Better Homes and Gardens Real Estate Rand Realty Quarterly Market Report For 2016Q4 – Passaic County, New Jersey

Sales in the Passaic County housing market rose again in the fourth quarter of 2016, but they are still not having their expected impact on pricing

Sales in the Passaic County housing market rose again in the fourth quarter of 2016, but they are still not having their expected impact on pricing

Sales. Passaic sales finished the year strong, rising almost 14% from last year’s fourth quarter and finishing the year up over 12%. We’ve now seen sustained increases in buyer demand for over five years, with quarterly sales up in 20 out of the last 22 quarters. As a result, Passaic closed almost 3,300 homes for the calendar year, the highest total we’ve seen in over 10 years, since the height of the last seller’s market.

Prices. Unfortunately, these sustained increases in buyer demand are not yet impacting pricing. Prices were down fairly sharply for the quarter, falling over 5% on average and almost 3% at the median. And that finished off a calendar year where prices were down almost 3% on average and 1% at the median. This is surprising, because we would normally expect sustained increases in buyer demand to drive meaningful price appreciation. It may just be a matter of time, but basic economic principles would indicate that increasing demand, coupled with declining inventory, should drive prices higher.

Inventory. The Passaic inventory of available homes for sale fell again, down over 22% from last year’s fourth quarter. We measure “months of inventory” by calculating the number of months it would take to sell all the available homes at the current rate of absorption, and generally consider anything below six months to signal a seller’s market that would normally drive prices up. So the fact that Passaic is now down to just over eight months of inventory is important, since it presages the possibility of price appreciation in 2017.

Negotiability. The negotiability indicators indicated that sellers are gaining leverage with buyers. The days-on-market were down sharply, falling 15 days from the fourth quarter of last year and now down to under five months of market time. The listing retention rate was relatively flat for the quarter, but up to almost 97% for the year. If the market tightens, we would expect that homes would continue to sell more quickly and for closer to the asking price.

Going forward, we believe that Passaic’s fundamentals are sound, with homes priced at relatively attractive levels, rates near historic lows, and a stable economy. Accordingly, we expect these sustained levels of buyer demand, coupled with declining inventory, to finally drive meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Bergen County, New Jersey

The Bergen County housing market finished strong in the fourth quarter of 2016, with sales up sharply and prices showing signs of meaningful appreciation.

The Bergen County housing market finished strong in the fourth quarter of 2016, with sales up sharply and prices showing signs of meaningful appreciation.

Sales. Bergen single-family home sales were up almost 11% for the quarter, the ninth straight quarter where we’ve seen year-on-year sales growth. And for the year, sales were also up 11%, marking the third straight year of sales increases. Indeed, sales in the 2016 calendar year hit their highest levels since 2005, and are now up 55% from their 2011 bottom.

Prices. These sustained increases in buyer demand showed signs of finally having their expected impact on pricing. Single-family home prices were up almost 4% on average and 3% at the median compared to the fourth quarter of last year, the largest quarterly increase in almost three years. Even with that strong fourth quarter, though, the calendar year was relatively mixed, with the average price down a tick and the median up just about 1%.

Inventory. Bergen single-family inventory tightened dramatically, with the number of available single-family homes falling almost 30% and the months of inventory now down under four months, well below the six-month mark that usually denotes a “tight” market. With inventory this low, and demand staying strong, we would expect some upward pressure on pricing.

Negotiability. The negotiability indicators were relatively mixed for single-family homes, with the days on market down a little and the listing retention rate up a bit. As inventory tightens and the market heats up, we would expect to start seeing sellers gain negotiating leverage, with homes selling more quickly and for closer to the asking price.

Condos. The Bergen condo market was relatively flat in the fourth quarter, with sales down a tick and prices mixed. For the year, though, the results were more encouraging, with sales up 10% and prices up about 4% across the board.

Going forward, we remain confident that Bergen County is slowly moving into a strong seller’s market. With inventory tightening, a relatively strong economy, near-historically low interest rates, and prices still at attractive 2004 levels, we believe that sustained buyer demand will drive meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall – Northern New Jersey

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

The Northern New Jersey housing market finished strong in the final quarter of 2016, with sales up sharply even while pricing continued to struggle. But with inventory levels falling throughout the region, we expect that sustained buyer demand will drive meaningful if modest price appreciation in 2017.

