Real Estate Market Report: 1st Quarter 2018 – Westchester County, NY

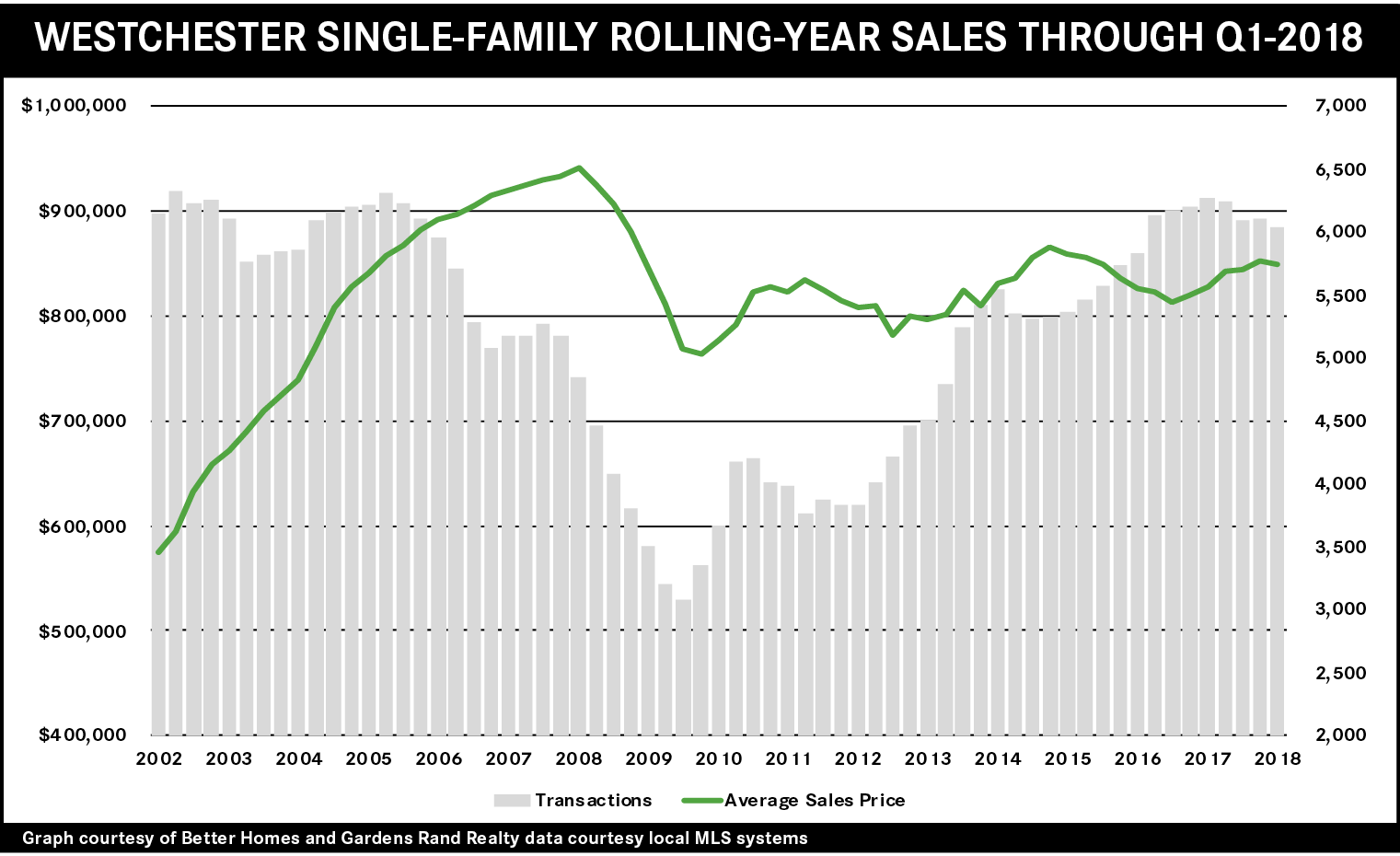

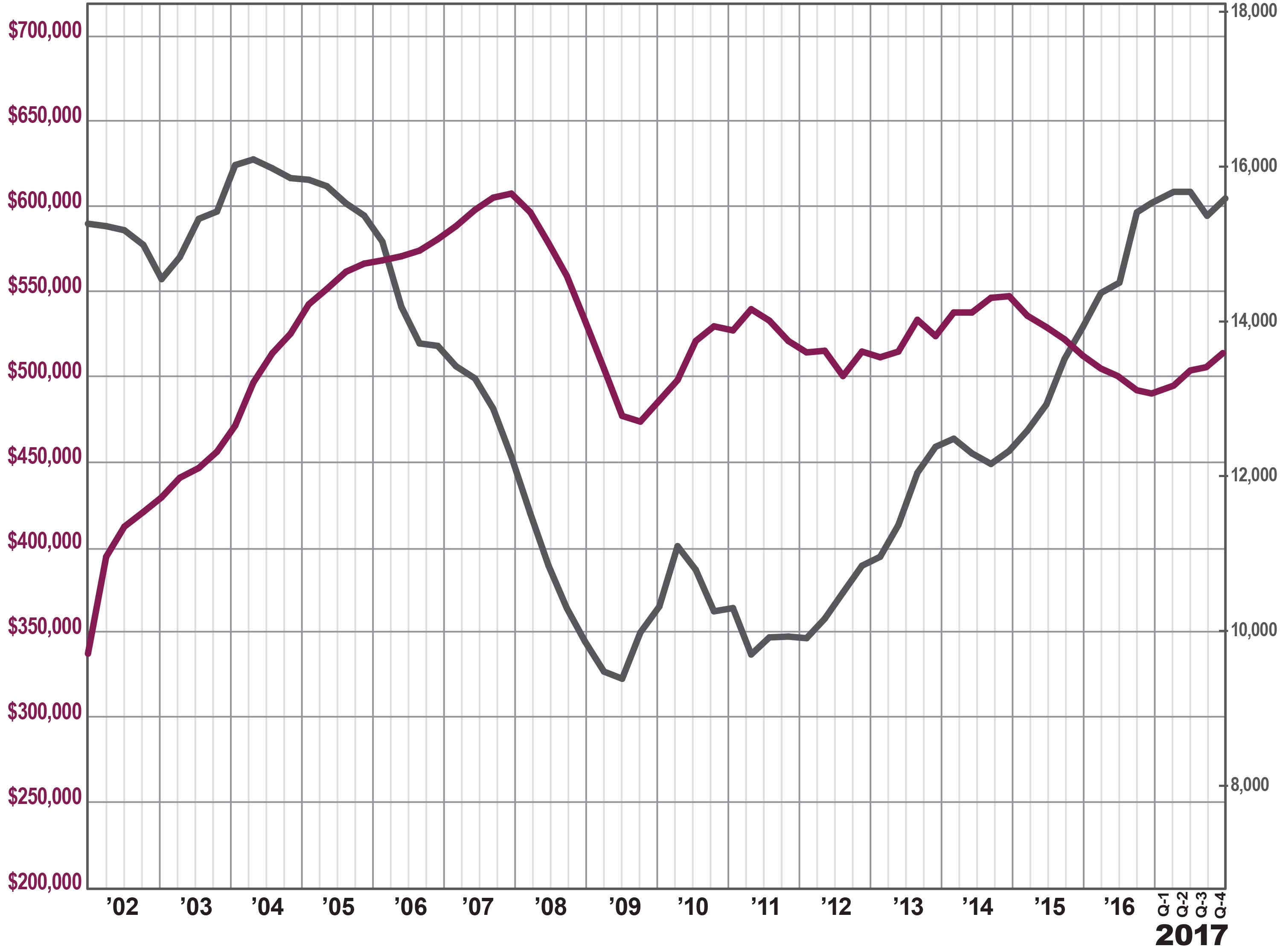

Westchester’s activity was again stifled by a depleted inventory, which drove sales down in single‑family homes and held them flat for condos and coops. Prices were mixed, with average prices down 3% for single‑family homes and 4% for condos, even while the entry level coop market soared, rising almost 13%. Over the full year, though, average prices are trending up for all property types, rising 3% for single‑family, 2% for condos, and 5% for coops. We expect that low inventory and high demand will drive more price appreciation in a robust spring, and that eventually these rising prices will bring more sellers into the market.

Westchester’s activity was again stifled by a depleted inventory, which drove sales down in single‑family homes and held them flat for condos and coops. Prices were mixed, with average prices down 3% for single‑family homes and 4% for condos, even while the entry level coop market soared, rising almost 13%. Over the full year, though, average prices are trending up for all property types, rising 3% for single‑family, 2% for condos, and 5% for coops. We expect that low inventory and high demand will drive more price appreciation in a robust spring, and that eventually these rising prices will bring more sellers into the market.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Real Estate Market Report: 1st Quarter 2018 – Lower Hudson Valley (NY)

