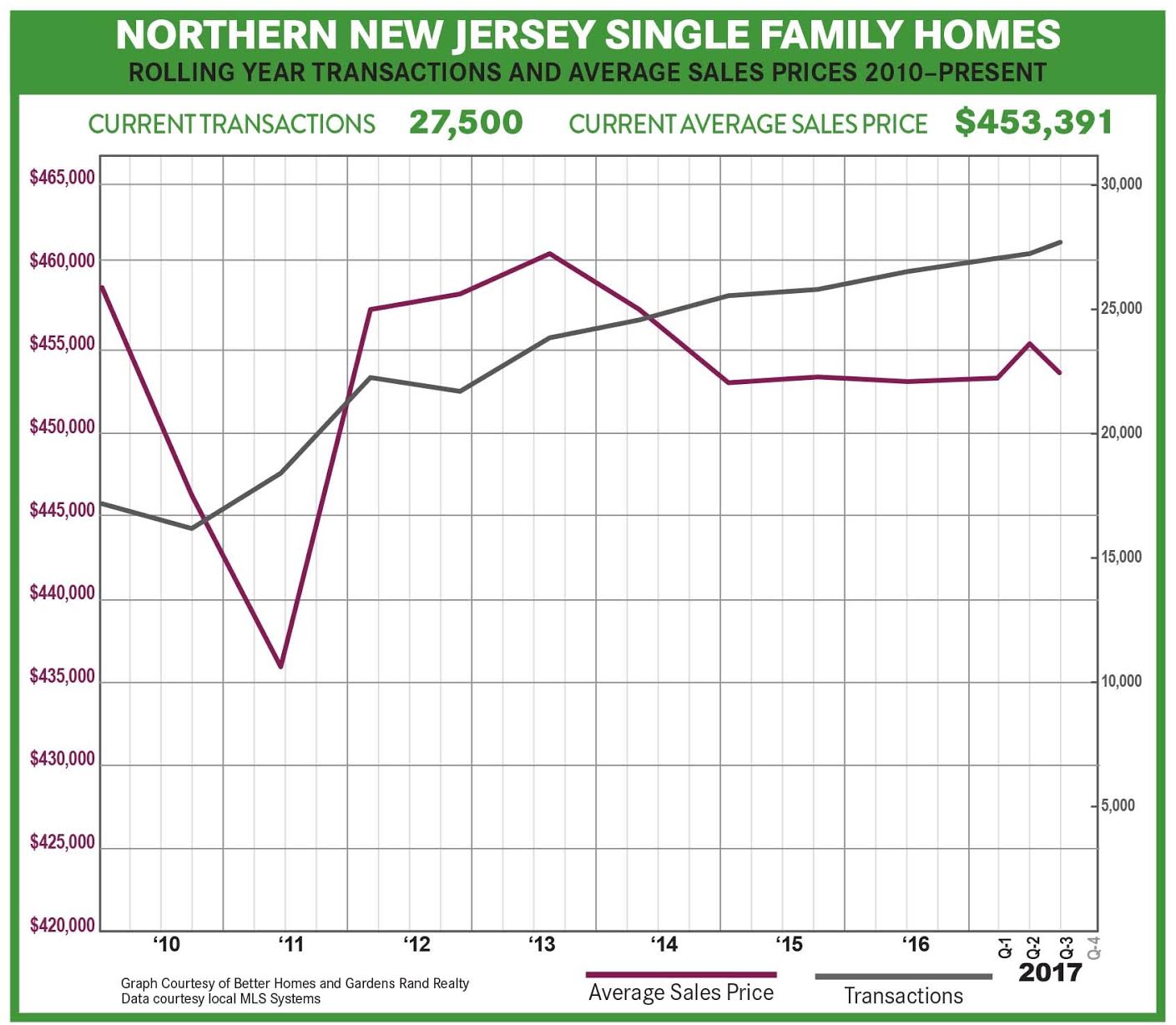

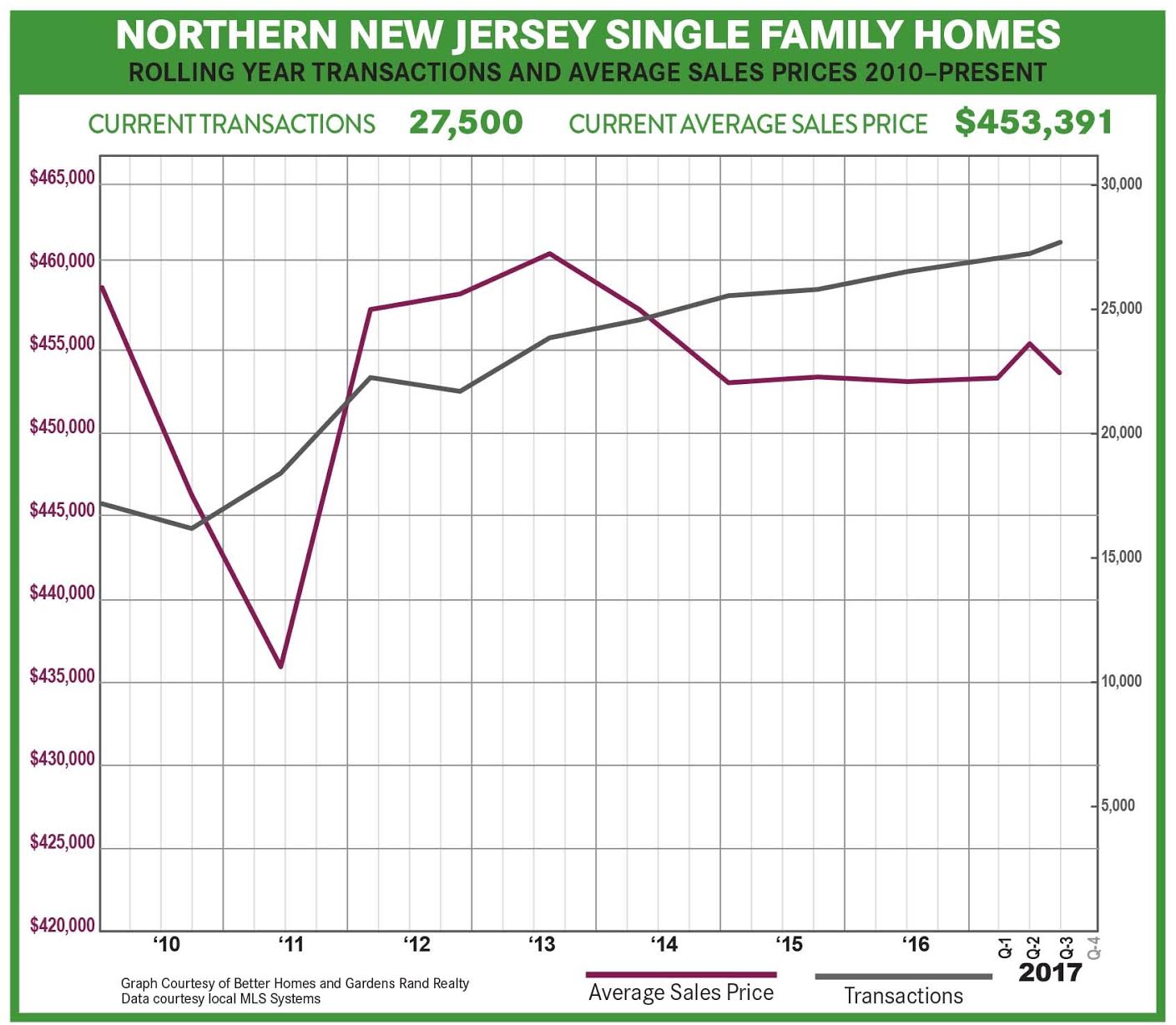

Fourth Quarter 2017 Real Estate Market Report: Northern New Jersey Overview

The Northern New Jersey housing market finished 2017 strong, with prices up even while declining inventory throughout the region stifled sales growth. With demand high, and available homes low, we believe that homeowners will continue to enjoy price increases throughout 2018.

The Northern New Jersey housing market finished 2017 strong, with prices up even while declining inventory throughout the region stifled sales growth. With demand high, and available homes low, we believe that homeowners will continue to enjoy price increases throughout 2018.