Sales were strong throughout the region. After a relatively slow third quarter, regional sales surged back, rising almost 11% and up sharply in every county in the report: rising 11% in Bergen, 14% in Passaic, 12% in Morris, 11% in Essex, and 18% in Sussex. This strong fourth quarter helped the region close the 2016 year up almost 11% in sales, reaching the highest yearly transactional total in over ten years, since the height of the last seller’s market. Indeed, regional sales are now up 63% from the bottom of the market in 2011.

Inventory continues to tighten. We determine the “months of inventory” in a market by measuring the number of homes for sale, and then calculating how long it would take to sell them all given the current absorption rate. The industry considers anything less than six months to be a “tight” inventory that signals the potential of a seller’s market that would drive prices up. Well, the months of inventory for the Northern New Jersey region has now crossed over that line, dropping down to 5.3 months. Moreover, inventory was down in every individual county in the Rand Report, and is now below or nearing the six-month level: Bergen single-family homes at 3.6 months and condos at 6.1 months, Passaic at 8.3, Morris at 7.3, Essex at 7.0, and Sussex at 11.3. Certainly, if inventory continues to tighten, and demand stays strong, we are likely to see upward pressure on pricing.

Even with sales up and inventory down, though, average prices have been flat or falling throughout the region. Basic economics of supply and demand tells us that after five years of steadily increasing buyer demand, we should expect to see some meaningful price increases. But prices languished, with the regional price down just a tick from last year’s fourth quarter, but down almost 2% for the year. Moreover, the average prices for the year were down in almost all of the individual counties, rising only for Bergen condos, with just a tick up for Sussex. And maybe that’s the tell it might be that the market is simply stronger at the lower end, so lower priced homes (like Bergen condos and Sussex properties) are making up a larger percentage of the mix of properties sold.

Going forward, we remain confident that rising demand and falling inventory will drive price appreciation in 2017. Sales have now been increasing for almost five years, which has brought inventory to the seller’s market threshold in much of the region. The economic fundamentals are all good: homes are priced at 2004 levels (without even adjusting for inflation), interest rates are still near historic lows, and the regional economy is stable. Accordingly, we continue to believe that better days are ahead, and that we are likely to see modest but meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Dutchess County, New York

The Dutchess County housing market finished strong in the fourth quarter of 2016, with a sustained increase in sales along with the largest yearly price appreciation in over ten years.

The Dutchess County housing market finished strong in the fourth quarter of 2016, with a sustained increase in sales along with the largest yearly price appreciation in over ten years.

Sales. Dutchess single-family home sales were up again in the fourth quarter, rising over 7% from last year and marking the ninth quarter in a row with year-on-year sales increases. And for the calendar year, sales were up almost 16%, rising to the highest yearly total that we’ve seen since 2005 and up 73% from the 2011 bottom.

Prices. This sustained increase in sales activity is finally having its expected impact on pricing, with single-family home pricing up just a tick for the quarter. For the year, though, prices were up almost 3% on average and 2% at the median. That may not seem like much, but it was the highest price appreciation that we’ve seen in a calendar year since 2006. Prices are still at 200304 levels (without controlling for inflation), but they are moving in a positive direction.

Negotiability. Dutchess inventory continues to decline, now down to 11.5 months of active single-family listings. Although we are nowhere near the six-month level of inventory that usually signals a “seller’s market,” we are certainly seeing some tightening that could support further price appreciation. The other negotiability indicators were mixed, with days on market flat while listing retention rose.

Condominiums. The condo market was also up, with sales rising almost 16% but prices falling a bit after a spike in the third quarter. For the year, condo sales are up almost 17%, and pricing is up sharply both on average and at the median.

Going forward, Dutchess is looking forward to a promising 2017. With tightening inventory, a stable economy, near-historically low interest rates, and homes still priced at appealing 2003-04 levels, Dutchess is likely to see meaningful price appreciation through next year.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Putnam County, New York

The Putnam County housing market finished the 2016 year strong, with sales continuing to rise even while inventory tightened.

The Putnam County housing market finished the 2016 year strong, with sales continuing to rise even while inventory tightened.

Sales. Putnam sales were up again in the fourth quarter, with single-family home closings up almost 10% from last year and now up almost 21% for the year. The market is just sizzling, with transactions up in 10 straight quarters and 18 out of the last 19.

Prices. Even with demand up, though, pricing is surprisingly stubborn. Single-family home prices were down across the board, falling 3% on average and almost 1% in the median and price-per-square foot. For the year, though, prices were up almost 2% on average, 6% at the median, and 10% in the price-per-square foot.

