Better Homes and Gardens Rand Realty Property Spotlight: Spectacular Home by Award Winning Architect Hits the Market in Scarsdale for $2,899,000

Scarsdale, NY– Better Homes and Gardens Rand Realty has announced the listing of a gorgeous, move-in ready five bedroom, six+ bathroom contemporary colonial, designed by award-winning architect Eran Chen featuring a loft-like flow and situated at the end of a cul-de-sac.

With over 6,000 square feet of bright, sun-filled living space, the house features floor-to-ceiling windows set off by black oak floors, along with state-of-the-art LED lighting. The kitchen is the heart of the home, designed by Vicente Wolf and complete with Calcutta gold countertops, four ovens, a built-in espresso machine, Sub Zero refrigerator and Viking range that will make even the most novice cook feel like a professional. Built in 2007, the home has been modernized with the most current smart home features, including Nest thermostats, electric vehicle charging station, custom closets, 7 zones, generator, and smart home security system.

Listed with Esther Berkowitz, Associate Broker at Better Homes and Gardens Real Estate Rand Realty, she says, “This home seamlessly blends colonial charm with a contemporary feel. As soon as you enter this house you are welcomed into a massive two-floor foyer with great natural light. The feeling of this home is like no other; it truly is a one-of-a-kind property in a serene setting.”

With close to an acre of beautiful park-like property, this home is ideal for indoor-outdoor living and has plenty of room to grow, including approvals already secured for an in-ground pool and basketball court.

For more details: https://www.bhgre.com/property/14-Rock-Hill-Ln-Scarsdale-NY-10583/50112294/detail

Fourth-Quarter 2018: Real Estate Market Report – Bronx, NY

With Better Homes and Gardens Rand Realty’s recent expansion into the Bronx, we are delighted to present the Rand Quarterly Market Report for Bronx County. We have been providing these quarterly market analyses for almost 15 years for the markets we service, which include Westchester and the Hudson Valley, Northern New Jersey, and now the Bronx. We hope you enjoy the Report, and if you have any questions, please reach out to your Rand Realty agent.

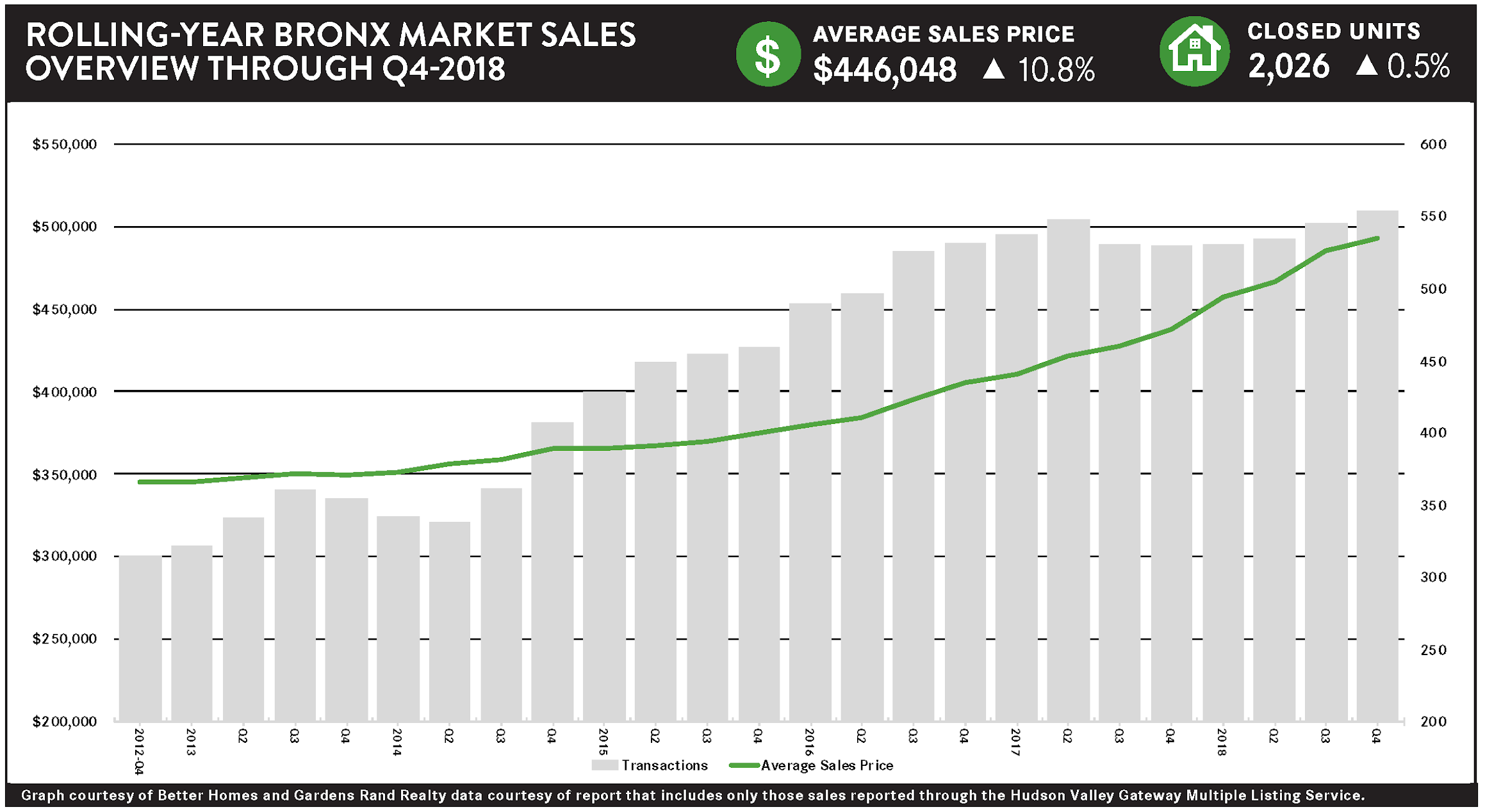

The Bronx housing market surged again in the fourth quarter of 2018, with prices rising sharply in a growing seller’s market, even while low levels of inventory held back sales growth. Going forward, we expect that strong demand will continue to drive meaningful price appreciation through a robust winter and spring market.

Prices were up across the board. For all property types, the average price rose over 13% from the fourth quarter of last year, and was relatively balanced: single‑family homes were up almost 6% on average and over 10% at the median, multi‑families were up 8% on average and almost 9% at the median; coops were up 10% on average and 8% at the median; and condos were up over 40% on average and 67% at the median. We caution not to read too much into the striking condo results because the market is relatively thin (only 45 sales in the quarter) and can be skewed by a couple of outliers. That said, even for the more reliable full 2018 year, we have some eye‑popping results for Bronx condos: up 16% on average and 13% at the median. Moreover, we’re seeing sustained price appreciation across the board, with the average price rising over 13% for all property types and up in every market segment.

But sales were down overall, and for most property types. For the borough as a whole, sales fell about 8%, even while they were relatively flat for the year. Most likely, we’re just seeing the impact of restricted inventory holding back sales, with the market lacking enough “fuel for the fire” to satiate demand. We would expect that these rising prices will eventually tempt more sellers into the market, which could help drive sales up.

Inventory continues to fall. We measure inventory by looking at the number of homes available for sale, and the rate at which homes are selling. A balanced market has about six months of inventory, meaning that at the current rate of home sales, it would take six months to sell all the homes currently available. What we’re seeing, though, is a clear sign of a seller’s market, with the months of inventory well below six months for all property types: 4.2 for single‑family homes, 5.0 for multi‑families, 4.9 for coops, and 5.6 for condos.

Overall, this is exactly what a robust seller’s market looks like. We have high demand and falling inventory driving sales and prices up throughout the borough. Textbook economics tells us that rising prices will eventually attract more sellers into the market, but in the meantime we can expect that high demand will continue to drive prices up through a robust winter and spring market.