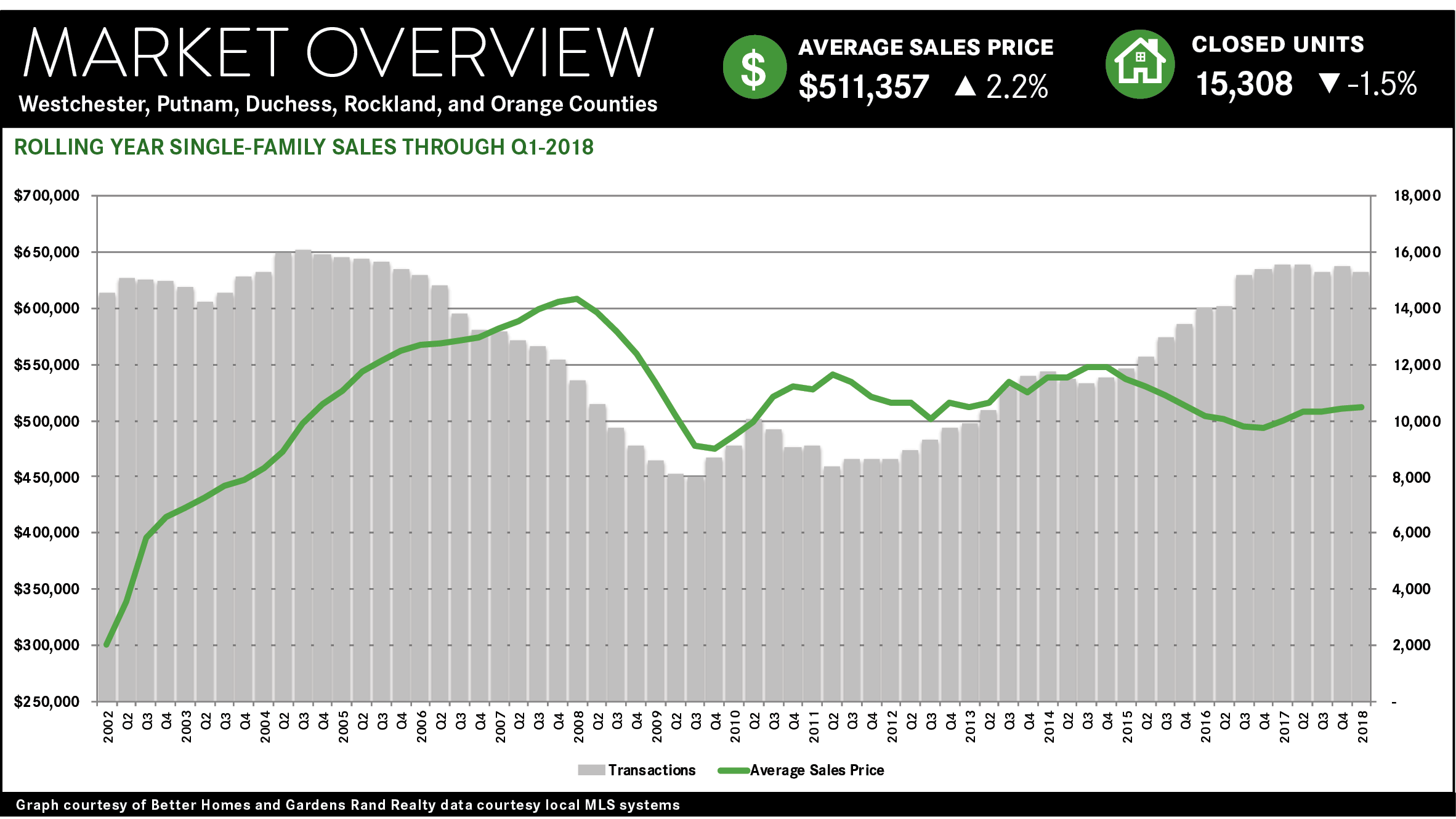

The housing market in the New York City northern suburbs of Westchester and the Hudson Valley has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The housing market in the New York City northern suburbs of Westchester and the Hudson Valley has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The regional market continues to suffer from a lack of inventory. The number of homes available for sale compared to last year fell sharply in every market in the region. At the current absorption rate, we are now down to well under five months of inventory in every county for single‑family homes, and down to under four months for the lower‑priced condo market. That’s significantly below the six‑month level that usually denotes a seller’s market.

This lack of inventory is holding back sales. Regional transactions were down over 6% from last year’s first quarter, and were down in every county except Putnam: falling 6% in Westchester, 19% in Rockland, 0.3% in Orange, and 13% in Dutchess. For the rolling year, the drop was more moderate, with sales down just 1.5% regionally. But this isn’t a demand problem—demand is strong everywhere in the region.

But with all this demand chasing fewer homes, prices are up significantly across the region. The average sales price was up for every county and property type except for Westchester single‑family homes and condos, which might be a reflection of stronger demand at more entry‑level price points. The longer‑term trend, though, indicates that prices are generally appreciating at a moderate but meaningful rate, with the rolling-year average sales price for single‑family homes up over 2% for the region, and up in each county: rising 3% in Westchester, 5% in Putnam, 4% in Rockland, 4% in Orange, and 5% in Dutchess.

Going forward, this is what a seller’s market looks like. Low levels of inventory will continue to hold sales back even while driving prices up. At some point in 2018, this price appreciation will attract more sellers into the market, which will increase supply, bring sales up, and maybe moderate price increases. But that will not happen right away, so we expect a spring market with even lower levels of inventory, which will stifle sales growth but continue to drive robust price appreciation.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Better Homes and Gardens Rand Realty to Hold Open-House Event

NANUET, NY – Better Homes and Gardens Rand Realty is excited to announce that they will be holding an open-house event, where attendees can receive advice on buying and selling homes. It will take place on Saturday, April 14, and Sunday, April 15, from 12:00-4:00 p.m. on both days.

NANUET, NY – Better Homes and Gardens Rand Realty is excited to announce that they will be holding an open-house event, where attendees can receive advice on buying and selling homes. It will take place on Saturday, April 14, and Sunday, April 15, from 12:00-4:00 p.m. on both days.

“We’re a few weeks into spring, which means it’s the prime season for the housing industry,” said Denise Friend, Rand Realty’s regional manager for Westchester County. “Our brokerage receives many potential clients during this time of the year, and we would like to offer them guidance on how to achieve their real estate goals.”

All 27 of Rand Realty’s sales offices will be participating in the event, with listings located throughout the Lower Hudson Valley and Northern New Jersey. At these sites, attendees can engage with an agent for one-on-one assistance on how to conduct a home search or market their home for sale. They will also have the opportunity to enter a raffle to win a gift basket, with one being provided by each of the four regions that Rand Realty serves: Rockland, Orange, and Westchester Counties in New York, and Northern New Jersey.

“Being involved in a real estate transaction can be challenging, so it’s important for us to interact with buyers and sellers to make sure that their questions are being answered,” said Friend. “We want them to feel confident when they enter the market.”

About Better Homes and Gardens Rand Realty

Better Homes and Gardens Rand Realty, founded in 1984, is the No. 1 real estate brokerage firm in the Greater Hudson Valley, with 28 offices (including a corporate location), serving Westchester, Rockland, Orange, Putnam, and Dutchess Counties in New York, as well as Bergen, Passaic, and Morris Counties in New Jersey.

Better Homes and Gardens Rand Realty has over 1,000 residential real estate sales associates, as well as a commercial real estate company (Rand Commercial) and the Hudson United Group, which provides residential mortgage lending, title services, and commercial and residential insurance.

These companies can be found online at www.RandRealty.com, www.RandCommercial.com, and www.HudsonUnited.com. Better Homes and Gardens Rand Realty can also be found and interacted with on Facebook, Twitter, Pinterest, and Instagram.

