Rand Realty is Orange County’s Best Real Estate Company

Better Homes and Gardens Rand Realty is Orange County’s Best Real Estate Company for the 5th Consecutive Year

The Times Herald Record Readers’ Choice Best of the Best 2019 Winner — Better Homes and Gardens Rand Realty

Central Valley, NY – Better Homes and Gardens Rand Realty has been named “Best Real Estate Company,” standing among the “Best of the Best” in The Times Herald Record Readers’ Choice Awards. This is the fifth consecutive win for the brokerage.

As a premier real estate company in the Hudson Valley for over 35 years, Better Homes and Gardens Rand Realty’s team of sales associates leads the way in excellence. “We’re humbled by the kindness and loyalty of our clients and The Times Herald Record readers – and we graciously thank them for voting for us year after year,” says Renee Zurlo, General Manager, Greater Hudson Valley Region, Better Homes and Gardens Rand Realty.

Better Homes and Gardens Rand Realty brings together the resources of a large national company, with the local expertise of a family-owned business. “Our family has grown up in the Hudson Valley, so we have a deep and personal understanding of our clients’ wants and needs and what the region has to offer. We greatly appreciate The Times Herald Record Readers for recognizing our company and sales associates, along with our endless commitment to our communities and the clients we serve,” says Matt Rand, CEO Better Homes and Gardens Rand Realty.

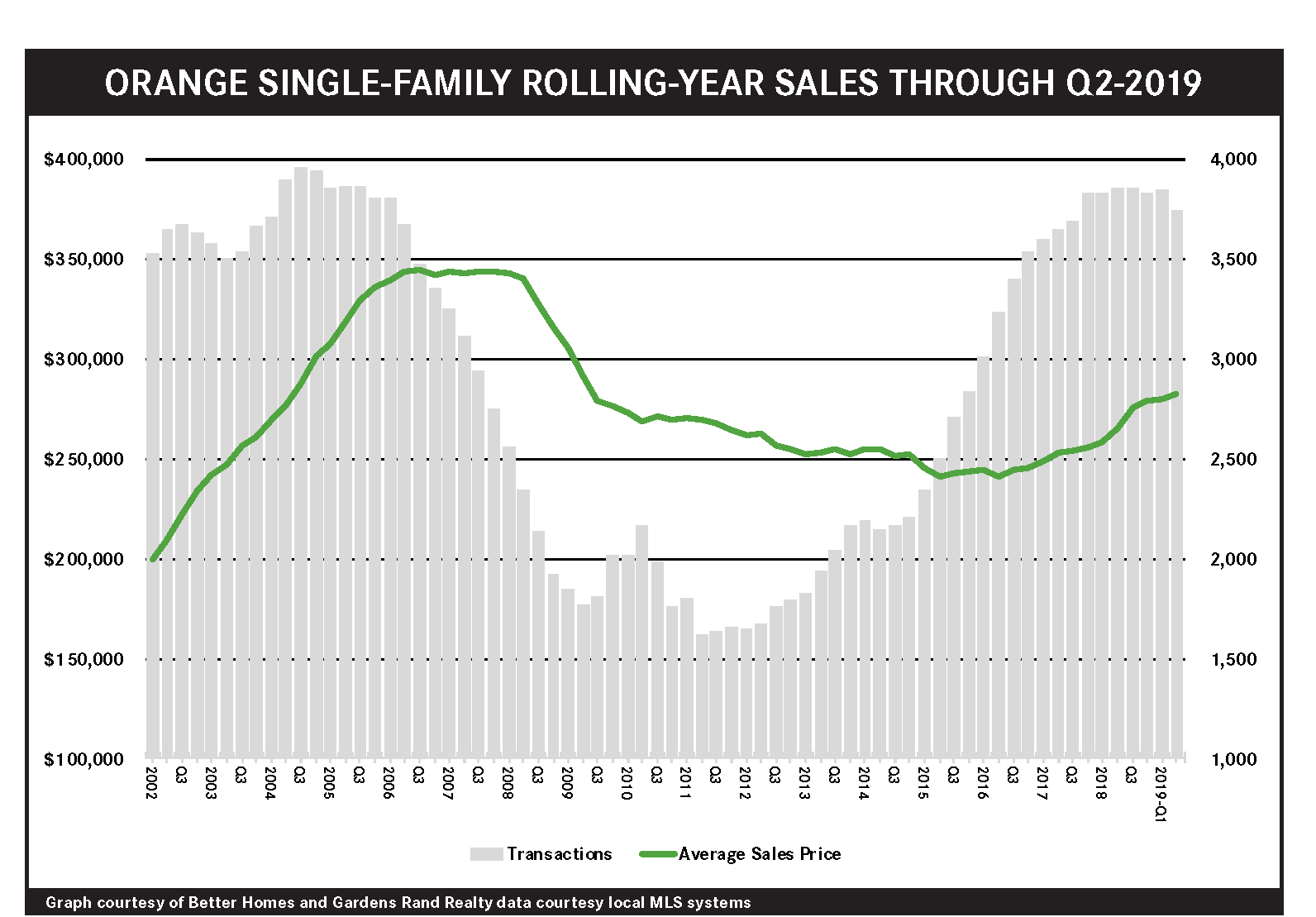

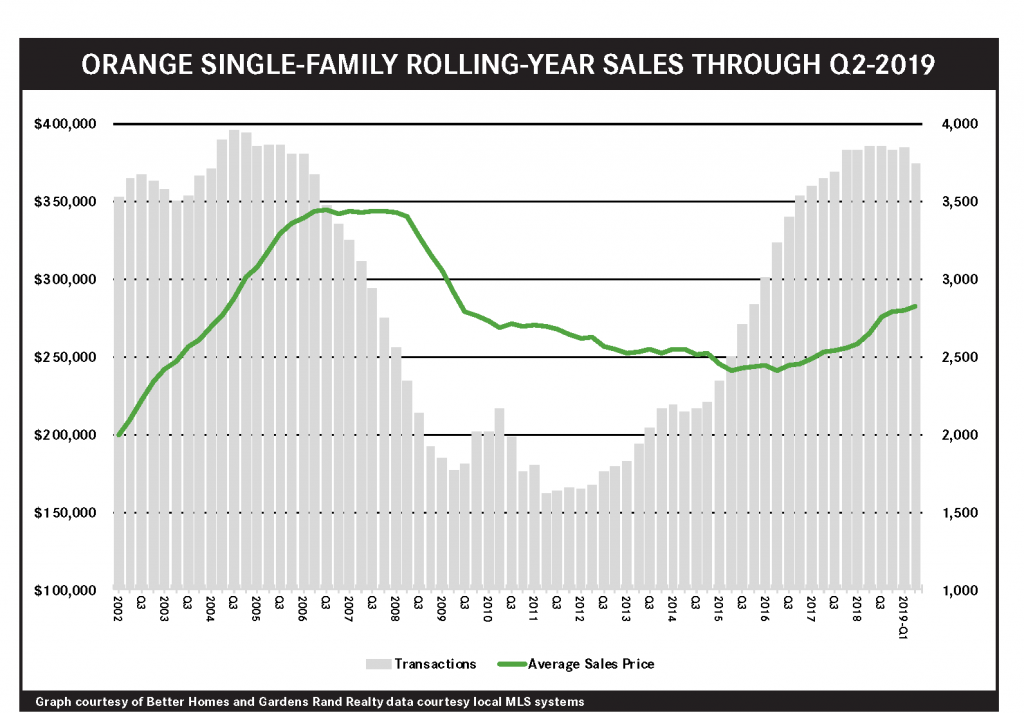

Second Quarter 2019: Real Estate Market Report – Orange County, New York

Demand in the Orange County housing market continued to grow in the second quarter of 2019, even while a lack of inventory stifled sales growth. Single-family home sales fell sharply compared to the second quarter of 2019, dropping almost 11%, but we believe that has more to do with a shortage of supply rather than a lack of demand. Why? Because quarterly single-family home prices were way up across the board, rising almost 3% on average, 6% at the median and 8% in the price-per-square-foot. And condo prices absolutely spiked, rising almost 20% on average, 16% at the median, and over 15% in the price-per-square-foot. Unlike its higher-priced neighbors like Westchester and Rockland, Orange has been largely immune from the impact of the 2018 tax reform cap on state and local tax deductions, because buyers at Orange’s price point are more likely to take the standard deduction anyway. Going forward, we believe Orange prices will continue to appreciate through the summer and fall, and expect that sales might go up if we see more inventory hit the market.

