Fourth Quarter 2019: Real Estate Market Report – Hudson County, New Jersey

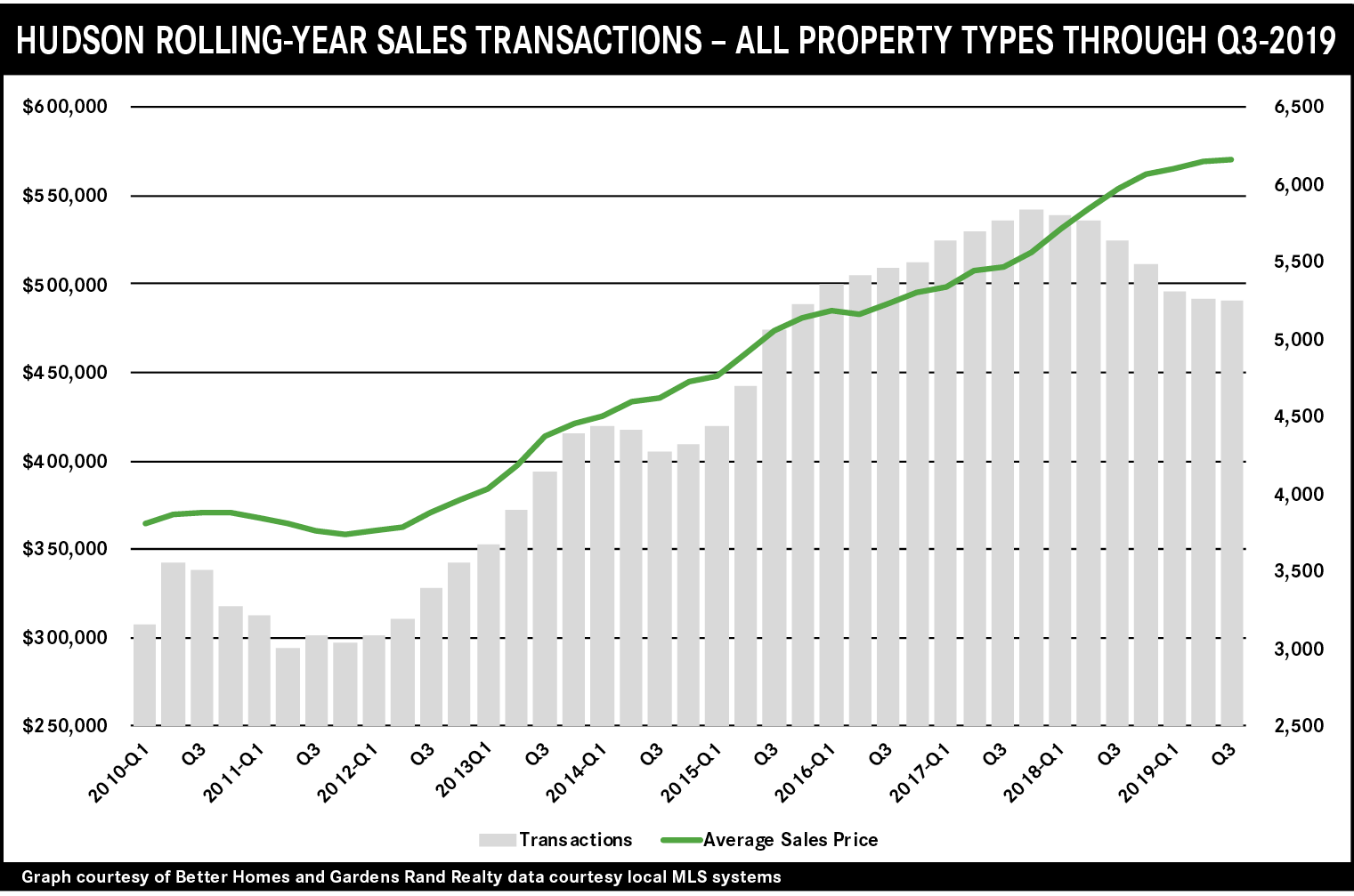

The Hudson County housing market continued to struggle toward the end of 2019, fighting through the impact of the 2018 Tax Reform’s cap on state and local tax deductions (“SALT Cap”). The SALT Cap has had a disproportionate impact on higher-end home buyers, which has slowed down the Manhattan housing market and adjacent high-priced markets like the Hudson County “Gold Coast.” For the quarter, overall sales fell 8%, finishing the 2019 calendar year down over 5% and down for all property types. Average pricing was down a tick, mostly driven by a 6% decline in condos, offsetting a 3% increase for single-family homes and a 9% increase for multi-families. For the 2019 calendar year, overall pricing was up a little over 1%, the lowest year-on-year price increase since 2011, at the bottom of the market. That said, the average price of a Hudson County home is now at an all-time high, after a staggering nine-year run of sharp appreciation. Going forward, we expect that the SALT Cap’s impact will eventually get priced into the market, and believe that the seller market fundamentals are strong: a growing economy, low-interest rates, and relatively low levels of inventory. Accordingly, we expect to see the market stabilize in the first quarter and throughout 2020.

