Tips for Single-Female Homebuyers

This Tuesday marked International Women’s Day, celebrating the achievements of women throughout the centuries. Because of this, we’re going to take the opportunity to discuss the growing presence single-female homebuyers have made in the current real-estate market. Over the last couple of years, more and more individuals in this demographic have been purchasing homes. According to a 2014 profile on homebuyers and sellers, done by the National Association of Realtors in 2015, single-women made up 16 percent of homebuyers, whereas single-male buyers constituted for only eight percent. It’s always exciting to read news of an emerging demographic in real estate, so we’ll take this time to provide some tips for single females who are thinking of buying a home.

Seeing as you’re going to be a single-income household, you must consider your finances before beginning your home search. You have to think about how much house you can afford, as well as paying for any repairs, renovations, taxes, and utility bills. By having an understanding of your budget, you won’t have to waste time looking at homes you won’t be able to pay for. Searching for a house requires a lot of time, so you certainly don’t want to use any of it looking at homes that won’t meet your financial requirements.

When searching for a new home, you have to make sure the community is safe. Maybe look into a property that’s part of a town with a neighborhood-watch program or in a gated residential area. As you do this, drive through the neighborhoods both at day and night so you can get an idea of what the area is like at these times. When looking at different neighborhoods, check to see how residents interact. If you see they are friendly towards one another and express a strong sense of support for each other, you know you’ll have a better chance at being safe in that neighborhood because the residents are outgoing and active.

If you’re a commuter who uses public transportation, not only should you make sure your new home will have a convenient route to where you need to go, but you should also see that it’s safe. When you can, ask a friend to accompany you as you test some of the area’s transportation to get a feel for the atmosphere on the train, bus, or whatever other mode of public transportation you may take. As you exit the train, bus, etc., take note of the amount of people who leave with you. Typically, the more people who get off at your stop, the safer your destination point will be because of how many others will be around you. It’s important to have your commuting route be every bit as safe as it is convenient.

Speaking of safety, it will also benefit you to get an alarm system. Even if your neighborhood is safe, some home security will provide you with peace of mind. Security systems are a wonderful feature for any house, and some extra safety can go a long way. Given how tech-savvy homes have become over the years, such a system won’t only protect your house against intruders, but will also offer video surveillance that will keep a very close eye on your house when you’re not at home. A security system such as that sounds too good to pass up.

As you look for a home, you should also do what you can to avoid unfair treatment by professionals, so whether you’re hiring a landscaper, a contractor, a plumber, or anyone else, make sure to seek out an expert in order to have someone with the best skills possible who will offer the right price. Being a single homebuyer, you have to make sure you stay on top of everything during the process. Whenever you hire someone to work on your home, it will benefit you to ask them for the contact information of some their former clients so you can reach out to them and ask for their opinions on the person’s work.

If you like to involve yourself in do-it-yourself projects, it may also help you to increase your skills in areas such as electrical, carpentry, and plumbing, which are offered at many vocational schools and community colleges. As a first-time homebuyer, it will help to know as much as you can about how to upkeep your home in order to have it in proper working order. Despite being in a new home, there are some things you may have to fix, and having these home skills at your disposal will certainly make your transition into a new home fairly easier.

You must realize that confidence is key, and you should use that confidence when you approach the housing market. Remember, single females is a growing demographic in real estate, so this is a great time to have your voice and opinions heard as to what you like best when you search for a home. As you begin to look around, know what you want and go for it. This is an exciting part of your life as you plan to invest in a property you love, so work hard and have fun with it.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

What to Expect in 2016’s Real-Estate Industry

It’s hard to believe 2015 is already at a close. But it’s happening, and everyone’s getting ready for the new year and preparing their resolutions. In the real-estate industry, we’re excited for the trends that are predicted to take place in the coming year. This is a business that’s used to big and rapid changes, so we’re looking forward to what the new year has in store for us.

It’s hard to believe 2015 is already at a close. But it’s happening, and everyone’s getting ready for the new year and preparing their resolutions. In the real-estate industry, we’re excited for the trends that are predicted to take place in the coming year. This is a business that’s used to big and rapid changes, so we’re looking forward to what the new year has in store for us.

