Second Quarter 2017 Real Estate Market Report – Northern New Jersey Market Overview

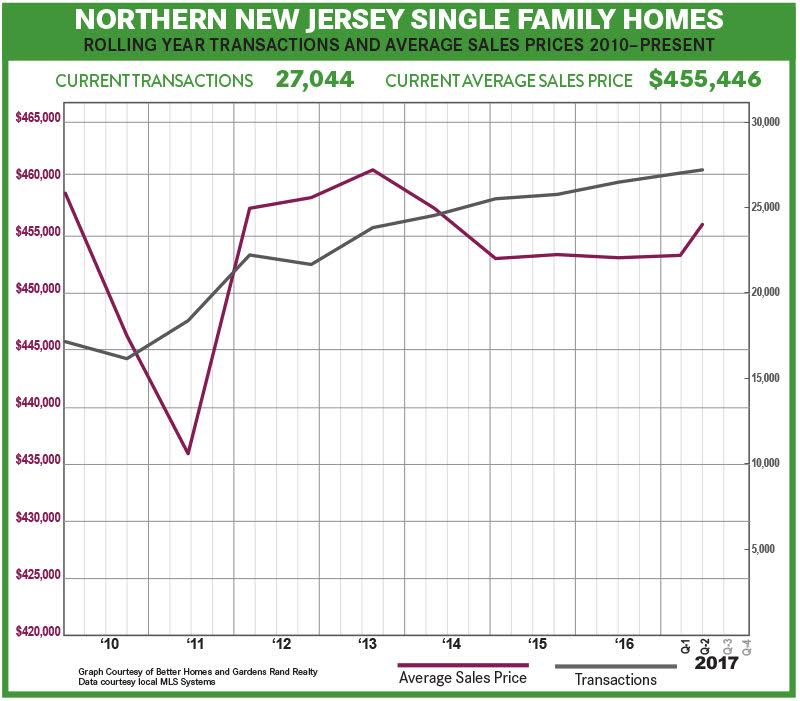

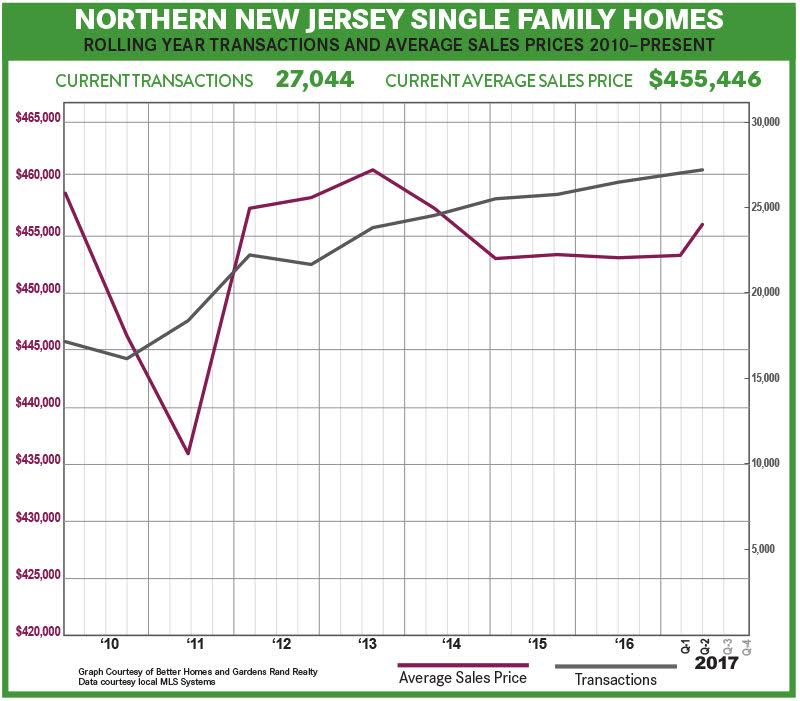

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

The Northern New Jersey housing market surged again in the second quarter of 2017, with another sharp increase in sales coupled with some more meaningful signs of price appreciation. With inventory levels continuing to fall throughout the region, we expect that sustained buyer demand will drive a robust seller’s market through the Summer and the rest of 2017.

Sales surged throughout the region. All the Northern New Jersey markets continued their strong start to the year, with regional sales up almost 8% and transactions rising in every market in the region: up 1% for Bergen houses, 9% for Bergen condos, 8% in Passaic, 3% in Morris, 13% in Essex, and 25% in Sussex. For the rolling year, sales were up almost 8%, reaching sales levels we have not seen since the height of the last seller’s market. Indeed, regional sales are now up over 70% from the bottom of the market in 2011.

The number of available homes for sale continues to go down. We calculate the “months of inventory” in a market by measuring the number of homes for sale, and then figuring how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up – and we’re now right at that level. Indeed, inventory was down from last year in every individual county in the Rand Report: Bergen single-family homes down 12%, and condos down 29%; Passaic down 31%; Morris down 31%; Essex down 24%; and Sussex down 26%. If inventory continues to tighten, and demand stays strong, we are likely to see more upward pressure on pricing.

With sales up and inventory down, prices are starting to show some “green shoots” of modest price appreciation. Basic economics of supply and demand would tell us that after five years of steadily increasing buyer demand, we would expect to see some meaningful price increases. And we’re starting to see some promising signs: the regional average sales price was up almost 2% from last year’s second quarter, and the average price was up in every county other than Sussex. Looking at the long-term, the rolling year average sales price was up just a tick, but was up in every county other than Passaic.