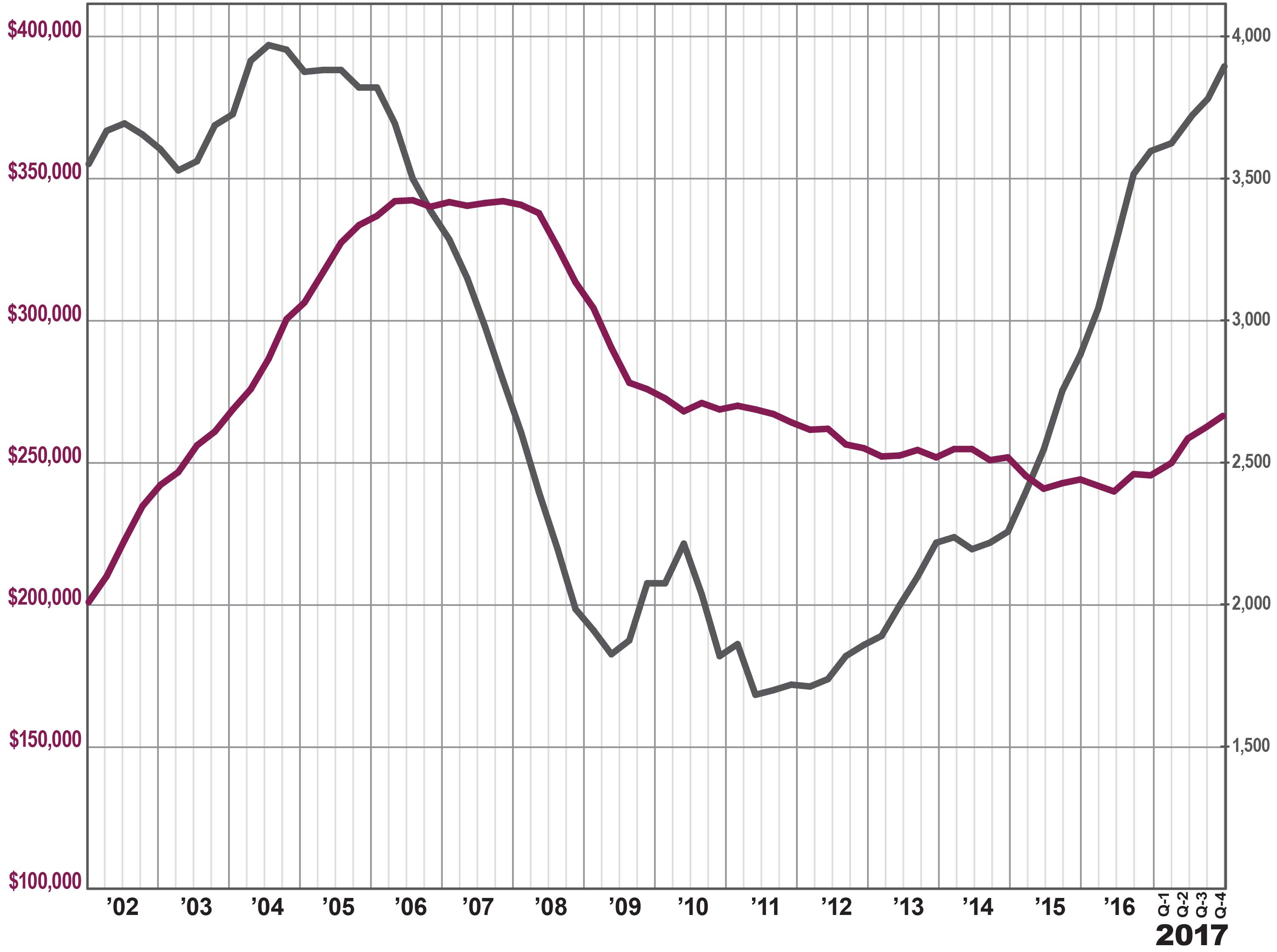

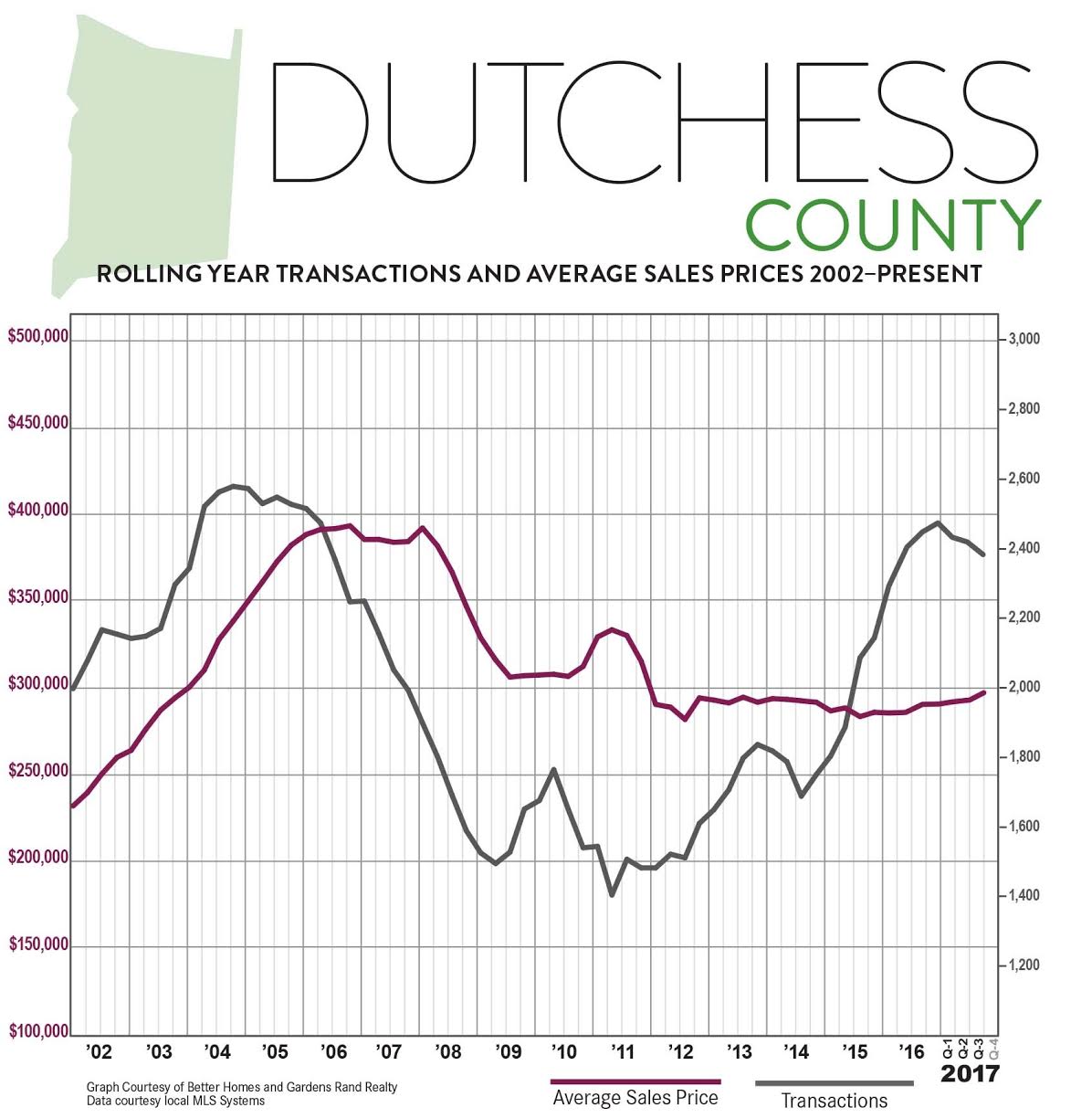

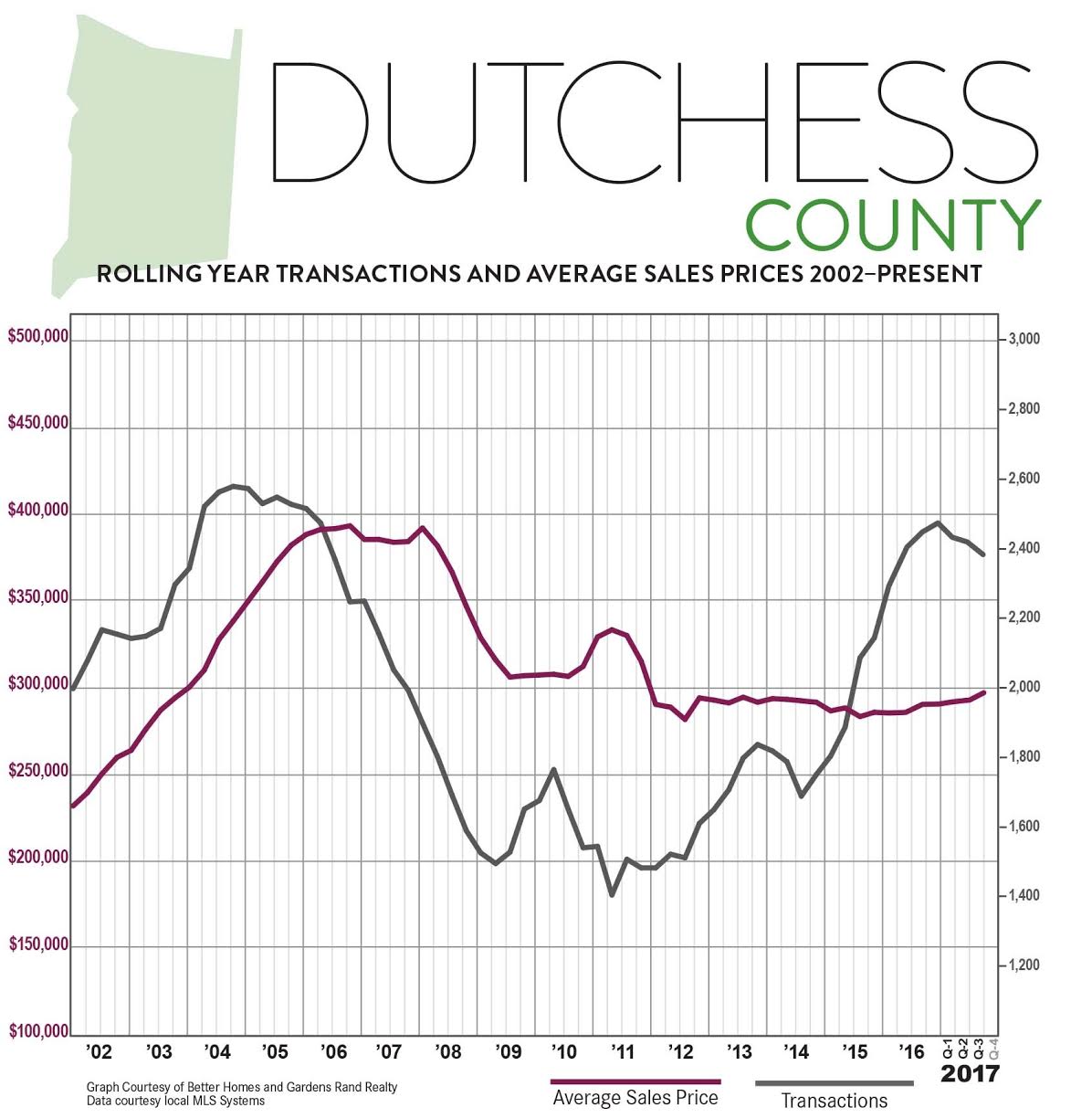

Fourth Quarter 2017 Real Estate Market Report: Dutchess County Overview

The Dutchess County housing market finished the year strong, with the first clear signs of meaningful price appreciation in years.

The Dutchess County housing market finished the year strong, with the first clear signs of meaningful price appreciation in years.