Inventory. Inventory continued to tighten, falling over 43%, now down to 5.05 months of inventory, which is below the six-month mark that usually denotes a tightening seller’s market. With inventory this low, we are likely to see some upward pressure on pricing going into 2017.

Negotiability. The negotiability indicators showed that sellers continue to gain leverage with buyers, with the listing retention rate rising to 96.6% and the days-on-market falling by 16 days for single-family homes. We would expect homes to continue to sell more quickly and for closer to the asking price if the market heats up.

Condos. The condo market was strikingly weak, with sales down 25% and prices down almost 13% for the quarter. The Putnam condo market is a very thin market, with only a few dozen sales per quarter, so we should be careful about drawing conclusions. For the year, sales were up 6%, but prices did show some sustained weakness, down 12% on average and 11% at the median.

Going forward, we do believe that the fundamentals of the market are strong prices at attractive levels, interest rates still near historic lows, and a gradually improving economy. Accordingly, we believe that tightening inventory, coupled with resilient demand, will drive meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Orange County, New York

The Orange County housing market surged yet again in the fourth quarter of 2016, with clear signs of meaningful price appreciation for the first time in years.

The Orange County housing market surged yet again in the fourth quarter of 2016, with clear signs of meaningful price appreciation for the first time in years.

Sales. Orange single-family sales were up yet again, rising almost 19% from last year’s fourth quarter, and finishing the full 2016 calendar year up almost 25%. This continues a trend we’ve been watching for almost five years, with Orange sales now up nine quarters in a row and 18 out of the last 19. Even more telling, the 3,542 yearly single-family home sales were the most since 2005, and were up 112% from the bottom of the market in 2011.

Prices. These sustained increases in buyer demand are finally having a meaningful impact on pricing, with single-family home prices up a tick on average and almost 4% at the median compared to last year’s fourth quarter. More importantly, prices were up ever-so-slightly for the year, just under 1% on both the average and the median. That may not seem like much, but it was the first time that Orange calendar-year prices rose since 2007.

Inventory. The available inventory continues to tighten in the single-family market, closing in on the six-month market that usually indicates a tight seller’s market. As inventory falls, we would expect even more upward pressure on pricing.

Condominiums. The Orange condo market showed signs of life, with sales up over 10% for the quarter and finishing the year up almost 9%. The condo market has struggled for years in Orange, particularly as the price point between condos and houses narrowed. But that gap might be widening as single-family home prices accelerate, which would likely stop the bleeding in the condo market pricing.

Going forward, we believe that the Orange County housing market is looking forward to its best year since the height of the last seller’s market. The fundamentals are strong: demand is high, prices are still at attractive 2003-04 levels, interest rates are at historic lows, and the economy is generally improving. With inventory declining, we expect to see more meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Rockland County, New York

The Rockland County housing market tapered off a bit in the fourth quarter of 2016, but still finished the year with significant increases in both sales and prices.

The Rockland County housing market tapered off a bit in the fourth quarter of 2016, but still finished the year with significant increases in both sales and prices.

Inventory. The story in Rockland County is the declining inventory, with the number of homes for sale falling again, now reaching levels we have not seen in over 10 years. We calculate the “months of inventory” by measuring how long it would take to sell out the existing available homes at the current rate of sales. Anything shorter than six months is considered a “tight” market, and Rockland has now crossed below that line for the first time in years, with the months of inventory at 4.9 months for single-family homes and 5.6 months for condos.

Sales. We can see the impact of declining inventories in the sales activity, with transactions down almost 4% for single-family homes. This broke a two-year streak of eight straight quarters of year-on-year sales increases, and marked only the second time in five years that sales went down from the prior year quarter. Why? We do not believe it’s a lack of demand, but rather that many buyers simply cannot find the right home at these levels of inventory. Still, though, the overall market is healthy: single-family home sales have now gone up for five straight calendar years, are at their highest level since 2004, and are up 77% from their 2011 bottom.

Prices. The flip side of declining inventory is rising prices, and Rockland pricing is showing sustained signs of meaningful price appreciation. Although single-family pricing was relatively mixed for the quarter, home prices have now gone up for four straight calendar years, and are now up 9% from the bottom in 2012. That’s not dramatic, but it’s something. We expect that with inventory at these levels, we will continue to see price appreciation in 2017.

Negotiability. Single-family homes sold more quickly and for closer to the asking price in the fourth quarter, which is generally a sign that sellers are gaining negotiating leverage with buyers.