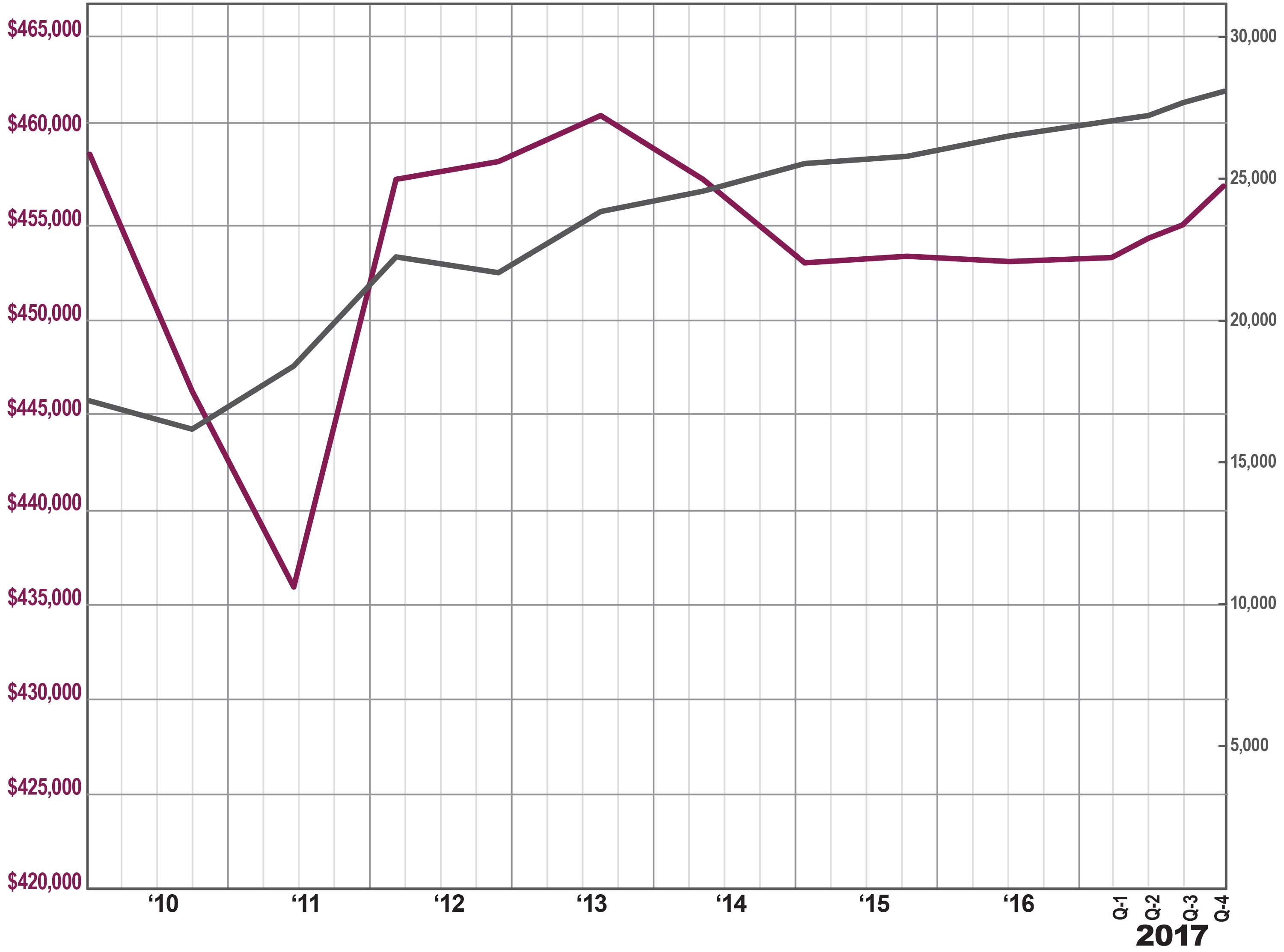

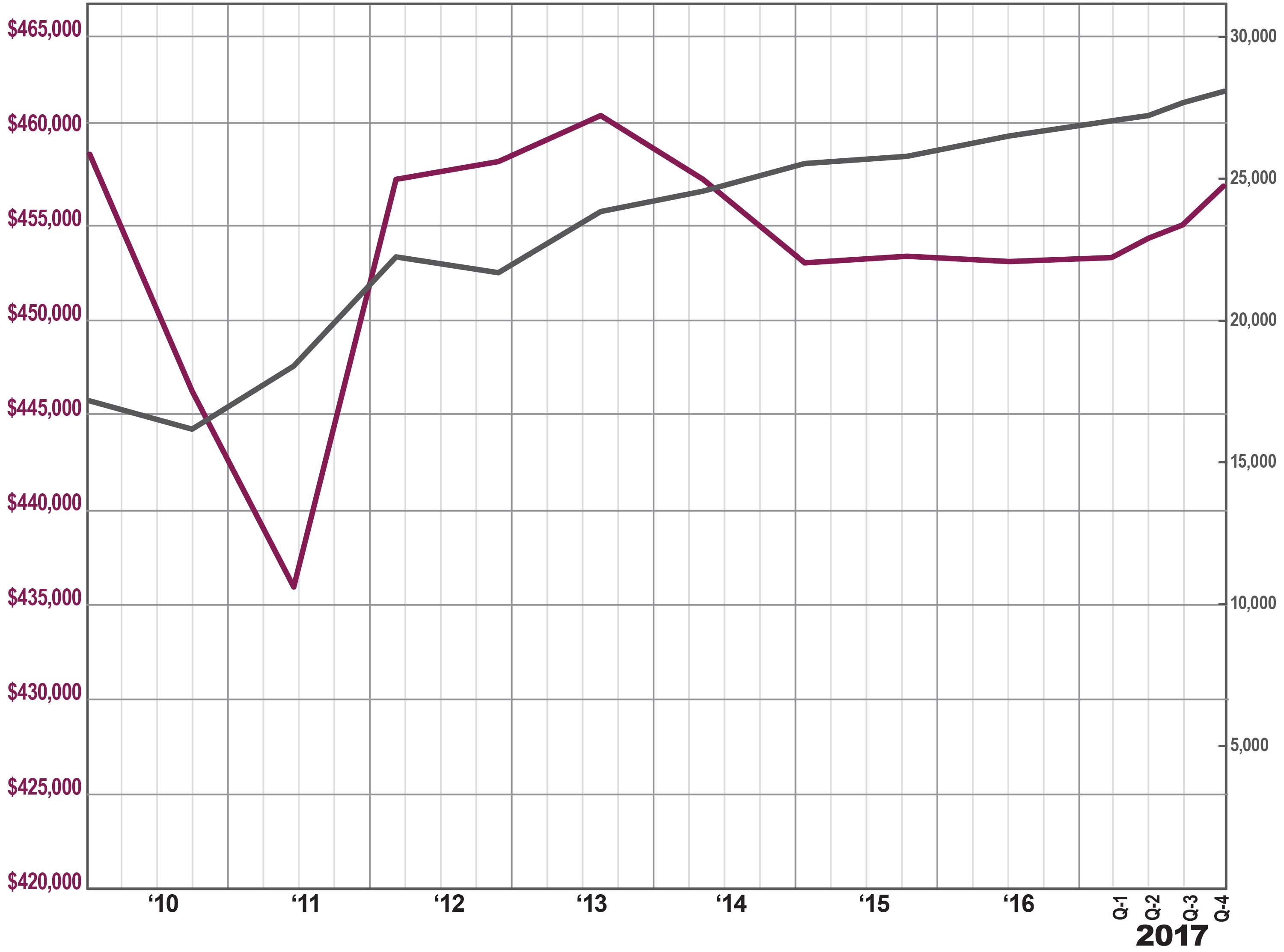

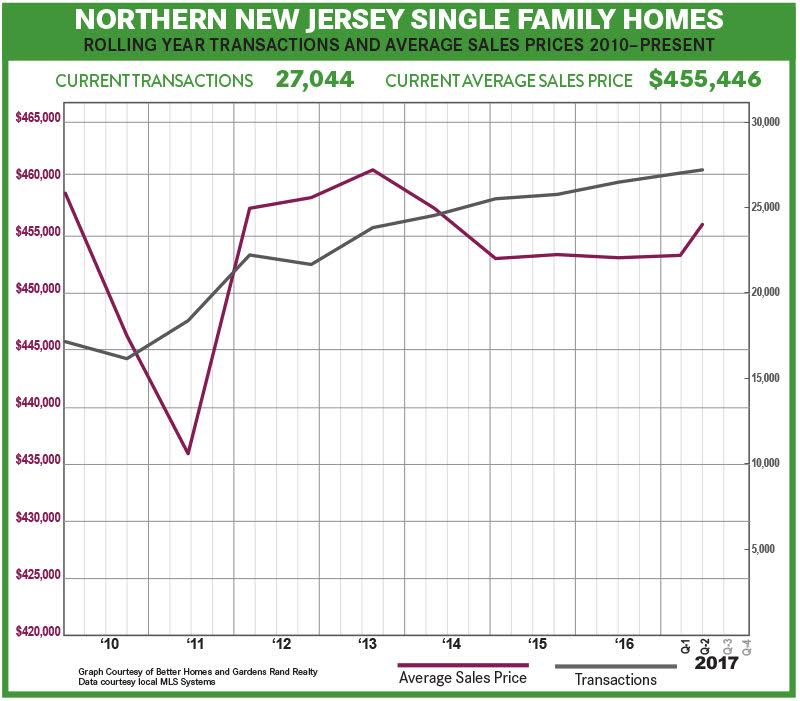

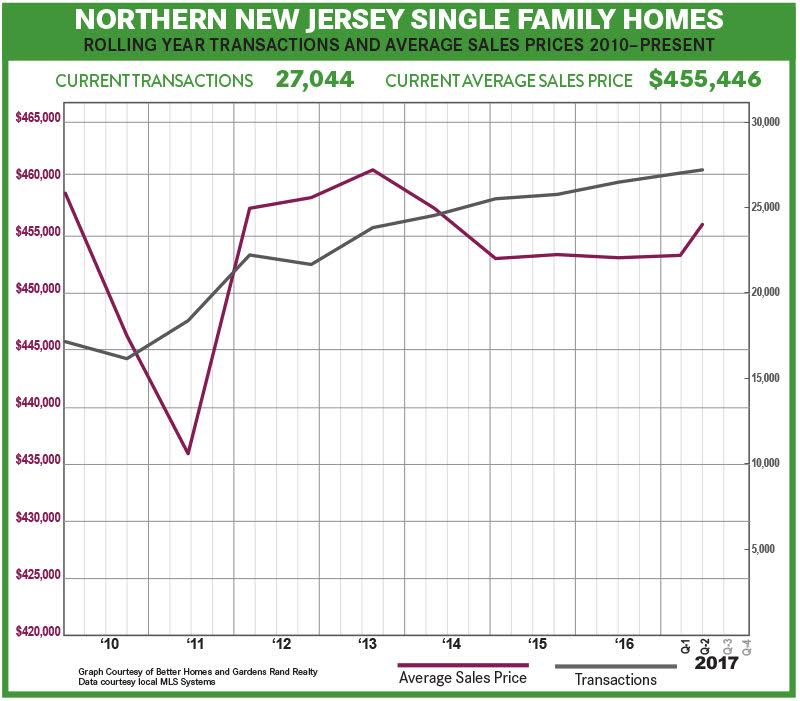

Regional sales were up, but not in every county. Regional sales were up slightly for the quarter, rising almost 2% from the fourth quarter of last year, even while some counties like Bergen and Morris were down slightly. We believe that a lack of inventory is stifling sales growth, simply because we don’t have enough “fuel for the fire” to satiate the existing buyer demand. That said, sales in every county were up for the full calendar year, with the 27,000 regional sales in 2017 representing almost a 6% increase from 2016, and a full 75% increase from the bottom of the market in 2011. Inventory was down significantly again. The number of homes for sale continued to fall in the fourth quarter, dropping in every county in the region. Indeed, most of our Northern New Jersey markets have now fallen below the six‑months‑of‑inventory level that traditionally starts to signal a seller’s market: Bergen at 3.4, Passaic at 4.9, Morris at 4.5, and Essex at 4.1. Only Sussex County, at 7.3 months of inventory, is above that six‑month indicator. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing. With sales up and inventory down, prices are starting to show some meaningful price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: for the 2017 year, the regional average price was up about 1%, and average prices were up in most of the counties in the region: Bergen up 4%, Passaic up 3%, Morris up 3%, Essex up 2%. Again, only Sussex was the outlier, with the average price down about 2%. Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through 2018. Sales have now been increasing for over five years, which has brought inventory below the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust seller’s market in 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

