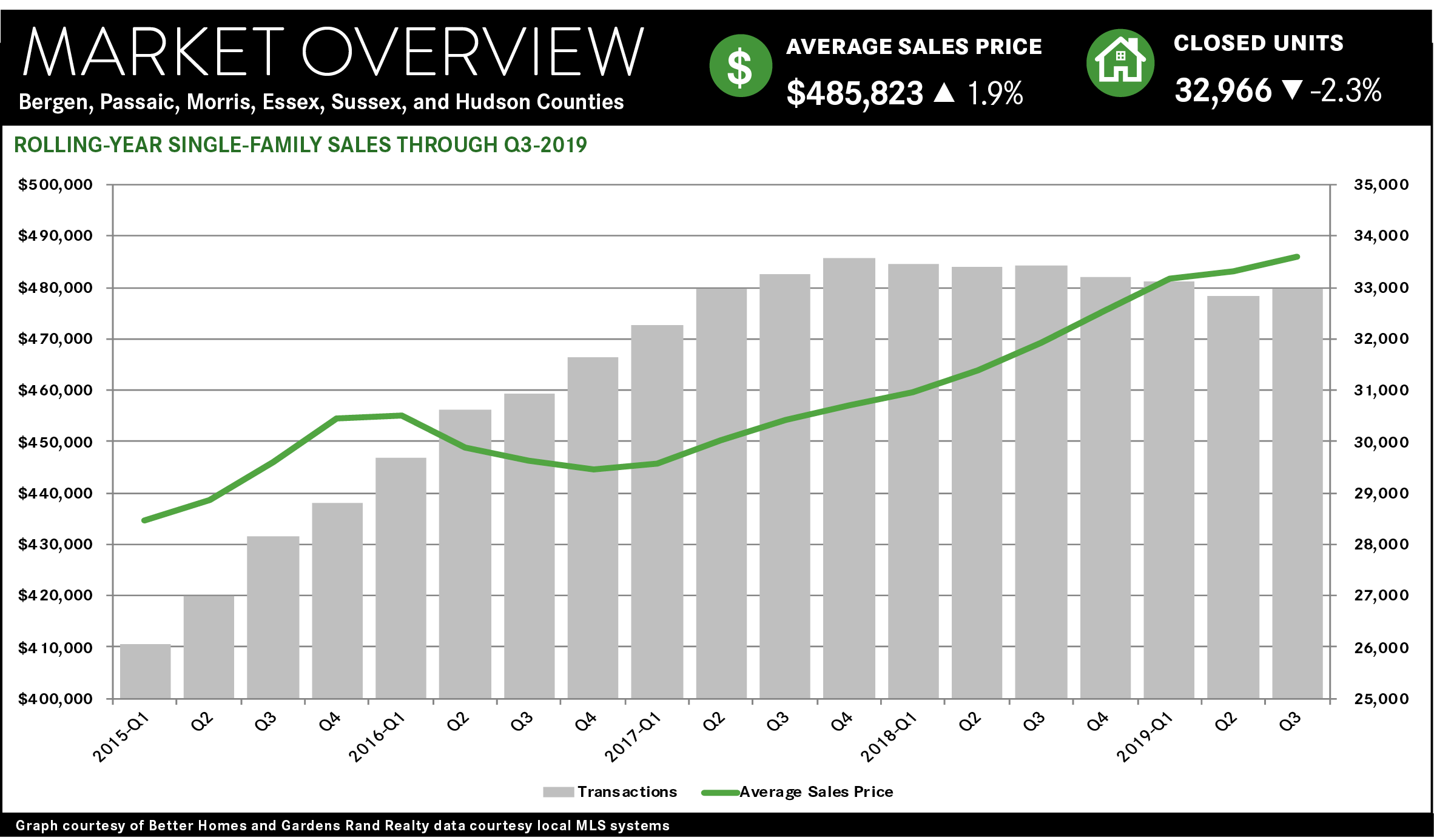

The Northern New Jersey housing market finished 2019 with a bit of a flourish, with sales and price increases in most of the county markets. We are still seeing some negative impact from the 2018 Tax Reform cap on state and local tax deductions (i.e., the “SALT Cap”), but outside of Hudson County, most of the suburban markets seem to be pricing in the partial loss of property tax deductibility. Going forward, we believe that strong housing fundamentals will continue to drive meaningful price appreciation and sales growth through a robust 2020.

Sales rose for the region and in most individual counties. Regional single-family sales rose 2.4% for the quarter, reversing a downward trend we had seen for most of the year. And the increase was pretty uniform throughout the region, with sales up in every almost every individual county. The exception was Hudson, which has been particularly impacted by both the SALT Cap and the decline in the Manhattan market resulting from the SALT Cap. Generally, the SALT Cap has suppressed buyer demand at the very highest end of the market, where home buyers who itemize their deductions are more likely to feel the pinch. This is hampering sales in the higher-end segments of every market, and thereby dampening average price appreciation, but the impact seems to be dissipating a bit outside of Hudson.

Prices were also up for the region and in most of the markets. For the region, the average price was up 2.1% for the fourth quarter and finished the year up 1.5%. Again, the trend was pretty uniform across the region, with average prices rising in every county outside of Hudson. We are now seeing pricing approaching higher levels than at any time since the height of the last seller’s market in the middle of the 2000-10 decade.

We still believe that this market is poised for significant growth. Inventory remains near or below the six-month level that usually denotes a seller’s market, but we expect that more homes will come on the market as prices increase. And the SALT Cap continues to have a suppressive effect in the high end, but will eventually get priced into the market and open up the high end a little more.

Going forward, we expect a rising market in 2020. The seller market fundamentals are very strong: the economy is growing, interest rates are near historic lows, inventory is relatively low, and homes are still priced below their last seller market highs. Accordingly, we expect that sales and prices will show some modest strength through the rest of the winter, leading into a traditionally robust spring market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link