The Leasing Experts Partners with Howard Hanna Rand Realty to Redefine Development Marketing

The Leasing Experts, a leader in development marketing, is proud to announce its strategic partnership with Howard Hanna Rand Realty, one of the nation’s largest and most respected real estate brands. This collaboration will set a new standard for development marketing, combining The Leasing Experts’ innovative approach with Howard Hanna’s extensive network and national presence.

A Partnership for Growth and Excellence

This partnership represents a bold step forward in The Leasing Experts’ mission to elevate the lease-up process and expand its reach into key markets. By aligning with Howard Hanna, The Leasing Experts gains access to unparalleled resources and market insights, positioning the company for continued growth in New York, Connecticut, New Jersey, and beyond.

“This partnership is a game-changer,” said David Cortez, Founder of The Leasing Experts. “Partnering with the Howard Hanna development team and collaborating allows us to take this vision to the next level by combining our expertise with the trust and scale of a national brand. Together, we’re setting a new benchmark for the industry.”

Matthew Rand, CEO of Howard Hanna Rand Realty, added, “We are thrilled to partner with The Leasing Experts. Their innovative approach to development marketing perfectly complements our commitment to delivering exceptional service and results to our clients. This collaboration is a tremendous opportunity to enhance the value we bring to developers and property owners, and we look forward to achieving great things together.”

The Leasing Experts Advantage

Known for its focus on high-velocity leasing, data-driven marketing, and performance-driven results, The Leasing Experts brings a proven track record of success, including:

- Over $1 billion in leasing transactions completed.

- Expertise in onboarding new developments and optimizing performance for existing properties.

- Proprietary AI-driven tech and tools that enable developers to position their properties with precision and maximize ROI.

With Howard Hanna’s extensive reach and reputation as a trusted industry leader, this partnership will enable The Leasing Experts to scale its operations and bring its innovative approach to an even broader audience of developers, lenders, and property owners.

Top-Producing Gino Bello Homes Team Joins Howard Hanna Rand Realty’s Scarsdale Office

Howard Hanna Rand Realty is pleased to announce that the highly acclaimed Gino Bello Homes Team has joined its Scarsdale office. Led by Gino Bello and Gerry Magnarelli, the team brings over two decades of exceptional real estate experience and a proven track record of success in Westchester County.

The Gino Bello Team, recognized as the #1 Real Estate Sales Team in White Plains and Greater White Plains by Houlihan Lawrence in 2023, has successfully closed over 1,600 transactions in the past 20 years. The team operating under the Hanna Luxury brand includes accomplished real estate professionals Daniel Cezimbra, Vincent Caiola, and Georgette Fryburg, supported by Operations Manager Lina Tinelli.

“Joining Howard Hanna Rand Realty represents an exciting new chapter for our team,” said Gino Bello, Team Leader. “Our decision was driven by our commitment to providing the highest level of service to our clients. The company’s innovative technology, marketing resources, and strong leadership align perfectly with our vision for growth while maintaining the personalized attention our clients have come to expect.”

Matt Rand, CEO of Howard Hanna Rand Realty, expressed enthusiasm about the partnership: “The addition of the Gino Bello Team to our Scarsdale office significantly enhances our presence in Westchester County. Their reputation for integrity, exceptional customer service, and consistent results make them a perfect fit for our organization. We’re thrilled to support their continued success and growth.”

“We are excited to welcome such an industry leader in Westchester and Connecticut”, said JP Endres Scarsdale Office Manager. “Their proven track record, deep market knowledge, and commitment to client service exemplify the values we champion at Howard Hanna Rand Realty. Their presence will further strengthen our position as a leading real estate firm in Westchester County and growth of our Hanna Luxury division. I am thrilled to be collaborating with this dynamic team and be apart of their expansion and growth”

The team has been featured as “Face of Westchester Real Estate” by Westchester Magazine from 2019 to 2023 and has received numerous industry accolades, including recognition among America’s Best Real Estate Agents by Real Trends.

Embrace the Magic of Winter: Your Complete Guide to Seasonal Activities in the Tri-State Area

As snowflakes dance through the crisp air and landscapes transform into pristine white canvases, winter beckons us to explore its enchanting offerings. From snow-covered trails to warm indoor sanctuaries, our region comes alive with seasonal charm and endless possibilities for adventure.

The Wonder of Winter

Winter is a season of warmth and wonder, where snow-covered landscapes inspire adventure and cozy nights invite relaxation. Whether you’re sipping hot cocoa by a crackling fire or enjoying a brisk outdoor event, winter offers moments to cherish. Let’s make the most of it together!

Warm Up with Our Featured Recipe: Spiced Apple Cider

Before we explore the winter wonderland awaiting you, let’s start with a comforting drink to warm your soul. This classic spiced apple cider recipe is perfect for warming up after a day of winter activities.

Ingredients:

- 6 cups apple cider

- 2 cinnamon sticks

- 4 whole cloves

- 2 whole star anise

- 1 orange, thinly sliced

- 2 tablespoons brown sugar (optional)

Directions:

- Combine all ingredients in a large pot

- Simmer on low heat for 30 minutes, stirring occasionally

- Strain spices and serve warm

- For an extra touch, garnish with a cinnamon stick or orange slice

Regional Winter Activities Guide

New York

Orange County

Embrace outdoor adventures at Bear Mountain Ice Rink, where skating beneath the open sky creates magical winter memories. For thrill-seekers, Mount Peter offers exhilarating snow tubing, while Storm King State Park and Goosepond Mountain State Park provide serene winter hiking and snowshoeing opportunities.

Putnam County

Fahnestock State Park becomes a winter paradise, offering both challenging hikes and peaceful snowshoe tours. Ice fishing enthusiasts can test their skills at Canopus Lake, where the frozen waters promise a unique outdoor experience.

Rockland County

Winter doesn’t stop the vibrant community spirit at Nyack Winter Farmers Market. The Palisades Center Ice Rink provides indoor skating fun, while Rockland Lake State Park offers peaceful winter bird watching opportunities.

Westchester County

Ward Pound Ridge Reservation transforms into a winter sports haven, perfect for cross-country skiing and stargazing. Art enthusiasts can explore winter exhibits at Katonah Museum of Art, while families enjoy sledding at Croton Gorge Park. Don’t miss the fascinating maple sugaring tours at Muscoot Farm.

Bronx County

The Bronx Zoo offers unique winter wildlife observation opportunities, while the iconic Yankee Stadium transforms into an ice skating destination. Warm up with delicious traditional Italian fare during Arthur Avenue Winter Food Tours.

Ulster County

Experience world-class skiing and snowboarding at Belleayre Mountain, or immerse yourself in culture during Woodstock’s winter art walks. Mohonk Preserve’s guided snowshoe tours offer intimate experiences with nature.