Editor’s Note: This report includes only those sales reported through the Hudson Valley Gateway Multiple Listing Service.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

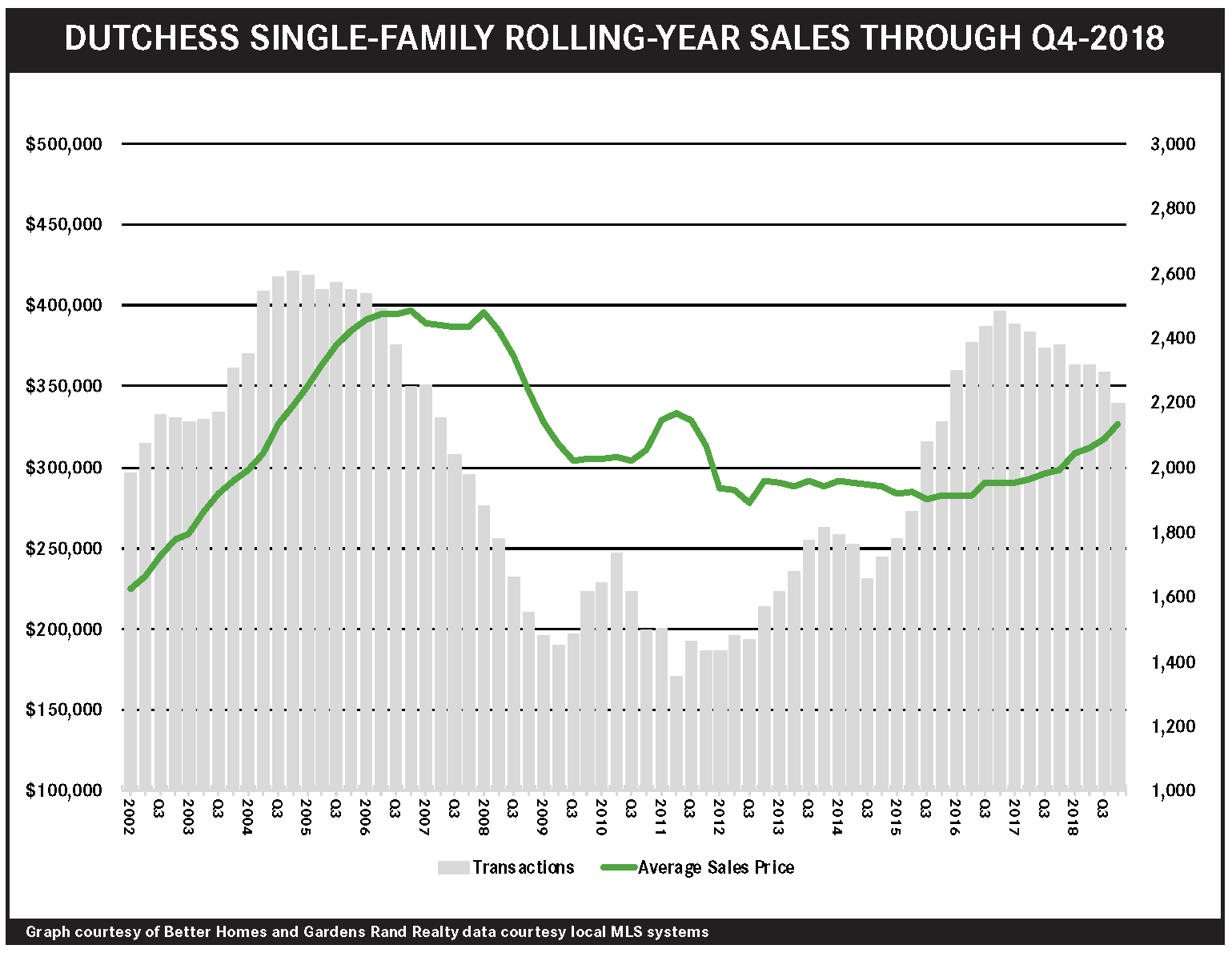

Fourth-Quarter 2018: Real Estate Market Report – Dutchess County, NY

Pricing in the Dutchess housing market soared again in the fourth quarter, with prices rising from high demand and limited inventory. Sales were down, just as in the rest of the region, with low levels of inventory holding back the market. But prices were up across the board: single‑family home prices rose over 12% on average and 6% at the median for the quarter, finishing the 2018 year up almost 10% on average and over 9% at the median. And we saw the same results in the condo market, with the full‑year prices rising 7% on average and almost 5% at the median. Going forward, we expect that sellers will eventually be attracted into this rising market, which might drive sales up in the winter and spring markets.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