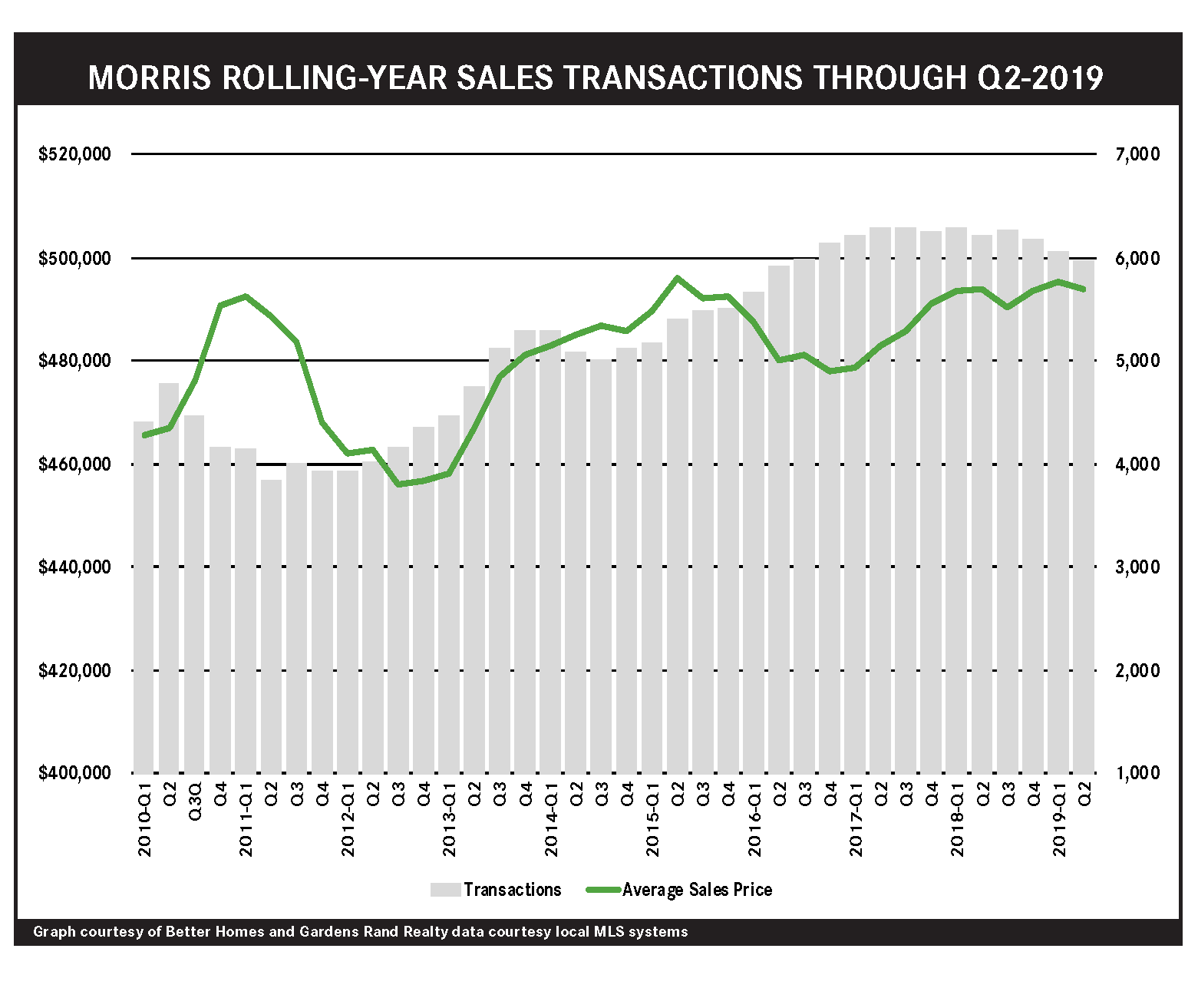

Fourth Quarter 2019: Real Estate Market Report – Morris County, New Jersey

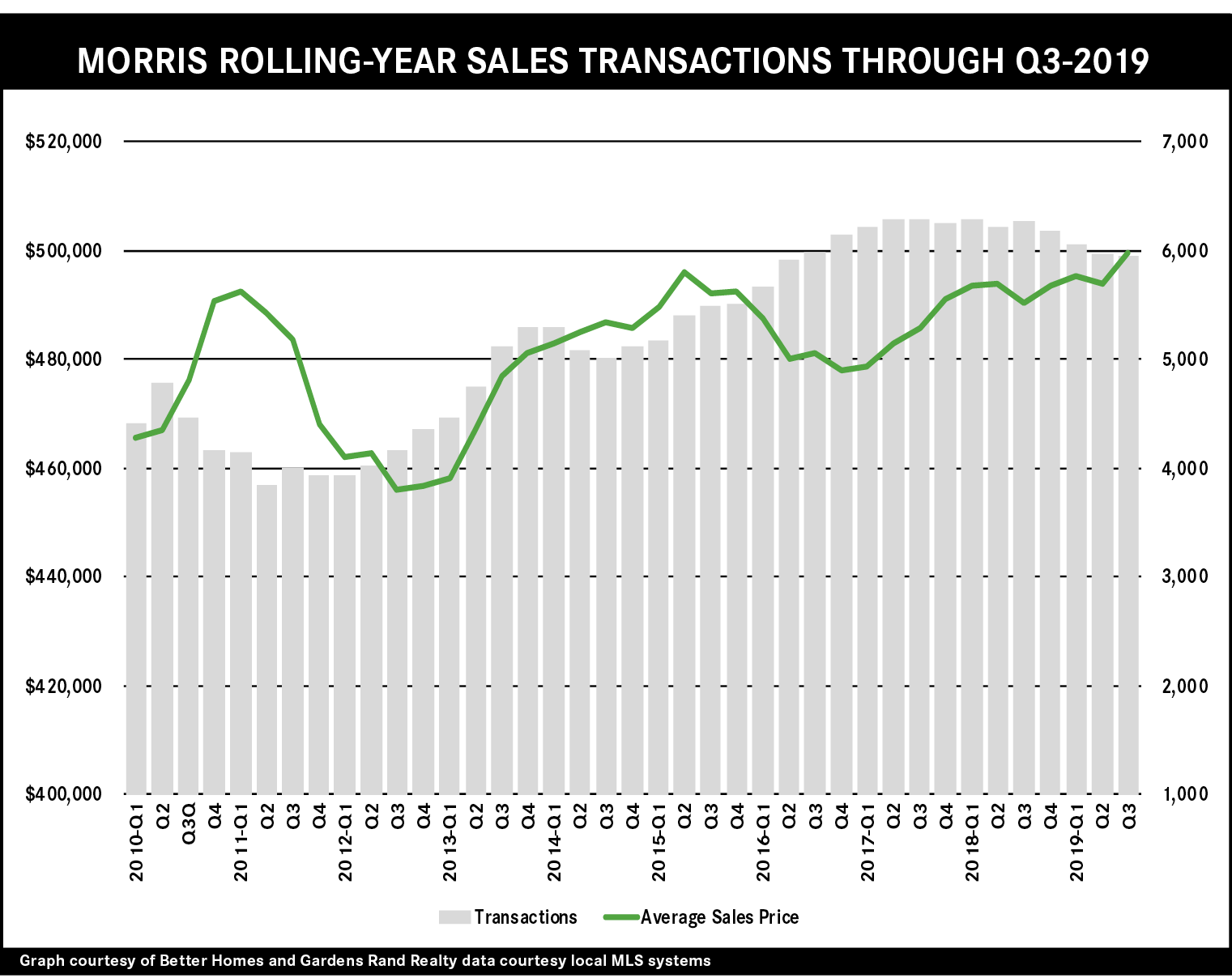

The Morris County housing market saved its 2019 year with a surge of activity in the fourth quarter. Sales were up over 12% from last year’s fourth quarter, which helped Morris finish the year basically flat in transactions – after being down sharply for most of the year. Quarterly prices were up from last year’s fourth quarter as well, rising a tick on average but up over 2% at the median. That helped drive positive price appreciation for the calendar year, with prices up over 1% on average and almost 3% at the median. Indeed, with the average price for the year just a shade under $500,000, we have now seen pricing come to its highest levels since the height of the seller’s market in 2005-06. Going forward, we believe the market is poised for both sales and price growth in 2020: the market fundamentals are strong, with prices still below historic highs, interest rates are low, and the economy is thriving.

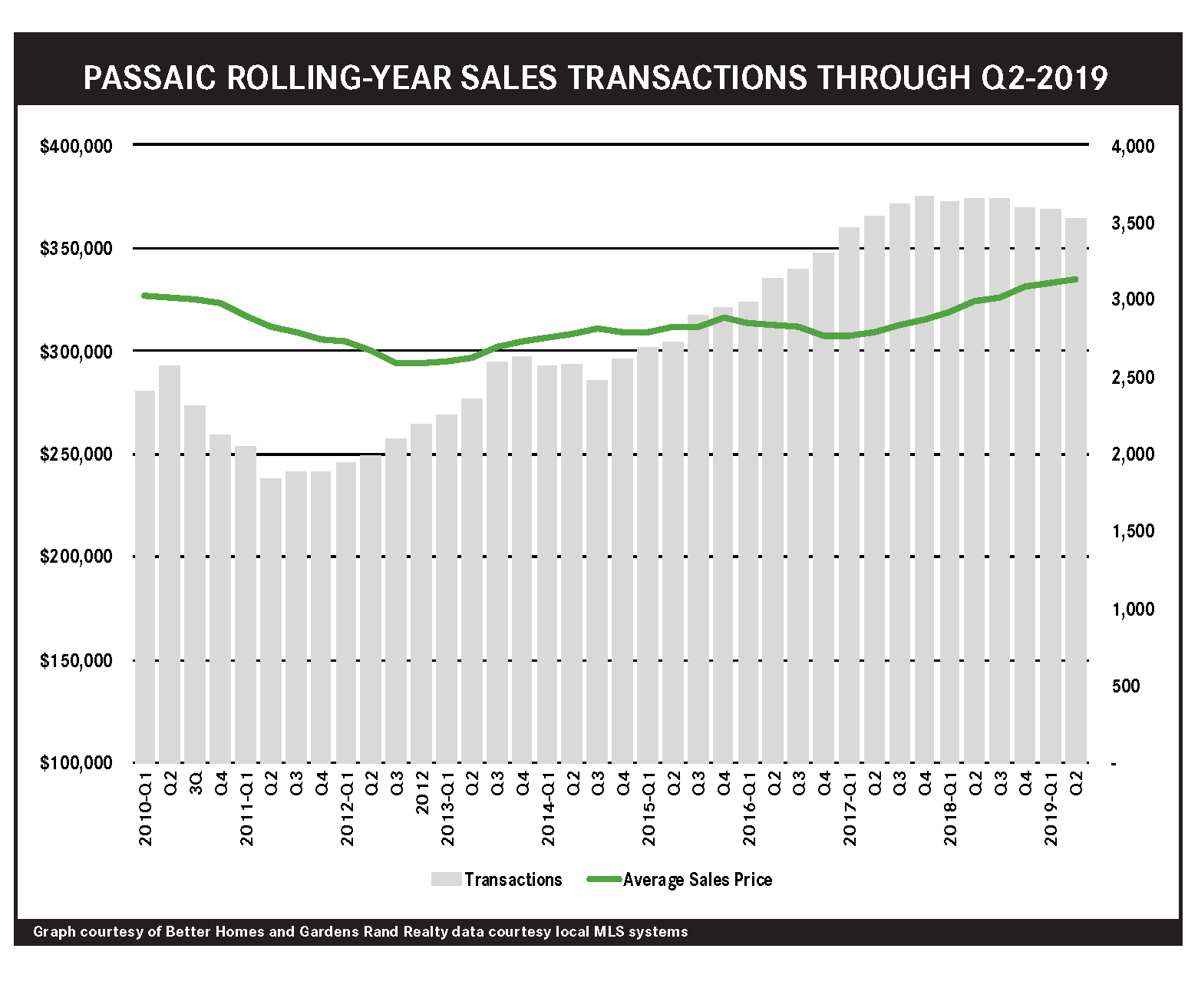

Fourth Quarter 2019: Real Estate Market Report – Passaic County, New Jersey

The Passaic County seller’s market continued through the fourth quarter of 2019, finishing the year with a flourish. Prices keep going up, with the average price rising almost 8% for the quarter and over 4% for the rolling year, and the median price up almost 7% for the quarter and 4% for the year. Indeed, Passaic pricing is at its highest levels since the height of the seller’s market in the 2005-06 era. And while relatively low levels of inventory held back sales growth for the 2019 calendar year, we did see sales go up over 2% for the quarter. Going forward, we believe that the market fundamentals are strong, with prices still below historic highs, interest rates low, and the economy thriving, so we expect both sales and price growth through a robust 2020.

