Real Estate Market Report: 1st Quarter 2018 – Lower Hudson Valley (NY)

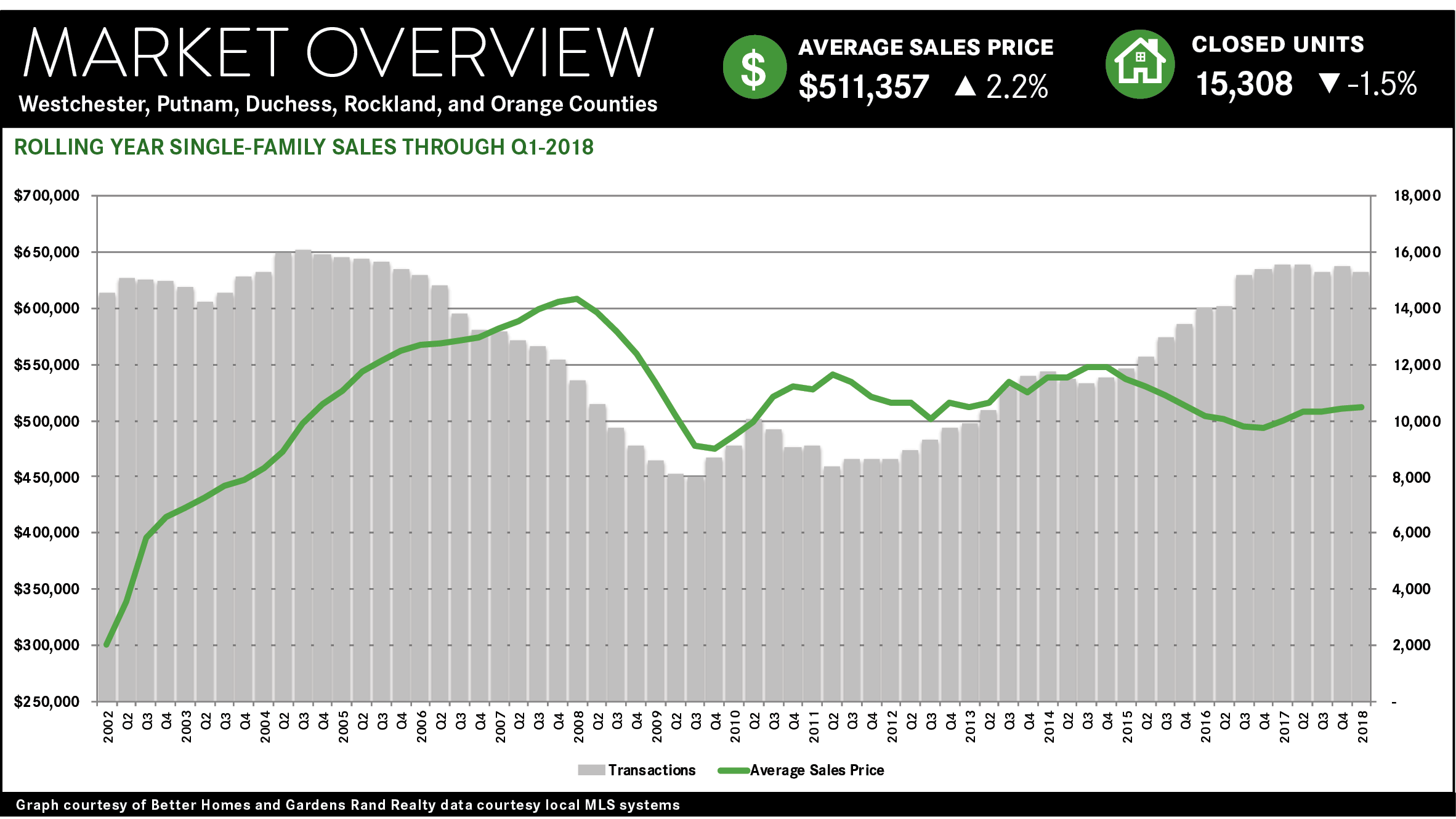

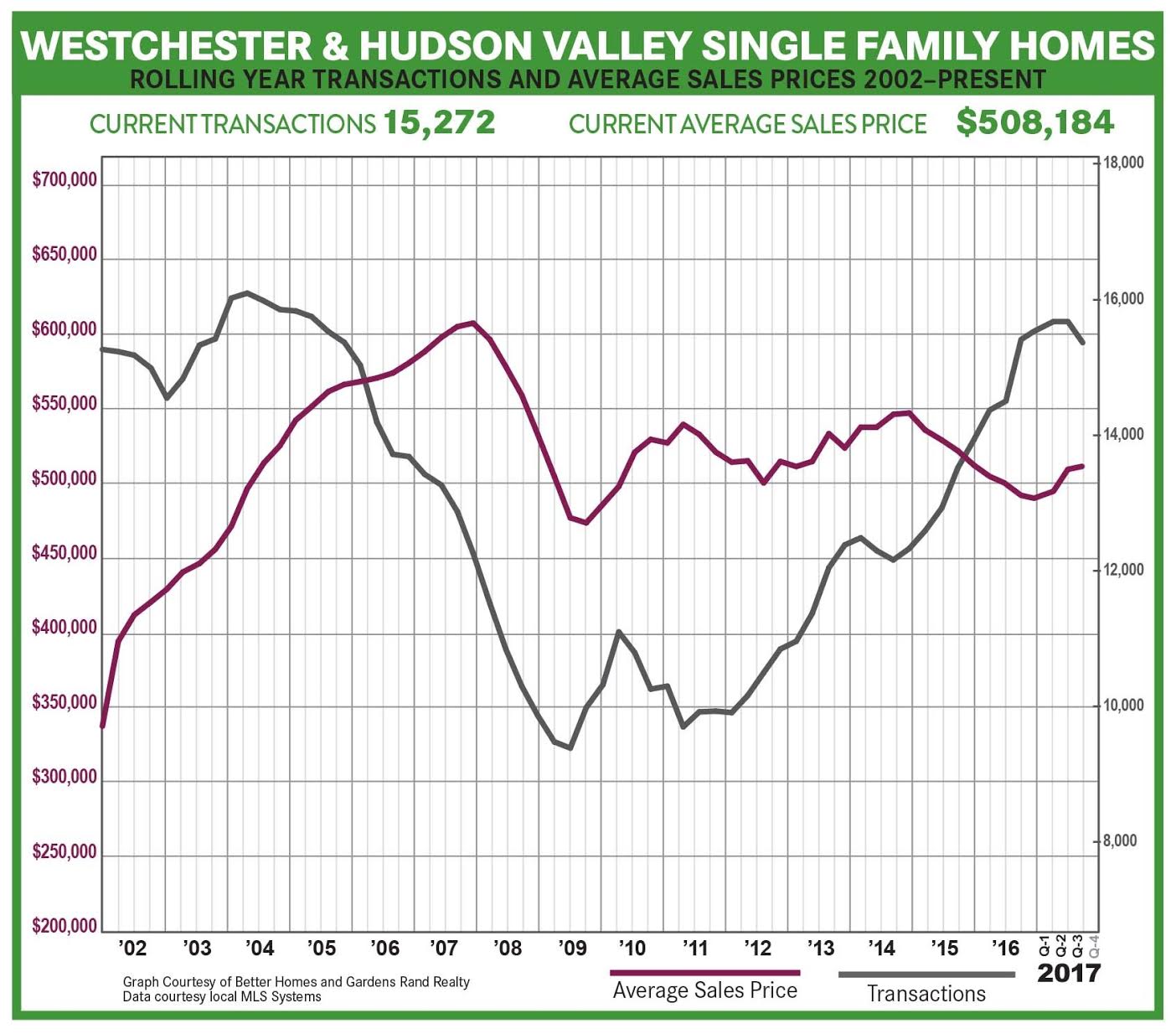

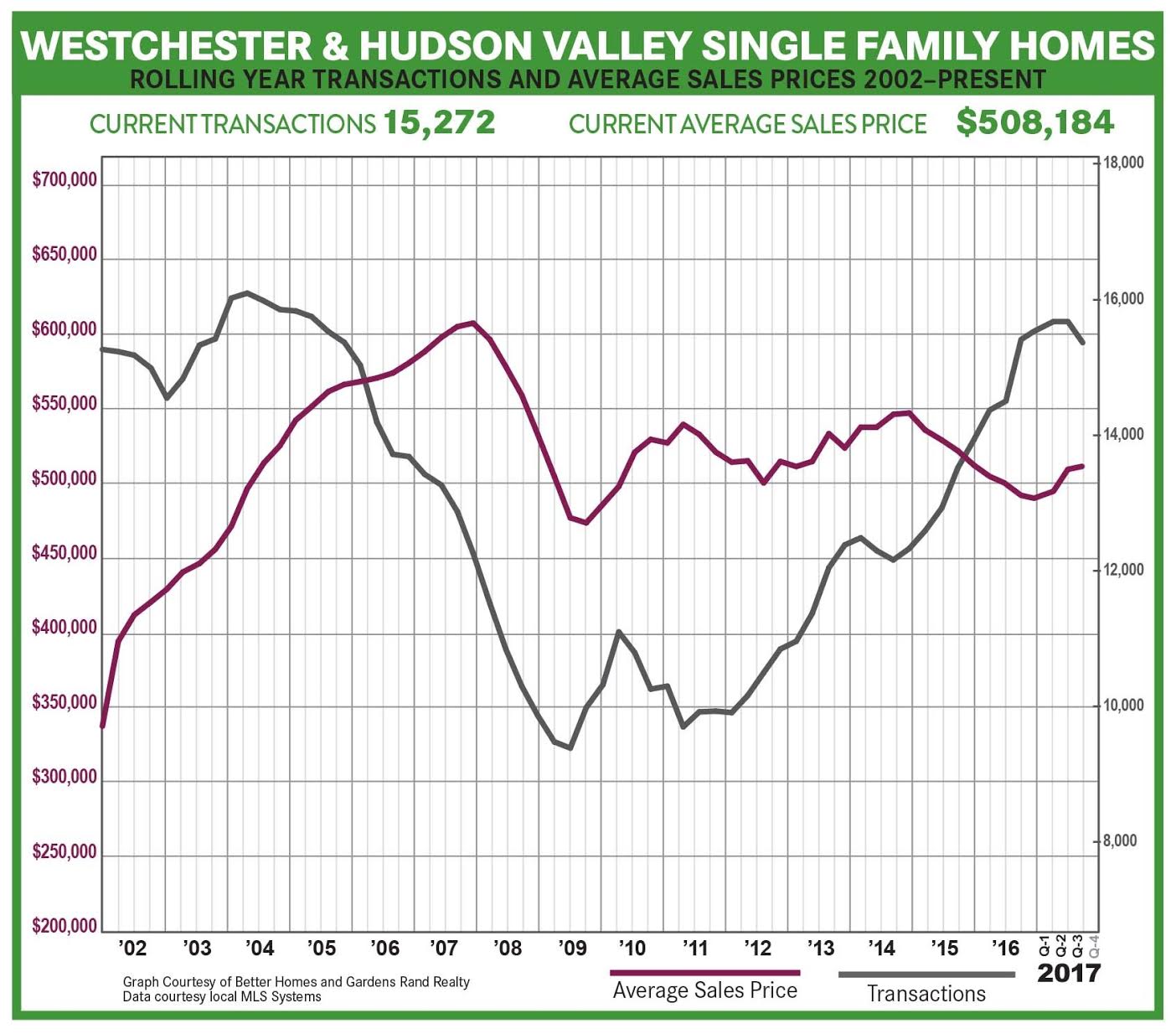

The housing market in the New York City northern suburbs of Westchester and the Hudson Valley has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The housing market in the New York City northern suburbs of Westchester and the Hudson Valley has become a fully‑realized seller’s market, with declining inventory stifling sales growth while driving meaningful price appreciation throughout the region.

The regional market continues to suffer from a lack of inventory. The number of homes available for sale compared to last year fell sharply in every market in the region. At the current absorption rate, we are now down to well under five months of inventory in every county for single‑family homes, and down to under four months for the lower‑priced condo market. That’s significantly below the six‑month level that usually denotes a seller’s market.

This lack of inventory is holding back sales. Regional transactions were down over 6% from last year’s first quarter, and were down in every county except Putnam: falling 6% in Westchester, 19% in Rockland, 0.3% in Orange, and 13% in Dutchess. For the rolling year, the drop was more moderate, with sales down just 1.5% regionally. But this isn’t a demand problem—demand is strong everywhere in the region.

But with all this demand chasing fewer homes, prices are up significantly across the region. The average sales price was up for every county and property type except for Westchester single‑family homes and condos, which might be a reflection of stronger demand at more entry‑level price points. The longer‑term trend, though, indicates that prices are generally appreciating at a moderate but meaningful rate, with the rolling-year average sales price for single‑family homes up over 2% for the region, and up in each county: rising 3% in Westchester, 5% in Putnam, 4% in Rockland, 4% in Orange, and 5% in Dutchess.