New Jersey

Bergen County

Discover the beauty of winter walks in Palisades Interstate Park, or perfect your skating skills at Winter Wonderland in Paramus.

Essex County

Turtle Back Zoo’s winter animal encounters offer unique wildlife experiences, while South Mountain Reservation provides scenic winter trails.

Morris County

Great Swamp National Wildlife Refuge reveals its winter charm through hiking trails, while Loantaka Brook Reservation welcomes cross-country skiing enthusiasts.

Passaic County

Step back in time with Lambert Castle winter tours, or explore the snow-covered trails of Garrett Mountain.

Connecticut

Fairfield County

Devil’s Den Preserve offers peaceful winter hiking, while adventurous souls can try winter kayaking on the Saugatuck River. Stamford Museum & Nature Center provides educational winter programs for all ages.

Howard Hanna Rand Realty Leads 2024 Middletown Community’s Choice Awards

Howard Hanna Rand Realty has once again emerged victorious in the 2024 Middletown Community’s Choice Awards, claiming the coveted title of Best Real Estate Company for the 10th consecutive year. This achievement highlights the firm’s unwavering commitment to service excellence and community leadership.

The company’s success extended to individual recognition, with June Cosgrove Hays earning the distinguished Best Agent award. This dual achievement showcases Howard Hanna Rand Realty’s comprehensive strength in the local real estate market.

“We are deeply honored to be recognized by the Middletown community,” said Matt Rand, CEO of Howard Hanna Rand Realty. “Winning Best Real Estate Company and having June receive the Best Agent award reflects our shared commitment to integrity, innovation, and client success.”

Additional category winners from the Hanna family of Companies include:

- Best Mortgage Lending Company, 1st Priority Mortgage was acknowledged for exceptional customer service and innovative lending solutions

- Best Insurance Agent: Barry Barkin, of Hudson United Insurance was recognized for outstanding client service and comprehensive coverage expertise

The Middletown Community’s Choice Awards, determined through community nominations and voting, celebrate businesses that demonstrate exceptional service and community commitment. This recognition reinforces Howard Hanna Rand Realty’s position as a trusted leader in local real estate.

Howard Hanna Rand Realty Howard Hanna Rand Realty stands as one of the Northeast’s premier family-owned real estate brokerages, serving New York, New Jersey, and Connecticut. The company’s innovative approach and commitment to excellence have established it as an industry leader, dedicated to creating seamless experiences for buyers, sellers, and investors.

Understanding the New Compensation Structure in Real Estate Transactions: An Explainer for Our Clients

We wanted to explain to you the issues that have developed with the new compensation systems in real estate transactions. Because of a recent litigation settlement by the National Association of REALTORS, all brokers have had to make some changes in the way that we structure compensation for services to our clients.

First, though, we wanted to tell you what has NOT changed. At Howard Hanna, we have always prided ourselves on providing all our clients — whether they are buyers, sellers, tenants, or landlords – with true fiduciary representation of their best interests. What does that mean?

- We always act in your best interests to get you the most favorable deal possible.

- We are always loyal to you over anyone else in a transaction.

- We keep all your private information confidential.

- We fully disclose anything we know about your deal to you.

- We obey you when you direct or instruct us.

- We keep careful accounts of any monies you entrust to us.

None of this is changing. We have always acted in your best interests, and we will always do so.

So what is changing? Simply put, what’s changing is how we get paid for our services. Traditionally, listing brokers signed agreements with sellers providing that the seller would pay the broker a commission when and if the house sold, usually a percentage of the selling price. Then, to market the home to the rest of the local brokerage industry, the listing brokers would make an “offer of compensation” to agents representing buyers, offering to split that commission with the buyer agents if they successfully helped sell the home. The commission would then normally be paid out of the proceeds of the sale – the buyer and the buyer’s lender would give the seller the purchase price for the home, and the seller would take the commission out of those proceeds and pay both the listing broker and the buyer’s broker.

But the system had some problems that have now been addressed. One problem was that the National Association of REALTORS, through the local MLS, mandated that sellers make an offer of compensation to buyer agents. The sellers didn’t have a choice. They had to offer something. Conversely, buyers had limited choices as well, because they never had a direct opportunity to negotiate the commission for their buyer’s agent. The “offer of compensation” to buyer agents was decided by the seller and the listing broker in their contract, before anyone even knew who the buyer would be. Maybe the buyer didn’t want to pay their buyer agent as much as the seller was offering – they didn ‘t have that choice.

Indeed, buyers sometimes misunderstood that the services they received from their buyer’s agent – fiduciary advice and confidentiality, screening properties, scheduling and guiding showings, negotiating the deal, and managing the transaction through the closing – they misunderstood that all those services were free, since they didn’t have to pay “out-of-pocket” for them. But they still paid for those services; they just paid them through the seller out of the proceeds of the sale.

That’s part of what those lawsuits were about – giving buyers and sellers more choices and more clarity about their compensation arrangements with their agents. And that’s what the settlement now provides. Accordingly, starting this summer, you’re going to have some new choices to make, whether you’re a buyer or a seller. If you’re a buyer, you can decide how you wish to compensate your buyer agent. And if you’re a seller, you can decide whether you’re going to make an offer of compensation to buyer’s agents – and how much to offer.

So what should you think about when making those choices?

For Buyers

If you’re a buyer, you should think your options for paying your buyer’s agent. The one benefit of the old system was that the commissions were all paid out of the proceeds of the sale. Buyers paid compensation to their buyer’s agent, but they almost never had to come “out of pocket.”. Instead, they essentially got to finance that commission over 30 years through their mortgage. They paid the seller the purchase price, and the seller took part of that purchase price and paid the agents. Now, with the system changing, you need to understand the options in front of you.

So what do you need to know now?

First, you will need to sign a representation agreement with your buyer’s agent. Under the settlement, the agreement is now a legal requirement, because we now need to confirm the terms of our representation of your interests. In that agreement, we’ll disclose our legal obligations to you, and the limits of our representation, and you’ll be able to negotiate the compensation terms directly with your agent. After all, your agent still deserves to get paid for the services they’re providing to you even if the seller isn’t making an unconditional offer of compensation.

Second, you should be aware that you don’t necessarily have to come out of pocket to pay your agent. We realize that most buyers take on a lot of financial obligations when they purchase a home, and might have difficulty paying that buyer agent compensation directly. But your agent will use every effort to structure your deal so that you can pay that compensation out of the proceeds of the deal, rather than coming out of pocket.

