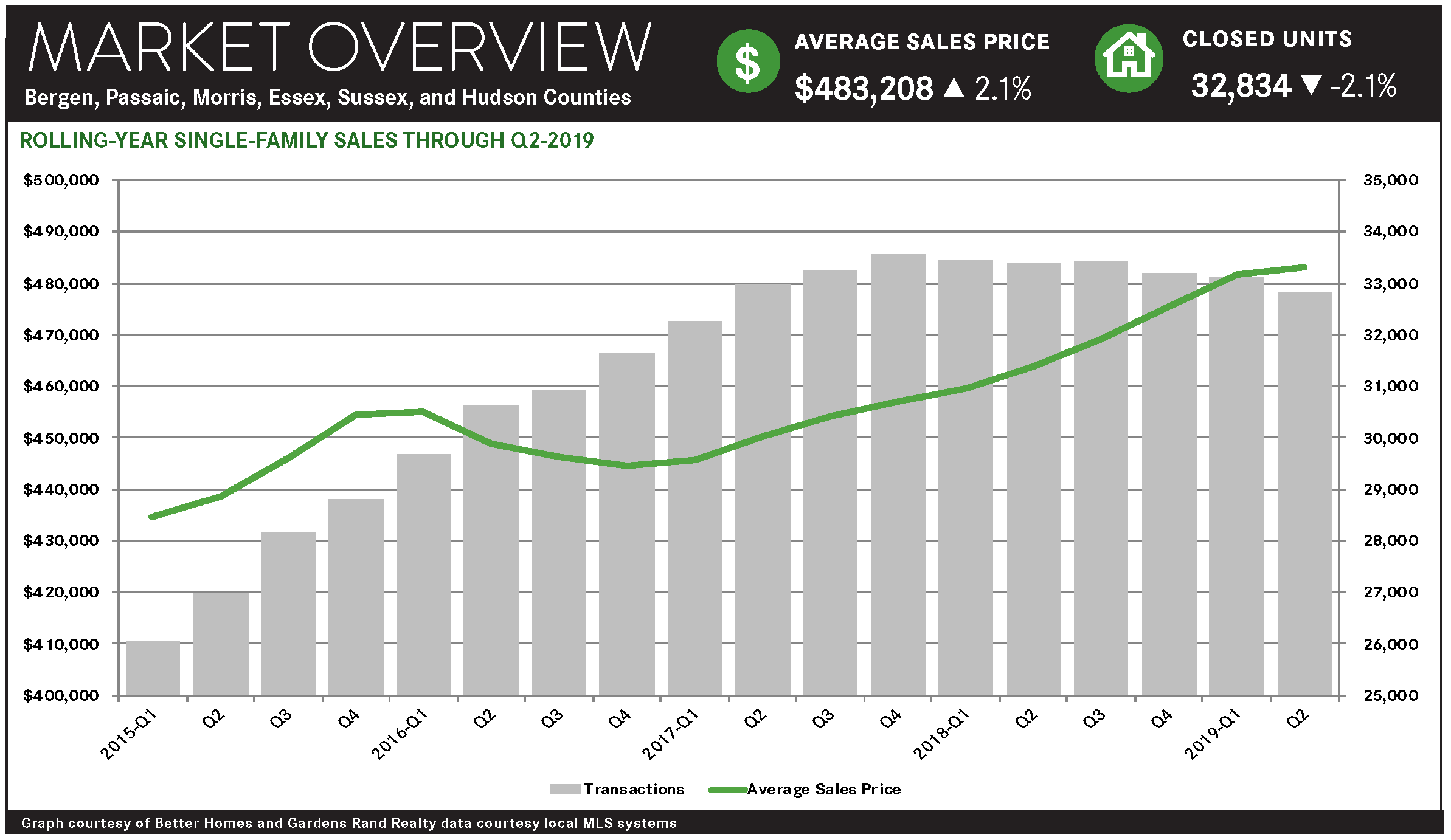

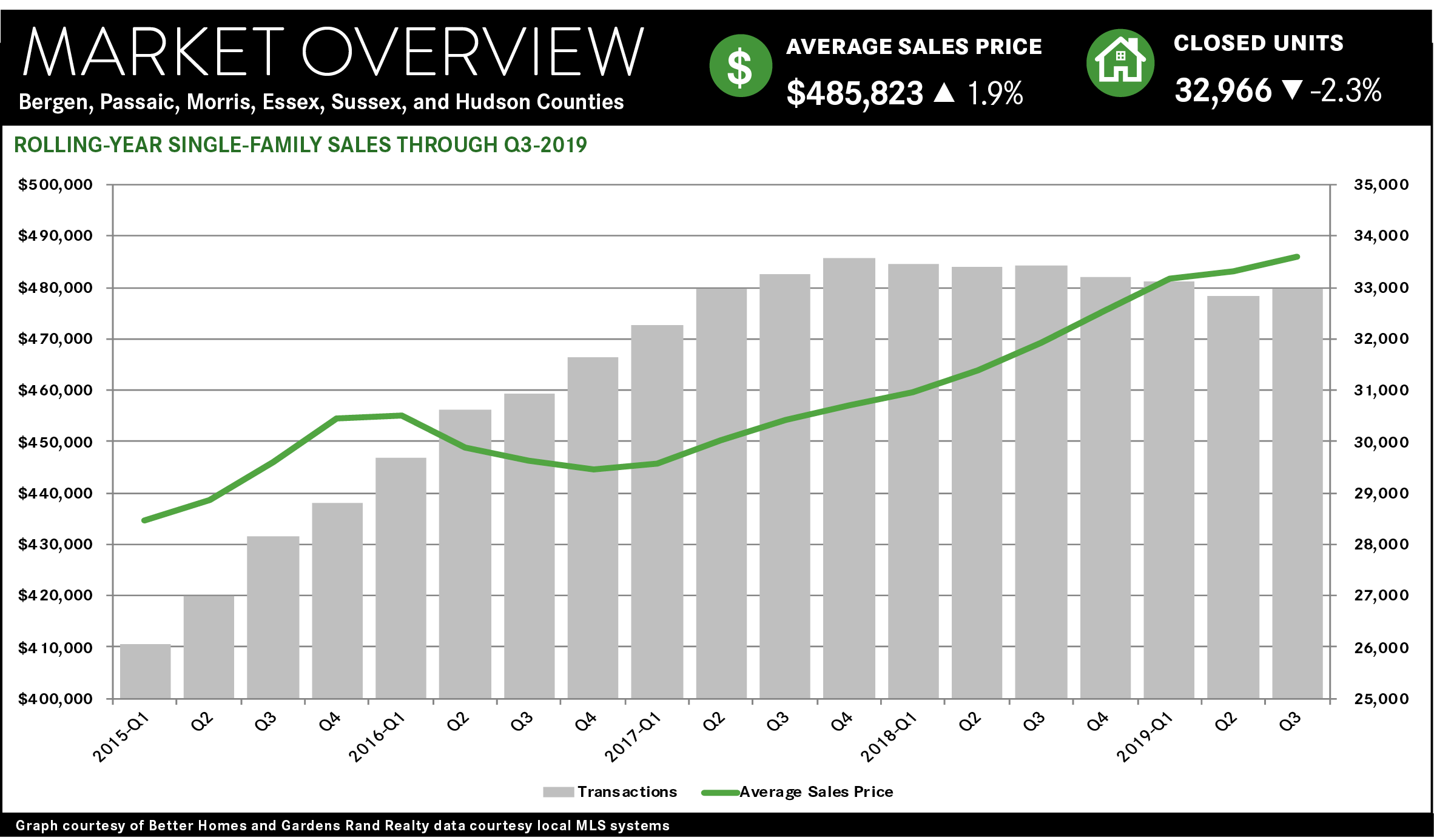

The Northern New Jersey housing market experienced modest but meaningful price appreciation through the third quarter of 2019, even while sales growth was stifled by a lack of inventory and the impact of the 2018 Tax Reform cap on state and local tax deductions (i.e., the “SALT Cap”). Going forward, we believe that strong housing fundamentals will continue to drive appreciation and eventually more sales through the fourth quarter and into 2020.

Regional sales were down just a tick, with the results varying by county. Regional single‑family sales fell 0.3% for the quarter, and are now down 2.3% for the rolling year. But the results varied significantly by county: sales were up for Bergen, Essex, and Sussex, but down in Passaic, Morris, and Hudson. Generally, the SALT Cap has suppressed buyer demand at the very highest end of the market, where home buyers who itemize their deductions are more likely to feel the pinch. This is holding down sales, but we’re not seeing any consistency across the region in how that dynamic is playing out.

Conversely, prices were up regionally, rising in most of the individual counties. For the region, the average price was up 1.8% for the third quarter, finishing a rolling year where prices rose by 1.9%. And they were generally up within each county in the region, down only for condos in Bergen and Hudson – which might indicate that the slowdown in Manhattan is starting to spread to the geographically adjacent markets.

We still believe that this market is poised for significant growth. The sluggishness in sales is not due to a lack of inherent demand, but is largely caused by (1) a lack of inventory and (2) the SALT Cap. But both those challenges might be dissipating. Inventory remains near or below the six‑month level that usually denotes a seller’s market, but it is starting to go back up as more sellers are tempted into a rising pricing market. And the SALT Cap continues to have a suppressive effect on upper-income buyers, but will eventually get priced into the market and open up the high end a little more.

Going forward, we expect the market to continue to appreciate through 2020. The seller market fundamentals are very strong: the economy is growing, interest rates are near historic lows, inventory is relatively low, and homes are priced well below their last seller market highs. Accordingly, we expect that sales and prices will show some modest strength through the winter, leading into a robust spring market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link