As we enter the new year, there are plenty of agents out there who want to help you with any real estate to-dos you may have.

“2016 looks to be a very lucrative year for real estate,” said Frank DiCocco, manager of Better Homes and Gardens Rand Realty’s office in Closter/Alpine, New Jersey. “There is plenty of business out there for our agents. Agents need to hone their skills, and put themselves out there. The years of sellers and buyers falling in our lap are over. It’s the presence, so let’s make one!”

There is also going to be a potential increase in affordable single-family housing. Before 2016, builders were working more on higher-priced homes, which didn’t meet the financial criteria of entry-level buyers. However, with a decrease in new-home prices and improving credit access, builders will be focusing more on constructing homes that are more affordable for new homebuyers. If you have a family, this news couldn’t be better, so if you’re looking for a new home in 2016, keep searching for low home prices throughout the year to see if any fit your financial requirements.

One source’s prediction says home prices may start to decrease, which will influence potential buyers to revisit the market and see if there are any properties they will be able to afford. A lowered price is the best thing a buyer could be given, so 2016 is a year where you’ll want to take advantage of the lowered prices and search for your dream home. With this, you must keep an eye on the market, and also consult with your agent about their views on the industry. Once you have a better idea of the market’s current state, it will be time to dive in.

Although some people believe home prices will lower in 2016, Better Homes and Gardens Rand Realty’s third-quarter market report details that home prices will rise in the new year, therefore creating a seller’s market. Because of these increased prices, this will cause more home sellers to list their properties. Home sellers will want to receive as much money as possible from their property, so they will be eager to place their homes on the market.

The real estate industry is more technological than it has ever been before. With smartphones, tablets, computers, and social media, we are given countless options when it comes to exploring potential real-estate investments. It has become difficult to think how we would have managed this in the past without the availability of these digital-age tools. However, despite the tremendous help modern technology provides for those searching for real estate, you can’t forget it’s the human touch that has been in the real-estate industry since the beginning. After all, you’ll be dealing with an agent the entire time, so it’s important to establish a friendly connection with them as you traverse through the ever-changing real estate market. Having someone to speak with who can provide firsthand knowledge of the real estate market is a wonderful service when buying or selling, so you should value the human factor as much as the technological one.

Parking has been an important factor for real-estate clients for decades. After all, who wants to buy a house without a proper place to park their car? However, it may be surprising to know parking will be seen as less of a concern among homebuyers in the new year. Lately, it has appeared an increasing number of buyers are forgoing cars and are instead using public transportation, cycling, and ride-sharing apps, such as Über. This is especially understandable for those looking to live in the city, seeing as parking normally costs extra and is rather difficult to find.

We will also see a greater solidification of generational buying trends. It has been evident lately that millennials make up a significant portion of current homebuyers, and that doesn’t show any sign of stopping. Nearly two million sales in 2015 involved millennial consumers, which equals about one-third of homebuyers. Despite the attention millennials are receiving in regard to the housing market, it should be noted there are two other demographics that will make an impact in the 2016 housing market: Generation Xers recovering from the financial crisis, and retiring baby-boomers who are looking to downsize. With these three very different generations looking for homes in the new year, we will see a surge in both the buying and selling markets, which will surely make for an interesting and lucrative year in the real estate industry.

A new year includes new beginnings, so whether you’re planning on buying or selling a home, these are a few trends you’ll want to keep track of. The start of a new year is a perfect time to be optimistic, so let that optimism carry you throughout the year as you work to accomplish any real estate goals you may have. With that being said, I wish you all a wonderful and prosperous 2016!

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

Tips for Renting Out Your Home

Sometimes, if people try to sell their home, they may have trouble attracting a buyer. If you’re one of these people, you’re probably wondering what you’re going to do about it. Maybe you plan on consulting a realtor to change around the marketing, or maybe you’ll choose to take your home off the market for a bit. But, have you ever thought about putting your house up for rent? If you don’t have any interested buyers at the moment, renting out your home can be the next best step. It’s worth a try, so here are some tips on how to prep your home for renters.