Condos. The condo market was mixed for the quarter, with sales up 20% but prices falling 10% on average even while rising over 5% at the median. The yearlong results were more consistent, with sales up 20% and prices down about 3% on average and at the median.

Going forward, we believe that buyer demand in Rockland will stay strong, with prices still at attractive levels, interest rates still near historic lows, and the economy generally strengthening. And with declining inventories, we believe that this demand will drive more meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 – Westchester County, New York

The Westchester housing market in the fourth quarter of 2016 started to show the impact of tightening inventory, with sales flattening out and prices rising as buyers chased fewer available homes for sale.

The Westchester housing market in the fourth quarter of 2016 started to show the impact of tightening inventory, with sales flattening out and prices rising as buyers chased fewer available homes for sale.

Inventory. The story in Westchester as 2016 ended was about the declining inventory. We calculate the “months of inventory” by measuring how long it would take to sell out the existing available homes at the current rate of sales. Anything below six months is considered a “tight” market, and Westchester has now crossed over that line in all property types: down to 3.8 months for single-family homes, 4.5 months for coops, and a sizzling 2.6 months for condos.

Sales. Westchester sales remain strong, with 2016 single-family transactions up over 8% for the year. Indeed, yearly sales hit their highest total since 2004, and are up 85% from their 2009 bottom. But you can see that the rate of growth is slowing if you look at the quarterly numbers, where single-family home sales were up just a tick and condo and coop sales were down sharply. Why? Because the market needs fuel for the fire, and the limited inventory is providing buyers with fewer options to purchase.

Prices. The flip side of limited inventory, of course, is rising prices, as buyers chase fewer options and get into multiple-offer situations and bidding wars that drive prices up. And we are finally starting to see the impact of limited inventory on Westchester pricing, with quarterly prices up over 3% for single-family homes, 10% for coops, and 3% for condos. For the year, prices were mostly down or flat, and they remain close to their 2004-05 levels, but we believe they are poised to rise in 2017.

Negotiability. The negotiability indicators also showed the impact of declining inventory, with listing retention up and days-on-market down. Simply put, homes are selling more quickly, and for closer to the asking price. Indeed, for single-family homes, the yearly listing retention rate of 97.5% homes was the highest since 2005, and the yearly days-on-market of 161 was the lowest since 2006.

Going forward, we believe that the fundamentals in the Westchester market are tremendous. With inventory tightening, pricing at 2004-05 levels, interest rates still near historic lows, and a generally improving economy, we expect that buyer demand will stay strong and eventually drive meaningful price appreciation in 2017.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