Going forward, this is what a seller’s market looks like. Low levels of inventory will continue to hold sales back even while driving prices up. At some point in 2018, this price appreciation will attract more sellers into the market, which will increase supply, bring sales up, and maybe moderate price increases. But that will not happen right away, so we expect a spring market with even lower levels of inventory, which will stifle sales growth but continue to drive robust price appreciation.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter, Pinterest, and Instagram.

Better Homes and Gardens Rand Realty to Hold Open-House Event

NANUET, NY – Better Homes and Gardens Rand Realty is excited to announce that they will be holding an open-house event, where attendees can receive advice on buying and selling homes. It will take place on Saturday, April 14, and Sunday, April 15, from 12:00-4:00 p.m. on both days.

NANUET, NY – Better Homes and Gardens Rand Realty is excited to announce that they will be holding an open-house event, where attendees can receive advice on buying and selling homes. It will take place on Saturday, April 14, and Sunday, April 15, from 12:00-4:00 p.m. on both days.

“We’re a few weeks into spring, which means it’s the prime season for the housing industry,” said Denise Friend, Rand Realty’s regional manager for Westchester County. “Our brokerage receives many potential clients during this time of the year, and we would like to offer them guidance on how to achieve their real estate goals.”

All 27 of Rand Realty’s sales offices will be participating in the event, with listings located throughout the Lower Hudson Valley and Northern New Jersey. At these sites, attendees can engage with an agent for one-on-one assistance on how to conduct a home search or market their home for sale. They will also have the opportunity to enter a raffle to win a gift basket, with one being provided by each of the four regions that Rand Realty serves: Rockland, Orange, and Westchester Counties in New York, and Northern New Jersey.

“Being involved in a real estate transaction can be challenging, so it’s important for us to interact with buyers and sellers to make sure that their questions are being answered,” said Friend. “We want them to feel confident when they enter the market.”