Going forward, we remain confident that rising demand and falling inventory will continue to drive price appreciation through the rest of 2017. Sales have now been increasing for five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe the region is poised for a robust Summer market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Dutchess County, New York

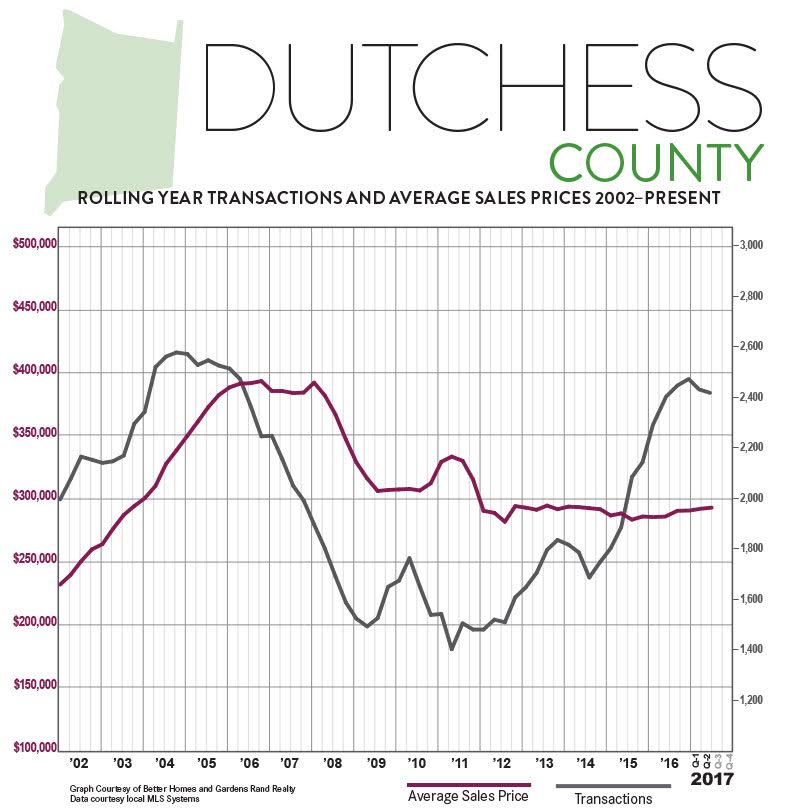

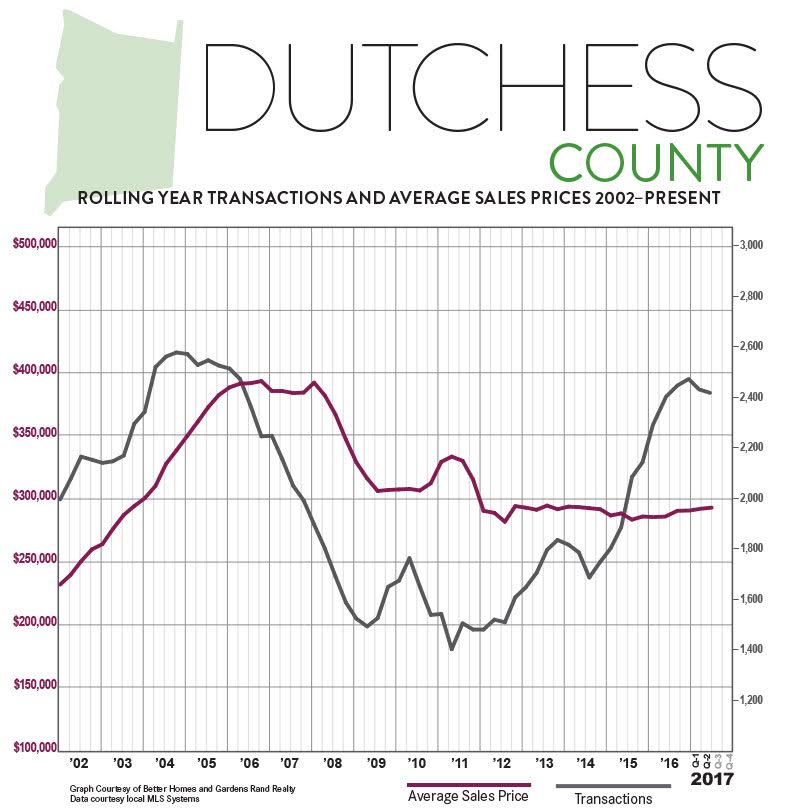

The Dutchess County housing market showed clear signs of an emerging seller’s market in the second quarter of 2017, with the first meaningful signs of price appreciation in years.

The Dutchess County housing market showed clear signs of an emerging seller’s market in the second quarter of 2017, with the first meaningful signs of price appreciation in years.

Sales. Dutchess sales were down a tick for the quarter, probably a reflection of falling inventory in the market. For the rolling year, sales are still up a tick, but Dutchess definitely needs some “fuel for the fire” to accommodate strong buyer demand.

Prices. Home prices showed the first signs of life in a long time, with pricing up across the board: rising almost 5% on average, 3% at the median, and over 8% in the price-per-square foot. We can see the same story in the rolling year numbers, indicating that Dutchess is moving into a sustained seller’s market.

Negotiability. Dutchess inventory declined sharply in the second quarter, down 51% from last year. This might be partly caused by a change in the way we are measuring Dutchess inventory, so we don’t know that the percentage change is reliable. But the prevailing months of inventory at 7.5 months does support the idea that we’re moving into a seller’s market.

Condominiums. The condo market was up sharply after a slow start to the year, with sales up almost 52% from the second quarter of last year. Similarly, prices were way up for the quarter, with meaningful appreciation for the rolling year. The condo market is in great shape right now.