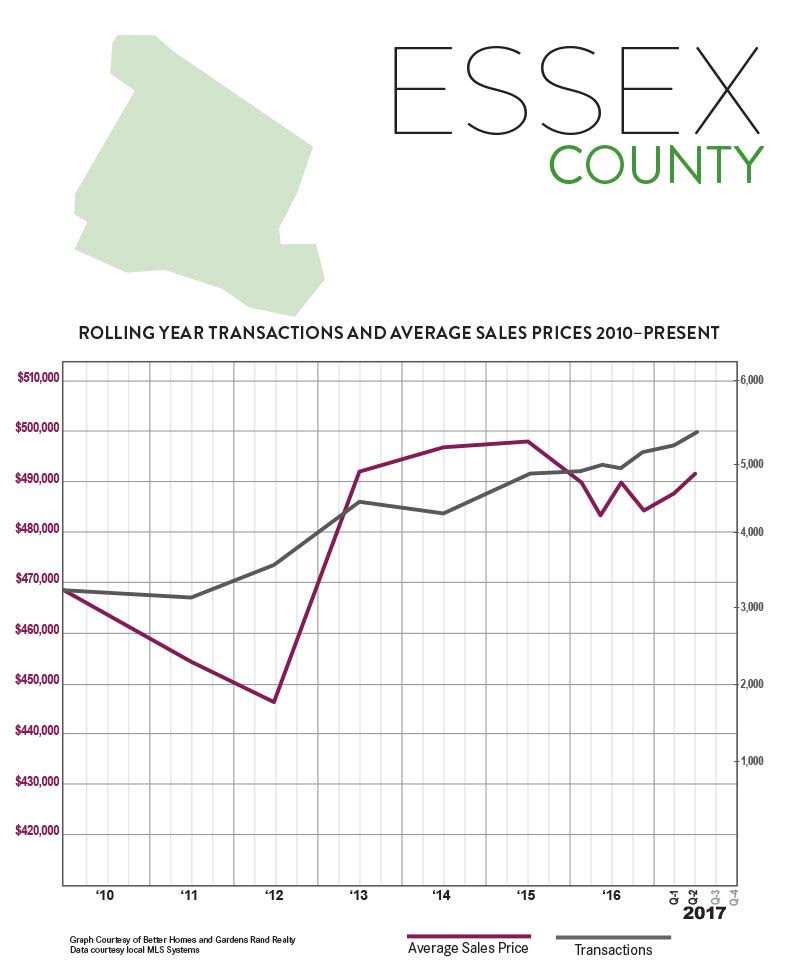

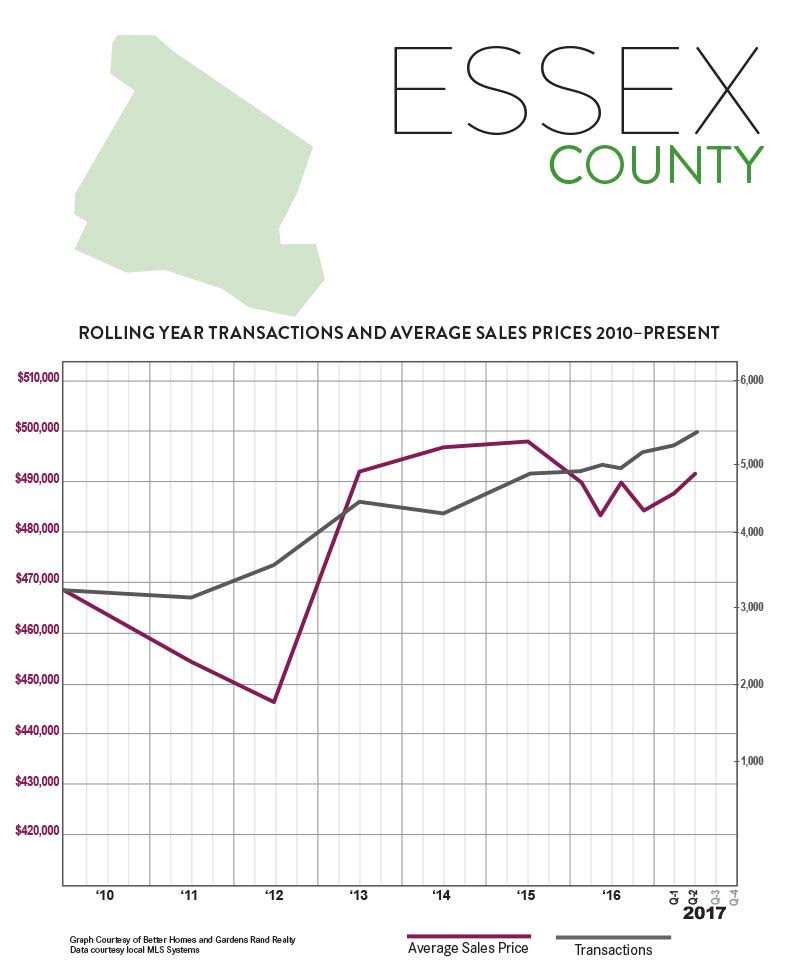

Third-Quarter Real Estate Market Report: Essex County Market Overview

The Essex County housing market slowed a touch in the third quarter of 2017, with sales up a bit but prices mixed.

The Essex County housing market slowed a touch in the third quarter of 2017, with sales up a bit but prices mixed.