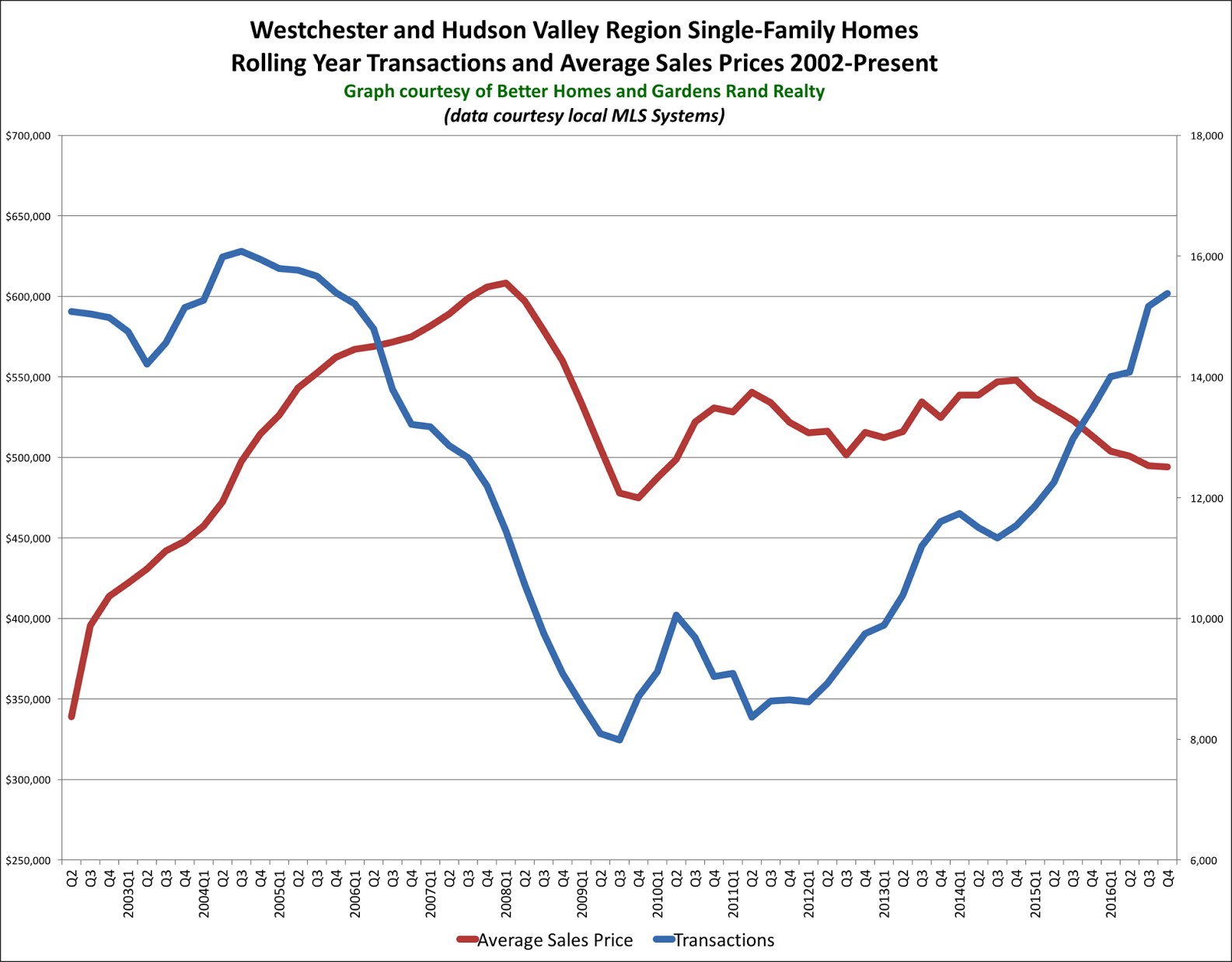

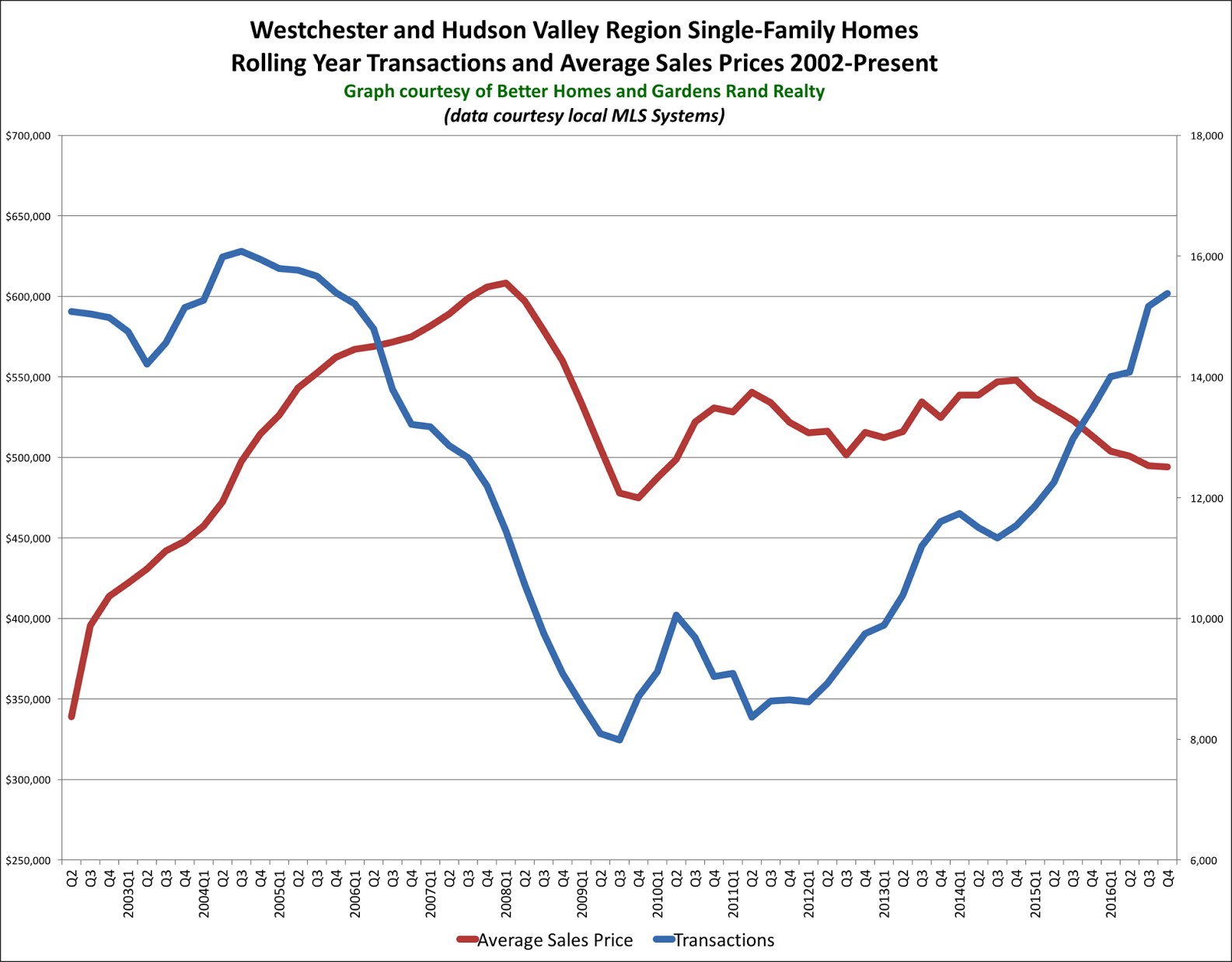

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Better Homes and Gardens Rand Realty Quarterly Market Report For 2016Q4 Overall: Westchester and Hudson Valley

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

The story of the housing market in Westchester and the Hudson Valley at the end of 2016 was all about inventory. The number of homes on the market continues to decline, which is already negatively impacting the rate of sales growth, but is likely to positively impact price appreciation in 2017.

Inventory throughout the region continues to fall. As we have explained before in the Rand Report, we measure the “months of inventory” by looking at the number of available homes on the market, and then calculating how long it would take to sell them all at the current rate of absorption. In the industry, we consider anything below six months of inventory to be a signal of a tightening market that will tend to drive prices up. So it’s notable that region inventory at the end of 2016 was down to 6.2 months. But the decline was more striking if you look at the individual counties, with inventory down to 3.8 months in Westchester, 5.0 in Putnam, 4.9 in Rockland, and 6.4 in Orange. Indeed, if you take Dutchess (which is still in the double digits) out of the calculation, the overall regional average is down to 4.2 months of inventory. That’s extraordinarily low, especially when you consider that regional inventory was over 10 months just two years ago.

The lack of inventory is starting to have an impact on sales. Sales are still relatively strong, but the pace of growth is slowing. Single-family transactions were up for the region, rising 6% from the fourth quarter of last year, which now marks nine straight quarters of year-on-year sales growth. And regional sales were up sharply for the calendar year, rising over 14% from 2015 and crossing over the 15,000 transaction mark for the first time since 2005. Indeed, yearly sales are now up 78% from the market bottom in 2011. But we see some