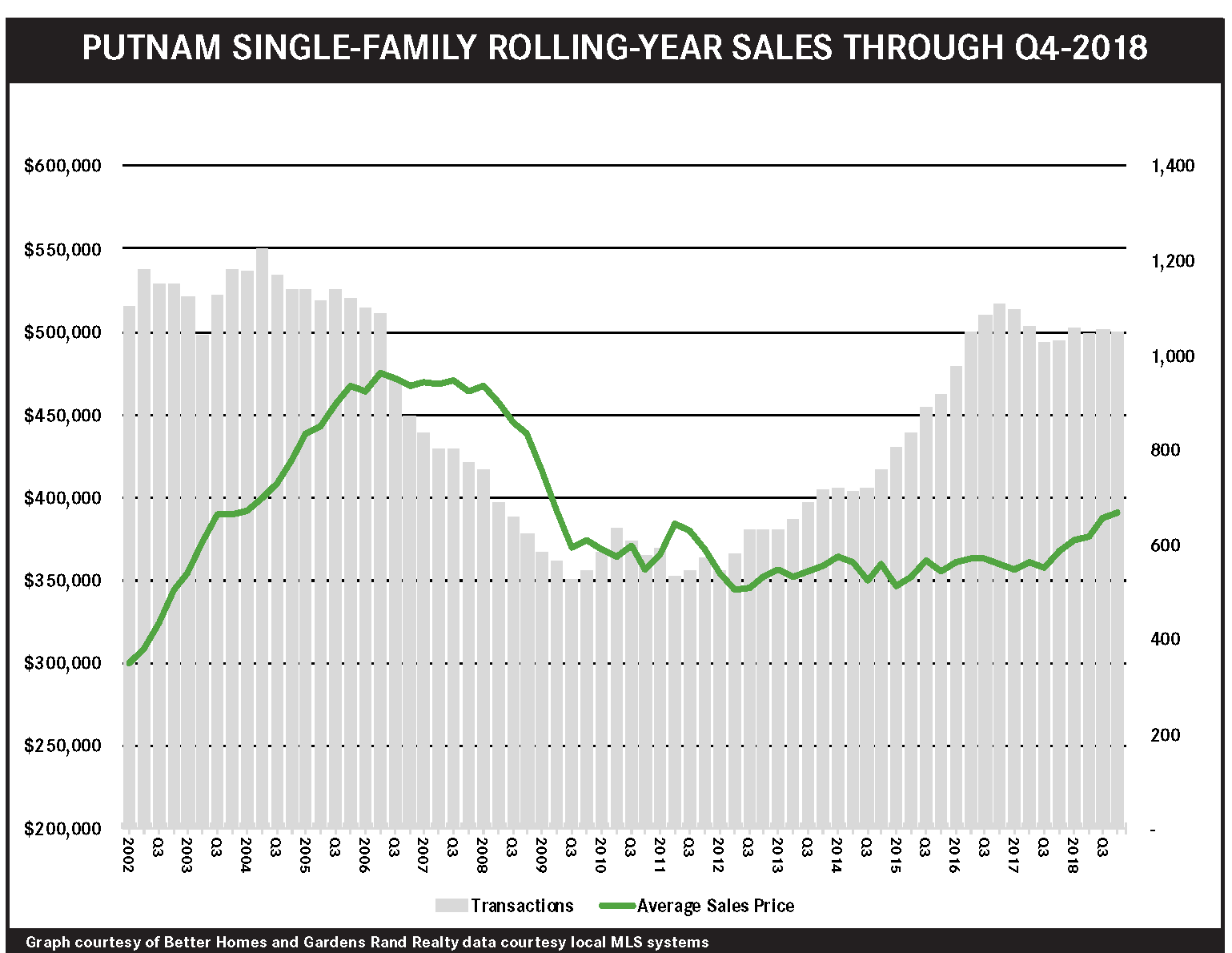

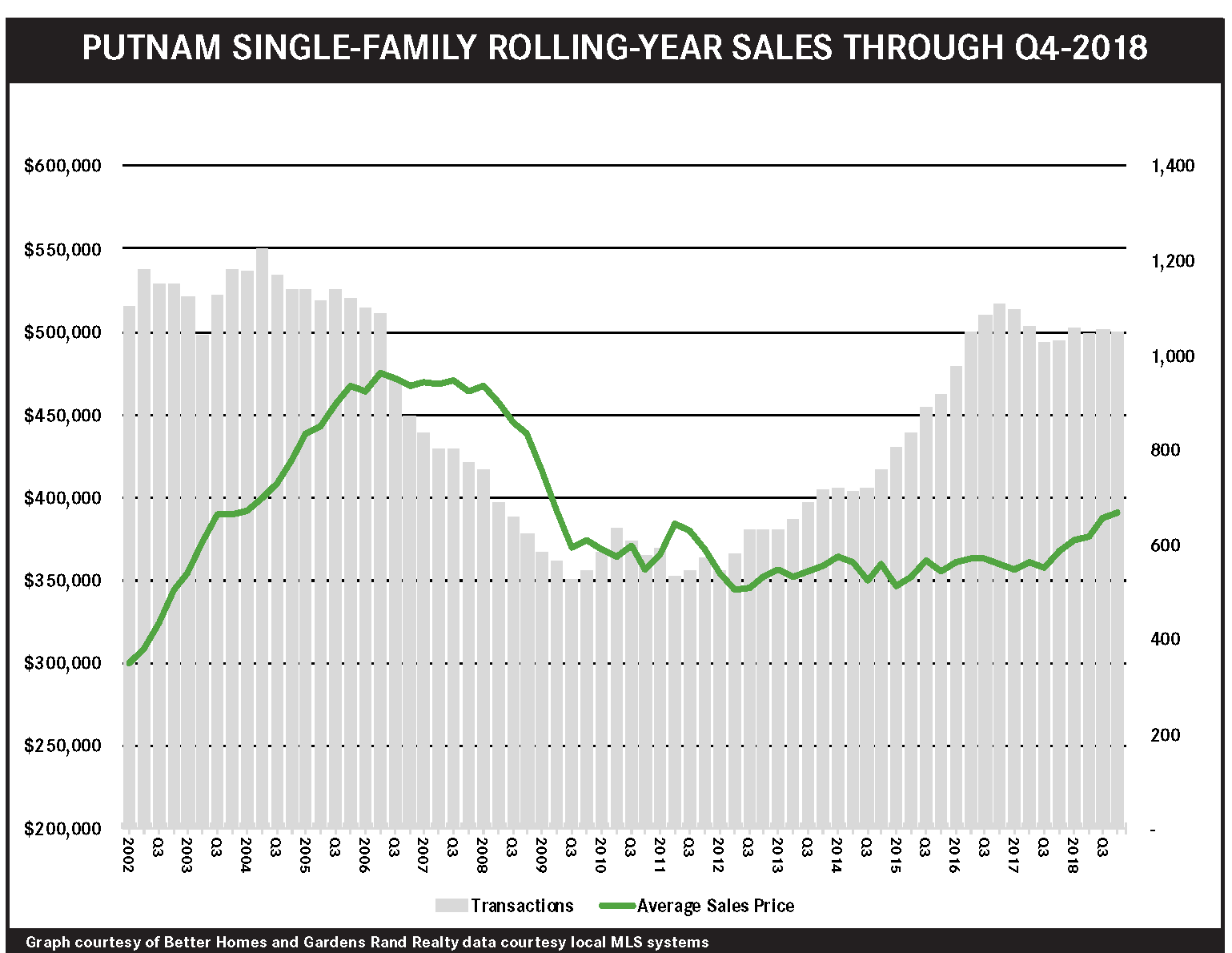

Fourth-Quarter 2018: Real Estate Market Report – Putnam County, NY

Putnam continues to show every sign of a thriving seller’s market, with low levels of inventory stifling sales growth but driving meaningful price appreciation. For the quarter, sales were down just a tick, but prices were up over 3% on average and almost 6% at the median. And that strong quarter closed a robust 2018, with sales up 2% and prices rising 6% on average and almost 5% at the median. Indeed, the condo market was downright frothy, with sharply reduced inventory holding back sales but driving the full‑year pricing up almost 15% on average and 19% at the median. We think that this kind of price appreciation is not sustainable over the long‑term, but that low levels of inventory, coupled with high demand, will continue to drive meaningful appreciation through the winter and spring markets.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