When trying to estimate a rental price, you have to realize the market is what establishes it. If you set the price too high, you’ll discourage potential renter from approaching you and expressing interest in the property. Determining the rental price isn’t an arduous task because all you have to do is talk with your realtor and conduct some research on the market, which will show you what prices other rental homes are asking for in your area. If you wish to find a renter in a timely fashion, it’s important to have a fair market price, not a price reflecting how much you think your home is worth. In order to have success when attracting renters, this is something you must remember.

You must also realize, as a landlord, you’re going to have many responsibilities with the property. Although you have the benefits of an occupied home warding off vandals and earning some income from the renters, there are many things you’ll have to focus on in order for your property to stay in the best condition. Maintenance is key to not only keeping your renters pleased with the property, but also to make sure your property remains in top condition for when you finally attract an interested buyer.

It’s important to walk through your home and check for any issues you may have to fix before you have any potential renters look at it. Just as if you’re getting your home ready for a buyer, you have to do the exact same thing for a renter. Check the plumbing, the heating, the electricity, and other amenities the renters will need during their rental period. If you aren’t able to sell the house, renters are the next best option, so you don’t want to drive them away with problems that should have been fixed before advertising your rental property to the public.

When you go through your home to prepare for the renters, make a list of the furnishings you would like to take for yourself and which ones you don’t mind leaving with the renters. Even if the renters are responsible people, you never know if an accident might occur with a favorite furnishing of yours that is left in the house, so if you want that piece of furniture for your new home, you should definitely take it with you before the renters move in. After you pick out the furnishings you want, hire a moving company to take what you want for your new home.

Take some time to find the best tenants. You have to make sure you rent out your property to people you know will take care of and respect your home. When you think you have found a possible tenant, your realtor will put them through a screening process and ask them to complete an application listing their name, employers, past landlords, and references. Once your agent gets in touch with the renter’s contacts, you will have a better idea of who the renter is and if you would like to approve their application. If you rent out your house to the wrong person, this be will pose a risk to your home suffering damage and will have you pulling out your hair with stress. With the hard work it comes from being a landlord, stress is something you don’t need.

If you’re having trouble selling your home, don’t fret over this bump in the road; you still have the option to rent it out. However, you have to remember there’s a considerable amount of preparation you must take to prepare for the renters to move in, just as if you were selling your home to a buyer. At least if you have people renting out your home, there will be less time the house is unoccupied. If you have a responsible individual renting out your home, you will know your home is in good hands until the right buyer comes along.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

How to Set the Best Price for Your House

Establishing a price is one of the most important aspects of the home-selling process. You want to receive as much money as you can for your property, but if you price it too high, you run the risk of driving buyers away. When setting a price, it would be wise to seek advice from a real estate agent, someone who knows the market and can gauge what would be an appropriate price. Although you’ll be using a professional, you’ll probably feel like having some input regarding the price, so here are some tips on how to successfully price your house.

“Setting the right price is like a perfect balancing act between the seller and the prospective buyers,” said Elizabeth Whiston, real estate salesperson for Better Homes and Gardens Rand Realty’s office in New Windsor, NY. “Hopefully, the price is acceptable. But, if the seller would like to start at a higher point and it is not totally unreasonable, I would list their property at the higher price. I would have an open house the first weekend after taking the listing with the understanding that if no one shows up for the open house and no one has called about the property, the price should be adjusted.”

Before you settle on a price, it’s important to study the housing market, which will tell you what you need to know about current real estate trends. A working knowledge of the market is one of the best tools you can use when determining an acceptable price. Of course, your agent will have a lot of information to offer regarding the market, due to their considerable experience in the real estate industry. Because of the kaleidoscopic nature of the housing market, it’s recommended you seek the help of an agent to assist you with pricing because they will always be on top of the present changes within the industry.

In terms of agents, it would be more beneficial to use one who’s local. That way, you will be working with someone who is familiar with your neighborhood and those around it, and they will be able to compare the prices from other properties on sale and gauge what some buyers are currently paying. A local agent will have an extensive knowledge of what houses typically sell for in a given area, so they will be able to provide you with a price range that may be attractive to local buyers.