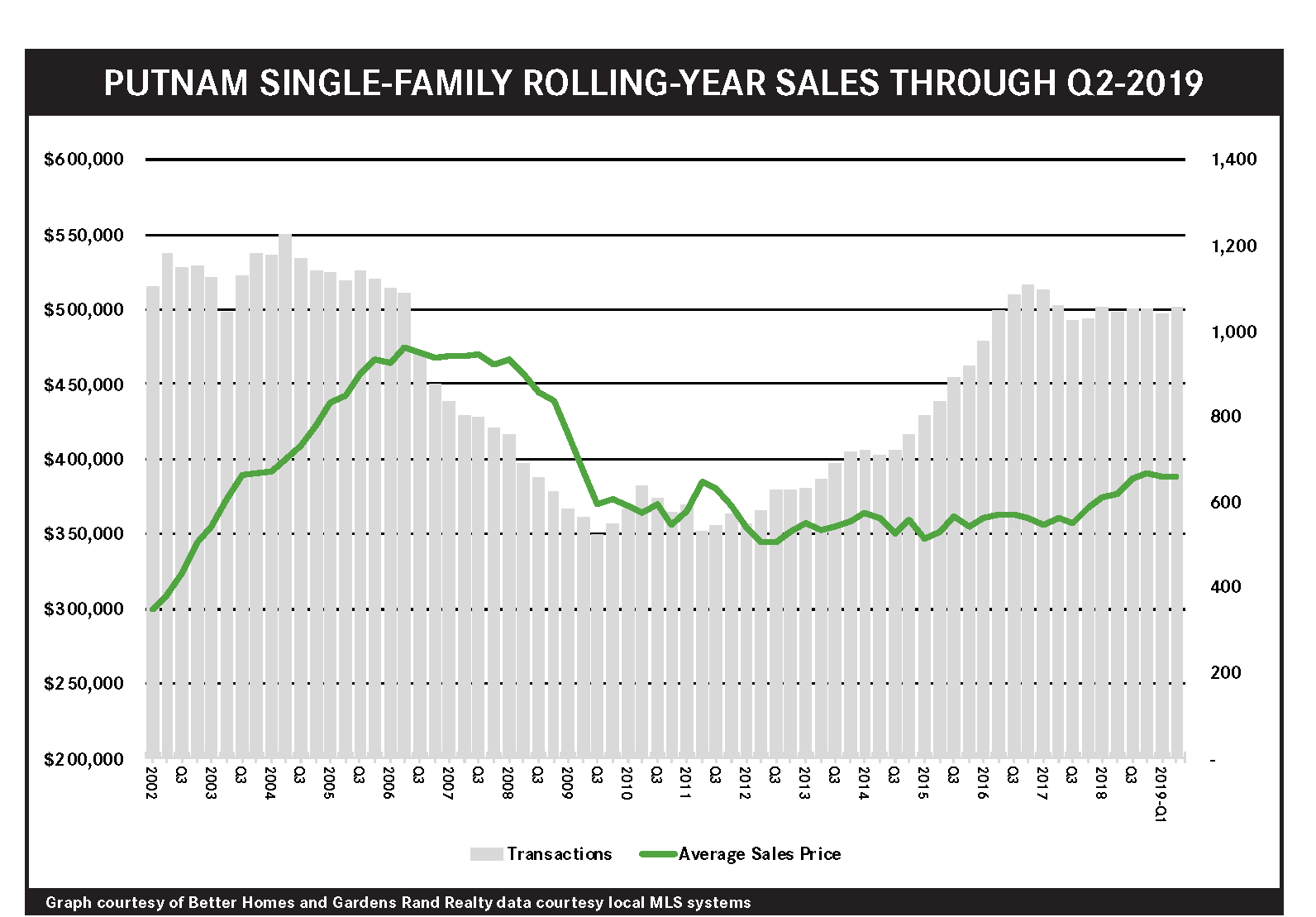

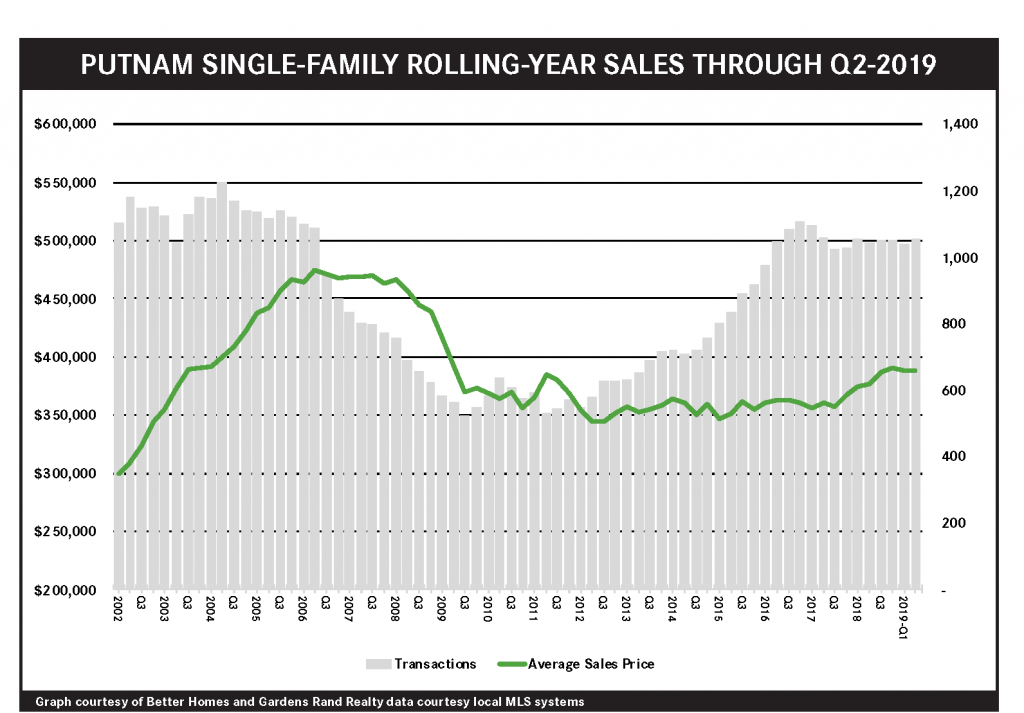

Second Quarter 2019: Real Estate Market Report – Putnam County, New York

The Putnam housing market cruised through the second quarter of 2019, with sales up and prices basically flat. Compared to the rest of the region, Putnam was a bit of an outlier, with single-family home sales rising 7% for the quarter and almost 1% for the rolling year – the only county in the region with rising sales. Single-family pricing was a little more mixed: flat on average, up almost 4% at the median, and down 1% in the price-per-square-foot. For the rolling year, though, prices have been generally appreciating. Moreover, the negotiability indicators signaled a rising seller’s market, with days-on-market falling and the listing retention rate up. Going forward, we expect that Putnam will continue to show modest sales growth and price appreciation through the summer and fall.