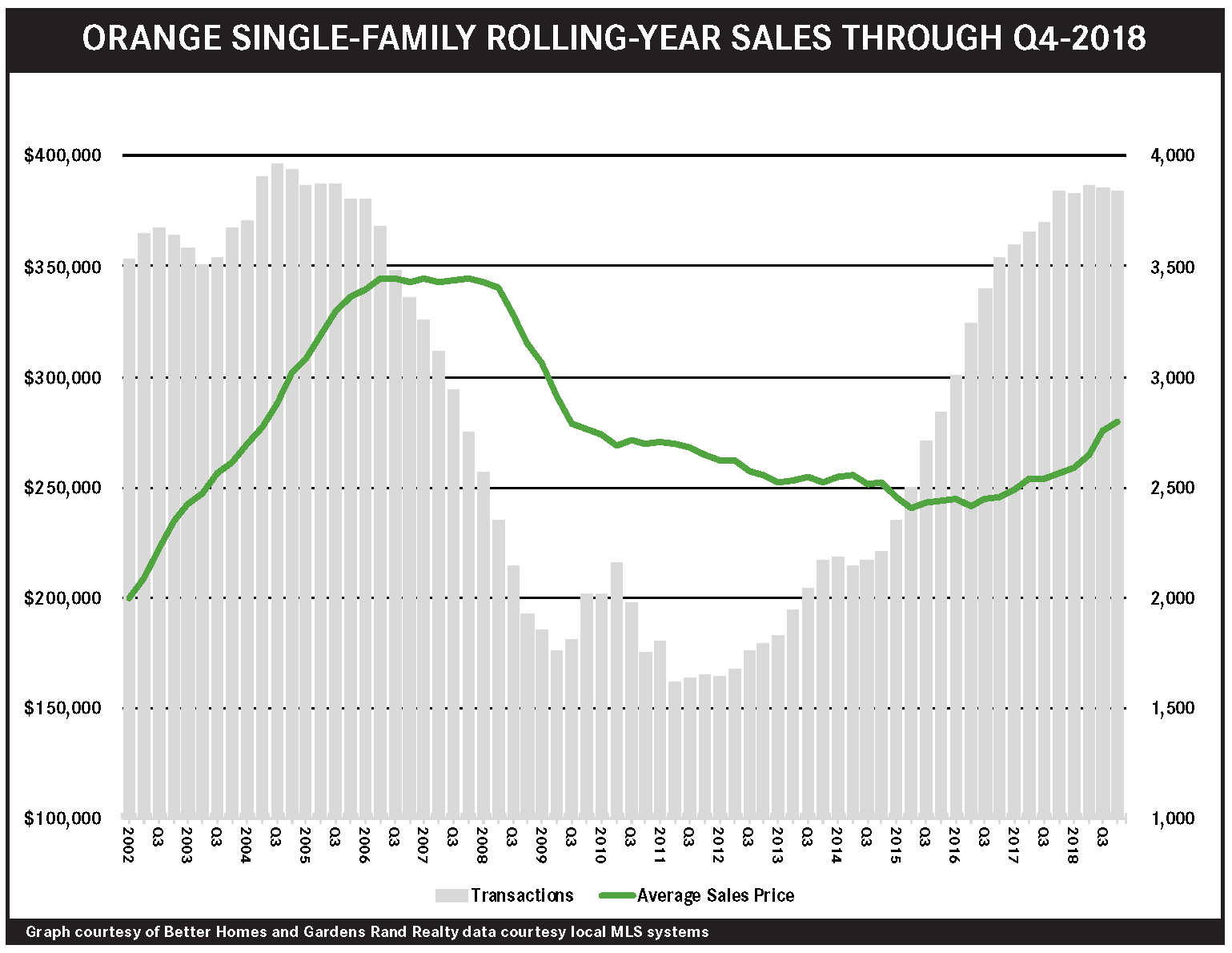

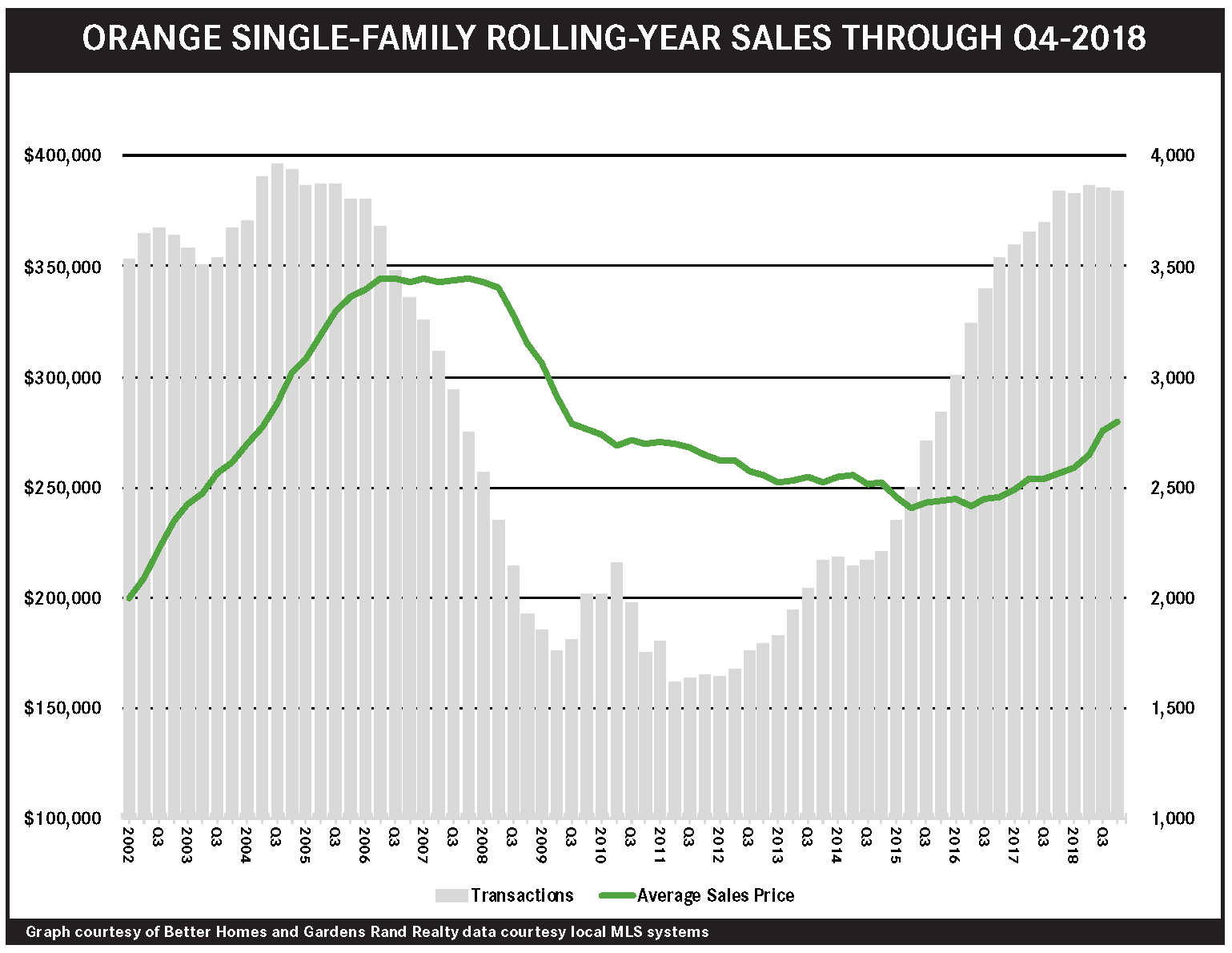

Fourth-Quarter 2018: Real Estate Market Report – Orange County, NY

The Orange housing market closed the best year for homeowners since the financial crisis 10 years ago, with the full‑year pricing up sharply for both single‑family homes and condos. Orange is now in a fully realized seller’s market, with low levels of inventory holding back sales, even while driving robust price appreciation. For the full 2018 year, prices were up across the board: single‑family home prices rose 9% on average, 7% at the median, and almost 10% in the price‑per‑square foot, while condo prices rose 12% on average, 8% at the median, and over 12% in the price‑per‑square‑foot. Pricing is now the highest it’s been since the financial crisis of 2008‑09, although it’s still down about 20% from the height of the market in 2006-07. Going forward, we expect that Orange still has some room for growth, and that demand will stay strong through the winter and spring markets.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth-Quarter 2018: Real Estate Market Report – Rockland County, NY