Fourth Quarter 2019: Real Estate Market Report – Bergen County, New Jersey

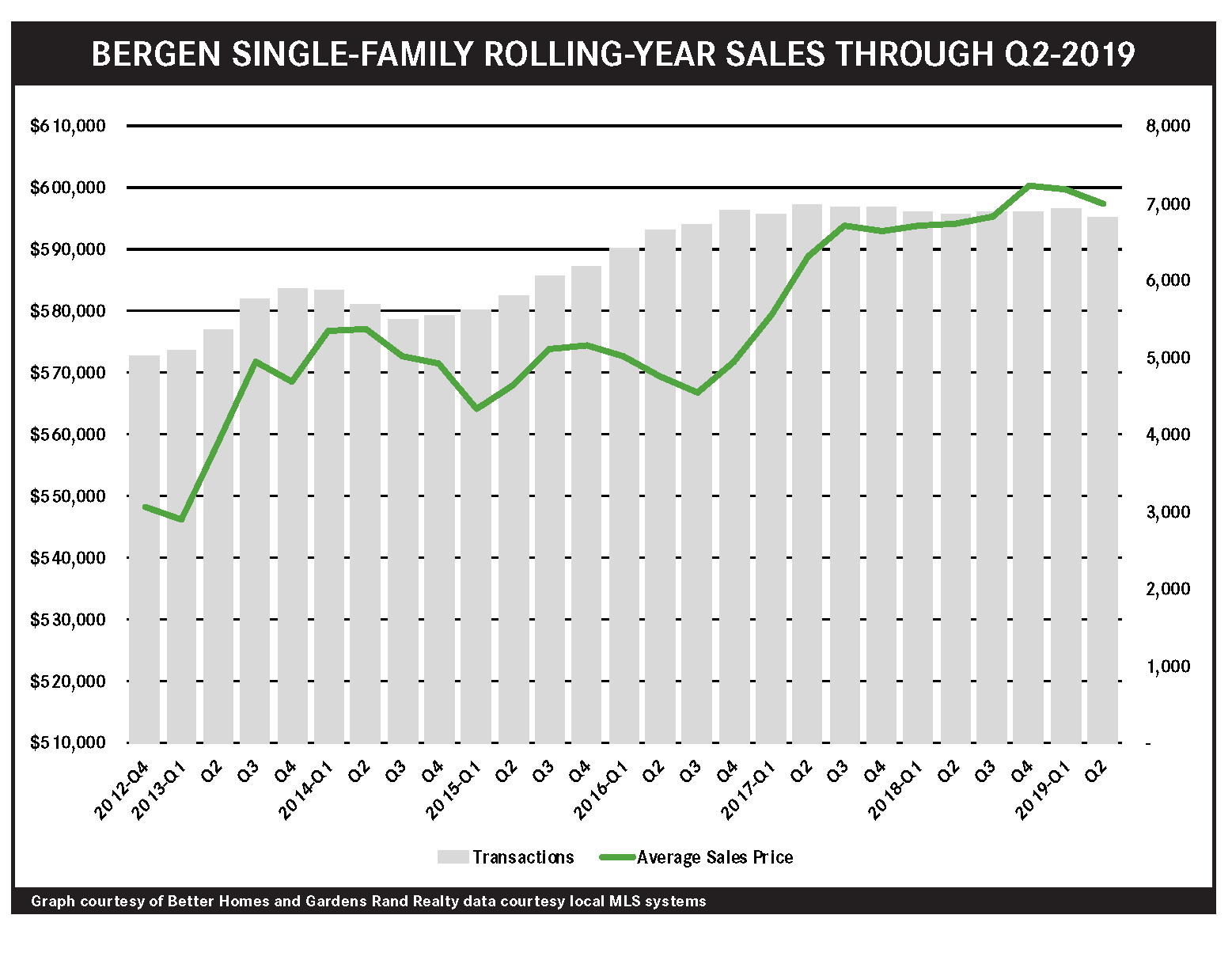

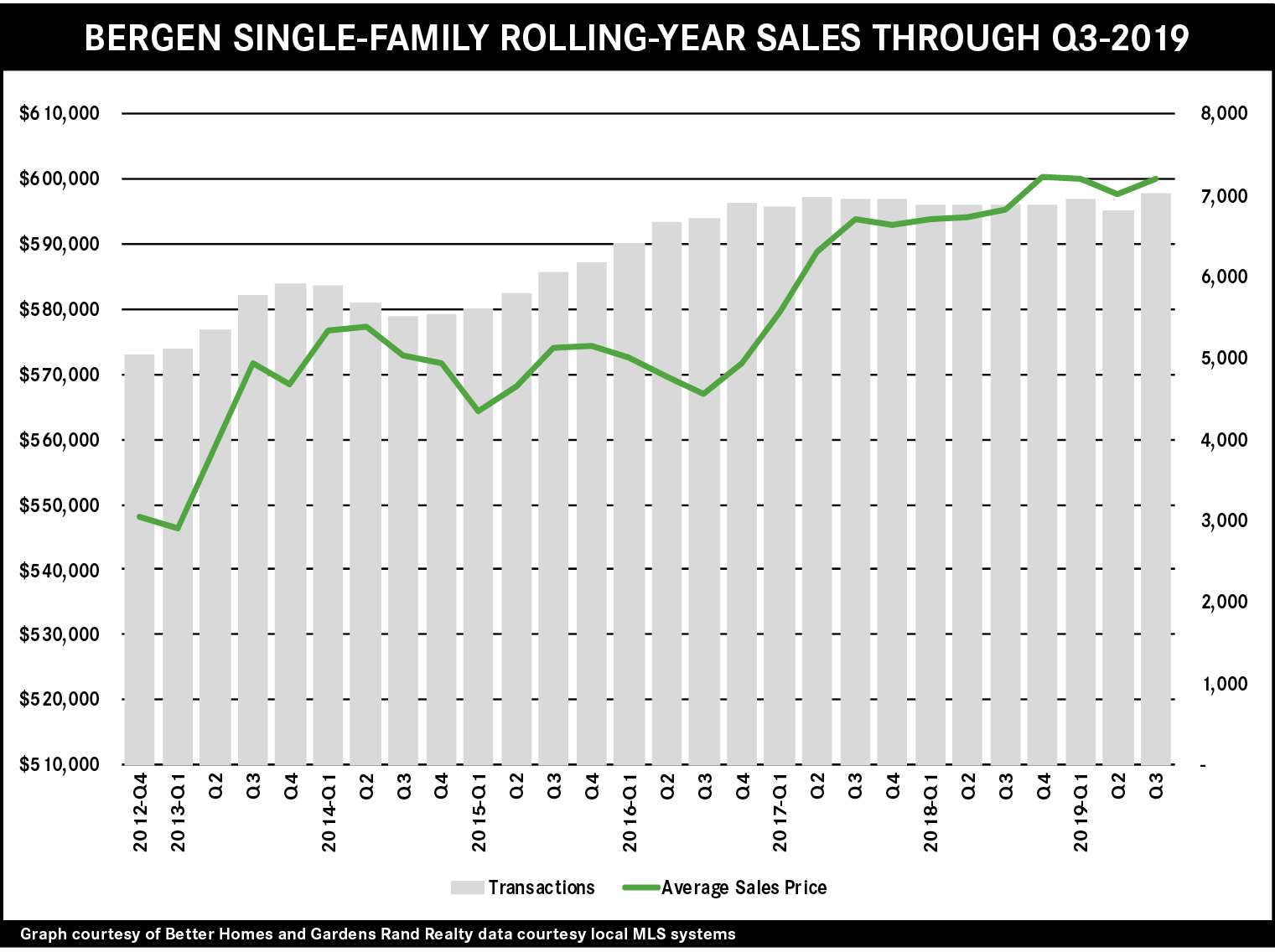

The Bergen County housing market finished the year with a solid increase in activity and modest rise in pricing. Single-family home sales were up over 4% from the fourth quarter of last year and finished the 2019 year up almost 3%. Moreover, single-family pricing was generally up, rising over 3% on average and 1% at the median for the quarter, and finishing the 2019 year up modestly. The condo market was more mixed, with prices down even while sales were up about 1% for the quarter and the year. Note, though, that condo prices in the fourth quarter of 2018 spiked dramatically, rising over 15% to an all-time high. So the baseline makes the price decrease a little misleading. In comparison, the average condo price is up over 11% from the fourth quarter of 2017, so the overall longer-term trend is solidly robust. Going forward, we believe that Bergen is set up for meaningful sales and price growth in 2020, with prices still lower than the height of the market, interest rates near historic lows, and a growing economy.