Going forward, we still believe that the Dutchess market will have a strong summer. With tightening inventory, a stable economy, near-historically-low interest rates, and homes still priced at appealing 2003-04 levels, Dutchess is likely to see meaningful price appreciation through the end of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

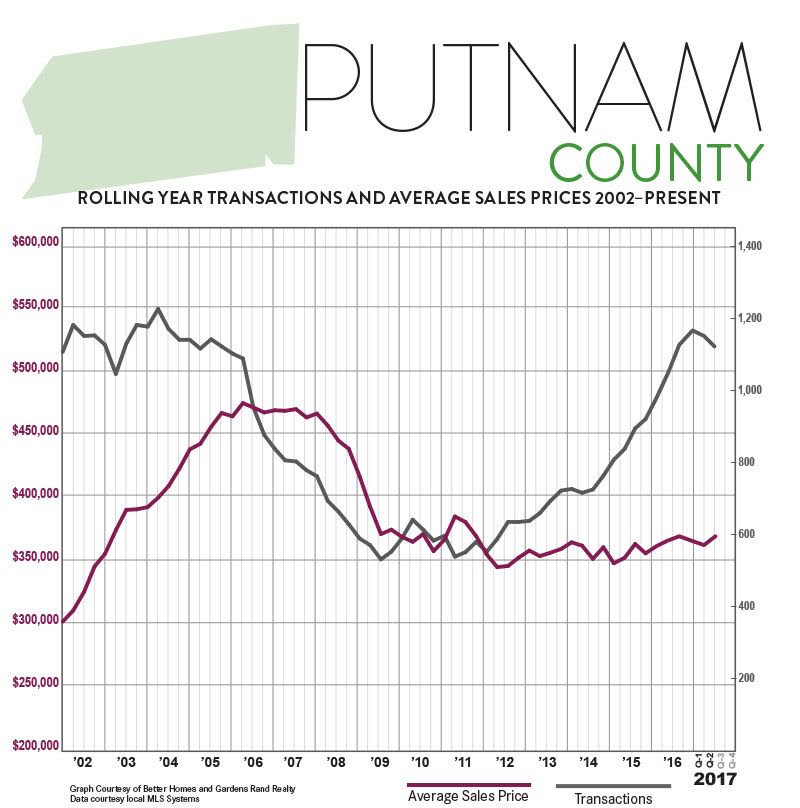

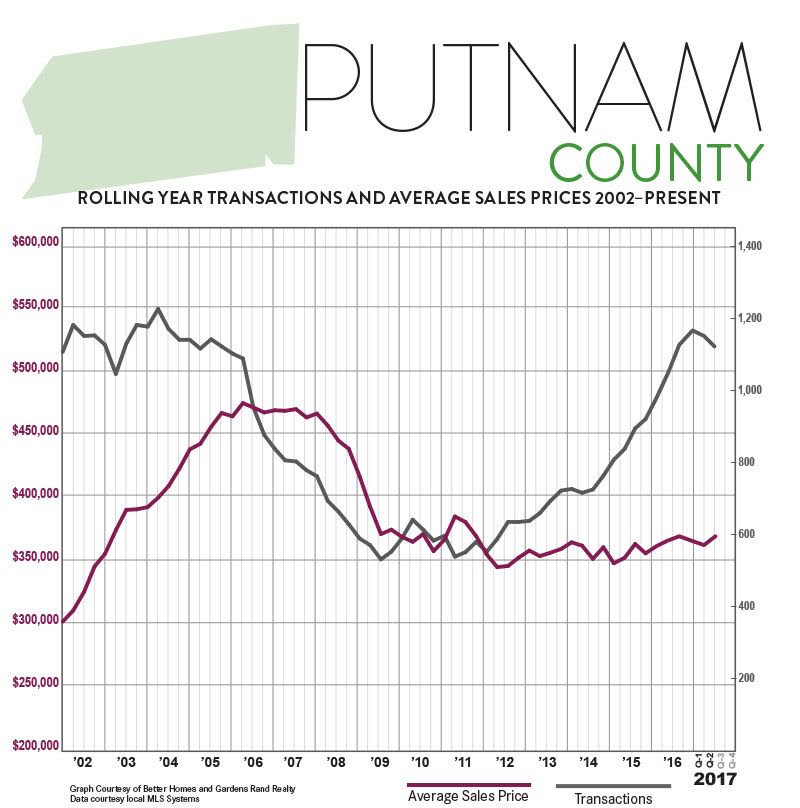

Second Quarter 2017 Real Estate Market Report – Putnam County, New York

The Putnam County housing market showed the clear signs of constricted inventory levels, with a slowdown in sales coupled with a spike in pricing.

The Putnam County housing market showed the clear signs of constricted inventory levels, with a slowdown in sales coupled with a spike in pricing.

Sales. Putnam single-family home sales were down over 12% for the quarter, the second straight quarter of a significant decline in transactions. After over five years of steadily increasing sales, Putnam is now seeing the impact of a lack of inventory, with sales now flat for the rolling year.

Prices. The lack of inventory is also having its impact on pricing, which was up across the board: rising over 6% on average, almost 10% at the median, and almost 2% in the price-per-square foot. For the year, the pricing results are more mixed, with the average down just a tick, the median up a tick, and the price-per-square-foot flat. We have been expecting meaningful appreciation in Putnam for some time now, and still believe that low levels of inventory and stable demand will continue to drive prices up this year.

Inventory. Inventory continued to tighten, falling 23% and now down to the six-month level that usually denotes a tightening seller’s market. This lack of available homes is what’s been restricting sales, since we don’t have enough “fuel for the fire” to keep the market going. But it’s also driving prices up, as buyers chase and compete for the limited inventory that’s available.