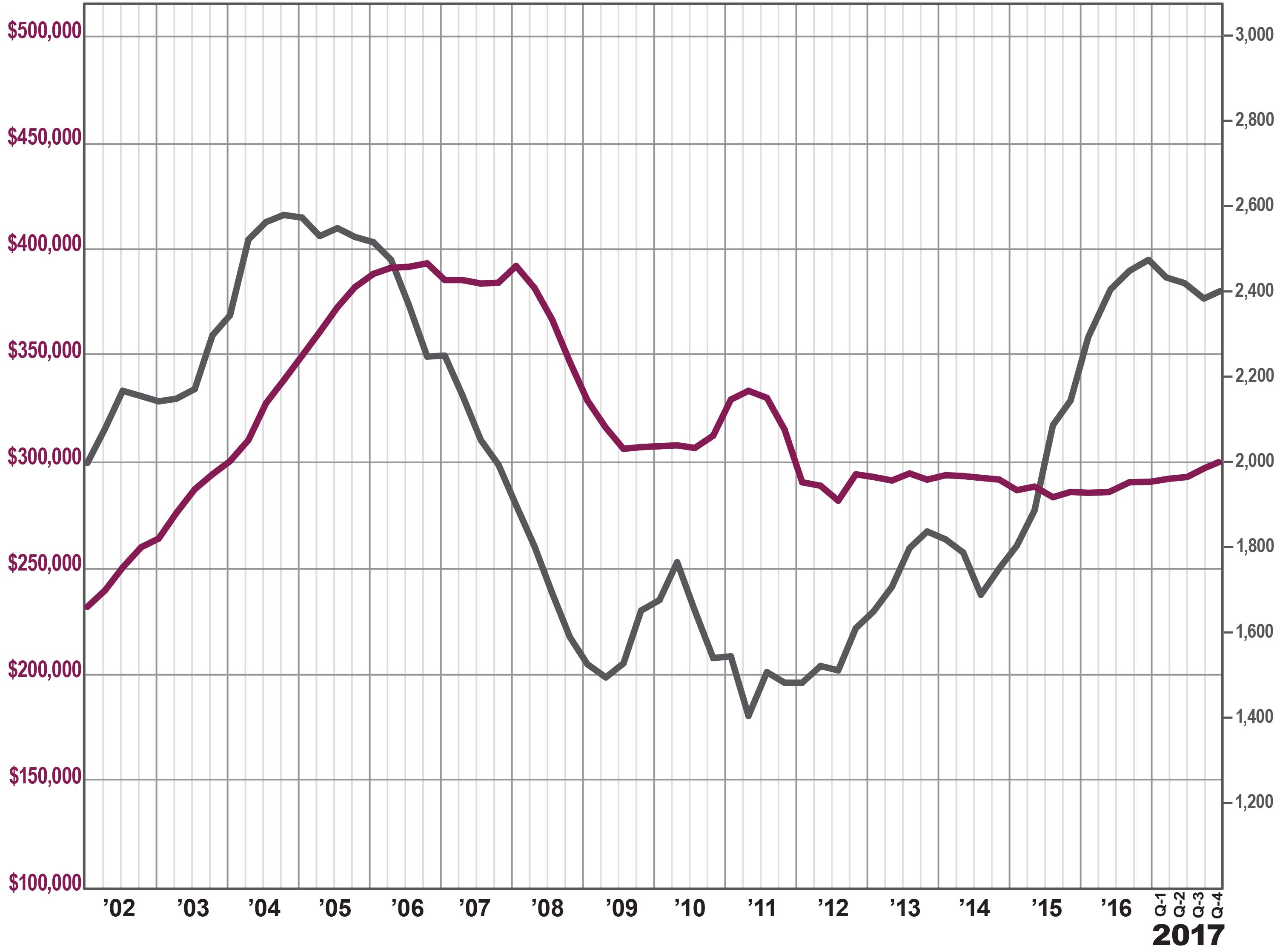

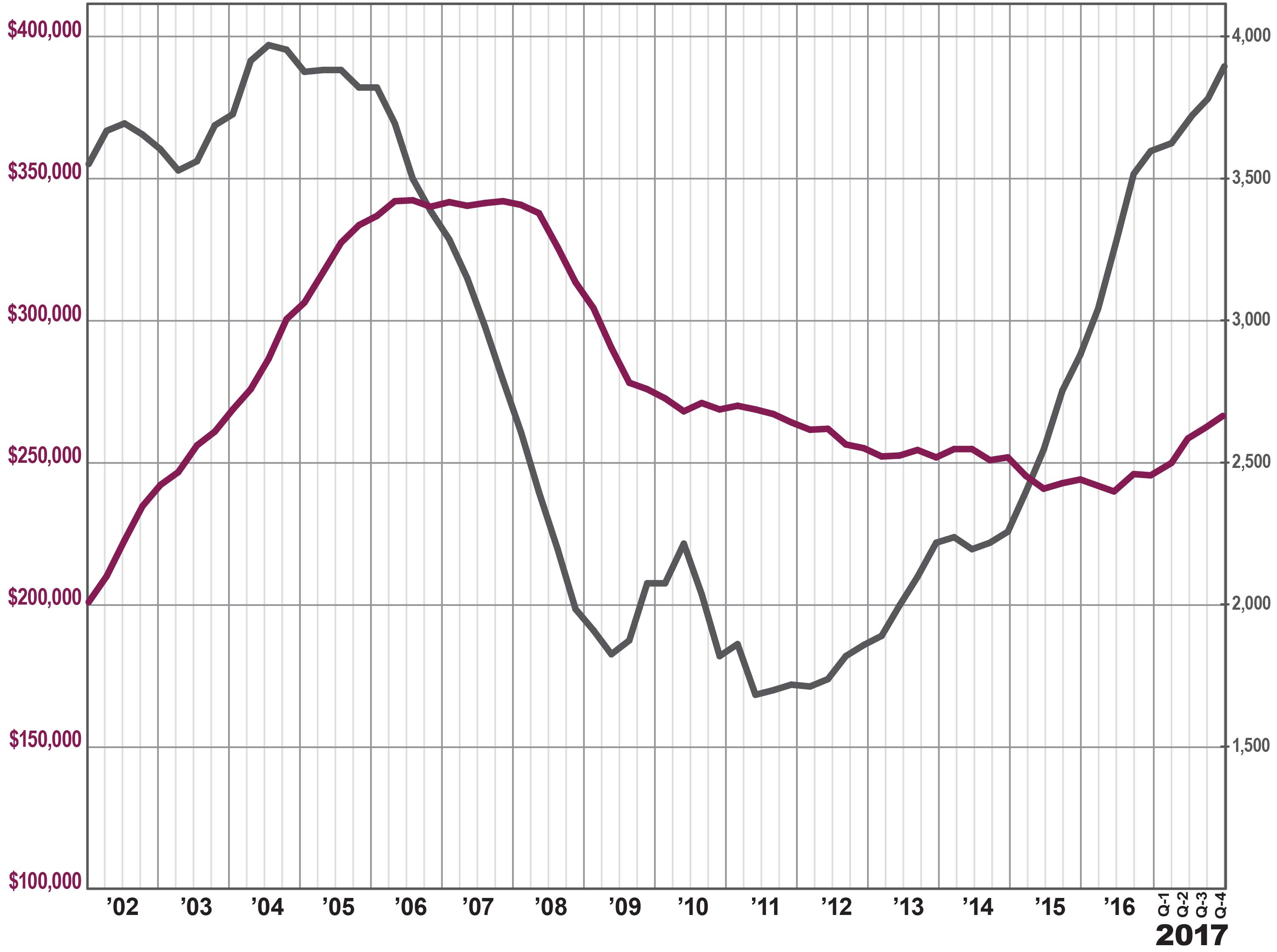

Sales. Dutchess sales rose slightly in the fourth quarter, up just about 1%. For the year, sales were down over 4%, which reflects low levels of inventory more than a lack of demand. Dutchess definitely needs more listings, some “fuel for the fire” to accommodate strong buyer demand.

Prices. Home prices continued to show the effects of declining inventory coupled with strong demand, with pricing up almost 3% on average, almost 8% at the median, and almost 3% in the price‑per‑square foot. For the calendar year, Dutchess experienced meaningful price appreciation, with the average up almost 3%, the median rising 4%, and the price‑per‑square‑foot up over 3%. Average prices in Dutchess have now gone up for two straight years, following four straight years of declines, where prices were bouncing around the bottom.

Negotiability. Dutchess homes are continuing to sell more quickly and for closer to the asking price, reflecting the negotiating leverage that sellers are getting in this market.

Condos. The condo market was mostly down for the quarter and flat for the year. In the fourth quarter, sales were down over 7%, and prices were down over 6% on average and almost 5% at the median. For the year, sales and prices were mostly flat, but the negotiability indicators signaled that Dutchess condos were moving into a seller’s market.

Going forward, we believe that the Dutchess market will experience a robust 2018. With tightening inventory, a stable economy, near‑historically‑low interest rates, and homes still priced at appealing 2003‑04 levels, Dutchess is likely to see meaningful price appreciation throughout the year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