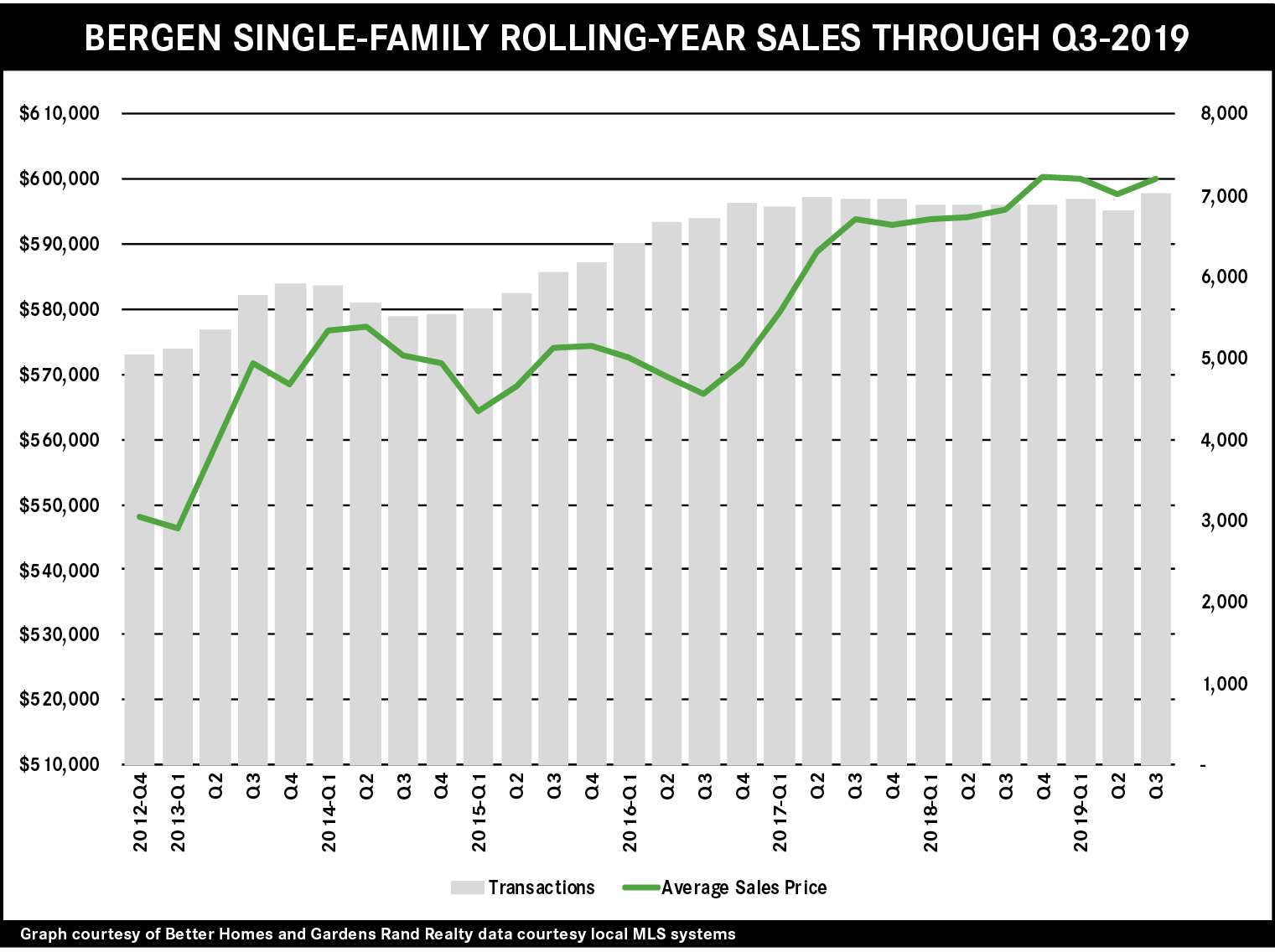

Third Quarter 2019: Real Estate Market Report – Bergen County, New Jersey

The Bergen County housing market cruised through the third quarter of 2019, with increases in both sales and prices. Single‑family home sales were up almost 5%, and are now positive for the rolling year. And prices were up, rising 1.5% on average even though flat at the median. We believe that the market is being hampered by both a lack of viable inventory and the 2018 Tax Reform cap on state and local tax deductions (the “SALT Cap”), which hits particularly hard in higher‑priced markets like Bergen. Going forward, though, we believe that inventory will eventually start to rise as more sellers are tempted into an appreciating market. Also, we expect that at some point the effects of the SALT Cap will get priced into the market. With prices still lower than their heights from the last seller’s market, interest rates near historic lows, and a growing economy, we believe that Bergen is poised for sales and price growth through the winter and into the spring market.