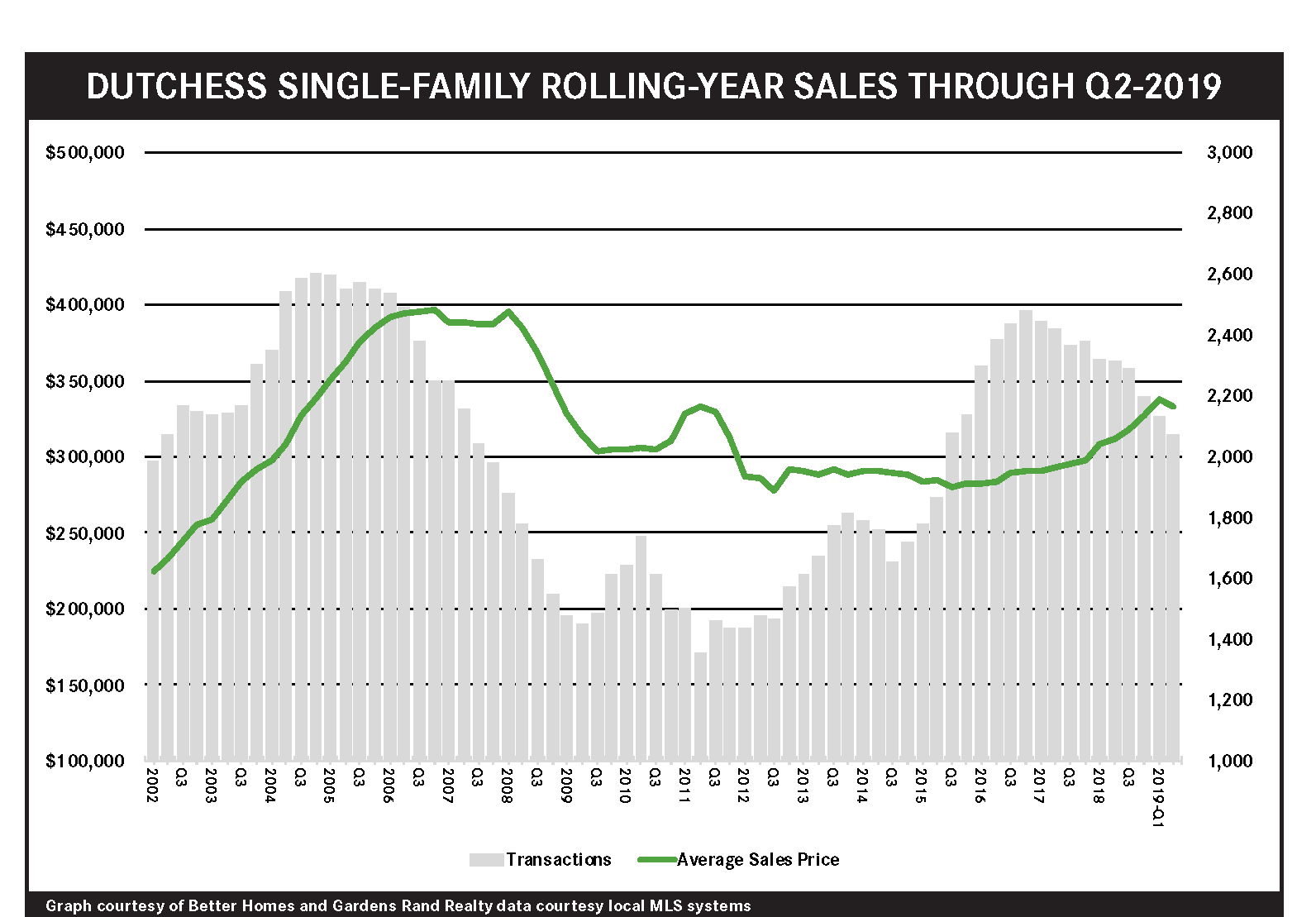

Second Quarter 2019: Real Estate Market Report – Dutchess County, New York

The Dutchess housing market was a “Tale of Two Markets” in the second quarter of 2019, with single-family home sales softening a bit even while condo sales surged. After a sizzling start to the year, the single-family market cooled, with sales and prices both falling. But the lower-priced condo market was up, with sales rising over 6% and prices up about 3% on average and 4% at the median. Essentially, both markets should be doing well with these kinds of strong housing fundamentals – rates are low, inventory is low, prices are relatively low, and the economy is strong, But only the condo market is behaving like a proper seller’s market, because the 2018 Tax Reform cap on state and local taxes has suppressed sales growth and price appreciation in higher-priced markets. Essentially, the SALT cap affects taxpayers who are more likely to itemize their taxes, which includes the higher-income home buyers for single-family homes. But the SALT cap has less of an impact in the lower priced-condo market, since buyers at that price point are more likely to take the standard deduction. All that said, we believe that at some point the SALT cap hit will get priced into the Dutchess market, and that the economic fundamentals will eventually drive sales growth and price appreciation in both single-family and condo markets.