Negotiability. The negotiability indicators support the idea that a seller’s market is emerging, with the listing retention rate up just a tick and the days-on-market continuing to fall. This is exactly what we would expect in a strengthening seller’s market — homes selling more quickly and for closer to the asking price.

Condos. The impact of low inventory on the condo market was even more severe, with sales down almost 18%. In this case, though, prices also fell, dropping over 10% on average and over 13% in the median. The Putnam condo market is very thin, though, with only a few dozen sales, so we try not to read too much into one quarter’s worth of data.

Going forward, we believe that Putnam is poised for a strong 2017, especially if some new inventory comes onto the market to satiate the available demand. The fundamentals of the market are tremendous: inventory is low, rates are near historic lows, and prices are still at attractive 2004-05 levels.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

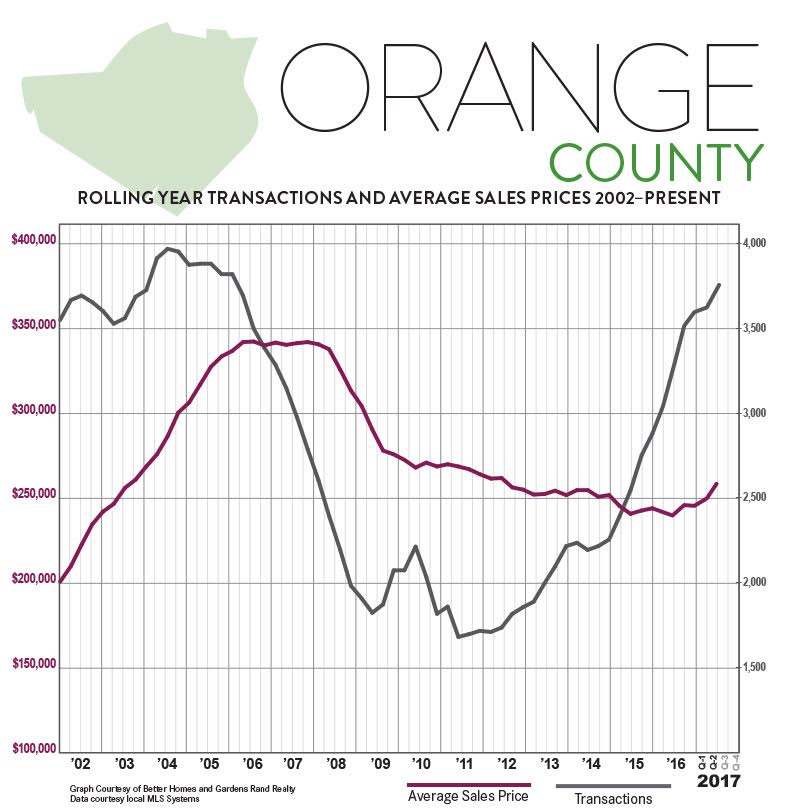

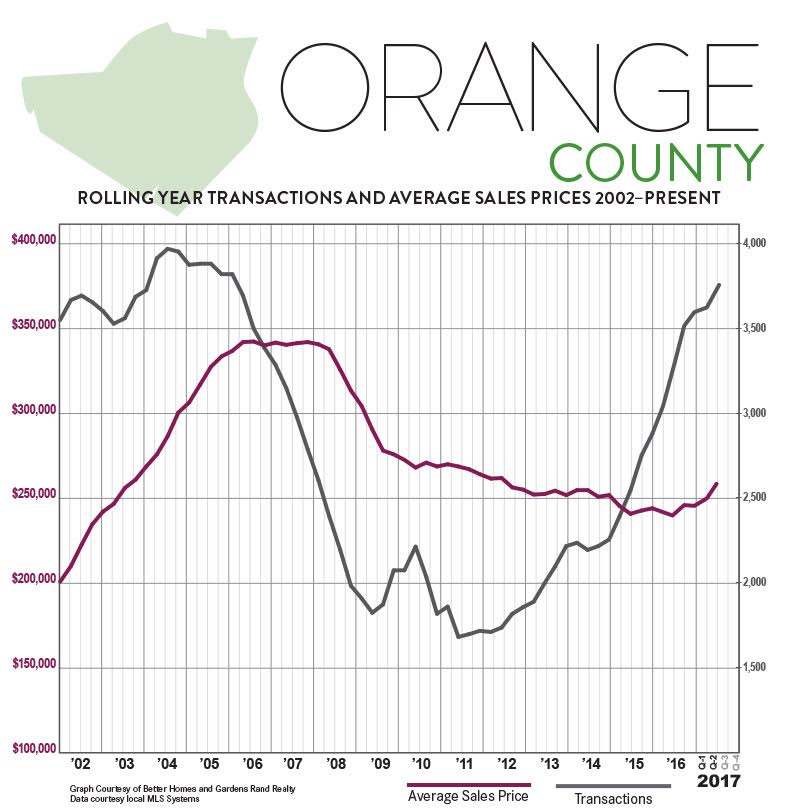

Second Quarter 2017 Real Estate Market Report – Orange County, New York

The Orange County housing market surged again in the second quarter of 2017, with both sales and prices up sharply while inventory continued to fall.

The Orange County housing market surged again in the second quarter of 2017, with both sales and prices up sharply while inventory continued to fall.

Sales. Orange sales were up yet again, rising over 6% from last year’s second quarter. Quarterly transactions have now gone up in 11 straight quarters and 20 out of the last 21. Indeed, for the rolling year, sales were up almost 13%, and the 3,655 single-family sales were the highest total we have seen since the second quarter of 2006 — at the height of the last seller’s market.