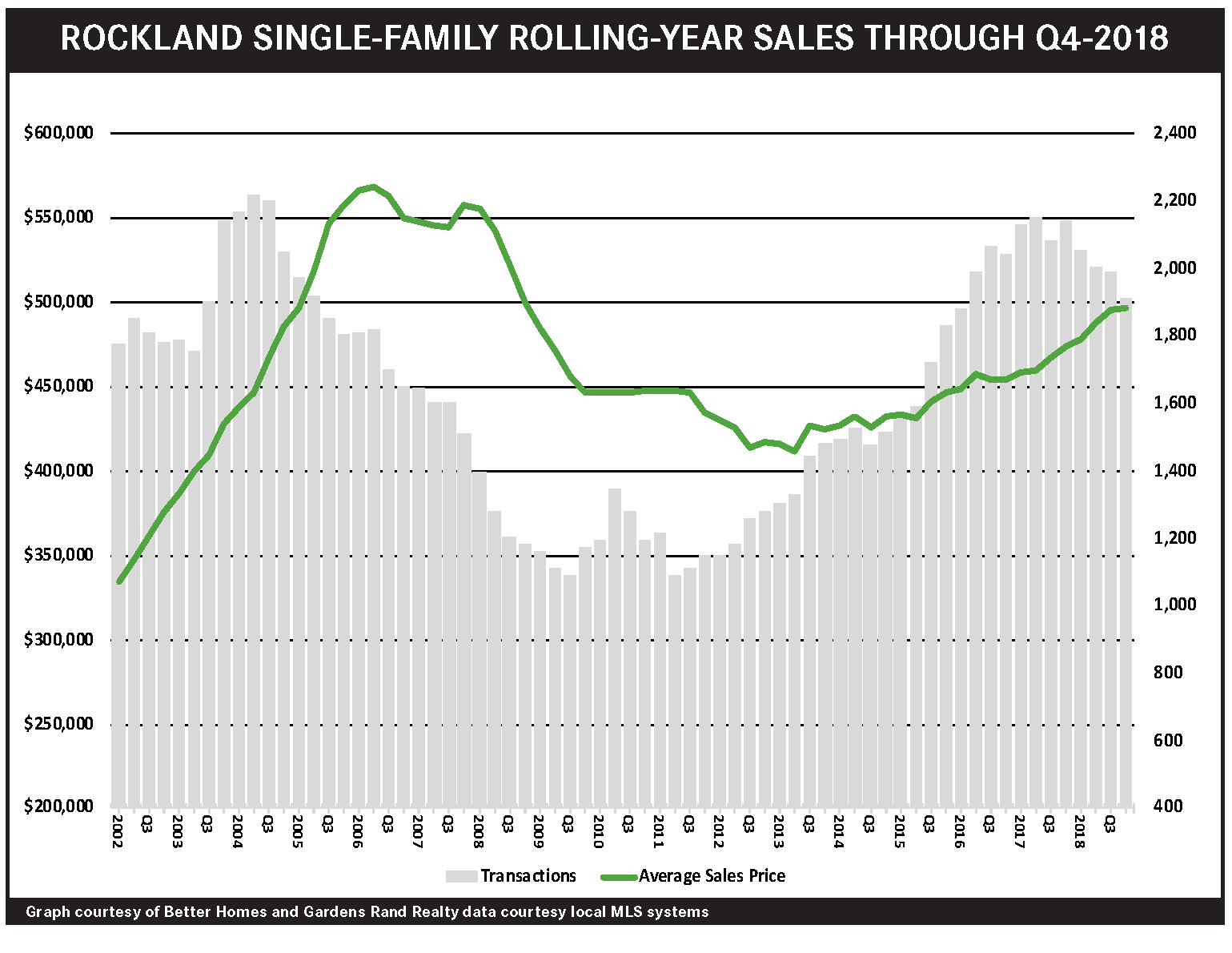

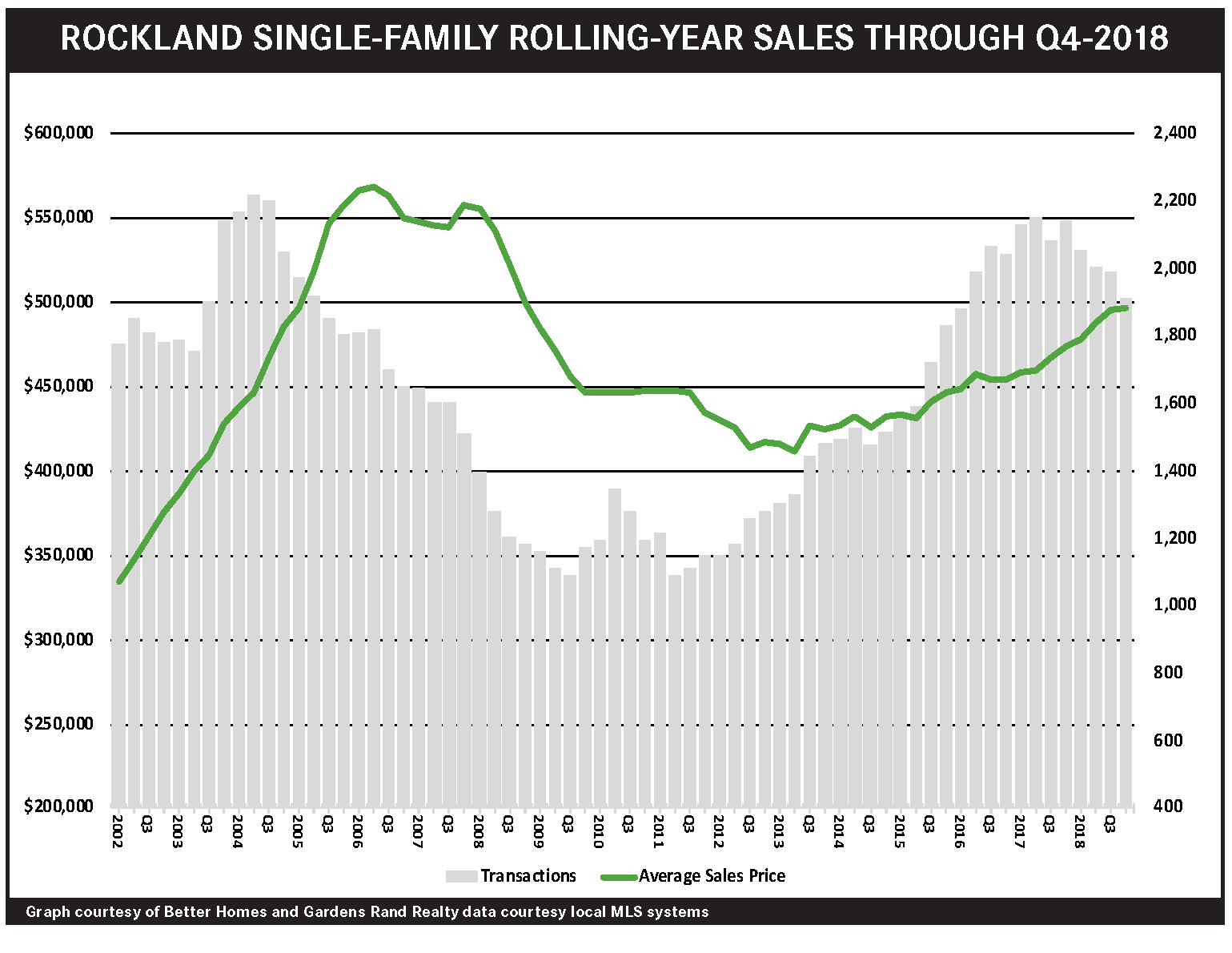

The Rockland seller’s market continues to be constricted by low levels of inventory, which are holding back sales, even while driving prices up. Single‑family home sales were down sharply in the fourth quarter, falling almost 14%, finishing a full year in which they fell almost 11%. But prices were up, rising a tick on average and almost 3% at the median, closing a year in which pricing rose 5% on average and almost 5% at the median. We see the same story with condos, with sales down and prices up for the quarter. So what’s going on? Basically, Rockland needs more fuel for the fire. Demand is strong, but supply is too low to sustain sales increases, even while too many buyers chasing too few homes is driving prices up across the board. But that might be changing, with inventory starting to rise after years of falling, as home owners see prices going up and are tempted into the market. Going forward, we expect that demand will sustain meaningful price appreciation through the winter and spring markets, and that increased inventory might help boost sales as well.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth-Quarter 2018: Real Estate Market Report – Westchester County, NY