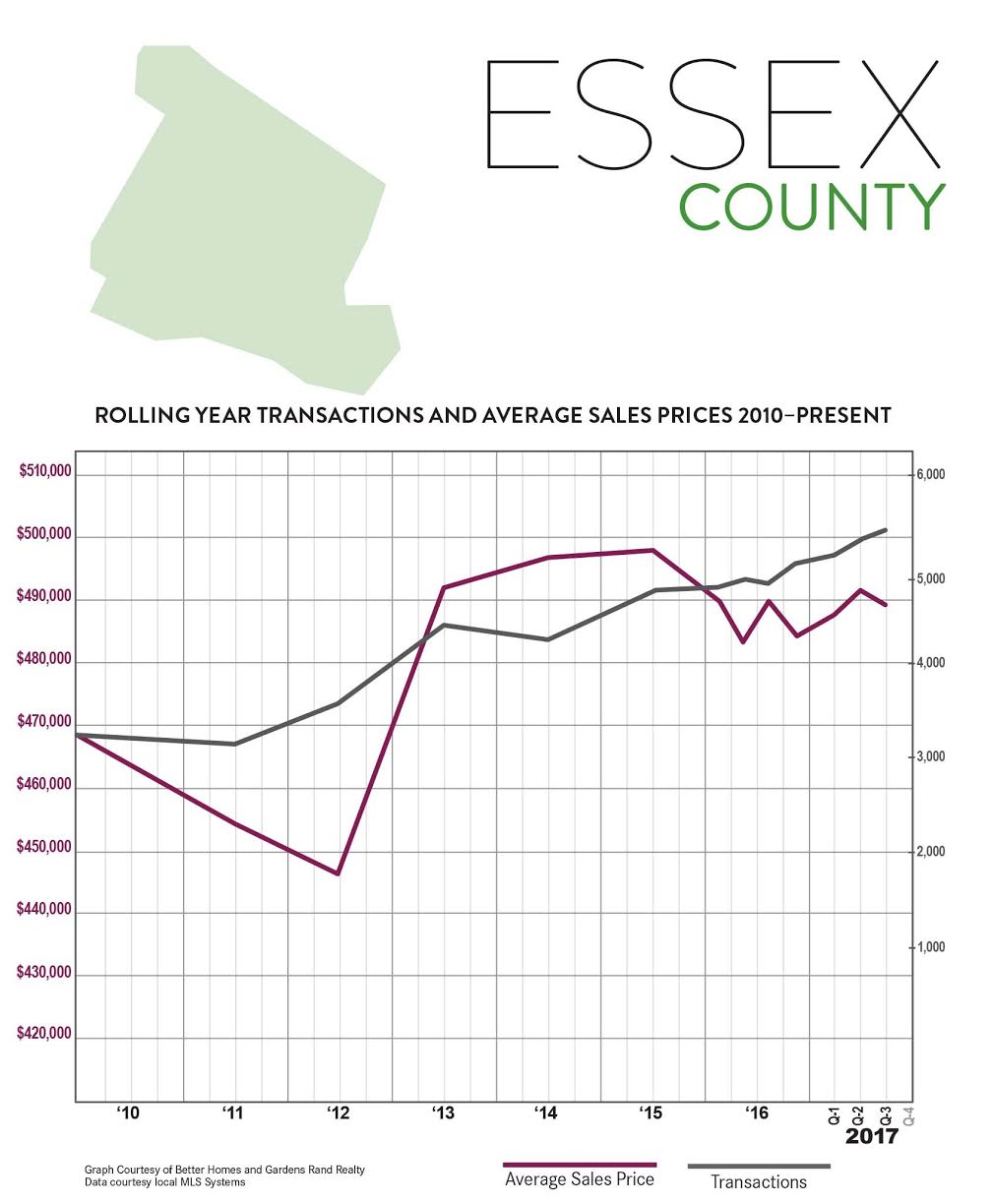

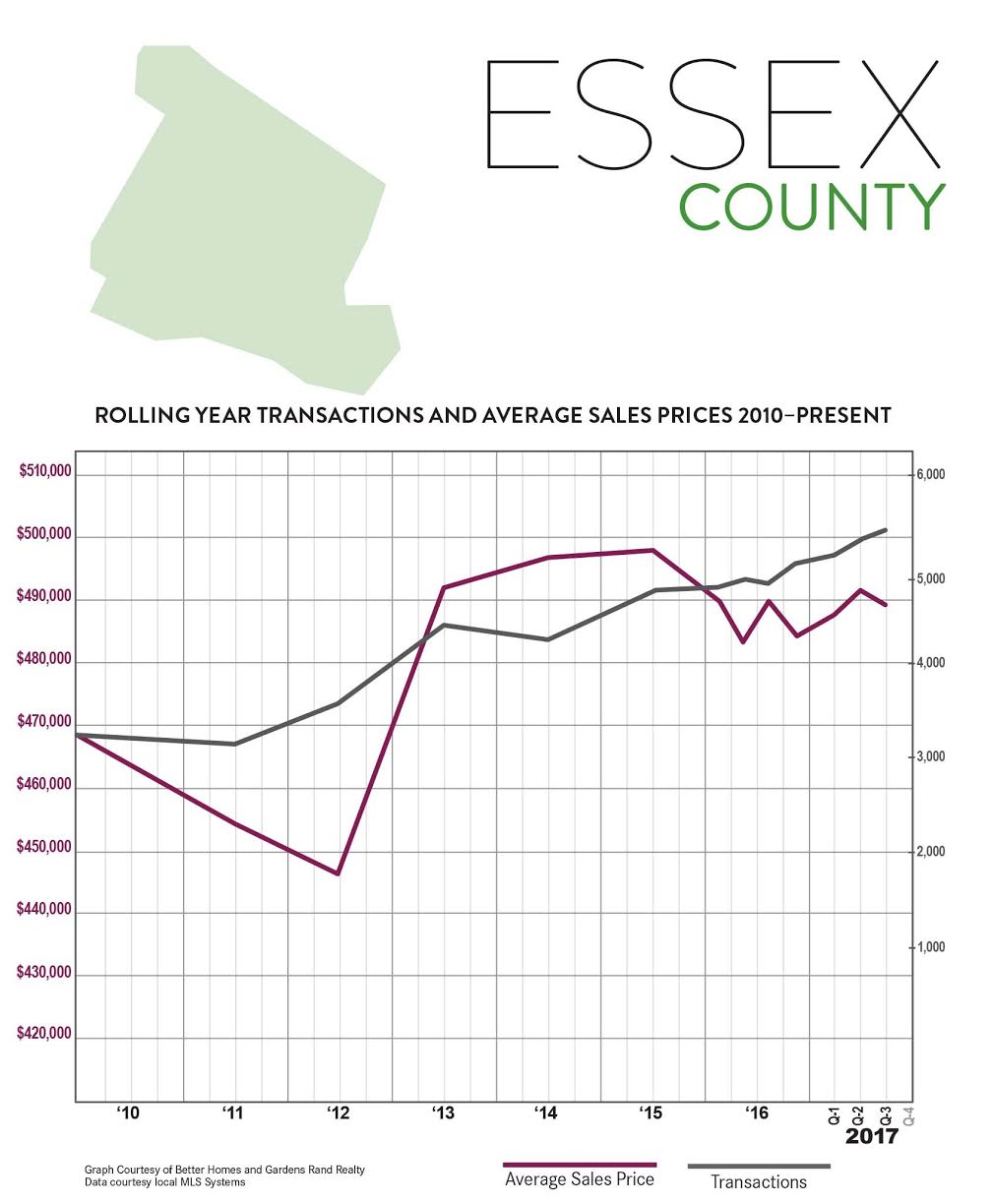

Sales. Essex sales activity was up again, rising almost 4% from the third quarter of last year. This continues a trend that’s been developing for a while, with the rolling year sales up over 9%. Indeed, Essex closed over 5,300 units over the rolling year, the largest 12‑month total since the height of the last seller’s market over 10 years ago, and up almost 70% from the bottom of the market in 2011.

