Renee Zurlo Takes on New Role as General Manager, Greater Hudson Valley Region for Better Homes and Gardens Rand Realty

Nanuet, NY—Better Homes and Gardens Rand Realty’s Renee Zurlo has been named General Manager of the Greater Hudson Valley region, covering Rockland, Orange, Sullivan, and Ulster Counties. Renee will be overseeing 11 offices in her new role. Previously, Renee served as the Orange County Regional Manager at Better Homes and Gardens Rand Realty. She has been a REALTOR® for over 24 years and has been with Better Homes and Gardens Rand Realty for the past ten years.

“I am thrilled to share my experience and skills with an even larger scope of the Greater Hudson Valley Region,” says Renee.

June Stokes will continue in her role as Rockland County Regional Manager. “I look forward to working with Renee as we continue the company’s success in Rockland County,” says June.

According to Matt Rand, CEO, Better Homes and Gardens Rand Realty, “Our goal with this new management structure is to accelerate our growth in the markets where we have dominant market share, as well as to serve our agents at an even higher level and help them grow their personal brand and business.”

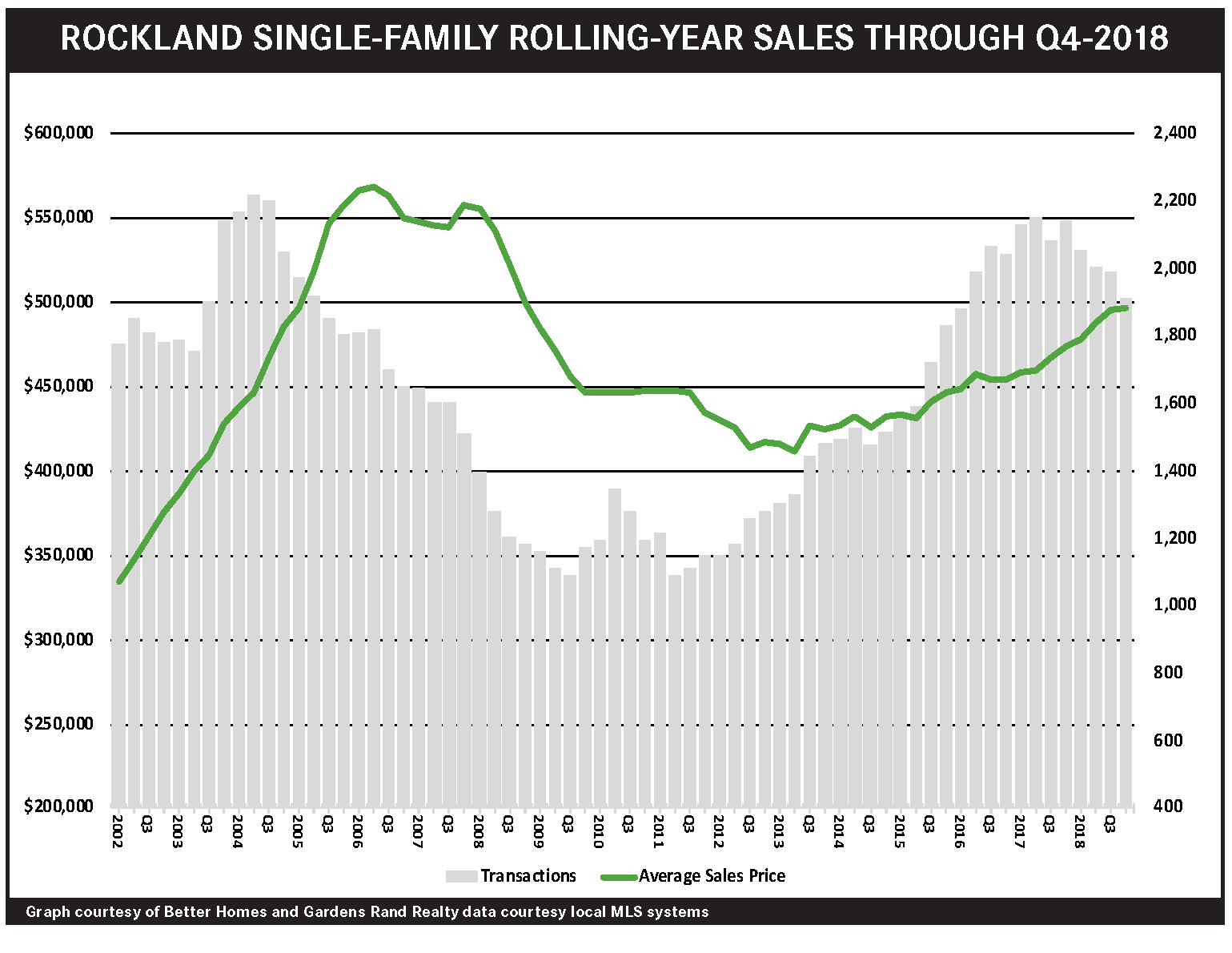

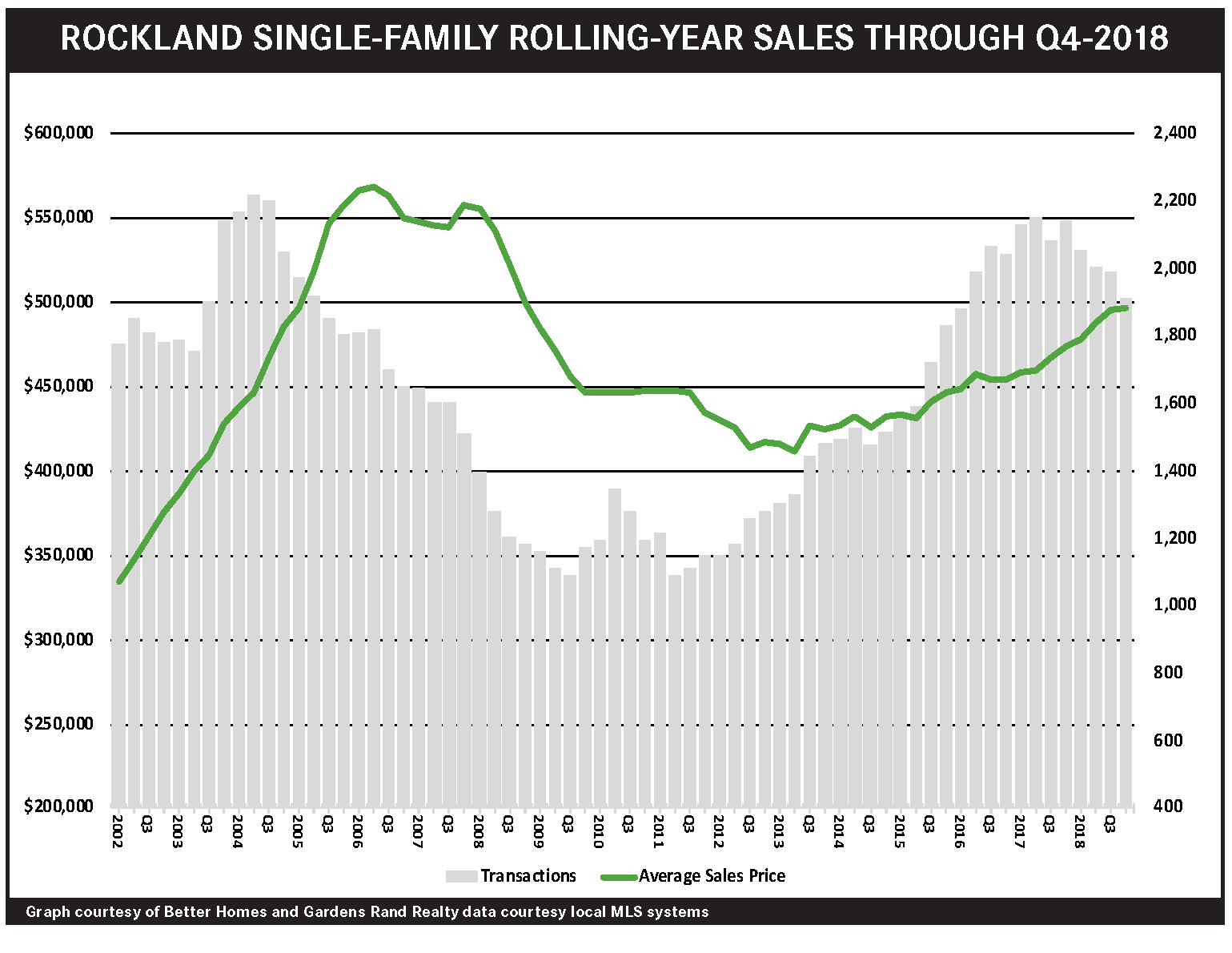

Fourth-Quarter 2018: Real Estate Market Report – Rockland County, NY

The Rockland seller’s market continues to be constricted by low levels of inventory, which are holding back sales, even while driving prices up. Single‑family home sales were down sharply in the fourth quarter, falling almost 14%, finishing a full year in which they fell almost 11%. But prices were up, rising a tick on average and almost 3% at the median, closing a year in which pricing rose 5% on average and almost 5% at the median. We see the same story with condos, with sales down and prices up for the quarter. So what’s going on? Basically, Rockland needs more fuel for the fire. Demand is strong, but supply is too low to sustain sales increases, even while too many buyers chasing too few homes is driving prices up across the board. But that might be changing, with inventory starting to rise after years of falling, as home owners see prices going up and are tempted into the market. Going forward, we expect that demand will sustain meaningful price appreciation through the winter and spring markets, and that increased inventory might help boost sales as well.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