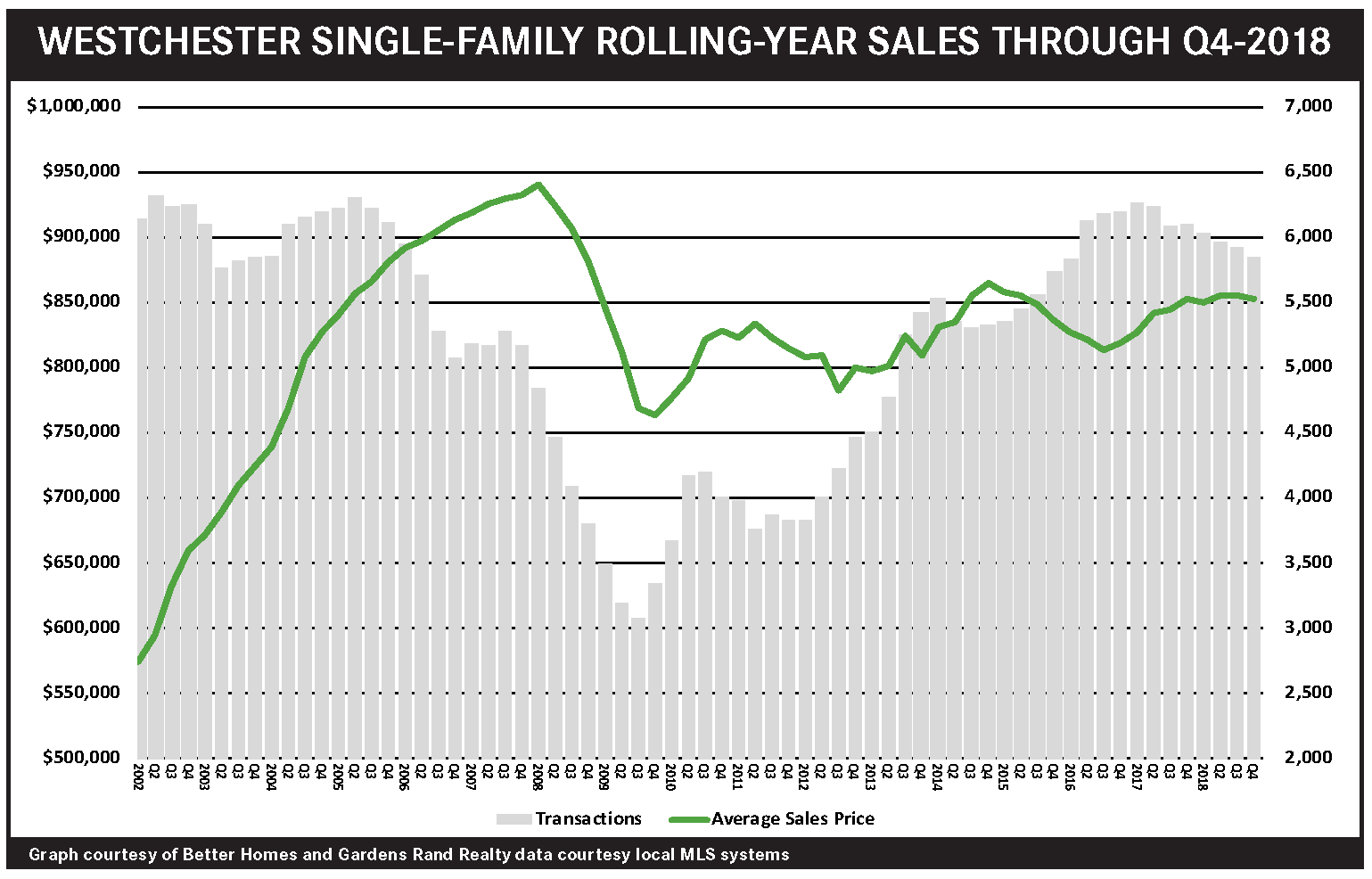

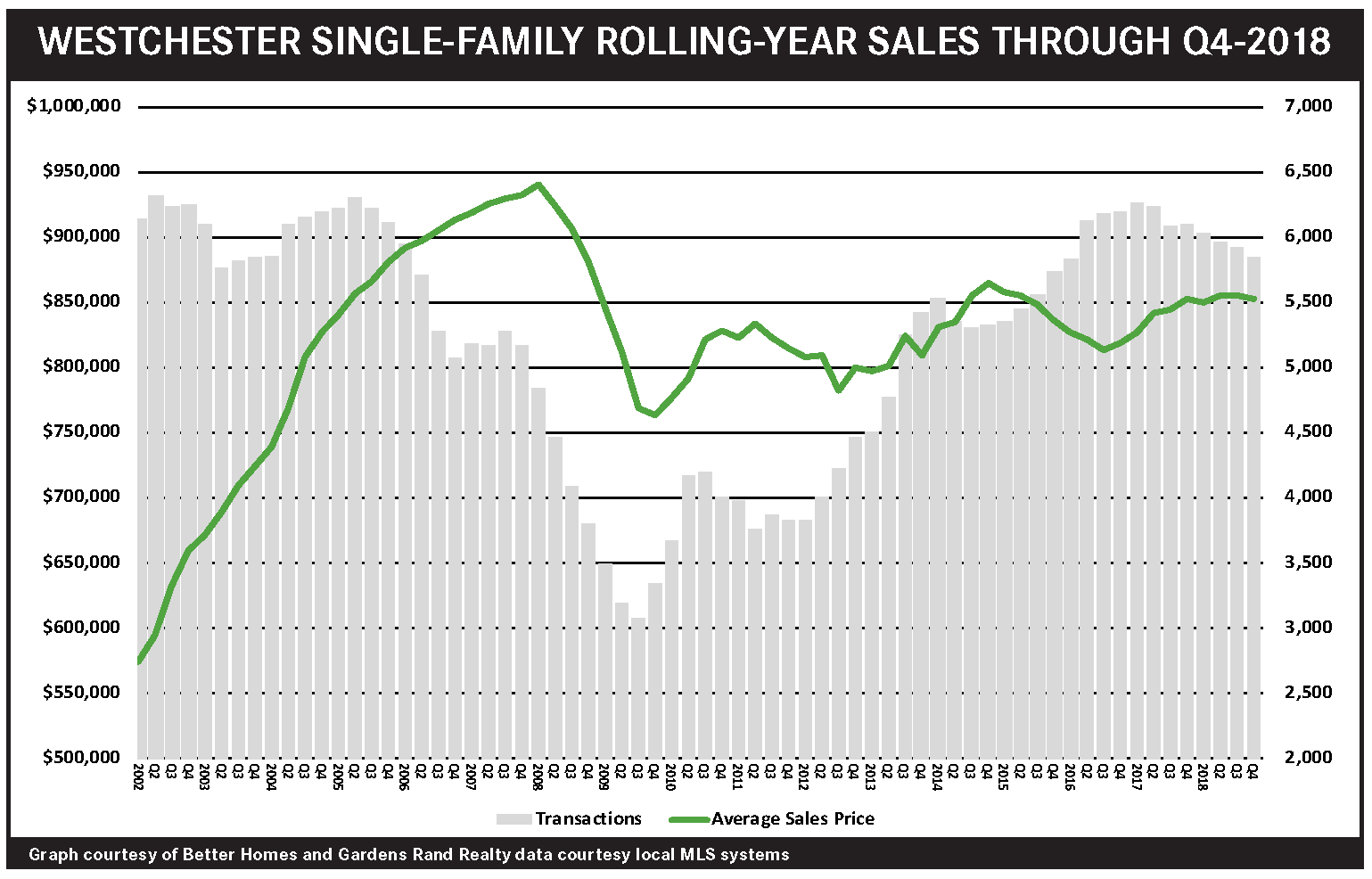

The Westchester housing slowed slightly in the fourth quarter of 2018, particularly in the higher‑priced segments of the market, perhaps as a result of the Tax Reform cap on state and local tax deductions. For the quarter, sales of single‑family homes fell almost 6%, and pricing was mixed: down about 2% on average, up a tick at the median, and down almost 3% in the price‑per‑square‑foot. In contrast, sales in the lower‑priced entry‑level coop and condo markets were more robust, with transactions up over 11% for coops and almost 2% for condos, and average prices up 5% for coops and 1% for condos. The divergence between the higher‑priced single‑family market and the coop/condo market might come from the tax changes, which would particularly hit higher‑income home‑buyers in the higher‑priced markets. Still, though, demand is relatively strong, and with inventory starting to creep up, we might see a more robust start to 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Fourth Quarter 2018: Real Estate Market Report – Lower Hudson Valley, NY