Prices. These sustained levels of buyer demand are finally having their expected impact on pricing. Home prices surged again in the second quarter, rising 9% on average, almost 7% at the median, and over 5% in the price-per-square foot. And home prices are now showing meaningful signs of appreciation over the longer-term, with the rolling year prices up over 5% on average, 4% at the median, and 3% in the price-per-square foot.

Negotiability. The available inventory continues to tighten, with the months of inventory falling almost 25% and now down close to the six-month level that usually indicates a seller’s market. Meanwhile, homes are selling more quickly and for closer to the asking price, with the days-on-market falling and the listing retention rate rising.

Condominiums. The condo market was also up sharply, continuing a welcome trend that we finally saw in the first quarter. Sales were up almost 27%, and prices were up sharply. We wouldn’t read too much into the eye-popping quarterly results, but even the rolling year totals were impressive: up 4% on average, over 2% at the median, and over 4% in the price-per-square foot.

Going forward, we believe that the Orange County housing market is poised for a strong summer. The fundamentals are tremendous: demand is high, prices are still at attractive 2003-04 levels, interest rates are at historic lows, and the economy is generally strong. With inventory continuing to decline, we expect to see meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

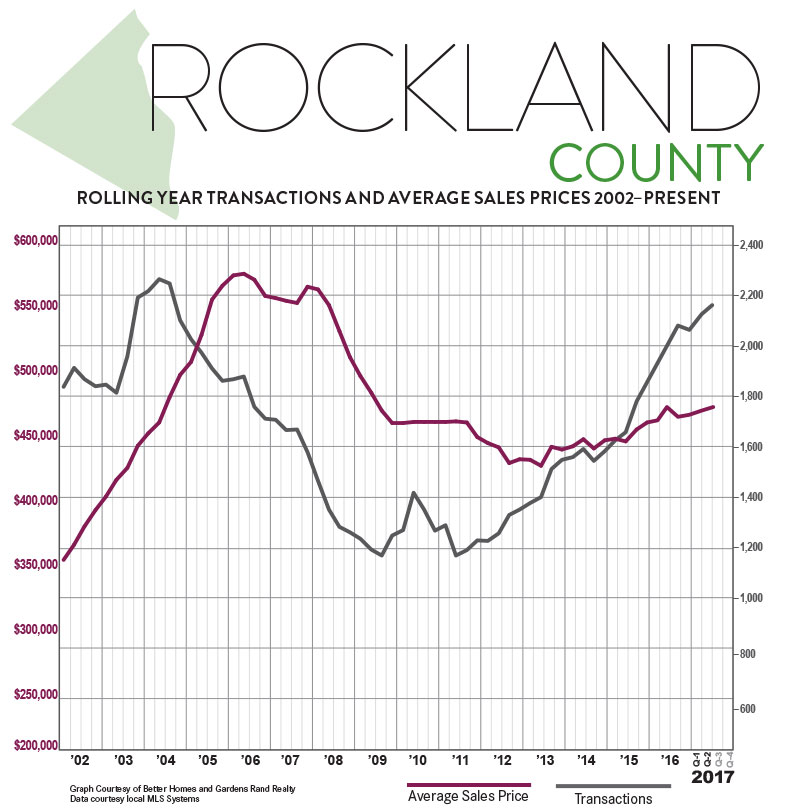

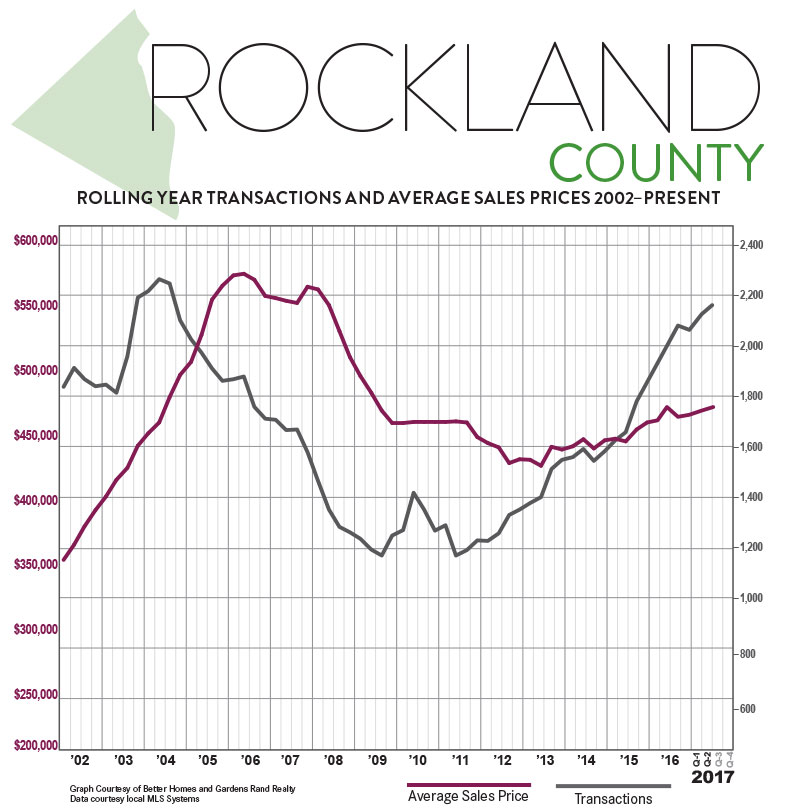

Second Quarter 2017 Real Estate Market Report – Rockland County, New York

The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

Sales. After spiking almost 24% in the first quarter, sales cooled down in the second, rising a little over 4% from last year. But this did continue a trend we’ve been watching for almost three years, the tenth time out of the last 11 quarters that year-on-year sales have gone up. Indeed, the 2,154 sales over the past rolling year marked the highest 12-month total since the third quarter of 2004.