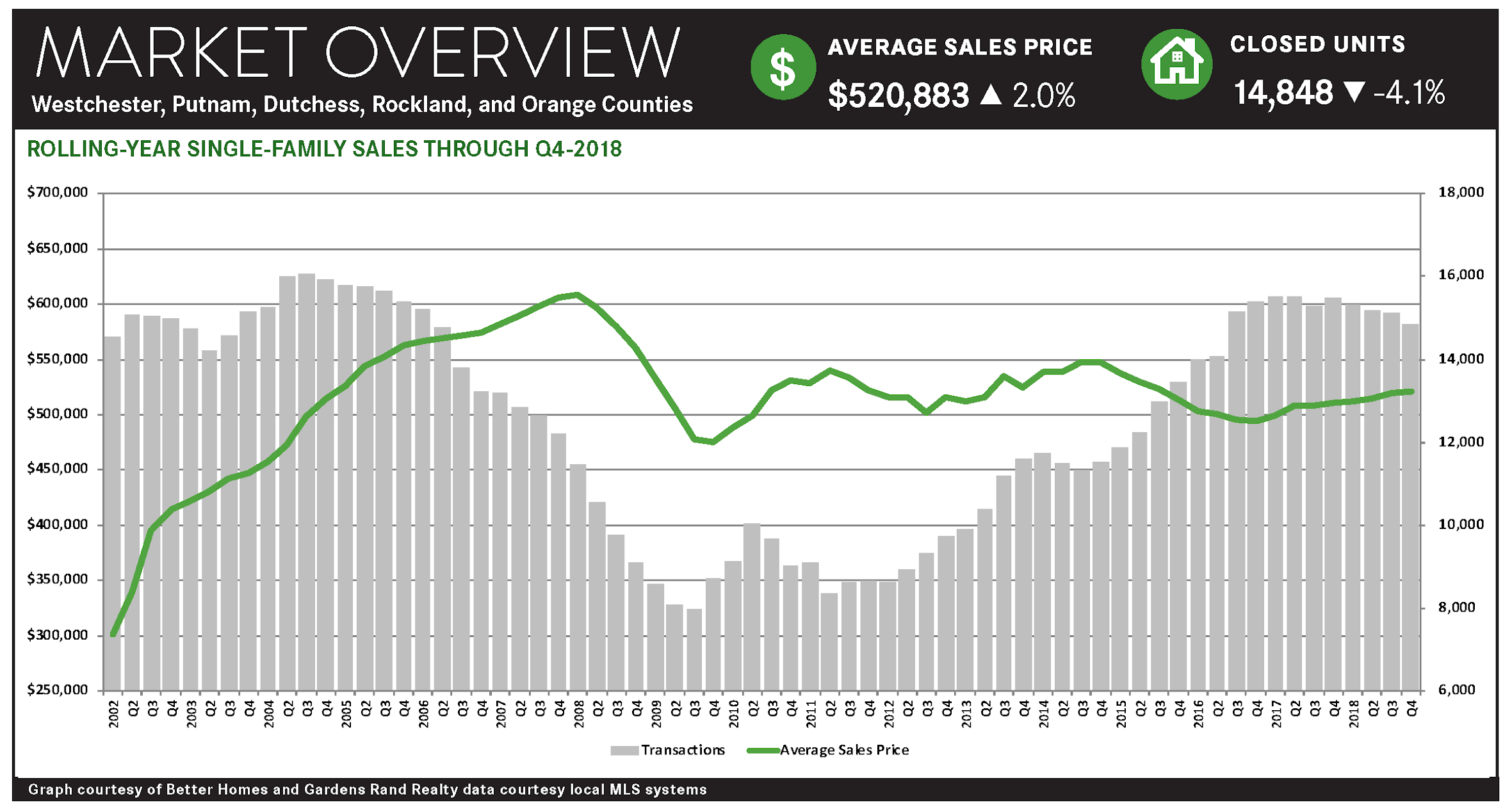

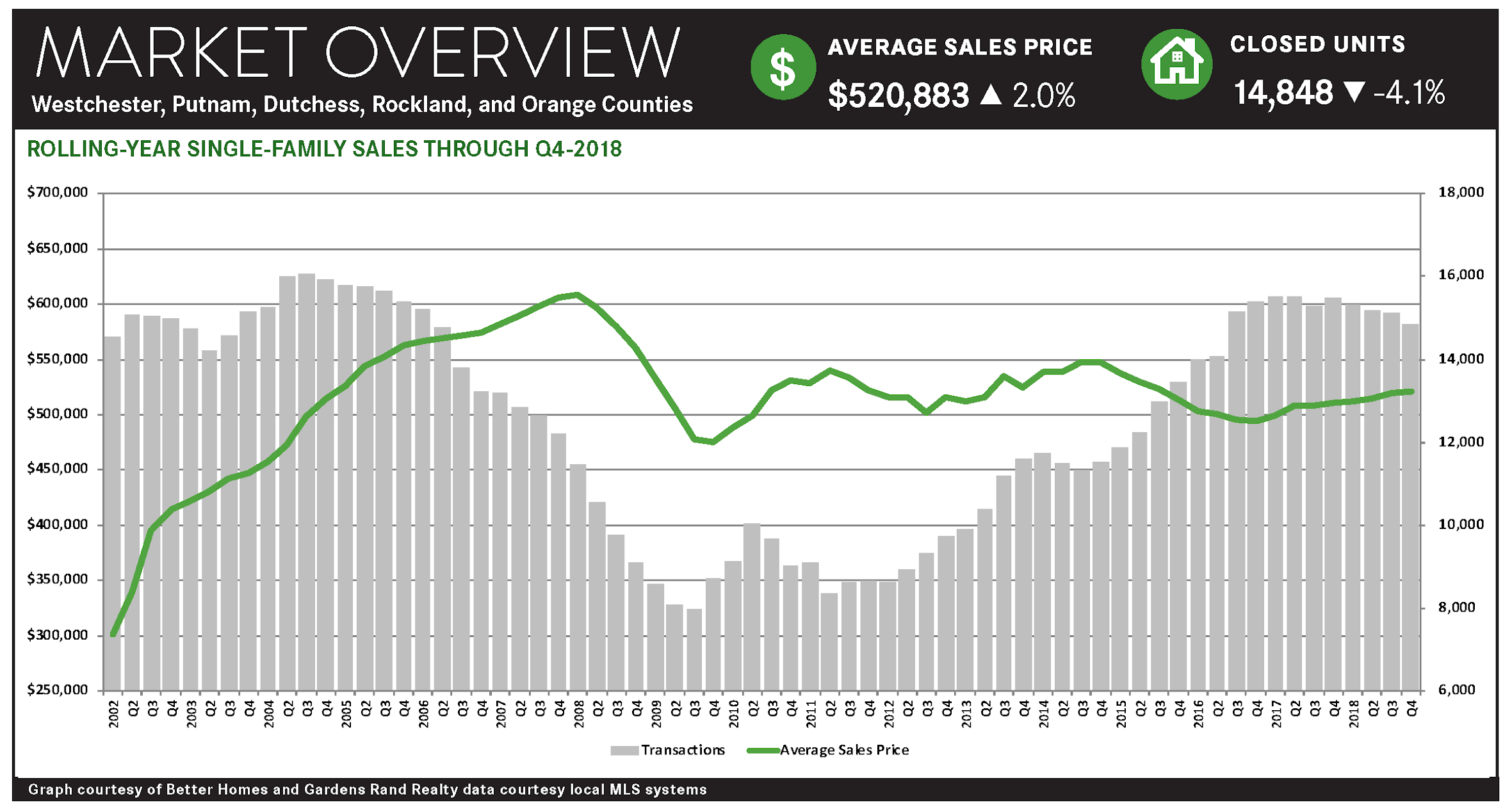

Fourth Quarter 2018: Real Estate Market Report – Lower Hudson Valley, NY

Sales in Westchester and the Hudson Valley housing markets were down throughout the region, even while high buyer demand, coupled with low levels of inventory, drove meaningful price appreciation in most of the regional markets.

Sales were down throughout the region. Regional transactions fell across the board in the fourth quarter, dropping almost 7% for single‑family homes and 5% for condos. We saw the same story for the full 2018 year, with sales down over 4% for single‑family homes and about 1% for condos. To put these numbers in perspective, though, we closed almost 15,000 single‑family homes and almost 3,000 condos in 2018, up from about 9,000 single‑family homes and 2,000 condos back at the bottom of the market 10 years ago. So we’ve had a pretty good run‑up of sales in the past 10 years and were due to plateau at some point.

Prices were up in most of the markets of the region, particularly in the lower‑priced market segments.

Essentially, we had a “tale of two markets” developing in the region, with pricing flat only for the highest‑priced property type in the region – Westchester single‑family homes – even while average prices were up for every other county in the region for the year: up 6% in Putnam, 5% in Rockland, 9% in Orange, and 10% in Dutchess. And full‑year pricing in the entry‑level condo and coop markets was up in every market: rising 6% for Westchester coops, with condos up 0.1% in Westchester, 15% in Putnam, 1% in Rockland, 12% in Orange, and 7% in Dutchess.

So what was holding back pricing for Westchester single‑family homes? We might be seeing the effects of the 2018 Tax Reform, which capped deductions for state and local taxes, and could be having a disproportionate impact on high‑end buyers in high‑property‑tax Westchester. Unlike buyers in the entry‑level condo and coop market, or in the lower‑priced counties, Westchester luxury buyers are more likely to itemize their taxes, so they might be feeling the bite of the cap more acutely. This could be reducing demand at the higher‑ends of the market, suppressing the price appreciation we are seeing in the rest of the region.

Going forward, we believe that the market is still poised for growth. Sales are falling mostly due to a lack of supply, not a lack of demand. Essentially, the market needs more “fuel for the fire” – more viable inventory for the buyers who are looking. And that might be happening: regional single‑family home inventory was up almost 10% from last year, rising for the second quarter in a row after 25 straight quarters of year‑on‑year declines. This makes some economic sense, of course, since we would expect that sustained price appreciation over a period of time should tempt more homeowners into the market. The question is whether buyer demand is strong enough to continue driving price appreciation, even while absorbing this increased inventory. Ultimately, we believe that the region is still growing as a seller’s market, which should allow for both increases in sales and prices in what will be a robust spring market.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Veteran Lydia Hendricks Named Career Development Manager at Better Homes and Gardens Rand Realty New City

Better Homes and Gardens Rand Realty announced that Lydia Hendricks, a seasoned real estate manager, has joined its New City office as the Career Development Manager.

Better Homes and Gardens Rand Realty announced that Lydia Hendricks, a seasoned real estate manager, has joined its New City office as the Career Development Manager.

Lydia, a licensed Real Estate Associate Broker for 17 years, “happily made the move to Better Homes and Gardens Rand Realty” last month.

“My decision to move to Better Homes and Gardens Rand Realty is one of the greatest career moves I have ever made. I look forward to assisting the agents in the New City office with their career direction so that they can achieve the greatest level of growth and success possible,” she said.