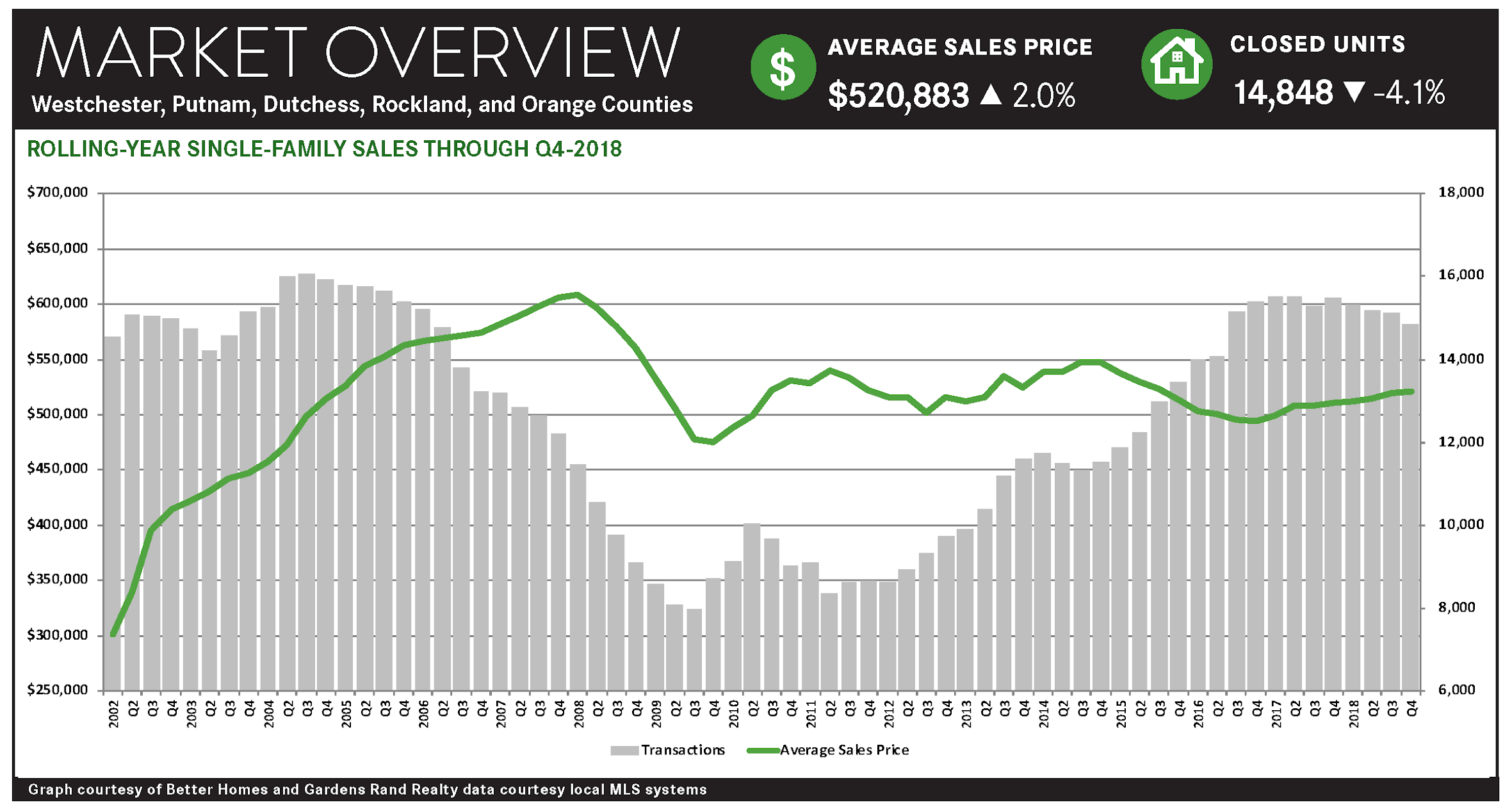

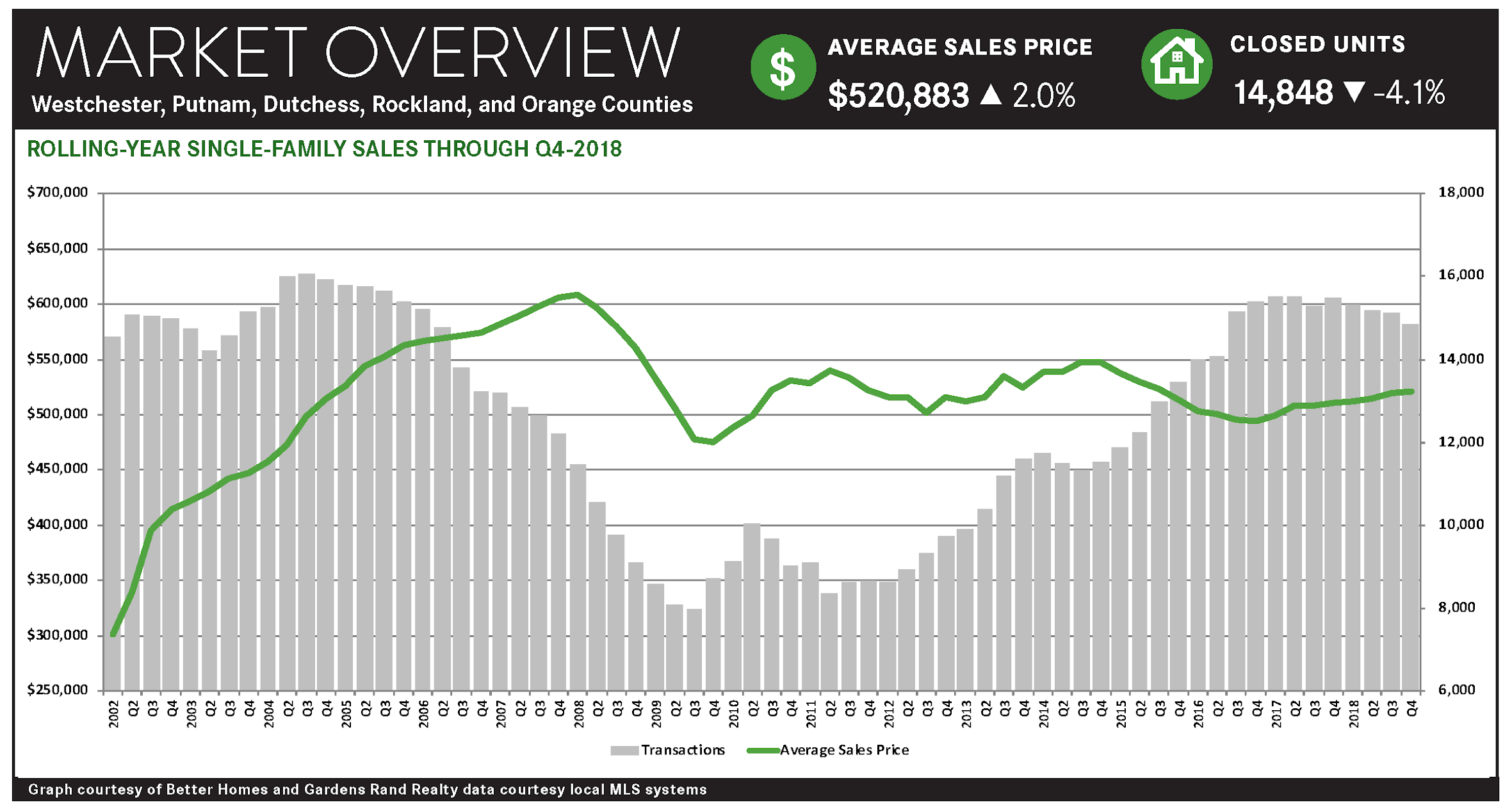

Sales in Westchester and the Hudson Valley housing markets were down throughout the region, even while high buyer demand, coupled with low levels of inventory, drove meaningful price appreciation in most of the regional markets.

Sales were down throughout the region. Regional transactions fell across the board in the fourth quarter, dropping almost 7% for single‑family homes and 5% for condos. We saw the same story for the full 2018 year, with sales down over 4% for single‑family homes and about 1% for condos. To put these numbers in perspective, though, we closed almost 15,000 single‑family homes and almost 3,000 condos in 2018, up from about 9,000 single‑family homes and 2,000 condos back at the bottom of the market 10 years ago. So we’ve had a pretty good run‑up of sales in the past 10 years and were due to plateau at some point.

Prices were up in most of the markets of the region, particularly in the lower‑priced market segments.

Essentially, we had a “tale of two markets” developing in the region, with pricing flat only for the highest‑priced property type in the region – Westchester single‑family homes – even while average prices were up for every other county in the region for the year: up 6% in Putnam, 5% in Rockland, 9% in Orange, and 10% in Dutchess. And full‑year pricing in the entry‑level condo and coop markets was up in every market: rising 6% for Westchester coops, with condos up 0.1% in Westchester, 15% in Putnam, 1% in Rockland, 12% in Orange, and 7% in Dutchess.

So what was holding back pricing for Westchester single‑family homes? We might be seeing the effects of the 2018 Tax Reform, which capped deductions for state and local taxes, and could be having a disproportionate impact on high‑end buyers in high‑property‑tax Westchester. Unlike buyers in the entry‑level condo and coop market, or in the lower‑priced counties, Westchester luxury buyers are more likely to itemize their taxes, so they might be feeling the bite of the cap more acutely. This could be reducing demand at the higher‑ends of the market, suppressing the price appreciation we are seeing in the rest of the region.

Going forward, we believe that the market is still poised for growth. Sales are falling mostly due to a lack of supply, not a lack of demand. Essentially, the market needs more “fuel for the fire” – more viable inventory for the buyers who are looking. And that might be happening: regional single‑family home inventory was up almost 10% from last year, rising for the second quarter in a row after 25 straight quarters of year‑on‑year declines. This makes some economic sense, of course, since we would expect that sustained price appreciation over a period of time should tempt more homeowners into the market. The question is whether buyer demand is strong enough to continue driving price appreciation, even while absorbing this increased inventory. Ultimately, we believe that the region is still growing as a seller’s market, which should allow for both increases in sales and prices in what will be a robust spring market.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Better Homes and Gardens Rand Realty Welcomes Sharon Burke to its Pearl River, NY and Closter, NJ Offices

Better Homes and Gardens Rand Realty announced that Sharon Burke, a top producer in Rockland County, NY and Northern NJ, has joined its Pearl River and Closter, NJ offices.

Better Homes and Gardens Rand Realty announced that Sharon Burke, a top producer in Rockland County, NY and Northern NJ, has joined its Pearl River and Closter, NJ offices.

Sharon, who has risen to achieve great successes in the last three years since transitioning from her work as a Senior Analyst of Performance Assurance & Compliance at Verizon Wireless, is known for helping both buyers and sellers reach their goals. In her previous position at Verizon Wireless, she identified and addressed risks in the Customer Care, Retail & Enterprise Channels. She has also held executive positions at NYNEX Mobile as Manager of Customer Acquisition Advertising, and at Jordan, McGrath, Case & Taylor Advertising as a Management Supervisor.