Prices. These sustained increases in buyer demand are starting to have a tangible impact on pricing. Home prices were up for the quarter across the board, rising over 1% on average, almost 3% at the median, and over 1% in the price-per-square foot. And we are seeing meaningful and sustainable price appreciation over the longer term, with the rolling year median price and price-per-square-foot up over 2%. Similarly, Rockland’s average is now up over 11% from the bottom of the market in 2012.

Negotiability. Inventory continued to fall in the second quarter, depriving Rockland of the “fuel for the fire” that would drive more sales growth. The months of inventory fell almost 19%, and is now consistently at that six-month level market that denotes a seller’s market. Similarly, the listing retention rate rose and the days-on-market fell sharply, indicating that sellers are gaining negotiating leverage with buyers.

Condos. The Rockland condo market absolutely surged in the second quarter, with sales up almost 36% and prices up almost 7% on average 4% at the median. For the year, sales are up over 32%, and prices are showing the first signs of life in years. With inventory falling almost 40%, and now down to well below six months, we expect that prices will continue to rise.

Going forward, we expect that Rockland will have a strong summer market, with prices up and sales rising as much as they can with these levels of inventory. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

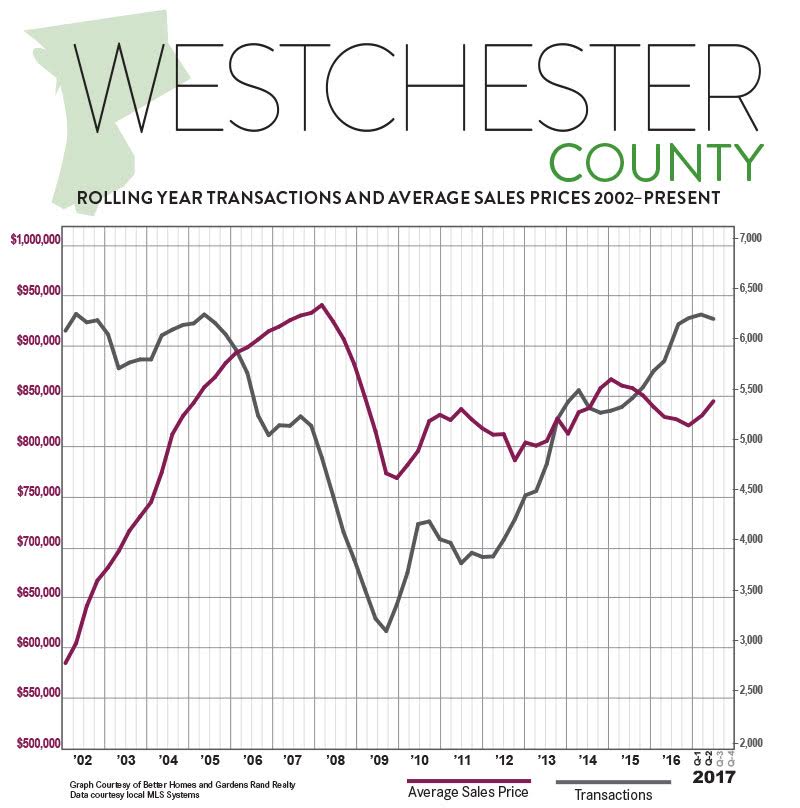

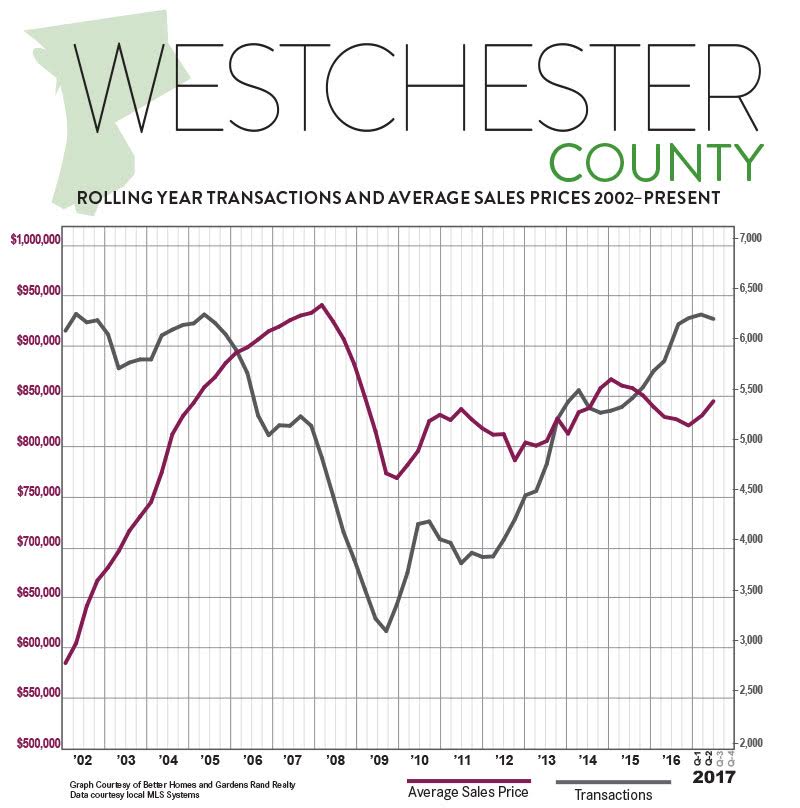

Second Quarter 2017 Real Estate Market Report – Westchester County, New York

Prices in the Westchester housing market surged forward in the second quarter of 2017, even while a lack of inventory stifled potential sales growth.