“Its focus on career development is what sets Better Homes and Gardens Rand Realty apart from other real estate firms. They really care about the success of their agents,” Lydia added.

According to JP Endres, manager of the Better Homes and Gardens Rand Realty New City, office: “Lydia’s experience and success in the industry will have an important impact on our agents and give them added support and every possible advantage in all areas of their business.”

She continues, “I have never been so excited for our future. Lydia completes our management dream team, she is the perfect fit for our office culture and our continued growth plan. Our office offers the best talent in the industry, working together as a team for the benefit of our agents and our clients.”

Prior to her new position, Lydia has been managing real estate offices and coaching agents. “I understand all levels and areas of the real estate industry,” she said. “I started as an agent, then I worked in recruiting and training, and now managing. I know what it takes to be successful in real estate and I look forward to passing this knowledge on to my new colleagues.”

Congratulations! Renee Zurlo: Realtor of The Year and Richard Herska: “Up and Coming” Award

Congratulations to Renee Zurlo, Orange County Regional Manager, named “Realtor of the Year” by the Hudson Gateway Association of Realtors (HGAR) – and to Richard Herska, Real Estate Salesperson, Nyack office, who received HGAR’s “Up and Coming Award,” selected out of a pool of 15,000 other local realtors. Renee and Rich were honored in front of a crowd of 1,500 members and affiliates who were in attendance for the 102nd Annual Meeting and Member’s Day of The Hudson Gateway Association of Realtors (HGAR). The event took place at the Doubletree Hotel in Tarrytown on Monday, October 29.

Congratulations to Renee Zurlo, Orange County Regional Manager, named “Realtor of the Year” by the Hudson Gateway Association of Realtors (HGAR) – and to Richard Herska, Real Estate Salesperson, Nyack office, who received HGAR’s “Up and Coming Award,” selected out of a pool of 15,000 other local realtors. Renee and Rich were honored in front of a crowd of 1,500 members and affiliates who were in attendance for the 102nd Annual Meeting and Member’s Day of The Hudson Gateway Association of Realtors (HGAR). The event took place at the Doubletree Hotel in Tarrytown on Monday, October 29.

Renee has been a REALTOR® for over 24 years and has been with Better Homes and Gardens Rand Realty for nine years. She has served as president of the Hudson Gateway Multiple Listing Service since 2016 and will continue to serve as president into 2019, when a newly formed MLS—a merger between the Multiple Listing Service of Long Island, Inc. (MLSLI) and Hudson Gateway Multiple Listing Service, is fully operational.

On receiving the honor of the HGAR Realtor of Year award, Renee said: “This award represents my many years of involvement in the real estate industry, building relationships and being able to give back to an industry that has given me so much. Throughout my career I have turned to many people for guidance, and I share this honor with them,” she added.

“Renee has truly earned the title of Realtor of Year with her exceptional talent, experience, skill and results,” said Matt Rand.

Says Marsha Rand, president of Better Homes and Gardens Rand Realty, “Renee has been a huge asset to the Better Homes and Gardens Rand Realty team. She is a real team player and loves to share her knowledge with others. There is no one more deserving of this award.”

Rich has been a REALTOR® with Better Homes and Gardens Rand Realty for three years and is also an active member of the HGAR Board of Directors. He says that combining his two passions – interior design and real estate – has been “a perfect fit” and has helped to propel his career forward at Better Homes and Garden Rand Realty.