We can do that in one of two ways:

- We believe many sellers are going to continue to make offers of compensation to buyer’s agents. Even though the offer is no longer required, most sellers understand how tough it is for buyers to come out of pocket for the buyer side compensation, and they’ll offer a concession to take that obligation off your hands. It’s no different than if they offered to pay some points toward reducing your mortgage rate, or if they threw in furniture, or any other concession – the seller is allowed to offer you attractive terms for buying the home. And picking up the cost of your buyer’s agent is a very attractive term.

- If the seller is not offering compensation, we can still shift your obligation to the seller in the offer to purchase. We just need to make your offer conditional on the seller paying your buyer agent’s compensation. For example, an offer of $500,000 where you have a 3% (as an example) buyer agent compensation obligation would become an offer of roughly $515,000, with the seller rebating $15,000 back to you as a concession to pay your buyer’s agent. It’s the same offer, just structured to allow you to roll the commission into the purchase price and finance it with your loan – rather than come out of pocket. Indeed, these “conditional offers” are likely to become common practice in the industry, to prevent situations where buyers refuse to consider homes that don’t make offers of compensation because they don’t want to have to come out of pocket to pay their agent.

Third, we want to warn you about foregoing a buyer’s agent and purchasing directly from the listing agent. We know that some of our clients are going to consider doing this, because they think they might save some money. That’s your choice, but just realize what you’re giving up. When you have a buyer’s agent, particularly with Howard Hanna, you get a fiduciary representative who is legally required to look out for your best interests, to get you the best possible terms on your deal, to give you the best possible experience. These are the same types of fiduciary duties that you get from attorneys.

Just remember that if you go directly to the listing agents on a property, you’re going to be totally unrepresented. No one is working for you. Listing agents are fiduciaries of the seller. They’re legally required to get the best possible deal for their seller, not for you. That’s their job. You might be thinking that you’re saving money not hiring a buyer’s agent, but you never know how much a great agent could save you through negotiating the purchase price, handling problems with the inspection, overcoming transactional delays, and managing all the other complicated aspects of home purchases.

That’s why we really recommend that you hire a buyer’s agent when you’re purchasing a home. If you don’t have a buyer’s agent, then buying a house is like buying a car. Think about it:

- First, when you buy a car, you don’t have someone who can take you to see everything on the market. Instead, you have to go from dealer to dealer, all by yourself, without anyone to help you screen and sort your preferences.

- Second, when you’re negotiating the price of the car, you get zero information about what similar cars have sold for. You’re flying blind. But when you buy a home, your agent can get you all the information on any recent relevant sales in the market, so you can prepare the right offer.

- Finally, at every dealership, you don’t get someone who’s your fiduciary to represent you. Far from it — you’re working directly with someone whose job it is to make the best possible deal for their boss. And you’re not their boss!

Yes, you can work on your own. But why would you do that to yourself?

For Sellers

If you’re a seller, you can decide whether you’re going to make an offer of compensation to buyer’s agents – and how much to offer. You don’t have to offer anything if you don’t want to. But as we discuss earlier in relation to buyer options, you might find that making an concession to buyers to cover the costs of their buyer agents will be an attractive feature. If you don’t pay the buyer agent’s compensation out of the proceeds of the sale, then that buyer will have to come out of pocket to pay their agent, which might be difficult for buyers who are already stretching to come up with a down payment, lender’s fees, and other closing costs.

That’s why you should strongly consider making an offer of compensation. It’s just an attractive feature you might offer a buyer to incentivize them to make an offer, similar to concessions like paying for some closing costs, paying down a mortgage so they can get a better rate, throwing in furniture, and things like that.

Indeed, even if you don’t make an offer of compensation, you might find that buyers will present offers that are contingent on you covering their obligation to pay their buyer’s agent. For example, if you’re not making an offer of compensation, a buyer who has a buyer agreement requiring them to pay their buyer agent 3% (as an example) might be willing to pay $500,000 for your home, but they’ll structure their offer so that it’s roughly for $515,000, with a condition that you pay that 3% or make a $15,000 concession to them in the purchase price. It’s the same offer, just structured to allow them to roll the commission into the purchase price and finance it with their loan – rather than come out of pocket. Indeed, these “conditional offers” are likely to become common practice in the industry, to ensure that buyers who don’t want to come out of pocket to pay their agents will still consider listings that do not make offers of compensation.

Conclusion

Finally, two last thoughts we wanted to share. First, we want you to know all commissions, whether on the list side or the buy side, are fully negotiable. They’re not set by state law, or by the industry. You are free to negotiate them with either your listing or your buyer agent.

Second, we want you to know that all our agents are always going to provide you with fiduciary representation, looking out for your best interests and working to get you your best deal possible. You deserve nothing less, so don’t accept anything less.

We hope you found this explainer helpful. If you have any further questions, you should ask your Howard Hanna agent, or get in touch with us at our corporate headquarters. Thank you for giving us the opportunity to work with you on your purchase, or sale, of your home.

Howard Hanna Rand Realty Welcomes the MIGO Team to Monroe-Woodbury Office

Howard Hanna Rand Realty is thrilled to announce that Frank Golio and Nick Miessmer, formerly of the Hudson Valley Realty Center, are joining our Monroe-Woodbury office as the MIGO Team. This strategic move brings together two dynamic forces in the Hudson Valley real estate market, further strengthening our position in the region.

“We are very excited to welcome Frank, Nick, and their team of agents to our Monroe-Woodbury office,” said Michelle Pfeffer, Sales Manager of the Monroe-Woodbury office. “Their expertise and commitment to excellence align perfectly with our values and vision for the future.”

Renee Zurlo, General Manager for Howard Hanna Rand Realty, added, “In addition to servicing buyers and sellers in all areas of residential and commercial real estate, Frank and Nick specialize in new construction. Together with their expertise, and the marketing services of our New Homes Division, this collaboration will allow us to offer even greater value and service to our clients, and further enhances our long standing position as the premier real estate company in Orange County and the Hudson Valley.”

Howard Hanna Rand Realty is a leading real estate brokerage firm with a strong presence in the Hudson Valley. With a commitment to providing unparalleled service, innovative marketing strategies, and expert knowledge of the local market, Howard Hanna Rand Realty helps clients achieve their real estate goals with confidence.

Frank Golio and Nick Miessmer bring a wealth of experience and a proven track record of success in the real estate industry. As part of Howard Hanna Rand Realty, they will continue to provide exceptional service, now backed by the extensive resources and support of one of the nation’s largest real estate companies.

“The addition of the MIGO Team to our Monroe-Woodbury office marks an exciting new chapter for Howard Hanna Rand Realty. We look forward to the innovative ideas and fresh perspectives Frank, Nick, and their team will bring to our organization”, added Matt Rand, CEO of Howard Hanna Rand Realty.