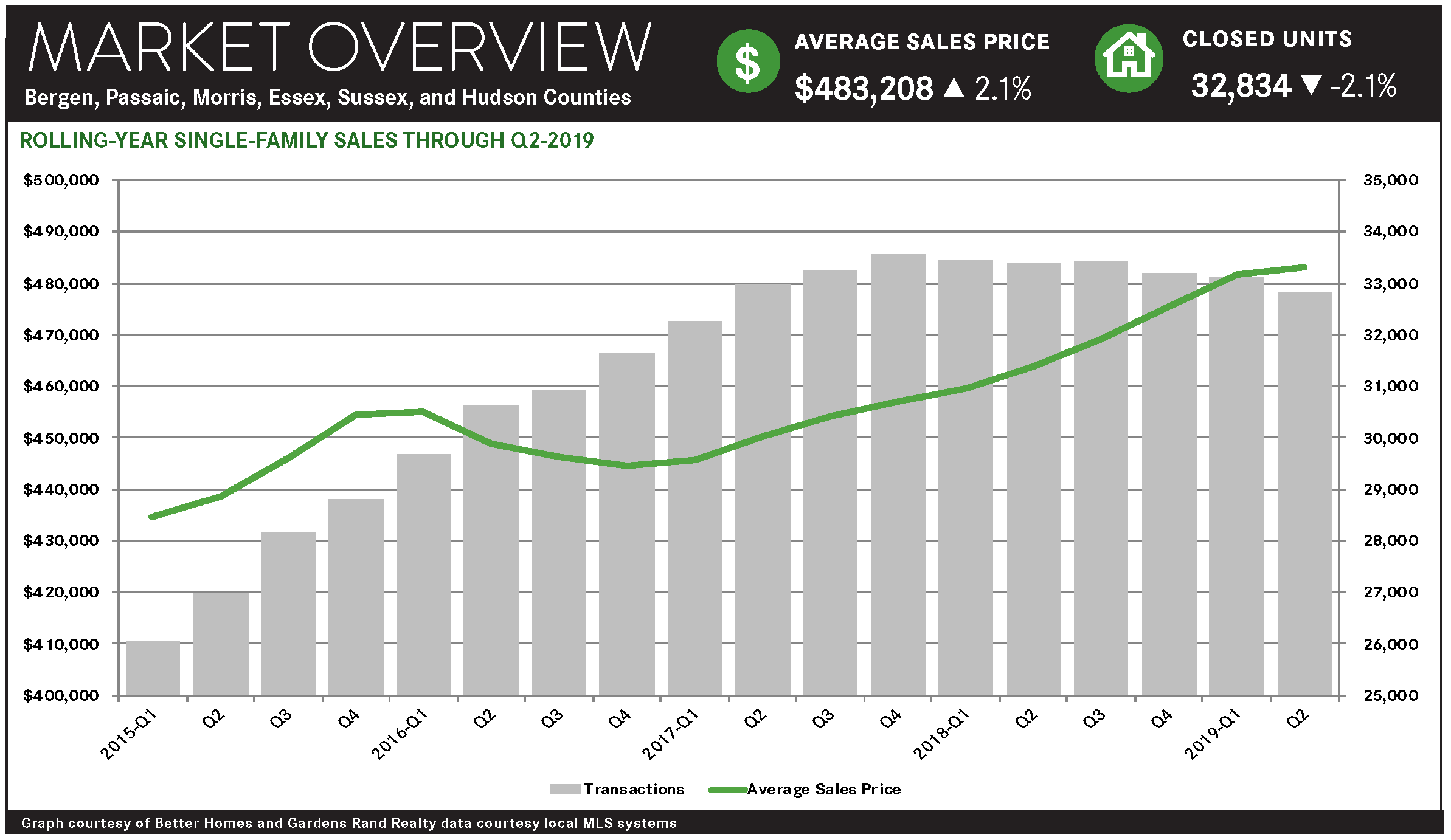

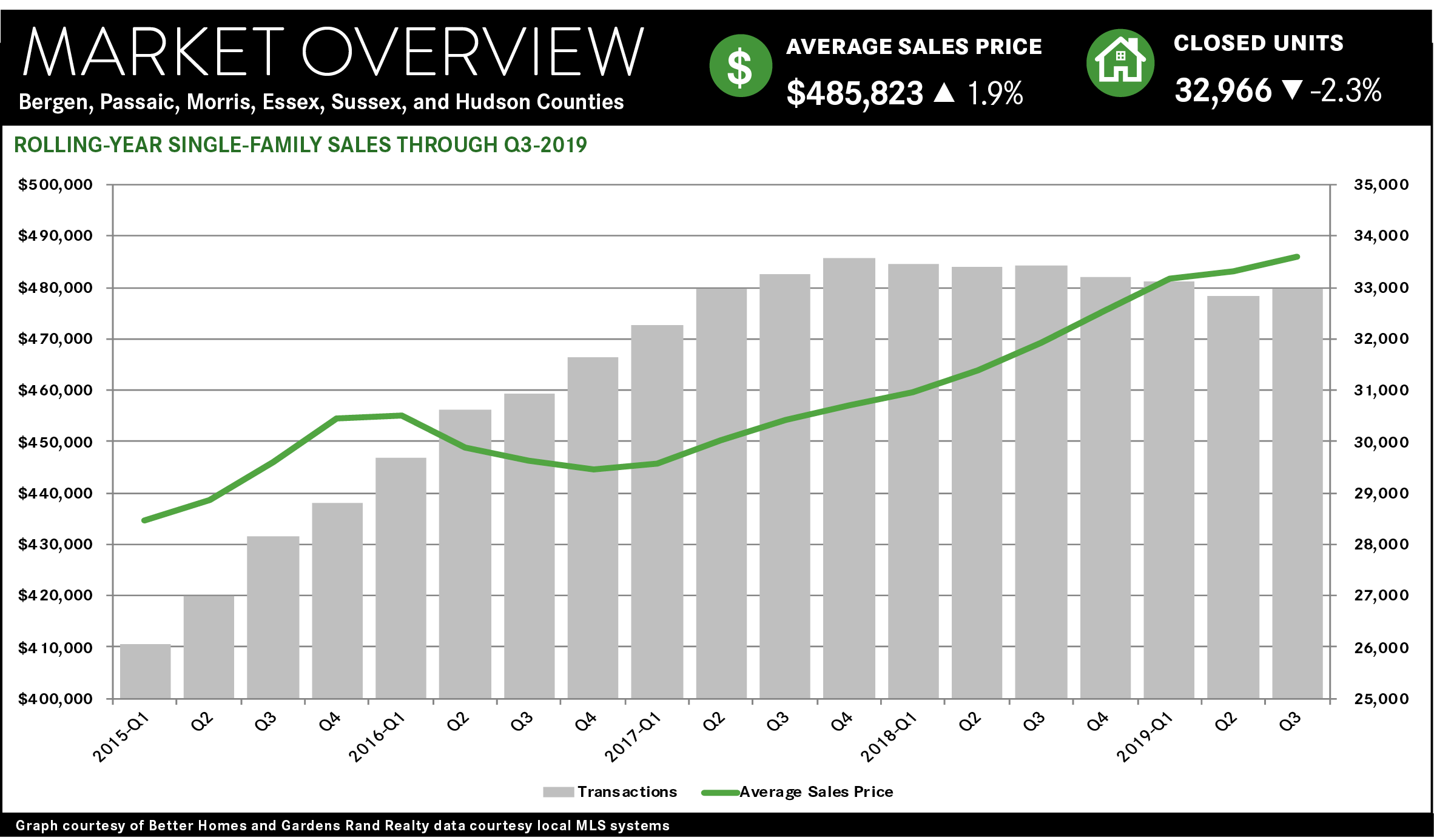

Third Quarter 2019: Real Estate Market Report – Northern New Jersey

The Northern New Jersey housing market experienced modest but meaningful price appreciation through the third quarter of 2019, even while sales growth was stifled by a lack of inventory and the impact of the 2018 Tax Reform cap on state and local tax deductions (i.e., the “SALT Cap”). Going forward, we believe that strong housing fundamentals will continue to drive appreciation and eventually more sales through the fourth quarter and into 2020.

Regional sales were down just a tick, with the results varying by county. Regional single‑family sales fell 0.3% for the quarter, and are now down 2.3% for the rolling year. But the results varied significantly by county: sales were up for Bergen, Essex, and Sussex, but down in Passaic, Morris, and Hudson. Generally, the SALT Cap has suppressed buyer demand at the very highest end of the market, where home buyers who itemize their deductions are more likely to feel the pinch. This is holding down sales, but we’re not seeing any consistency across the region in how that dynamic is playing out.

Conversely, prices were up regionally, rising in most of the individual counties. For the region, the average price was up 1.8% for the third quarter, finishing a rolling year where prices rose by 1.9%. And they were generally up within each county in the region, down only for condos in Bergen and Hudson – which might indicate that the slowdown in Manhattan is starting to spread to the geographically adjacent markets.

We still believe that this market is poised for significant growth. The sluggishness in sales is not due to a lack of inherent demand, but is largely caused by (1) a lack of inventory and (2) the SALT Cap. But both those challenges might be dissipating. Inventory remains near or below the six‑month level that usually denotes a seller’s market, but it is starting to go back up as more sellers are tempted into a rising pricing market. And the SALT Cap continues to have a suppressive effect on upper-income buyers, but will eventually get priced into the market and open up the high end a little more.

Going forward, we expect the market to continue to appreciate through 2020. The seller market fundamentals are very strong: the economy is growing, interest rates are near historic lows, inventory is relatively low, and homes are priced well below their last seller market highs. Accordingly, we expect that sales and prices will show some modest strength through the winter, leading into a robust spring market.