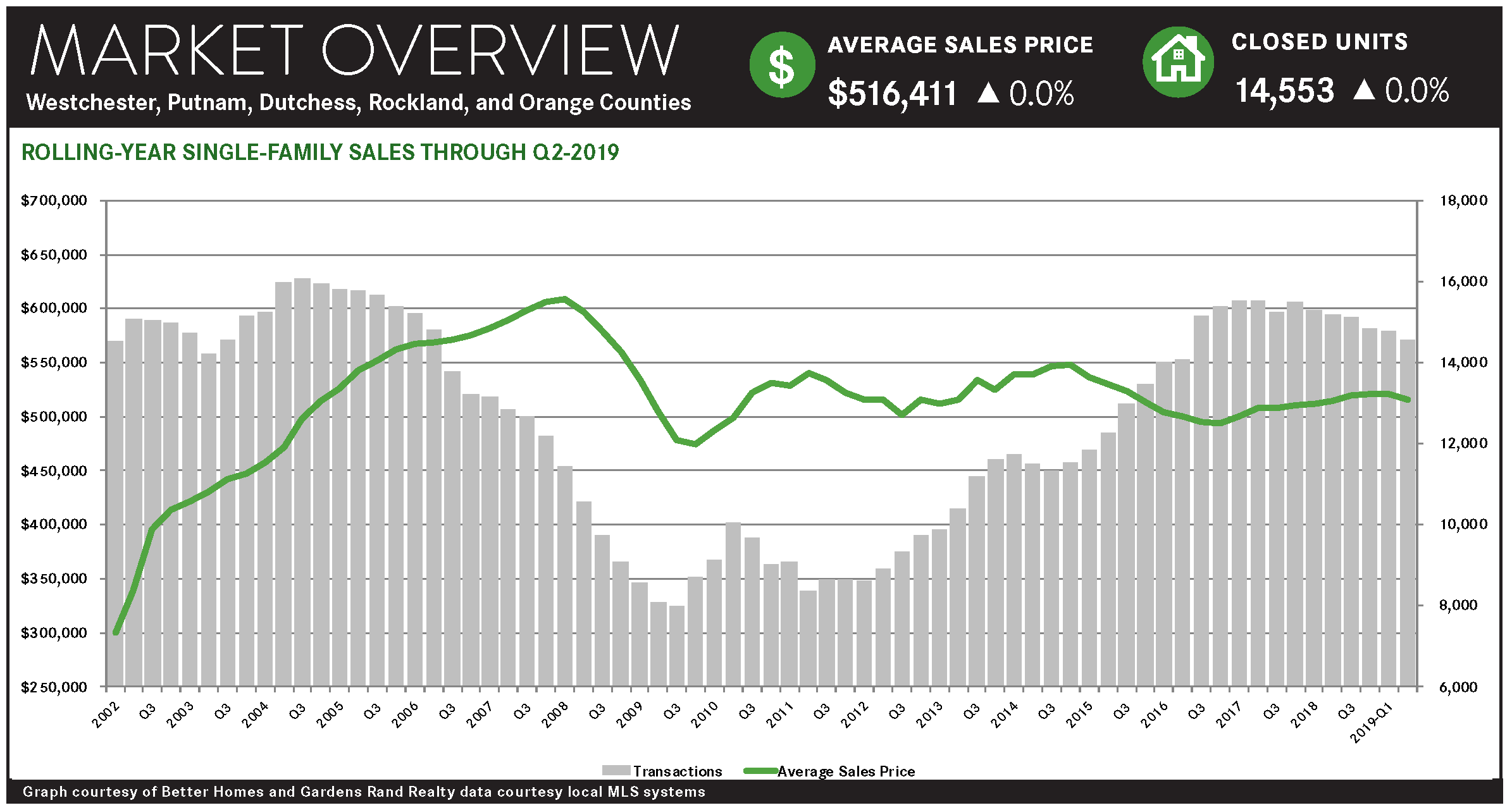

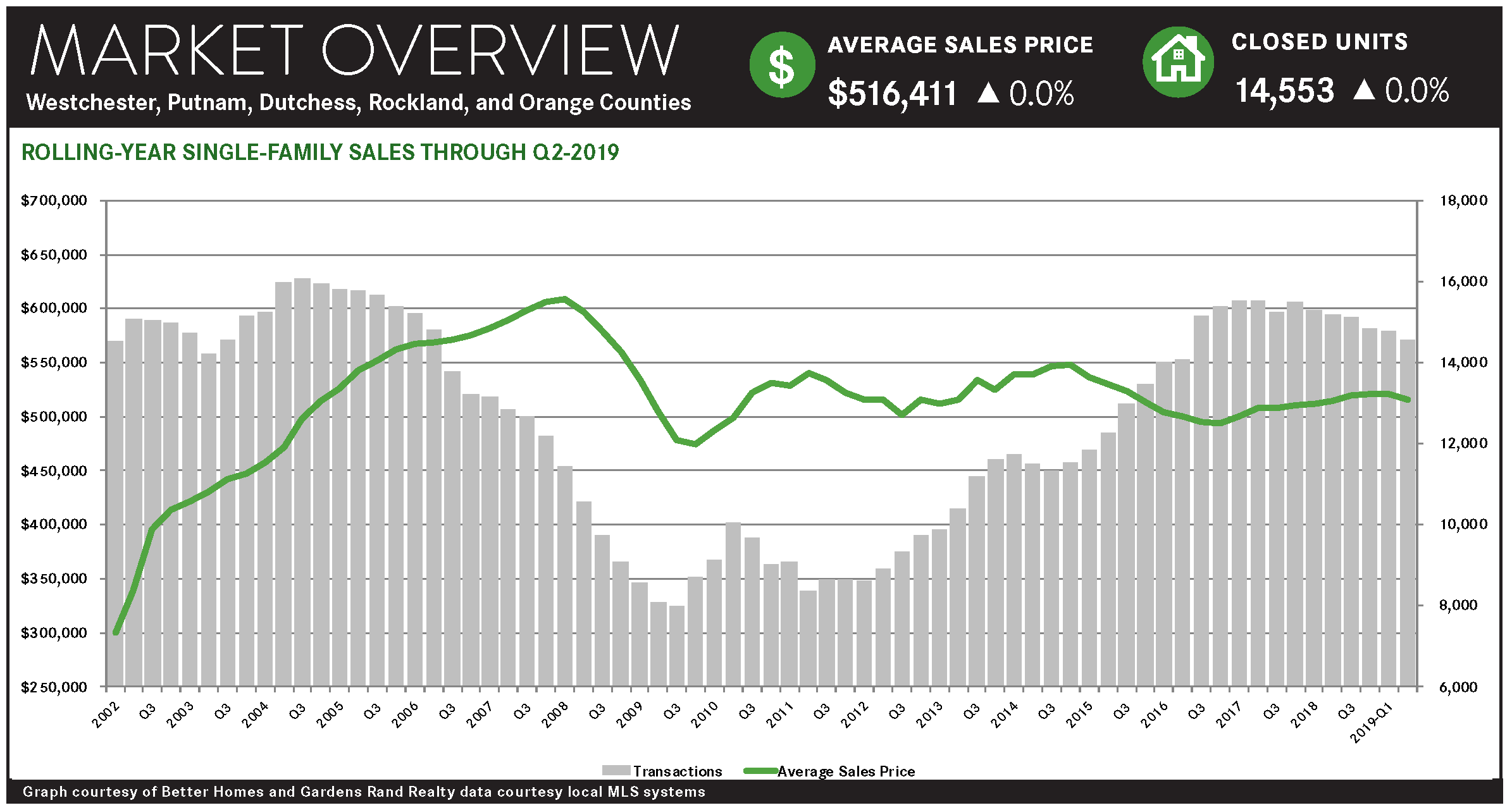

Second Quarter 2019: Real Estate Market Report – New York Overview

The housing market in Westchester and the Hudson Valley continued to be a “tale of two markets” in the second quarter of 2019, with more expensive single‑family home sales and prices continuing to struggle while lower‑priced condo markets soared. We attribute this divergence to the 2018 Tax Reform cap on state and local tax deductions, which is suppressing what should be a strong, growing seller’s market. Single‑family home sales and prices were down across the board. Regional sales compared to last year’s second quarter were down almost 6%, and down in just about every county. Similarly, the regional average price for a single‑family home fell 2.5% from the second quarter of last year, with prices down in every county other than Orange, the lowest‑priced market in the region. The regional average sales price was up just a tick for the rolling year, so we have not yet seen any longer‑term depreciation in the market. On the other hand, the lower‑priced condo markets are booming. Regional condo sales were up over 2% from last year’s second quarter, with average prices rising an eye‑popping 14%. Indeed, the average condo price spiked in many counties throughout the region: Westchester up 15% (and up 6% for coops), Rockland up 16%, Orange up 20%, and Dutchess up 3%. This capped an extraordinarily strong yearlong run for condos, with prices up almost 7% for the year, and rising in every county in the region. So why is the condo market booming? Well, the fundamentals of the market could not be stronger: interest rates are back down to historic lows, prices are basically at 2004 levels without even adjusting for inflation, and every national and regional economic indicator is positive. That’s why we are seeing condo sales and prices at levels we haven’t reached since the market correction ten years ago. The better question is: why isn’t the single‑family market booming? And the answer to that is simple: the 2018 Tax Reform cap on state and local tax deductions (the “SALT Cap”), which is having a disproportionate impact on middle‑ and higher‑end home buyers. Why? Because taxpayers in those markets are more likely to itemize their taxes rather than take the standard deduction, which means they’re more likely to feel the pinch of the $10,000 SALT Cap. That’s why we have a “Tale of Two Markets.” The SALT Cap is suppressing sales and price appreciation in the higher‑priced markets but having little or no impact on lower‑price markets – including single‑family counties like Orange, and condos throughout the region. The SALT Cap hasn’t caused anything like the devastation of the market correction in 2008‑09, but it is still hampering the growth of what should be a robust seller’s market. Going forward, we still believe that the market is still poised for growth in the summer and fall. At some point, the impact of the SALT Cap will get priced into the market, and the single‑family market will start behaving like the condo market. Again, the seller market fundamentals are very strong: the economy is growing, interest rates are near historic lows, inventory is relatively low, and homes are still priced at attractive levels well below their historical highs.