For more information about Howard Hanna Rand Realty and the MIGO Team, please visit https://randrealty.com/ or contact Frank Golio directly at (941) 363-1075 or frank@migoteam.com.

Celebrating Excellence: Howard Hanna Rand Realty Agents Shine in RealTrends Verified Rankings

At Howard Hanna Rand Realty, we are thrilled to celebrate the remarkable achievements of our agents who have been recognized in the prestigious RealTrends “RealTrends Verified” rankings this year. This recognition is a testament to their hard work, dedication, and unwavering commitment to serving our clients with excellence.

The RealTrends Verified rankings are an esteemed industry benchmark, acknowledging the top real estate professionals across the nation. These rankings are compiled through a rigorous verification process, ensuring that only the most accurate and trustworthy data is used to identify the leaders in the real estate sector.

Our agents’ inclusion in this list not only highlights their exceptional skill and professionalism but also their ability to navigate the complex landscape of today’s real estate market, achieving outstanding results for their clients. Their success is not just a reflection of individual achievement but is also a result of the collaborative environment and the support system that Howard Hanna Rand Realty fosters among its team members.

This years recipients are (listed alphabetically):

Anthony Armagno – Jersey City, NJ

Margo Bohlin – New City, NY

Marion Bruhns – Pine Bush, NY

Amy Brown Vigotsky – New City, NY

Linda DeFilippo – New City, NY

Douglass Holmes – Livingston, NJ

Trudi Iglesias – White Plains, NY

The Kirkwood Group – Morris Plains, NJ

The Gene Lowe Team – Wayne, NJ

Elizabeth Manna – Jersey City, NJ

Terry May – New City, NY

Mary Orapello – Kingston, NY

Joseph Paoli – Goshen, NY

Barri Plawker – Englewood Cliffs, NJ

Mark Seiden Real Estate Team – Briarcliff, NY

Joseph Simone – Wayne, NJ

Sandra Spector – New Windsor, NY

Chris Staritz – Warwick, NY

Karen Treacy – Livingston, NJ

We extend our heartfelt congratulations to each of our agents who have earned this distinguished honor. Your hard work does not go unnoticed, and it is your drive and passion that help set Howard Hanna Rand Realty apart in the competitive real estate market.

As we celebrate this success, we are also reminded of our commitment to providing the highest level of service to our clients and continuing to achieve excellence in all aspects of our business. Thank you to our esteemed agents for your dedication and to our clients for your trust and support.

Here’s to continuing to set the standard for excellence in real estate!

Why You Might Want to Buy a Home – Even in a Seller’s Market!

WHY YOU MIGHT WANT TO BUY A HOME

(EVEN IN A SELLER'S MARKET)

Sometimes, it’s a “great time to buy.” When prices are falling, inventory is high, and rates are low, you’re probably in a “buyer’s market.” And when it’s a buyer’s market, that’s a great time to buy a home -- indeed, that’s why they call it a “buyer’s market”!

rates are low, you’re probably in a “buyer’s market.” And when it’s a buyer’s market, that’s a great time to buy a home -- indeed, that’s why they call it a “buyer’s market”!

But that’s not what’s happening in the Spring of 2024. Right now, we’re in a “seller’s market” -- prices are at all-time highs, inventory is at an all-time low, and interest rates have been going up for two years.

So if we’re in a seller’s market, does that mean that it’s a “bad time to buy”? Not necessarily. It depends on you, and your personal situation. Everyone is different, and even though the market timing might not be ideal, you might have very good reasons to consider purchasing a home in this market.

In other words -- even if right now isn’t the ideal time to buy a home from a financial perspective, it might be the best time from your personal perspective. Moreover, as we’ll show below, even buying during a seller’s market can be an excellent investment if you stay in your home for a while.

People Buy For Personal Reasons

The first point we want to make is simple: people buy for personal reasons, not financial reasons.

Maybe you have a family that has outgrown your current home, or an “empty-nester” who now needs to downsize. Maybe you want to live closer to work, or maybe you work from home so much now that you can get a bigger or cheaper home further from the city. Or maybe you’ve simply never owned a home of your own, and want to take that step.

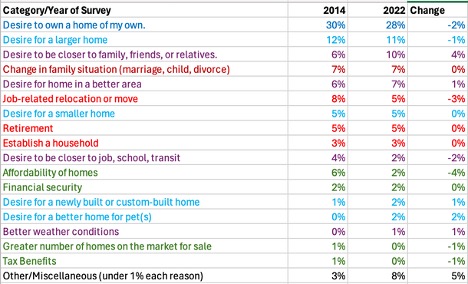

If that’s your situation, then you’re like most people. In the past ten years, The National Association of REALTORS has surveyed home buyers about their “primary reason for purchasing a home” in two very different types of markets:

2014, when the market was slowly recovering from the financial crisis, a fairly robust buyer’s market with prices stabilized after falling precipitously from 2008-2010.

2022, when the market was roaring in the post-COVID bull market, a classic seller’s market with limited inventory and sharply rising prices.

Even in two very different markets, though, the results were strikingly similar, with most people identifying personal rather than financial reasons for buying a home. For example, in both surveys, the top reason was the “Desire to own a home of my own” – 30% of respondents in 2014, and 28% in 2022. Similarly, other top reasons had to do with the desire for different types of homes, homes in a new location, or changes in personal situations.

What about the financial side? Very few people identified a financial motivation in buying a home. In 2022, only 2% for “affordability of homes,” with another 2% for “financial security.” Now, that was in a robust seller’s market, but even in the buyer’s market of 2014, when prices were still down from the financial crisis, only 6% chose “affordability” and 2% “financial security, with another 1% choosing the “greater number of homes on the market” and 1% the “tax benefits”. In other words, even when prices were down and rates were falling, only about 10% of buyers cited specifically financial reasons for purchasing a home.

Here are the results, and the changes between the two surveys. We’ve color coded the results as follows:

Dark blue for “desire to own a home of my own”

Red for changes in personal circumstances

Light blue for desires for a different type of home

Purple for a desire for a new location to live

Green for the financial reasons for buying a home.

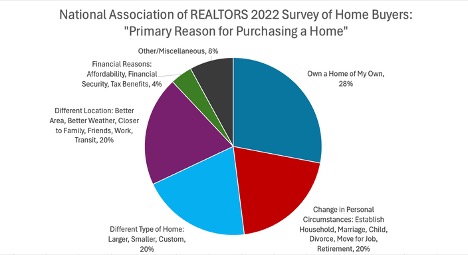

Also, here’s a pie chart combining all the different categories for the more recent 2022 survey so you can see how they stack up:

The point is this: we don’t buy homes the way we buy stocks and bonds, as a purely financial investment. We buy homes to meet our personal needs -- because we want to own our own home, we need a different type of home or a home in a new place, or we have to adapt to a change in our personal lives.