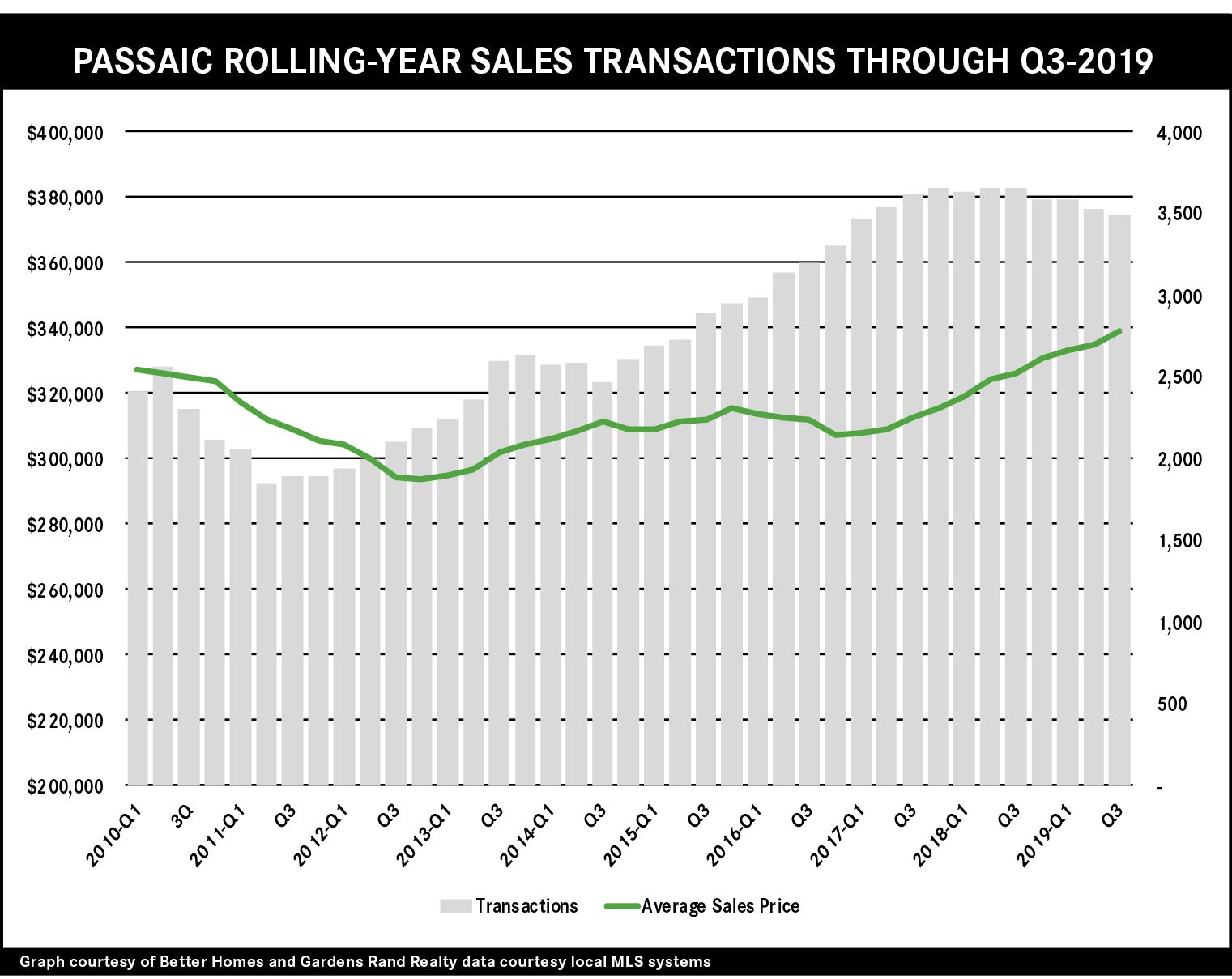

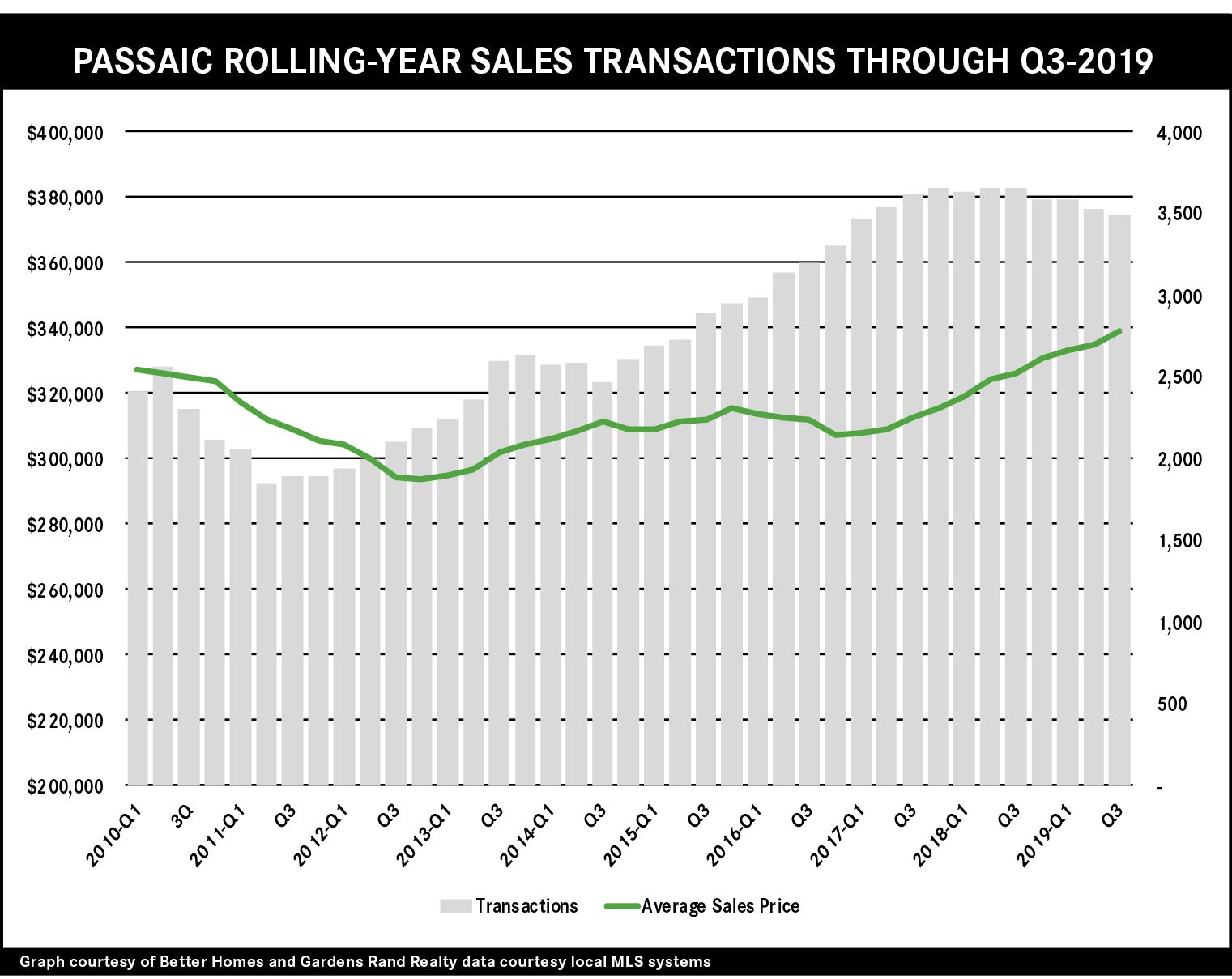

Third Quarter 2019: Real Estate Market Report – Passaic County, New Jersey

The Passaic County seller’s market continued through the third quarter of 2019, with limited inventory driving strong price appreciation even while it held back sales growth. Prices keep going up, with the average price rising almost 5% for the quarter and over 4% for the rolling year. And while relatively low levels of inventory are still stifling sales growth, causing a 3% decline in transactions this quarter, that inventory is starting to creep up as homeowners are getting tempted into the market by the rising prices. Going forward, we expect that higher levels of inventory will provide more “fuel for the fire,” which will push sales up a bit, but that strong demand will still drive meaningful price appreciation. The market fundamentals are strong, with prices still below historic highs, interest rates low, and the economy thriving, so we expect both sales and price growth through the winter and into 2020.

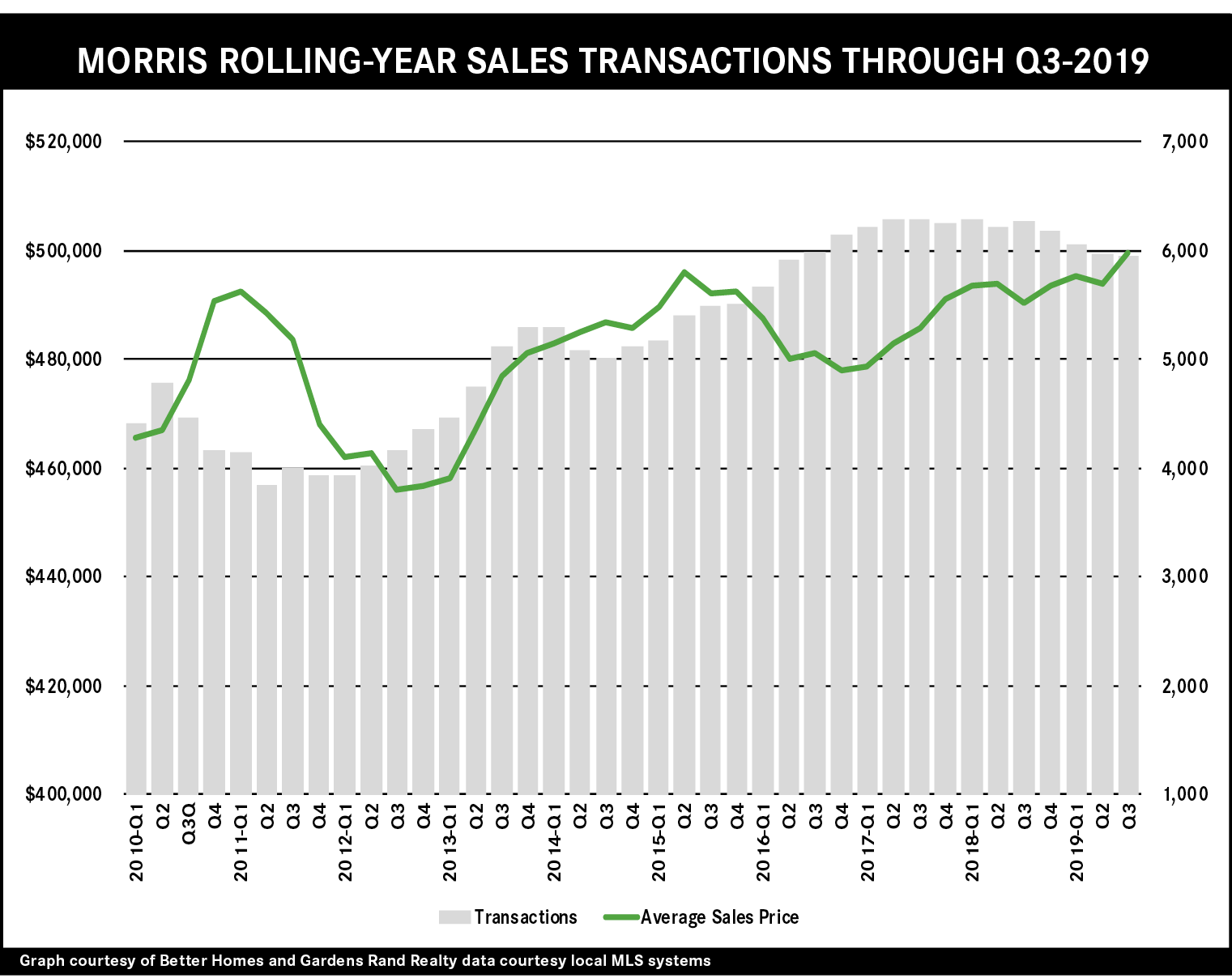

Third Quarter 2019: Real Estate Market Report – Morris County, New Jersey

The Morris County housing market surged forward in the third quarter of 2019, with prices rising sharply even while limited inventory stifled sales growth. Prices experienced their biggest quarterly jump in over two years, rising almost 4% on average and 5% at the median compared to the third quarter of last year. For the rolling year, prices were up more modestly, reflecting how pricing has been a little more lackluster through most of 2019. Meanwhile, though, sales are down, falling 1% for the quarter and now down 5% for the rolling year, mostly because relatively low levels of inventory are stifling sales activity. But inventory went up almost 20% in the quarter, the largest increase in about 10 years, because sellers are starting to see prices go up and are getting tempted into the market. Going forward, we believe that if inventory continues to rise to meet buyer demand, the market is poised for both sales and price growth through the winter and into 2020. The market fundamentals are strong: the economy is solid, interest rates are back down to historic lows, and home values are still below their heights from the last seller’s market.