About Better Homes and Gardens Rand Realty

Better Homes and Gardens Rand Realty, founded in 1984, is the No. 1 real estate brokerage firm in the Greater Hudson Valley, with 28 offices (including a corporate location), serving Westchester, Rockland, Orange, Putnam, and Dutchess Counties in New York, as well as Bergen, Passaic, and Morris Counties in New Jersey.

Better Homes and Gardens Rand Realty has over 1,000 residential real estate sales associates, as well as a commercial real estate company (Rand Commercial) and the Hudson United Group, which provides residential mortgage lending, title services, and commercial and residential insurance.

These companies can be found online at www.RandRealty.com, www.RandCommercial.com, and www.HudsonUnited.com. Better Homes and Gardens Rand Realty can also be found and interacted with on Facebook, Twitter, Pinterest, and Instagram.

Fourth Quarter 2017 Real Estate Market Report: Rockland County Overview

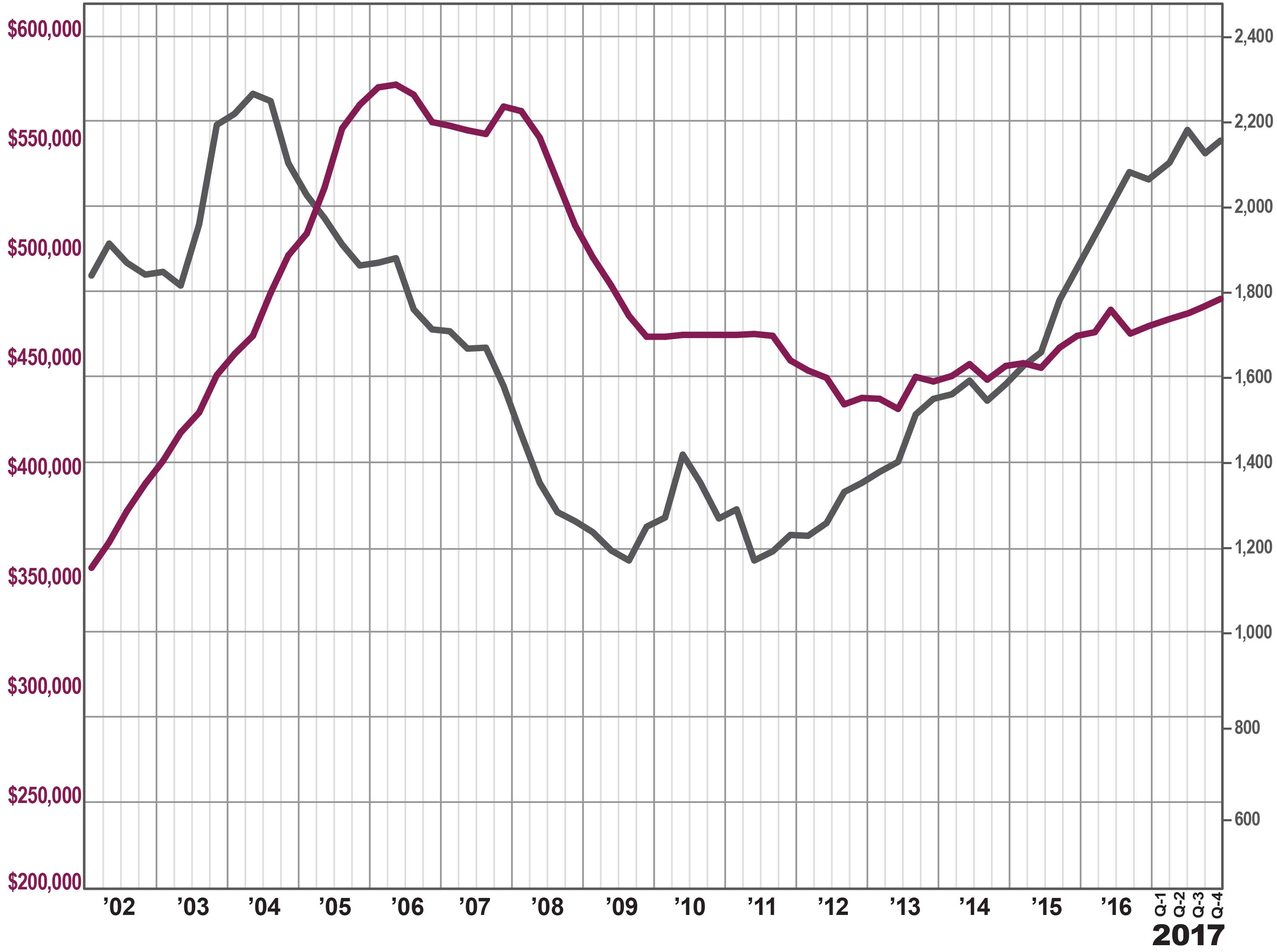

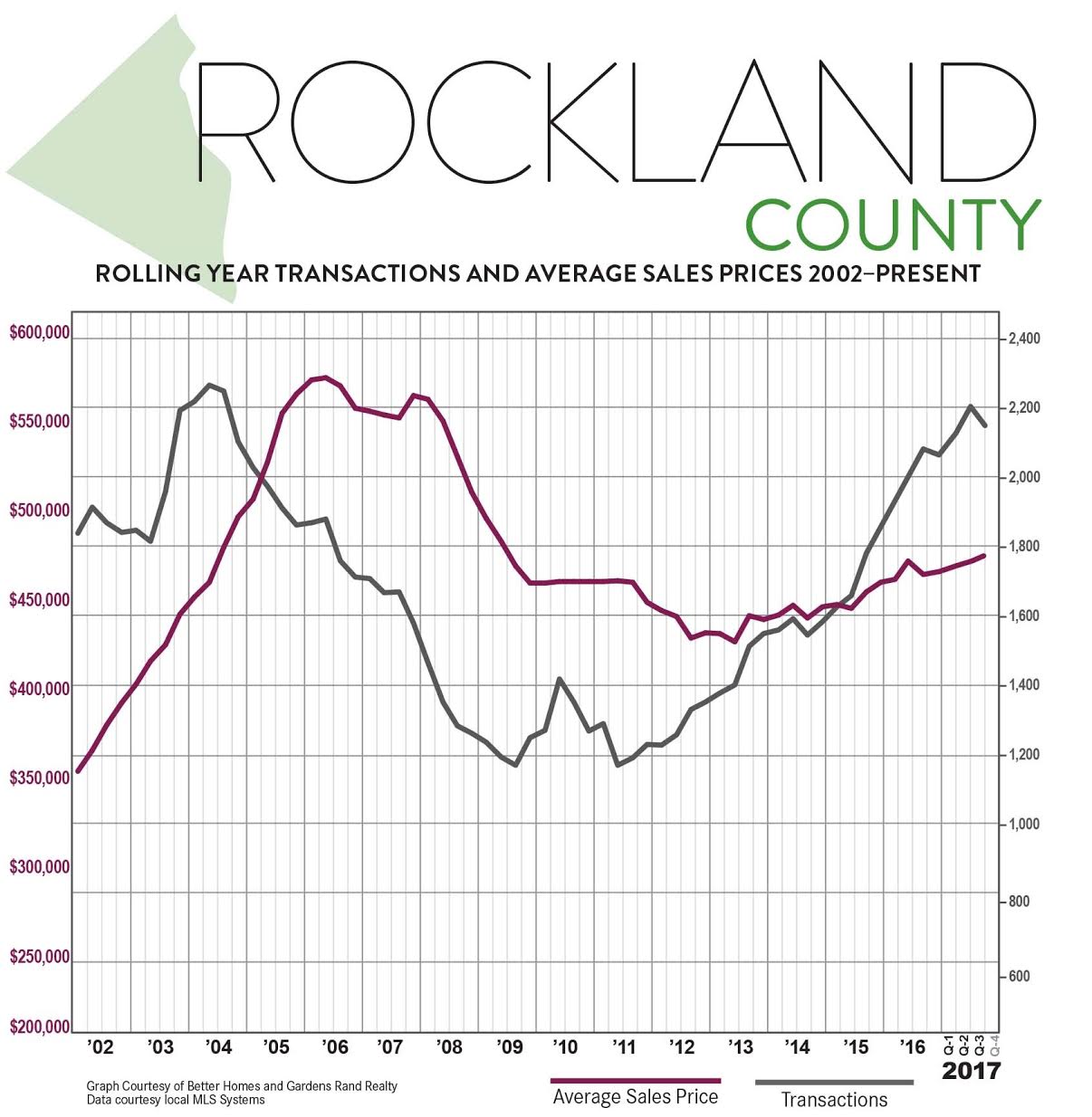

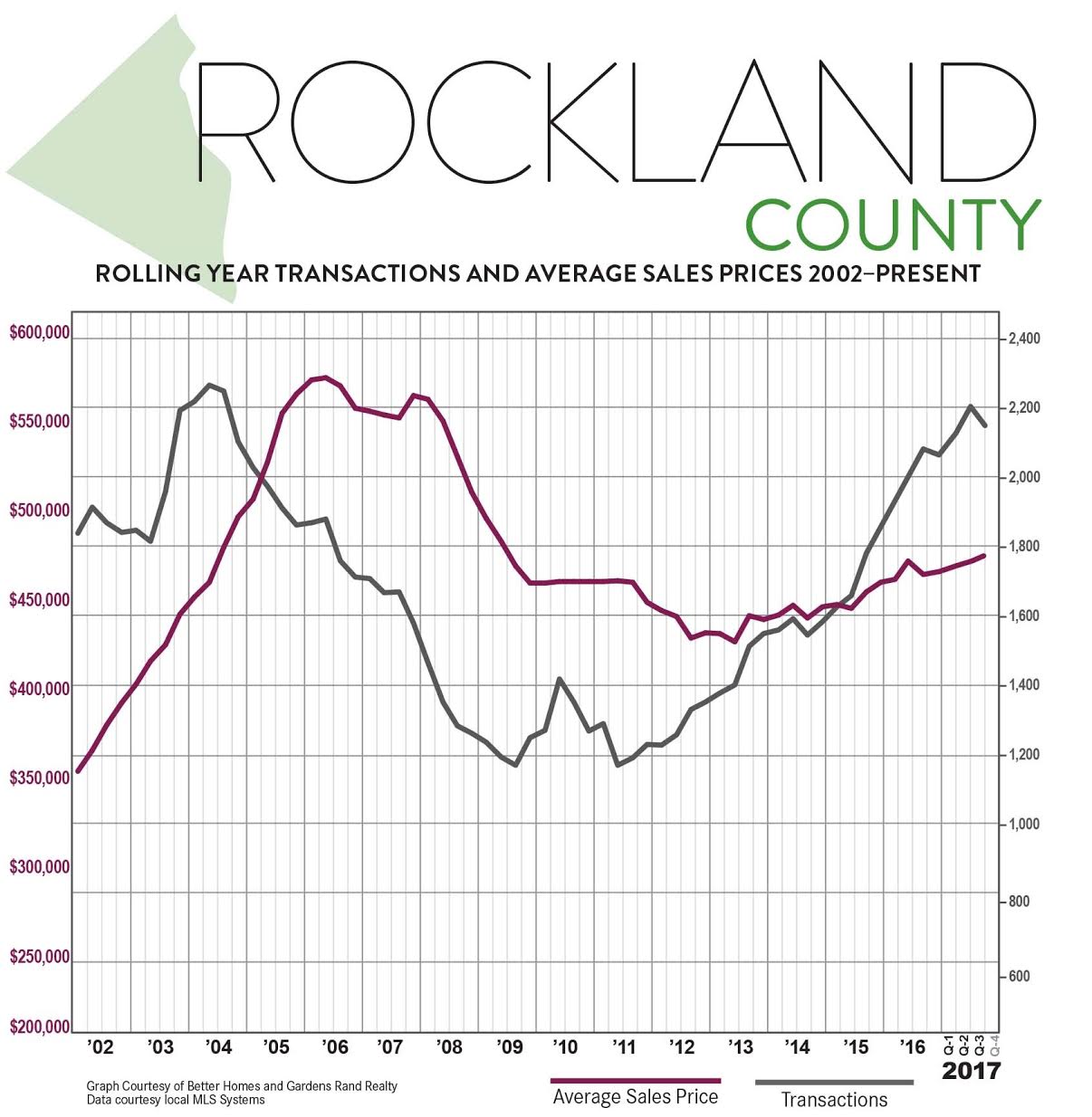

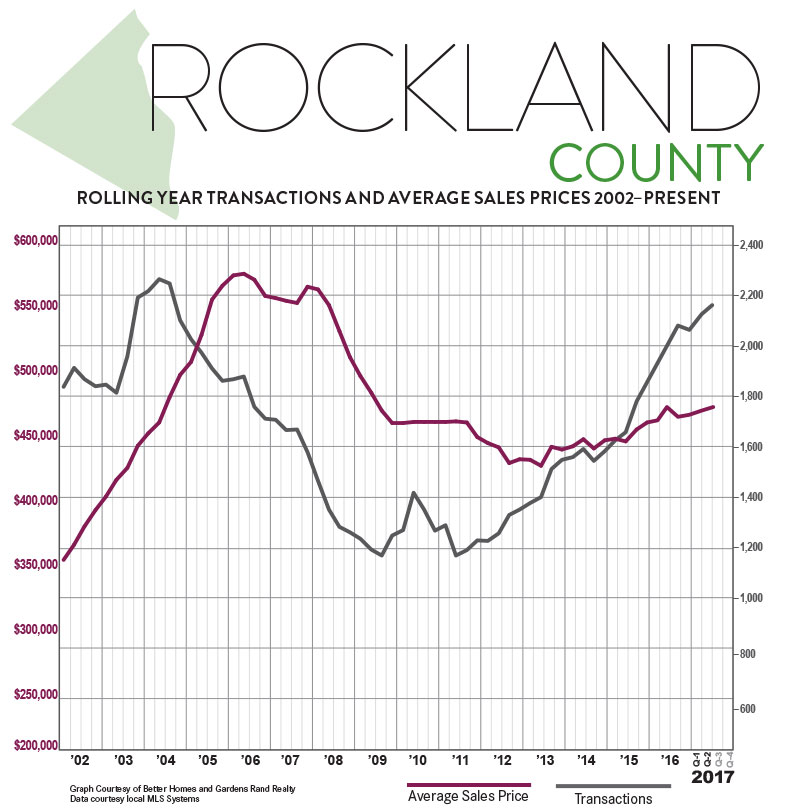

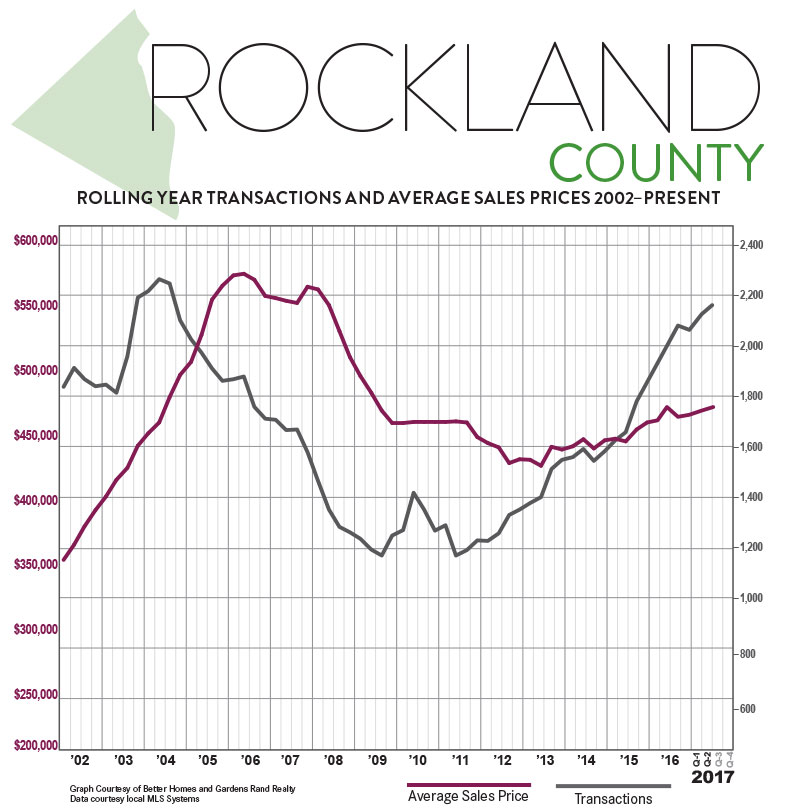

The Rockland County housing market capped off a strong 2017 with a robust finish, with both prices and sales up significantly in the fourth quarter.

The Rockland County housing market capped off a strong 2017 with a robust finish, with both prices and sales up significantly in the fourth quarter.

Sales. After a decline in the third quarter, sales roared back in the fourth, rising almost 11%. This drove the yearly transaction total up almost 5% for the year, marking the sixth straight calendar year of increasing sales. Indeed, the 2,140 single‑family sales in 2017 was the highest calendar year total since 2003, at the height of the last seller’s market.