Rich has been a REALTOR® with Better Homes and Gardens Rand Realty for three years and is also an active member of the HGAR Board of Directors. He says that combining his two passions – interior design and real estate – has been “a perfect fit” and has helped to propel his career forward at Better Homes and Garden Rand Realty.

“I am both honored and humbled to receive this award,” he said. “This confirms that hard work, dedication and patience yields positive acknowledgment. I look forward to a long future in real estate and with the Rand Realty family.”

“Rich has accomplished so much at Rand Realty in the past few years,” said Marsha Rand. “His eye for design is impeccable, and he gives his all to every client. He is on his way to the top!”

According to Matt Rand, “Richard’s Up and Coming Award is well deserved. He is one of our rising stars and we so appreciate the interior design expertise he brings to our clients.”

“We are extremely proud of both award winners!”

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

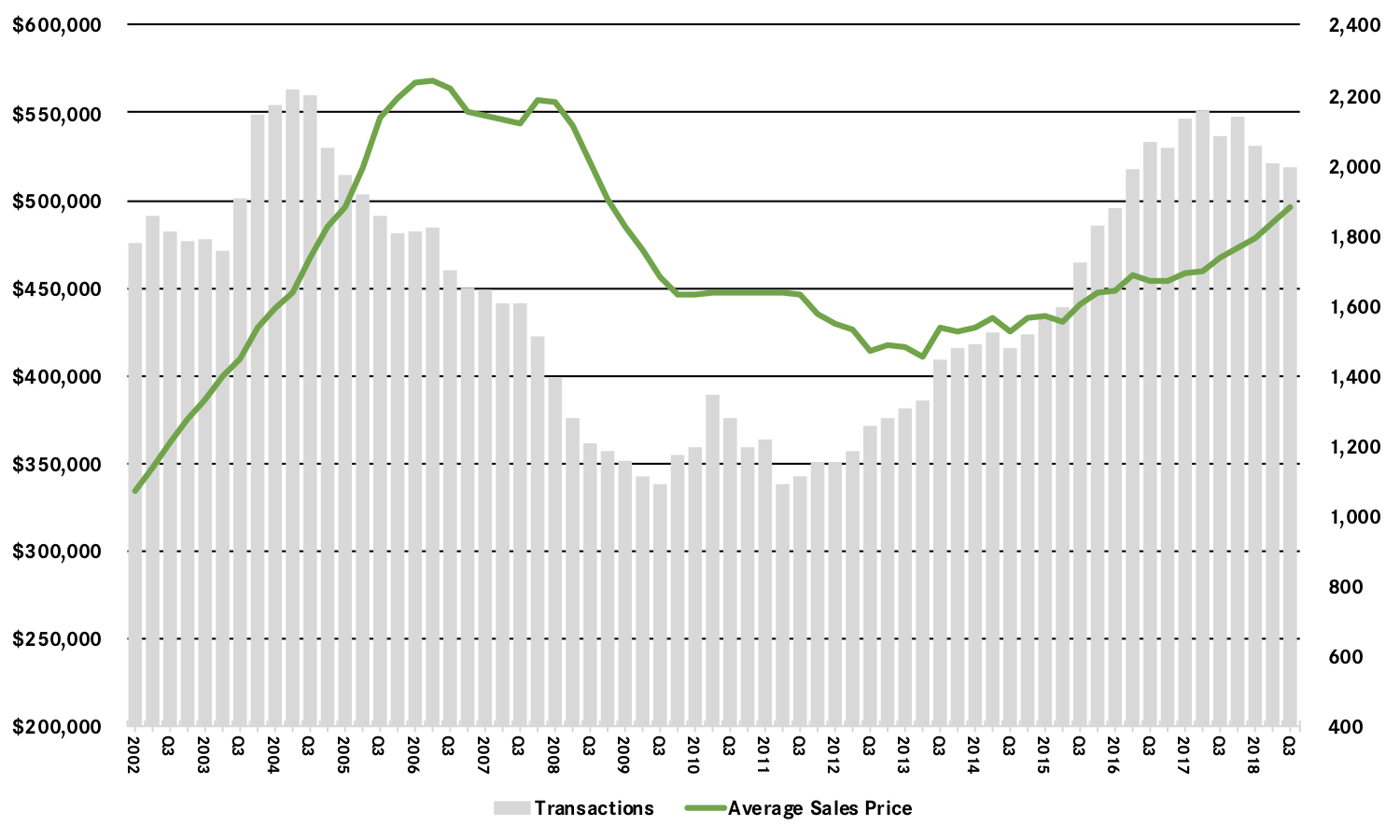

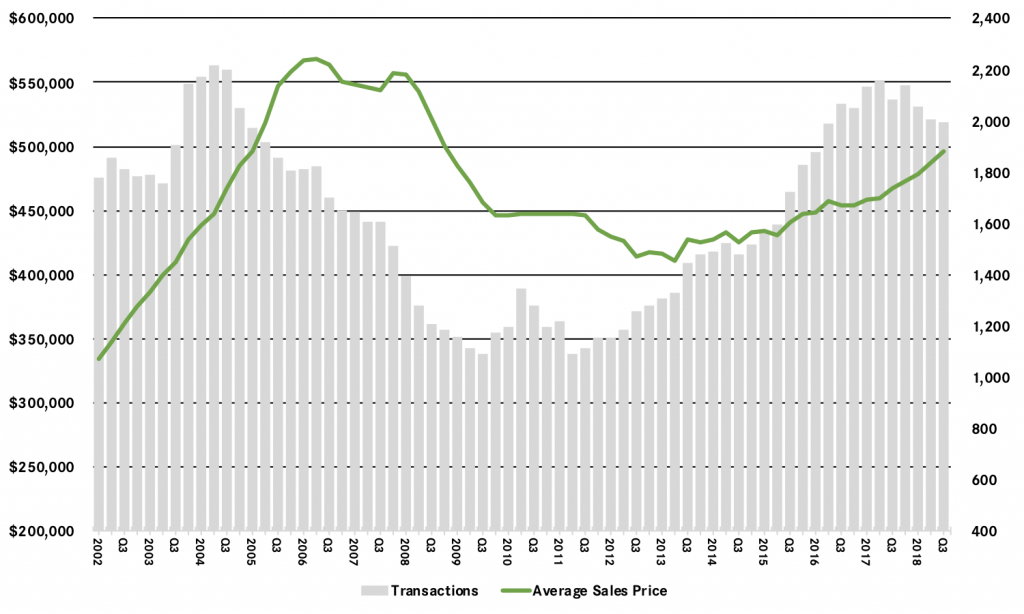

Real Estate Market Report: Third Quarter 2018 – Rockland County, NY

The Rockland housing market had another strong quarter, with prices up, even while a lack of inventory held back sales growth. Sales of houses were down almost 3% for the quarter, and are now down almost 5% for the year. But that’s more a reflection of a lack of supply, not a lack of demand, evidenced by continuing appreciation, with prices up 6% on average and 7% at the median for the quarter, and now up 6% on average and 7% for the year. We are starting to see signs, though, that rising prices might be tempting more sellers into the market – months of inventory rose almost 11%, the first increase in over six years. Going forward, we expect that buyer demand is strong enough to absorb this additional inventory and still post meaningful price appreciation through the rest of the year and into 2019.