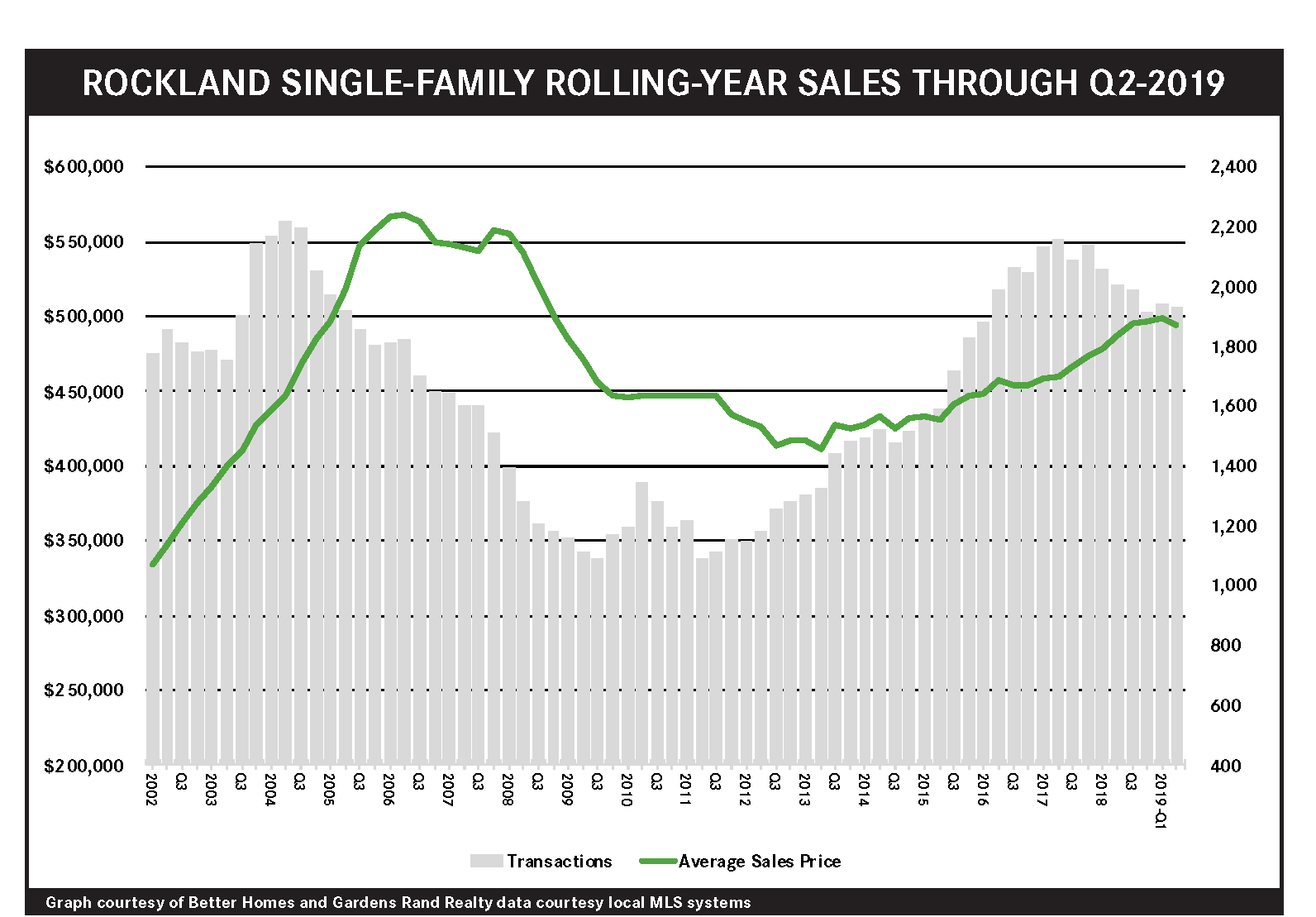

Second Quarter 2019: Real Estate Market Report – Rockland County, New York

The Rockland housing market was a “Tale of Two Markets” in the second quarter of 2019, with single-family home sales struggling and condo sales soaring. After a surge to start the year, the single-family market softened, with sales and prices both falling. But the lower-priced condo market surged, with quarterly prices spiking over 16% on average and at the median. Essentially, both markets should be booming in response to the strong housing fundamentals – rates are low, inventory is low, prices are relatively low, and the economy is strong – but only the condo market is behaving like a proper seller’s market. Why the discrepancy? We believe it’s due to the 2018 Tax Reform cap on state and local tax deductions, which particularly suppresses growth in higher-priced markets (like Rockland single-family homes), where buyers are more likely to itemize their taxes. The SALT cap has less of an impact in the lower priced-condo market, since buyers at that price point are more likely to take the standard deduction. That’s why the condo market is soaring while the single-family market struggles a bit. All that said, we believe that at some point the SALT cap hit will get priced into the market, and that the economic fundamentals will eventually drive sales growth and price appreciation in both markets.

