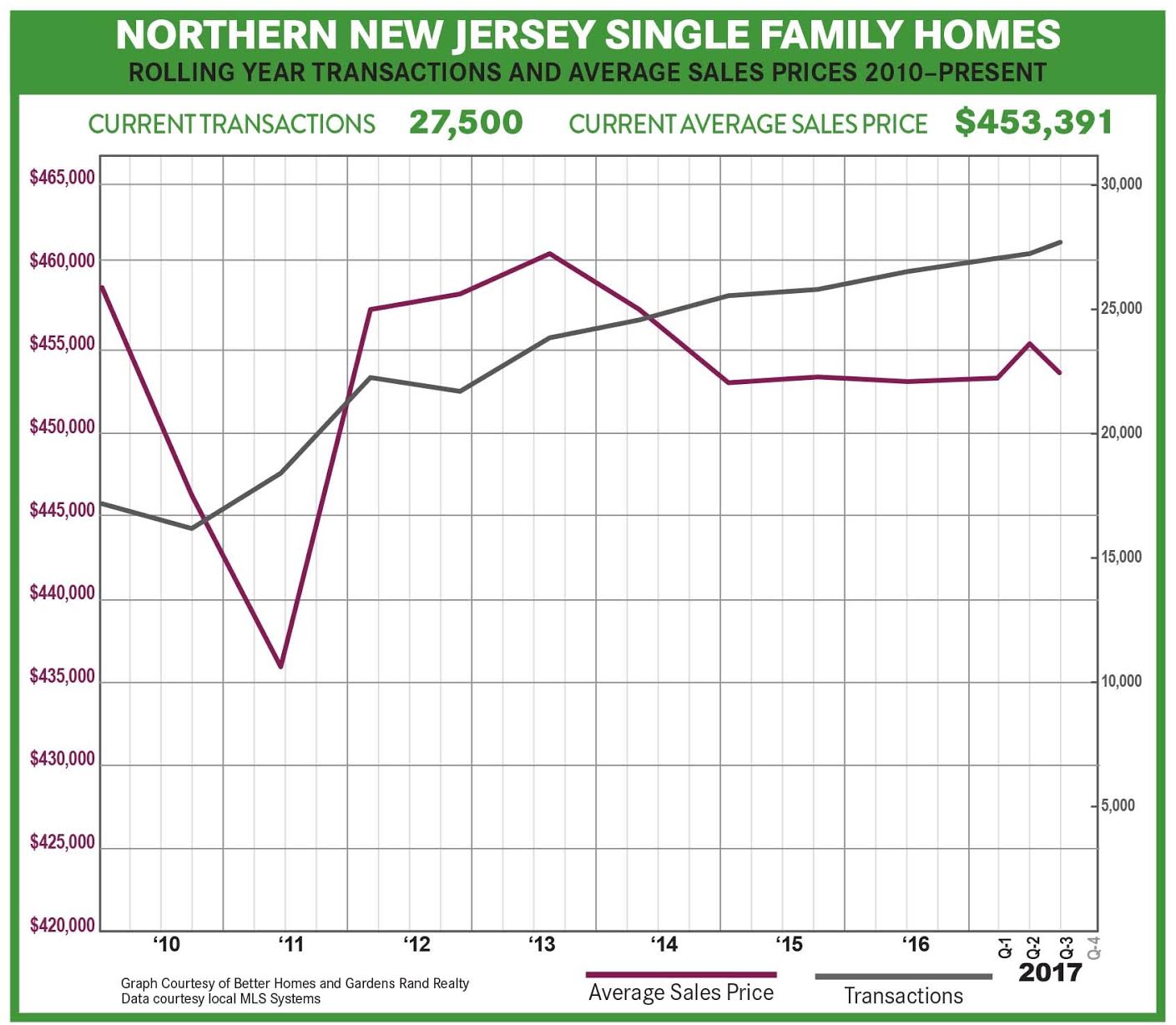

Third-Quarter 2017 Real Estate Market Report: Northern New Jersey Market Overview

The Northern New Jersey housing market surged again in the third quarter of 2017, with another increase in sales and modest-but-meaningful price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through rest of the year and into 2018.

The Northern New Jersey housing market surged again in the third quarter of 2017, with another increase in sales and modest-but-meaningful price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through rest of the year and into 2018.