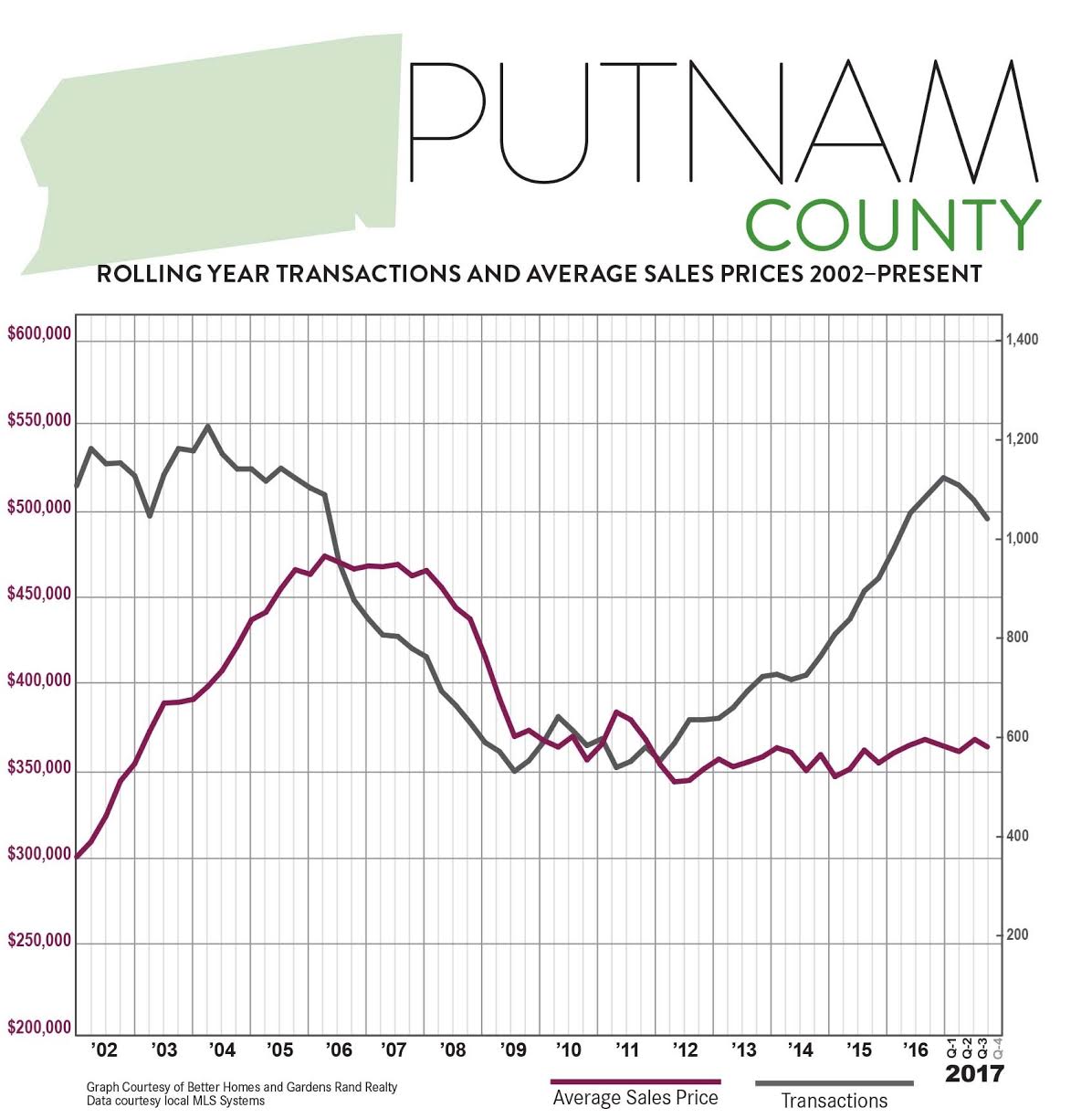

Fourth Quarter 2017 Real Estate Market Report: Putnam County Overview

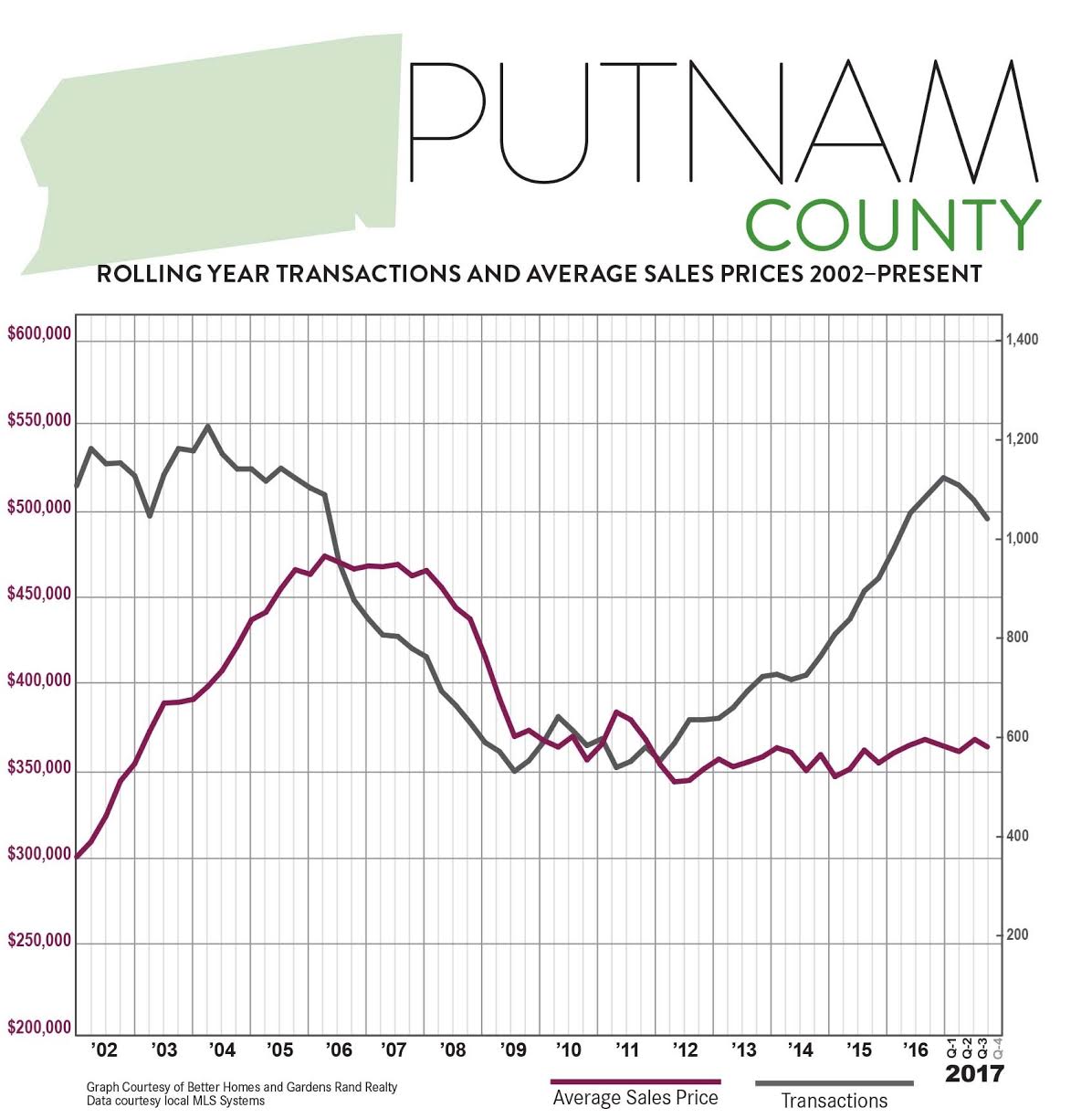

The Putnam County housing market finished 2017 with a flourish, as low levels of inventory drove prices up dramatically.

The Putnam County housing market finished 2017 with a flourish, as low levels of inventory drove prices up dramatically.

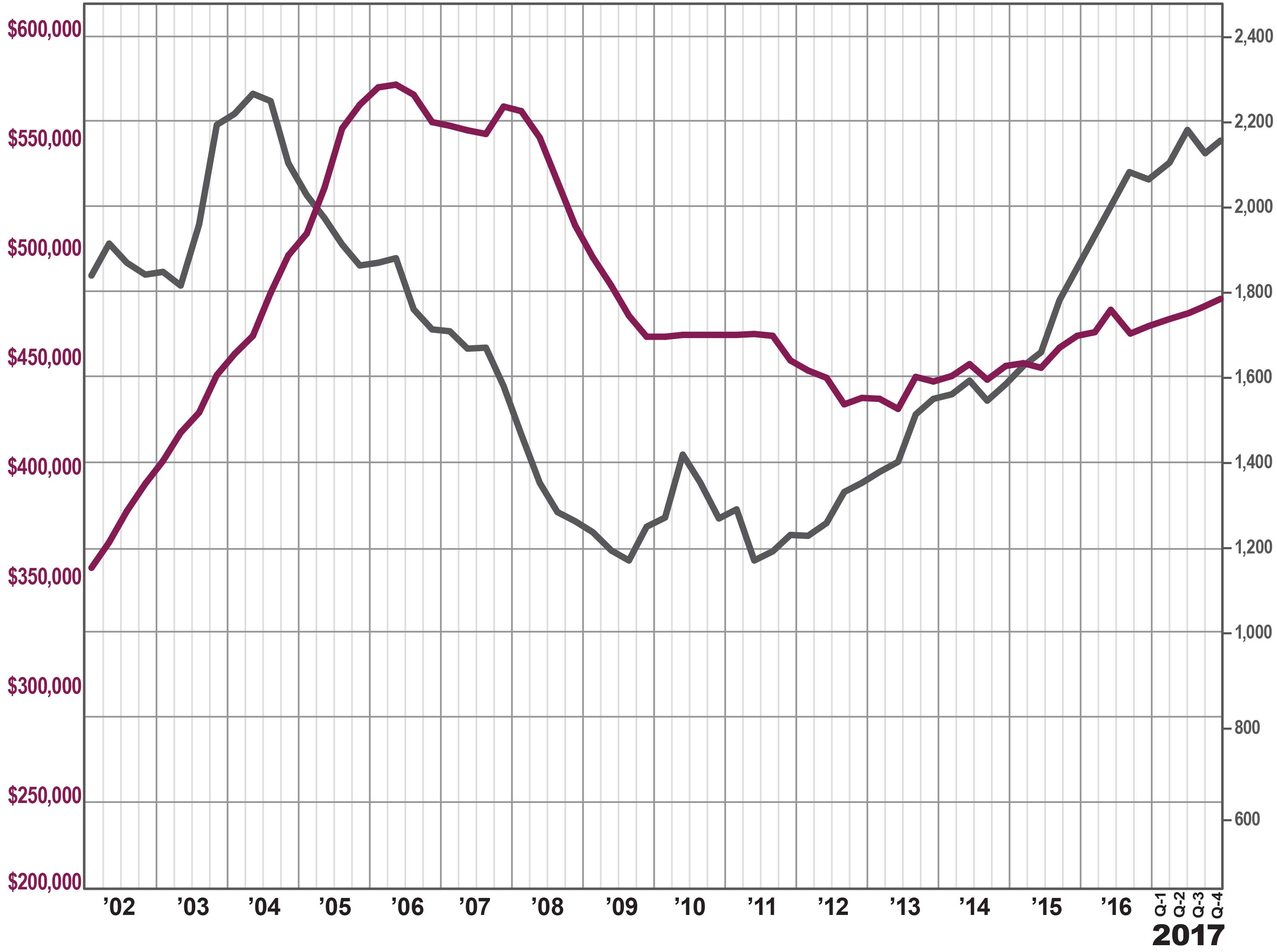

Sales. Putnam single‑family home sales were up a tick for the quarter, following three straight quarters of decline. For the calendar year, sales were down over 7%, marking the first time in over five years where the yearly sales have gone down. This is not, though, due to a lack of demand, but rather a sign of the impact of severely low levels of inventory.

Prices. This lack of inventory drove a major spike in pricing in the fourth quarter, with prices up dramatically across the board: up almost 11% on average, over 8% at the median, and over 10% in the price‑per‑square‑foot. This was by far the largest quarterly increase in over 12 years, since the height of the last seller’s market. And one good quarter saved the year, with 2017 prices finishing up just a bit for the second year in a row.

Inventory. Inventory continued to tighten, falling over 6% and now down well below the six‑month level that usually denotes a tightening seller’s market. This lack of available homes is what’s been holding back sales, since we don’t have enough “fuel for the fire” to keep the market going.

Negotiability. The negotiability indicators support the idea that a seller’s market is emerging, with the listing retention rate up just a tick and the days‑on‑market continuing to fall.

Condos. The smallish condo market surged in the fourth quarter, with sales up over 18% and prices up just a tick. For the year, though, sales were down sharply and prices gave back a little, even while inventory continued to fall.