It will also help to be patient. After all, it’s a virtue. Don’t rush your house to the market with the highest price you think the property is worth. If you use a high price first, buyers will feel apprehensive about considering your house. This will cause your property to stay on the market longer. The trick is to wait until you and your agent have figured out an appropriate price for your house, and then place it on the market. There’s always room for your agent to negotiate if a potential buyer thinks the asking price is still a little high, but at least it will look better if you establish a realistic price right at the beginning, instead of trying your luck first with a price that won’t be appealing to buyers.

Setting a price for your house isn’t just important, but it can also be fairly tricky. You may be split between pricing the house for however much you think it’s worth and how much it’s actually worth. The price you set for your house is going to either make or break the success of the sale, so by using your and your agent’s combined knowledge of the real estate market, you can figure out the best possible price for your house. Like a fish to a worm, once you hook the potential buyers with an attractive price, you’ll start reeling them in!

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

Mistakes to Avoid When Selling a House

Last week, we discussed the mistakes you should sidestep when buying a house. This week, we’ll transition to the other end of the spectrum and talk about the mistakes to dodge when selling a house. With this task being as significant as buying a house, you have to make sure to be every bit as diligent when you place your house on the market.

Curb appeal is essential. As soon as a potential buyer drives up to your property, you want them to feel excited about going into your house. But, if you don’t spruce up the exterior, it may turn away the buyer immediately, and you don’t want a buyer skipping your house before they even place a foot in the door. By neglecting to improve your curb appeal, it may send the buyers a message that you don’t upkeep your property on a regular basis, not just on the outside, but also on the inside. You’ve heard that first impressions are everything when it comes to meeting new people, and this notion applies just as strongly when it comes to properly maintaining your house for a buyer.

Never withhold any information from the buyer, such as your house having issues with pest infestations or leaking pipes. You should always make sure your agent is aware of any and all issues so they can disclose that information to the buyer. Place yourself in the shoes of the buyer and think to yourself that you wouldn’t want a seller keeping any important information to themselves if you were trying to purchase a house. If you choose to keep some details to yourself about the house’s faults, you’re setting yourself up for a very rocky negotiation, and even some possible legal troubles. The final buyer is putting a considerable amount of money into your house, and it will be very unfair to them if they are not given all of the necessary information before making an informed decision on your house.

If you have a pet or child, you know they’re prone to creating a mess every so often. However, you want to make sure your house is clean before an open house or a private showing. It’s important the buyers are able to envision themselves living in the house, but if there is a mess that gives the hint of pets or children, it will take the buyers out of their visualization. When you take your children out of the house during an open house or private showing, either take your pet with you, or place it somewhere in the house where it won’t be in the way of the agent and buyer. With these buyers taking the time to visit your house, it’s your responsibility to clean the house so they can see the house appearing at its best.

Speaking of buyers envisioning themselves in your house, this will be easier for them if you de-clutter your house. When you forego getting rid of your house’s clutter, the buyer won’t get a clear idea of the exact space a certain part of your room may have, such as a buyer taking a look at your closet, but not knowing exactly how the space looks because of your clothing taking up too much room. Although you’re still living in the house when it’s being shown, the buyers don’t want to be constantly reminded of that fact as they are looking around at someone else’s house, so remove any clutter that may prevent a buyer’s ability to imagine themselves in the home. De-cluttering will also allow a buyer to move around more freely without the worry of disturbing anything.

As far as pricing is concerned, this is probably the biggest pitfall of the home-selling process. You must realize you and your buyer are going to view the house’s price differently. Seeing as you don’t want to set a price too high in the beginning and turn away buyers, use your agent to help figure out a realistic market price that will attract buyers.

When you’re selling a house, you want to make sure everything goes right because you’re parting with something that has been an important part of your life. I know these mistakes may be worrisome, but if you take your time during the selling process and seek help where you need it, you’ll be fine. Just collaborate with your agent, establish the best course of action, and sell, sell, sell!

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Sources

Dutchess County Affordability: The Monthly Payment You Need to Buy a Home is as Low as it’s Been for the Past 15 Years

Homes in Dutchess County are about as affordable as they have been in over 13 years.