So if you need a new home, don’t get too caught up in the “market timing” about whether it’s the idea time for making an investment in real estate. Do what makes sense for you and your needs.

Can Buying a Home Right Now be a Good Investment?

Of course, that doesn’t mean that buying a home in a seller’s market is necessarily a “bad investment.” Even if the market timing is not ideal, home ownership can still make financial sense for you, especially if you’re planning on staying in your new home for a significant amount of time.

Why? Because home ownership is generally a good long-term investment, even if you don’t time the market perfectly. Here are some of the primary reasons why.

You build equity in your home over time. Assuming you’re going to get a mortgage loan to purchase your home, you’ll start building equity in your home as you pay down the principal in that loan. Conversely, f you’re paying rent, you’re paying down your landlord’s loan, not your own.

You get “leveraged” appreciation. People think that if they buy a home for $500,000 and sell it for $600,000, they’ve gotten the benefit of 20% appreciation – that is, a $100,000 gain on a $500,000 investment. But if they financed that home by putting down $100,000 and borrowing $500,000, they’ve actually doubled their money – they invested $100,000 and pulled out $200,000 when they sold. That’s not 20% appreciation -- it’s 100% appreciation! Obviously, we’re simplifying this a bit, but people often overlook the benefits of “leveraged appreciation” when considering buying a home.

You get all the tax benefits of home ownership. When you own a home, you can realize significant tax benefits over renting. For example, you can deduct the interest on your home loan, deduct some of your property taxes, and save on capital gains taxes when you sell. (We’re not your accountants, but you should talk to a professional if you want to get a better sense of the tax benefits of owning your own home.)

Why Market Timing Isn’t Everything

Let’s use an example to demonstrate the concept that real estate investments can make sense even if the market timing isn’t ideal.

For example, let’s say that you bought a single-family home in Westchester County in early 2008, at the very end of a long and lustrous seller’s market. The average price for a home in Westchester at the time was about $930,000. To buy that home, we’ll say for purposes of using round numbers that you put down about $200,000, which is a little more than the standard 20% down payment. You then financed the remaining $730,000 with a 30-year fixed rate mortgage of 6%, which was the average rate in 2008.

| Home Purchase 2008

|

|

| Purchase Price

|

$930,000 (average 2008 price)

|

| Down Payment

|

$200,000 (22%)

|

| Amount Financed

|

$730,000 (78%)

|

| Mortgage Rate

|

6% (average 2008 rate)

|

| Monthly Payment

|

$4,376

|

Obviously, this was not good market timing, because the financial crisis of 2008-09 drove prices down precipitously over the next few years.

But let’s look at how that investment performed if you held that home until this year. Now, that’s 15 years of owning that home, which is a long time, but it’s actually only a little longer than the national median time of home ownership. So it’s a reasonable baseline. And remember, we’re trying to measure today’s value against the very top of the last seller’s market, when it was especially bad market-timing for buying a home.

What does that badly-timed purchase look like 15 years later?

Well, let’s say that you sold the property at the end of 2023. At that time, the average home price in Westchester was about $1.2M.

| Home Sale 2023 (15 Years)

|

|

| Investment (Down Payment)

|

$200,000

|

| Sales Price

|

$1,200,000 (average 2013 price)

|

| Principal Pay-Down

|

$233,000

|

| Remaining Loan

|

$497,000

|

| Payoff (Sales Price – Remaining Loan)

|

$703,000

|

That’s about $270,000 more than the purchase price, an increase of about 29%. That may not seem like much over a 15-year period, but let’s go back to the three benefits of home ownership and see how they play out.

You Built Equity by Paying Down Principal

When you took out your loan in 2008, you owed about $730,000 after your $200,000 down payment investment. But over those 15 years, part of every month’s mortgage payment slowly paid down the principal of that loan.

You can see from the table below that home loans are front-loaded, meaning that most of your monthly payments at the beginning apply toward interest, and you pay off your principal very slowly. But over time, those payments do add up. After 15 years, you paid down over $230,000 of that principal, leaving you with a little less than $500,000 still on your loan.

So if you were to sell that home for the 2023 average sales price of $1.2M, you’d have about $700,000 that you’d pull out at the closing table. That’s pretty good, considering that you came to the closing table with $200,000 15 years ago.

Your Investment Appreciated Off Your $200,000 Down Payment

The home appreciated by $230,000, which was an increase of 25% off the purchase price. But you didn’t buy the home for cash. You bought it with that down payment of $200,000. So when we’re calculating your appreciation, we have to consider what you actually put in and what you actually pulled out. You put in $200,000 You pulled out over $700,00. That’s about a $500,000 profit from the investment, a 250% return on your $200,000.

Tax Benefits

Finally, you also got tax benefits over the time that you owed the home, particularly the home mortgage interest deduction. The interest you paid on your home mortgage was deductible against your income. You paid over $600,000 of interest during those 15 years, approximately $3,333 per month and about $40,000 per year. Because of the home mortgage interest tax deduction, that $40,000 of interest came off the top of your income. If you would have paid a 40% combined tax rate for state and federal on that $40,000, you would have saved about $16,000 taxes per year. And over 15 years, that would be about $240,000 in taxes, just in the mortgage interest deduction.

Of course, this all depends on your particular financial situation -- including whether you’re earning enough to pay the highest tax rate on your last dollars of income, whether you’re itemizing your deductions versus taking the standard deduction, whether your mortgage interest exceeds the allowed cap, etc. Again, talk to your accountant about this, because it gets complicated. But the general idea is that home ownership does confer tax benefits that should be factored into your investment calculation.

Comparing Investments

All that leaves us with a simple question: did the investment work out? Well, to answer that, we need to look at the alternative. How does that badly-timed real estate investment compare to, say, investing in the stock market?

Well, let’s go back to 2008. Let’s say that instead of investing that $200,000 down payment in a house, you put it in the stock market. According to the Down Jones return calculator at www.dqydj.com, your $200,000 investment in January 2008 would have turned into about $662,000 by December 2023. That’s about a 331% return over those 15 years – making a profit of about $462,000 on the $200,000 investment.

So let’s compare the investments:

| Category | Home to Live In | Dow Jones Stocks |

| Amount Invested

|

$200,000

|

$200,000

|

| Amount Pulled Out

|

$700,000

|

$662,000

|

| Change

|

$514,000

|

$462,000

|

In other words, your return on your poorly-timed real estate investment was better than what you would have gotten by investing in the stock market.