Going forward, we believe the Putnam County market will thrive in 2018 as a robust seller’s market. Demand will stay strong, with interest rates near historic lows, prices still at attractive 2004‑05 levels, and a strengthening economy. And if inventory remains low, prices will likely continue to appreciate meaningfully through the new year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

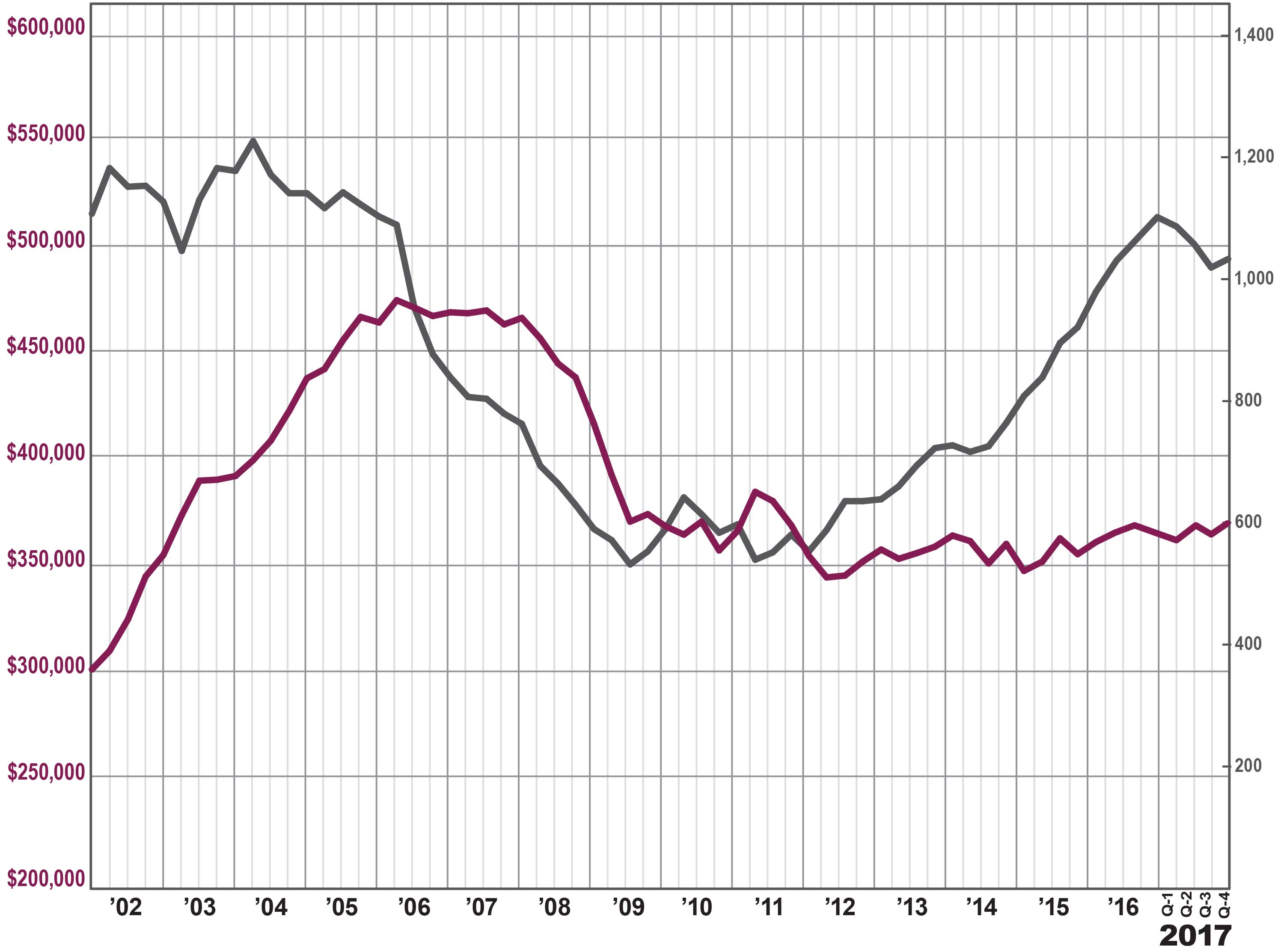

Fourth Quarter 2017 Real Estate Market Report: Orange County Overview

The Orange County housing market surged again in the fourth quarter of 2017, finishing a robust year with a flourish.

The Orange County housing market surged again in the fourth quarter of 2017, finishing a robust year with a flourish.

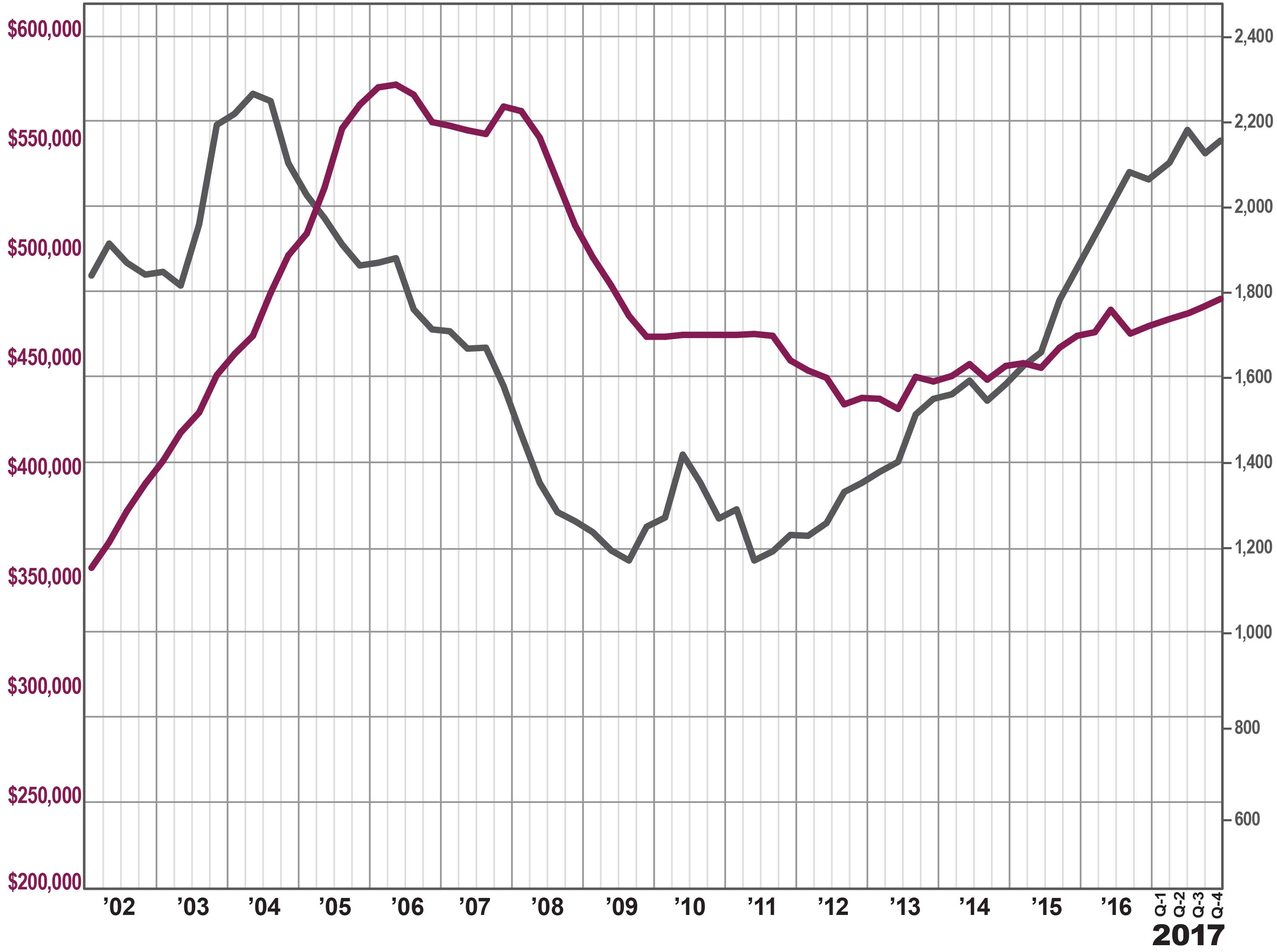

Sales. Orange sales spiked in the fourth quarter, rising almost 15%. Quarterly transactions have now gone up in 13 straight quarters and 22 out of the last 23. Similarly, sales were up almost 8% for the calendar year, marking the sixth straight year of increasing transactions. Indeed, the 3,837 calendar year sales was the highest yearly total since 2004, at the height of the last seller’s market, and is more than double the sales totals from the bottom of the market in 2009.

Prices. These continued increases in buyer demand are finally having a sustained impact on pricing. Home prices rose again in the fourth quarter, up 3% on average, over 7% at the median, and almost 5% in the price‑per‑square‑foot. And for the first time in years, prices were up meaningfully for the calendar year, rising almost 5% on average, almost 6% at the median, and over 3% in the price‑per‑square‑foot. Price appreciation was a long time coming in Orange County, but it’s finally here.

Negotiability. The available inventory continues to tighten, down almost 27% and now well below the six‑month level that signals a seller’s market. Meanwhile, homes are selling more quickly and for closer to the asking price. Indeed, over the past year, the days‑on‑market average fell 23 days, and the listing retention rate rose over a full point.

Condos. The condo market absolutely exploded in the fourth quarter, continuing a welcome trend that we finally started to see this year. Sales were up a whopping 37% and prices spiked almost 13% on average and 14% at the median. For the year, sales were up almost 23% and prices were up sharply. This marked the first year where condo prices have gone up since 2007 ‑‑ over 10 years ago.