Homes in Dutchess County are about as affordable as they have been in over 13 years.

What do I mean by that? It’s simple. Basically, the monthly mortgage payment it takes to purchase the average-priced home in Dutchess is about as low as it’s been since 2002 – and probably well before that.

If you look at the attached graph, you’ll see what I’m talking about. On that graph, we’ve plotted the monthly payment that a purchaser in the county would have to make to purchase the average-priced home at various points over the years. After all, affordability is not just a matter of the sales price – it’s a matter of the monthly payment you’re going to have to make, which is partly a function of the prevailing interest rate. And then to measure the change in the monthly payment over time, we factored in the effects of inflation.

So we took the following data points:

- The average price of a single family home up to the second quarter of 2015 – from the local MLS data.

- The average interest rate for a 30-year fixed-rate mortgage for June 2015 – from Freddie Mac.

- The prevailing inflation rate up to 2014 year-end – from the US Department of Labor.

You can see the results on the graph. The monthly payment you have to make to purchase the average-priced home in the county is just about as low as it’s been in years. We’ve seen just the slightest uptick in the past few years, partially because of a slight increase in pricing and a slow inflating of interest rates. But we’re still talking about a monthly payment that is as low as anytime in the past 12 years. Moreover, although we don’t have data for Dutchess going back further than that, we do have data in Westchester going back to 1981 – and the monthly payment there is about as low right now as it’s been in those 35 years. Given how closely Dutchess tracks Westchester, it’s likely that homes in Dutchess are more affordable right now than they’ve been since the 1980s.

Why? Part of it is that we have not seen prices go up in any measurable way in almost 10 years, during which inflation has reduced the “true” cost of purchasing a home.

But more importantly, rates are significantly lower than they’ve been at any time in modern history. After all, about ten years ago, the average interest rate was about 6%. It’s now 4%. That’s a huge difference in your monthly payment.

Listen, I HATE it when real estate professionals say that “this is a great time to buy,” because at many times in our history that has been bad advice. But if you measure a “great time to buy” by looking at the monthly payment you’ll have to make to buy a home, then we’re talking about as good a time to buy as any in the past decades. Prices have been flat for almost 10 years, and they’re down significantly if you factor in the effects of inflation. And interest rates are still as low as we’ve ever seen them, even while they’re slowly creeping up (and most observers think they will continue to increase). Unless we see some major shock to the economy, I think we’re looking at a near-decade of reasonable price appreciation coupled with increasing interest rates – both of which are going to drive that monthly payment up over the next few years.

So if it’s up to me, I’m buying right now. And just so you know, I’m putting my money where my mouth is – I closed on my new home in the Hudson Valley 10 days ago.

To learn more about Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Putnam County Affordability: The Monthly Payment You Need to Buy a Home is as Low as it’s Been for the Past 15 Years

Homes in Putnam County are about as affordable as they have been in over 13 years.

Homes in Putnam County are about as affordable as they have been in over 13 years.

What do I mean by that? It’s simple. Basically, the monthly mortgage payment it takes to purchase the average-priced home in Putnam is about as low as it’s been since 2002 – and probably well before that.

If you look at the attached graph, you’ll see what I’m talking about. On that graph, we’ve plotted the monthly payment that a purchaser in the county would have to make to purchase the average-priced home at various points over the years. After all, affordability is not just a matter of the sales price – it’s a matter of the monthly payment you’re going to have to make, which is partly a function of the prevailing interest rate. And then to measure the change in the monthly payment over time, we factored in the effects of inflation.

So we took the following data points:

- The average price of a single family home up to the second quarter of 2015 – from the local MLS data.

- The average interest rate for a 30-year fixed-rate mortgage for June 2015 – from Freddie Mac.

- The prevailing inflation rate up to 2014 year-end – from the US Department of Labor.

