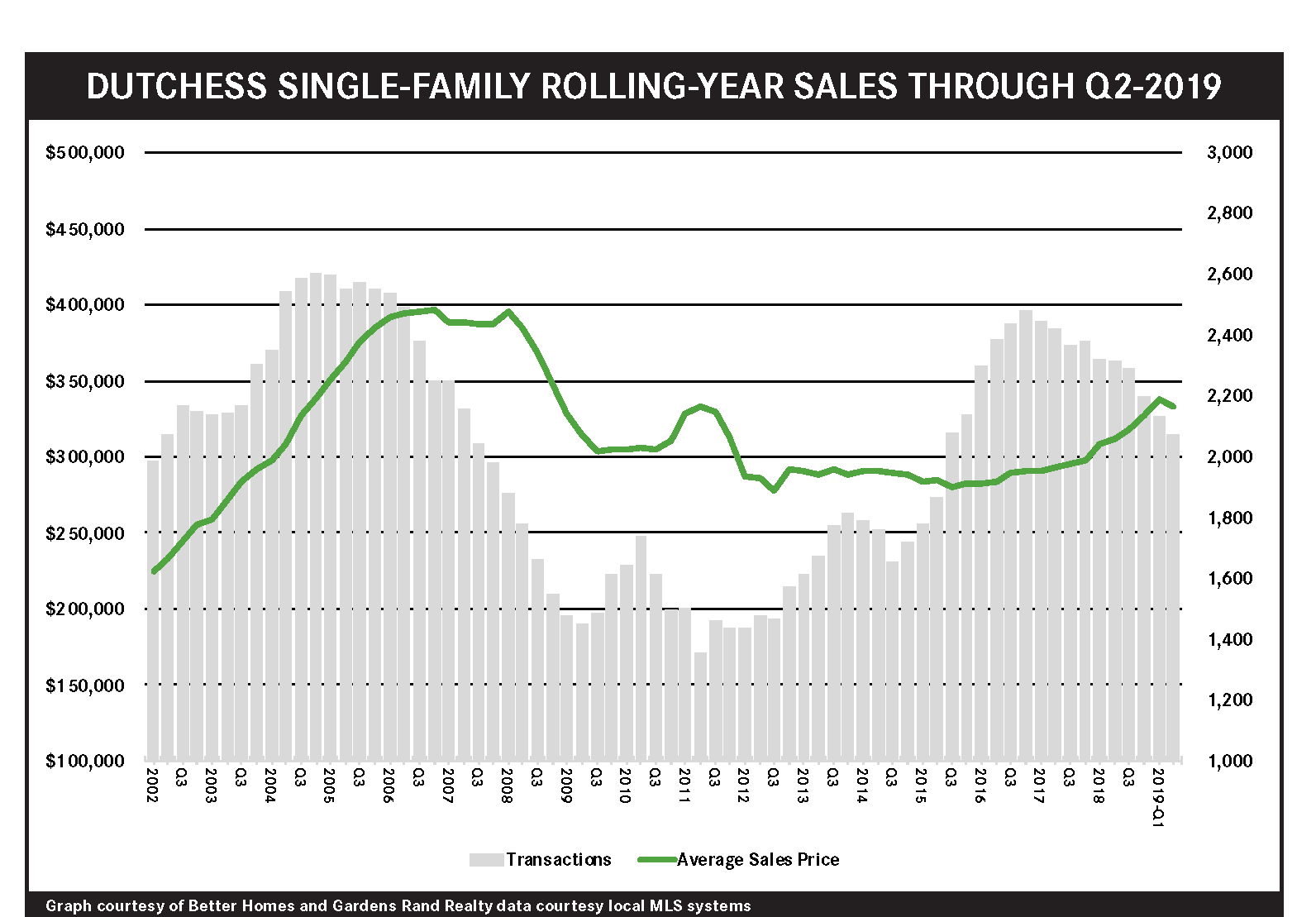

The Dutchess housing market was a “Tale of Two Markets” in the second quarter of 2019, with single-family home sales softening a bit even while condo sales surged. After a sizzling start to the year, the single-family market cooled, with sales and prices both falling. But the lower-priced condo market was up, with sales rising over 6% and prices up about 3% on average and 4% at the median. Essentially, both markets should be doing well with these kinds of strong housing fundamentals – rates are low, inventory is low, prices are relatively low, and the economy is strong, But only the condo market is behaving like a proper seller’s market, because the 2018 Tax Reform cap on state and local taxes has suppressed sales growth and price appreciation in higher-priced markets. Essentially, the SALT cap affects taxpayers who are more likely to itemize their taxes, which includes the higher-income home buyers for single-family homes. But the SALT cap has less of an impact in the lower priced-condo market, since buyers at that price point are more likely to take the standard deduction. All that said, we believe that at some point the SALT cap hit will get priced into the Dutchess market, and that the economic fundamentals will eventually drive sales growth and price appreciation in both single-family and condo markets.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link