Prices. These sustained increases in buyer demand have started to make a dramatic impact on prices, which were up across the board in the fourth quarter: up almost 6% on average, 4% at the median, and over 5% in the price‑per‑square‑foot. And for the calendar year, prices were up significantly, rising about 4% on average, at the median, and in the price‑per‑square‑foot. Rockland prices have now gone up for five straight calendar years, and are now up 15% from the bottom of the market in 2012. Still, though, pricing is at 2005 levels, without even accounting for inflation, so we have significant room for growth.

Negotiability. Inventory continued to fall in the fourth quarter, dropping over 18% and now down to just about four months of inventory. Similarly, the listing retention rate rose and the days‑on‑market fell sharply again, indicating that sellers are increasingly gaining negotiating leverage with buyers in this full‑blown seller’s market.

Condos. The Rockland condo market also finished strong, with both sales and prices up significantly for the year. Condo inventory is now down to almost three months, which indicates we’re looking at more price appreciation in 2018.

Going forward, we expect that buyer demand in Rockland will continue to drive prices up and inventory down. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that this sustained buyer demand will drive meaningful price appreciation through 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Fourth Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley Market Overview

The housing market in Westchester and the Hudson Valley finished the year strong in the fourth quarter of 2017, with meaningful price appreciation throughout the region driven by low inventory and high demand. Although sales have slumped a bit due to the lack of available homes for sale, rising prices might tempt new sellers to come into this growing seller’s market.

The housing market in Westchester and the Hudson Valley finished the year strong in the fourth quarter of 2017, with meaningful price appreciation throughout the region driven by low inventory and high demand. Although sales have slumped a bit due to the lack of available homes for sale, rising prices might tempt new sellers to come into this growing seller’s market.