Prices in the Westchester housing market surged forward in the second quarter of 2017, even while a lack of inventory stifled potential sales growth.

Sales. Home sales were basically flat through the second quarter, falling just about 1% from the second quarter of last year. This marked the first quarter in almost three years where sales fell from the prior year, reflecting the lack of inventory available in the market. Still, though, sales are at levels we have not seen since the last seller’s market in 2005, and up almost 90% from the bottom of the market at the end of 2009.

Prices. Low levels of inventory also had an impact on prices, which were up significantly over last year. Home prices rose across the board: up over 7% on average, almost 4% at the median, and 3% in the price-per-square foot. Over the longer-term, we’re starting to see some meaningful price appreciation, with average prices up almost 3% for the rolling year.

Negotiability. The negotiability indicators continue to signal the emergence of the seller’s market. Inventory declined again, falling almost 12% and now at the lowest level of inventory we have had in Westchester in over 12 years, since the height of the last seller’s market. Similarly, the listing retention rate was up a full percentage point, exactly what we would expect when sellers start to gain negotiating leverage.

Condos and Coops. The condo and coop market was mixed. Sales of coops were up over 12%, but condo sales were down over 6%, the clear result of constricted inventory levels. But that shortage of available condos and coops is having its expected impact on pricing, which was up across the board for both property types.

Going forward, we expect that Westchester is going to continue to see meaningful price appreciation through a strong summer market. With inventory still tightening, pricing at 2004-05 levels, and interest rates still near historic lows, we expect that buyer demand will stay strong for the rest of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

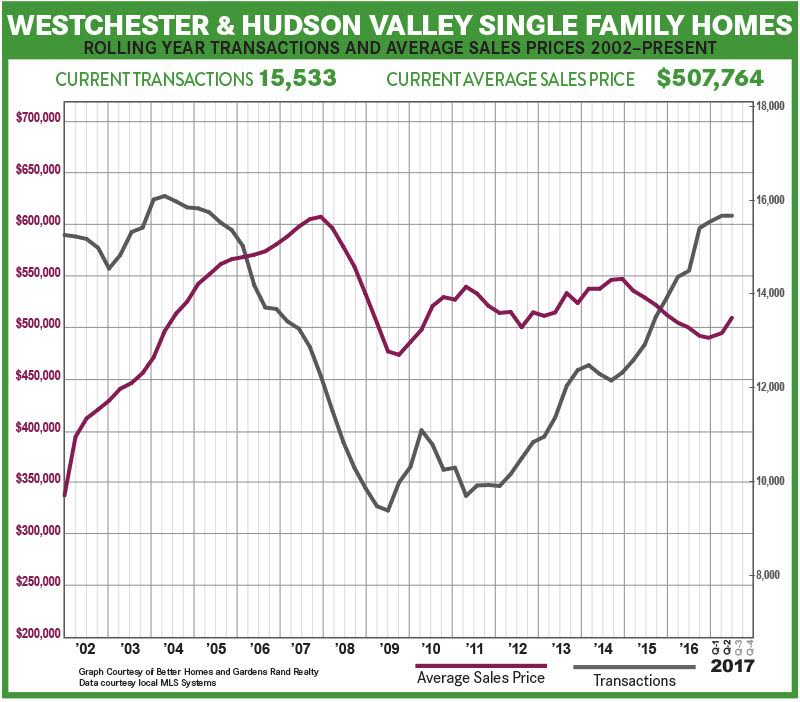

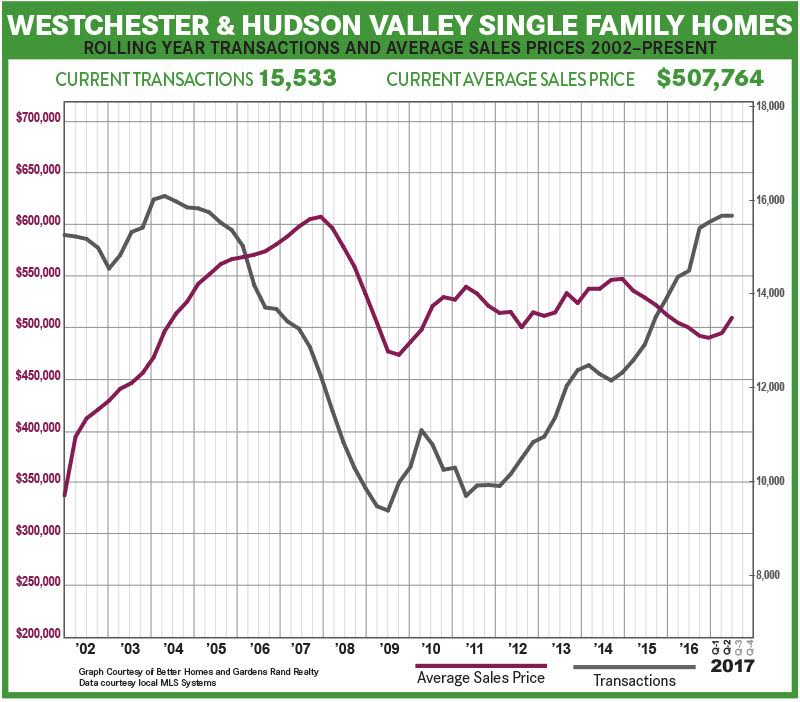

Second Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley – Market Overview

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

Inventory throughout the region continues to drop. Regional inventory was down almost 18%, and is now down to 7.1 months — right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now down around six months, moving into “seller’s market” territory.