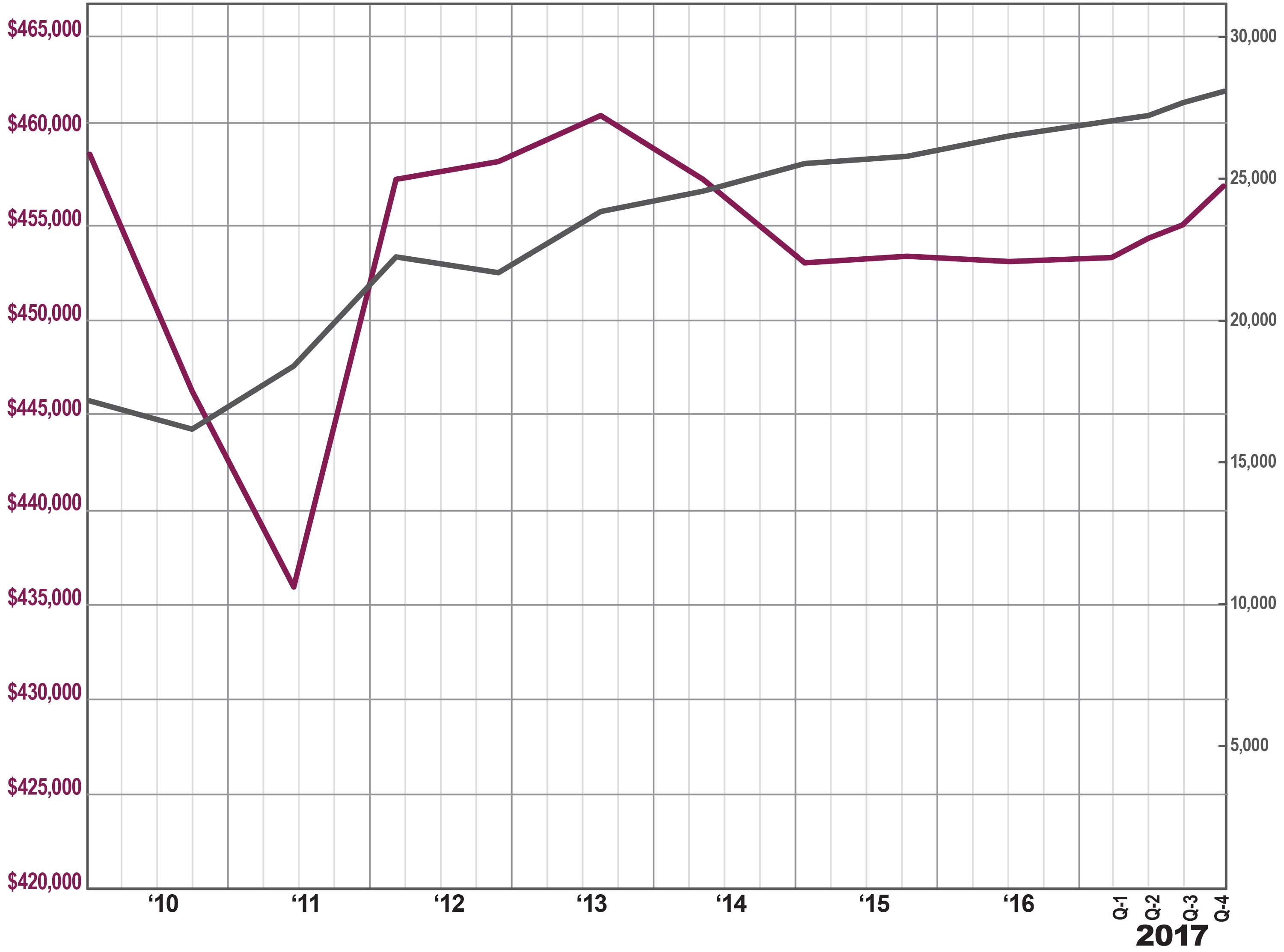

Sales surged throughout the region. All the Northern New Jersey markets continued to grow, with regional sales up over 4% and transactions rising in every market in the region: up 1% for Bergen houses, 5% for Bergen condos, 8% in Passaic, 0.4% in Morris, 4% in Essex, and 17% in Sussex. For the rolling year, sales were up 8%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 75% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. Indeed, inventory was down from last year in every individual county in the Rand Report: Bergen single‑family homes down 17%, and condos down 22%; Passaic down 28%; Morris down 29%; Essex down 29%; and Sussex down 11%. Moreover, most of our Northern New Jersey markets have reached the six‑months‑of‑inventory level that traditionally starts to signal a seller’s market. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing.