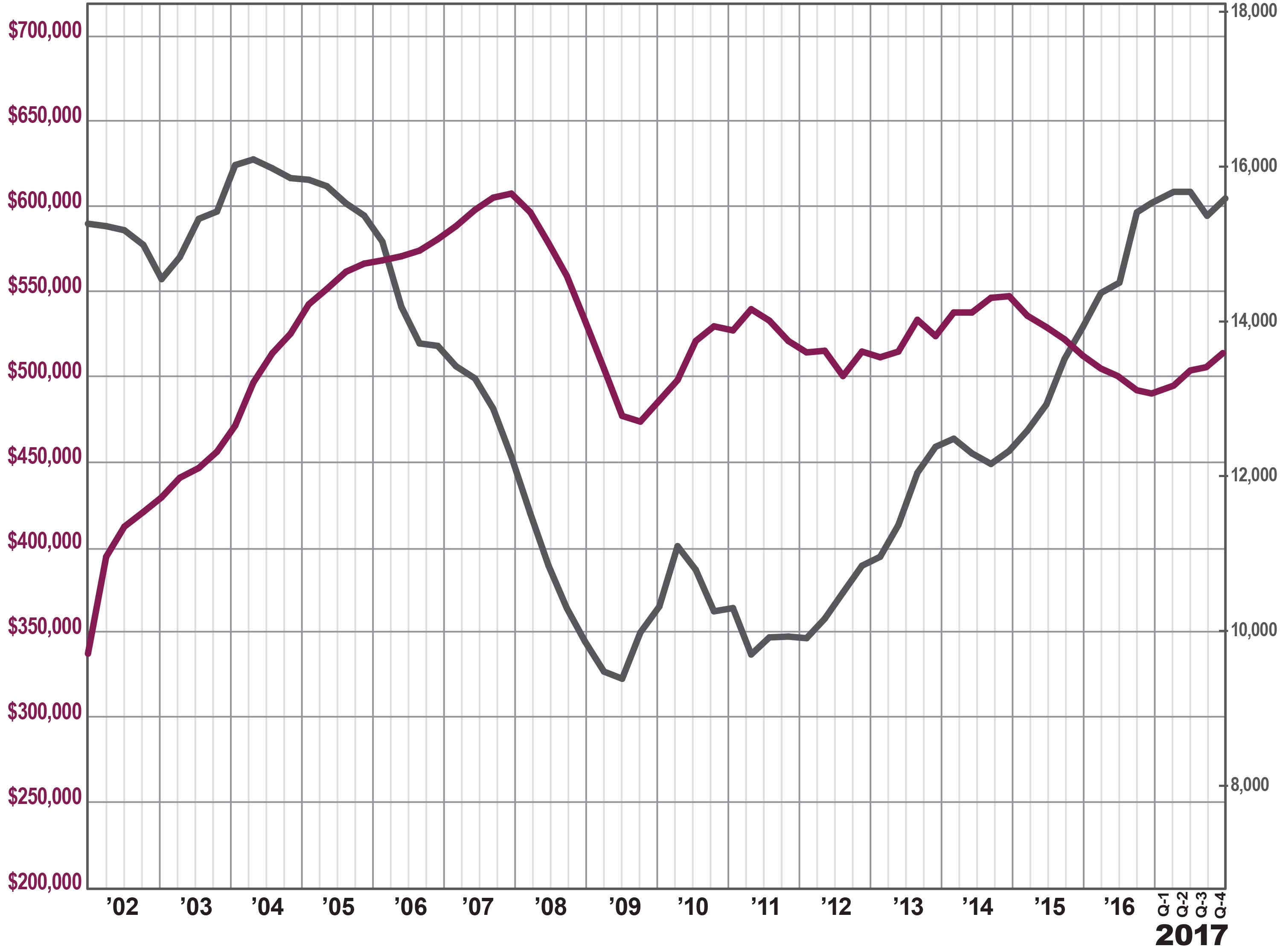

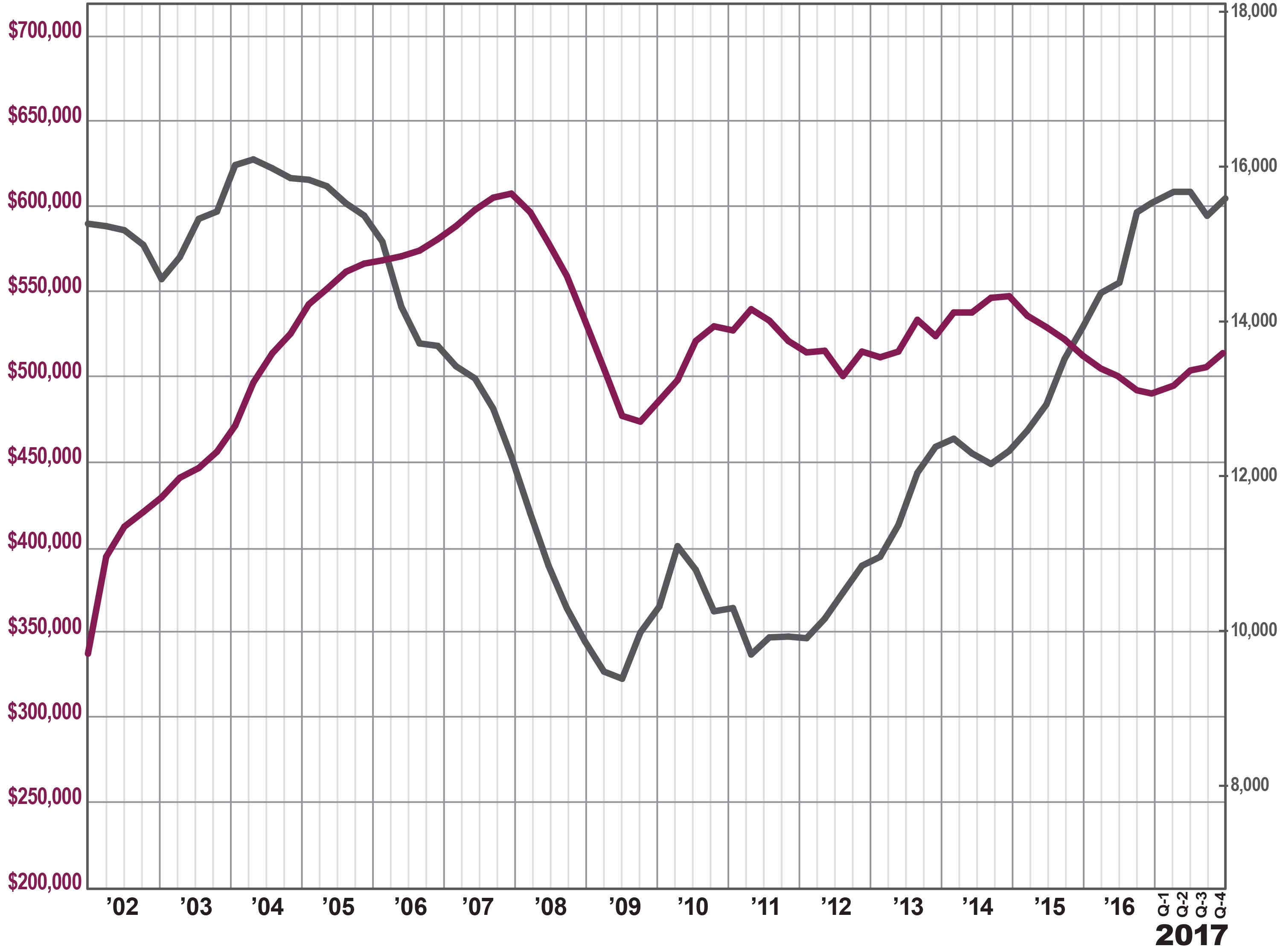

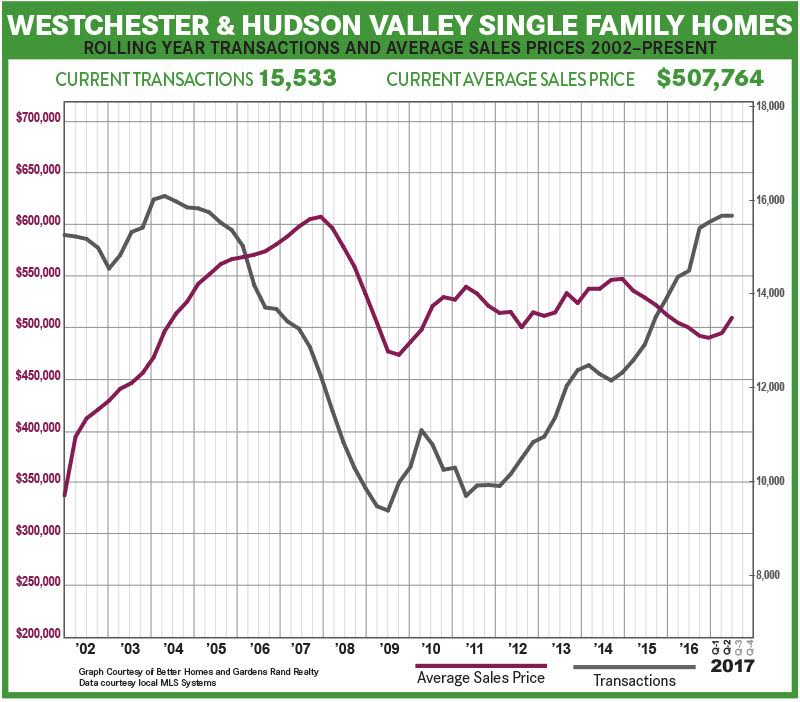

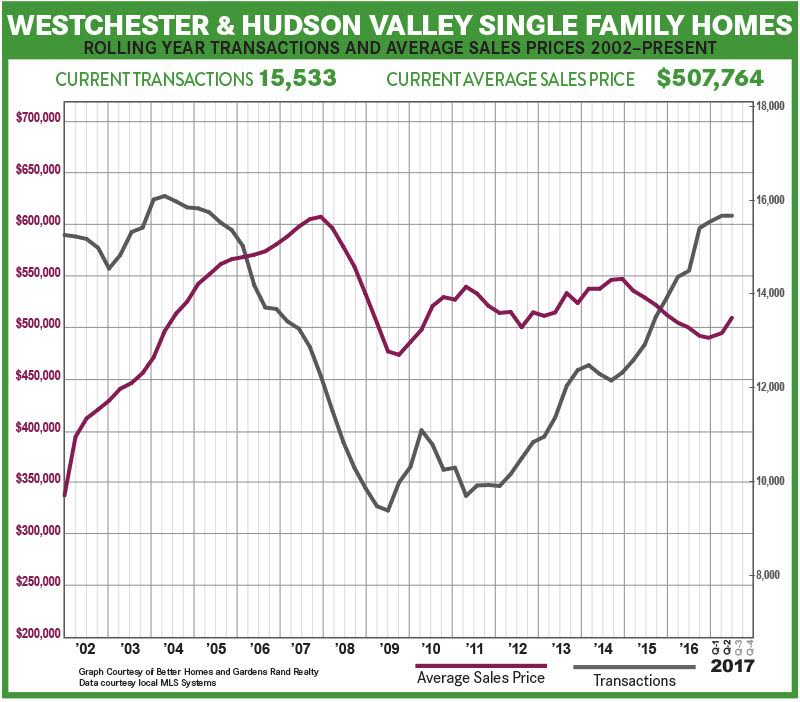

Inventory throughout the region continues to fall. Regional inventory was down to 4.6 months. Historically, when inventory drops below the six month level, it usually signals a seller’s market, and many of the individual counties in the region are now at‑or‑below six‑months’ worth of inventory: Westchester single‑family homes are now at 3.5, Putnam at 4.7, Rockland at 4.0, and Orange at 4.7. The lack of inventory continues to stifle sales growth. Regional sales were up for the first time in three quarters, rising almost 6% from the fourth quarter of last year. For all of 2017, sales were up less than 1%, the lowest year‑on‑year increase since 2011. But the problem isn’t lack of buyer demand, which remains strong. Rather, it’s simply that we don’t have enough homes for sale to satisfy the existing demand. Even with the lack of inventory, sales are approaching record highs. The 15,489 regional single‑family home sales in 2017 marked the highest yearly total since 2004, at the height of the last seller’s market. Indeed, sales totals are now almost doubling what we saw at the bottom of the market in 2009. Most significantly, high demand and low inventory are driving meaningful price appreciation. The regional average sales price was up for the fourth quarter in a row, rising almost 3%. We are starting to see long‑term price appreciation, with the regional average price also up 3% for the year. Moreover, appreciation was widespread, with yearlong average prices up in every county in the region: 4% in Westchester, 2% in Putnam, 4% in Rockland, 5% in Orange, and 3% in Dutchess. This is the first time we’ve seen such shared prosperity in over 10 years. Going forward, we believe that prices will continue to appreciate through 2018. Demand is strong, bolstered by near‑historically‑low interest rates, prices that are still near 2003‑04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. The question is if we will see sales growth, which will depend on whether homeowners see prices going up and decide to get into this market, bringing fresh new listings to satiate the existing buyer demand. All in all, this is what a seller’s market looks like. High sales totals. Low inventory. Rising prices. All the signs point to an extremely robust 2018 throughout the region. WESTCHESTER

The Westchester housing market finished strong in 2017, with a surge in prices even while a lack of inventory held back sales growth.

Sales. Home sales were up just a tick, rebounding a bit from their sudden decline in the third quarter. You can see the continued impact of a lack of inventory, though, with sales down almost 2% for the full year. Still, with over 6,100 sales for the year, transactions in Westchester are now at their highest level since 2005, and almost double where they were at the bottom of the market in 2009.

Prices. With inventory this low, and demand remaining high, we are starting to see some acceleration in price appreciation. Prices were up 5% on average and at the median for the quarter, and for the year finished up 4% on average and 3% at the median. This is welcome news for Westchester homeowners, who saw small average and median price drops over the past two years. That said, the average and median price are still at 2005 levels, without even accounting for inflation.