The Rockland housing market had another strong quarter, with prices up, even while a lack of inventory held back sales growth. Sales of houses were down almost 3% for the quarter, and are now down almost 5% for the year. But that’s more a reflection of a lack of supply, not a lack of demand, evidenced by continuing appreciation, with prices up 6% on average and 7% at the median for the quarter, and now up 6% on average and 7% for the year. We are starting to see signs, though, that rising prices might be tempting more sellers into the market – months of inventory rose almost 11%, the first increase in over six years. Going forward, we expect that buyer demand is strong enough to absorb this additional inventory and still post meaningful price appreciation through the rest of the year and into 2019.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

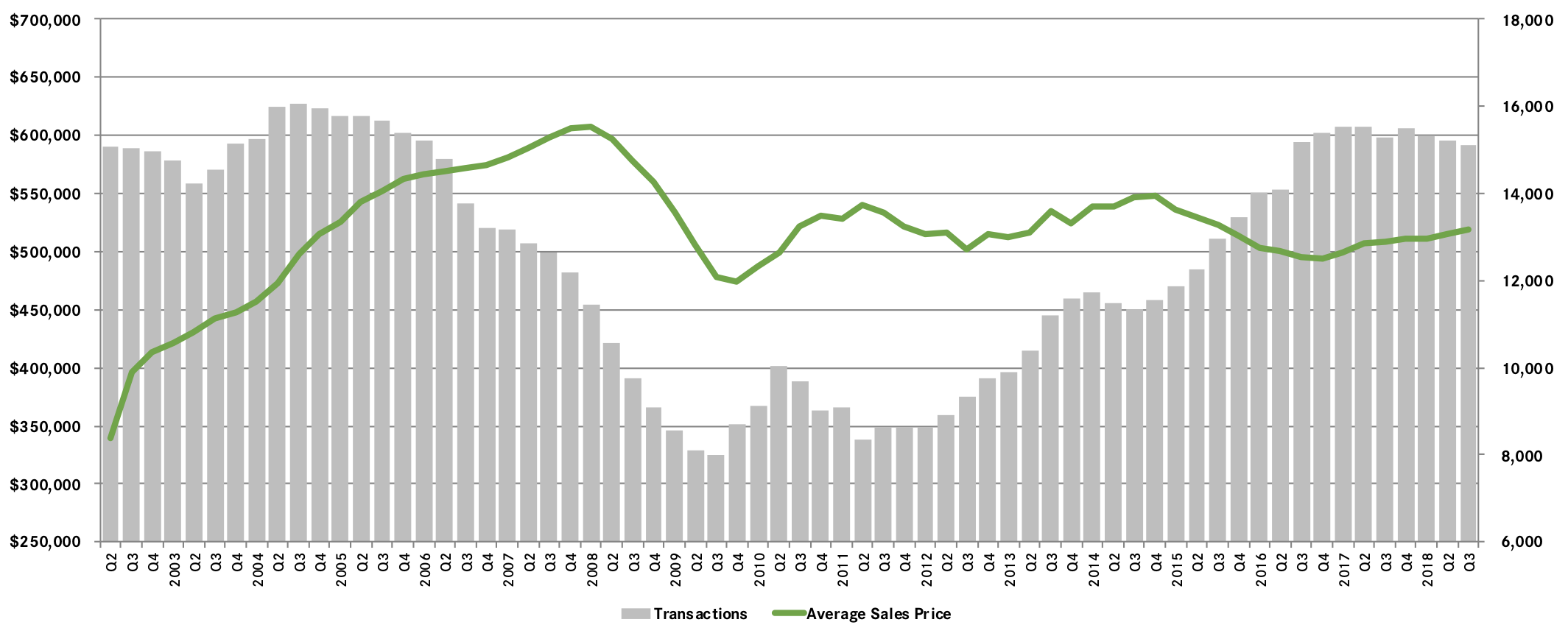

Real Estate Market Report: Third Quarter 2018 – Westchester and Hudson Valley

Despite concerns that the 2018 tax reform law would undermine housing values, Westchester and the Hudson Valley held steady in the third quarter, with prices rising throughout the region and up dramatically in some counties.

Some analysts have expressed concerns about the effects of the 2018 Tax Reform law on our regional housing market. The tax law capped the deductibility of state and local taxes and reduced the mortgage interest deduction, which particularly impacts high‑tax areas, like Westchester and the Hudson Valley. Indeed, those analysts might see evidence for this theory in the third-quarter results, with regional single‑family home sales falling almost 2% from last year, and down in almost every individual county.

For the most part, though, sales are down because of a lack of supply, not a lack of demand. Regional inventory levels have gone down 25 straight quarters, falling from a high of around 16 months to the current six months. Quarter after quarter, inventory went down until we reached a point where we have a shortage of desirable homes for sale. That’s what’s holding back sales – a lack of “fuel for the fire.”

How do we know that falling sales aren’t the result of slackening demand from the impact of tax reform? A couple of reasons:

First, this trend of declining sales predates tax reform. We’ve been tracking falling sales for almost two years, with regional sales down, in five out of the last six quarters, well before the passage of tax reform in late 2017.

Second, sales are down in all markets, not just high‑priced markets. Tax reform would not explain why sales are down even in the lower‑priced markets, where most buyers do not itemize taxes in a way that they’d be affected by changes in deductibility. And yet, quarterly sales were down more in Rockland and Dutchess than they were in Westchester.

Third, prices are up in almost every market segment. Regional average sales prices were up almost 3% for houses and 5% for condos in the third quarter and were up (in some cases dramatically) in every individual county for almost every property type. If tax reform had sapped demand in the market, we’d be seeing flat or declining pricing, not robust appreciation.

All that said, tax reform might be having a small impact on the very high end of the market, where the loss of deductibility for mortgage interest and local taxes hits the hardest. Price appreciation was more pronounced in the lower‑priced markets, with single‑family average prices rising 11% in Putnam, 6% in Rockland, 14% in Orange, and 7% in Dutchess. Meanwhile, Westchester’s single‑family home pricing was up just a tick on average, and only fell 1% at the median. We’re talking about a marginal, not a major, impact. Prices aren’t rising at the rate they are in the lower‑priced markets, they’re basically flat, not falling.

Moreover, inventory is starting to respond to these rising prices. For the first time since 2012, inventory levels went up this quarter, which illustrates fundamental economic market theory: If demand is strong, and supply stays steady (or goes down), prices will go up. And when prices go up, new inventory will come onto the market. That’s what we’re seeing now: After years of decline, single‑family inventory was up in almost every county in the region, stabilizing near that six‑month level that usually signals a balancing market.

Going forward, we believe that the appetite in the market can handle both the impact of tax reform and this increased inventory while still driving continued price appreciation. With strong economic conditions, relatively low‑interest rates (and the specter of rate increases on the horizon), and pricing still at attractive 2004‑05 levels, we expect a robust market through the end of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