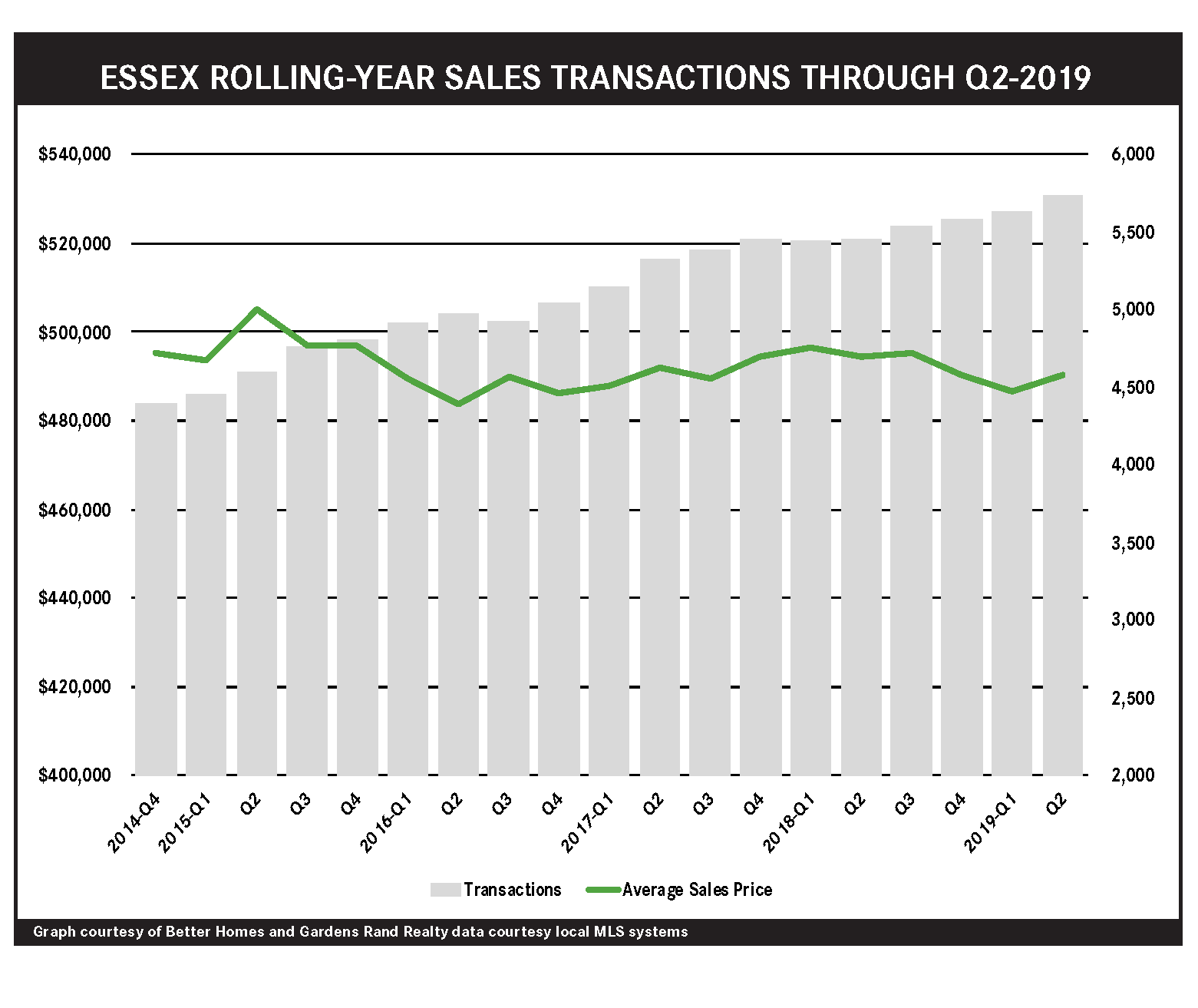

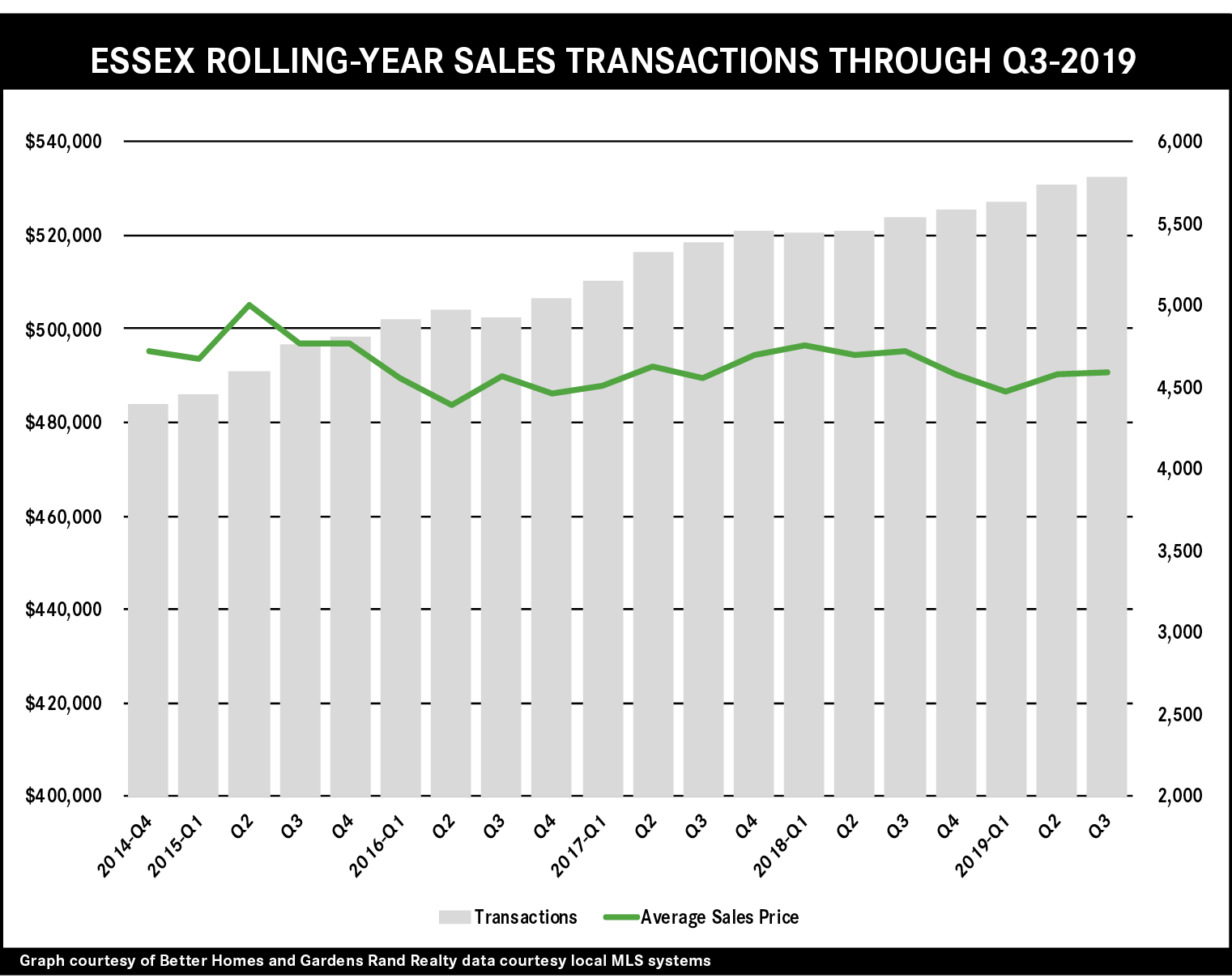

Third Quarter 2019: Real Estate Market Report – Essex County, New Jersey

Sales in the Essex housing market went up yet again in the third quarter of 2019, even while prices leveled off after some modest increases earlier in the year. Sales rose almost 3% for the quarter, and finished the rolling year up almost 5%. But this continued increase in sales is not yet having a sustained impact on pricing, which was flat on average and down almost 3% at the median compared to the third quarter of last year. And if you look at the rolling year, pricing is virtually flat, down just a tick on average and at the median. We might be seeing some impact from the 2018 Tax Reform’s $10,000 cap on state and local tax deductions (SALT Cap), which particularly affected higher‑income taxpayers like Essex County homeowners and home buyers, who are more likely to itemize their deductions and feel the pinch. Going forward, though, we expect that the SALT Cap’s impact will eventually get priced into the market, and believe that the seller market fundamentals are strong: a growing economy, prices well below historic highs, low interest rates, and low levels of inventory. Accordingly, we expect modest sales growth and appreciation through the winter and into the 2020 market.