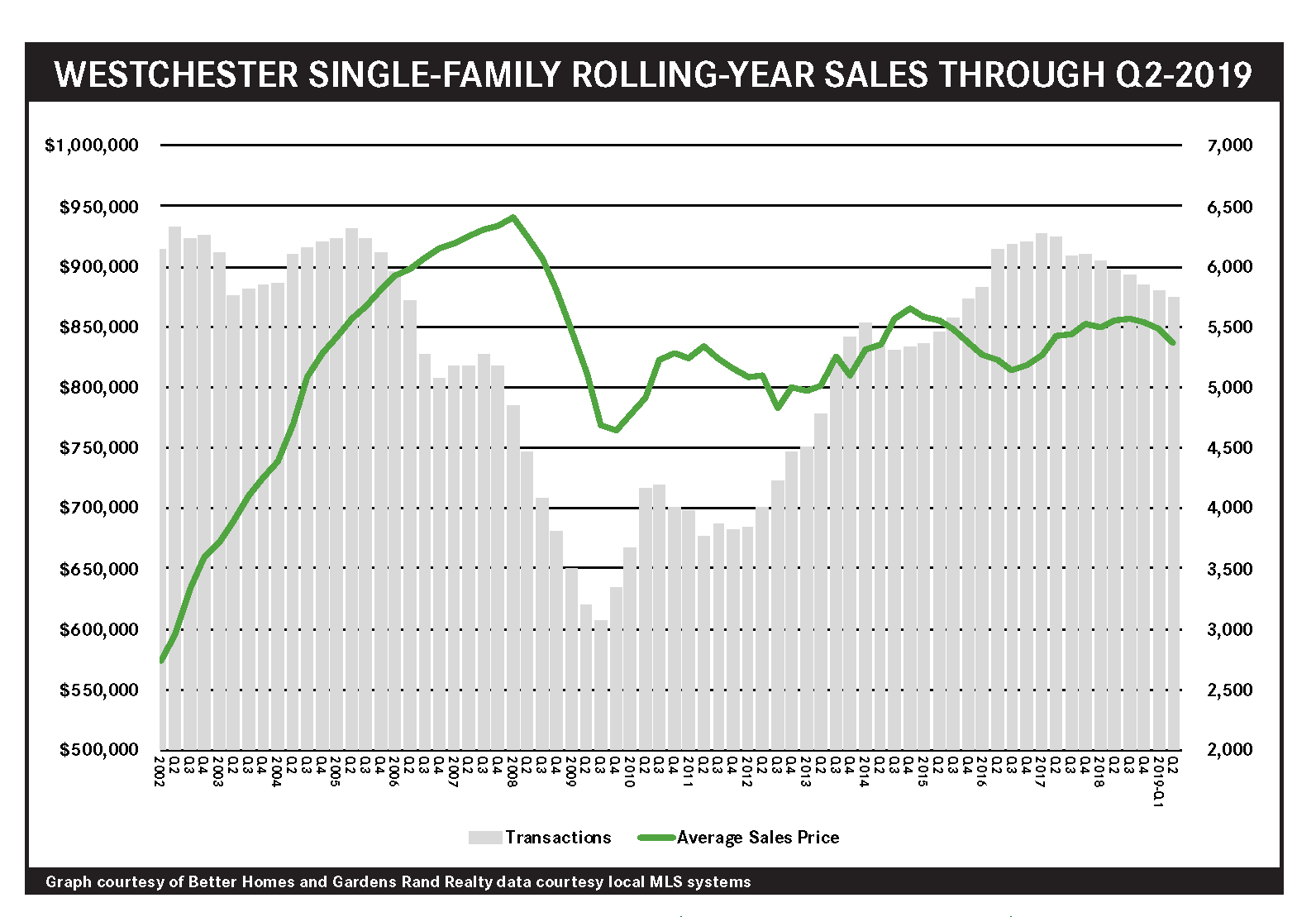

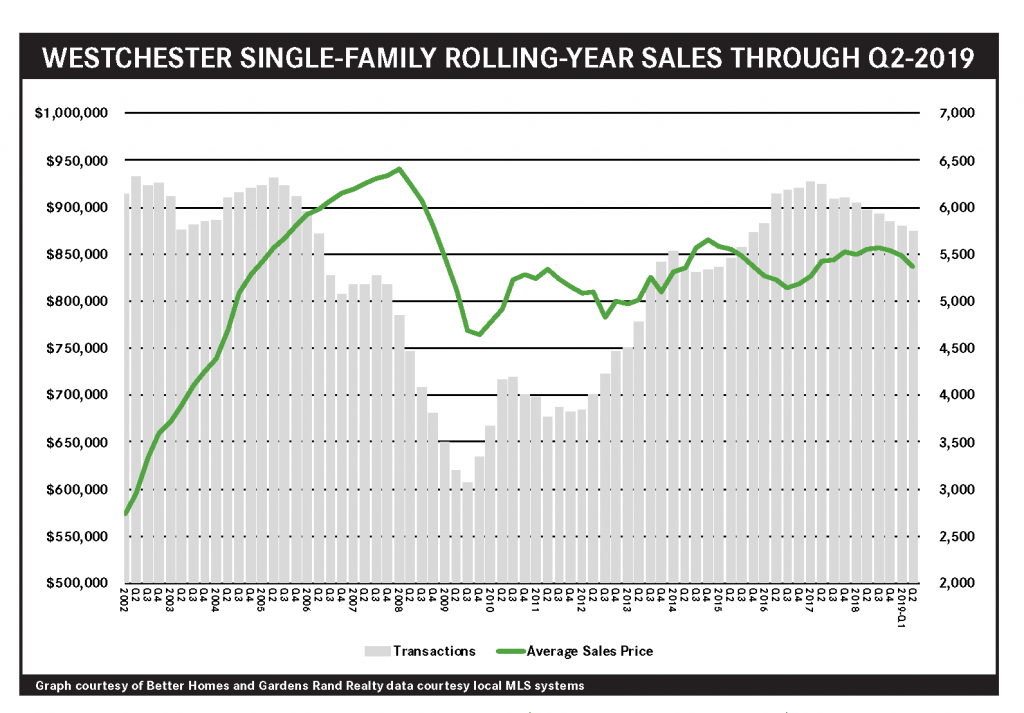

Second Quarter 2019: Real Estate Market Report – Westchester County, New York

The Westchester housing market was the quintessential “Tale of Two Markets” in the second quarter of 2019, with single-family homes struggling while condo and coop sales soared. Single-family home sales were down, continuing a trend we have been watching since the 2018 Tax Reform’s cap on state and local tax deductions (“SALT Cap”). As we expected, the SALT Cap has impacted the higher-end Westchester single-family market, where more home buyers are likely to itemize their deductions and feel the effect of the cap. But condo and coop buyers are more likely to take the standard deduction for the federal taxes, which means they’re not feeling the pinch of the SALT Cap. And as a result, coop and condo sales are soaring, with quarterly sales up almost 8% for coops and 7% for condos, and average prices up over 6% for coops and an eye-popping 15% for condos. The question is when the single-family market will finally price in the SALT Cap hit and start responding to the fundamentals that are driving growth in the lower-priced condo market: interest rates back near historic lows, attractive pricing, and a strong economy.

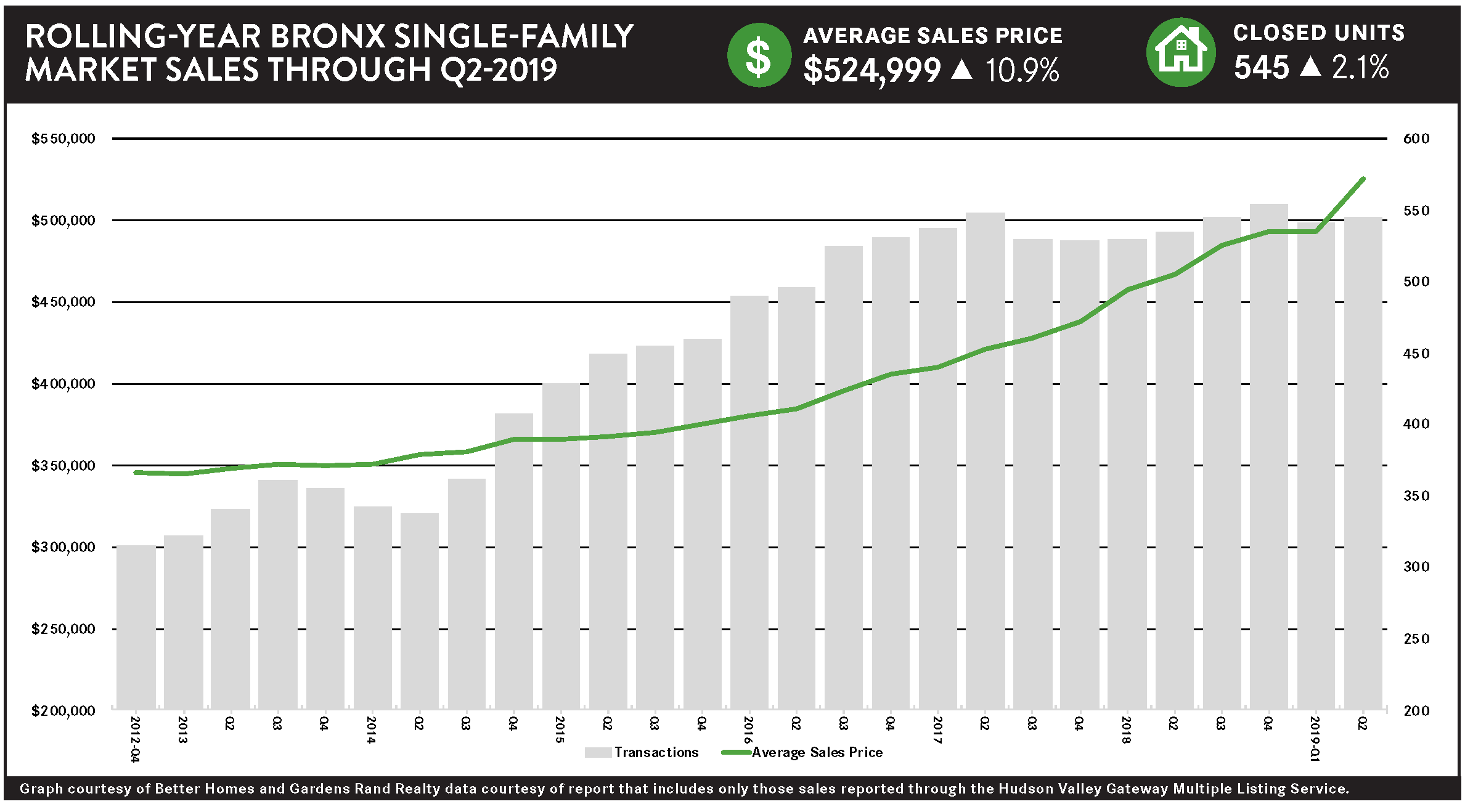

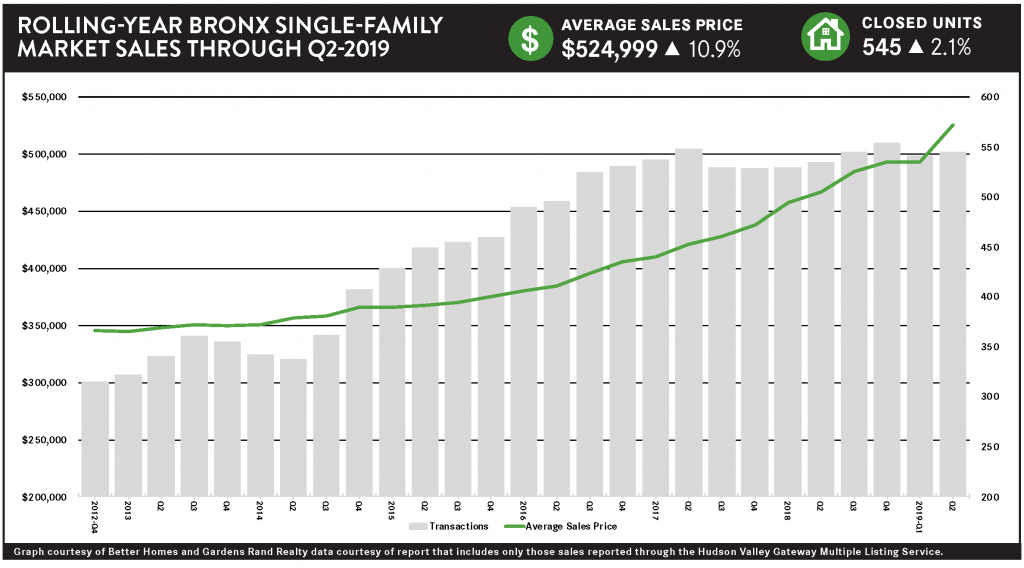

Second Quarter 2019: Real Estate Market Report – Bronx County, New York

Strong demand in the Bronx housing market in the second quarter of 2019 drove pricing up even while limited inventory stifled sales growth.

