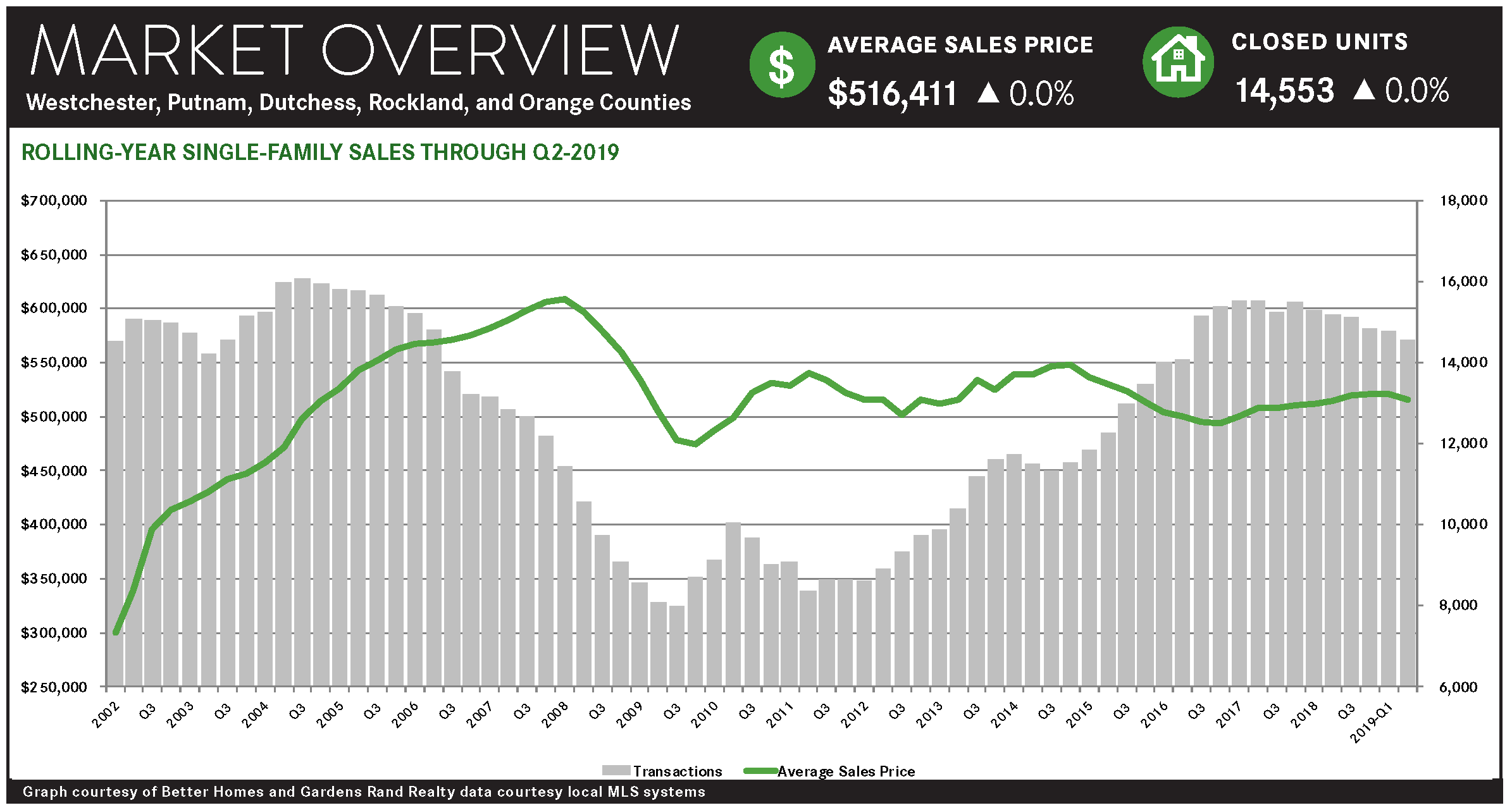

The housing market in Westchester and the Hudson Valley continued to be a “tale of two markets” in the second quarter of 2019, with more expensive single‑family home sales and prices continuing to struggle while lower‑priced condo markets soared. We attribute this divergence to the 2018 Tax Reform cap on state and local tax deductions, which is suppressing what should be a strong, growing seller’s market. Single‑family home sales and prices were down across the board. Regional sales compared to last year’s second quarter were down almost 6%, and down in just about every county. Similarly, the regional average price for a single‑family home fell 2.5% from the second quarter of last year, with prices down in every county other than Orange, the lowest‑priced market in the region. The regional average sales price was up just a tick for the rolling year, so we have not yet seen any longer‑term depreciation in the market. On the other hand, the lower‑priced condo markets are booming. Regional condo sales were up over 2% from last year’s second quarter, with average prices rising an eye‑popping 14%. Indeed, the average condo price spiked in many counties throughout the region: Westchester up 15% (and up 6% for coops), Rockland up 16%, Orange up 20%, and Dutchess up 3%. This capped an extraordinarily strong yearlong run for condos, with prices up almost 7% for the year, and rising in every county in the region. So why is the condo market booming? Well, the fundamentals of the market could not be stronger: interest rates are back down to historic lows, prices are basically at 2004 levels without even adjusting for inflation, and every national and regional economic indicator is positive. That’s why we are seeing condo sales and prices at levels we haven’t reached since the market correction ten years ago. The better question is: why isn’t the single‑family market booming? And the answer to that is simple: the 2018 Tax Reform cap on state and local tax deductions (the “SALT Cap”), which is having a disproportionate impact on middle‑ and higher‑end home buyers. Why? Because taxpayers in those markets are more likely to itemize their taxes rather than take the standard deduction, which means they’re more likely to feel the pinch of the $10,000 SALT Cap. That’s why we have a “Tale of Two Markets.” The SALT Cap is suppressing sales and price appreciation in the higher‑priced markets but having little or no impact on lower‑price markets – including single‑family counties like Orange, and condos throughout the region. The SALT Cap hasn’t caused anything like the devastation of the market correction in 2008‑09, but it is still hampering the growth of what should be a robust seller’s market. Going forward, we still believe that the market is still poised for growth in the summer and fall. At some point, the impact of the SALT Cap will get priced into the market, and the single‑family market will start behaving like the condo market. Again, the seller market fundamentals are very strong: the economy is growing, interest rates are near historic lows, inventory is relatively low, and homes are still priced at attractive levels well below their historical highs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link