The lack of inventory continues to stifle sales growth. Regional sales were down just a tick compared to the second quarter of last year, just barely breaking a 10-quarter streak of year-on-year sales growth. We noted in our last report that the pace of growth was slowing. Now, it has stalled, at least until we get more “fuel for the fire.” All that said, buyer demand is as strong as we’ve seen in over 10 years, with regional sales up 5% for the year and reaching the highest 12-month sales total since the height of the last seller’s market in 2005.

These inventory levels are starting to drive meaningful price appreciation. The regional average sales price was up over 6% for the quarter, following a similar 7% increase in the first quarter. After several years of slow declines, prices are now up over 1% for the rolling year. That may not seem like much, but it’s a sign of things to come. Indeed, average prices were up in every county in the region, rising over 7% in Westchester, over 6% in Putnam, over 1% in Rockland, 9% in Orange, and almost 5% in Dutchess. We should not be surprised — sales have been going up year after year, and it was only a matter of time before this type of demand drove some meaningful price appreciation.

Going forward, we expect that prices will continue to appreciate through the rest of the year. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2003-04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. We will need fresh new listings to drive more sales growth, but we expect that we will continue to see price appreciation through a robust Summer market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Sussex County, New Jersey

Activity in the Sussex County housing market surged yet again in the first quarter of 2017, with sales up sharply even while prices retreated slightly after a strong showing last year.

Activity in the Sussex County housing market surged yet again in the first quarter of 2017, with sales up sharply even while prices retreated slightly after a strong showing last year.

Sales. Sussex sales were up yet again in the first quarter, rising over 32% from last year. And for the year, sales increased over 19%, with almost 2,500 home sales representing the highest 12-month total in over 10 years. Indeed, Sussex sales are now up almost 120% from the bottom of the market in 2011, as a clear seller’s market begins to emerge.

Prices. In our last Report, we noted that the 8% spike in the average sales price in the fourth quarter was probably not sustainable. Well, that played out as we expected in the first quarter, with prices retreating almost 2% on average and an eye-popping 7% at the median. Again, though, don’t read too much into quarterly price changes. Instead, focus on the rolling year, which shows more meaningful, and sustainable, price appreciation levels of over 1% on average and almost 5% at the median.

Inventory. The Sussex inventory of available homes for sale fell dramatically by over 36%, dropping to just 9.2 months. That’s a significant decline, but inventory is still higher than in other Northern New Jersey counties, which are all approaching the six-month inventory line that usually signals the beginning of a seller’s market. But if inventory continues to go down, we would expect that to put some additional upward pressure on pricing.

Negotiability. The negotiability metrics indicated that sellers were gaining some negotiating leverage with buyers. The days-on-market fell dramatically, dropping by 23 days and now down to just over five months of market time. And sellers were retaining a little more of their asking price, with listing retention jumping up to 96.5% for the quarter and over 95% for the year.

Going forward, we expect that Sussex is going to continue to see rising sales coupled with more consistent price appreciation. With an improving economy, homes priced at attractive levels, and near-historically-low interest rates, we expect buyer demand, coupled with declining inventory, to drive a robust Spring market and a strong 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Essex County, New Jersey

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

The Essex County housing market started the year strong, with another increase in sales activity finally showing some impact on pricing.

Sales. Essex sales activity was up sharply from the first quarter of last year, rising almost 12% and driving the rolling year activity up almost 5%. Buyer demand has been inconsistent throughout the year, certainly not as strong as we are seeing in neighboring Northern New Jersey counties. But Essex closed over 5,000 units over the rolling year, the largest 12-month total since the height of the last seller’s market over 10 years ago, and up over 65% from the bottom of the market in 2011.

Prices. Essex buyer demand is finally showing signs of an impact on pricing. The average price was up almost 4% from the first quarter of last year. Although the median was down just a tick for the quarter, and the rolling year pricing is still down, that increase in the average price was still promising. With inventory continuing to fall and buyer demand relatively strong, we would expect prices to gain some momentum in the Spring market.

Inventory. Essex inventory fell again, dropping almost 39% from last year’s first quarter and now down to 5.8 months. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Essex crossed that threshold this quarter augurs well for pricing in 2017.

Negotiability. The negotiability indicators – the amount of time sold homes were on the market, and the rate at which sellers were able to retain their full asking price – suggested that sellers might be gaining just a little bit of negotiating leverage. The days-on-market fell by six days, and the listing retention rate was up sharply. Indeed, for the calendar year, sellers retained over 99% of their last list price. That’s another positive signal of potential future appreciation.

Going forward, we expect that Essex County’s sales activity will eventually have a meaningful impact on pricing. With homes still at historically affordable prices, interest rates low, and a generally improving economy, we believe that low inventory levels coupled with stable buyer demand will drive modest but meaningful price appreciation through a robust Spring market and the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

There aren’t two ways around it, you’re going to encounter stress when you’re searching for a home. But it’s not just you; everyone experiences it. And why wouldn’t you? This is one of the most significant investments you’ll make in life. I know acknowledging this will make you nervous, but there isn’t any use in denying this while searching for your next living space. But no matter the stress you face, there are ways you can deal with it, and that’s what we’re here for today.

There aren’t two ways around it, you’re going to encounter stress when you’re searching for a home. But it’s not just you; everyone experiences it. And why wouldn’t you? This is one of the most significant investments you’ll make in life. I know acknowledging this will make you nervous, but there isn’t any use in denying this while searching for your next living space. But no matter the stress you face, there are ways you can deal with it, and that’s what we’re here for today.