Now, we’ve obviously simplified the numbers to make the comparisons a little clearer, and to keep ourselves from bogging down. So you might think of a couple of objections to this analysis showing that even a poorly-time real estate investment can outperform stock market returns.

Here are a couple of the obvious objections:

Taxes and Insurance

The biggest objection would be that we have not factored in the other costs of home ownership, particularly property taxes, insurance, utilities, etc. That’s fair, especially since you don’t incur those same costs in owning stocks. So if we include those as expenses against the returns on real estate investment, we’d see the returns go down a bit.

Maintenance Costs

Anyone who has owned a home knows that maintenance costs can also add up: a new roof, hot-water heater, lawn cutting, etc. Again, that’s a fair objection, because those costs can add up.

Transaction Costs

Finally, if we want to be fair, we should include the transaction costs of buying and selling a home: transfer taxes, title insurance, commissions, lawyer’s or escrow fees, and so on. Again, those costs will take away from our real estate investment returns.

So that’s all totally fair. And if we wanted to present a more robust 20-page analysis of the comparison between real estate and stock investments, we’d have to go through all that.

On the other hand, though, we also haven’t factored in some of the secondary benefits of home ownership in our comparison, especially those that are far more favorable than stock ownership, including:

Tax Savings

We talked earlier about the benefits of the home mortgage interest deduction, but we didn’t calculate that as part of the investment returns because it’s so dependent on your personal situation. But if you’re indeed saving thousands of dollars from those deductions every year, they do add up to a substantial amount of money that probably offsets much of those home ownership and maintenance costs.

Moreover, we haven’t even talked about the capital gains treatment on the sale of your primary residence. You can exclude between $250,000 (for single people) and $500,000 (for married couples) of the capital gains on the sale of your home. So in our particular example, the $270,000 in capital gains appreciation on the home would almost entirely be capital gains fee. You don’t get that when you sell stocks.

Again, every time we talk about taxes, we’ll remind you to talk to your accountant. But there’s no denying that you get many more tax benefits from real estate ownership than owning stocks.

Investment Fees

Since we stipulated to the objection based on transaction costs in buying and selling real estate, we should also mention that stock market investments aren’t fee. You can invest in many low-cost ways, but most investments involve some sort of percentage fee when you purchase, or a fee for every year that your financial advisers manage your money. The fees vary widely, but we just think it’s fair to point out that stocks have “transaction costs” as well.

The Rental Replacement Cost

Finally, here’s one really big thing. If you invested in the stock market rather than buy a house back in 2008, you still needed a place to live for those 15 years! And that costs money!

Unless you stayed in your parents’ basement, or crashed on couches with your increasingly impatient friends all those years, you probably would had to rent a home for the last 15 years. You can’t live in your stock portfolio. And a single-family rental in Westchester is not cheap. We don’t want to get into the weeds on this, but our experience is that most renters spend about 1/3 of their income on their rent, which happens to be about the same percentage that homeowners spend on their monthly payments for their mortgage, interest, and taxes.

In other words, if you want to factor in the additional expenses of home ownership, maintenance, and transaction sots, you also need to factor in the tax benefits and the value of not having to rent a home. That’s only fair!

Conclusion: All decisions are personal

Listen, we don’t really know whether purchasing your home in this market is the right decision for you personally. Indeed, our first point was that the reason most people buy a home has to do with intensely personal reasons about what they want and need in their lives. Every situation is different!

right decision for you personally. Indeed, our first point was that the reason most people buy a home has to do with intensely personal reasons about what they want and need in their lives. Every situation is different!

But we did want to reassure you that buying a home in a seller’s market isn’t necessarily a poor financial decision. Market timing isn’t everything. As we tried to show you, even if you’d bought in early 2008 with the very worst market timing of the past 50 years, you would still have done very well in your investment over that time, even compared to the stock market.

But, again, every situation is different. That’s why you should meet with your Howard Hanna | Rand Realty agent to see whether buying right now makes sense for you.

So give them a call today, or call 1-800-431-3010 to get connected to someone great!

Four Reasons Why You Should List Your Home in Spring Market 2024

Sometimes, it’s not a great time to sell. If prices are falling, inventory is high, and buyer demand is slackening, the market timing for selling is certainly not ideal.

But that’s not what’s happening in the Spring of 2024. Right now, prices are at an all-time high, inventory is at an all-time low, and buyer demand is still very strong despite rising interest rates. In this kind of market environment, it really is a very good time to consider listing your home for sale.

Here are four reasons why.

1. Your home is worth more than ever!

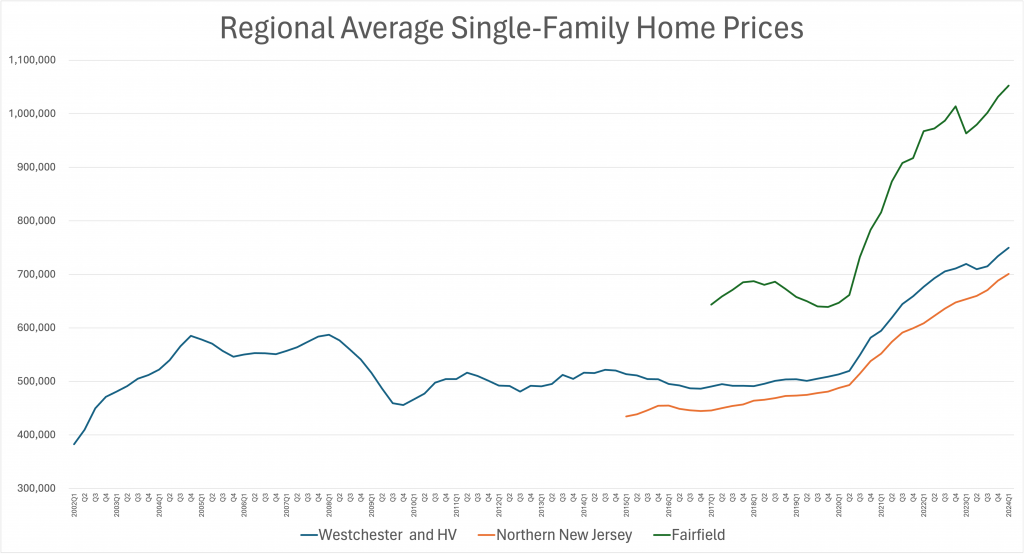

Home prices throughout the region are at an all-time high. It took some time for the market to recover following the Financial Crisis of 2008-09, but starting with the lifting of the “stay-at-home” COVID restrictions in mid-2020, the housing market shot up like a rocket. As a result, average home prices are now up about 50% across the region in just the past five years.