Negotiability. The negotiability indicators continue to signal the emergence of the seller’s market. Inventory declined again, falling over 8% and now at the lowest level of inventory we have had in Westchester in over 12 years, since the height of the last seller’s market. Similarly, for the full year, the listing retention rate was up, and the days‑on‑market was down, indicating that homes are selling more quickly and for closer to the asking price.

Condos and Coops. The condo and coop market was more uneven. The condo market was sizzling, with average prices up over 8% in the quarter and almost 5% for the year. Sales were down, but that’s certainly because inventory is below the three‑month level. The coop market was more mixed, with sales up for the year and prices relatively flat, even while inventory fell to the three‑month level.

Going forward, we expect that Westchester will continue to see meaningful price appreciation in 2018, especially if inventory remains tight. With pricing near 2005 levels and interest rates near historic lows, we believe that the seller’s market will thrive in the new year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Third-Quarter 2017 Real Estate Market Report: Rockland County Market Overview

Prices in the Rockland County housing market soared in the third quarter of 2017, even while a lack of inventory stifled sales growth.

Prices in the Rockland County housing market soared in the third quarter of 2017, even while a lack of inventory stifled sales growth.

Sales. After spiking at the beginning of the year, sales gave some of that growth back, dropping over 8% from the third quarter of last year. This was only the second time in the last four years that year‑on‑year sales have gone down. That said, sales were still up slightly for the year, marking the highest twelve‑month total in over 12 years.

Prices. These sustained increases in buyer demand had a dramatic impact on prices, which were up over 5% on average, almost 4% at the median, and almost 9% in the price‑per‑square foot. And we are continuing to see meaningful and sustainable price appreciation over the longer term, with the rolling year average price up almost 3%, the median up almost 4%, and the price‑per‑square‑foot up almost 5%. Rockland is now up over 14% from the bottom of the market in 2012.

Negotiability. Inventory continued to fall in the third quarter, depriving Rockland of the “fuel for the fire” that would drive more sales growth. The months of inventory fell over 14%, and is now consistently at that six‑month market that denotes a seller’s market. Similarly, the listing retention rate rose and the days‑on‑market fell sharply again, indicating that sellers are increasingly gaining negotiating leverage with buyers.

Condos. The Rockland condo market cooled a little in the third quarter, with sales up a tick and prices mixed. For the year, sales are up over 21%, and prices are showing the first signs of life in a decade. With inventory falling, we expect that prices will continue to rise.