troubling signs. For example, that 6% rise in sales from last year is the smallest year-on-year sales increase in eight quarters. Moreover, although regional sales were up, individual counties were flat or down: Westchester was up only 1.4%, and Rockland was down 3.6%. Essentially, the market needs more fuel for the fire — without more listings on the market, we are likely to see sales flatten or even decline in 2017.

Prices continue to struggle throughout the region. The regional average sales price was down just a tick for the quarter, but fell almost 4% for the calendar year. How can that be? We are seeing sustained buyer demand coupled with declining inventory over the past few years, and sales totals that approach the tail end of the last seller’s market. Basic economics tells us that increasing demand and falling supply should drive prices up. And, well, they will. It’s just a matter of time. At some point soon, these high levels of buyer demand, along with the low levels of inventory, will start creating the kind of multiple offer situations and bidding wars that will drive prices up. In turn, as prices go up, homeowners watching and waiting from the sidelines will be tempted into the market, which will moderate the potential surge in price appreciation. In other words, we’re about the witness “Economics 101” in action.

Going forward, we remain confident that the market conditions are ripe for meaningful price appreciation in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2004-05 levels (without controlling for inflation), and a generally strong economy. And supply is tight, at least until some price appreciation brings more sellers into the market. So in the short term, we might see some declines in home sales off the highs set in 2016. But over time, as high-demand-and-short-supply starts driving prices up, inventory will come back. And we will eventually see the return of sales growth, this time coupled with meaningful price appreciation.

To learn more about Better Homes and Gardens Real Estate® – Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link