With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: the regional average sales price was flat, but prices were up sharply in Bergen, Passaic, and Morris, even while they continue to struggle in Essex and Sussex.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a strong fall market and a strong 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Morris County, New Jersey

Prices in the Morris County housing market showed meaningful signs of appreciation in the second quarter of 2017, even while low levels of inventory stifled sales growth.

Prices in the Morris County housing market showed meaningful signs of appreciation in the second quarter of 2017, even while low levels of inventory stifled sales growth.

Sales. Morris County sales were up slightly, rising over 3% from the second quarter of last year. This continued a streak in which year-on-year sales have now gone up for 11 straight quarters, almost three years of sustained buyer demand. For the year, sales were up over 6%, and are now up over 60% from the bottom of the market in 2011.

Prices. These sustained levels of buyer demand are finally having some modest impact on pricing. Continuing a trend we saw in the first quarter, prices were up, this time by about 3% on average and at the median. For the year, prices are up slightly, demonstrating that we might be seeing the first meaningful and lasting Morris price appreciation in years. We believe that sustained buyer demand coupled with falling inventory is likely to drive pricing up through the rest of the year.

Inventory. Morris inventory fell again, dropping almost 31% from last year’s second quarter and now down to just over six months’ worth of inventory. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Morris inventory is now close to that six-month mark indicates that we could be in for some meaningful price appreciation throughout 2017.

Negotiability. The negotiability indicators showed that sellers are starting to gain negotiating leverage with buyers. The days-on-market indicator was down by 10 days, falling almost 8%, indicating that homes were selling more quickly. And the listing price retention rate continues to rise, now up to just about 98% for the quarter and the year, signaling that sellers are having more success getting buyers to meet their asking prices.

Going forward, we expect that Morris County’s sales activity and low levels of inventory will continue to have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that Morris will have a robust Summer market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets continued their strong start to the year, with regional sales up almost 8% and transactions rising in every market in the region: up 1% for Bergen houses, 9% for Bergen condos, 8% in Passaic, 3% in Morris, 13% in Essex, and 25% in Sussex. For the rolling year, sales were up almost 8%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 70% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We calculate the “months of inventory” in a market by measuring the number of homes for sale, and then figuring how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up – and we’re now right at that level. Indeed, inventory was down from last year in every individual county in the Rand Report: Bergen single-family homes down 12%, and condos down 29%; Passaic down 31%; Morris down 31%; Essex down 24%; and Sussex down 26%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing.

With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: the regional average sales price was up almost 2% from last year’s second quarter, and the average price was up in every county other than Sussex. Looking at the long-term, the rolling year average sales price was up just a tick, but was up in every county other than Passaic.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Summer market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Morris County, New Jersey

The Morris County housing market got off to a strong start in 2017, with an increase in sales activity coupled with some promising signs for pricing.

The Morris County housing market got off to a strong start in 2017, with an increase in sales activity coupled with some promising signs for pricing.

Sales. Morris County sales were up solidly, rising almost 9% from the first quarter of last year. This continued a streak in which year-on-year sales have now gone up for 10 straight quarters, over two years of sustained buyer demand. Transactions were also up 10% for the year, and are now up almost 60% from the bottom of the market in 2011. So sales have been strong for several years now, indicating sustained levels of buyer demand.

Prices. These persistent levels of buyer demand are finally having some modest impact on pricing. For the first time in several years, the average price was up, rising a little over 1%. And even though the median was down 1%, and the yearlong price trend is negative, we believe that sustained buyer demand coupled with falling inventory is likely to drive pricing up through the rest of the year.

Inventory. Morris inventory fell again, dropping over 34% from last year’s first quarter and now down to just over six months worth of inventory . We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Morris inventory is now close to that six-month mark indicates that we could be in for some meaningful price appreciation in 2017.

Negotiability. The negotiability indicators showed that sellers are starting to gain leverage with buyers. The days-on-market indicator was down by 15 days, falling over 10%, indicating that homes were selling more quickly. And the listing price retention rate continues to rise, now up to just about 97% for the quarter and the year, signaling that sellers are having more success getting buyers to meet their asking prices.