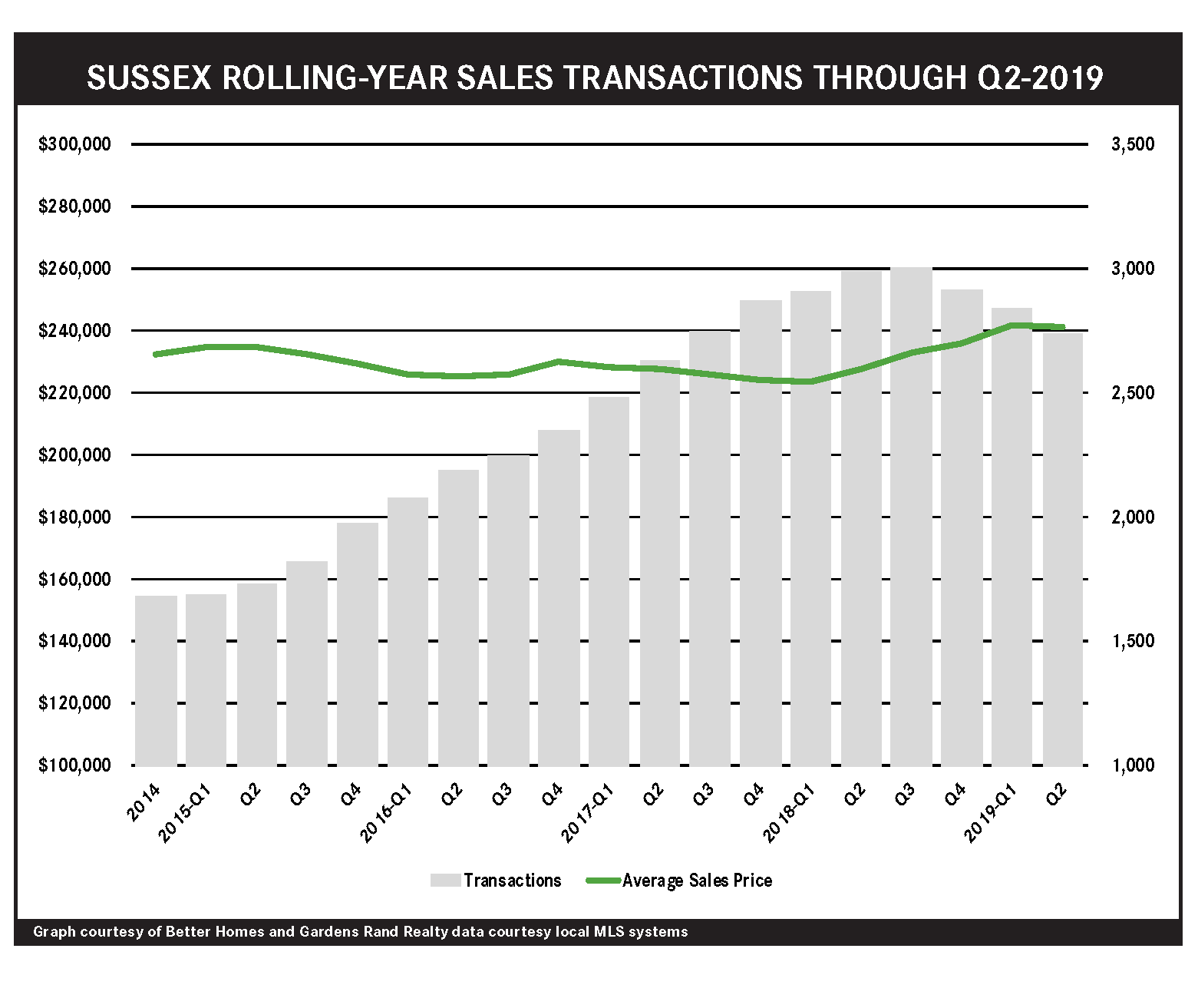

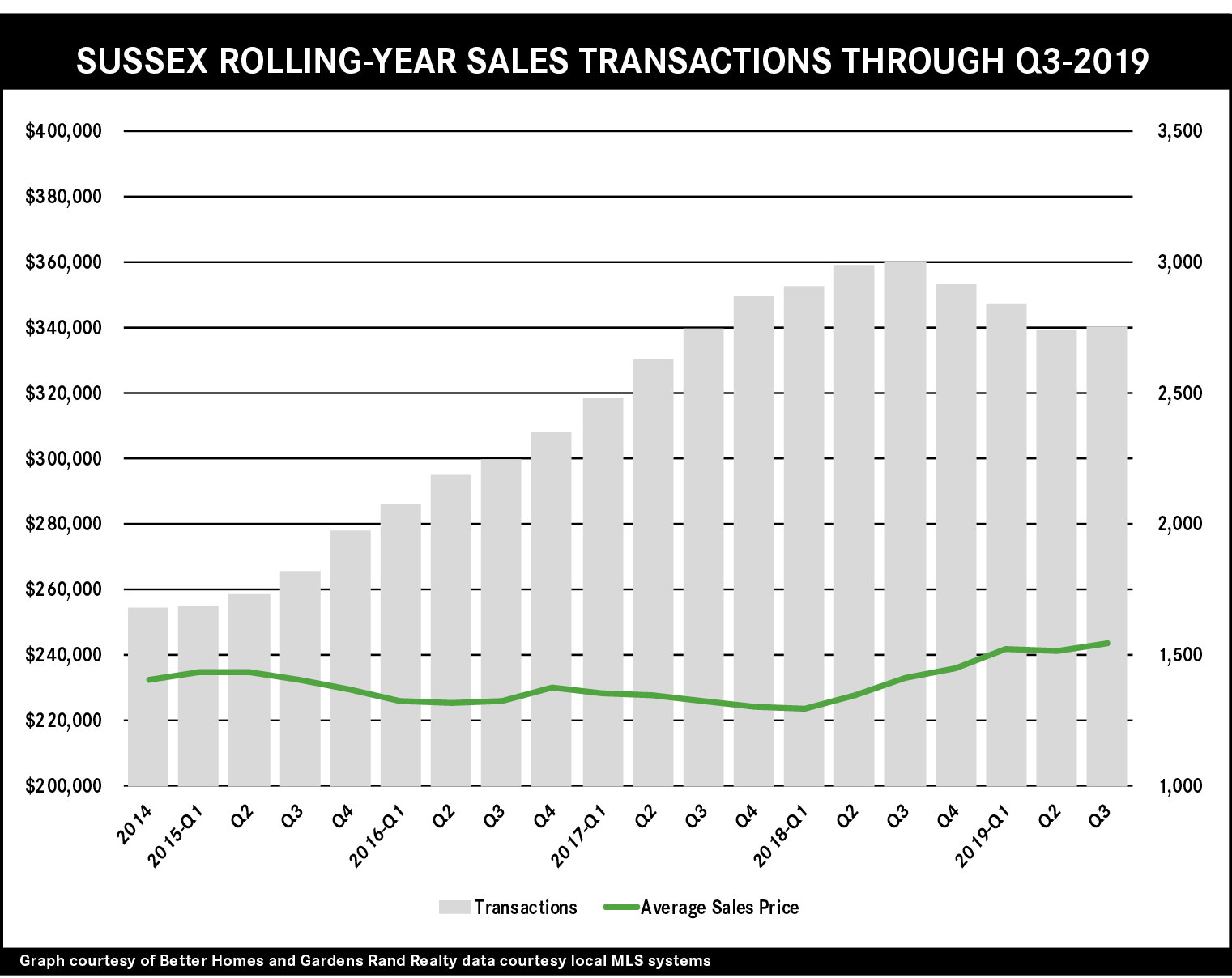

Third Quarter 2019: Real Estate Market Report – Sussex County, New Jersey

The Sussex County housing market showed significant signs of strength in the third quarter of 2019, with modest sales increases coupled with sharp price appreciation. Sales were up almost 2%, a welcome change from the past two quarters. Even with that quarterly increase, though, sales are still down over 8% for the rolling year. But the real story is pricing, which was up across the board: rising almost 3% on average and 8% at the median for the quarter, and finishing a rolling year up over 4% on average and 10% at the median. The other indicators support the theory that Sussex has moved into a seller’s market, with the days‑on‑market falling and the listing retention rate rising: homes are selling more quickly and for closer to the asking price, demonstrating that sellers are continuing to gain negotiating leverage with buyers. Going forward, we believe that the seller market fundamentals are strong: a growing economy, prices well below historic highs, low interest rates, and relatively low levels of inventory. So we expect to see continued appreciation and maybe even some sales growth through the winter and into 2020.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link