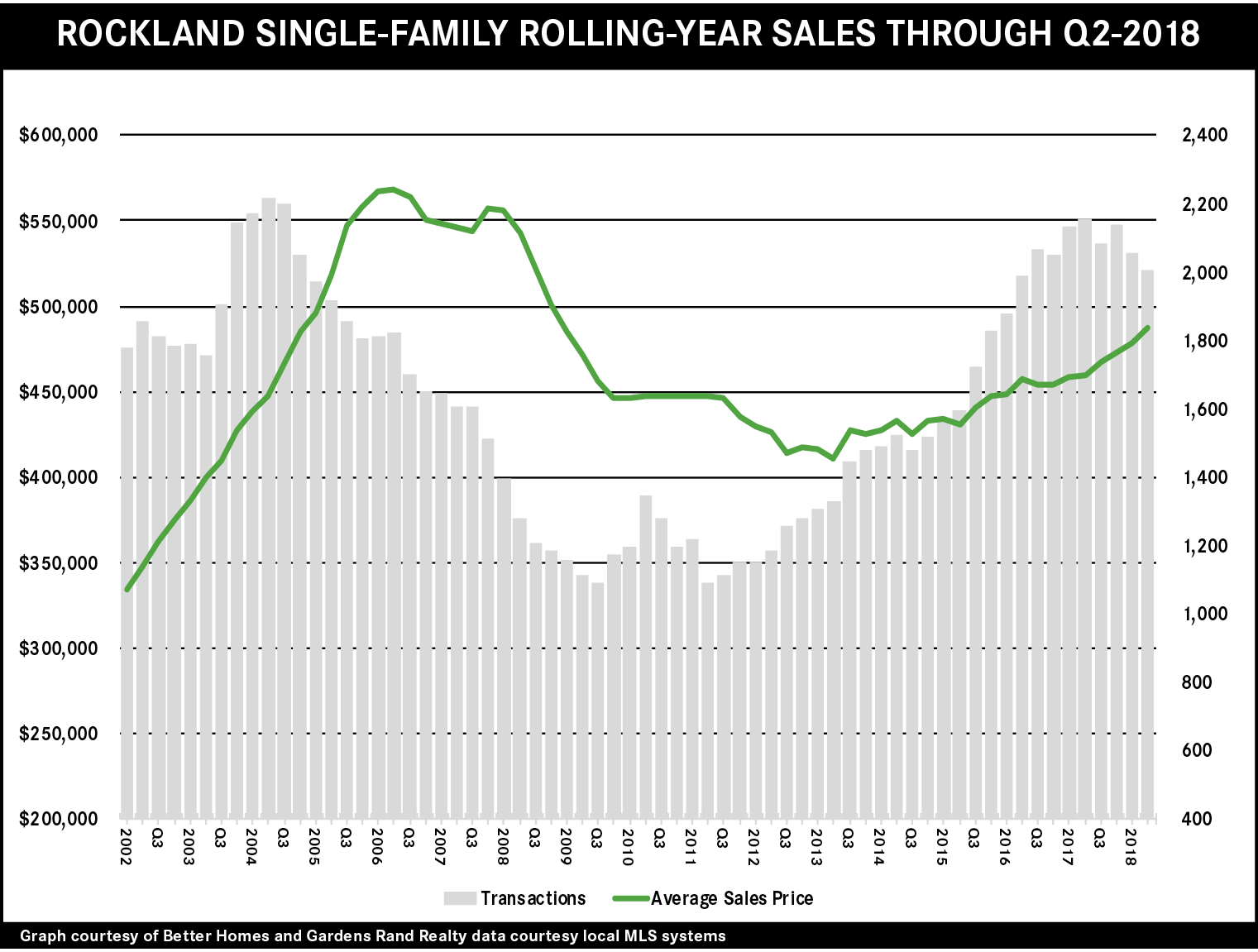

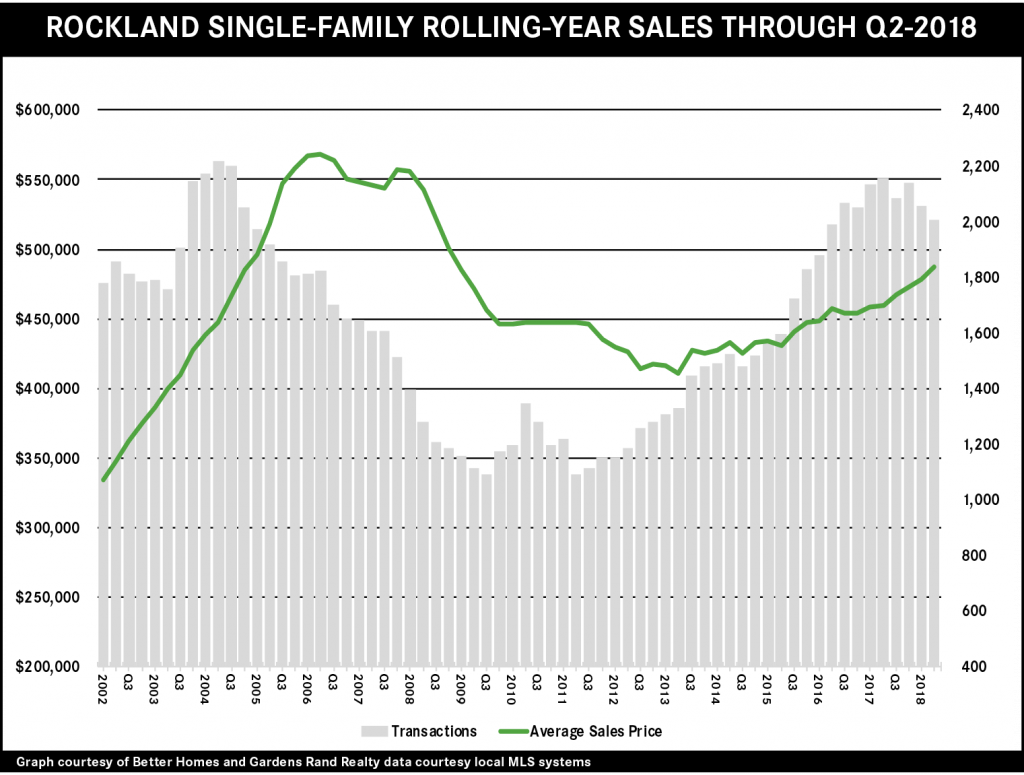

Real Estate Market Report: 2nd Quarter 2018 – Rockland

Activity in Rockland’s housing market continued to be shackled by low levels of inventory in the second quarter, which drove sales down again, even while pushing prices up sharply. Transactions fell almost 10% for houses and 13% for condos, the largest drops since the market correction almost 10 years ago. As a result, pricing is way up from last year, with house prices rising over 8% on average, almost 6% at the median, and almost 5% in the price‑per‑square foot (condo pricing is more mixed). But we are starting to see signs that rising prices might be attracting more sellers into the market, which should eventually stabilize sales. Going forward, though, we think that high demand and low inventory will continue to stifle sales and drive price appreciation at least through the end of the year.

Activity in Rockland’s housing market continued to be shackled by low levels of inventory in the second quarter, which drove sales down again, even while pushing prices up sharply. Transactions fell almost 10% for houses and 13% for condos, the largest drops since the market correction almost 10 years ago. As a result, pricing is way up from last year, with house prices rising over 8% on average, almost 6% at the median, and almost 5% in the price‑per‑square foot (condo pricing is more mixed). But we are starting to see signs that rising prices might be attracting more sellers into the market, which should eventually stabilize sales. Going forward, though, we think that high demand and low inventory will continue to stifle sales and drive price appreciation at least through the end of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