Pricing. Overall pricing was up 14.5% compared to the second quarter of last year, and up for most property types: rising a whopping 32% for single‑family homes, 4% for multi‑families, and 11% for condos. The exception was pricing for cooperative apartments, which fell about 9% for the quarter – even while it was up over 2% for the rolling year.

Sales. We saw much the same story in sales, which were up 3% for single‑families, 9% for multi‑families, and 10% for condos – but, again, were down for coops, by almost 20%. We do not see why coops would be behaving so differently from other property types, so we will keep an eye on this for the third quarter.

Inventory. The number of homes for sale was up in most property types, with homeowners responding to the attraction of rising prices. Inventory is still, though, in the 5‑6 month range for most property types, a level that usually indicates a seller’s market.

Outlook. Going forward, we believe that Bronx sellers and homeowners have reason to be optimistic about where the market is going. The fundamentals are very strong: the economy is growing, inventory is still low, interest rates are near historic lows, and demand is strong. We expect that, even with the challenges of a slowdown in Manhattan, the Bronx market will grow through the summer and fall, with both sales growth and price appreciation

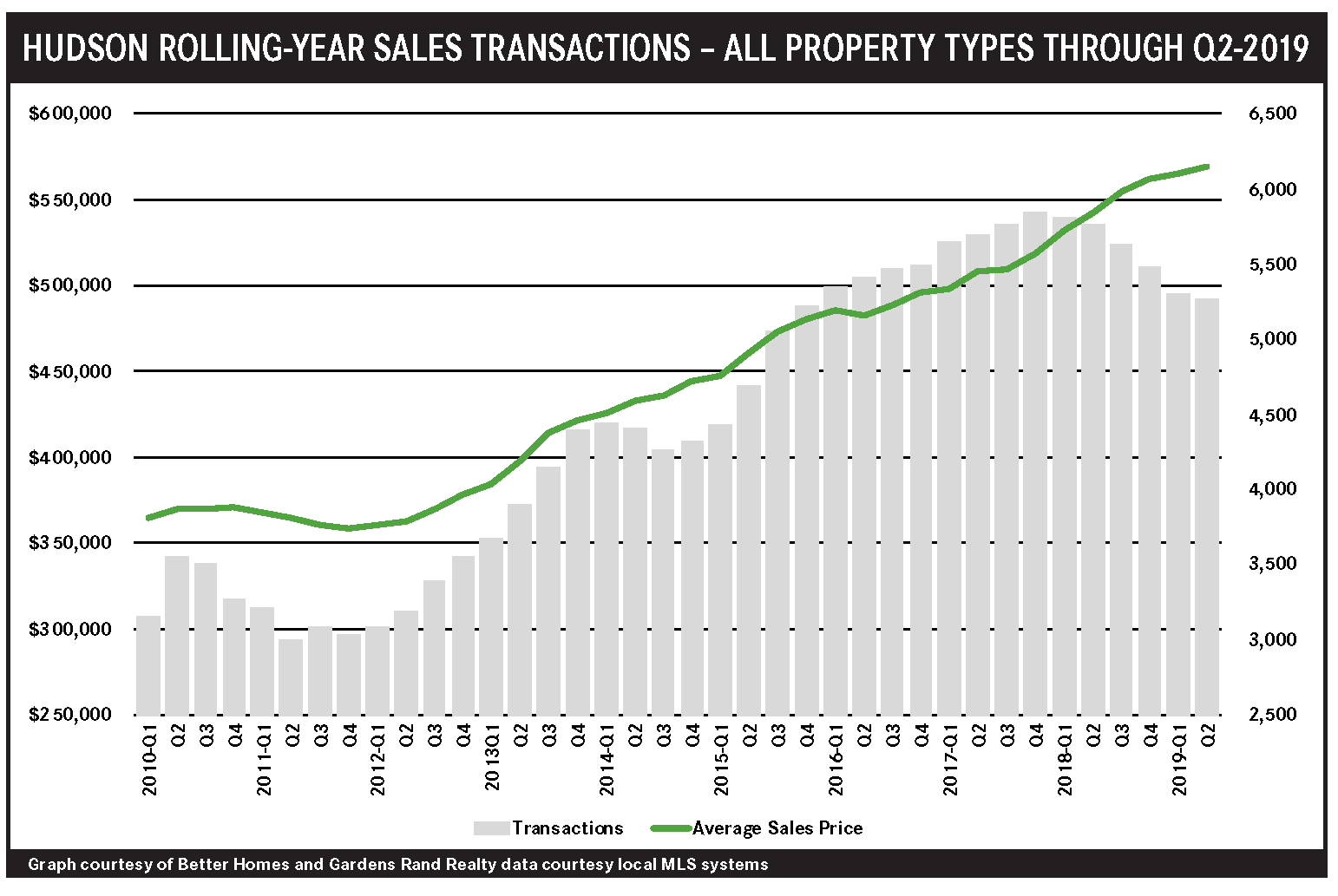

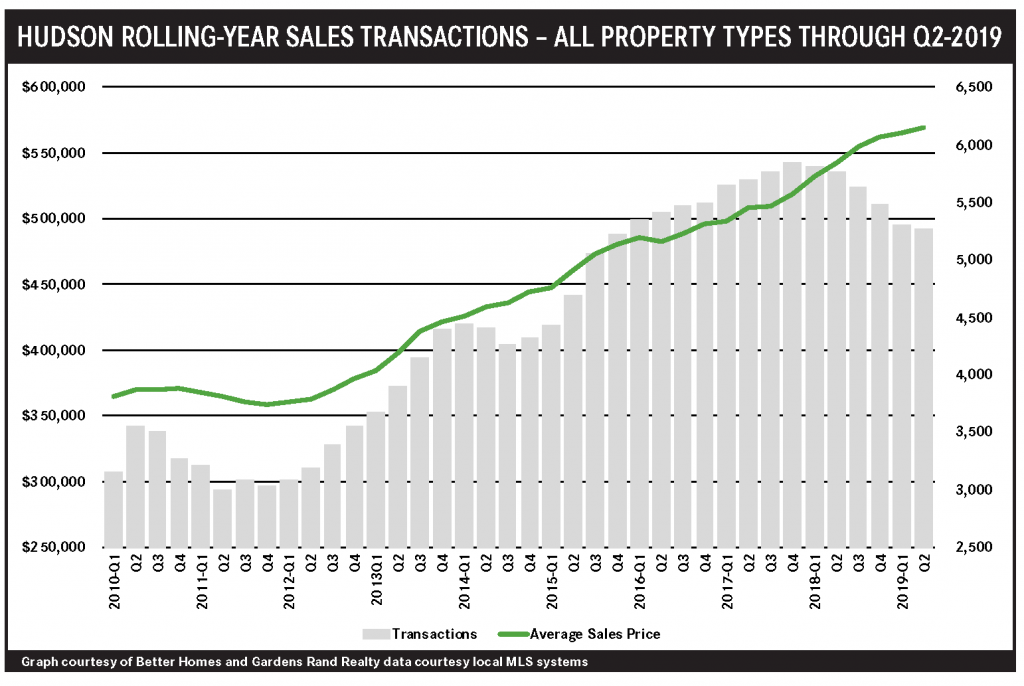

Second Quarter 2019: Real Estate Market Report – Hudson County, New Jersey

After sizzling throughout 2018, the Hudson County housing market continued to slow down in the second quarter of 2019. Sales were down over 6% overall from last year’s second quarter, and now down 6% for the rolling year. But this decline in sales did not have a dramatic effect on pricing, which was up about 4% overall and rising across the board: up 5% for single‑family homes, over 5% for multi‑families, and up 3% for condos. We might be seeing some impact from the 2018 Tax Reform’s $10,000 cap on state and local tax deductions (SALT Cap), which particularly affected higher‑income taxpayers, who are more likely to itemize their deductions and feel the pinch. And we are certainly seeing some reverberations from the slowdown of the Manhattan market. Going forward, though, we expect that the SALT Cap’s impact will eventually get priced into the market, and believe that the seller market fundamentals are strong: a growing economy, low interest rates, and low levels of inventory. Accordingly, we expect to see a relatively robust summer and fall market in Hudson County.