Going forward, we believe that the Orange County housing market is poised for a great year: demand is high, prices are still at attractive 2003‑04 levels, interest rates are at historic lows, and the economy is generally strong. With inventory continuing to decline, we expect to see significant sales growth and meaningful price appreciation throughout 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

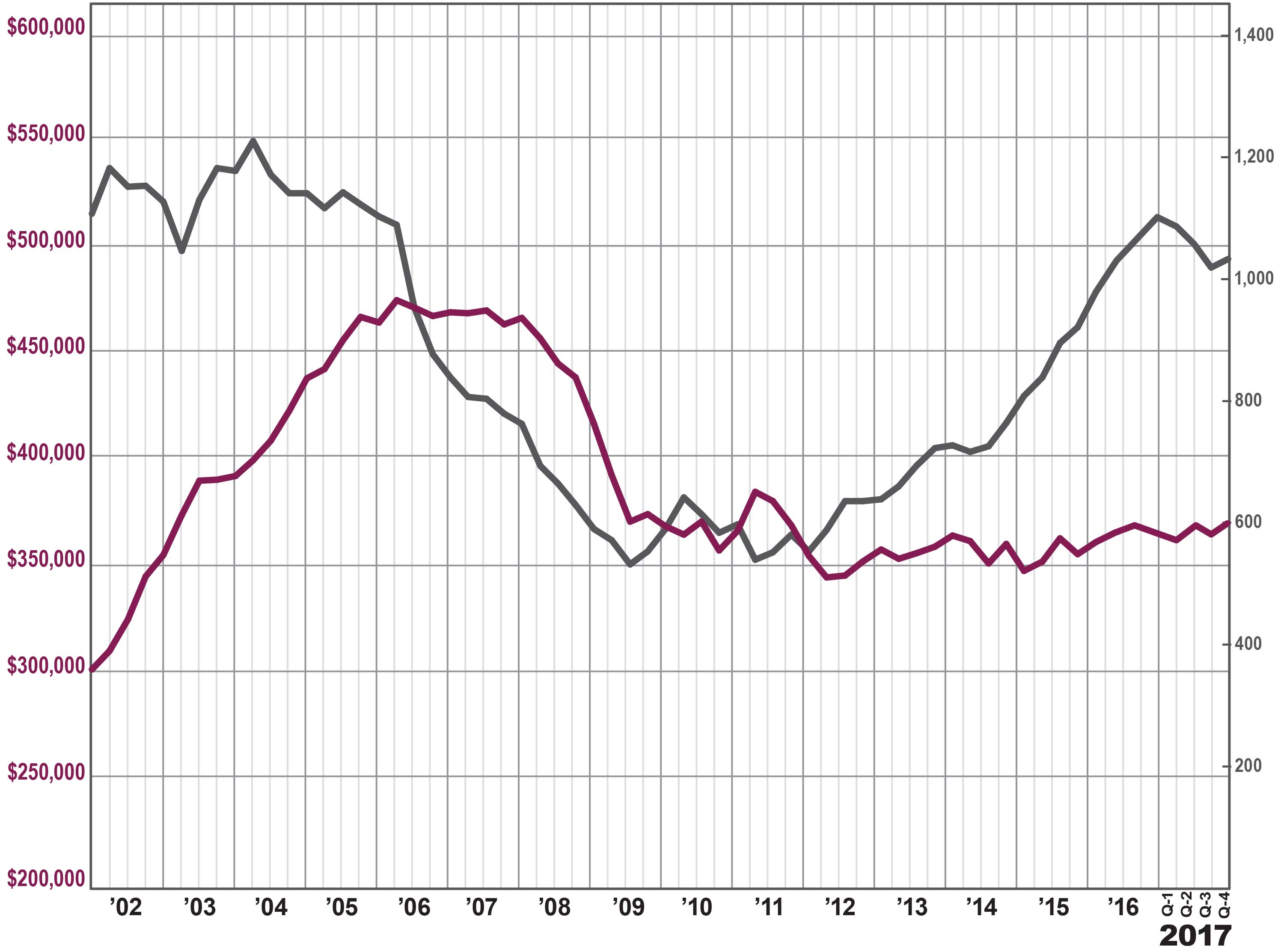

Fourth Quarter 2017 Real Estate Market Report: Rockland County Overview

The Rockland County housing market capped off a strong 2017 with a robust finish, with both prices and sales up significantly in the fourth quarter.

The Rockland County housing market capped off a strong 2017 with a robust finish, with both prices and sales up significantly in the fourth quarter.

Sales. After a decline in the third quarter, sales roared back in the fourth, rising almost 11%. This drove the yearly transaction total up almost 5% for the year, marking the sixth straight calendar year of increasing sales. Indeed, the 2,140 single‑family sales in 2017 was the highest calendar year total since 2003, at the height of the last seller’s market.

Prices. These sustained increases in buyer demand have started to make a dramatic impact on prices, which were up across the board in the fourth quarter: up almost 6% on average, 4% at the median, and over 5% in the price‑per‑square‑foot. And for the calendar year, prices were up significantly, rising about 4% on average, at the median, and in the price‑per‑square‑foot. Rockland prices have now gone up for five straight calendar years, and are now up 15% from the bottom of the market in 2012. Still, though, pricing is at 2005 levels, without even accounting for inflation, so we have significant room for growth.

Negotiability. Inventory continued to fall in the fourth quarter, dropping over 18% and now down to just about four months of inventory. Similarly, the listing retention rate rose and the days‑on‑market fell sharply again, indicating that sellers are increasingly gaining negotiating leverage with buyers in this full‑blown seller’s market.

Condos. The Rockland condo market also finished strong, with both sales and prices up significantly for the year. Condo inventory is now down to almost three months, which indicates we’re looking at more price appreciation in 2018.

Going forward, we expect that buyer demand in Rockland will continue to drive prices up and inventory down. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that this sustained buyer demand will drive meaningful price appreciation through 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Fourth Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley Market Overview

The housing market in Westchester and the Hudson Valley finished the year strong in the fourth quarter of 2017, with meaningful price appreciation throughout the region driven by low inventory and high demand. Although sales have slumped a bit due to the lack of available homes for sale, rising prices might tempt new sellers to come into this growing seller’s market.

The housing market in Westchester and the Hudson Valley finished the year strong in the fourth quarter of 2017, with meaningful price appreciation throughout the region driven by low inventory and high demand. Although sales have slumped a bit due to the lack of available homes for sale, rising prices might tempt new sellers to come into this growing seller’s market.

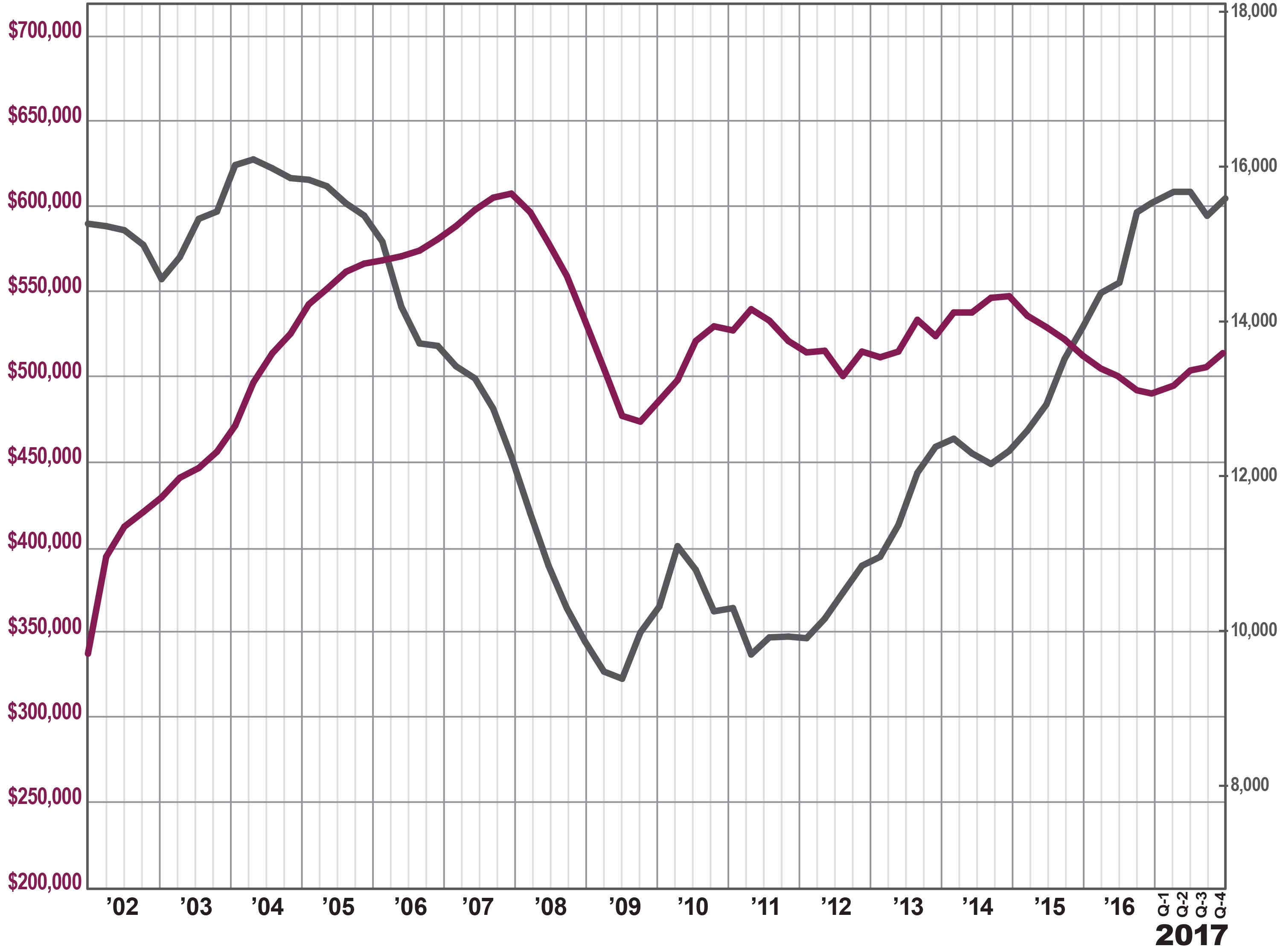

Inventory throughout the region continues to fall. Regional inventory was down to 4.6 months. Historically, when inventory drops below the six month level, it usually signals a seller’s market, and many of the individual counties in the region are now at‑or‑below six‑months’ worth of inventory: Westchester single‑family homes are now at 3.5, Putnam at 4.7, Rockland at 4.0, and Orange at 4.7. The lack of inventory continues to stifle sales growth. Regional sales were up for the first time in three quarters, rising almost 6% from the fourth quarter of last year. For all of 2017, sales were up less than 1%, the lowest year‑on‑year increase since 2011. But the problem isn’t lack of buyer demand, which remains strong. Rather, it’s simply that we don’t have enough homes for sale to satisfy the existing demand. Even with the lack of inventory, sales are approaching record highs. The 15,489 regional single‑family home sales in 2017 marked the highest yearly total since 2004, at the height of the last seller’s market. Indeed, sales totals are now almost doubling what we saw at the bottom of the market in 2009. Most significantly, high demand and low inventory are driving meaningful price appreciation. The regional average sales price was up for the fourth quarter in a row, rising almost 3%. We are starting to see long‑term price appreciation, with the regional average price also up 3% for the year. Moreover, appreciation was widespread, with yearlong average prices up in every county in the region: 4% in Westchester, 2% in Putnam, 4% in Rockland, 5% in Orange, and 3% in Dutchess. This is the first time we’ve seen such shared prosperity in over 10 years. Going forward, we believe that prices will continue to appreciate through 2018. Demand is strong, bolstered by near‑historically‑low interest rates, prices that are still near 2003‑04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. The question is if we will see sales growth, which will depend on whether homeowners see prices going up and decide to get into this market, bringing fresh new listings to satiate the existing buyer demand. All in all, this is what a seller’s market looks like. High sales totals. Low inventory. Rising prices. All the signs point to an extremely robust 2018 throughout the region. WESTCHESTER

