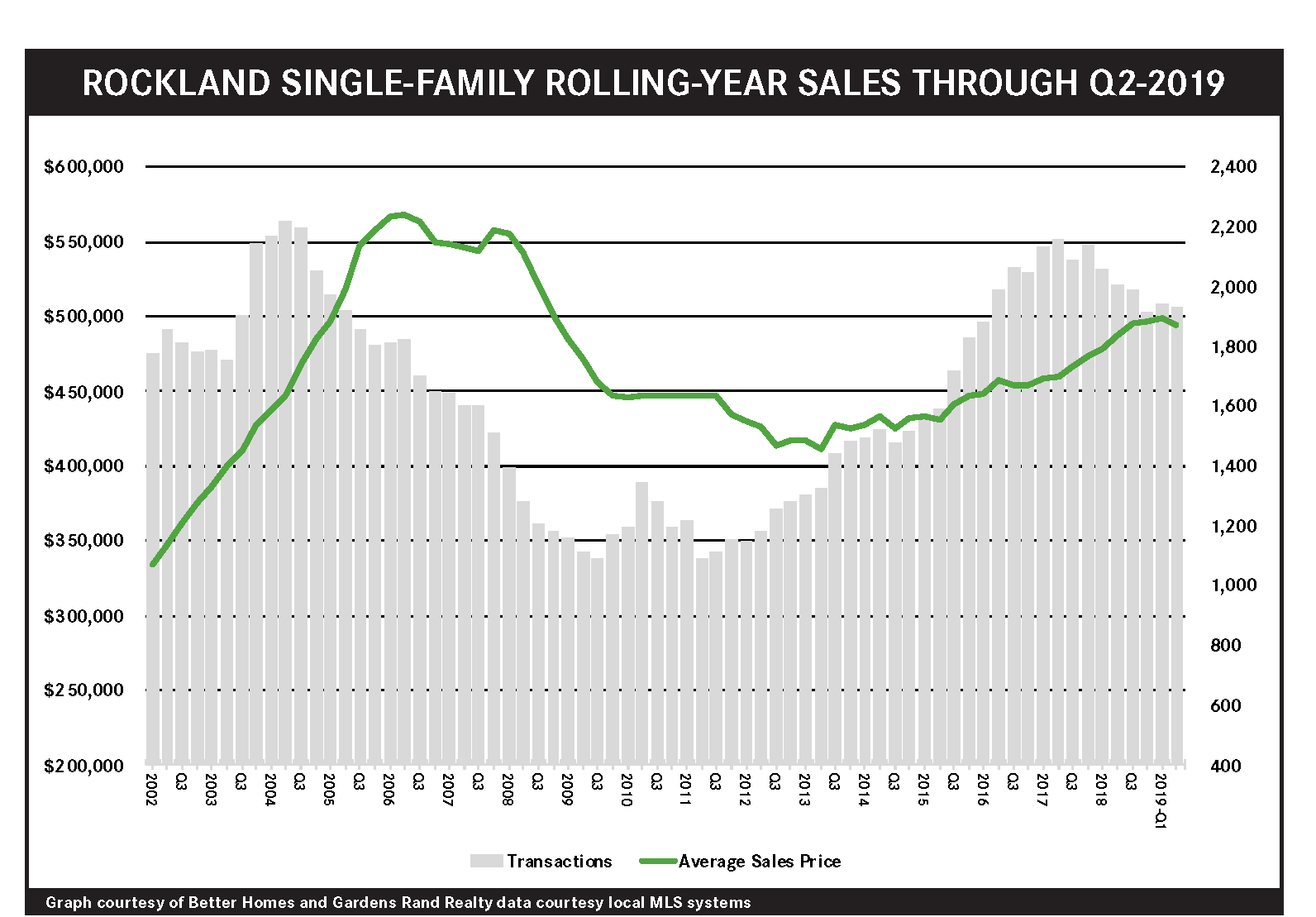

The Rockland housing market was a “Tale of Two Markets” in the second quarter of 2019, with single-family home sales struggling and condo sales soaring. After a surge to start the year, the single-family market softened, with sales and prices both falling. But the lower-priced condo market surged, with quarterly prices spiking over 16% on average and at the median. Essentially, both markets should be booming in response to the strong housing fundamentals – rates are low, inventory is low, prices are relatively low, and the economy is strong – but only the condo market is behaving like a proper seller’s market. Why the discrepancy? We believe it’s due to the 2018 Tax Reform cap on state and local tax deductions, which particularly suppresses growth in higher-priced markets (like Rockland single-family homes), where buyers are more likely to itemize their taxes. The SALT cap has less of an impact in the lower priced-condo market, since buyers at that price point are more likely to take the standard deduction. That’s why the condo market is soaring while the single-family market struggles a bit. All that said, we believe that at some point the SALT cap hit will get priced into the market, and that the economic fundamentals will eventually drive sales growth and price appreciation in both markets.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link