Will they continue to go up? Maybe. But if you look at the graph, you can see that the trend seems to be topping out. And if rates continue to go up, and inventory starts to recover, we will see a lot of downward pressure on housing prices.

Takeaway: it’s better to get out a year too early than a year too late.

2. You have almost no market competition!

Why are prices going up? Basic supply-and-demand – we have so little inventory on the market that buyer demand is still driving prices up.

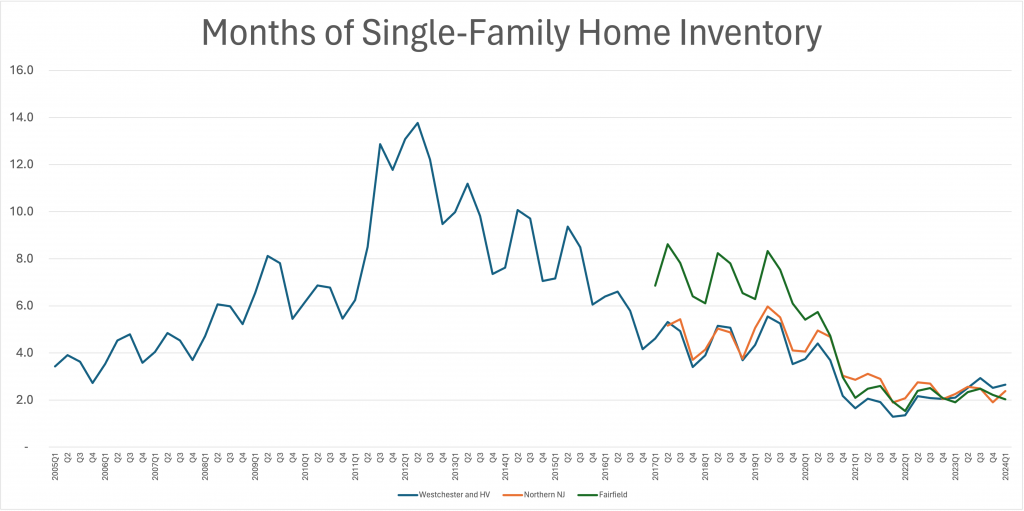

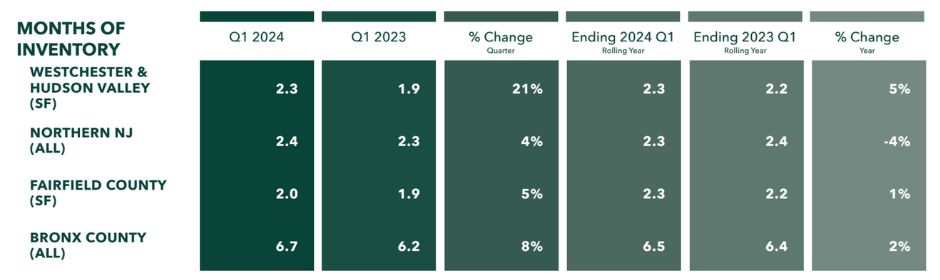

We measure housing inventory by taking the number of homes currently for sale, and then calculating how many months it would take to sell out that existing supply at the current rate of monthly sales. Historically, six months of inventory is considered a “balanced” market between buyers and sellers.

So where are we right now? Currently, most counties in the region have less than three months of inventory, and have been near a historical low for over three years. That drought of supply, coupled with continuing strong demand, has been pushing sales down but prices up. And that’s in the overall regional and county-wide market – if you were to look at just your own neighborhood, in your price point, you might not have any competition. That’s how you end up with bidding wars, which is exactly what you want as a home seller.

Takeaway: when everyone else is zigging (not selling), it’s time to zag (sell).

3. The buyers are out there!

We all know that interest rates have been climbing, more than doubling from the 3% rates buyers were getting just two years ago. But even with rates rising about 7%, buyers are still out there? Why? Because the economy is extremely hot right now – GDP is way up, wages are up, the stock market is up, and unemployment is way down. People have jobs and money to spend. The problem is that we don’t have enough homes to sell to them.