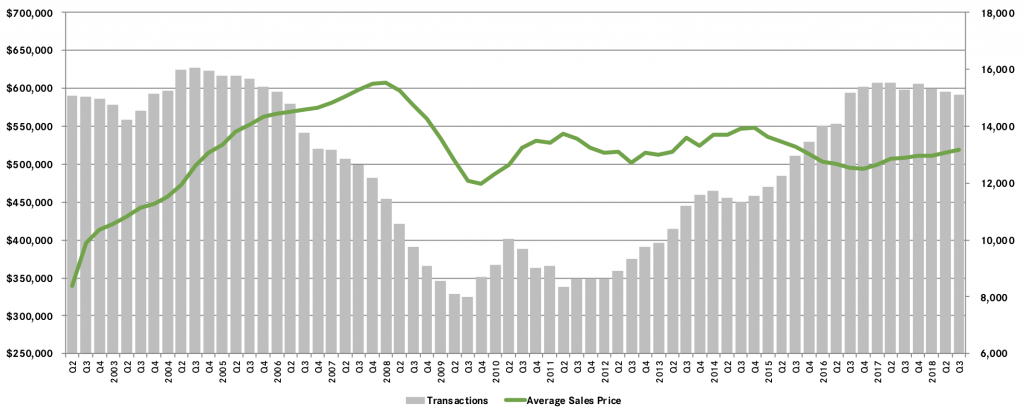

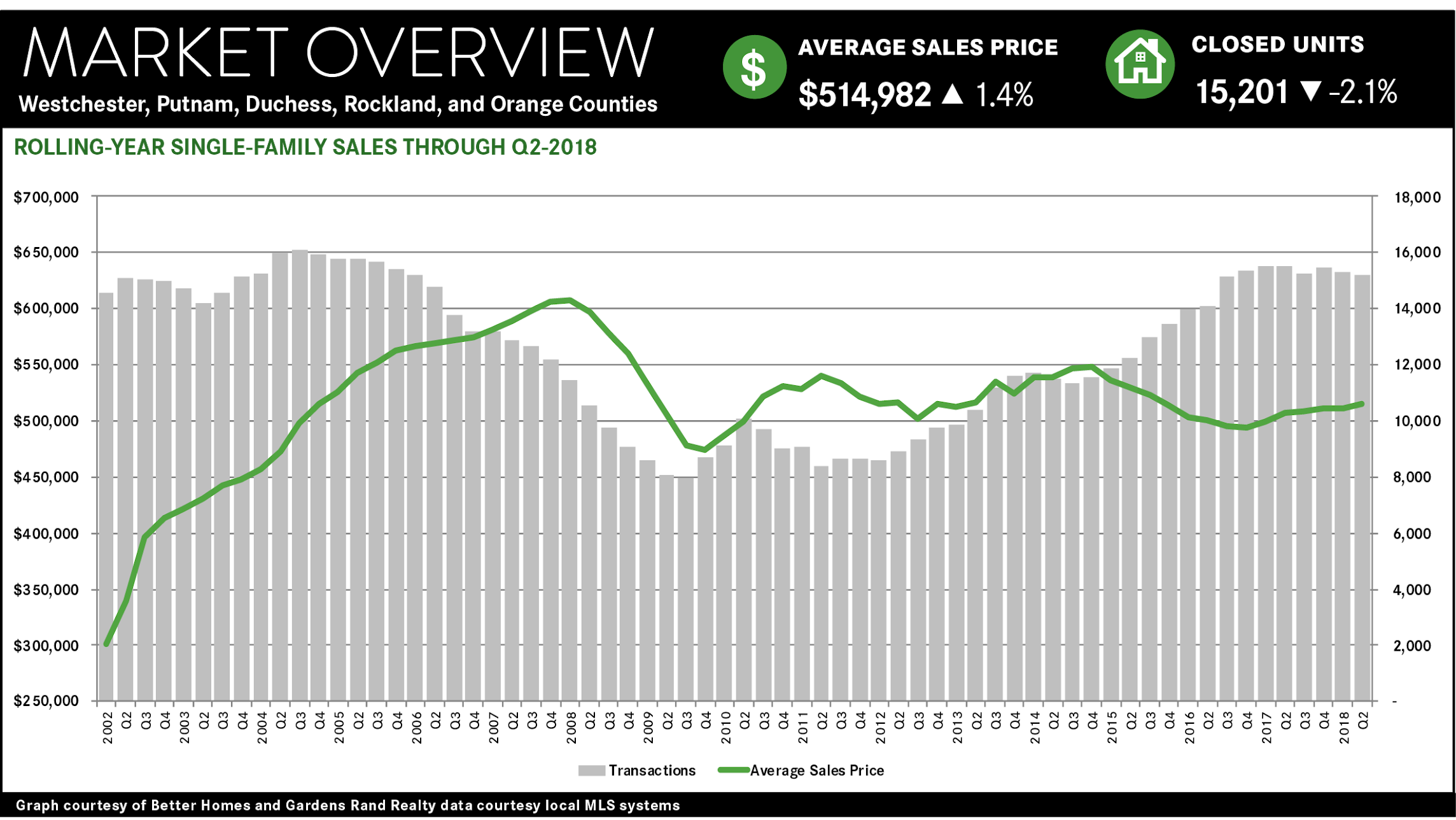

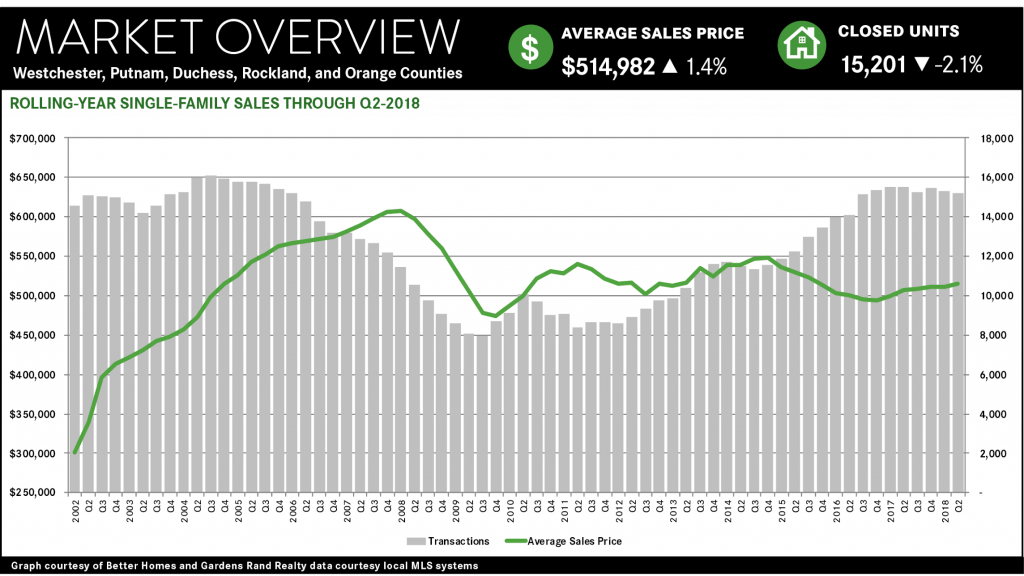

Real Estate Market Report: 2nd Quarter 2018 – Lower Hudson Valley (New York)

The regional housing market in the New York City northern suburbs surged again in the second quarter of 2018, with high demand and low supply driving prices up throughout the area.

The regional housing market in the New York City northern suburbs surged again in the second quarter of 2018, with high demand and low supply driving prices up throughout the area.

We are clearly in a “seller’s market.” The main story in the market right now is a textbook illustration of basic economic principles: when demand is high, and supply is low, prices go up. This is essentially what a seller’s market looks like, with low levels of inventory coupled with high demand holding sales down while driving prices up. And that’s exactly what we’re seeing throughout the region:

Sales are down. Regional single‑family home sales in the quarter fell almost 3%, and condo sales fell 7%, continuing a trend we’ve been watching for the past year ‑‑ indeed, the rolling-year sales were down about 2% for all property types. To put this in perspective, rolling-year sales had gone up in 24 out of the last 25 quarters prior to the first quarter of this year. And the decline is universal, with single‑family sales down in virtually every county in the region: falling almost 5% in Westchester, 4% in Putnam, and 10% in Rockland (sales rose slightly in Orange and Dutchess).

Prices are up. But all this demand, coupled with a lack of supply, is having its expected impact on pricing. Single‑family average prices were up across the board, rising over 3% for the region and up in every county in the region: up over 2% in Westchester, almost 3% in Putnam, over 8% in Rockland, almost 11% in Orange, and over 10% in Dutchess. And for the first time in over 10 years, single‑family average prices for the rolling year were up in every county in the region.

Inventory is low, but is starting to rise. The key to this market, of course, is the amount of available supply: the number of homes for sale in the market. Inventory has been falling for several years now, holding back sales and driving prices up. But that same economics textbook teaches us that as prices go up, eventually supply starts to rise. Why? Because rising prices attract sellers into the market.

And that is exactly what we’re starting to see: stabilizing inventory. Inventory is still low, but it’s starting to settle at about the six‑month level that signals a balanced market. Indeed, the months of inventory in the region was at 6.2 months, flat compared to the second quarter of last year. And inventory was actually up in both Westchester and Rockland. It might be too early to call a shift in the market, but this was a noticeable change after several years of sharp inventory declines quarter after quarter.