Prices. Pricing, though, was mixed. Even with these sustained increases in buyer demand, the average price was down almost 2% for the quarter, even while the median was up just a tick. We see the same mixed story in the yearlong trends, with the average down just a tick while the median is up about 1%. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the fall.

Inventory. Essex inventory fell again, dropping over 29% from last year’s third quarter and now down to just under six months’ worth of available homes. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested the sellers might be gaining significant negotiating leverage. Most notably, the listing retention rate crossed the 100% threshold for second quarter in a row, meaning that Essex homes on average are selling for higher than the listed price. Similarly, the days‑on‑market fell about 5%, and is now down to under four months of market time. Those are both positive signals of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will slowly drive some meaningful price appreciation. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive a strong market through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Third-Quarter 2017 Real Estate Market Report: Northern New Jersey Market Overview

The Northern New Jersey housing market surged again in the third quarter of 2017, with another increase in sales and modest-but-meaningful price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through rest of the year and into 2018.

The Northern New Jersey housing market surged again in the third quarter of 2017, with another increase in sales and modest-but-meaningful price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through rest of the year and into 2018.

Sales surged throughout the region. All the Northern New Jersey markets continued to grow, with regional sales up over 4% and transactions rising in every market in the region: up 1% for Bergen houses, 5% for Bergen condos, 8% in Passaic, 0.4% in Morris, 4% in Essex, and 17% in Sussex. For the rolling year, sales were up 8%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 75% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. Indeed, inventory was down from last year in every individual county in the Rand Report: Bergen single‑family homes down 17%, and condos down 22%; Passaic down 28%; Morris down 29%; Essex down 29%; and Sussex down 11%. Moreover, most of our Northern New Jersey markets have reached the six‑months‑of‑inventory level that traditionally starts to signal a seller’s market. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing.

With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: the regional average sales price was flat, but prices were up sharply in Bergen, Passaic, and Morris, even while they continue to struggle in Essex and Sussex.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a strong fall market and a strong 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Essex County, New Jersey

The Essex County housing market surged again in the second quarter of 2017, with increases in both sales and prices coupled with another drop in available inventory.

The Essex County housing market surged again in the second quarter of 2017, with increases in both sales and prices coupled with another drop in available inventory.

Sales. Essex sales activity was up again, rising over 13% from the second quarter of last year. For the rolling year, sales are now up over 7%. Indeed, Essex closed over 5,300 units over the rolling year, the largest 12-month total since the height of the last seller’s market over 10 years ago, and up almost 70% from the bottom of the market in 2011.

Prices. Essex buyer demand is finally showing signs of an impact on pricing. Compared to the second quarter of last year, the average price was up over 2% and the median was up almost 4%. More importantly, we’re starting to see meaningful long-term price appreciation, with the average up almost 2% for the rolling year. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the Summer.

Inventory. Essex inventory fell again, dropping over 24% from last year’s second quarter and now down to just about six months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested that sellers might be gaining significant negotiating leverage. Most notably, the listing retention rate crossed the 100% threshold for the first time in memory, rising over two percentage points to 101.8%. That’s remarkable. Similarly, the days-on-market fell by two weeks, and is now down to under four months of market time. Those are both positive signals of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will continue to have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but meaningful price appreciation through a robust Summer market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets continued their strong start to the year, with regional sales up almost 8% and transactions rising in every market in the region: up 1% for Bergen houses, 9% for Bergen condos, 8% in Passaic, 3% in Morris, 13% in Essex, and 25% in Sussex. For the rolling year, sales were up almost 8%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 70% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We calculate the “months of inventory” in a market by measuring the number of homes for sale, and then figuring how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up – and we’re now right at that level. Indeed, inventory was down from last year in every individual county in the Rand Report: Bergen single-family homes down 12%, and condos down 29%; Passaic down 31%; Morris down 31%; Essex down 24%; and Sussex down 26%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing.

With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: the regional average sales price was up almost 2% from last year’s second quarter, and the average price was up in every county other than Sussex. Looking at the long-term, the rolling year average sales price was up just a tick, but was up in every county other than Passaic.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Summer market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Essex County, New Jersey

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

Sales. Essex sales activity was up sharply from the first quarter of last year, rising almost 12% and driving the rolling year activity up almost 5%. Buyer demand has been inconsistent throughout the year, certainly not as strong as we are seeing in neighboring Northern New Jersey counties. But Essex closed over 5,000 units over the rolling year, the largest 12-month total since the height of the last seller’s market over 10 years ago, and up over 65% from the bottom of the market in 2011.

Prices. Essex buyer demand is finally showing signs of an impact on pricing. The average price was up almost 4% from the first quarter of last year. Although the median was down just a tick for the quarter, and the rolling year pricing is still down, that increase in the average price was still promising. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the Spring market.