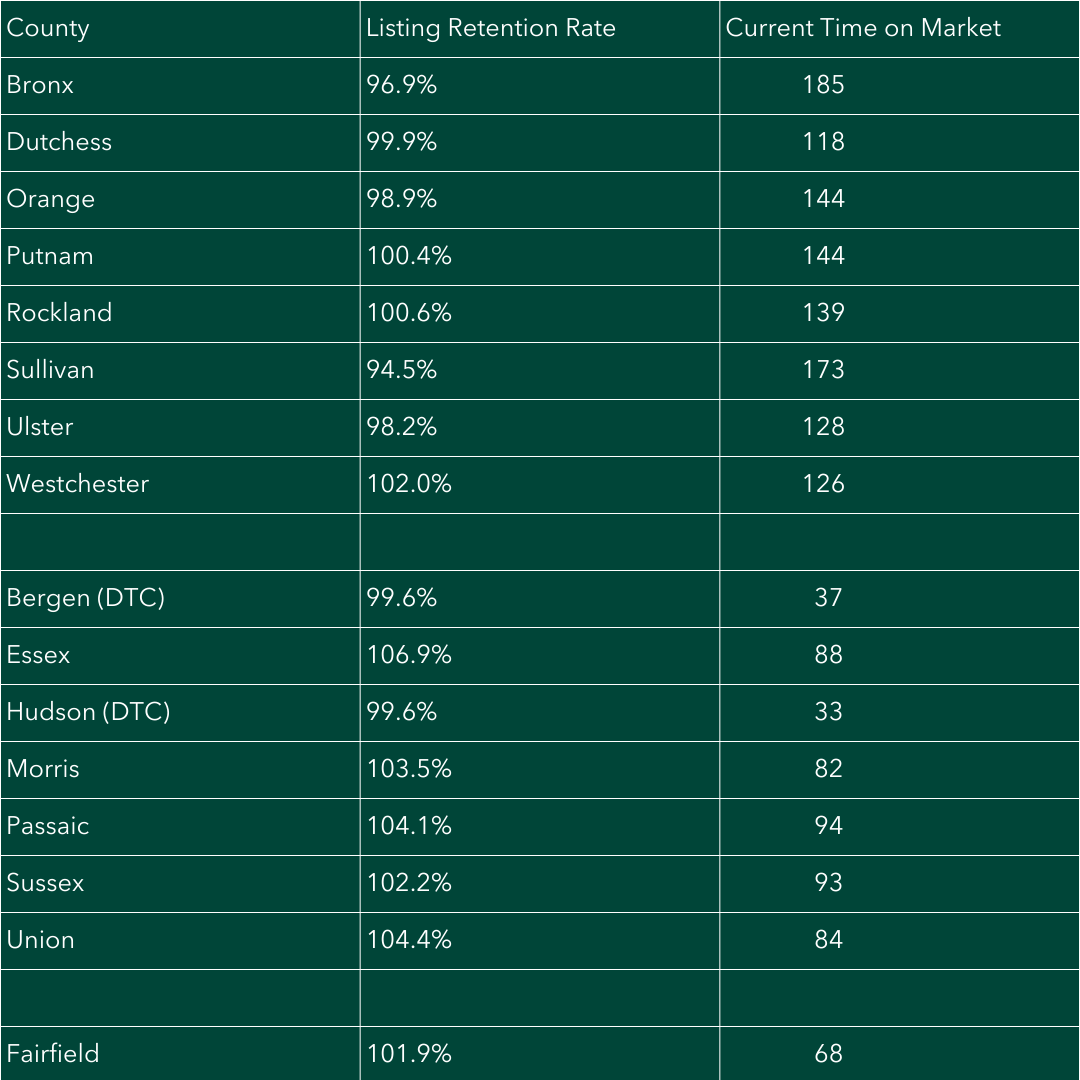

This is what a seller’s market looks like. And it’s not just that prices are going up. You can also see the signs of a seller’s market by looking at how quickly homes are selling for (the “Days-on-Market”) and how much sellers are discounting their asking price to get them sold (the “Listing Discount”). By those metrics, homes are selling very quickly, and sellers are getting close to (or above) their asking prices.

Takeaway: When it’s a “seller’s market,” you should . . . sell!

4. You may not need to be so rate-sensitive.

Many homeowners want to sell their home, but they hate to give up their rate. They bought or refinanced their homes during the era of historically-low interest rates, and they’re loathe to give it up, especially if it means buying their next home with a 7% interest rate. We call these the “Golden Handcuffs” – interest rates that are locking homeowners into their current home even if they’d like to make a move.

Maybe that’s your situation. Maybe you have personal reasons why your current home no longer meets your needs: your family is getting bigger, or smaller, or you’ve got a new job, or you just want a change, or you want to be closer to or further from work/family/whatever.

So should you let those Golden Handcuffs keep you from moving? It depends on your situation, but many homeowners are too rate-sensitive in deciding whether to put their home on the market. For example, many homeowners have so much equity in their current home that they don’t even need a loan to buy their next home, so they won’t need to trade in their amazing rate for a higher one. And other homeowners owe so little on their home, and would need such a small loan, that the difference between a high rate and a low rate is pretty marginal. And that’s not even considering the estimated 30% of homeowners who own their homes outright!

Are you in any of those situation? If you’ve been in your current home for a while, you’ve probably paid down a lot of your principal of your home loan, and your home has probably appreciated significantly since you bought it. If that’s the case, it might make sense for you to make the move that you’ve been putting off for so long.

With our free online home valuation tool, you can see how much your home has appreciated since you purchased it. Now, of course, this is an “estimate”, and doesn’t take into consideration the details of your home. It’s no substitute for a “comparative market analysis” from a trained Howard Hanna real estate professional. But it will give you an idea of just how much equity you have in your home, and you might realize that you don’t need to be so rate sensitive.

Takeaway: Don’t let your “Golden Handcuffs” lock you into a home you don’t want anymore.

Conclusion: All decisions are personal

Listen, we don’t really know whether putting your home on the market is the right decision for you personally. Every situation is different. That’s why you should meet with your Howard Hanna | Rand Realty agent to see whether selling right now makes sense for you.

So give them a call today, or call 1-800-431-3010 to get connected to someone great.

Plawker Real Estate Merges With Local Real Estate Leader Howard Hanna Rand Realty

Plawker Real Estate, one of Bergen County’s leading brokers, is excited to announce that it has joined forces with real estate leader Howard Hanna Rand Realty. The Plawker Real Estate office will now operate as Howard Hanna Rand Realty – Plawker Group. Additionally, the Plawker Commercial office will now operate as Rand Commercial – Plawker Group.

Plawker Real Estate, one of Bergen County’s leading brokers, is excited to announce that it has joined forces with real estate leader Howard Hanna Rand Realty. The Plawker Real Estate office will now operate as Howard Hanna Rand Realty – Plawker Group. Additionally, the Plawker Commercial office will now operate as Rand Commercial – Plawker Group.

“I have so much respect for Terry, Adam, and Barri Plawker, and we are thrilled to welcome them to the Howard Hanna Rand family,” said Matt Rand, CEO of Rand Realty. “Howard Hanna Rand Realty is currently well positioned as a Top 10 Bergen County broker, and we are looking forward to tremendous growth with the addition of the Plawker Group.”

Plawker Real Estate made this decision to further the ability of their agents to provide best in class service, local expertise, global exposure, and innovative technologies. Howard Hanna Rand Realty also prides itself on its one-stop shopping offerings and luxury portfolio marketing systems, which serve homeowners through their entire buying or selling experience. Programs such as the 100% Money Back Guarantee are also exclusively available through Howard Hanna Real Estate Services.

“We have been operating for over forty years in Englewood Cliffs and are looking forward to this exciting next chapter for our company and our family,” said Terry Plawker, founder of Plawker Real Estate. “Our clients will benefit from this new affiliation with the Rand and Hanna families. Their global marketing and technology tools are sure to enhance our unmatched service and local market knowledge.”

Adam Plawker, Managing Director of Plawker Real Estate, added, “I’m looking forward to heading up the North Jersey expansion of Rand Commercial – Plawker Group. I will continue to do what I love, dealing with people, while growing and managing a powerhouse commercial real estate office based in Englewood Cliffs.”

The September partnership of Howard Hanna and Rand Realty has added to the strength of both family-owned real estate companies throughout New Jersey and New York. Howard Hanna finished 2019 with a closed sales volume of more than $23 billion and over 100,000 homes sold in total, according to a research report produced by REAL Trends in March 2020.

“We’re so excited to have the Plawker Real Estate group join us as we work to consistently deliver an amazing real estate experience throughout the country,” said Howard W. “Hoby” Hanna, IV, President of Howard Hanna Real Estate Services. “Under Matt Rand’s leadership and direction in New Jersey and New York, this is the first of what we believe will be multiple mergers in the tri-state area in the coming months.”

Howard Hanna Rand Realty has more than 1,000 residential real estate sales associates, as well as a commercial real estate company (Rand Commercial) and Hudson United Home Services, which provides residential mortgage lending, title services, and personal lines and commercial insurance. Its 28 offices serve Bergen County, Passaic County, Hudson County, Morris County, and Essex County in New Jersey, as well as Westchester County, Rockland County, Orange County, Dutchess County, Ulster County, and the Bronx in New York.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link