You can see the results on the graph. The monthly payment you have to make to purchase the average-priced home in the county is just about as low as it’s been in years. We’ve seen just the slightest uptick in the past few years, partially because of a slight increase in pricing and a slow inflating of interest rates. But we’re still talking about a monthly payment that is as low as anytime in the past 12 years. Moreover, although we don’t have data for Putnam going back further than that, we do have data in Westchester going back to 1981 – and the monthly payment there is about as low right now as it’s been in those 35 years. Given how closely Putnam tracks Westchester, it’s likely that homes in Putnam are more affordable right now than they’ve been since the 1980s.

Why? Part of it is that we have not seen prices go up in any measurable way in almost 10 years, during which inflation has reduced the “true” cost of purchasing a home.

But more importantly, rates are significantly lower than they’ve been at any time in modern history. After all, about ten years ago, the average interest rate was about 6%. It’s now 4%. That’s a huge difference in your monthly payment.

Listen, I HATE it when real estate professionals say that “this is a great time to buy,” because at many times in our history that has been bad advice. But if you measure a “great time to buy” by looking at the monthly payment you’ll have to make to buy a home, then we’re talking about as good a time to buy as any in the past decades. Prices have been flat for almost 10 years, and they’re down significantly if you factor in the effects of inflation. And interest rates are still as low as we’ve ever seen them, even while they’re slowly creeping up (and most observers think they will continue to increase). Unless we see some major shock to the economy, I think we’re looking at a near-decade of reasonable price appreciation coupled with increasing interest rates – both of which are going to drive that monthly payment up over the next few years.

So if it’s up to me, I’m buying right now. And just so you know, I’m putting my money where my mouth is – I closed on my new home in the Hudson Valley 10 days ago.

To learn more about Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Orange County Affordability: The Monthly Payment You Need to Buy a Home is as Low as it’s Been for the Past 15 Years

Homes in Orange County are about as affordable as they have been in over 20 years.

Homes in Orange County are about as affordable as they have been in over 20 years.

What do I mean by that? It’s simple. Basically, the monthly mortgage payment it takes to purchase the average-priced home in Orange is about as low as it’s been since 1994 – and probably well before that.

If you look at the attached graph, you’ll see what I’m talking about. On that graph, we’ve plotted the monthly payment that a purchaser in the county would have to make to purchase the average-priced home at various points over the years. After all, affordability is not just a matter of the sales price – it’s a matter of the monthly payment you’re going to have to make, which is partly a function of the prevailing interest rate. And then to measure the change in the monthly payment over time, we factored in the effects of inflation.

So we took the following data points:

- The average price of a single family home up to the second quarter of 2015 – from the local MLS data.

- The average interest rate for a 30-year fixed-rate mortgage for June 2015 – from Freddie Mac.

- The prevailing inflation rate up to 2014 year-end – from the US Department of Labor.

You can see the results on the graph. The monthly payment you have to make to purchase the average-priced home in the county is just about as low as it’s been in years. We’ve seen just the slightest uptick in the past few years, partially because of a slight increase in pricing and a slow inflating of interest rates. But we’re still talking about a monthly payment that is as low as anytime in the past 20 years.

Why? Part of it is that we have not seen prices go up in any measurable way in almost 10 years, during which inflation has reduced the “true” cost of purchasing a home.

But more importantly, rates are significantly lower than they’ve been at any time in modern history. After all, about ten years ago, the average interest rate was about 6%. It’s now 4%. That’s a huge difference in your monthly payment.

Listen, I HATE it when real estate professionals say that “this is a great time to buy,” because at many times in our history that has been bad advice. But if you measure a “great time to buy” by looking at the monthly payment you’ll have to make to buy a home, then we’re talking about as good a time to buy as any in the past decades. Prices have been flat for almost 10 years, and they’re down significantly if you factor in the effects of inflation. And interest rates are still as low as we’ve ever seen them, even while they’re slowly creeping up (and most observers think they will continue to increase). Unless we see some major shock to the economy, I think we’re looking at a near-decade of reasonable price appreciation coupled with increasing interest rates – both of which are going to drive that monthly payment up over the next few years.

So if it’s up to me, I’m buying right now. And just so you know, I’m putting my money where my mouth is – I closed on my new home in the Hudson Valley 10 days ago.