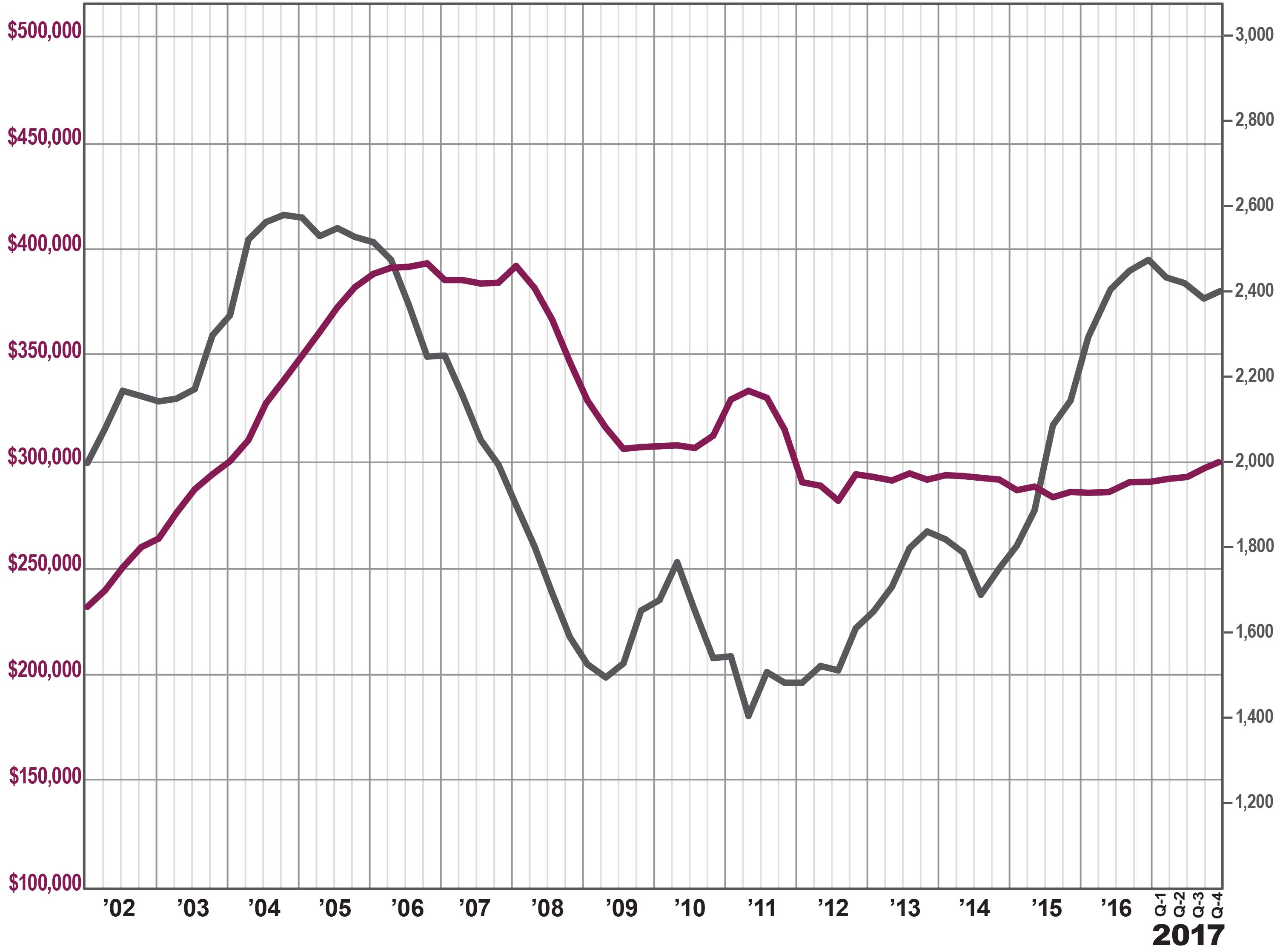

The Westchester housing market finished strong in 2017, with a surge in prices even while a lack of inventory held back sales growth.

Sales. Home sales were up just a tick, rebounding a bit from their sudden decline in the third quarter. You can see the continued impact of a lack of inventory, though, with sales down almost 2% for the full year. Still, with over 6,100 sales for the year, transactions in Westchester are now at their highest level since 2005, and almost double where they were at the bottom of the market in 2009.

Prices. With inventory this low, and demand remaining high, we are starting to see some acceleration in price appreciation. Prices were up 5% on average and at the median for the quarter, and for the year finished up 4% on average and 3% at the median. This is welcome news for Westchester homeowners, who saw small average and median price drops over the past two years. That said, the average and median price are still at 2005 levels, without even accounting for inflation.

Negotiability. The negotiability indicators continue to signal the emergence of the seller’s market. Inventory declined again, falling over 8% and now at the lowest level of inventory we have had in Westchester in over 12 years, since the height of the last seller’s market. Similarly, for the full year, the listing retention rate was up, and the days‑on‑market was down, indicating that homes are selling more quickly and for closer to the asking price.

Condos and Coops. The condo and coop market was more uneven. The condo market was sizzling, with average prices up over 8% in the quarter and almost 5% for the year. Sales were down, but that’s certainly because inventory is below the three‑month level. The coop market was more mixed, with sales up for the year and prices relatively flat, even while inventory fell to the three‑month level.

Going forward, we expect that Westchester will continue to see meaningful price appreciation in 2018, especially if inventory remains tight. With pricing near 2005 levels and interest rates near historic lows, we believe that the seller’s market will thrive in the new year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Third-Quarter 2017 Market Report: Dutchess County Market Overview

The Dutchess County housing market showed clear signs of an emerging seller’s market in the third quarter of 2017, with a lack of inventory constricting growth but driving prices up.

The Dutchess County housing market showed clear signs of an emerging seller’s market in the third quarter of 2017, with a lack of inventory constricting growth but driving prices up.

Sales. Dutchess sales were down again in the third quarter, more a reflection of falling inventory in the market than a decline in buyer demand. Sales were down almost 5% for the quarter and are now down over 2% for the rolling year. Dutchess definitely needs some “fuel for the fire” to accommodate strong buyer demand.

Prices. Home prices continued to show the effects of declining inventory coupled with strong demand, with pricing up over 3% on average, 5% at the median, but down almost 12% in the price‑per‑square foot. We can see the same story in the rolling year numbers, with the average price up 2% and the median up over 3%, indicating that Dutchess is moving into a sustained seller’s market.

Negotiability. Dutchess homes are continuing to sell more quickly and for closer to the asking price, reflecting the negotiating leverage that sellers are getting in this market.

Condominiums. The condo market was down after a spike in the second quarter, with sales falling almost 11%. Prices were also down for the quarter, even while the yearlong trend was mostly positive.

Going forward, we believe that the Dutchess market will finish the year strong. With tightening inventory, a stable economy, near‑historically‑low interest rates, and homes still priced at appealing 2003‑04 levels, Dutchess is likely to see meaningful price appreciation through the end of the year and into next year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Third-Quarter 2017 Market Report: Putnam County Market Overview

The Putnam County housing market slowed a bit in the third quarter of 2017, with sales falling and prices mixed.

The Putnam County housing market slowed a bit in the third quarter of 2017, with sales falling and prices mixed.

Sales. Putnam single‑family home sales were down almost 10% for the quarter, the third straight quarter of a significant decline in transactions. After over five years of steadily increasing sales, Putnam is now seeing the impact of a lack of inventory, with sales now down 5% for the rolling year.

Prices. This lack of inventory, though, is not driving sustained increases in pricing. Prices were mixed at best: down 3% on average, up a tick at the median, and flat in the price‑per‑square‑foot. We see the same thing in the yearlong trend, with the average down almost 2%, and the median and price‑per‑square‑foot mixed. We have been expecting meaningful appreciation in Putnam for some time now, and still believe that low levels of inventory and stable demand will eventually drive prices up.

Inventory. Inventory continued to tighten, falling over 12% and now down to the six‑month level that usually denotes a tightening seller’s market. This lack of available homes is what’s been restricting sales, since we don’t have enough “fuel for the fire” to keep the market going.

Negotiability. The negotiability indicators support the idea that a seller’s market is emerging, with the listing retention rate up just a tick and the days‑on‑market falling sharply. Homes in Putnam are now selling in about five months from listing to closing.

Condos. The impact of low inventory on the condo market was even more severe, with sales down almost 17%. In this case, though, prices were up sharply, rising 6% on average, almost 5% at the median, and over 1% in the price‑per‑square foot. For the year, though, both sales and prices are down.

Going forward, we believe that Putnam is struggling through some growing pains, but that it will soon start to show the same signs of life that we’re seeing in Westchester and the rest of the Hudson Valley. The fundamentals of the market are tremendous: inventory is low, rates are near historic lows, and prices are still at attractive 2004‑05 levels. We think that meaningful price appreciation in Putnam is just a matter of time.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link