Going forward, we expect that Morris County’s sales activity will eventually have a more meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that reduced inventory, coupled with rising buyer demand, will drive price appreciation through a robust Spring market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets got off to a strong start to the year, with regional sales up almost 12% and transactions rising in every market in the region: up 1% in Bergen, 30% in Passaic, 8% in Morris, 12% in Essex, and 32% in Sussex. For the rolling year, sales were up over 9%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 65% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We measure the “months of inventory” in a market by looking at the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything fewer than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up — and we’ve now seen this market cross below that line for the second quarter in a row. Indeed, inventory was down from last year in every individual county in the Report: Bergen single-family homes down 21%, and condos down 34%; Passaic down 38%; Morris down 34%; Essex down 39%; and Sussex down 36%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing. With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re beginning to see some promising signs: the regional average sales price was up almost 1% from last year’s first quarter, and the average price was up in almost every county in the report.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Spring market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Real Estate Rand Realty Quarterly Market Report For 2016Q4 – Morris County, New Jersey

The Morris County housing market finished the year with a sharp increase in sales, but sustained buyer demand throughout 2016 still has not had a significant impact on pricing.

The Morris County housing market finished the year with a sharp increase in sales, but sustained buyer demand throughout 2016 still has not had a significant impact on pricing.

Sales. Morris County sales were up significantly, rising almost 12% from the fourth quarter of last year. This continued a streak in which year-on-year sales have now gone up for nine straight quarters, over two years of sustained buyer demand. Transactions were also up 12% for the year, and are now up about 56% from the bottom of the market in 2011. So sales have now been strong for several years, indicating that buyer demand is growing.

Prices. All this sales activity, though, has not yet had its expected impact on pricing. Prices were mostly mixed for the quarter, falling over 2% on average even while the median was flat. For the year, prices were stubbornly resistant to the increasing buyer demand, falling almost 3% on average and 1% at the median. This was surprising and disappointing, particularly after the modest price appreciation that we saw in 2015.

Inventory. Morris inventory fell again, dropping over 26% from last year’s fourth quarter and now down to 7.3 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Morris inventory is now down to just over seven months of inventory could indicate that we will see meaningful price appreciation next year.

Negotiability. The negotiability indicators showed signs that sellers might be gaining leverage with buyers. The days-on-market indicator was down by nine days, falling almost 7%, indicating that homes were selling more quickly. And the listing price retention rate continues to rise, now up to just under 97% for the quarter and the year, signaling that sellers might be having a bit more success getting buyers to meet their asking prices.

Going forward, we expect that Morris County’s sales activity will eventually have a meaningful impact on pricing. With homes still at relatively affordable 2004 prices (without even adjusting for inflation), interest rates low, and a generally improving economy, we believe that reduced inventory coupled with rising buyer demand will drive price appreciation through 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall – Northern New Jersey

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

Sales were strong throughout the region. After a relatively slow third quarter, regional sales surged back, rising almost 11% and up sharply in every county in the report: rising 11% in Bergen, 14% in Passaic, 12% in Morris, 11% in Essex, and 18% in Sussex. This strong fourth quarter helped the region close the 2016 year up almost 11% in sales, reaching the highest yearly transactional total in over ten years, since the height of the last seller’s market. Indeed, regional sales are now up 63% from the bottom of the market in 2011.

Inventory continues to tighten. We determine the “months of inventory” in a market by measuring the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up. Well, the months of inventory for the Northern New Jersey region has now crossed over that line, dropping down to 5.3 months. Moreover, inventory was down in every individual county in the Rand Report, and is now below or nearing the six-month level: Bergen single-family homes at 3.6 months and condos at 6.1 months, Passaic at 8.3, Morris at 7.3, Essex at 7.0, and Sussex at 11.3. Certainly, if inventory continues to tighten, and demand stays strong, we are likely to see upward pressure on pricing.

Even with sales up and inventory down, though, average prices have been flat or falling throughout the region. Basic economics of supply and demand tells us that after five years of steadily increasing buyer demand, we should expect to see some meaningful price increases. But prices languished, with the regional price down just a tick from last year’s fourth quarter, but down almost 2% for the year. Moreover, the average prices for the year were down in almost all of the individual counties, rising only for Bergen condos, with just a tick up for Sussex. And maybe that’s the tell it might be that the market is simply stronger at the lower end, so lower priced homes (like Bergen condos and Sussex properties) are making up a larger percentage of the mix of properties sold.

Going forward, we remain confident that rising demand and falling inventory will drive price appreciation in 2017. Sales have now been increasing for almost five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe that better days are ahead, and that we are likely to see modest but meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link