Going forward, we expect that buyer demand in Rockland will continue to drive prices up and inventory down. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017 and into next year.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Third-Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley Market Overview

The housing market in Westchester and the Hudson Valley surged again in the third quarter of 2017, with strong buyer demand driving meaningful price appreciation even while declining inventory stifled sales growth. With inventory rates continuing to fall, we expect this trend to continue through the rest of the year.

The housing market in Westchester and the Hudson Valley surged again in the third quarter of 2017, with strong buyer demand driving meaningful price appreciation even while declining inventory stifled sales growth. With inventory rates continuing to fall, we expect this trend to continue through the rest of the year.

Inventory throughout the region continues to fall. Regional inventory was down almost 23%, and is now down to 6.1 months– right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now at‑or‑below six‑months’ worth of inventory, which usually signals a rising seller’s market: Westchester single family homes are now at 5.5, Putnam at 6.4, Rockland at 5.5, and Orange at 6.3.

The lack of inventory is stifling sales growth. Regional sales were down for the second straight quarter, falling over 5% from the third quarter of last year. Even though sales were up just a tick for the rolling year, we’re definitely seeing some pressure on sales growth from the lack of inventory on the market. Essentially, we need more “fuel for the fire.” That said, sales are now at levels we have not seen down since the height of the last seller’s market in 2005

These inventory levels are starting to drive meaningful price appreciation. The regional average sales price was up for the third quarter in a row, rising just about 1%. Most importantly, though, we’re starting to see long‑term meaningful price appreciation, with the average price up almost 3% for the rolling year. And quarterly average prices were up in almost every county in the region, rising 1% in Westchester, over 5% in Rockland, 1% in Orange, and over 3% in Dutchess (prices fell about 3% in Putnam).

Going forward, we expect that prices will continue to appreciate through the rest of the year. Demand is strong, bolstered by near‑historically‑low interest rates, prices that are still near 2003‑04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. We will need fresh new listings to drive more sales growth, but we expect that we will continue to see price appreciation through a strong fall market and into 2018.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report – Rockland County, New York

The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

The Rockland County housing market cooled down a little in the second quarter, with transactions and prices up only slightly after a sizzling start to the year, as the lack of inventory continues to stifle sales growth.

Sales. After spiking almost 24% in the first quarter, sales cooled down in the second, rising a little over 4% from last year. But this did continue a trend we’ve been watching for almost three years, the tenth time out of the last 11 quarters that year-on-year sales have gone up. Indeed, the 2,154 sales over the past rolling year marked the highest 12-month total since the third quarter of 2004.