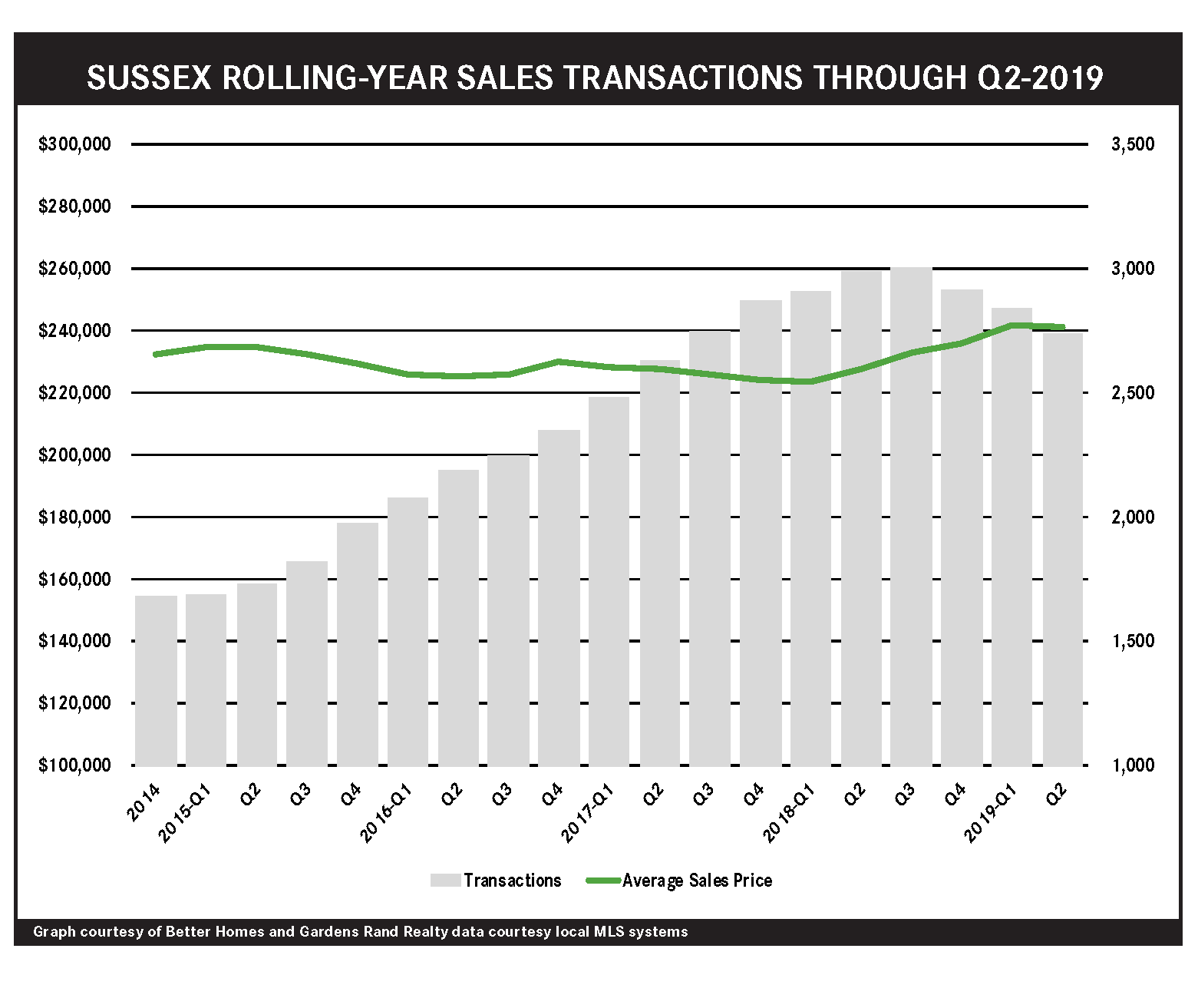

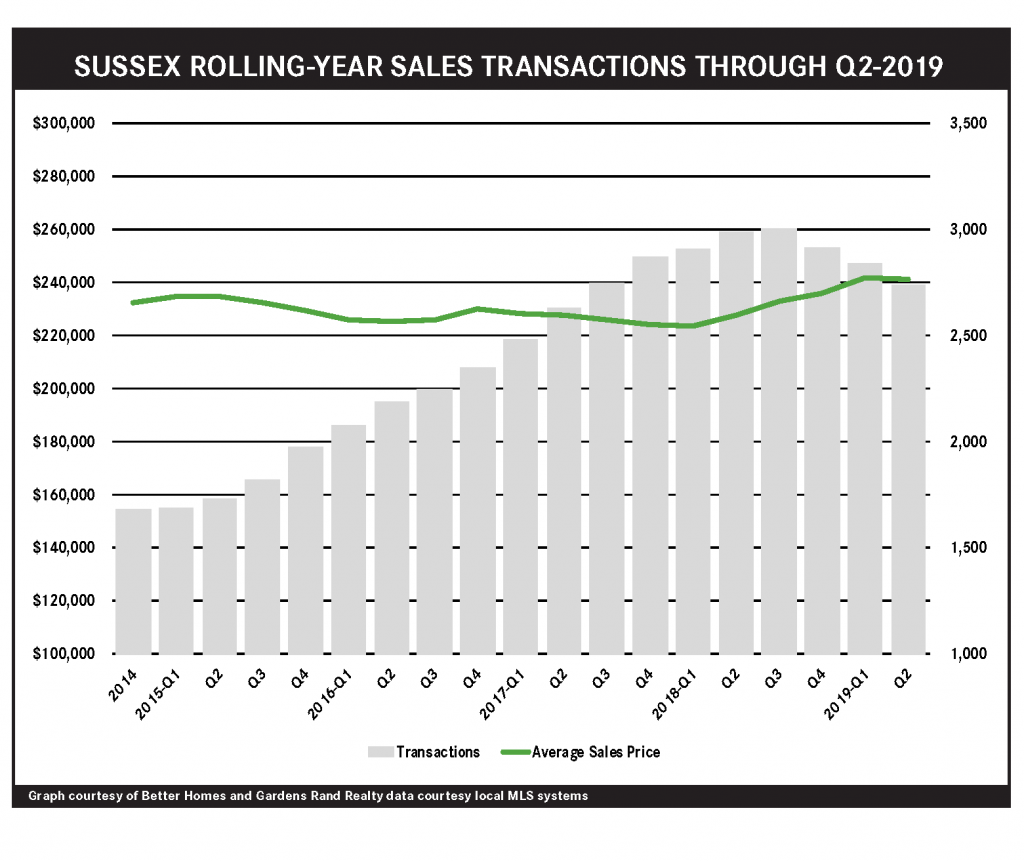

Second Quarter 2019: Real Estate Market Report – Sussex County, New Jersey

The Sussex market slowed considerably in the second quarter, with sales down even while pricing was more positive. Transactions were down sharply, falling 13% for the quarter and now down over 8% for the rolling year. But the drop in sales clearly did not indicate a lack of demand, with median pricing up over 5% for the quarter and almost 4% for the year. More importantly, inventory has finally come down to manageable levels, even though it’s still not at the 6‑month level that denotes a sellers’ market. Going forward, we believe that the seller market fundamentals are strong: a growing economy, prices well below historic highs, low interest rates, and low levels of inventory. So we expect to see continued appreciation and maybe even some sales growth in a robust summer and fall market

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link