Going forward, we expect the market to continue to grow through 2018. The seller’s market is really just starting to hit its stride, where high demand meets higher supply and pushes both sales and prices up over last year. Higher prices might be tempting more sellers into the market, but we believe that demand is strong enough to accommodate this supply, and drive price appreciation through the end of the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

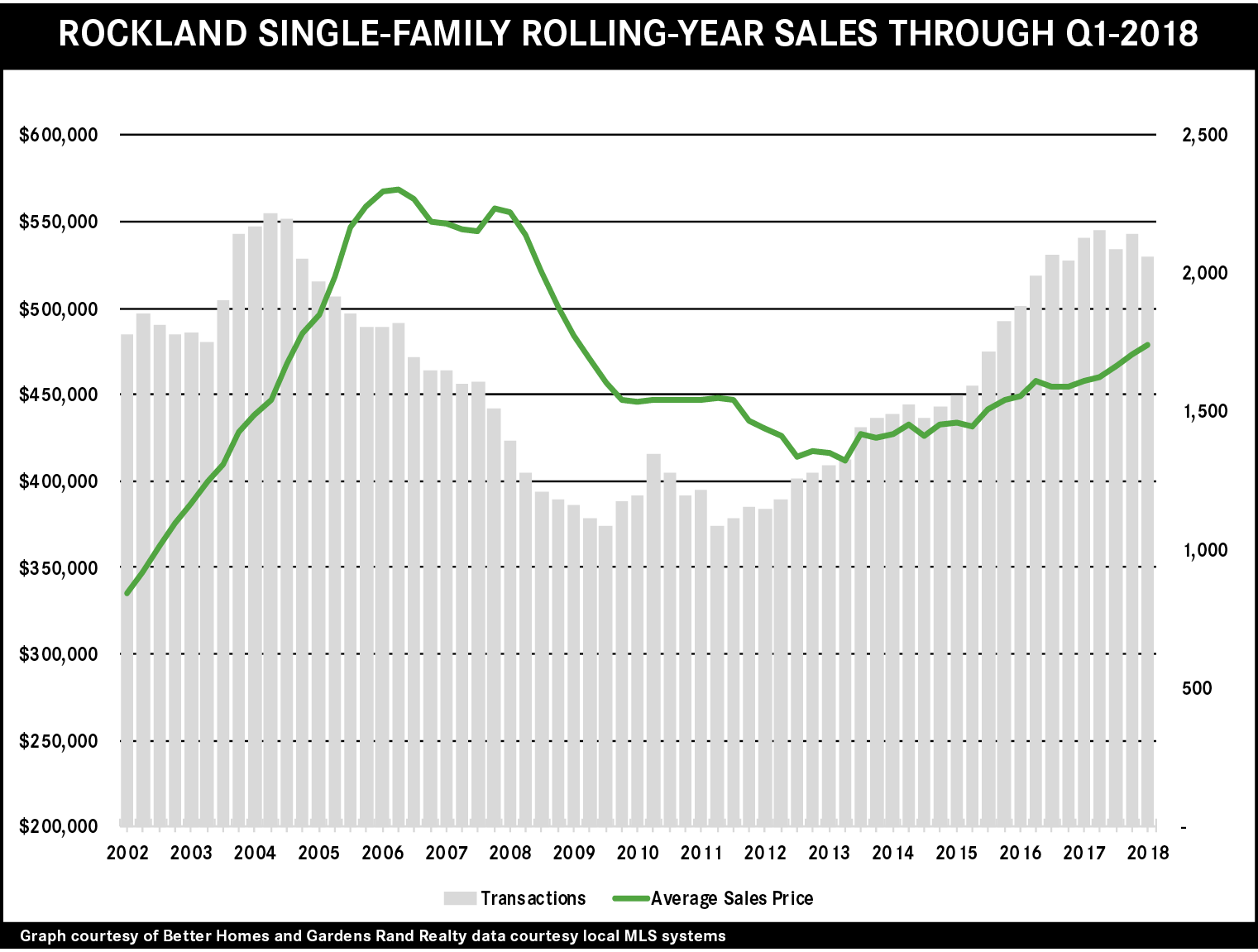

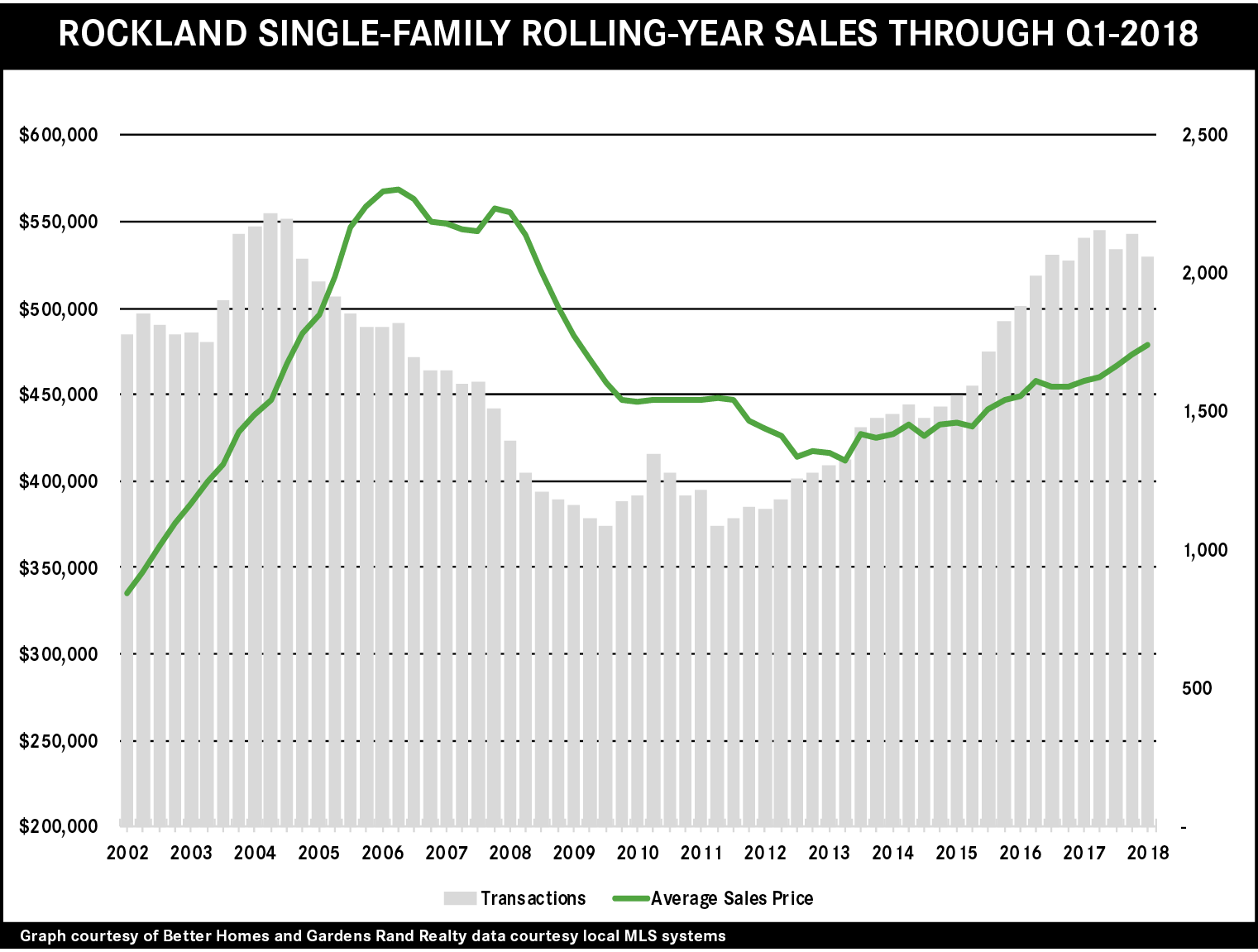

Real Estate Market Report: 1st Quarter 2018 – Rockland County, NY

Rockland’s housing market was absolutely stifled in the first quarter by a depleted inventory, which was drove sales down almost 19%. Rockland demand is high, which is why single‑family prices were up across the board: almost 6% on average, over 2% at the median, and a whopping 10% in the price‑per‑square‑foot. Average prices for the year are now up over 4% for single‑family and 1% for condos. If prices keep going up, more homeowners will be tempted into the market, which should help bring sales back up in what is likely to be a torrid spring.

Rockland’s housing market was absolutely stifled in the first quarter by a depleted inventory, which was drove sales down almost 19%. Rockland demand is high, which is why single‑family prices were up across the board: almost 6% on average, over 2% at the median, and a whopping 10% in the price‑per‑square‑foot. Average prices for the year are now up over 4% for single‑family and 1% for condos. If prices keep going up, more homeowners will be tempted into the market, which should help bring sales back up in what is likely to be a torrid spring.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link