Prices. These sustained increases in buyer demand are starting to have a tangible impact on pricing. Home prices were up for the quarter across the board, rising over 1% on average, almost 3% at the median, and over 1% in the price-per-square foot. And we are seeing meaningful and sustainable price appreciation over the longer term, with the rolling year median price and price-per-square-foot up over 2%. Similarly, Rockland’s average is now up over 11% from the bottom of the market in 2012.

Negotiability. Inventory continued to fall in the second quarter, depriving Rockland of the “fuel for the fire” that would drive more sales growth. The months of inventory fell almost 19%, and is now consistently at that six-month level market that denotes a seller’s market. Similarly, the listing retention rate rose and the days-on-market fell sharply, indicating that sellers are gaining negotiating leverage with buyers.

Condos. The Rockland condo market absolutely surged in the second quarter, with sales up almost 36% and prices up almost 7% on average 4% at the median. For the year, sales are up over 32%, and prices are showing the first signs of life in years. With inventory falling almost 40%, and now down to well below six months, we expect that prices will continue to rise.

Going forward, we expect that Rockland will have a strong summer market, with prices up and sales rising as much as they can with these levels of inventory. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Second Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley – Market Overview

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

The housing market in Westchester and the Hudson Valley continued to show signs of meaningful price appreciation in the second quarter of 2017, with prices up in every county in the region. With inventory rates dropping, and demand strong, we expect this trend to continue through a robust Summer market and through the rest of 2017.

Inventory throughout the region continues to drop. Regional inventory was down almost 18%, and is now down to 7.1 months — right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now down around six months, moving into “seller’s market” territory.

The lack of inventory continues to stifle sales growth. Regional sales were down just a tick compared to the second quarter of last year, just barely breaking a 10-quarter streak of year-on-year sales growth. We noted in our last report that the pace of growth was slowing. Now, it has stalled, at least until we get more “fuel for the fire.” All that said, buyer demand is as strong as we’ve seen in over 10 years, with regional sales up 5% for the year and reaching the highest 12-month sales total since the height of the last seller’s market in 2005.

These inventory levels are starting to drive meaningful price appreciation. The regional average sales price was up over 6% for the quarter, following a similar 7% increase in the first quarter. After several years of slow declines, prices are now up over 1% for the rolling year. That may not seem like much, but it’s a sign of things to come. Indeed, average prices were up in every county in the region, rising over 7% in Westchester, over 6% in Putnam, over 1% in Rockland, 9% in Orange, and almost 5% in Dutchess. We should not be surprised — sales have been going up year after year, and it was only a matter of time before this type of demand drove some meaningful price appreciation.

Going forward, we expect that prices will continue to appreciate through the rest of the year. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2003-04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. We will need fresh new listings to drive more sales growth, but we expect that we will continue to see price appreciation through a robust Summer market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report – Rockland County, New York

The Rockland County housing market simply exploded in the first quarter of 2017, with a surge in sales and prices that drove the market to levels we have not seen since the height of the last seller’s market.

The Rockland County housing market simply exploded in the first quarter of 2017, with a surge in sales and prices that drove the market to levels we have not seen since the height of the last seller’s market.

Sales. Single-family home sales spiked in the first quarter, rising almost 24% from last year, marking the ninth time out of the last 10 quarters with sales increasing from the prior year quarter. Indeed, the 2,132 sales over the past rolling year marked the highest 12-month total since the third quarter of 2004, and represented a 95% increase off the bottom of the market in 2011.

Prices. These sustained increases in buyer demand are starting to have a dramatic impact on pricing. Home prices were up for the quarter across the board, rising almost 5% on average, almost 7% at the median, and over 6% in the price-per-square foot. And we are seeing meaningful and sustainable price appreciation over the longer term, with the rolling year pricing up between 2% and 3% across the board.

Inventory. The story in Rockland County continues to be declining inventory. The months of inventory on the market declined again in the first quarter, dropping over 27% and now down to 4.8 months. Anything shorter than six months is considered a “tight” market, and Rockland is now well below that line.

Negotiability. Single-family homes again sold more quickly and for closer to the asking price in the first quarter, which is generally a sign that sellers are gaining negotiating leverage with buyers.

Condos. For the first time in years, we started to see some dramatic changes in the condo market. Sales simply surged, rising almost 39% from the first quarter of last year and now up almost 26% for the rolling year. And although pricing has been down the last several years, the combination of rising demand and falling inventory caused prices to spike across the board: up almost 13% on average, 12% at the median, and 2% in the price-per-square foot. With inventory down 40% and now below six months, we believe that this market will stay hot through 2017.

Going forward, we expect that Rockland will continue to sizzle through the traditionally robust Spring market. With prices still at attractive 2004 levels, interest rates near historic lows, inventory falling, and the economy generally strengthening, we believe that sustained buyer demand will continue to drive meaningful price appreciation through the rest of 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

First Quarter 2017 Real Estate Market Report: Westchester & Hudson Valley – Market Overview

The regional housing market in Westchester and the Hudson Valley started to show the first signs of meaningful price appreciation in the first quarter of 2017, with prices up in most of the counties. Moreover, with inventory rates dropping, we expect this trend to continue through a robust Spring market and for the rest of 2017.

The regional housing market in Westchester and the Hudson Valley started to show the first signs of meaningful price appreciation in the first quarter of 2017, with prices up in most of the counties. Moreover, with inventory rates dropping, we expect this trend to continue through a robust Spring market and for the rest of 2017.

Inventory throughout the region continues to drop. Regional inventory fell almost 26%, and is now down to 6.3 months–right at the level that the industry considers a “balanced” market. But many of the individual counties in the region are now well below six months, moving into “seller’s market” territory. For example, Westchester is now down to 5.0 months for single-family homes, 4.6 months for coops, and 3.2 months for condos. Indeed, outside of Dutchess County, every single market segment in every county in the region is at or below 6.1 months of inventory.

The lack of inventory is continuing to stifle sales growth. Regional sales were up 5% from the first quarter of last year, marking 10 straight quarters of year-on-year sales growth. But that 5% increase was the smallest in that 10-quarter streak, indicating that the pace of growth is slowing due to the lack of inventory. Essentially, the market is capable of even greater sales growth, but only if it gets more “fuel for the fire.” All that said, buyer demand is as strong as we’ve seen in over 10 years, with regional sales up 11% for the year and reaching the highest 12-month sales total since the third quarter of 2005 — the height of the last seller’s market.

High demand and low inventory is starting to drive modest-but-meaningful price appreciation. In our last Report, we said that we were “about to witness ‘Economics 101’ in action,” explaining that rising demand and falling supply were poised to drive prices up. Well, from that perspective, we had a “textbook” result in the first quarter, with the regional average sales price up over 7% from the first quarter of last year.

Moreover, average prices spiked in several counties in the region, rising almost 7% in Westchester, 5% in Rockland, and 7% in Orange. Prices were down in Putnam and Dutchess, but even in those counties, the yearlong trend was relatively promising. Essentially, the market is capable of even greater sales growth, but only if it gets more “fuel for the fire.”

Going forward, expect big things for this market in 2017. Demand is strong, bolstered by near-historically-low interest rates, prices that are still near 2003-04 levels (without controlling for inflation), a generally strong economy, and sharply declining inventory. Given these conditions, we expect that prices will continue to go up in a robust Spring market and throughout 2017.

To learn more about Better Homes and Gardens Real Estate Rand Realty, visit their website and Facebook page, and make sure to “Like” their page. You can also follow them on Twitter.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link