To learn more about Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

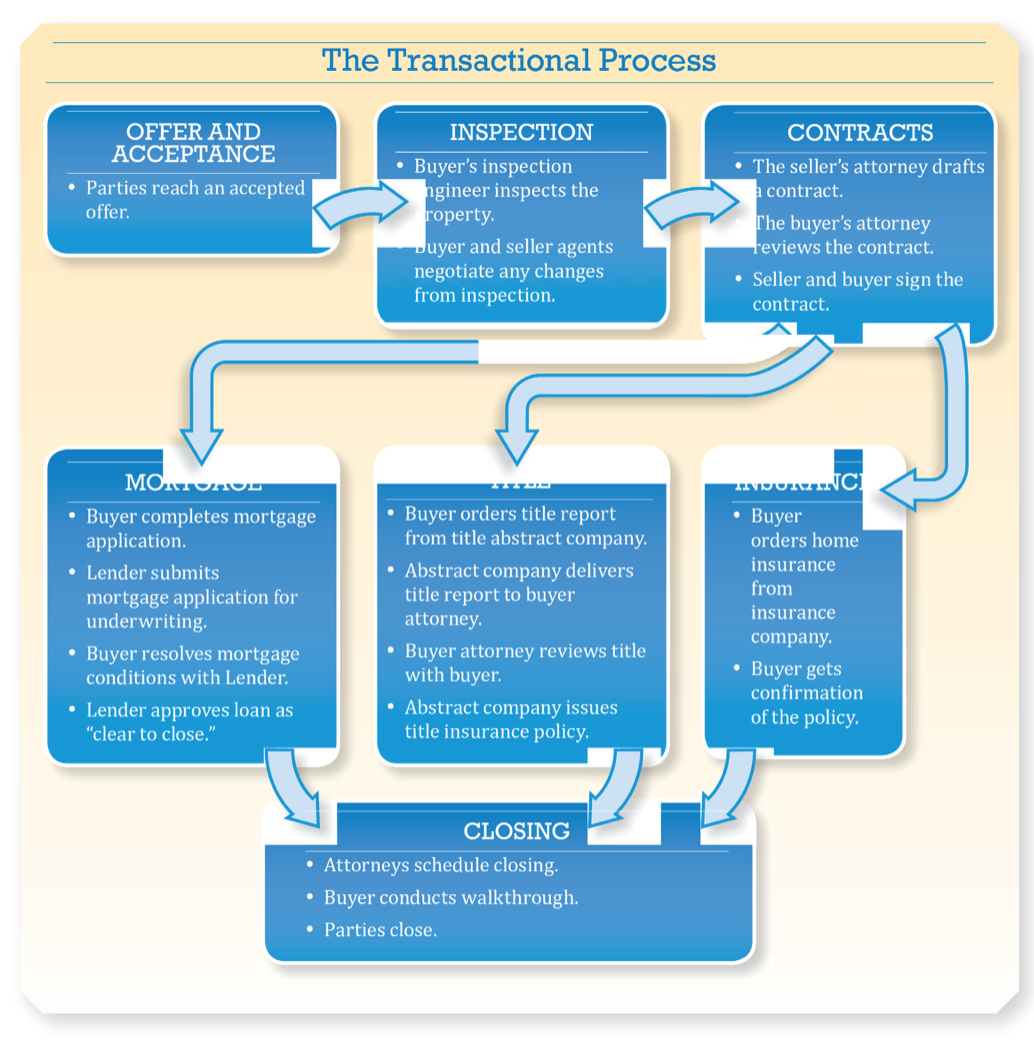

Believe it or not, there are some people who might choose to search for a new house without assistance from a real estate professional. While it may seem like the ideal route, I want to explain why working with a buyer’s agent is the way to go. There is a lot of work involved when purchasing a new house, and a professional will be there to guide you through the intricacies as seamlessly as possible from your initial search, all the way through your closing.

Believe it or not, there are some people who might choose to search for a new house without assistance from a real estate professional. While it may seem like the ideal route, I want to explain why working with a buyer’s agent is the way to go. There is a lot of work involved when purchasing a new house, and a professional will be there to guide you through the intricacies as seamlessly as possible from your initial search, all the way through your closing.