Sharon says that taking the time to get to know each client has been the key to her success. “Knowing that each transaction is different and requires its own understanding and approach, is what makes this job so interesting and exciting. I thrive on understanding first and then determining the best way to move forward,” she said.

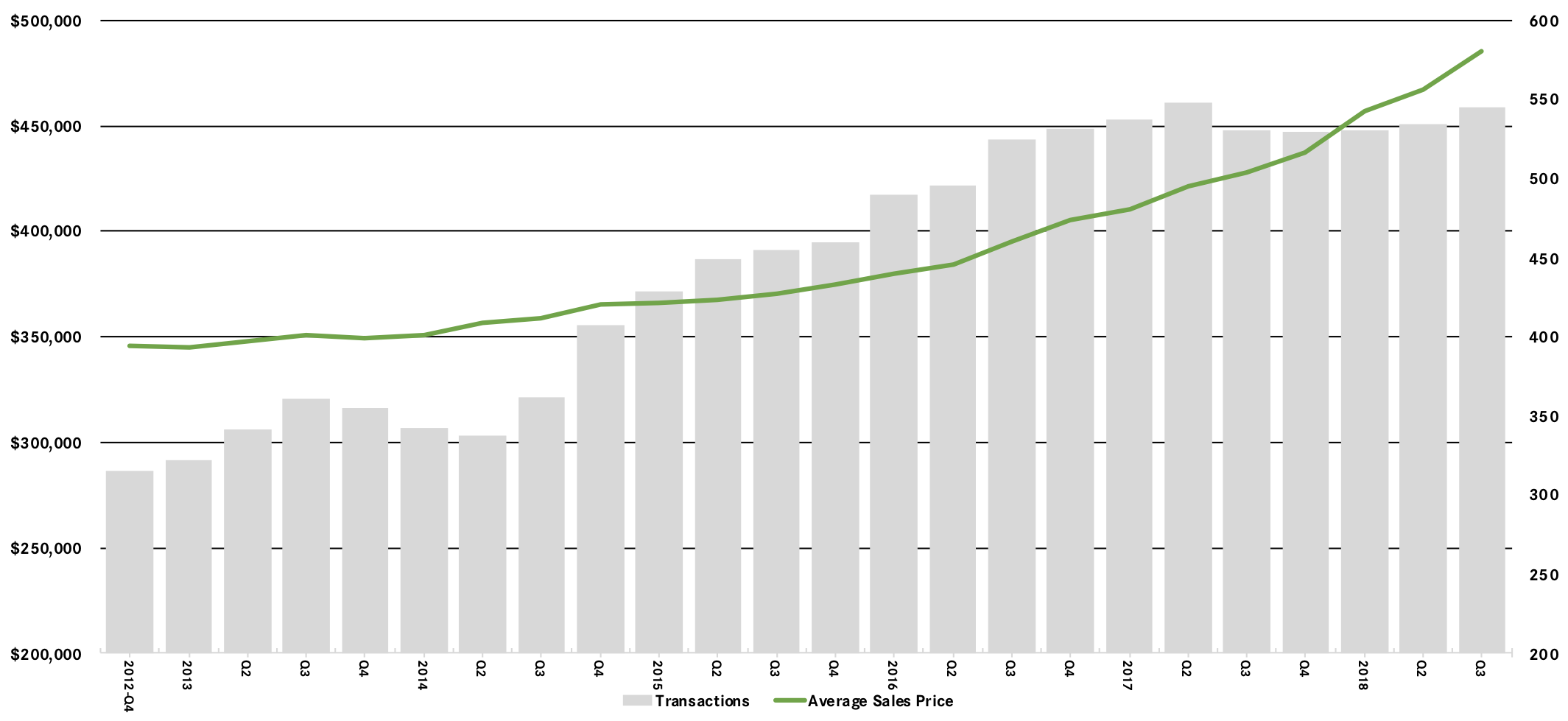

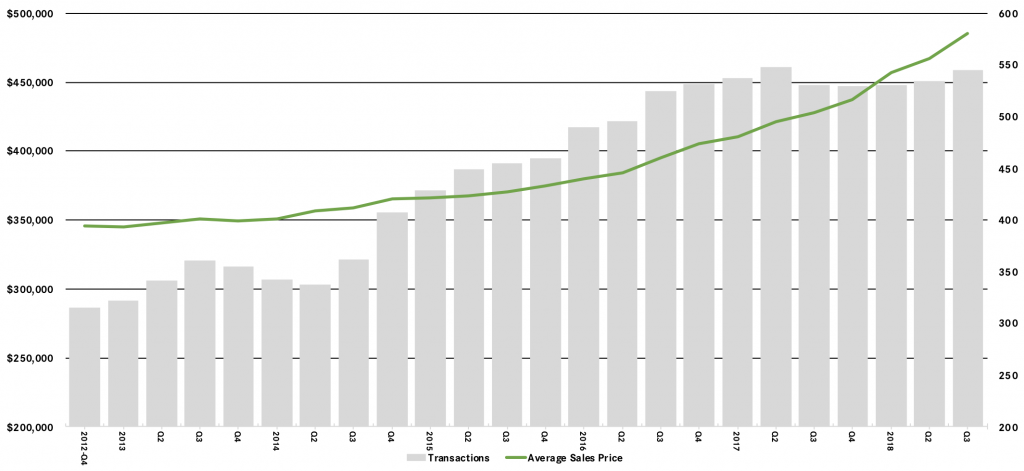

Real Estate Market Report: Third Quarter 2018 – The Bronx

With Better Homes and Gardens Rand Realty’s recent expansion into the Bronx, we are delighted to present the Rand Quarterly Market Report for Bronx County. We have been providing these quarterly market analyses or almost 15 years for the markets we service, which include Westchester and the Hudson Valley, Northern New Jersey, and now the Bronx. We hope you enjoy the Report, and if you have any questions, please reach out to your Rand Realty agent.

With Better Homes and Gardens Rand Realty’s recent expansion into the Bronx, we are delighted to present the Rand Quarterly Market Report for Bronx County. We have been providing these quarterly market analyses or almost 15 years for the markets we service, which include Westchester and the Hudson Valley, Northern New Jersey, and now the Bronx. We hope you enjoy the Report, and if you have any questions, please reach out to your Rand Realty agent.

The Bronx housing market surged again in the third quarter of 2018, with both prices rising sharply in a growing seller’s market, even while low levels of inventory held back sales growth. Going forward, we expect that strong demand will continue to drive meaningful price appreciation through the end of the year and into 2019.

Prices were up across the board. The average price rose almost 12% from the third quarter of last year and was relatively balanced: Single‑family homes were up almost 10% on average and 6% at the median; multi‑families were up 11% on average and almost 10% at the median; coops were up 2% on average, but almost 20% at the median; and condos were up over 12% on average and over 3% at the median. Moreover, we’re seeing sustained price appreciation, with the average price rising almost 11% for all property types and up in every market.

But sales were flat overall, and for most property types. For the borough as a whole, sales fell just a tick during the quarter, even while finishing the rolling year up 6%. Most likely, we’re just seeing the impact of restricted inventory holding back sales, with the market lacking enough “fuel for the fire” to satiate demand. We would expect that these rising prices will eventually tempt more sellers into the market, which could help drive sales up.

Inventory continues to fall. We measure inventory by looking at the number of homes available for sale, and the rate at which homes are selling. A balanced market has about six months of inventory, meaning that at the current rate of home sales, it would take six months to sell all the homes currently available. What we’re seeing, though, is a clear sign of a seller’s market, with the months of inventory well below six months for all property types: 5.2% for single‑family homes, 6.0% for multi‑family, 5.3% for coops, and 4.8% for condos. Inventory might be stabilizing, though, something we’ll be watching in the fourth quarter.

Overall, this is exactly what a robust seller’s market looks like. We have high demand and falling inventory driving sales and prices up throughout the borough. Textbook economics tells us that rising prices will eventually attract more sellers into the market, but in the meantime, we can expect that high demand will continue to drive prices up through a strong fourth quarter and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Editor’s Note: This report includes only those sales reported through the Hudson Valley Gateway Multiple Listing Service.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link