Inventory. Essex inventory fell again, dropping almost 39% from last year’s first quarter and now down to 5.8 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Essex crossed that threshold this quarter augurs well for pricing in 2017.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested that sellers might be gaining just a little bit of negotiating leverage. The days-on-market fell by six days, and the listing retention rate was up sharply. Indeed, for the calendar year, sellers retained over 99% of their last list price. That’s another positive signal of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but meaningful price appreciation through a robust Spring market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

The Northern New Jersey housing market surged ahead in the first quarter of 2017, starting the year with a dramatic increase in home sales coupled with modest-but-meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Spring and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets got off to a strong start to the year, with regional sales up almost 12% and transactions rising in every market in the region: up 1% in Bergen, 30% in Passaic, 8% in Morris, 12% in Essex, and 32% in Sussex. For the rolling year, sales were up over 9%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 65% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We measure the “months of inventory” in a market by looking at the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything fewer than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up — and we’ve now seen this market cross below that line for the second quarter in a row. Indeed, inventory was down from last year in every individual county in the Report: Bergen single-family homes down 21%, and condos down 34%; Passaic down 38%; Morris down 34%; Essex down 39%; and Sussex down 36%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing. With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re beginning to see some promising signs: the regional average sales price was up almost 1% from last year’s first quarter, and the average price was up in almost every county in the report.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Spring market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Essex County, New Jersey

The Essex County housing market finished the year with a surge in sales, but these sustained increases in buyer demand have not had their expected impact in driving price appreciation.

The Essex County housing market finished the year with a surge in sales, but these sustained increases in buyer demand have not had their expected impact in driving price appreciation.

Sales. Essex sales activity recovered from a disappointing third quarter, with sales rising almost 11% from the fourth quarter of last year and finishing the calendar year up almost 5%. Buyer demand has been inconsistent throughout the year, certainly not as strong as we are seeing in neighboring Northern New Jersey counties. That said, Essex closed over 5,000 units in 2016, the largest calendar year total since the height of the last seller’s market over 10 years ago, and up almost 61% from the bottom of the market in 2011.

Prices. Essex pricing was also a bit disappointing, with the average down over 2% and the median down 3% from the fourth quarter of last year. The results were similar when we looked at the full 2016 calendar year, where prices were down over 2% on average and almost 4% at the median. This is a little surprising, given that an increase in buyer demand is usually associated with some upward pressure on pricing.

Inventory. Essex inventory fell again, falling almost 27% from last year’s fourth quarter and now down to 7.0 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So Essex’s relatively low inventory levels raise the possibility of meaningful price appreciation in 2017.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested the sellers might be gaining just a little bit of negotiating leverage. The days-on-market fell by five days, and the listing retention rate was up sharply. Indeed, for the calendar year, sellers retained over 99% of their last list price. That’s another positive signal of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but measurable price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall – Northern New Jersey

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

Sales were strong throughout the region. After a relatively slow third quarter, regional sales surged back, rising almost 11% and up sharply in every county in the report: rising 11% in Bergen, 14% in Passaic, 12% in Morris, 11% in Essex, and 18% in Sussex. This strong fourth quarter helped the region close the 2016 year up almost 11% in sales, reaching the highest yearly transactional total in over ten years, since the height of the last seller’s market. Indeed, regional sales are now up 63% from the bottom of the market in 2011.

Inventory continues to tighten. We determine the “months of inventory” in a market by measuring the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up. Well, the months of inventory for the Northern New Jersey region has now crossed over that line, dropping down to 5.3 months. Moreover, inventory was down in every individual county in the Rand Report, and is now below or nearing the six-month level: Bergen single-family homes at 3.6 months and condos at 6.1 months, Passaic at 8.3, Morris at 7.3, Essex at 7.0, and Sussex at 11.3. Certainly, if inventory continues to tighten, and demand stays strong, we are likely to see upward pressure on pricing.

Even with sales up and inventory down, though, average prices have been flat or falling throughout the region. Basic economics of supply and demand tells us that after five years of steadily increasing buyer demand, we should expect to see some meaningful price increases. But prices languished, with the regional price down just a tick from last year’s fourth quarter, but down almost 2% for the year. Moreover, the average prices for the year were down in almost all of the individual counties, rising only for Bergen condos, with just a tick up for Sussex. And maybe that’s the tell it might be that the market is simply stronger at the lower end, so lower priced homes (like Bergen condos and Sussex properties) are making up a larger percentage of the mix of properties sold.

Going forward, we remain confident that rising demand and falling inventory will drive price appreciation in 2017. Sales have now been increasing for almost five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe that better days are ahead, and that we are likely to see modest but meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Real Estate Market Report: Third Quarter 2016 – Essex County, New Jersey

The Essex County housing market was a mass of contradictions in the third quarter of 2016, with sales down but prices up.

The Essex County housing market was a mass of contradictions in the third quarter of 2016, with sales down but prices up.

Sales. Essex activity continued to disappoint in the third quarter, with transactions down almost 3% from last year. This marked the first quarter of year‑on‑year sales declines in almost two years, breaking a six‑quarter streak of sales growth. After a robust beginning to the year, Essex is now significantly underperforming its neighboring counties, with the rolling year sales up only about 3%, well below what we’re seeing elsewhere in the region.

Prices. Even with the slackening of activity, prices showed some signs of life. The average price was up about 4%, with the median up just a tick. This was welcome news to Essex homeowners, since we had seen prices go down over the past two quarters. The overall picture, though, is not promising, with rolling year pricing down over 1% on average and almost 5% at the median.

Inventory. The “months of inventory” indicator measures how long it would take to sell out the existing inventory of homes at the current rate of home sales. In the industry, we generally consider anything below six months as a signal for a seller’s market, where tight inventory leads to multiple offer situations, bidding wars, and ultimately appreciating prices. Essex continues to see declining inventory, falling almost 18% in the quarter down to under seven months. That’s a pretty tight market, so we would normally expect to see some upward pressure on pricing.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested the sellers might be gaining just a little bit of negotiating leverage. The days‑on‑market fell just a day, but the listing retention rate was up to almost 100%. Those are both positive signals of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that buyer demand will strengthen and drive modest but meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link